Morning Forecast: Friday, 2 January

Why electricity now limits AI growth, Chinese chipmakers gain ground, Baidu unlocks value via Kunlunxin, housing stalls despite lower rates, 2026 optimism builds, and Berkshire waits patiently.

This content is for informational and educational purposes only and does not constitute financial advice. Always do your own research. Not financial advice (NFA).

👀 Today’s Stories at a Glance

⚡ AI power bottleneck shifts: Silicon demand remains steady, but electricity shortages and grid delays now limit hyperscaler deployment capabilities.

🚀 Chinese AI chips surge: Biren and Kunlunxin listings challenge Nvidia’s dominance as efficiency gains become the new competitive frontier.

🧠 Baidu’s Kunlunxin IPO filing signals accelerating Chinese AI chip momentum, driving share gains and shrinking conglomerate sum-of-parts discounts.

🏠 Mortgage rates hit low: Average 30-year rates dropped to 6.15%, yet high prices and low inventory continue to stall buyers.

🤖 Wall Street 2026 outlook: Institutions forecast a Goldilocks economy, but massive AI capital expenditures risk creating an infrastructure bubble.

🏢 The Berkshire leadership shift: Greg Abel takes over as CEO, managing a record $381 billion cash pile for future acquisitions.

🧠 One Big Thing

Berkshire’s Strategic Liquidity

Berkshire Hathaway has accumulated a record $381 billion cash reserve by aggressively selling equities and halting share buybacks. This massive liquidity position reflects a disciplined refusal to participate in an overpriced market where primary valuation metrics exceed historical crisis levels. The strategy leverages profitable insurance float to maintain a capital cushion that thrives during volatility. For investors, this capital represents strategic readiness rather than simple hoarding. It grants new CEO Greg Abel the unique ability to execute massive acquisitions if market prices drop. This positioning prioritizes institutional patience over immediate performance. For more see deep dive section in this newsletter.

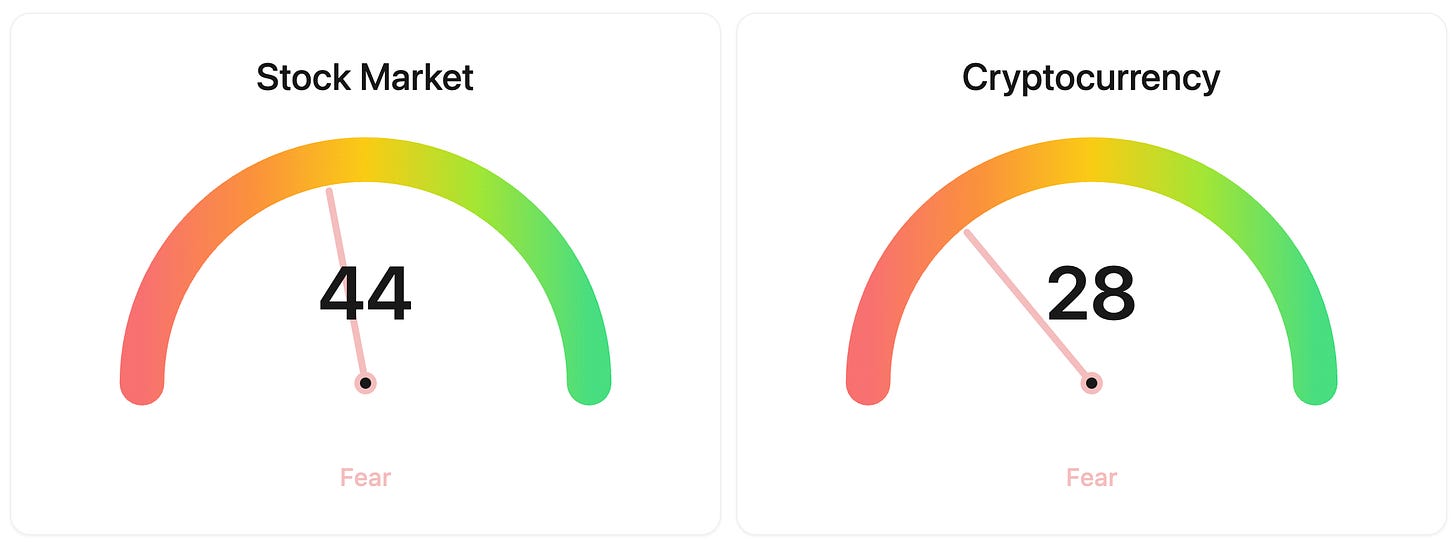

⚖️ Fear & Greed

📉 The Number That Matters

6.15%

Freddie Mac reported the average 30-year fixed mortgage rate hit 6.15%, a yearly low for 2025. Following three Federal Reserve cuts, this 6.15% level represents the most favorable borrowing environment since the decade began.

