Morning Forecast: Friday, 9 January

The Jobs Data That Decides 2026, Amid Bailouts, Mergers, and Global Unrest

This content is for informational and educational purposes only and does not constitute financial advice. Always do your own research. Not financial advice (NFA).

👀 Today’s Stories at a Glance

🏠 Trump targets mortgage rates: The administration plans a $200 billion intervention to suppress borrowing costs and boost homeownership.

⛏️ Rio and Glencore eye merger: Potential $200 billion deal could create the world’s largest miner focused on energy-transition metals.

🏠 Soho House deal hits wall: A critical $200 million funding shortfall threatens the $2.7 billion plan to take the club private.

🇮🇷 Iran blackouts follow rial collapse: The regime cut internet access as hyperinflation and currency devaluation triggered widespread national protests

🏥 Republicans join ACA subsidy extension: Seventeen GOP members broke ranks to extend health subsidies, challenging leadership to avoid premium spikes.

📊 Jobs report dictates rate path: December’s employment data acts as the binary trigger for Federal Reserve interest rate cuts in 2026.

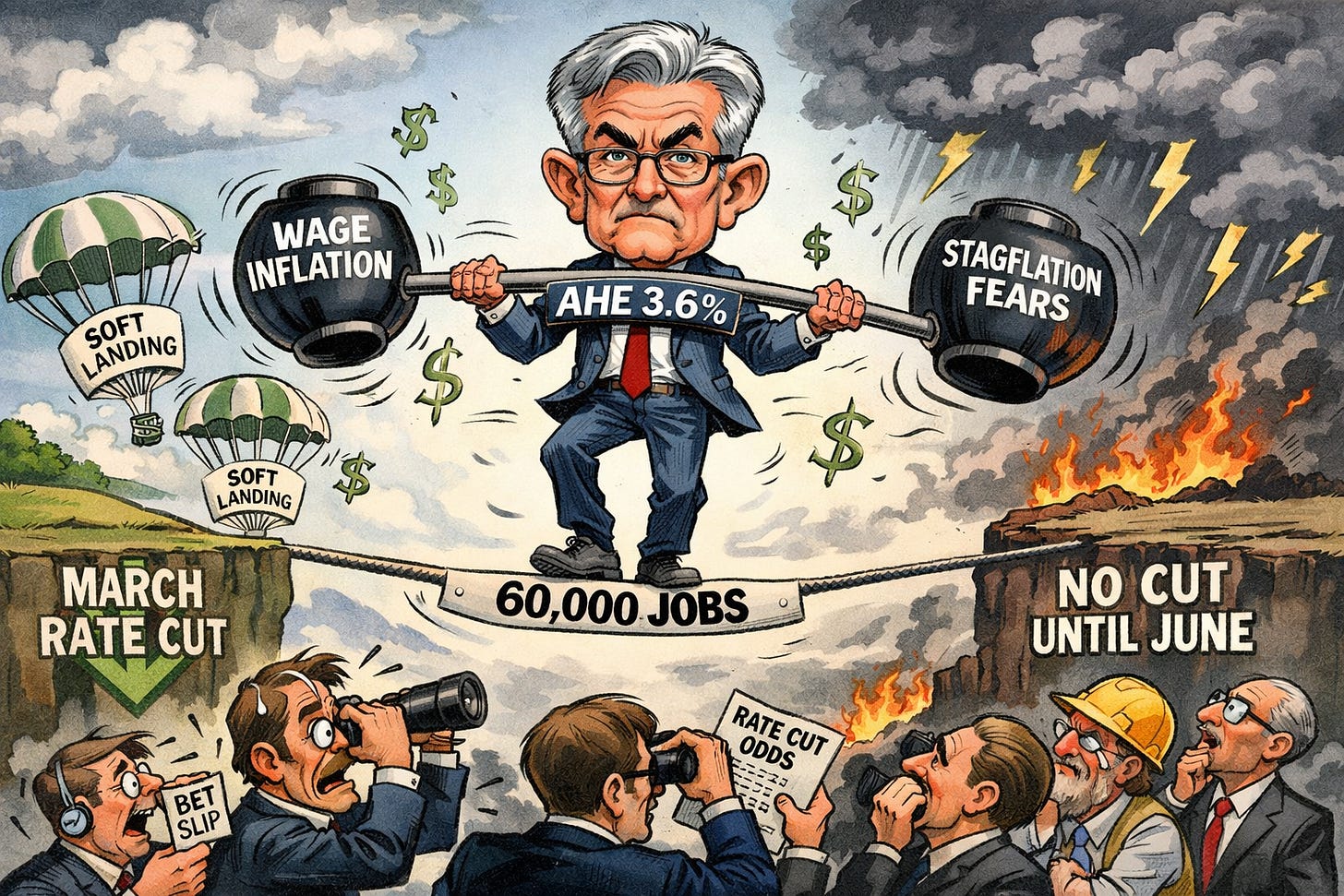

🧠 One Big Thing

The December employment report centers on a narrow shift in the jobless rate that will dictate Federal Reserve policy. Economists forecast unemployment will edge down to 4.5 percent from the peak reached in November. While payroll gains should remain positive, the central bank is prioritizing the unemployment metric to evaluate labor market health. A confirmed decline in unemployment would likely lock in a rate pause at the January meeting. By contrast, flat or rising unemployment keeps the door open to further interest-rate cuts. This report released at 08:30 ET serves as the primary signal for investors before the Fed determines interest rates for early 2026.

I will be covering this live at 12:30 GMT / 07:30 ET.

⚖️ Fear & Greed

📉 The Number That Matters

4.5%

The headline unemployment rate is expected to drop to 4.5%. A move to 4.5% would reverse November's spike, though institutions remain focused on the broader direction of travel rather than this static figure.

