Morning Forecast: $100 XRP? Japan Rate Hike, Power Shifts, Oil Stalls & JPM Shake-Up

Buffett lieutenant jumps to JPM, Thailand shatters ceasefire, China posts a record surplus, and Japan’s tightening risks draining global liquidity , crypto included.

👀 Today’s Stories at a Glance

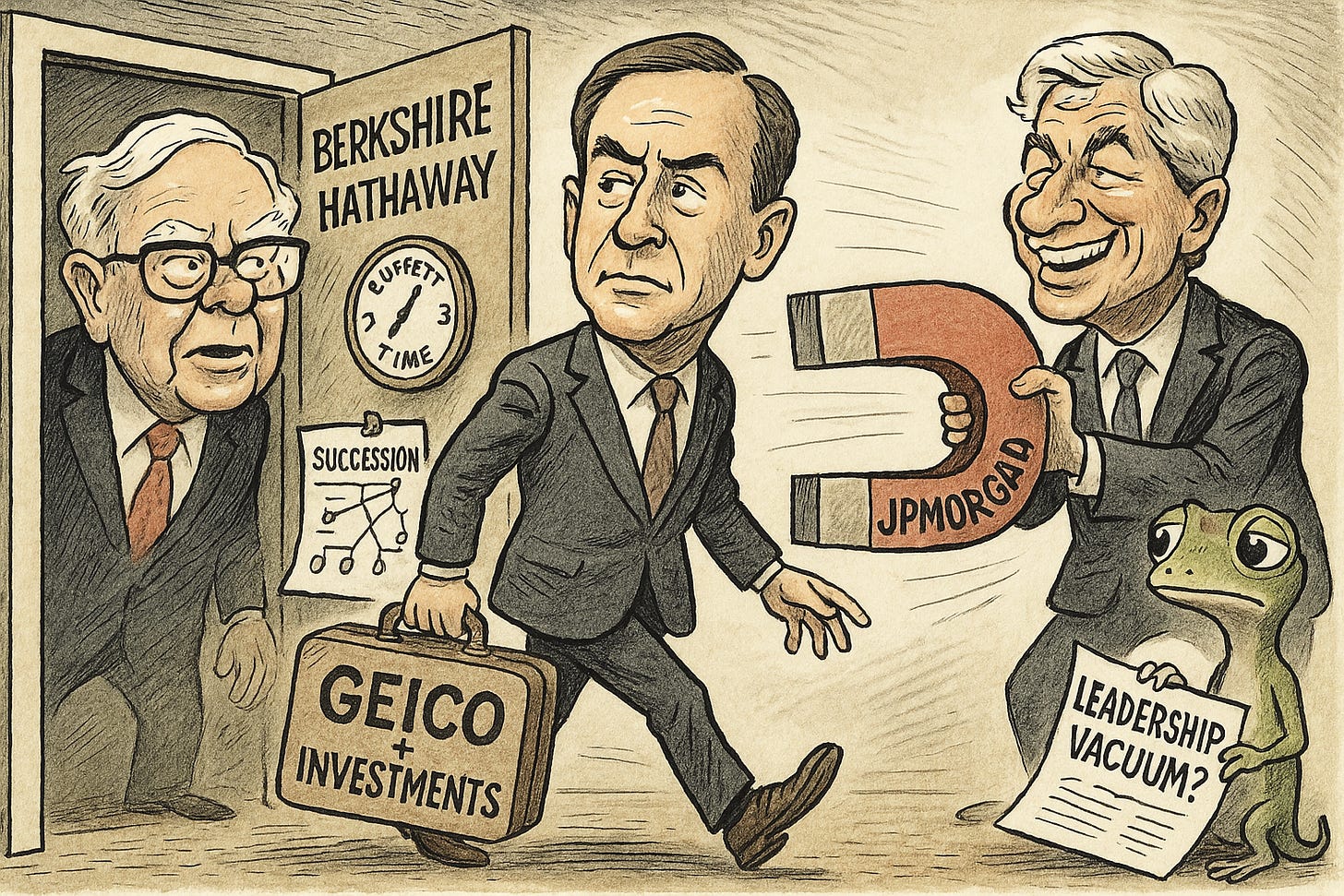

🚪 Combs Joins JPMorgan: Buffett’s lieutenant leaves Berkshire to lead a new security investment unit.

