Morning Forecast: Friday, 16 January

The Cost of Power in an AI-Driven World

This content is for informational and educational purposes only and does not constitute financial advice. Always do your own research. Not financial advice (NFA).

👀 Today’s Stories at a Glance

⚡ Tech giants forced to fund power: Trump mandates tech firms finance $15 billion in new plants to fix grid shortfalls.

⚛️ Meta launches trillion-dollar compute plan: Zuckerberg commits massive capital to AI data centers, pivoting toward sovereign wealth and nuclear power.

🚀 TSMC profit smashes market expectations: Record earnings and massive CapEx hikes signal a multi-year structural shift in global AI demand.

🇬🇱 NATO allies defend Greenland borders: European troops deploy to Nuuk, signaling a major diplomatic fracture over U.S. annexation ambitions.

🏎️ Porsche sales hit record slump: China delivery collapses and EV cooling trigger a sharp 10% decline, threatening luxury margins.

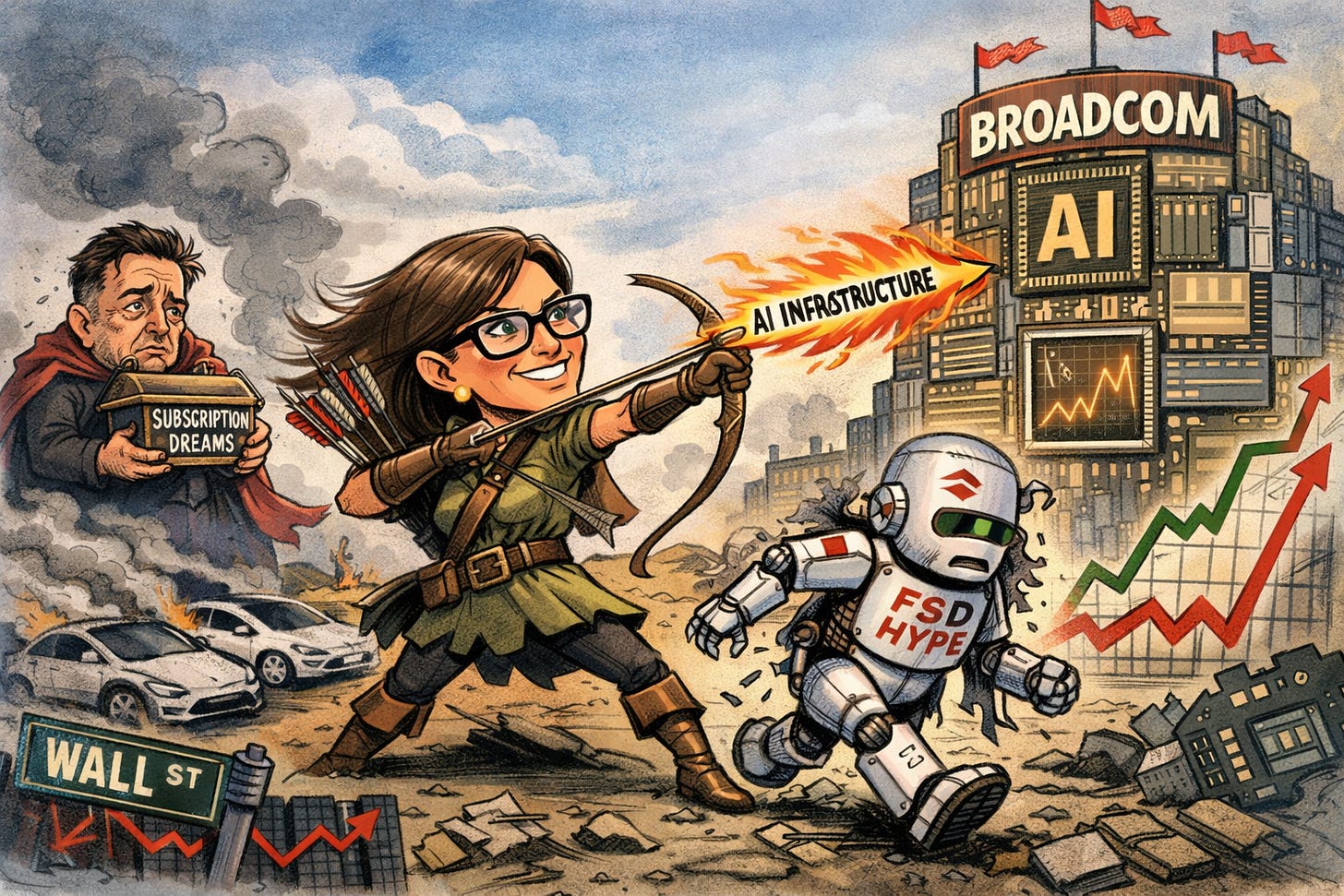

🔍 ARK pivots to custom silicon: Wood dumps Tesla for Broadcom, betting on infrastructure backlogs over speculative autonomous software narratives.