⚔️ Winners vs Losers

Winners

LDI 0.00%↑: loanDepot, Inc. shares surged on digital mortgage expansion momentum and positive sector tailwinds following government mortgage rate reduction plans.

KALV 0.00%↑ : KalVista Pharmaceuticals rose after reporting a strong EKTERLY launch and receiving an analyst upgrade following a 2025 revenue update.

RVMD 0.00%↑ : Revolution Medicines shares climbed following reports that Merck is in talks to acquire the company for up to $32 billion.

LPTH 0.00%↑ : LightPath Technologies gained after a Lake Street upgrade to $14 and the announcement of a $4.8 million defense order.

RKT 0.00%↑ : Rocket Companies jumped following an announcement from the Trump administration regarding a plan to reduce mortgage rates.

TLRY 0.00%↑ : Tilray Brands shares moved higher after reporting record Q2 revenue and achieving a significant net cash position.

OPEN 0.00%↑ : Opendoor Technologies rallied following the appointment of new leadership and the completion of the Homebuyer.com acquisition.

BETR 0.00%↑ : Better Home & Finance Holding Company gained ahead of the CEO’s scheduled presentation at the upcoming Needham Growth Conference.

HUYA 0.00%↑ : HUYA Inc rose as the company expanded its e-sports presence by organizing the Demacia Cup amid broader tech sector strength.

Losers

BBNX 0.00%↑: Beta Bionics shares dropped as investors reacted to uncertainty

$IHRT -5.53%: iHeartMedia, Inc. shares fell after Goldman Sachs downgraded the stock to Sell, citing concerns over a $5.1 billion debt load.

SLS 0.00%↑: SELLAS Life Sciences Group slipped due to profit-taking as its Phase 3 REGAL trial approached a final data trigger.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $90,529 (▼ 0.55%)

Ethereum (ETH): $3,099 (▼ 0.15%)

XRP: $2.10 (▼ 1.05%)

Equity Indices (Futures):

S&P 500: $6,927 (▼ 0.03%)

NASDAQ 100: $25,729 (▲ 0.16%)

FTSE 100: £10,088 (▲ 0.13%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.19% (▲ 0.48%)

Oil (WTI): $58 (▼ 0.35%)

Gold: $4,473 (▼ 0.12%)

Silver: $78.05 (▲ 1.40%)

