Morning Forecast: Chip Deals, Hostile Bids, Rate Hikes & The Bitcoin Unwind

Chips flow to China, Paramount bypasses the board, Google reaches for orbit.

👀 Today’s Stories at a Glance

🇺🇸 Trump permits Nvidia exports to China: Nvidia can export chips to China subject to tariffs and mandatory US inspections.

⚔️ Paramount launches hostile WBD takeover: Paramount Skydance bypassed the board to offer shareholders $108 billion in cash directly.

🇯🇵 Japan signals December interest rate hike: The central bank plans to raise rates to 0.75% as the economy stabilizes.

🇪🇺 EU investigates Google AI scraping: Regulators are investigating if Google scrapes publisher content for AI without fair payment.

📉 MicroStrategy Bitcoin premium collapses: MicroStrategy may be forced to sell Bitcoin as its stock premium over holdings evaporates.

🛰️ Google moves data centers to space: Google plans to launch orbital data centers to utilize solar energy and bypass grid limits.

🧠 One Big Thing

The Pivot to Weaponized Monetization

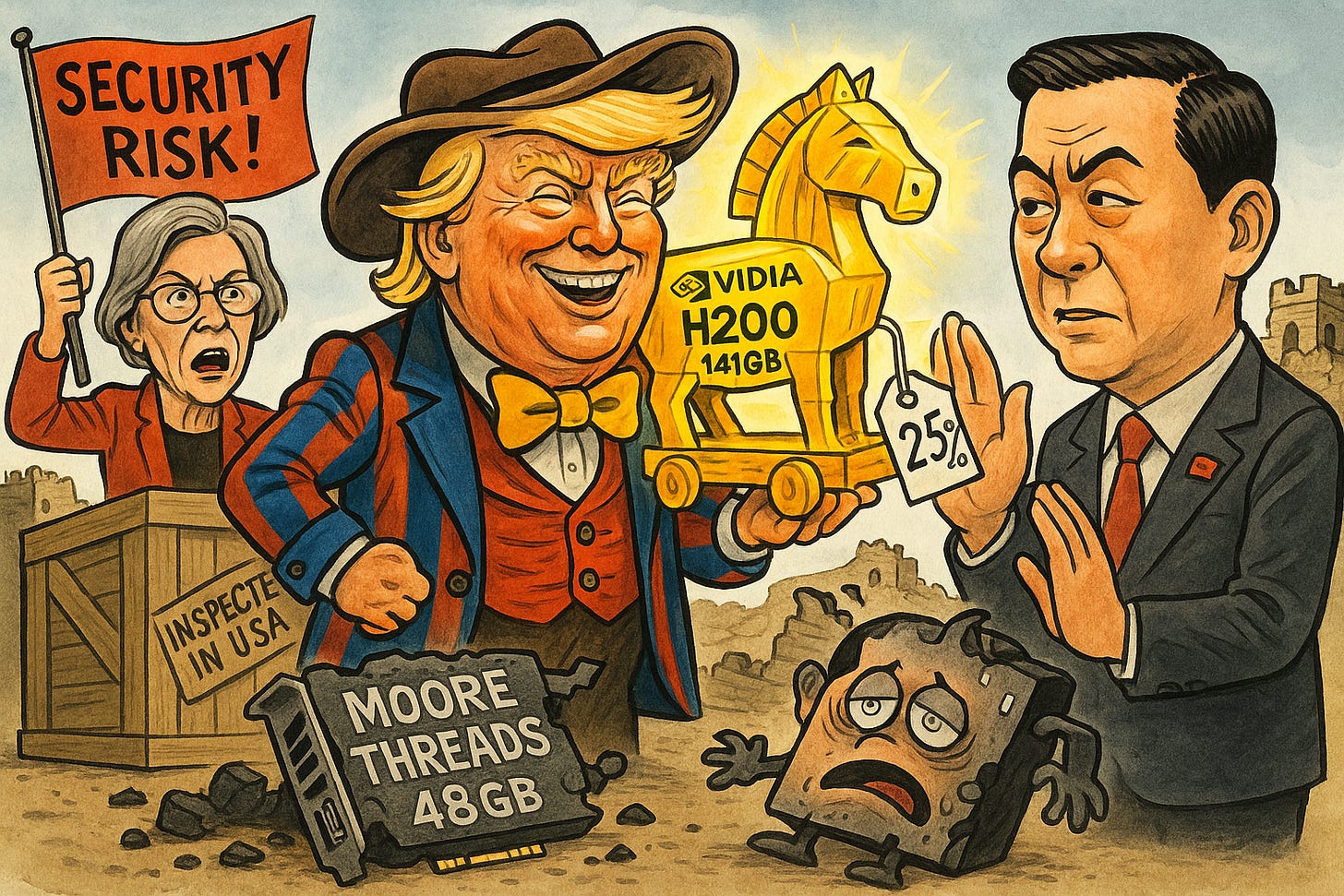

