Morning Forecast: Jobs data & 90% chance of Rate Cut

Salesforce proves AI pays, BlackRock pivots to Bitcoin, UK banks get a boost, while Google challenges OpenAI and the Fed stands on trial.

👀 Today’s Stories at a Glance

🤖 Salesforce AI Beats Expectations: Strong earnings prove enterprise AI generates real revenue, driven by Agentforce platform growth.

🔄 BlackRock CEO Embraces Bitcoin: Fink admits past skepticism was wrong, signaling a massive institutional pivot toward crypto.

🇬🇧 UK Banks Get Boost: The Bank of England cut capital requirements, aiming to stimulate lending and boost profits.

🌊 Altcoin ETFs See Action: Institutional demand varies wildly, with XRP dominating inflows while meme coins struggle.

🚨 Google Overtakes OpenAI Tech: OpenAI froze projects to fix ChatGPT after Google’s Gemini 3 claimed the performance lead.

🔍 Fed Credibility Face Test: Markets are pricing in significant risk regarding future Federal Reserve policy decisions.

🧠 One Big Thing

Today’s jobless claims report is no longer routine; it is the final verdict on whether yesterday’s shocking ADP contraction was a fluke or a trend. With continuing claims already at multi-year highs, the labor market is flashing genuine warning signs of stagnation, workers aren’t just getting fired; they aren’t getting rehired. A print above 225,000 would validate the “cooling” narrative, cementing the case for a December rate cut and potentially sinking the dollar. Conversely, a resilient number below 220,000 would muddy the waters, forcing the Fed to reconsider if the economy actually needs immediate rescue. In a data-sparse environment caused by the shutdown, this single metric carries disproportionate weight for the Fed’s decision.