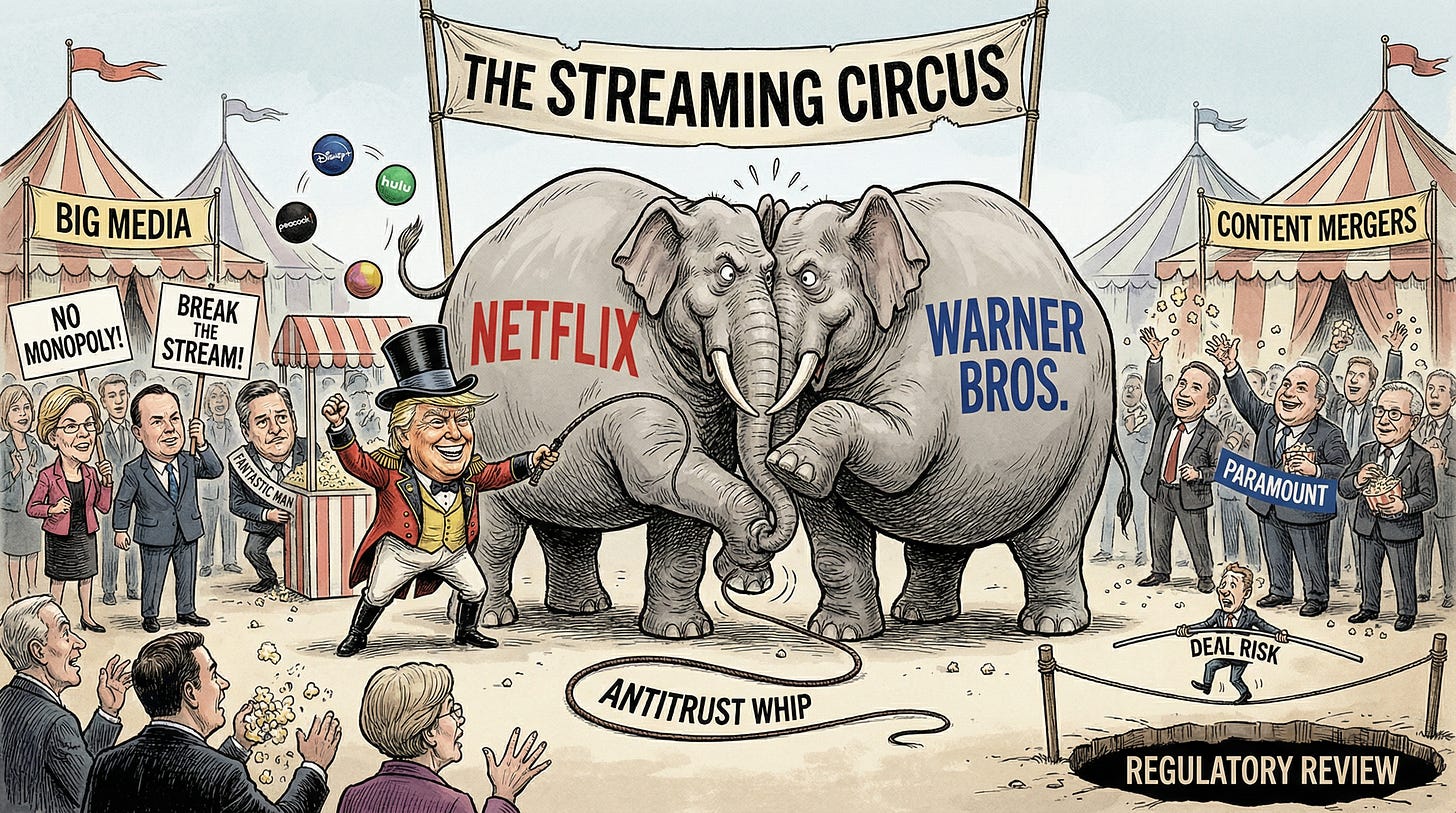

📺 Trump Doubts Deal: The President warns the Netflix-Warner merger creates problematic market share issues.