President Trump has authorized Nvidia H200 exports to China, replacing bans with a high-tariff “pay-to-play” model. This pivot aims to flood the market with superior American silicon, effectively pricing out Beijing’s nascent domestic startups. By undercutting the protectionism that nurtured rivals like Moore Threads, Washington is gambling on economic dominance over strict containment. Markets reacted instantly, but the true impact on Chinese venture capital is just beginning. Will this aggressive shift successfully starve China’s indigenous chip sector?

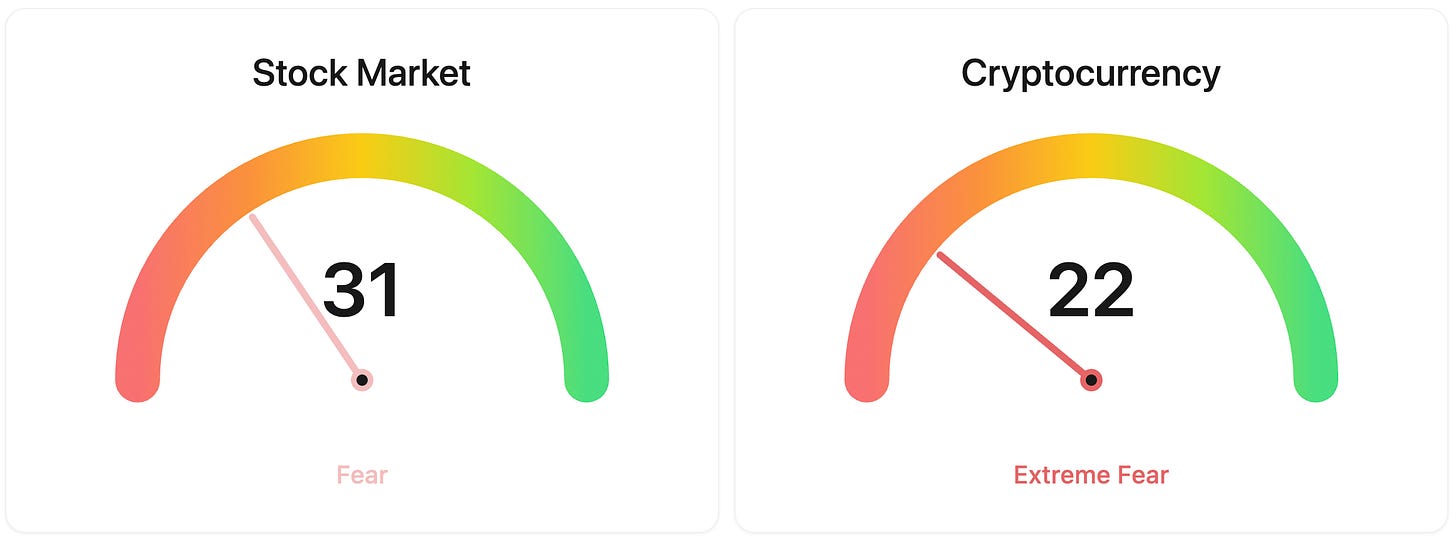

⚖️ Fear & Greed

📉 The Number That Matters

25%

Nvidia is now required to remit 25% of all H200 sales revenue generated in China directly to the U.S. Treasury. This figure represents a mandated government rake, effectively functioning as a geopolitical tariff that compresses Nvidia’s gross margins on these units while simultaneously legalizing the trade flow. While the 25% levy is a steep cost of doing business, it removes the binary risk of a total ban, converting a regulatory wall into a quantifiable expense line.