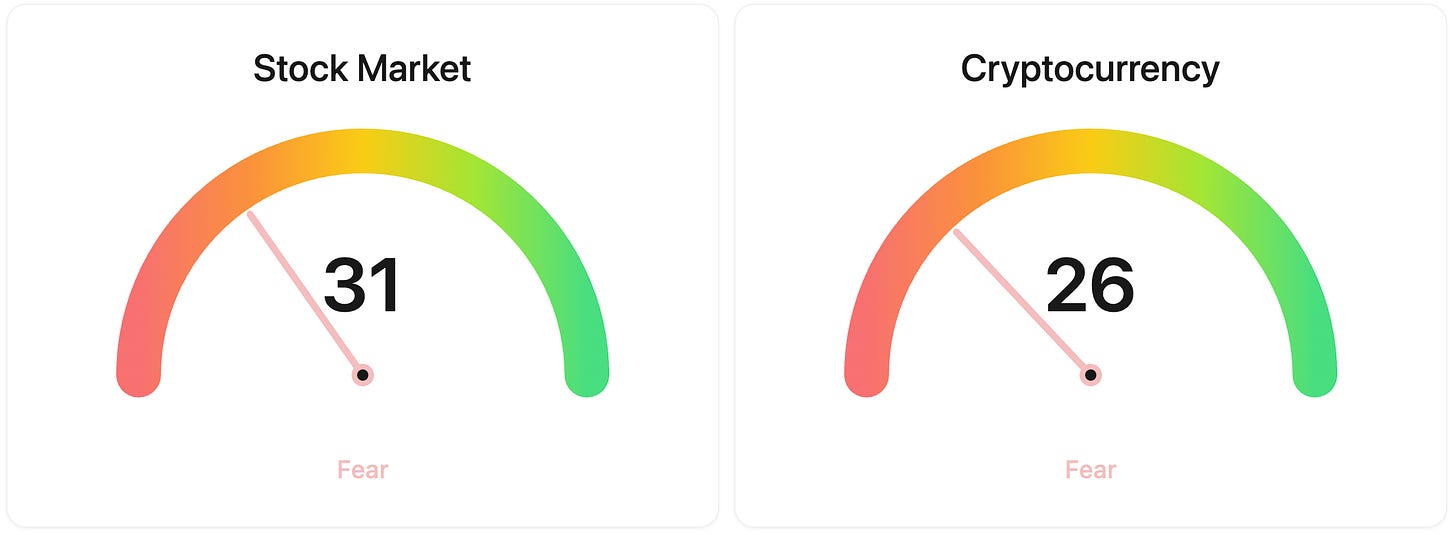

⚖️ Fear & Greed

📉 The Number That Matters

85% CUT PROBABILITY

The current market pricing for a 25 basis point Federal Reserve rate cut in December. A “hot” jobless claims print (above 225K) could push this near certainty (95%+), while a significant beat (below 215K) could trim odds marginally.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $92,924 (▼ 0.59%)

Ethereum (ETH): $3,187 (▼ 0.10%)

XRP: $2.15 (▼ 2.21%)

Equity Indices (Futures):

S&P 500: $6,854 (▲ 0.01%)

NASDAQ 100: $25,637 (▼ 0.08%)

FTSE 100: £9,713 (▲ 0.05%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.08% (▲ 0.44%)

Oil (WTI): $59 (▲ 0.29%)

Gold: $4,199 (▼ 0.09%)

Silver: $57.52 (▼ 1.63%)

