Morning Forecast: Fed, Crypto, Japan + Burry is Back

CRISIS WARNING: Yen Unwind is Draining Global Liquidity

Hi everyone!

A huge thank you for your patience lately! We’ve been heads-down behind the scenes building some incredible upgrades for you. Get ready for a new weekly edition, fresh newsletter sections, and a full training course added to your membership. Plus, we’re launching powerful new tools like our Budget Planner, Debt Planner, and a portfolio app. The best part? These are being rolled out to all members at no extra cost. Now, let’s jump into today’s analysis.

👀 Today’s Stories at a Glance

🦅 Hassett Favorites for Fed Chair: Trump’s pick signals a potential shift toward aggressive rate cuts and easy money policies.

📉 Yearn Exploit Triggers Crypto Selloff: A DeFi minting glitch drained millions; resulting fear caused widespread market liquidations.

🛑 China Hides Real Estate Collapse: Officials halted housing data releases as developer Vanke’s bonds crashed, signaling deepening crisis.

🏦 Bank Concentration Risks Options Market: Record trading volume relies dangerously on just five banks clearing nearly half all trades.

🚨 Burry Shorts as Tesla Sales Drop: European registrations plummeted while Michael Burry attacked the valuation, warning of further declines.

🔍 Yen Rate Hikes Threaten Liquidity: Japan’s potential rate hike is unwinding the carry trade, draining global liquidity and crushing crypto.

🧠 One Big Thing

The Yen Carry Trade Unwind

Global markets face a systemic shock from the unwinding of the Yen carry trade. For decades, investors borrowed low-interest Yen to fund purchases of high-yield assets like U.S. tech stocks. That arbitrage is now failing as the Bank of Japan raises rates and the currency strengthens. This shift forces traders to liquidate risk assets immediately to repay increasingly expensive loans. The sell-off is a structural deleveraging event rather than a change in investor sentiment. As Japanese yields rise, the mathematical model supporting trillions in global leverage is officially broken. (See more in the deep dive today)

⚖️ Fear & Greed

📉 The Number That Matters

1.19x NAV

Strategy Inc.’s premium over its Bitcoin holdings has compressed significantly. CEO Phong Le warns that falling below 1x NAV (currently 1.19x) could force “last resort” Bitcoin sales to fund dividends, creating a potential liquidation risk for the company.

⚔️ Winners vs Losers

Winners

CNCK +143%: Coincheck Group N.V. rallied in sympathy with the broader crypto sector, bolstered by residual optimism from its recent return to profitability.

AHMA +198%: Ambitions Enterprise Management Co. LLC surged on retail momentum after its subsidiary was named a preferred partner for the World Chinese Entrepreneurs Convention.

ETHZ +16.1%: Ethzilla Corp. moved higher on sympathy with the Ethereum ecosystem following its strategic pivot to staking and tokenization, despite profit-taking later in the session.

MDB +23.9%: MongoDB Inc. spiked after crushing Q3 earnings estimates and issuing strong guidance, driven by accelerated growth in its Atlas platform.

CRDO +17.6%: Credo Technology Group Holding Ltd. jumped after reporting 272% revenue growth and beating estimates, fueled by demand for its AI data center connectivity solutions.

BYND +36.5%: Beyond Meat Inc. shares staged a volatile rally in what appears to be a retail-driven short squeeze, despite no news or fundamental changes.

Losers

JANX -39.9%: Janux Therapeutics Inc. plummeted after Phase 1 data for its prostate cancer drug met clinical goals but failed to satisfy highly speculative market expectations.