⚔️ Winners vs Losers

Winners

ALEX +37.6%: Alexander & Baldwin, Inc. skyrocketed after agreeing to a $2.3 billion take-private deal with a consortium including Blackstone at $21.20 per share.

VOR +27.6%: Vor Biopharma Inc. surged after JPMorgan initiated coverage with an Overweight rating, highlighting the de-risked potential of its autoimmune asset telitacicept.

MAMA +15.0%: Mama’s Creations, Inc. rallied on a Q3 earnings beat driven by 50% revenue growth and successful integration of the Crown 1 acquisition.

PRME +6.9%: Prime Medicine, Inc. gained on continued momentum from a recent Citi price target increase and anticipation of gene-editing clinical milestones.

Losers

TORO -5.5%: Toro Corp. retreated on profit-taking following a sharp run-up triggered by the announcement of a massive $1.75 per share special dividend.

GPK -5.0%: Graphic Packaging Holding Co. fell on No News amid sector weakness and lingering headwinds from a previous earnings guidance cut.

TOL -4.6%: Toll Brothers, Inc. dropped after reporting fourth-quarter earnings of $4.58 per share, which missed the analyst consensus estimate of $4.91.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $90,164 (▼ 0.55%)

Ethereum (ETH): $3,103 (▼ 0.71%)

XRP: $2.05 (▼ 0.98%)

Equity Indices (Futures):

S&P 500: $6,849 (▼ 0.09%)

NASDAQ 100: $25,655 (▼ 0.04%)

FTSE 100: £9,658 (▲ 0.14%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.16% (▼ 0.31%)

Oil (WTI): $59 (▲ 0.25%)

Gold: $4,202 (▲ 0.28%)

Silver: $58.47 (▲ 0.57%)

Data as of UK (GMT): 11:21 / US (EST): 06:21 / Asia (Tokyo): 20:21

✅ 5 Things to Know Today

🇺🇸 Trump Unlocks Nvidia’s H200 for China (With a Catch)

In a decisive reversal of Biden-era containment strategy, President Trump has authorized Nvidia to export its high-performance H200 AI chips to China. This isn’t a free-trade olive branch; it’s a “pay-to-play” deal. Nvidia must pay a 25% tariff on every unit - a cost likely passed to Chinese buyers - and route chips from Taiwan to the U.S. for physical inspection before they reach China. Markets reacted immediately: Nvidia shares rose ~2% on the reopened revenue stream, while Chinese domestic rival Moore Threads slumped 5.73% (Bloomberg)

This shift moves U.S. policy from “denial” to “monetization.” The administration is betting that flooding China with superior American tech (the H200 boasts 141GB of memory vs. Moore Threads’ ~48GB) will crush the business case for Beijing’s homegrown chip startups. While Elizabeth Warren labeled this a “colossal security failure,” the economic logic is ruthless: the 25% surcharge acts as a luxury tax on Chinese innovation. By allowing these exports, the U.S. undercuts the protectionist wall that was nurturing competitors like Huawei, forcing Chinese firms to choose between superior U.S. imports or inferior domestic hardware.

Sensei’s Insight: The real trade here is the “Trojan Horse” effect. By selling China the superior H200, the U.S. effectively kills the business case for local rivals like Moore Threads. Watch for a collapse in Chinese domestic chip VC funding, not just Nvidia’s export volumes.