Data as of UK (GMT): 11:52 / US (EST): 06:52 / Asia (Tokyo): 20:52

✅ 5 Things to Know Today

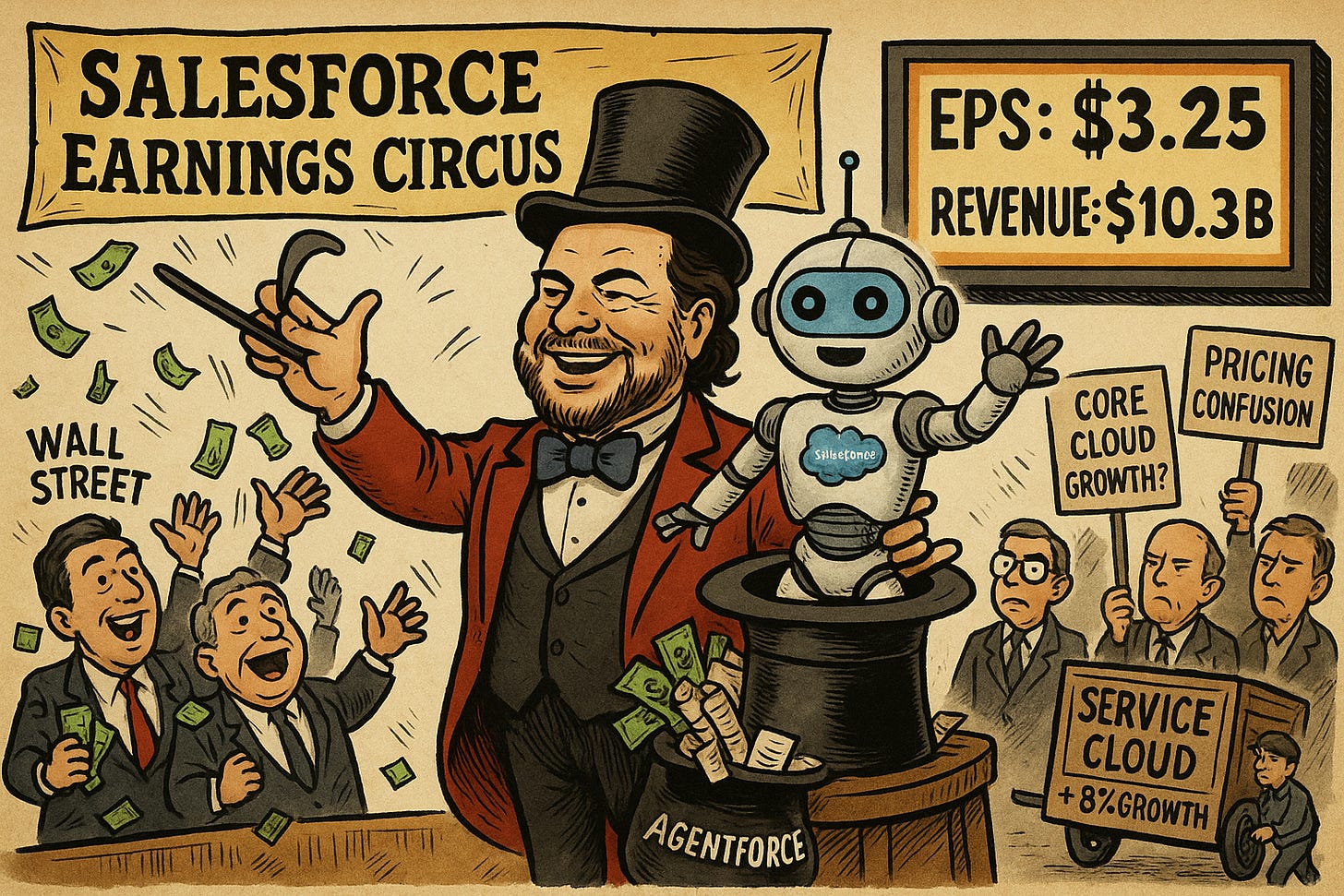

🤖 Salesforce Earnings: AI “Agents” Finally Show Real Cash

Salesforce (CRM) proved the AI skeptics wrong yesterday with a decisive Q3 beat. The enterprise software giant posted $10.3 billion in revenue, an 8.6% increase that nudged past estimates, while adjusted earnings per share hit $3.25, crushing the $2.86 consensus. The real headline is the guidance raise: management lifted full-year revenue expectations to roughly $41.5 billion. This optimism is fueled by Agentforce, their autonomous AI platform, which saw paid deals surge 60% quarter-over-quarter to nearly 9,500. Investors cheered the concrete numbers, sending shares up roughly 5% in extended trading (Bloomberg).

This offers early proof that enterprise AI is generating actual revenue rather than just hype. The key metric to watch is the 15% growth in Current Remaining Performance Obligations (cRPO). This backlog of committed revenue beat the 10% forecast, signaling that big clients are signing multi-year contracts again. However, friction remains. Analysts note that core Sales and Service clouds are growing at a modest 8%, and customer confusion over Agentforce’s consumption-based pricing persists. The recent $8 billion Informatica acquisition is a direct attempt to fix the “messy data” problem that often stalls faster AI rollouts.

Sensei’s Insight: Watch the execution risk here. While 9,500 AI deals sounds massive, pricing confusion could stall the shift from “pilot” to “production.” If core growth dips below 8%, the AI narrative may not be enough to sustain the rally.