⚔️ Winners vs Losers

Winners

SOC +21.95%: Sable Offshore Corp. rallied following federal approval to restart the Las Flores Pipeline, clearing a path for the company to resume production operations.

DGNX +21.10%: Diginex Limited climbed as it appeared to track a broader speculative rally in the cryptocurrency and technology sectors.

SIDU +19.43%: Sidus Space, Inc. maintained upward momentum following the closing of a $16.2 million offering and a massive $151 billion Missile Defense Agency contract.

SLS +14.32%: SELLAS Life Sciences shares rose on investor anticipation regarding upcoming Phase 3 REGAL study clinical data.

BIDU +12.10%: Baidu, Inc. surged after announcing a planned Hong Kong IPO for Kunlunxin, its artificial intelligence chip business unit.

DVLT +12.04%: Datavault AI Inc. moved higher ahead of a January 7 record date for a special dividend involving warrants and digital collectibles.

ASST +7.05%: Strive, Inc. shares rose in a speculative small-cap rotation favoring tech and AI sectors.

ASML +4.74%: ASML Holding NV gained as semiconductor equipment stocks rallied in response to positive AI chip news from Baidu.

BABA +3.87%: Alibaba Group Holding rose in sympathy with Baidu amid broader optimism for the Chinese technology and artificial intelligence sectors.

MU +3.40%: Micron Technology, Inc. climbed alongside semiconductor peers as sector-wide strength followed positive news from major industry players.

Losers

OTLK -61.71%: Outlook Therapeutics, Inc. shares plunged after the FDA issued a third Complete Response Letter for its wet AMD drug candidate citing insufficient evidence.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $89,381 (▲ 0.75%)

Ethereum (ETH): $3,045 (▲ 1.51%)

XRP: $1.89 (▲ 0.58%)

Equity Indices (Futures):

S&P 500: $6,889 (▲ 0.61%)

NASDAQ 100: $25,720 (▲ 1.03%)

FTSE 100: £9,979 (▲ 0.27%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.16% (▼ -0.19%)

Oil (WTI): $57 (▼ -0.44%)

Gold: $4,394 (▲ 1.75%)

Silver: $74.43 (▲ 3.94%)