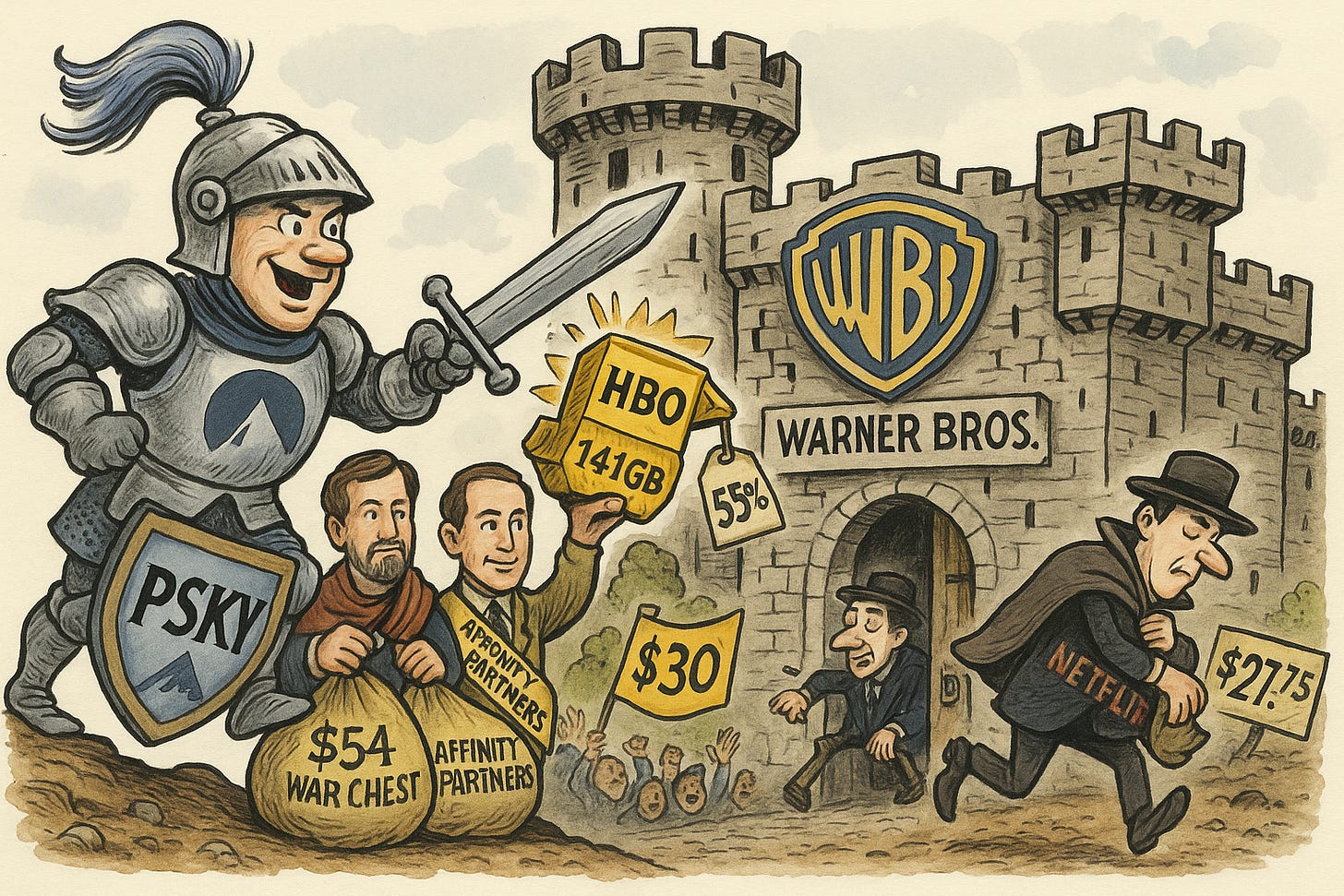

⚔️ Paramount Goes Hostile: $108B War for Warner Bros

It is officially a bidding war. Paramount Skydance (PSKY) just launched a hostile takeover bid for Warner Bros. Discovery (WBD), bypassing the board to offer shareholders $30 per share in cold, hard cash. The offer values WBD at $108.4 billion and is a direct strike against Netflix, which had agreed to buy WBD’s studio assets just days ago for roughly $27.75 per share. Backed by Oracle’s Larry Ellison and Jared Kushner’s Affinity Partners, Paramount has secured $54 billion in bridge loans to ensure they can write the check immediately (Reuters).