Data as of UK (GMT): 11:18 am / US (EST): 6:18 am / Asia (Tokyo): 8:18 pm

✅ 5 Things to Know Today

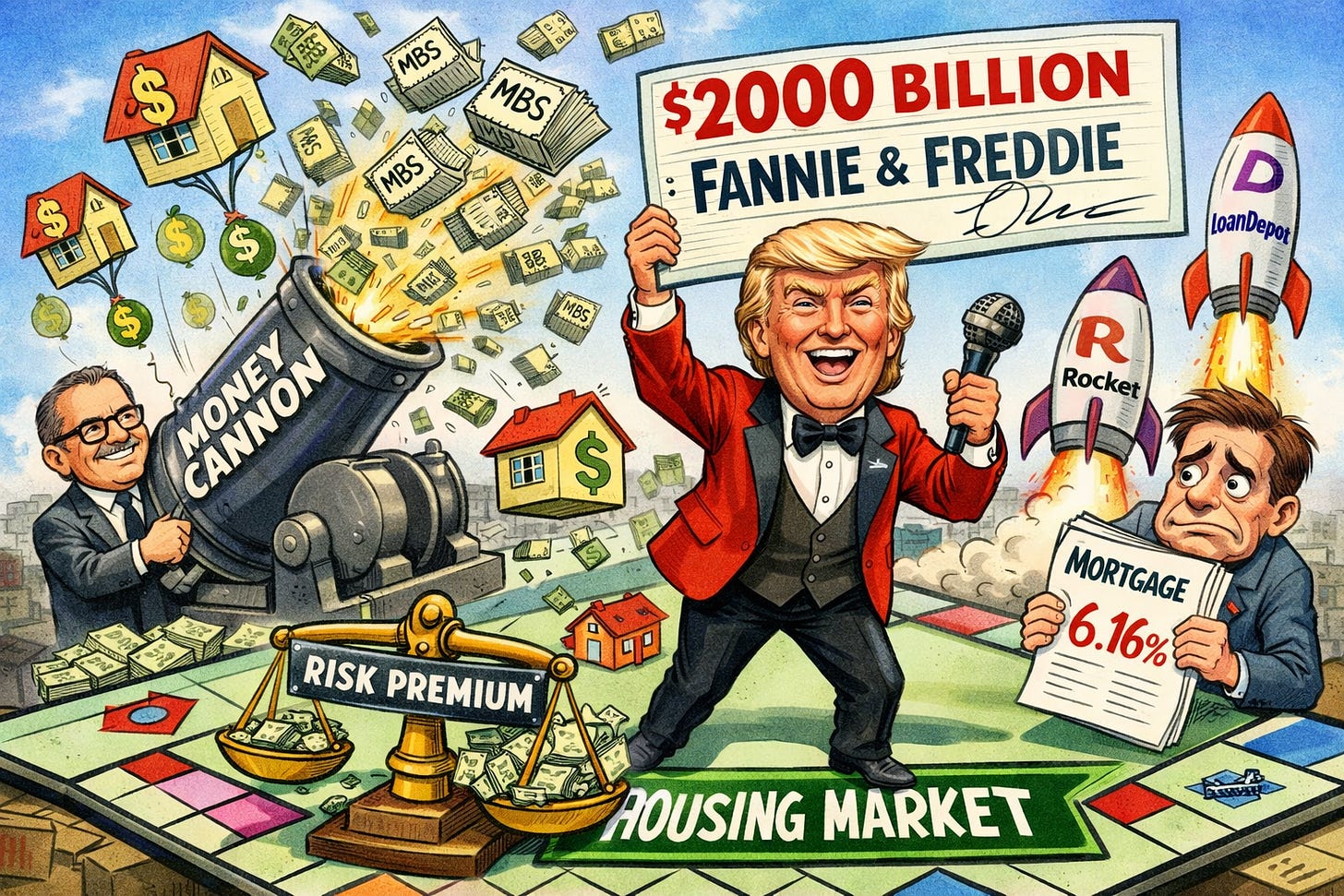

🏠 Trump Targets Mortgage Rates With $200B

President Trump announced a directive on Thursday for Fannie Mae and Freddie Mac to purchase $200 billion in mortgage-backed securities (MBS) from the open market. The plan uses the massive cash reserves these agencies built up while under federal oversight since the 2008 crisis. FHFA Director Bill Pulte noted the administration has the liquidity to move “very quickly” to suppress borrowing costs before the 2026 midterms. It’s an aggressive attempt to lower the average 30-year fixed mortgage rate, which currently hovers at 6.16%, up slightly from last week’s 6.15% average (Politico).

This intervention matters because it targets the “risk premium” investors demand for mortgage bonds. By flooding the market with $200 billion in demand, the government aims to force yields down, potentially cutting consumer mortgage rates by 0.25% to 0.50% according to Citigroup analysis. This could be a catalyst for the 76% of homeowners currently “locked in” with rates below 5%. Markets reacted instantly: mortgage originators Rocket Companies RKT 0.00%↑ and loanDepot LDI 0.00%↑ saw shares jump 9.7% and 19% respectively. However, if the move doesn’t stimulate new supply, lower rates might just drive home prices even higher.

Sensei’s Insight: Watch the mortgage-to-Treasury spread. If this $200 billion buy doesn’t spark a meaningful narrowing, it signals the market has already “priced in” the intervention, leaving little upside for lenders.

