Morning Forecast: Friday, 23 January

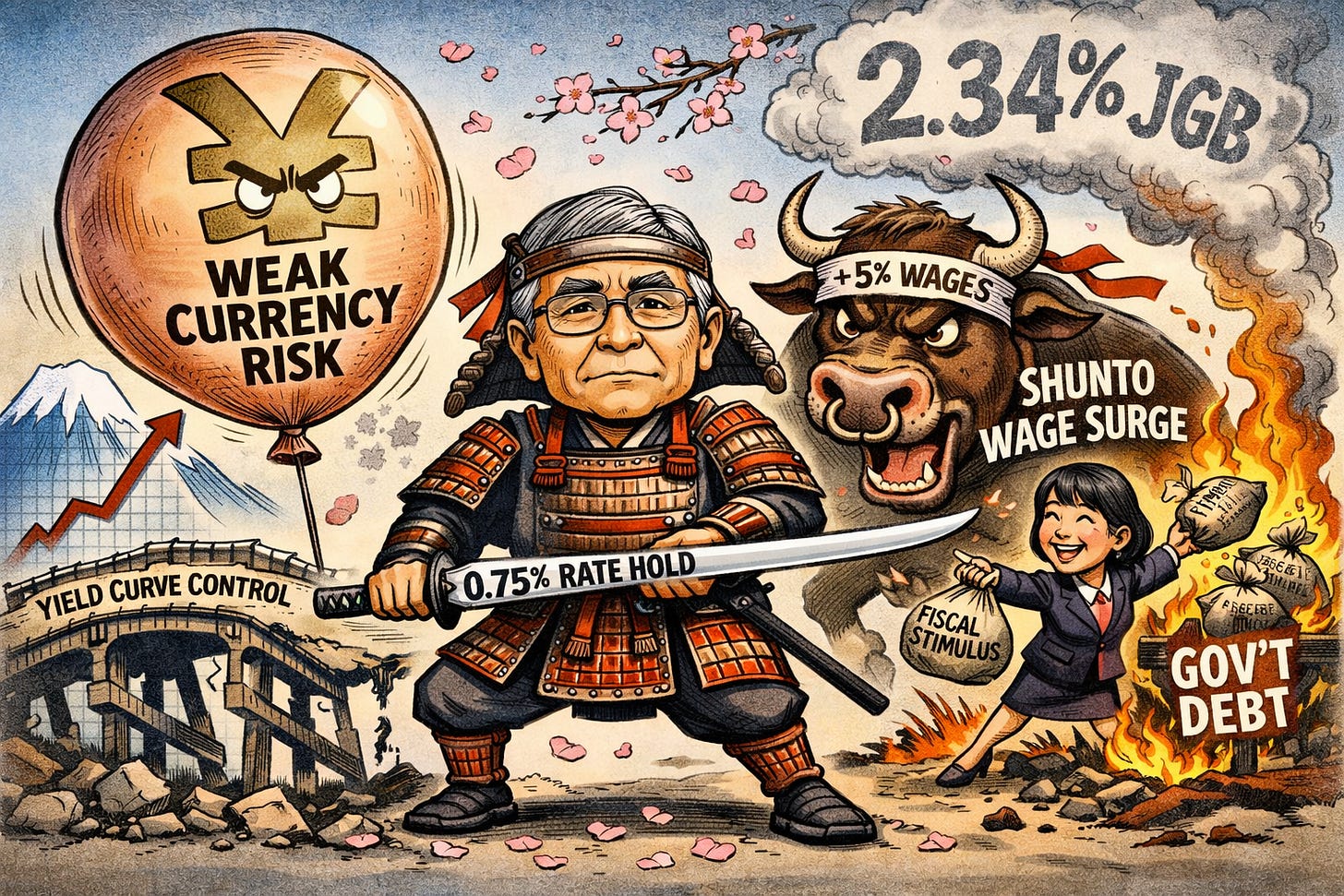

Today's BOJ Policy Meeting That Forces Markets to Reprice April

This content is for informational and educational purposes only and does not constitute financial advice. Always do your own research. Not financial advice (NFA).

👀 Today’s Stories at a Glance

📉 Intel stock crashes on guidance: Production bottlenecks outweighed strong earnings, causing a major share price plunge.