This matters because it offers investors two radically different exits. While Netflix wanted to cherry-pick WBD’s “crown jewels” (HBO and studios) and spin off the declining cable networks, Paramount is pitching a cleaner “One Company, One Check” solution for 100% of the asset. The market clearly favors the aggression. WBD stock jumped 4.4% on the news, signaling hope for a higher payout, while Netflix slid 3.4% as analysts fear they will get dragged into an expensive fight. Crucially, the Ellison/Kushner backing suggests this deal might navigate the “Trump Era” regulatory maze smoother than a Netflix monopoly would.

Sensei’s Insight: Watch the $30 price level closely. If WBD trades significantly above it, the market is pricing in a sweeter counter-offer from Netflix. If it stays pinned to $30, the “MAGA trade” capital likely wins.

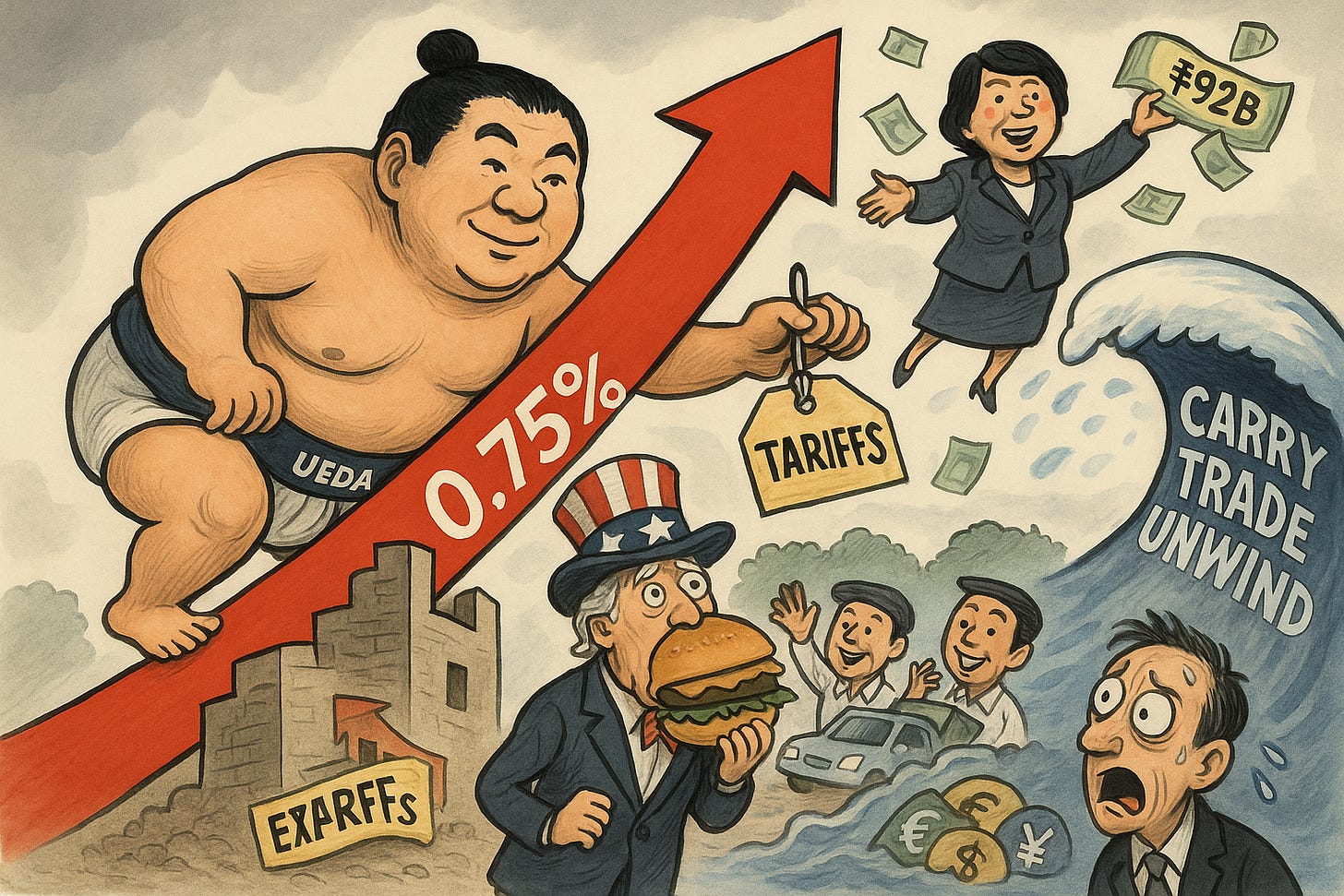

🇯🇵 BoJ Signals Rate Hike After Defying Tariffs Fire

Bank of Japan Governor Kazuo Ueda confirmed today that Japan’s economy has successfully “weathered the shock” of President Trump’s tariffs. Speaking at a global summit, Ueda explained that US corporations “swallowed the burden” rather than passing costs to consumers, while Japanese automakers cut prices to maintain export volumes. With the “real side of the economy” stabilized, the central bank is shifting gears. Traders are now assigning a 91% probability that the BoJ will hike interest rates at its December 18-19 meeting, pushing the policy rate toward 0.75%, a level unseen in three decades (Yahoo Finance)

This marks the end of Japan’s defensive posture. We are seeing a rare convergence of fiscal expansion and monetary tightening. Prime Minister Takaichi’s $92 billion stimulus package is hitting the market just as the BoJ prepares to raise borrowing costs. While this environment suggests wider profit margins for Japanese banks, it puts pressure on government debt. Yields on 10-year Japanese Government Bonds are already approaching 2% as investors brace for reduced central bank support and higher bond supply. The era of ultra-cheap liquidity is officially closing.

Sensei’s Insight: Watch the Yen closely. As the rate gap between the US and Japan narrows, the massive “carry trade” unwind could accelerate, triggering volatility across global markets.