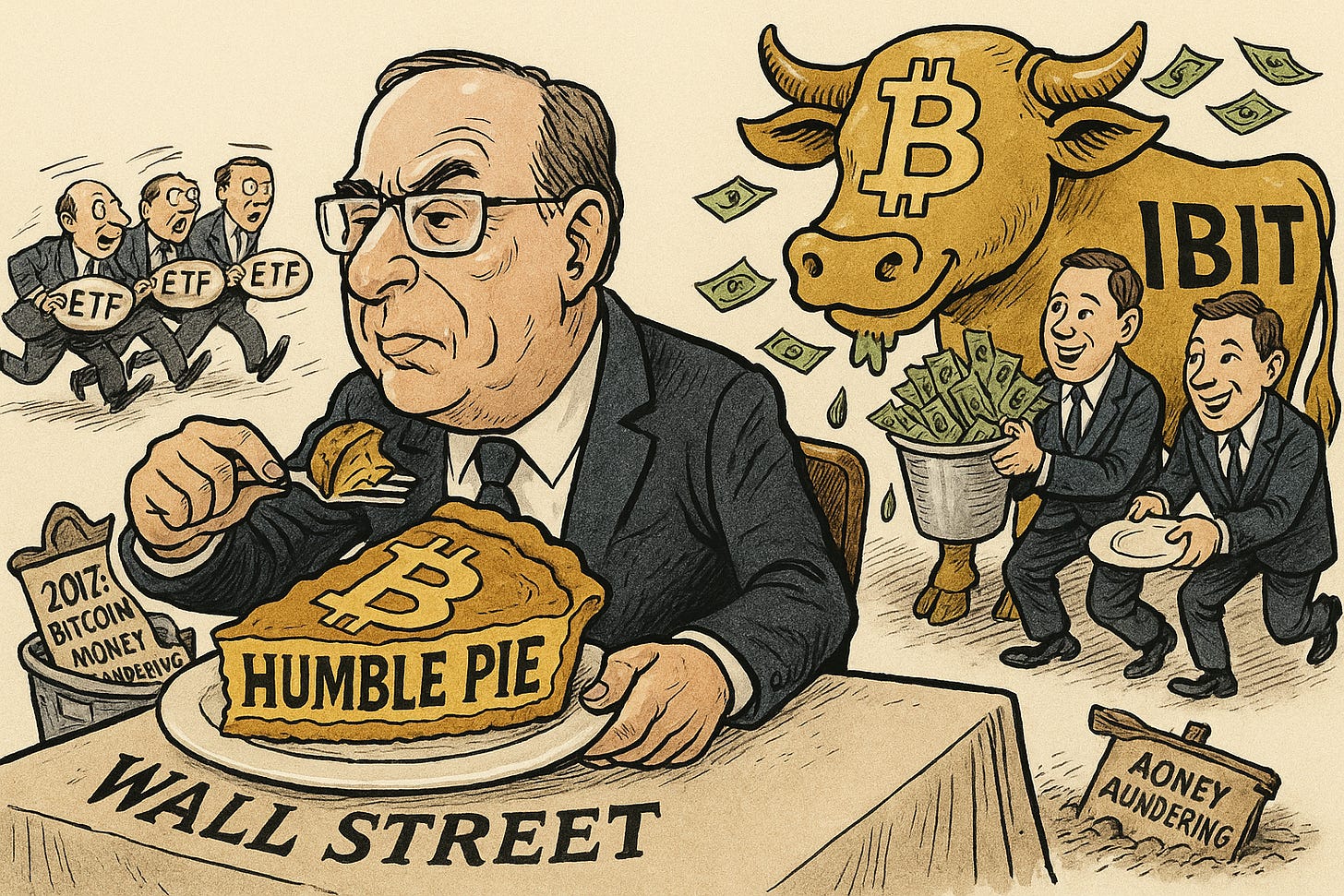

🔄 Larry Fink of BlackRock Folds: “I Was Wrong About Bitcoin”

Larry Fink, CEO of BlackRock (managing $12.5 trillion), just ate humble pie live at the NYT DealBook Summit. The most powerful man in finance explicitly admitted he was “fundamentally wrong” to label Bitcoin an “index of money laundering” back in 2017. Today, he’s not just apologizing; he’s all in. His firm’s Bitcoin ETF (IBIT) has rocketed to nearly $70 billion in assets, becoming their most profitable product line. BlackRock now holds over 776,000 BTC, roughly 3% of the total supply, proving this is a high-conviction pivot, not just a PR stunt.

This matters because Fink effectively sets the “acceptable” risk parameters for global institutions. By rebranding Bitcoin from a criminal tool to what he now calls an “asset of fear,” he has framed it as insurance against geopolitical chaos and U.S. debt instability (a concern he highlighted, noting $952 billion in U.S. interest payments). This isn’t about speculation anymore; it’s about macro-protection. With the Senate preparing to vote on the Clarity Act, Fink’s timing gives political cover for pension funds and sovereign wealth funds to enter the market without reputational risk.

Sensei’s Insight: Cynic’s Note: IBIT is now BlackRock’s most profitable product line. Fink has to praise his own cash cow. Even so motives are irrelevant here. His endorsement forces the rest of Wall Street to play catch-up, legitimizing the asset class whether he’s a true believer or just loves the fees.