🇨🇳 China permits Nvidia H200 orders: Beijing cleared tech giants to buy chips while mandating domestic hardware pairings.

📱 TikTok deal avoids ban: ByteDance gave American investors majority control to satisfy U.S. divestiture requirements.

🌕 Gold nears record $5,000: Prices surged as central banks swapped Treasuries for safe haven bullion.

⚖️ Trump sues JPMorgan for $5B: A lawsuit claims political bias drove the bank to shutter accounts.

🇯🇵 BOJ signals more rate hikes: The bank maintained current rates while raising inflation forecasts toward 2.2%.

🧠 One Big Thing

The End of Cheap Japanese Capital

The Bank of Japan is pivoting toward aggressive tightening as structural inflation finally exceeds its 2.0 percent target. While January rates held at 0.75 percent, revised price forecasts suggest a rapid climb toward a 1.50 percent neutral rate. The bank now links future hikes to April wage results and the 160.00 yen psychological floor. By refusing to suppress surging bond yields, the bank is decoupling monetary policy from government fiscal needs. This transition signals the definitive end of subsidized Japanese capital. Global investors should expect a repatriation of funds that will tighten liquidity across all major asset classes.

⚖️ Fear & Greed

📉 The Number That Matters

2.2%

The Bank of Japan revised its 2026 core-core inflation forecast to 2.2%, signaling that price pressures are becoming entrenched. This shift above the 2.0% target provides the economic justification for an aggressive rate path and structural policy tightening.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $89,173 (▼ 0.35%)

Ethereum (ETH): $2,930 (▼ 0.70%)

XRP: $1.91 (▼ 0.70%)

Equity Indices (Futures):

S&P 500: $6,907 (▲ 0.01%)

NASDAQ 100: $25,587 (▼ 0.28%)

FTSE 100: £10,157 (▲ 0.13%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.23% (▼ 0.56%)

Oil (WTI): $61 (▲ 1.48%)

Gold: $4,937 (▼ 0.02%)

Silver: $99.17 (▲ 3.12%)