🛩️ Airstrikes Break Truce: Thai jets struck Cambodia , ending the recent U.S.-brokered ceasefire.

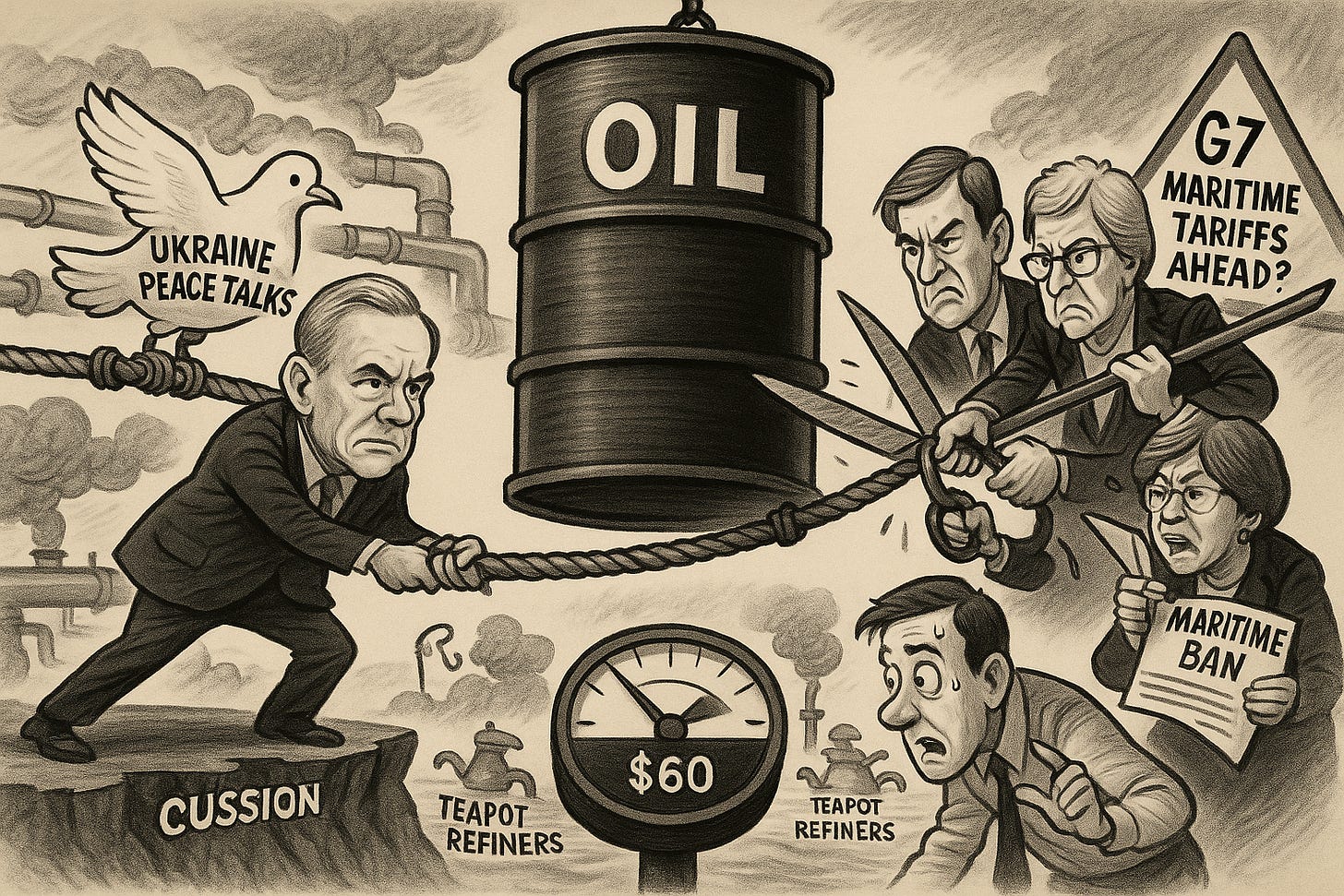

⚔️ Oil Prices Stalled: Traders weigh potential Ukraine peace deals against looming maritime export bans.

🇨🇳 China Surplus Record: The trade surplus topped $1 trillion as exports rerouted globally.