ABTC -15.6%: American Bitcoin Corp. traded lower in sympathy with falling Bitcoin prices, which directly impacted the valuation of its corporate treasury holdings.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $87,067 (▲ 0.88%)

Ethereum (ETH): $2,820 (▲ 0.72%)

XRP: $2.03 (▼ 0.07%)

Equity Indices (Futures):

S&P 500: $6,833 (▲ 0.27%)

NASDAQ 100: $25,482 (▲ 0.36%)

FTSE 100: £9,744 (▲ 0.48%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.09% (▲ 0.05%)

Oil (WTI): $59 (▼ 0.44%)

Gold: $4,188 (▼ 1.00%)

Silver: $57.01 (▼ 1.64%)

Data as of UK (GMT): 11:15 / US (EST): 06:15 / Asia (Tokyo): 20:15

✅ 5 Things to Know Today

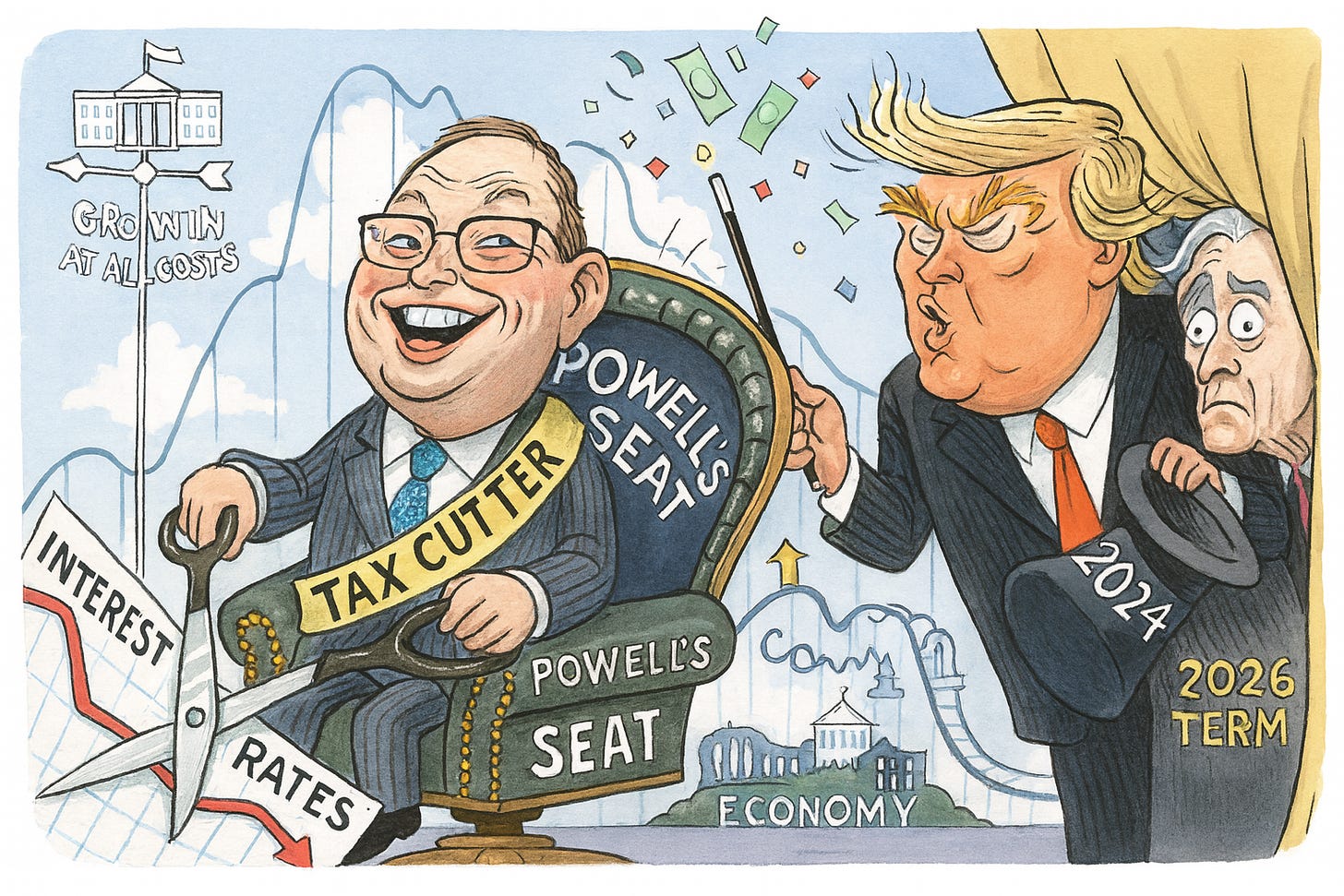

🦅 Trump Confirms Fed Pick; Hassett Leads the Pack

On Sunday, President Trump confirmed he has selected the next Federal Reserve chair. While he kept the specific name private, insiders identify Kevin Hassett, his current top economic adviser, as the overwhelming frontrunner. Hassett appeared on Sunday talk shows to claim that recent drops in Treasury yields prove the market supports the administration’s direction. With Treasury Secretary Scott Bessent hinting at a formal announcement before Christmas, the White House is moving fast to replace Jerome Powell well before his term officially ends in 2026 (Bloomberg)

This matters because Hassett represents a regime shift toward aggressive “easy money.” Unlike the typical cautious central banker, he is a tax-policy architect who actively argues that current interest rates are strangling the economy. He has publicly stated that rates are up to 3 percentage points too high and that he would “be cutting right now” if he held the gavel. A Hassett nomination signals that the Fed would pivot from strictly fighting inflation to prioritizing maximum growth, likely operating with much closer alignment to the White House’s political agenda.