Data as of UK (GMT): 11:47 / US (EST): 06:47 / Asia (Tokyo): 20:47

✅ 5 Things to Know Today

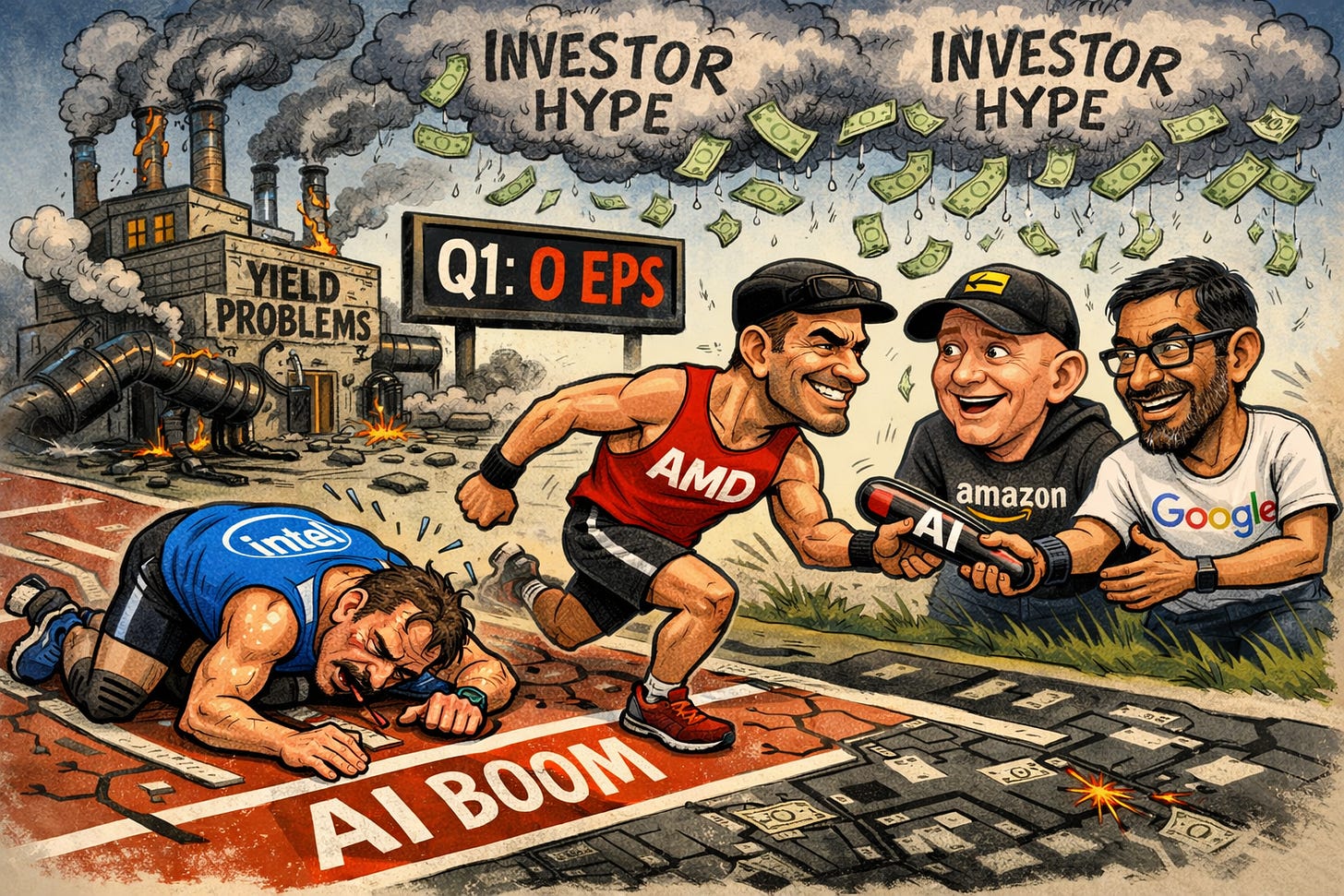

📉 Intel’s 13% Plunge Re-ignites Tech Sector Anxiety

Intel shares collapsed 13% in premarket trading on Friday, January 23, 2026, after a stark disconnect in its earnings report. While the company technically “beat” Q4 expectations with $13.7 billion in revenue and $0.15 adjusted EPS, its guidance for the first quarter of 2026 was a total letdown. Intel projected breakeven earnings ($0.00 EPS) on revenue of $11.7–$12.7 billion, missing Wall Street’s $12.55 billion consensus. This erased a 16% rally from the prior week, dragging the stock back down to $47 and pressuring the broader Nasdaq as investors digest a second straight week of market declines (Reuters).

This isn’t just a “miss” on the numbers, it’s a supply-side crisis during a demand boom. Intel management admitted that while demand for AI-linked server processors is accelerating, the company simply can’t manufacture enough chips to keep up. Its “wafer yields”—the percentage of usable chips from a production run—are struggling, forcing a gross margin forecast of just 32.3%, a historic low for the firm. For retail investors, this is the red flag: when a titan like Intel can’t convert a massive AI tailwind into profit because of manufacturing bottlenecks, it suggests the broader “AI gold rush” may hit a wall of physical reality.

Sensei’s Insight: Watch if customers like Amazon and Google migrate to AMD due to Intel’s supply shortages. If Intel loses the “hyperscalers” now, they might not come back once production recovers.

🇨🇳 China’s conditional green light for Nvidia’s H200

Beijing just gave the “in-principle” nod for Alibaba, Tencent, and ByteDance to start planning major orders for Nvidia’s H200 chips. It’s a significant shift after weeks of silence, but it’s far from a blank check. These tech giants are looking to snag over 200,000 units each, a massive haul considering Nvidia currently only has about 700,000 units in inventory for 2026. While the US already cleared these exports with a 25% tariff, Chinese regulators held the process in limbo to extract concessions. Now, the gate is open for detailed negotiations on pricing and volume, though actual shipments are still waiting for a final sign-off (Bloomberg News).

This move is a classic piece of industrial policy. Beijing is “encouraging” these firms to buy a specific ratio of domestic AI chips from local players like Huawei or Cambricon alongside their Nvidia orders. By forcing this mix, China ensures that while its tech leaders get the high-end compute they need to stay competitive, they also provide a guaranteed revenue stream for domestic chipmakers. It’s a clever way to fund their own semiconductor ecosystem while reducing long-term dependency on Western hardware. For investors, it means the total addressable market is back on the table, but with much higher complexity and potential margin pressure due to these forced local pairings.