🧠 One Big Thing

ARK Invest is reallocating capital from consumer AI applications to the foundational hardware layer of the semiconductor industry. The firm liquidated $38.5 million in Tesla shares to deepen its stake in Broadcom, a leader in custom artificial intelligence accelerators. This shift reflects Tesla's struggle to monetize autonomous software versus Broadcom’s ironclad $73 billion contracted backlog. As hyperscalers move away from generic chips, Broadcom’s role in designing proprietary silicon creates a structural competitive advantage through ecosystem lock-in. This pivot signals a transition where institutional conviction favors physical infrastructure over speculative software growth narratives. For investors, the primary value has moved from disruptive potential to the predictable revenue of the companies building the actual AI machinery (more in today’s deep dive section).

⚖️ Fear & Greed

📉 The Number That Matters

$50.7 MILLION

ARK Invest executed a $50.7 million purchase of Broadcom shares, pivoting away from Tesla to capture the custom AI semiconductor boom. The move targets Broadcom’s $73 billion contracted backlog as hyperscalers move toward proprietary silicon and locked-in infrastructure ecosystems.

⚔️ Winners vs Losers

Winners

CGTL 0.00%↑: Creative Global Technology Holdings Limited shares surged following a strategic AI partnership breakthrough and expansion into the European market.

IBRX 0.00%↑: ImmunityBio, Inc. shares climbed after Saudi FDA accelerated approval for ANKTIVA and a reported 431% year-over-year increase in product revenue.

SNDK 0.00%↑: Sandisk Corporation shares rose due to a data center NAND shortage and disciplined supply management sustaining the company’s pricing power.

WDC 0.00%↑ : Western Digital shares moved higher in sympathy with a strong earnings report from TSMC which recorded a 35% profit jump.

Losers

SGML 0.00%↑: Sigma Lithium Corporation declined after Brazil waste pile restrictions threatened its sole operational asset, despite an $11M fines sale.

THH 0.00%↑: TryHard Holdings Limited plummeted after a put-share agreement created significant shareholder dilution risk alongside negative operating margins.

NVX 0.00%↑: NOVONIX Ltd shares fell as the Brazil Labor Ministry shut down waste piles, though the minor move suggests the market already priced challenges.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $95,393 (▼ -0.23%)

Ethereum (ETH): $3,302 (▼ -0.52%)

XRP: $2.06 (▼ -0.72%)

Equity Indices (Futures):

S&P 500: $6,961 (▲ 0.22%)

NASDAQ 100: $25,862 (▲ 0.61%)

FTSE 100: £10,235 (▲ 0.10%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.18% (▲ 0.10%)

Oil (WTI): $60 (▲ 1.08%)

Gold: $4,613 (▼ -0.07%)

Silver: $91.14 (▼ -1.34%)