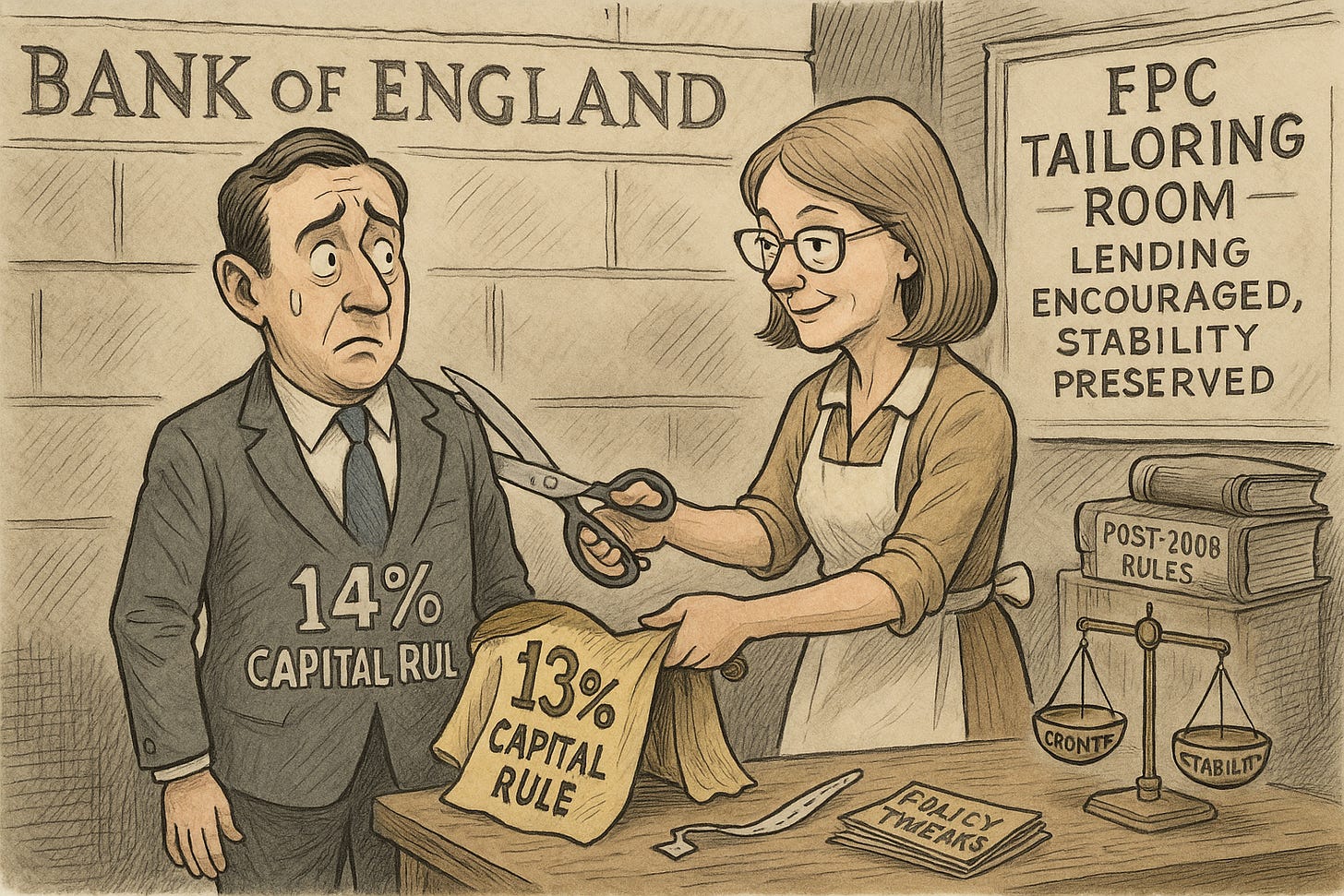

🇬🇧 BoE Cuts Capital Requirements: First Since 2008

The Bank of England’s Financial Policy Committee (FPC) just made a significant move, cutting the system-wide Tier 1 capital benchmark for UK banks from 14% to 13% of risk-weighted assets. This is the first time the benchmark has been lowered since the post-2008 reforms were locked in. Led by Deputy Governor Sarah Breeden, the FPC determined the previous level was slightly too restrictive. The new target consists of an “optimal” 11% baseline plus a 2% add-on to cover measurement blind spots (like the interest rate risks that sank Silicon Valley Bank). The goal isn’t deregulation for its own sake, but rather fine-tuning the rules to encourage lending without sacrificing stability. Bank of England - Financial Stability in Focus | FT Op-Ed by Sarah Breeden