Sensei’s Insight: Watch the Lunar New Year deadline on February 17. If those chips aren’t cleared through customs by then, this approval might be more about geopolitical posturing than actual hardware delivery.

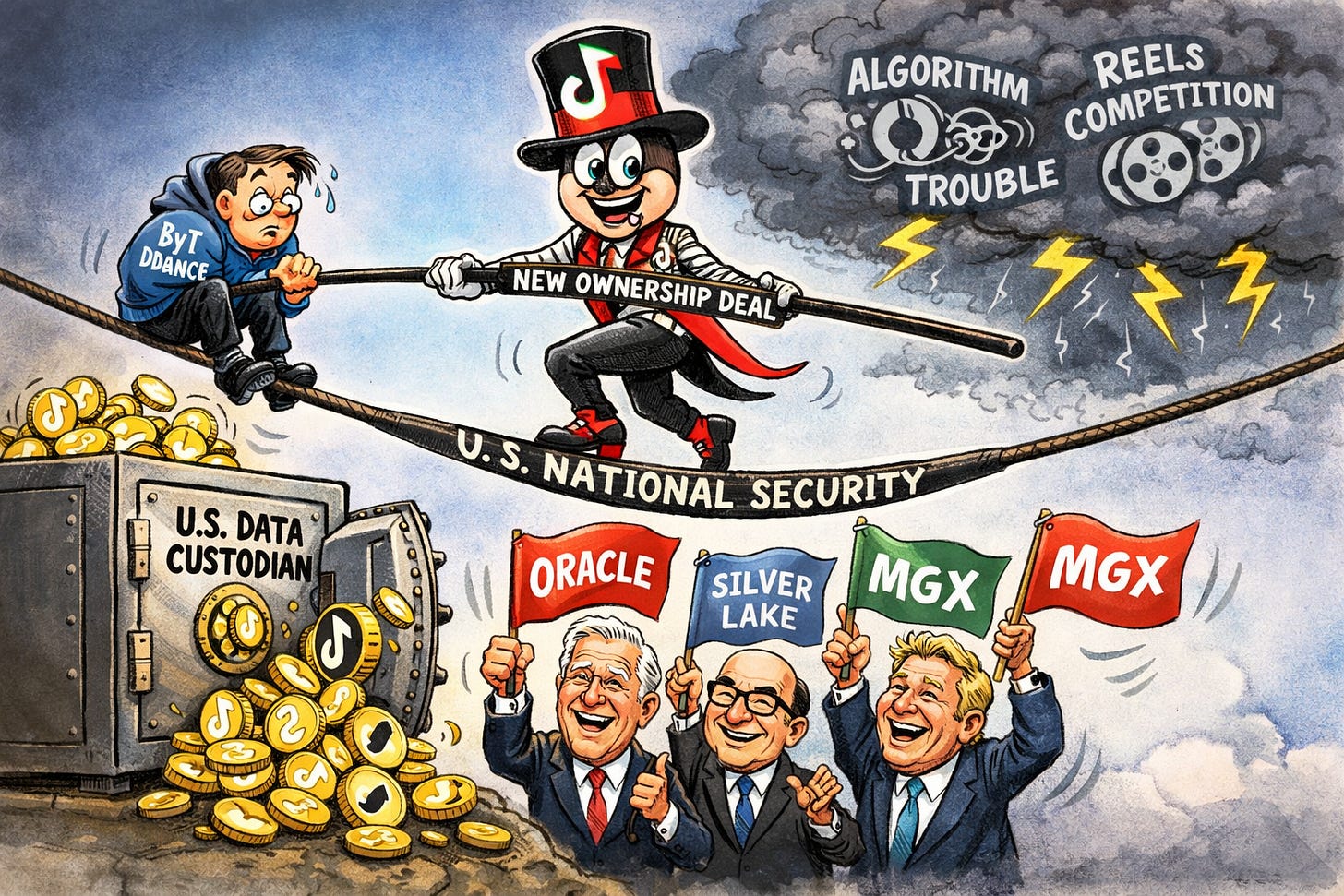

📱 TikTok Dodges the Ban Hammer

ByteDance has officially finalized a joint venture agreement to keep TikTok operating in the U.S., narrowly beating a January 23 deadline. The new entity, TikTok USDS Joint Venture LLC, hands 80.1% of its ownership to a group of American and international investors, including Oracle, Silver Lake, and MGX. Oracle and Silver Lake each took 15% stakes, while ByteDance retains a minority share of 19.9% to stay under the 20% legal limit required by the 2024 divestiture law. While the deal is valued at approximately $14 billion, significantly lower than the $50 billion analysts once predicted, it removes the immediate threat of a total shutdown for TikTok’s 200 million American users (Wall Street Journal).