🔍 Japan’s Stagflation Risks Liquidity Shock: Rising JGB yields threaten to unwind the carry trade, draining liquidity from global and crypto markets.

🧠 One Big Thing

The Danger of Influencer Fantasies

Investors relying on viral narratives predicting XRP will hit astronomical targets due to global banking shifts are courting financial disaster. This “influencer math” conflates real macroeconomic events with fantasy outcomes that collapse under scrutiny. Historical data proves that liquidity crunches drive capital into U.S. Treasuries and Fed Swap Lines rather than speculative digital assets. The global banking system simply cannot utilize a token with insufficient liquidity depth to settle trillion-dollar flows. Betting on a $100 price target ignores the reality that rate hikes usually suppress risk assets. You must construct a flexible strategy based on independent research rather than banking on a social media moonshot.

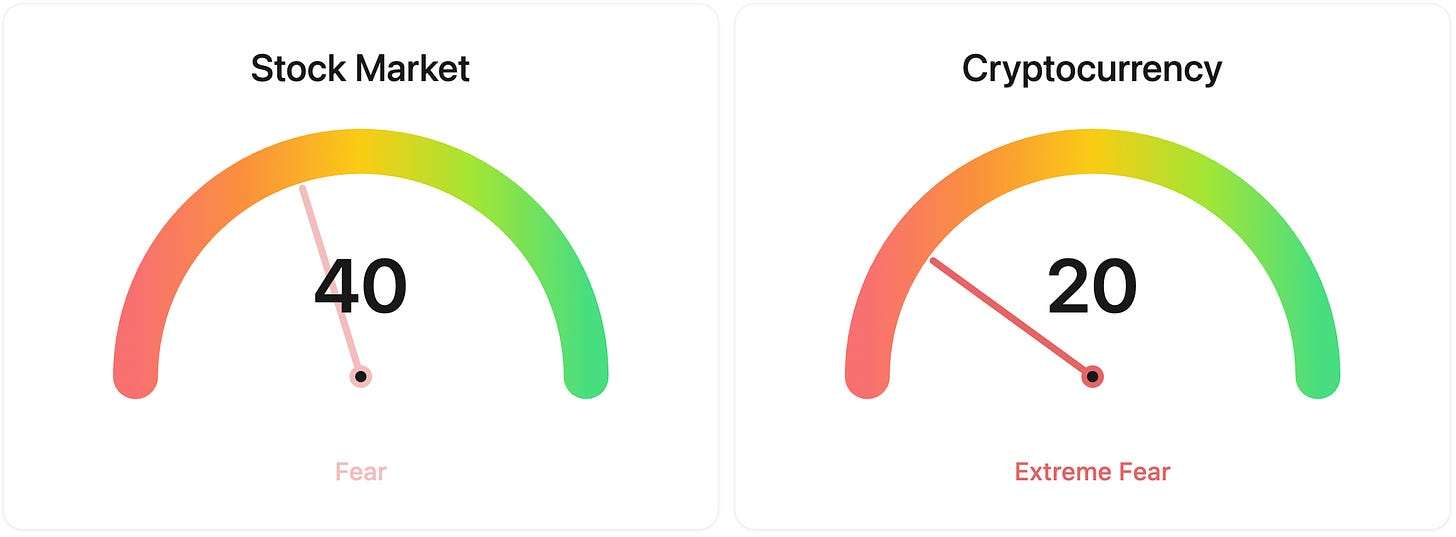

⚖️ Fear & Greed

📉 The Number That Matters

90%

Probability of a Bank of Japan rate hike. Markets effectively lock in a December 18-19 hike as Japan combats currency collapse. This pivot acts as a global liquidity vacuum, threatening to drain capital from international risk assets back into the yen.

⚔️ Winners vs Losers

Winners

FULC +44.94%: Fulcrum Therapeutics surged after presenting positive Phase 1b results for its sickle cell disease drug at ASH 2025.

CFLT +27.48%: Confluent, Inc. shares spiked following reports that IBM is in advanced talks to acquire the company for approximately $11 billion.

IMMX +21.76%: Immix Biopharma rose after reporting a 75% complete response rate in its Phase 2 AL Amyloidosis trial at ASH.