This signals the end of the “ratchet-up” era of banking regulation. For over a decade, the only direction for capital requirements was up; now, the BoE is admitting that holding too much capital acts as a drag on the economy by raising funding costs and dampening credit. For investors, this is a green light for the UK banking sector. A lower benchmark reduces the need for banks to hoard cash above regulatory minimums. While the BoE’s public focus is on stimulating lending to households and businesses, this creates breathing room for bank management to potentially increase dividends or buybacks, provided they stay resilient.

Sensei’s Insight: Hmm connect the dots: The BoE is cutting bank capital rules while simultaneously proposing a strict £20,000 limit on personal stablecoin holdings. This is a coordinated defense of the status quo. They are making traditional banks leaner and more competitive, while literally capping the size of their digital rivals to prevent “deposit flight.”

🌊 The Altcoin ETF Floodgates Are Officially Open

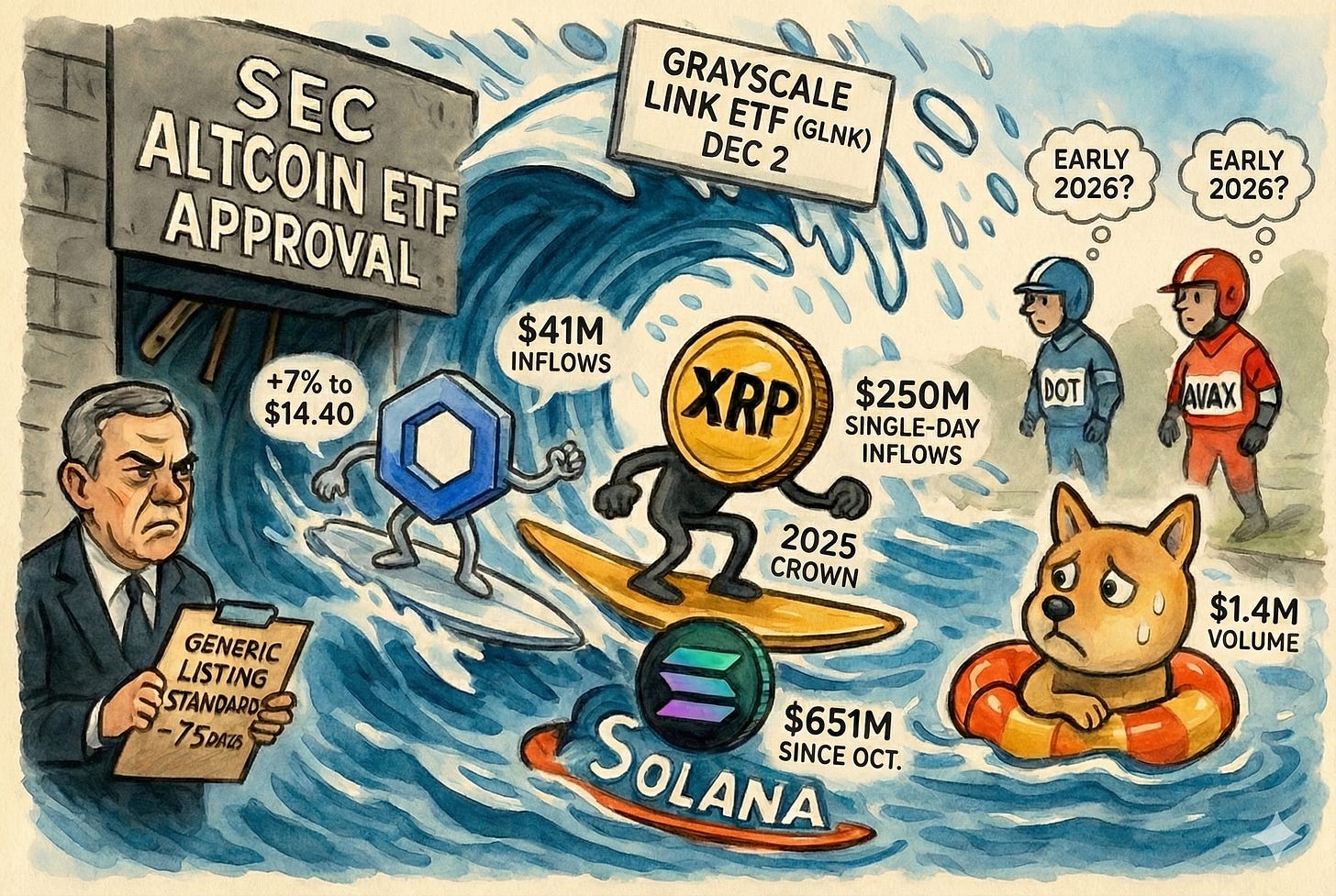