The significance here is the shift from “existential threat” to “manageable policy risk.” For investors, Oracle is the clear winner: it’s now the sole custodian of U.S. user data and will review all source code. Oracle’s stock jumped 2-4% on the news as it secures a massive, recurring revenue stream from this national security cloud role. However, the platform’s secret sauce, the algorithm, faces a period of volatility. The deal requires the algorithm to be retrained exclusively on U.S. data. This transition could lead to 6-12 months of unpredictable content distribution, potentially giving Meta’s Instagram Reels a window to steal engagement if TikTok’s “For You” feed loses its edge.

Sensei’s Insight: Watch the engagement metrics over the next two quarters. If the retrained algorithm fails to mimic the original’s “stickiness,” the $14 billion valuation might actually look expensive.

🌕 Gold’s $5,000 Gravity Pull

Gold hit a record $4,967 an ounce this Friday, January 23, closing in on a massive 8 percent weekly gain. It’s not just a gold story, though: silver is flirting with $100 and the Bloomberg Dollar Spot Index just had its worst week in seven months. The catalyst is a “regime-shift” cocktail: central banks are dumping Treasuries, and the U.S. military’s recent capture of Venezuela’s president has investors spooked about a breakdown in the global rules-based order. With President Trump renewing pressure for a Greenland framework deal and the Fed chair vacancy still a mystery, the metal has already climbed 15 percent in the first three weeks of 2026 (Bloomberg News).

This isn’t a speculative bubble; it’s a structural re-rating. Central banks like Poland’s aren’t buying because they think gold is “cheap”—they’re buying to build “unstable times” portfolios, regardless of price. Even India is slashing its Treasury holdings to record lows to protect its currency against U.S. tariffs. For us, the move in miners like AngloGold Ashanti, up nearly 8 percent, shows how much leverage is tucked into this trade. Goldman Sachs just bumped its year-end target to $5,400, suggesting that even at these heights, institutional money is still looking for a place to hide from currency debasement and trade war fallout.

Sensei’s Insight: Watch the $5,000 psychological barrier. If we break it, the “FOMO” from private wealth managers could turn this steady climb into a vertical melt-up toward Goldman’s $5,400 target.

⚖️ Trump Sues JPMorgan for $5B Over “Debanking”

Donald Trump filed a $5 billion lawsuit against JPMorgan Chase and CEO Jamie Dimon on January 22, 2026, alleging the bank shuttered his accounts in 2021 based on political bias rather than financial risk. The complaint, filed in Miami-Dade County, claims the bank blacklisted Trump and his businesses—including Trump National Golf Club—just weeks after the January 6 Capitol riot. JPMorgan has denied the allegations, stating the closures were necessitated by “legal or regulatory risk” and not ideology. Despite the high-stakes legal drama, JPMorgan shares rose 1.2% following the news, as the bank simultaneously reported strong Q4 earnings of $5.23 per share (Reuters).

This case is a major test for the banking sector’s ability to navigate “reputational risk.” While banks argue they must have the autonomy to drop clients who pose compliance headaches, a 2025 executive order now restricts them from using vague “reputational” excuses to close accounts. For investors, the immediate impact is minimal because the legal bar for Trump to prove “political intent” is high. However, the discovery process could be messy, potentially exposing internal emails about how the world’s largest bank weighs political climate against its bottom line. It also provides a narrative tailwind for fintech and crypto firms positioning themselves as “neutral” alternatives to traditional finance.

Sensei’s Insight: Watch the discovery phase for leaked internal memos. Even if JPMorgan wins the legal battle, any evidence of “values-based” filtering could trigger aggressive new regulatory crackdowns on how big banks manage client lists.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_live_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

🔍 🇯🇵 Deep Dive: Japan’s April Problem - Why the BOJ Hold Was Anything But Dovish

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.