Data as of UK (GMT): 11:48 / US (EST): 06:48 / Asia (Tokyo): 20:48

✅ 5 Things to Know Today

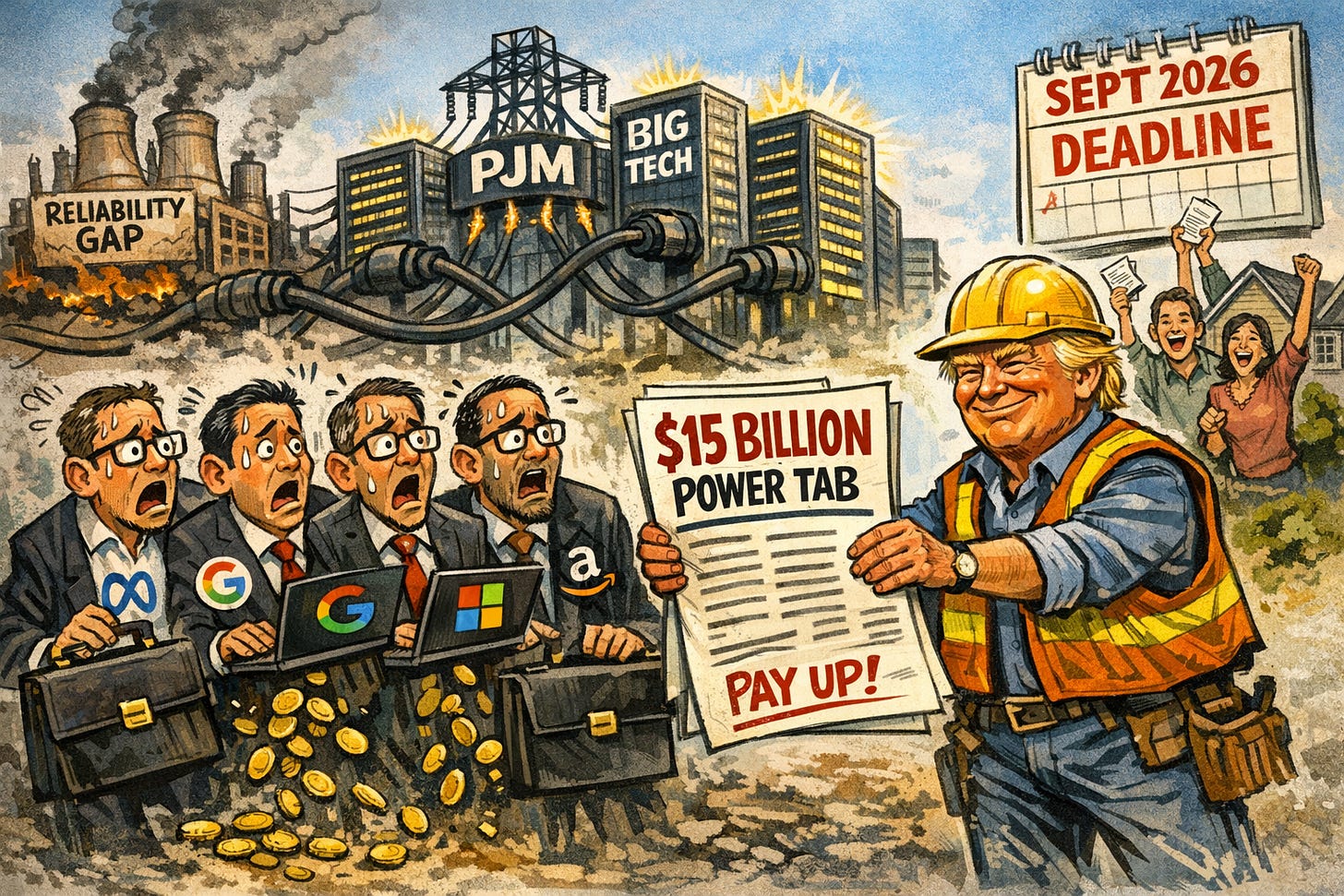

⚡ Trump Forces Tech to Foot the Power Bill

On January 16, 2026, the Trump administration and a bipartisan group of governors from Pennsylvania, Ohio, Virginia, and Maryland issued a directive for an emergency electricity auction targeting the PJM Interconnection. This move forces tech giants and hyperscalers to bid on 15-year contracts to finance approximately $15 billion in new power plants. The intervention follows a massive 6.6 gigawatt shortfall in the December 2025 capacity auction, which left the grid serving 67 million people without enough power to meet its reliability margins. By shifting the financial burden of new generation to data centers, the administration aims to stop the “unjust wealth transfer” from residential ratepayers to Big Tech (Bloomberg).

This isn’t just about policy, it’s a structural reset for the energy market. With average U.S. electricity prices hitting a record 18.07 cents per kilowatt-hour, retail investors should watch the “pay their own way” doctrine. This setup favors established nuclear and gas players like Constellation Energy (CEG) and Talen Energy (TLN), who now have a 15-year visibility on revenue that’s rare in this sector. However, the costs could squeeze margins for smaller AI infrastructure firms like Nebius or CoreWeave that can’t absorb these premiums. If PJM complies by the September 2026 deadline, it sets a precedent for every other grid operator facing an AI-driven power crunch.

Sensei’s Insight: Watch the PJM board’s response. They weren’t invited to the announcement, and their cooperation is the only thing standing between this plan and a protracted legal battle over grid independence.