Data as of UK (GMT): 11:43am / US (EST): 6:43am / Asia (Tokyo): 8:43pm

✅ 5 Things to Know Today

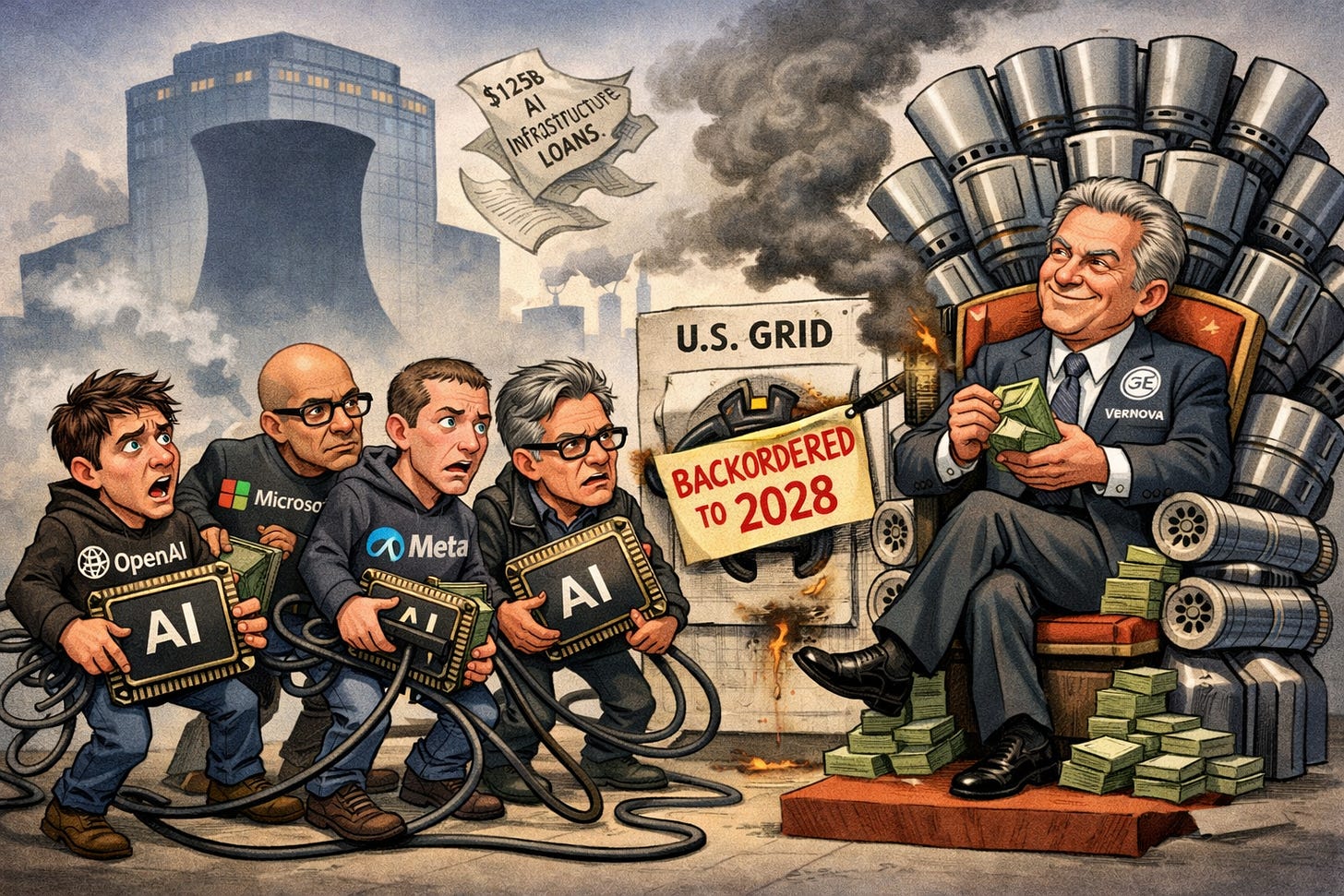

⚡ AI’s 2026 bottleneck moves from chips to electricity

We’ve spent years obsessed with Nvidia’s silicon, but 2026 is shifting the bottleneck from the chip to the socket. Hyperscalers like Microsoft and Meta are hitting a physical wall: they can’t get enough electricity. New data center designs now consume up to 1 gigawatt, which is the total output of a full nuclear reactor. While hardware demand looks steady through mid-2026, the primary power solution provider, GE Vernova, is already sold out of gas turbines through 2028. Even with SoftBank’s massive $40 billion injection into OpenAI, the chips are useless if there isn’t a grid to plug them into (Barron’s).

This matters because the AI trade is maturing into a capital-intensive industrial cycle. Data center financing exploded to $125 billion in 2025, an 8x increase from the previous year. That’s a staggering amount of debt riding on the hope that AI returns arrive before the interest payments do. If grid interconnection wait times in hubs like Northern Virginia remain stuck at seven years, hyperscalers may be forced to tap the brakes on spending. We’re entering a phase where the companies building the power “pipes” could hold more leverage than the ones making the AI “water.”

Sensei’s Insight: Watch for hyperscalers blaming “deployment delays” for lower capex. It’s often code for power shortages, which signals that the hardware supercycle is finally hitting its physical limit.