Grayscale launched its Chainlink ETF (GLNK) on December 2, pulling in a respectable $41 million in day-one inflows while LINK surged 7% to $14.40. However, the real story is the disparity in institutional appetite across these new products. Canary Capital’s XRP ETF (XRPC) still wears the 2025 crown, having smashed records with $250 million in single-day inflows on November 13. Contrast that with the utility-focused Bitwise Solana ETF (accumulating $651 million since October) versus Grayscale’s Dogecoin ETF, which landed with a thud ($1.4 million volume). Wall Street is clearly differentiating between infrastructure plays and meme coins.

This rapid-fire issuance is the result of the SEC’s new “Generic Listing Standards” approved in September, which collapsed the typical approval timeline from 240+ days to a streamlined 75-day review. While the October government shutdown briefly froze the gears, the regulatory machinery is moving again. With the path cleared, filings for Polkadot (DOT) and Avalanche (AVAX) could clear hurdles by early 2026. This shifts the asset class from “niche exchange” to “standard brokerage account,” effectively forcing legacy money managers to take a stance on protocol utility.

Sensei’s Insight: The institutional hierarchy is set: XRP is the clear favourite with Solana a close second, while Dogecoin is dead last. Wall Street buys infrastructure, not jokes. Follow the flows, not the memes.