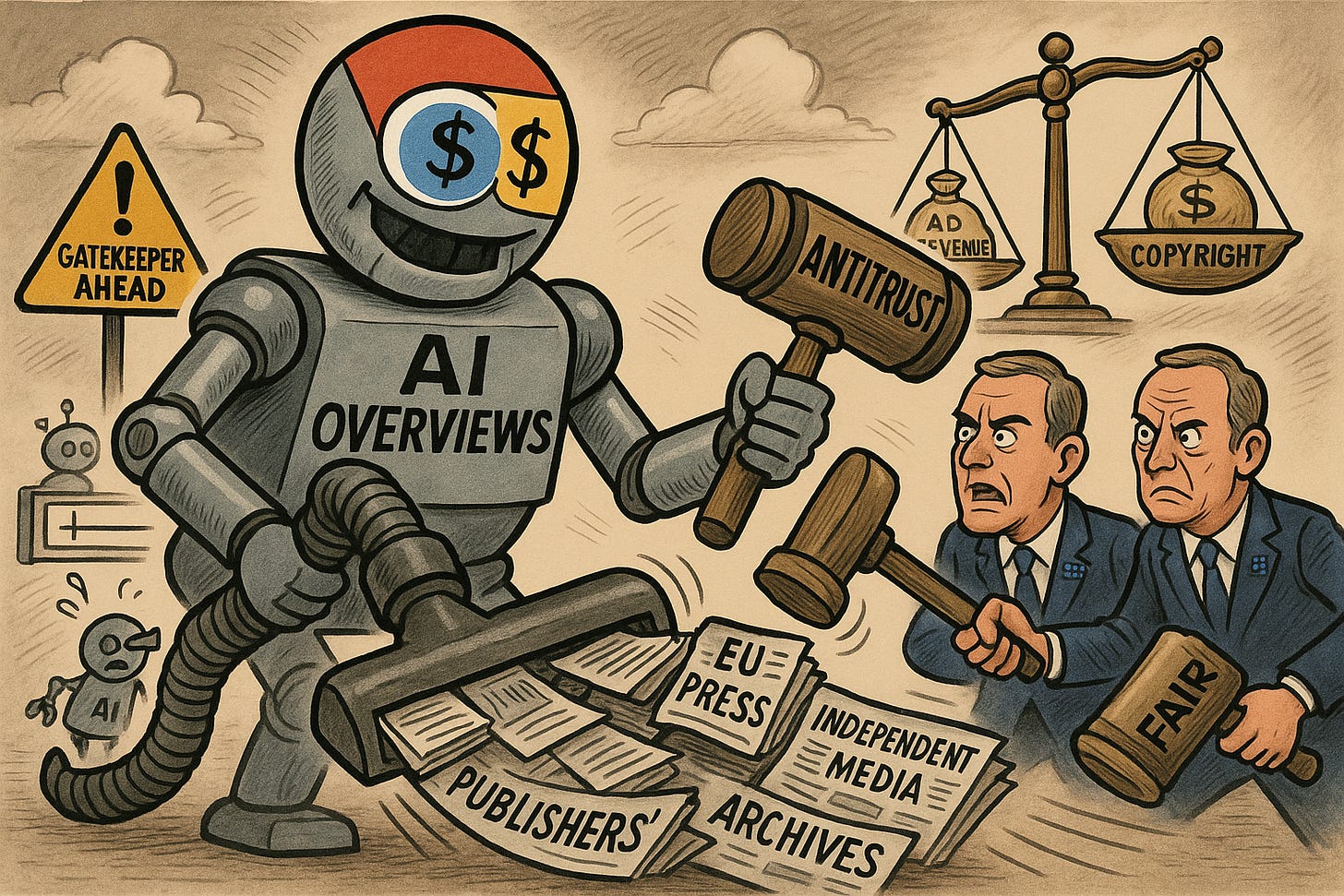

🇪🇺 EU Launches Antitrust Probe Into Google’s AI Content

Today, December 9, the European Commission formally opened an antitrust investigation into Alphabet’s Google. The regulator is examining whether Google abuses its search dominance to scrape publisher content for its “AI Overviews” and “AI Mode” without fair compensation. This is Google’s fifth major clash with EU enforcers, arriving just days after a similar probe into Meta. The stakes are massive: if found guilty of violating competition rules, Google could face fines up to 10% of its global annual turnover, a penalty exceeding $30 billion based on 2024 figures (Wall Street Journal).

This battle strikes at the heart of the AI economic model. Publishers claim Google offers a “toxic” binary choice: allow your content to be used for AI training for free, or be erased from Google Search entirely. The EU fears this “gatekeeper” power prevents fair negotiation and handicaps rival AI models that don’t have free access to the entire web. For investors, this signals that the era of “free” training data may be ending. If the EU forces Google to pay for content, similar to OpenAI’s licensing deals with News Corp, expect operational costs to rise for major AI platforms while “legacy” media companies with deep archives could see their valuations re-rated.