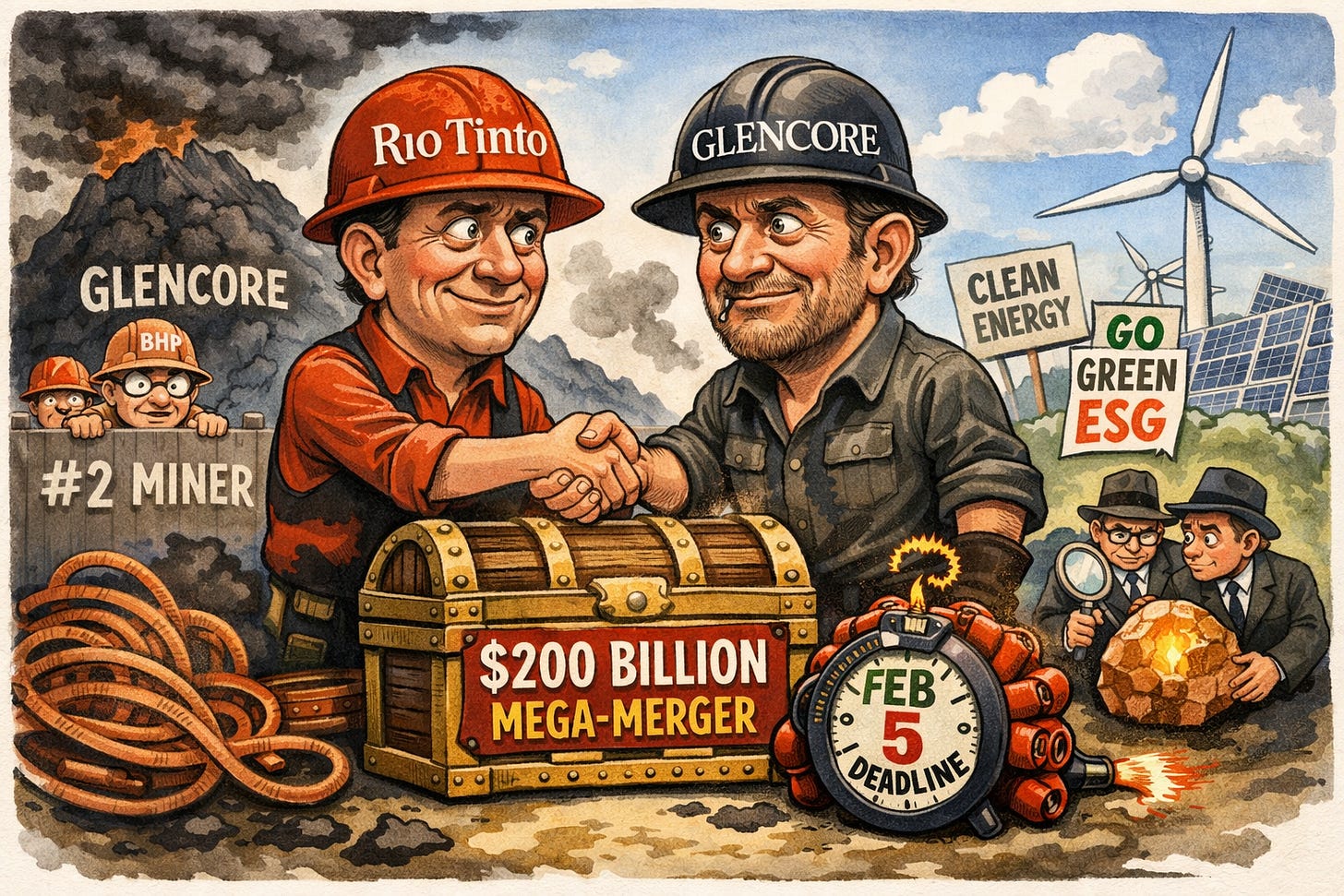

⛏️ Rio and Glencore Eye $200 Billion Mega-Merger

Rio Tinto and Glencore officially confirmed they’re in early-stage discussions for a massive all-share merger. The deal could value the combined entity at over $200 billion, with Rio Tinto potentially acquiring Glencore via a court-sanctioned scheme. This isn’t their first dance. Talks stalled in 2014 and late 2024, but the setup has changed. Glencore recently consolidated its coal assets, a move that suggests it’s preparing for a cleaner break. Markets reacted instantly: Glencore shares jumped around 8% in London, while Rio’s stock slipped 5.5% in Australia as investors weighed the potential for overpayment (Rio Tinto).