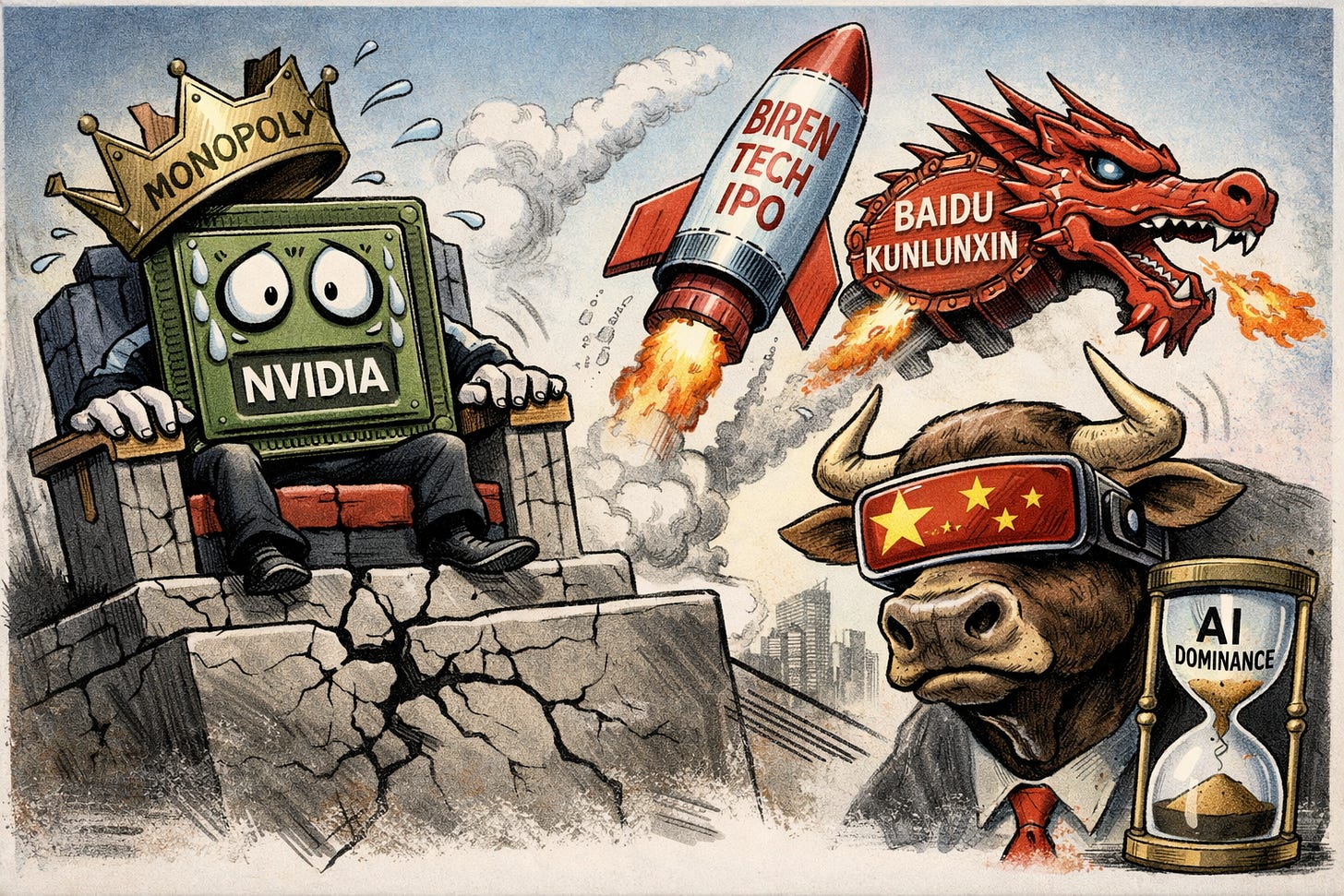

🚀 China’s AI Chip Surge Shakes Up 2026 Opening

The first full trading day of 2026 is seeing a massive shift in the AI narrative as Chinese chipmakers take center stage. Shanghai Biren Technology, a GPU designer, saw its Hong Kong IPO shares gap-open 82% higher, eventually settling up 76% at HK$34.46. This demand was fueled by an incredible retail oversubscription of 2,348 times. Simultaneously, Baidu’s AI chip division, Kunlunxin, filed for its own Hong Kong listing, sending Baidu’s stock up 12% in early trading. Amidst this, DeepSeek released a new training framework that cuts computational overhead to just 6.7%, signaling that efficiency gains could be the next frontier in the AI race (Bloomberg).

For a long time, the AI trade was basically a bet on Nvidia’s total dominance. These developments suggest that alternative stacks are becoming a legitimate threat to that monopoly, especially as China pushes for technological self-sufficiency. The 30-year Treasury yield hitting 4.88% shows investors are rotating out of safe-haven bonds and into these growth stories, buoyed by a resilient labor market. While Tesla’s 11% drop in Q4 deliveries indicates structural cooling in EVs, the market’s appetite for AI hardware remains insatiable. This represents a fundamental repricing of who controls the infrastructure necessary for the next generation of models.