Sensei’s Insight: Watch the 10-year Treasury yield. Hassett wants lower rates, but if long-term yields spike above 4.5% on his nomination, it signals the bond market fears his dovish policies will actually reignite inflation.

📉 BTC, ETH, XRP Slide on Yearn “Infinite Mint” Glitch

Bitcoin and the broader crypto complex sold off into the Asia open after Yearn Finance disclosed a critical exploit in its yETH liquidity pool. An attacker utilized an “infinite mint” vulnerability to print tokens and drain roughly $9 million in liquid-staking assets, routing 1,000 ETH through Tornado Cash to obfuscate the trail. While Yearn confirmed its core v2 and v3 vaults remain secure, the incident triggered hundreds of millions in derivative liquidations, dragging BTC, ETH, and XRP down into the red (CoinDesk)

The dollar loss here is relatively small, but the outsized market reaction reveals serious structural fragility. Investors were already on edge following a weak November and ETF outflows, so this headline acted as a spark in a room full of gas. The heavy liquidations suggest traders were over-leveraged and betting on a December rebound that didn’t materialize. Furthermore, seeing a “blue-chip” DeFi protocol like Yearn suffer an exploit, just days after the Upbit hack, reignites fears about smart contract risk and composability in the liquid staking sector.

Sensei’s Insight: Watch the liquidation data closely. We need the forced selling to exhaust itself before calling a bottom. If BTC can’t hold the $85k support, new lower levels may come into play.