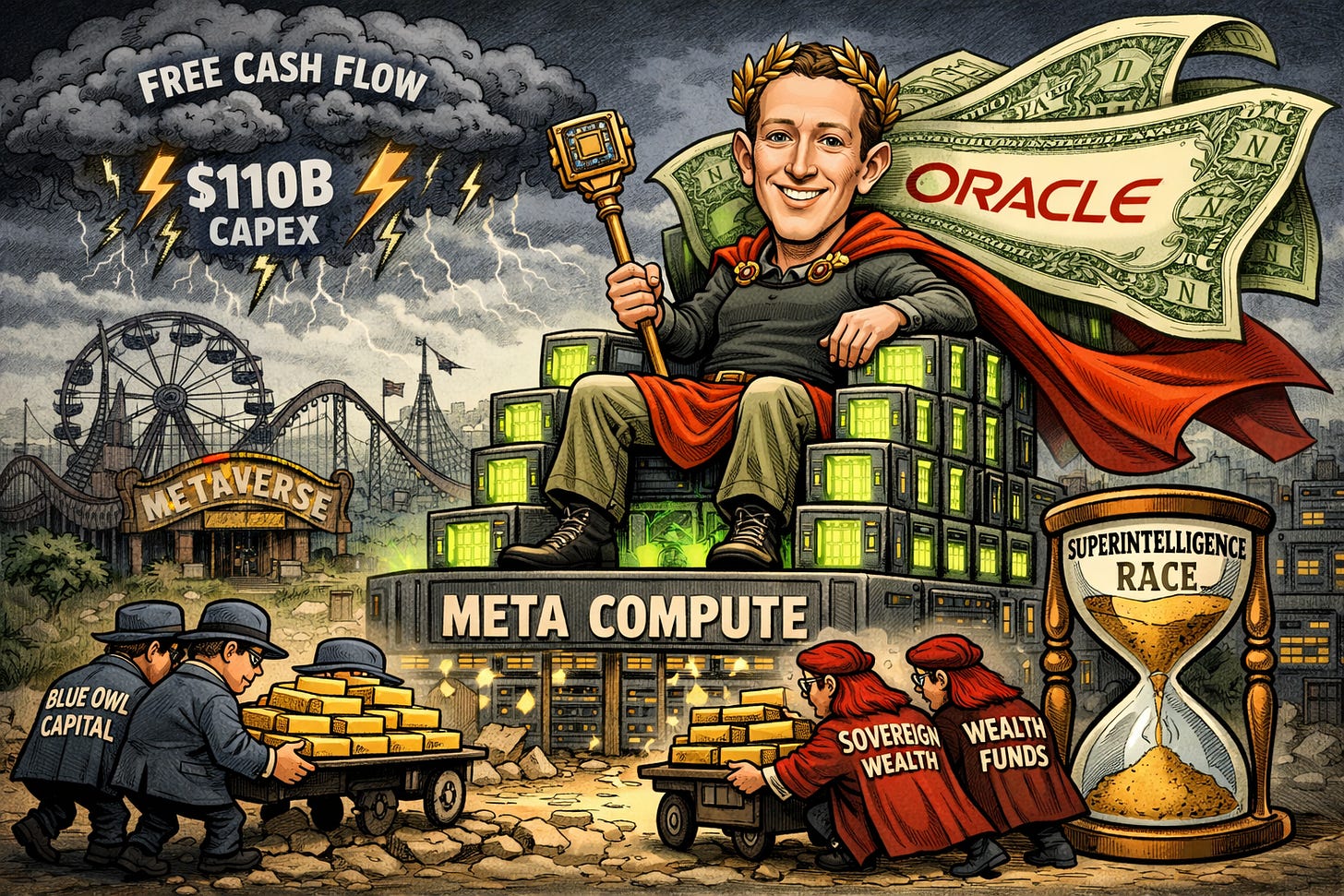

⚛️ Zuck’s Trillion-Dollar Power Play

Mark Zuckerberg just launched “Meta Compute,” a massive initiative to build out AI data centers at a scale that makes the “Metaverse” look like a side project. On January 13, 2026, Meta committed to constructing tens of gigawatts of capacity this decade, with plans for hundreds more over time. To put the math in perspective, a single gigawatt of Nvidia-powered capacity costs roughly $50 billion, meaning Meta’s 2030 target of 20+ gigawatts implies a capital requirement exceeding $1 trillion. This staggering figure is roughly equal to the entire market cap of Oracle. To fuel this, Meta hired Dina Powell McCormick as President and Vice Chairman, a role vacant since 2012, to tap into Middle Eastern sovereign wealth and her deep ties to the Trump administration (Barron’s).