ACLX +14.22%: Arcellx, Inc. gained on positive data from its pivotal Phase 2 iMMagine-1 multiple myeloma study presented at ASH.

OCUL +13.04%: Ocular Therapeutix rallied as the FDA permitted an accelerated NDA filing for its wet AMD drug.

CVNA +9.29%: Carvana Co. climbed after S&P Dow Jones announced the company will join the S&P 500 effective December 22.

Losers

MRVL -6.38%: Marvell Technology dropped after being snubbed for S&P 500 inclusion in favor of Carvana.

AGIO -7.50%: Agios Pharmaceuticals fell after the FDA missed the PDUFA deadline for a decision on its thalassemia drug.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $92,004 (▲ 1.74%)

Ethereum (ETH): $3,143 (▲ 2.68%)

XRP: $2.09 (▲ 2.31%)

Equity Indices (Futures):

S&P 500: $6,874 (▲ 0.07%)

NASDAQ 100: $25,780 (▲ 0.19%)

FTSE 100: £9,668 (▲ 0.08%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.16% (▲ 0.39%)

Oil (WTI): $60 (▼ −1.12%)

Gold: $4,211 (▲ 0.32%)

Silver: $58.37 (▲ 0.13%)

Data as of UK (GMT): 11:57 / US (EST): 06:57 / Asia (Tokyo): 20:57

✅ 5 Things to Know Today

🚪 Buffett Lieutenant Combs Leaves for JPMorgan

Todd Combs is leaving Berkshire Hathaway to join JPMorgan Chase. Currently the CEO of Geico and a key investment manager for Berkshire, Combs was widely viewed as a central figure in Warren Buffett’s succession plan. He will now lead JPMorgan’s $10bn Strategic Investment Group, a unit focused on national security deals, where he will report directly to Jamie Dimon. Buffett confirmed the move today, noting Combs accepted an “interesting and important job” amid wider leadership changes at the $1.1tn conglomerate (Financial Times).

This departure changes the picture for Berkshire’s future just as Buffett prepares to step back. Combs wasn’t just managing stocks. He ran Geico, a critical cash engine for the group. Losing a veteran who has been inside the circle since 2010 suggests the transition era at Berkshire might be more complex than investors expected. For JPMorgan, it’s a massive win. Dimon is securing a proven capital allocator to handle sensitive growth investments in national security, signaling the bank is betting big on defense-adjacent sectors.

Sensei’s Insight: Watch the Geico leadership vacuum closely. Insurance float powers Berkshire’s investments, so operational stability there is vital during this transition.

📺 Trump Signals “Problem” for $82B Netflix-Warner Deal

On Sunday, President Trump broke his silence on Netflix’s massive $82.7 billion acquisition of Warner Bros. Discovery. Speaking at the Kennedy Center, Trump warned the combined entity’s “big market share... could be a problem,” despite calling Netflix co-CEO Ted Sarandos a “fantastic man.” This is the first meaningful signal from the administration that will oversee the antitrust review. The market was already nervous: Warner Bros. (WBD) stock traded around $24.77 Friday, a glaring 10% discount to the $27.75 offer price, suggesting investors seriously doubt this deal crosses the finish line intact (Bloomberg)

Here is why that arbitrage spread (the gap between share price and offer price) is so wide. Federal guidelines trigger a “presumptive” antitrust challenge if a merger creates a company with over 30% market share. This deal likely breaches that threshold by combining Netflix’s 301 million global subscribers with HBO Max’s 128 million. It is not just about size; it is about leverage. Critics argue this effectively locks up the Warner Bros. studio, potentially starving rival streamers of premium content. With heavy hitters like Paramount lobbying against it and bipartisan concern from Senators Warren and Lee, the regulatory road looks steep.

Sensei’s Insight: Watch the WBD discount closely. If that 10% gap widens, the smart money is pricing in a blocked deal or painful asset sales. Regulatory theater is standard, but the math here is genuinely tricky.