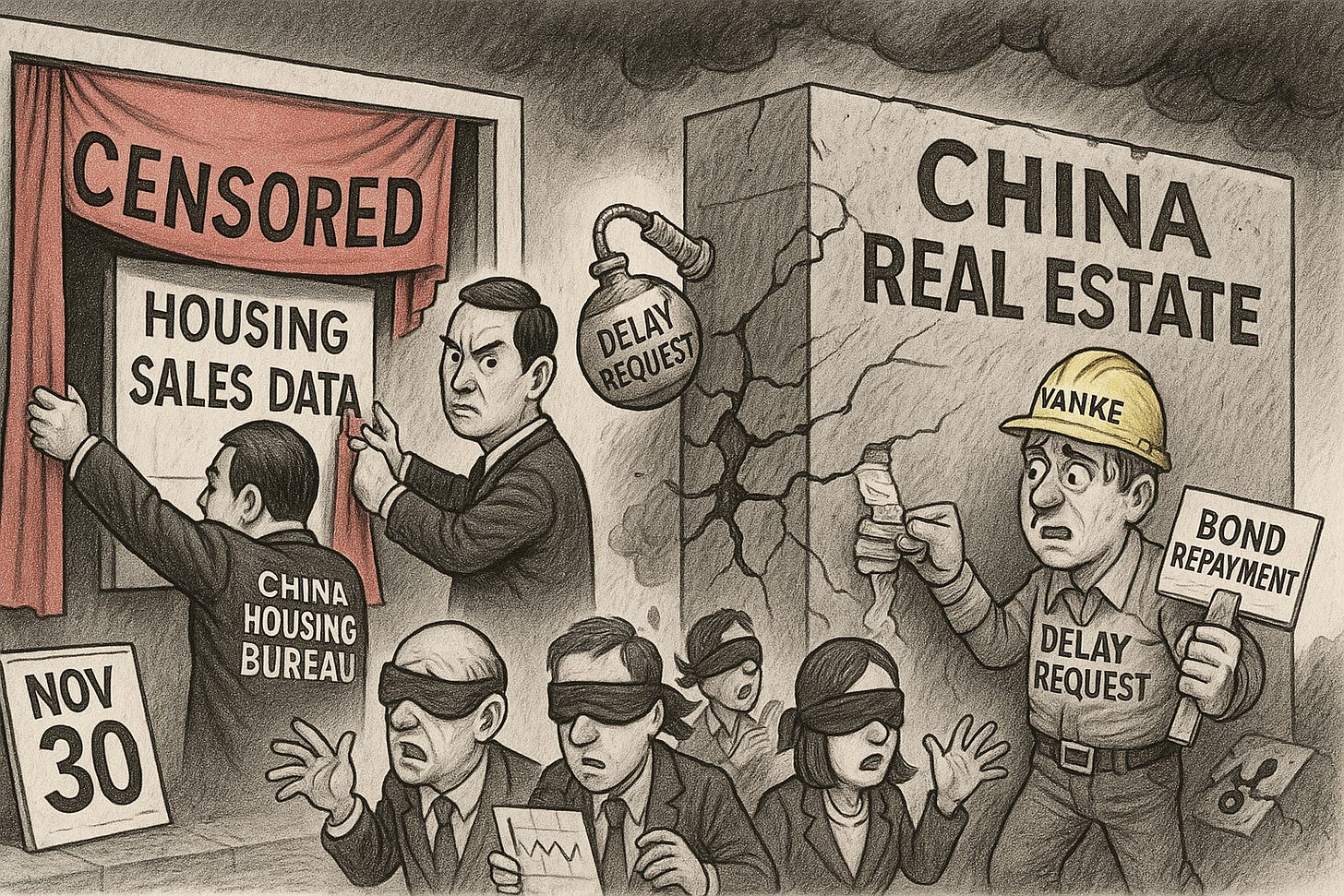

🛑 China Goes Dark on Housing Data

China’s housing bureau has ordered the country’s two leading private data agencies to stop publishing monthly sales figures for the top 100 developers. This blackout hit on November 30, effectively blinding retail investors to real-time market health. The timing is aggressive: it arrived just days after Vanke, a massive state-backed developer historically viewed as a safe haven, asked to delay repayment on a 2 billion yuan ($282.5 million) onshore bond. That distress signal sent Vanke’s 2027 bonds crashing from 85 cents on the dollar to roughly 40 cents in under a week (Yahoo)

This combination of data suppression and blue-chip distress changes the risk calculation for the entire sector. Vanke is 30% state-owned, implying that even government-linked giants are no longer immune to the liquidity crunch. The silence from the data providers is loud; the last public figures showed October sales collapsing 41.9% year-over-year, the worst drop in 18 months. Hiding the November numbers suggests the data likely deteriorated further. JPMorgan analysts note that historically, nearly every Chinese developer requesting a bond extension has eventually defaulted, suggesting this specific crisis has room to run.