This isn’t just a spending spree, it’s a fundamental shift in how tech giants finance their futures. Meta is already burning cash, with 2026 capex expected to jump 55% to around $110 billion, causing free cash flow to potentially plummet from $45 billion to $20 billion. To manage this without wrecking the balance sheet, Meta is using creative financial engineering, like its $27 billion joint venture with Blue Owl Capital. In that deal, Meta owns only 20% of the facility but maintains full operational control, essentially converting massive upfront costs into manageable lease payments. By securing 6.6 gigawatts of nuclear power through deals with Vistra and Oklo, Meta is ensuring that even if the grid struggles, its pursuit of superintelligence won’t lose power.

Sensei’s Insight: watch the free cash flow margins. Zuckerberg is betting that the risk of being second to superintelligence is far higher than the risk of overspending on nuclear-powered servers.

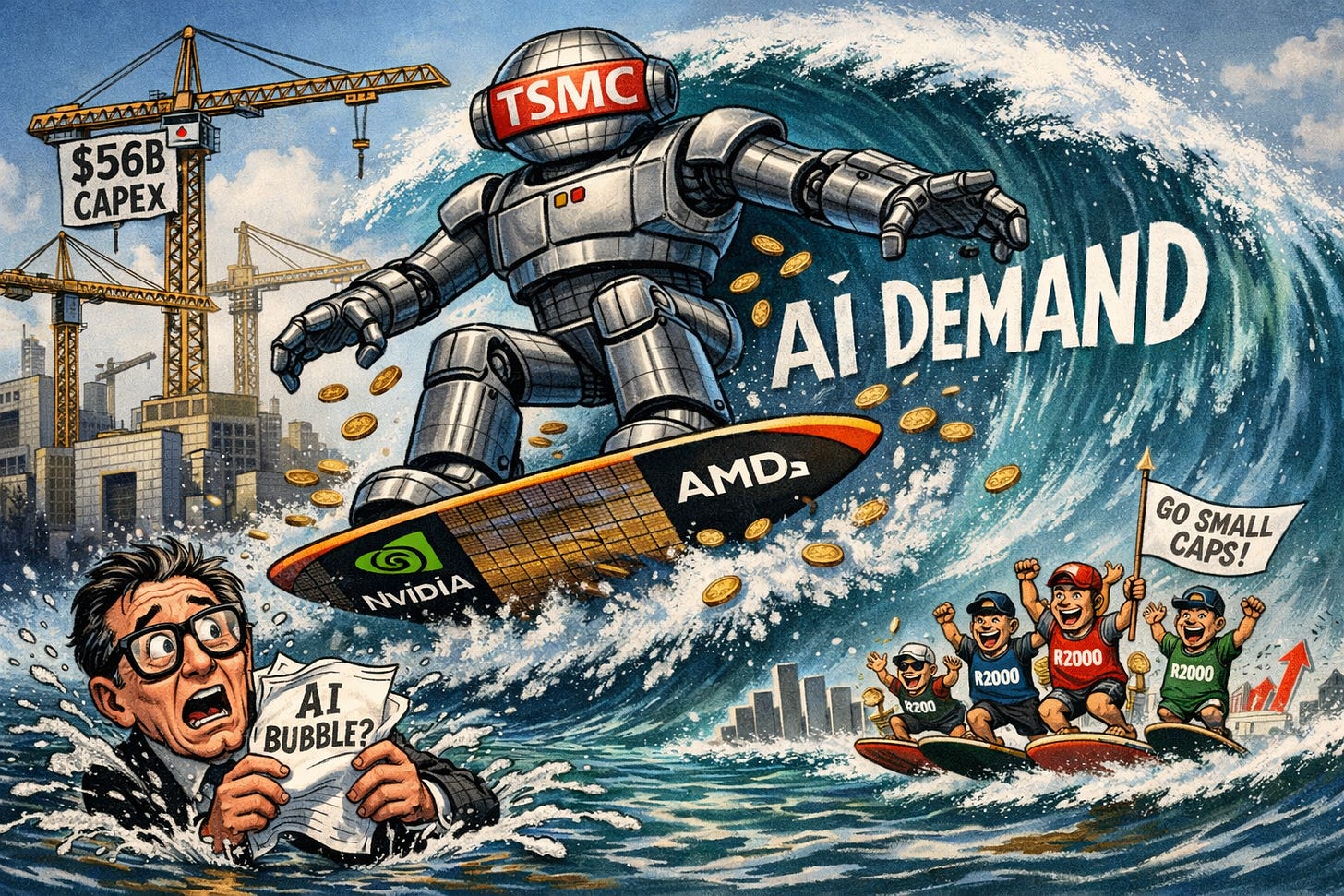

🚀 TSMC Smashes Skepticism with an AI Growth Spurt

Taiwan Semiconductor Manufacturing Co. (TSMC) just handed the market a reality check on the AI trade, reporting a record net profit of $16 billion for Q4 2025—a 35% jump from last year. Revenue hit $33.7 billion, pushing the company’s full-year total past the $1 trillion mark. More importantly, TSMC isn’t just riding a wave; they’re building a bigger one, forecasting annual AI-related revenue growth of 55% to 59% through 2029. To support this, they’re hiking capital expenditures by up to 37% this year, a massive signal that the demand for high-performance computing isn’t a flash in the pan but a multi-year structural shift (CNBC).

This matters because TSMC is the ultimate gatekeeper for companies like Nvidia and AMD. When they spend $56 billion on new capacity, it suggests they have ironclad visibility into future orders. The report didn’t just lift chipmakers; it triggered a “rising tide” effect, helping the Russell 2000 small-cap index maintain its 7.8% year-to-date lead over the S&P 500. This broadening of the market suggests investors are finally finding the confidence to rotate into cheaper, economically sensitive stocks without feeling like they have to abandon the tech narrative. It’s a rare moment where the “AI bubble” talk is being replaced by hard, record-breaking numbers.