🛩️ Thai Airstrikes Shatter Trump-Backed Ceasefire

Thailand deployed F-16 fighter jets to strike Cambodian artillery positions this morning, shattering the peace deal brokered by President Trump less than two months ago. The airstrikes were a retaliation after Cambodian forces reportedly used BM-21 rocket launchers in a dawn assault, killing one Thai soldier and wounding four in Ubon Ratchathani province. This marks the most severe escalation since July 2025. The human cost is immediate: over 35,000 Thai civilians have been evacuated from border communities today, with total regional displacement estimated at 300,000 as heavy artillery duels continue along the 800-kilometer frontier.

This collapse reveals the fragility of “leverage-only” diplomacy. The October accord, signed after Trump threatened 36% tariffs, forced a handshake but failed to resolve the century-old territorial dispute over the Preah Vihear temple. For investors, the risk is contagious. During the July conflict, Thai hospitality giant Minor International (MINT) fell 18% as tourism evaporated. Conversely, the defense sector is decoupling from the broader market. Thai Aerospace Industries has surged on government contracts, while logistics firms rerouting supply chains through Laos are seeing demand spike by 30%.

Sensei’s Insight: Watch the defense sector for short-term tactical plays, but be disciplined. History shows these stocks rally on gunfire and crash on handshakes. If international mediation gains momentum, be ready to exit.

⚔️ Oil trapped: Ukraine peace talks vs. new sanctions

Oil markets are paralyzed in a geopolitical standoff, trading in a tight band near two-week highs. Brent crude slipped to around $63.18 and WTI hovered near $59.48 intraday as traders attempted to price in conflicting timelines. The bear case is gaining traction due to U.S. envoy Keith Kellogg’s claim that a Ukraine peace deal is “really close,” a move that could unlock a flood of Russian supply. However, downside is capped by an 84% implied probability of a Federal Reserve rate cut this week and emerging reports that the G7 may replace its Russian price cap with a strict maritime services ban, threatening to choke off exports (Channel News Asia)

This setup creates a binary risk profile for energy portfolios well into 2026. We are witnessing a massive “tug of war” between supply relief and supply destruction. If peace talks succeed, analysts like PVM’s Tamas Varga warn that unlocked Russian exports will drive prices lower. Conversely, if talks fail and the EU enforces a full maritime ban on Western insurance, it could strand millions of barrels. With China’s “teapot” refiners already soaking up Iranian crude to clear inventory, the floor is shaky. The market isn’t reacting to daily flow anymore; it’s waiting to see if next year brings a ceasefire or a blockade.

Sensei’s Insight: Ignore the intraday chop and watch the $60 WTI support level. The critical signal isn’t the Fed cut; it is whether the G7 commits to the maritime ban. That is the catalyst for a structural supply shock.

🇨🇳 China’s Trade Surplus Hits Historic $1 Trillion Record

For the first time in history, a single nation has logged a trade surplus exceeding $1 trillion. In data released today, China reported a cumulative surplus of $1.076 trillion through November 2025, smashing its previous annual record with a month still to go. November alone saw a $111.68 billion surplus, beating economist estimates despite a massive 28.6% collapse in exports to the U.S. While shipments to America plummeted for the eighth straight month, Chinese manufacturers successfully pivoted elsewhere. Exports to Southeast Asia surged 8.2% and shipments to Australia jumped 35.8%, proving the factory floor is moving goods faster than tariffs can stop them (Bloomberg).

This number hides a massive geopolitical shell game. While U.S. tariffs have successfully strangled direct trade, Beijing has effectively routed around the blockade. A significant portion of those surging exports to Southeast Asia are likely “transshipped”, minimally processed and re-labeled to bypass American duties. Meanwhile, a 14.8% spike in exports to the EU suggests Europe is becoming the new clearinghouse for excess Chinese capacity, explaining President Macron’s recent warnings about defensive tariffs. Critically, China’s anemic 1.9% import growth signals their domestic economy remains broken. They aren’t buying from the world; they are just selling to it.

Sensei’s Insight: This surplus confirms the trade war hasn’t stopped Chinese goods, only rerouted them. Watch for a U.S. crackdown on “transshipment” hubs like Vietnam and Mexico as Washington moves to plug these leaks.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive: Japan’s Stagflation Dilemma: Global Liquidity, The Carry Trade, and Crypto Contagion

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.