Sensei’s Insight: Data blackouts often mask systemic cracks, mirroring the early signals we saw before the Evergrande contagion spread. Vanke was the “safe” firewall; if it breaches, the containment narrative fails. Watch the Yuan (CNY) and Chinese sovereign bonds, instability there signals this is leaping from a real estate problem to a broader macro crisis.

🏦 The Hidden Bottleneck Threatening the Options Boom

The US options market has a serious plumbing problem. While trading volumes have soared 52% year-over-year to hit record highs, the infrastructure supporting those bets is getting dangerously top-heavy. New data reveals that a “Concentrated 5” group of banks, including heavyweights like Goldman Sachs and Bank of America, now guarantee nearly half of all trades at The Options Clearing Corp (OCC). This small cadre acts as the ultimate backstop for the entire derivatives market. The strain is becoming tangible. Bank of America has already doubled its clearing fees for some clients from roughly 2 cents to 4 cents per contract just to manage the escalating risk.

Think of this as a narrow doorway for a very crowded room. Market makers (like Citadel) don’t always clear their own trades; they effectively “rent” balance sheets from these few banks to keep liquidity flowing. If one of these clearing members stumbles, think MF Global in 2011, or simply decides to retreat due to capital constraints, the liquidity you rely on vanishes. We are already seeing the “cost of doing business” rise with fee hikes. In a worst-case scenario, a failure among the “Concentrated 5” wouldn’t just hurt bank stocks, it could freeze the options market entirely because the OCC’s safety net relies on the very banks that would be in trouble.

Sensei’s Insight: Don’t ignore the “boring” plumbing. If you see sudden, unexplained widening in bid-ask spreads on major ETF options, it signals these clearing banks are tapping out. Watch for regulatory caps on leverage next.