Sensei’s Insight: Watch the semiconductor equipment makers like ASML and Applied Materials next. TSMC’s massive CapEx hike is essentially a pre-order for their machines, suggesting the equipment sector has a long runway ahead.

🇬🇱 NATO Allies Draw a Line in Greenland

Europe is sending a pointed message to Washington by putting boots on the ground in Greenland. France just deployed mountain infantry to Nuuk and plans to open a consulate by February 6. Germany, Sweden, and the U.K. are joining in with reconnaissance teams and Arctic exercises. It’s a symbolic move meant to complicate President Trump’s stated ambition to “acquire” the island for national security. While the troop numbers are small, the friction is massive. Danish Prime Minister Mette Frederiksen warned that any attempt by the U.S. to seize the territory could effectively end the NATO alliance (Wall Street Journal).

For investors, this isn’t just a quirky diplomatic spat. It’s a “fat tail” risk that’s already hitting the tape. European defense stocks like BAE Systems and Rheinmetall are seeing renewed strength as markets bet on a multi-year surge in Arctic security spending. Gold has also climbed to record levels, signaling that investors are seeking protection against a structural fracture in the post-war order. We’re seeing a first for NATO: members deploying forces not to deter Russia, but to raise the political cost of action by their own biggest ally. Watch for how the proposed U.S.-Danish security working group handles these “fundamental disagreements” without triggering a flight from European assets.

Sensei’s Insight: Keep a close eye on European defense indices and gold prices. If the “annexation” rhetoric escalates, it may signal a sharper move toward safe-havens and a re-rating of Nordic sovereign risk.