🚨 OpenAI “Code Red”: Google Retakes the AI Throne

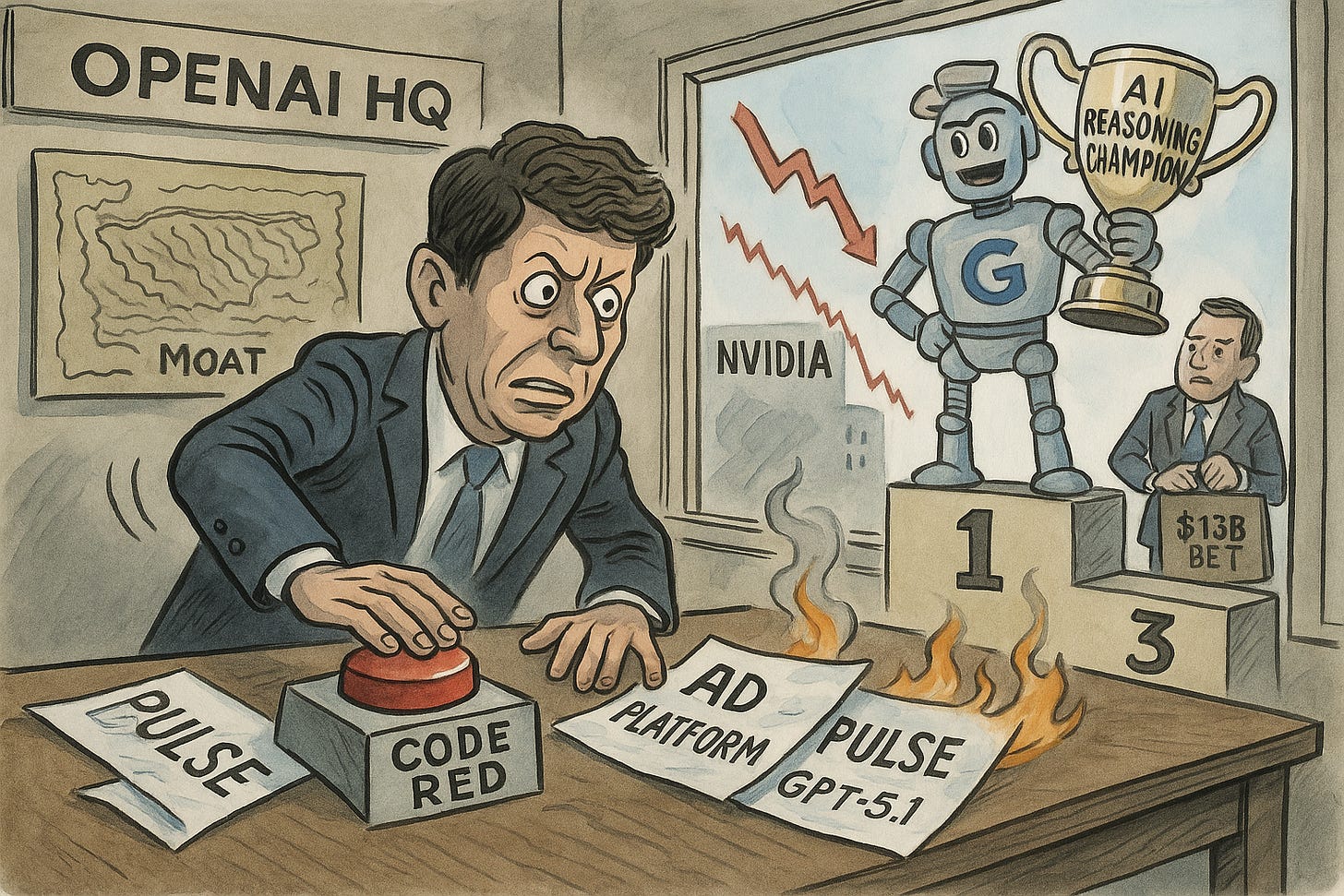

OpenAI CEO Sam Altman hit the panic button. He issued a strict “Code Red” directive that freezes development on high-margin products like “Pulse” and new ad platforms to focus entirely on fixing the core ChatGPT experience. This defensive pivot arrives just days after Google’s Gemini 3 technically “leapfrogged” OpenAI’s latest GPT-5.1. The numbers driving this decision are brutal. Gemini 3 beat GPT-5.1 by roughly 11% on reasoning benchmarks, and OpenAI reportedly suffered a user churn of 6% in the single week following Google’s launch. The industry leader is now playing catch-up (Forbes).

The concept of an invincible AI “moat” is evaporating. Google achieved this victory using its own custom TPU chips, completely bypassing the Nvidia hardware that constrains OpenAI. That technical independence triggered a $250 billion loss in Nvidia’s market cap last week. For investors, the narrative has shifted from “winner-take-all” to a capital-intensive war of attrition. This stumble also complicates the picture for Microsoft. With OpenAI delaying revenue-focused products to patch their tech, the ROI on Microsoft’s massive capital expenditure likely faces significant delays.

Sensei’s Insight: The “Nvidia Monopoly” thesis just showed its first real fracture. If Google can win without H100s, hardware margins could shift. Watch Alphabet’s valuation carefully; they are approaching $4 trillion by proving they can win the entire stack, from chip to chat.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive: 🏦 Fed Credibility on the Line: The “Hassett Risk” Pricing Mechanism

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.