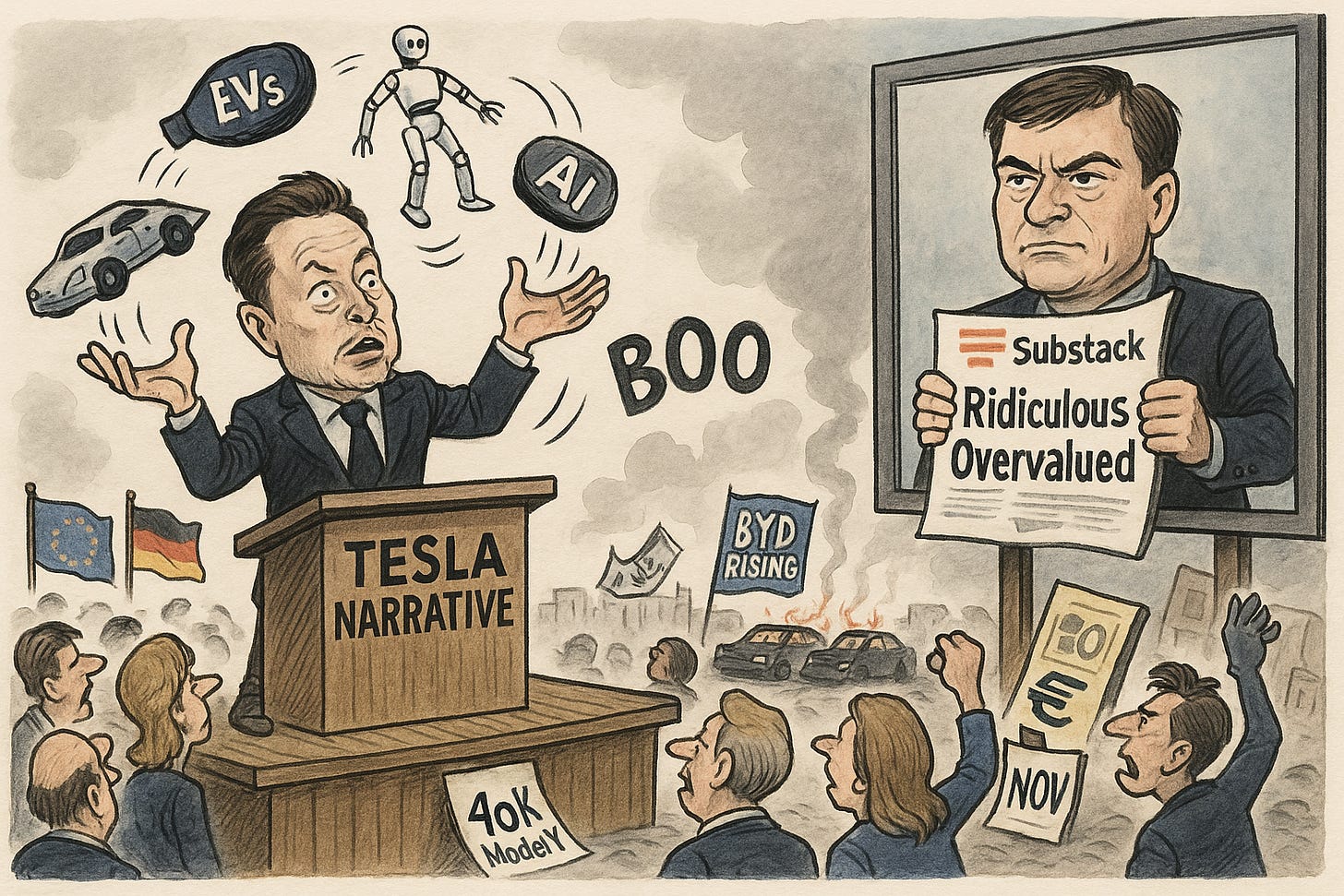

🚨 Tesla’s Double Blow: Sales Crash & Burry’s “Big Short”

November brought a brutal reality check for Tesla. Registrations collapsed 58% in France and 59% in Sweden, with Denmark dropping 49% a massive deterioration in key markets (despite a record-breaking outlier month in Norway). Adding fuel to the fire, “Big Short” legend Michael Burry released a scathing Substack post Sunday calling Tesla “ridiculously overvalued.” Burry slammed the “Elon cult” for constantly pivoting narratives, from EVs to robots, whenever competition heats up, warning that Musk’s $1T pay package will only dilute shareholders further (Reuters)

This combination of poor fundamentals and high-profile bearishness suggests a “reputational discount” is finally hitting the stock. Following Musk’s political controversies, European sentiment has cratered, evidenced by an arson attack destroying 24 Teslas in France last month. Burry’s thesis aligns with this data: he argues the valuation assumes a dominance that is rapidly evaporating as Chinese rivals like BYD capture defectors. While a cheaper €40k Model Y just launched, it arrived too late to save November, leaving the stock vulnerable to Burry’s narrative that the growth story is broken.

Sensei’s Insight: Watch the December data for the new “budget” Model Y impact. If aggressive price cuts fail to reverse these registration drops, Burry’s “overvalued” thesis moves from contrarian opinion to market consensus.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive: 🇯🇵 Global Liquidity Shock: The Yen Carry Trade Unwind Meets Structural Fragility

Global markets are currently digesting a “perfect storm” scenario where macroeconomic policy shifts are colliding with specific structural weaknesses in the crypto ecosystem. The core narrative driving the current sell-off, which saw Bitcoin dip to nearly $86,000 and Ethereum below $2,800, is the potential end of Japan’s three-decade-long zero-interest-rate policy. Bank of Japan (BOJ) Governor Kazuo Ueda has signaled a decisive shift toward tightening. This threatens to reverse the “yen carry trade,” a massive source of global liquidity that has historically supported risk assets. Simultaneously, the crypto market is facing internal pressure from record ETF outflows and credit warnings regarding Tether (USDT) and Strategy Inc. Sophisticated investors are not viewing this as a simple correction. They are analyzing it as a repricing of global liquidity conditions.

Key Drivers & Analysis

1. The Macro Pivot: Japan Turns Off the Spigot

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.