This move represents a strategic land grab for copper and energy-transition metals. A combined giant would likely leapfrog BHP to become the world’s largest miner. For retail investors, the friction points are the real story. Rio exited coal years ago, so absorbing Glencore’s massive coal operations may spark a backlash from climate-focused institutional funds. There’s also a significant culture clash between Rio’s project-driven engineering and Glencore’s high-octane trading DNA. Regulators will likely scrutinize copper concentration. Under UK rules, Rio has until February 5 to make a firm offer or walk away.

Sensei’s Insight: Watch the February 5 “put up or shut up” deadline. If Rio can’t reconcile Glencore’s coal business with its own ESG targets, we might see a pivot toward a partial asset buyout.

🏠 Soho House’s $2.7B exit hits a funding wall

The high-stakes plan to take Soho House private is stumbling just as it reached the finish line. Lead investor MCR Hotels recently informed billionaire Ron Burkle’s Yucaipa Companies that it can’t fulfill its $200 million equity commitment, a critical piece of the $2.7 billion deal. This last-minute shortfall forced Soho House to file an emergency disclosure on January 8, 2026, just 24 hours before a scheduled shareholder vote. The news sent the stock (SHCO) tumbling nearly 10% to $8.11, a sharp drop from the $9.00 offer price that previously looked like a done deal (Wall Street Journal).

This isn’t just about a club for the creative elite: it’s a signal of tightening liquidity in the hospitality sector. When a major operator like MCR suddenly pulls back on a written commitment, it suggests capital constraints or a shift in risk appetite that could ripple through other sponsor-backed deals. Soho House has never turned an annual profit in its 31-year history and carries over $700 million in debt. Negotiators are now scrambling to fill the $200 million hole, potentially asking Goldman Sachs to roll over more equity or seeking new third-party backers.

Sensei’s Insight: Watch the arbitrage spread. The gap between the $8.11 trading price and $9.00 offer signals the market now sees a high probability of this deal collapsing or being aggressively renegotiated.