Sensei’s Insight: Watch the cost of data. If Europe sets a precedent that AI training requires paid licensing, the margins for LLM builders will tighten globally.

📉 Saylor’s “Infinite” Bitcoin Flywheel Finally Jammed

The math that powered Michael Saylor’s Strategy is breaking. In early December, the company’s market cap briefly dipped below the spot value of its 650,000 Bitcoin holdings ($45B vs $55B), signaling a near-total collapse of the premium investors once paid. The stock has plummeted nearly 60% from its July peak of $473, erasing $82 billion in value. Consequently, the “infinite money glitch”, issuing expensive stock to buy Bitcoin, has stalled. Saylor, once the ultimate “hodler,” has admitted the unthinkable: if the valuation metric (mNAV) stays below 1.0x, the company may be forced to sell Bitcoin to service debt (Financial Times)

This matters because the “arbitrage” is dead. For years, Strategy traded at a massive premium (up to 2.45x NAV), allowing it to print equity to buy Bitcoin accretively. With that ratio now at a perilous 1.16x, the machine works in reverse. If the stock trades at a discount to its holdings, the company effectively becomes a drag on the Bitcoin it owns. Complicating matters is a looming January 15, 2026 decision by MSCI. If Strategy is excluded from major indices for being too crypto-heavy, it could trigger up to $9 billion in forced selling by passive funds.