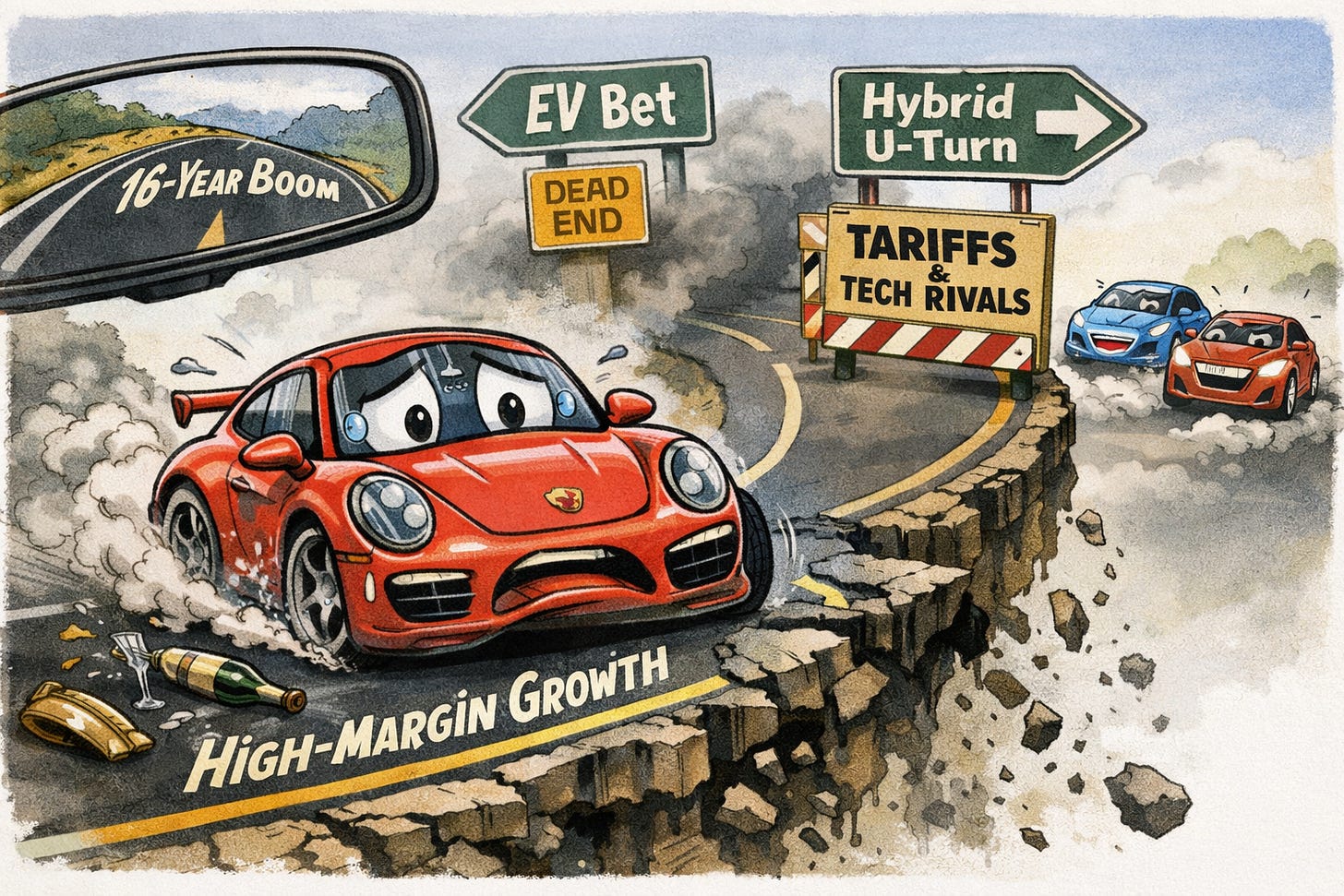

🏎️ Porsche’s Record Slump Signals Luxury Sector Stress

Porsche just reported a 10% drop in vehicle deliveries for 2025, moving 279,449 units compared to over 310,000 the year prior. It’s the sharpest annual decline since the 2009 financial crisis, snapping a 16-year growth streak. The pain is concentrated in China, where sales plummeted 26% as local tech-heavy rivals like Huawei and BYD eat into the premium segment. Meanwhile, the flagship electric Taycan saw a 22% delivery slide, which the company blames on a global cooling of EV adoption. Even home turf wasn’t safe, with German deliveries falling 16% as the brand grappled with “supply gaps” caused by phasing out older models before electric replacements were fully ready '(Bloomberg).

This isn’t just a bad year for car geeks: it’s a warning shot for the broader luxury market. Porsche’s struggles suggest that even the “recession-proof” affluent consumer is pulling back, especially as used Taycans lose 50% of their value in just two years. The company is now in a tight spot, facing a 15% U.S. import tariff while trying to pivot back to hybrids and combustion engines after overcommitting to an all-electric future. For investors, the concern is margin compression. Porsche once boasted 17-19% margins, but analysts now expect those to tighten to 10-15% as the company maintains two different production technologies at once.

Sensei’s Insight: Watch the 2026 margin guidance. If Porsche can’t protect its premium pricing power against Chinese tech rivals and U.S. tariffs, its status as a high-margin luxury outlier is at risk.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_live_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

🔍Deep Dive: ARK’s Strategic AI Pivot: From Tesla Optionality to Custom Silicon Conviction

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.