Sensei’s Insight: Watch Nvidia’s pricing power in Asia. If Biren and Kunlunxin prove they can run the newest DeepSeek models at high efficiency, the "Nvidia Tax" becomes a very hard sell.

🚀 Baidu’s Kunlunxin Files for IPO as China’s AI Hardware Booms

Baidu officially moved to spin off its AI chip unit, Kunlunxin, through a confidential IPO filing in Hong Kong on January 1, 2026. This follows years of strategic preparation since the unit went independent in 2021 to attract outside capital. While financial details are currently private, Jefferies analysts estimate the company’s valuation between $16 billion and $23 billion. The news sent Baidu’s ADRs up 12% in premarket trading as investors realize the parent company’s 59% stake could be worth nearly $12 billion alone. This move coincides with a massive market “proof-of-concept” from competitor Shanghai Biren Technology, which saw its shares explode over 75% in its Hong Kong debut today (Bloomberg).

This surge in domestic AI hardware is fueled by a “perfect storm” of geopolitical friction. President Trump’s recent policy requiring a 25% US government cut on Nvidia’s H200 sales to China has effectively created a price floor for domestic alternatives. When US chips come with a 25% surcharge and political strings, Kunlunxin’s chips, optimized for Baidu’s “Ernie” model, become far more attractive on a price-performance basis. This shift signals a significant capital rotation back into Chinese “Hard Tech.” The massive success of Biren’s IPO and Baidu’s subsequent filing suggest the Hong Kong Exchange is reclaiming its spot as the primary liquidity hub for Chinese tech, ending a long drought of major listings.

Sensei’s Insight: Watch for a valuation re-rating of Chinese tech conglomerates. As Kunlunxin and Biren prove the domestic chip thesis, the “sum-of-the-parts” discount on parents like Baidu may continue to shrink.