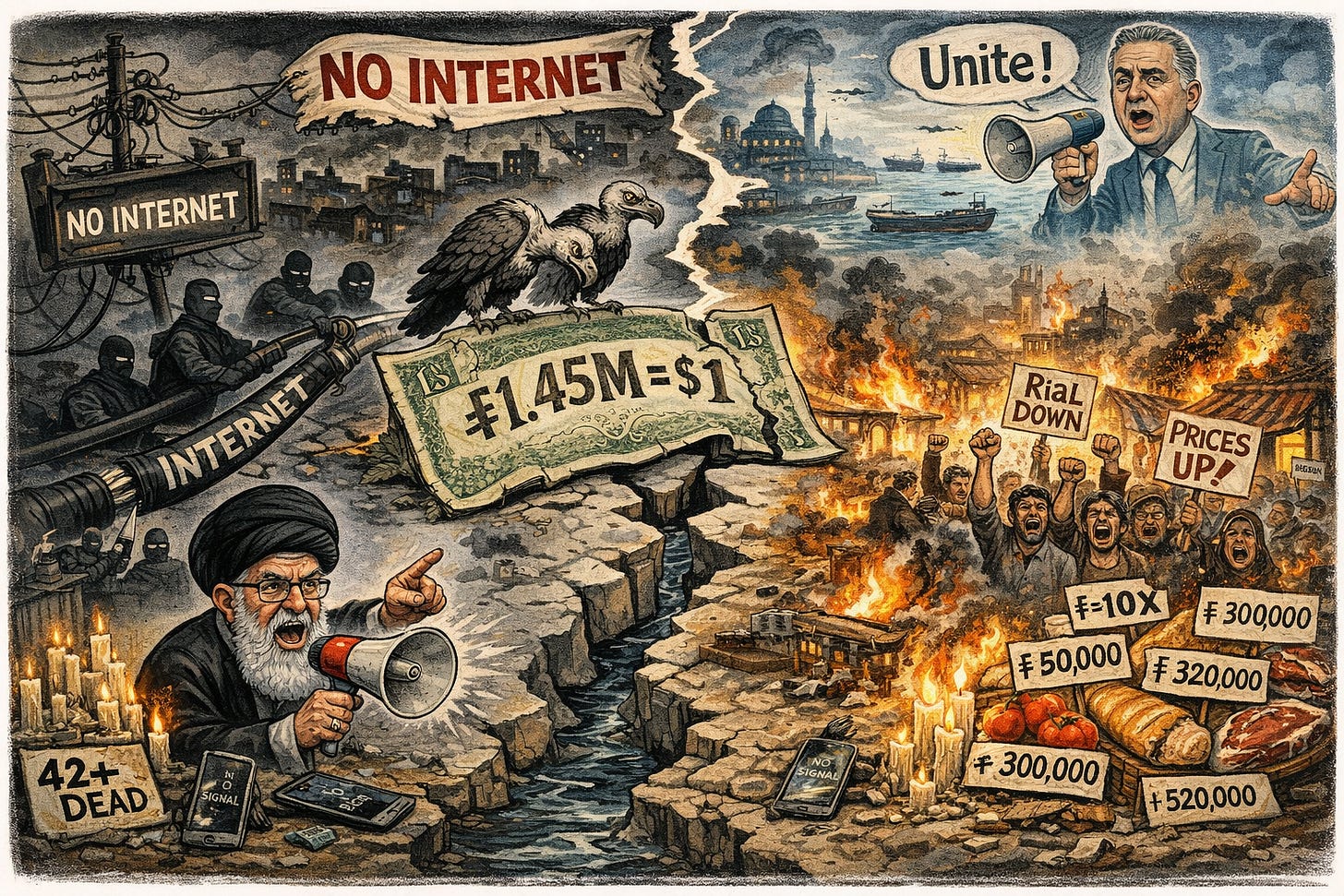

🇮🇷 Iran Goes Dark as Rial Collapse Triggers Unrest

Iran’s regime just pulled the plug on the nation’s internet after the rial’s collapse turned a merchant strike into a full-blown legitimacy crisis. The currency hit 1.45 million per USD, which means it’s lost 91% of its value in seven years. Inflation is officially north of 40%, making basic groceries a luxury for most families. By January 8, connectivity crashed to just 5% of normal levels as the government scrambled to block coordination from exiled Prince Reza Pahlavi. With 42 deaths already reported, the Supreme Leader’s rhetoric suggests he’s preparing a heavy-handed response, framing protesters as foreign-backed rioters (Bloomberg).

You’d expect a regional explosion like this to light a fire under oil, but Brent crude is staying remarkably cool around $60. The market’s reading this as a supply-neutral event for now. The regime is essentially broke and needs its 1.5 million barrels of daily exports to pay the security forces, so they aren’t likely to voluntarily choke off production. However, the recent capture of Venezuela’s Maduro adds a layer of existential panic for Tehran. Retail investors should monitor whether the unrest hits the shadow fleet tankers or if Trump’s threats of “hell” materialize into actual intervention.

Sensei’s Insight: Watch the $60 support level for Brent crude. If the regime loses its grip on oil infrastructure or if internal fractures lead to a rapid collapse, the current supply glut could vanish.

🏥 House Republicans break ranks on Obamacare subsidies

On Thursday, the House passed a 230–196 vote to extend enhanced Affordable Care Act (ACA) subsidies through 2029, a direct challenge to Speaker Mike Johnson’s leadership. In a significant shift, 17 Republicans joined a unified Democratic front to pass the measure. This legislative push follows the January 1 “premium cliff” where national average premiums spiked 114% after previous subsidies expired. With roughly 22 million Americans currently enrolled in the marketplace, nonpartisan estimates suggest 4 million people may drop coverage entirely due to the doubled costs. While the House bill faces a steep climb in the Senate, the vote signals deep fractures within the GOP as healthcare costs become a primary concern for swing-district voters (Bloomberg)

This legislative drama follows the longest government shutdown in U.S. history: a 43-day standoff triggered when Democrats refused to fund the government without these subsidies. That freeze left federal workers unpaid and SNAP benefits in legal limbo until a November compromise provided a temporary funding “minibus.” We are now careening toward another Jan 30 deadline with six major appropriations bills still unfinished. For investors, the risk isn’t just political theater: it’s a massive revenue threat to hospital systems and insurers like Centene and Molina. While some insurers benefit from higher premiums, a massive enrollment drop could destabilize the entire risk pool.

Sensei’s Insight: Watch the Senate next week. Negotiators are floating a two-year compromise with a $5 minimum premium and a shift to Health Savings Accounts (HSAs) to win over the White House.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_live_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

🔍Deep Dive: 📊 The Rate-Cut Fulcrum: Decoding the December Jobs Report

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.