Sensei’s Insight: Watch the 1.0x mNAV level closely. If Strategy trades at a sustained discount to its Bitcoin stack, the company shifts from a “buyer of last resort” to a forced seller, potentially flooding the market with supply.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

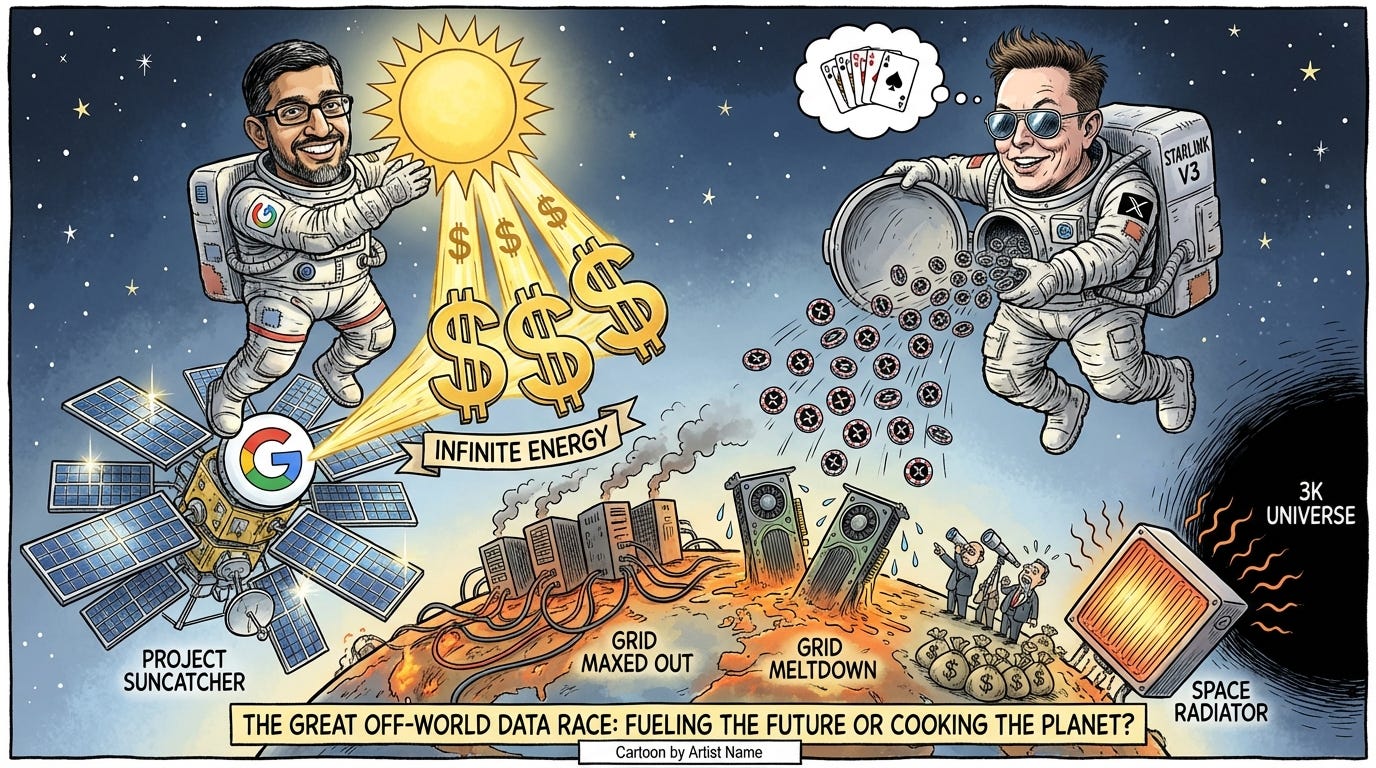

🔍Deep Dive: 🛰️ Project Suncatcher: The Industrialization of Low Earth Orbit

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.