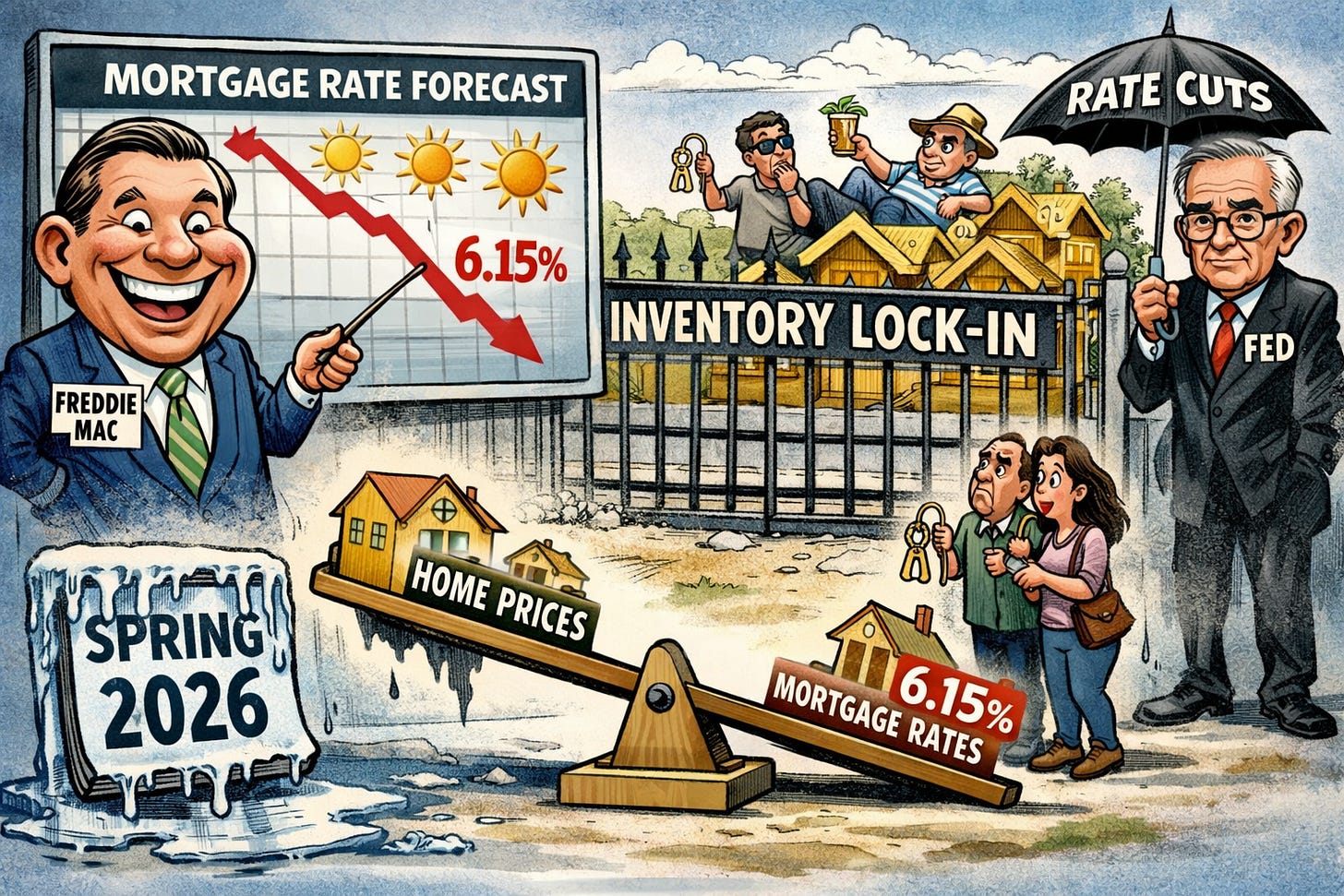

🏠 Mortgage rates hit a yearly low to end 2025

Freddie Mac just capped off the year with the average 30-year fixed mortgage rate hitting 6.15%, the lowest point of 2025. It is a notable slide from the 7% levels we saw back in January 2025. This move tracked the 10-year Treasury yield, which settled around 4.14% as the year closed. While a 0.03% weekly drop seems small, the total 85-basis-point decline across 2025 reflects the market’s reaction to the Federal Reserve’s three rate cuts, including the most recent move in December. It’s the most favorable borrowing environment we have seen since the decade began (Freddie Mac).

Lower rates usually spark a housing rally, but the inventory lock-in effect remains a massive hurdle. Many homeowners are still sitting on sub-4% rates from years ago, keeping supply tight and median home prices above $400,000. For retail investors, the story is about selection rather than a broad sector bet. Companies like Toll Brothers may show more resilience than high-volume builders like Lennar, who face tighter margins. Meanwhile, mortgage REITs like AGNC have quietly outperformed as stabilizing yields compress risk. The real test is the 2026 spring season: if Fed dissent pauses further cuts, this rate floor could quickly become a ceiling.

Sensei’s Insight: Watch the 10-year Treasury yield for a breakout above 4.2%. If inflation stalls the Fed’s momentum, mortgage rates may spike, potentially freezing the 2026 spring buying season before it starts.

🤖 The $527 Billion Bet: Wall Street’s 2026 Outlook

Wall Street’s outlook for 2026 reveals a rare level of consensus, with 60 institutions clustering S&P 500 targets between 7,000 and 8,100. This narrow 16% spread signals a collective belief in a “Goldilocks” economy, yet the underlying numbers are staggering. Goldman Sachs has revised its 2026 AI hyperscaler capital expenditure forecast to $527 billion, a significant jump from earlier estimates of $465 billion. Meanwhile, a major divide is emerging between the Federal Reserve, which projects only one rate cut, and market participants like Mark Zandi who anticipate three cuts to combat a softening labor market (Bloomberg).

This uniformity in forecasts suggests that markets may be underestimating tail risks, particularly the “infrastructure bubble” potential of half a trillion dollars in annual AI spending. If enterprise ROI doesn’t materialize, this massive debt-funded capex could pivot from an economic engine to a deflationary shock. Investors should also monitor the Bank of Japan’s move to 0.75%, as further hikes toward 1.25% may trigger a chaotic unwind of the yen carry trade. With President Trump likely to nominate a “dovish” Fed Chair by May 2026, the traditional boundary between political pressure and central bank independence faces a serious test.

Sensei’s Insight: Watch the Q1 earnings from hyperscalers closely. If the projected deceleration in capex growth from 75% to 25% happens without a corresponding surge in enterprise revenue, the “Goldilocks” narrative could evaporate quickly.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_live_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

🔍Deep Dive: 🏢 The Berkshire Shift: From Buffett’s Playbook to Abel’s Operating Machine

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.