Morning Forecast: Monday, 12 January

Trump weighs Iran strikes as oil jumps, banks face earnings pressure, NATO moves into Greenland, Exxon is sidelined in Venezuela, AI funds soar, and DOJ subpoenas put the Fed at risk.

This content is for informational and educational purposes only and does not constitute financial advice. Always do your own research. Not financial advice (NFA).

👀 Today’s Stories at a Glance

💥 Trump reviews Iran strikes: Military options follow protests as oil prices jump on supply risks

🏦 Banks face margin tests: Major banks report earnings amid rising AI costs and shrinking interest spreads

🇬🇱 NATO secures Greenland: European forces plan Arctic Sentry to counter U.S. territorial threats and monitor activity

🛢️ Exxon blocked in Venezuela: Trump sidelines the firm after its CEO labeled the country uninvestable

🤖 DeepSeek fund gains 57%: High-Flyer quant returns now finance AI research through aggressive long-only strategies

⚖️ Fed independence under fire: DOJ subpoenas target Chair Powell, sparking market volatility and sovereign risk

🧠 One Big Thing

The Fed Under Fire

The Justice Department has targeted Federal Reserve Chair Jerome Powell with subpoenas regarding building project costs. Powell identifies this criminal probe as a calculated attempt to pressure the central bank into lowering interest rates. Financial markets are responding by fleeing U.S. assets and the dollar in favor of record-breaking safe havens. This institutional confrontation forces investors to price in a premium for the potential loss of monetary independence. A politicized Fed risks losing control over future price projections and destabilizing long term bond markets. Consequently, the structural trust that supports the greenback’s status as the world’s primary anchor is facing an existential test.

⚖️ Fear & Greed

📉 The Number That Matters

4%

Markets price in a 4% probability of a rate cut for the January 27–28 FOMC meeting. This reflects expectations of institutional resilience against criminal subpoenas; a surprise cut would signal Federal Reserve capitulation to Department of Justice pressure.

⚔️ Winners vs Losers

Winners

ANPA 0.00%↑: Rich Sparkle Holdings Limited shares surged after closing the acquisition of TikTok star Khaby Lame’s company to tap into live-commerce and AI digital twins.

BARK 0.00%↑: BARK, Inc. stock soared following a take-private proposal from a CEO-led investor group at a 45% premium of $0.90 per share.

SNCY 0.00%↑: Sun Country Airlines Holdings, Inc. shares rallied on news of a $1.5 billion definitive merger agreement with Allegiant Travel Company.

KC 0.00%↑: Kingsoft Cloud Holdings Limited rose as reports of Beijing approving NVIDIA H20 chip imports signaled improved AI infrastructure access for the company.

CRML 0.00%↑: Critical Metals Corp. moved higher after announcing it is 70% complete with 2026 production milestones and expects Greenland supply deals in Q1.

BABA 0.00%↑: Alibaba Group Holding Limited gained momentum on reports of NVIDIA H20 chip approvals and strong developer adoption of its Qwen AI models.

WMT 0.00%↑: Walmart Inc. moved higher after news that the company will be included in the Nasdaq-100 Index effective January 20, 2026.

SCCO 0.00%↑: Southern Copper Corporation shares rose after reporting a Q3 earnings beat supported by continued strength in copper commodity prices.

Losers

BBNX 0.00%↑: Beta Bionics, Inc. fell sharply after BofA Securities downgraded the stock to Neutral citing valuation concerns ahead of Q4 results.

STOK 0.00%↑: Stoke Therapeutics, Inc. declined as positive news regarding accelerated Phase 3 enrollment was offset by broader biotech sector headwinds.

BFH 0.00%↑ : Bread Financial Holdings, Inc. shares dropped following President Trump’s announcement of a 10% credit card interest rate cap effective January 20.

SYF 0.00%↑: Synchrony Financial slumped as its pure-play store card exposure left it highly vulnerable to the proposed 10% federal cap on interest rates.

COF 0.00%↑: Capital One Financial Corp. shares retreated significantly due to the anticipated impact on profit margins from the upcoming regulatory credit card rate cap.

AXP 0.00%↑: American Express Company traded lower on rate cap concerns, though its premium customer base offered more resilience compared to high-yield peers.

C 0.00%↑: Citigroup Inc. shares declined in sympathy with the financial sector following regulatory proposals to limit credit card interest rates to 10%.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $90,576 (▼ -0.35%)

Ethereum (ETH): $3,113 (▼ -0.20%)

XRP: $2.04 (▼ -1.51%)

Equity Indices (Futures):

S&P 500: $6,923 (▼ -0.60%)

NASDAQ 100: $25,723 (▼ -0.83%)

FTSE 100: £10,124 (▼ -0.13%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.20% (▲ 0.62%)

Oil (WTI): $59 (▼ -0.40%)

Gold: $4,586 (▲ 1.70%)

Silver: $83.65 (▲ 4.69%)

Data as of UK (GMT): 11:29 AM / US (EST): 6:29 AM / Asia (Tokyo): 8:29 PM

✅ 5 Things to Know Today

💥 Trump Weighs Military Strikes as Iran Protests Escalate

President Trump is weighing “very strong” military options against Iran following a violent crackdown on nationwide protests that have left between 544 and 6,000 people dead. After the Iranian rial collapsed to a record low of 1.42 million per dollar in late December, bazaar merchants and students sparked unrest across all 31 provinces. Trump confirmed he’ll meet with Joint Chiefs Chair General Dan Caine on Tuesday to review options including precision strikes and cyber operations. While Tehran reached out for talks on Saturday, Trump suggested the U.S. may act before any meeting occurs to stop the escalating violence (Al Jazeera).

For investors, this signals the return of the geopolitical risk premium. Brent crude jumped to $63.67, its sharpest two-day gain since October, as markets price in a 10% to 15% chance of major supply disruptions. Iran’s daily output of up to 3.2 million barrels is at stake if the IRGC faces internal defections or if U.S. strikes target infrastructure. While a global oil surplus of 1.5 million barrels is expected for 2026, acute supply shocks often override long-term supply concerns. Watch for Elon Musk’s potential involvement with Starlink, which could further accelerate protest momentum and force the regime’s hand.

Sensei’s Insight: Keep a close eye on the Tuesday security briefing. If Trump moves from rhetoric to action, oil could quickly test the $70 resistance level despite the broader 2026 surplus forecast.

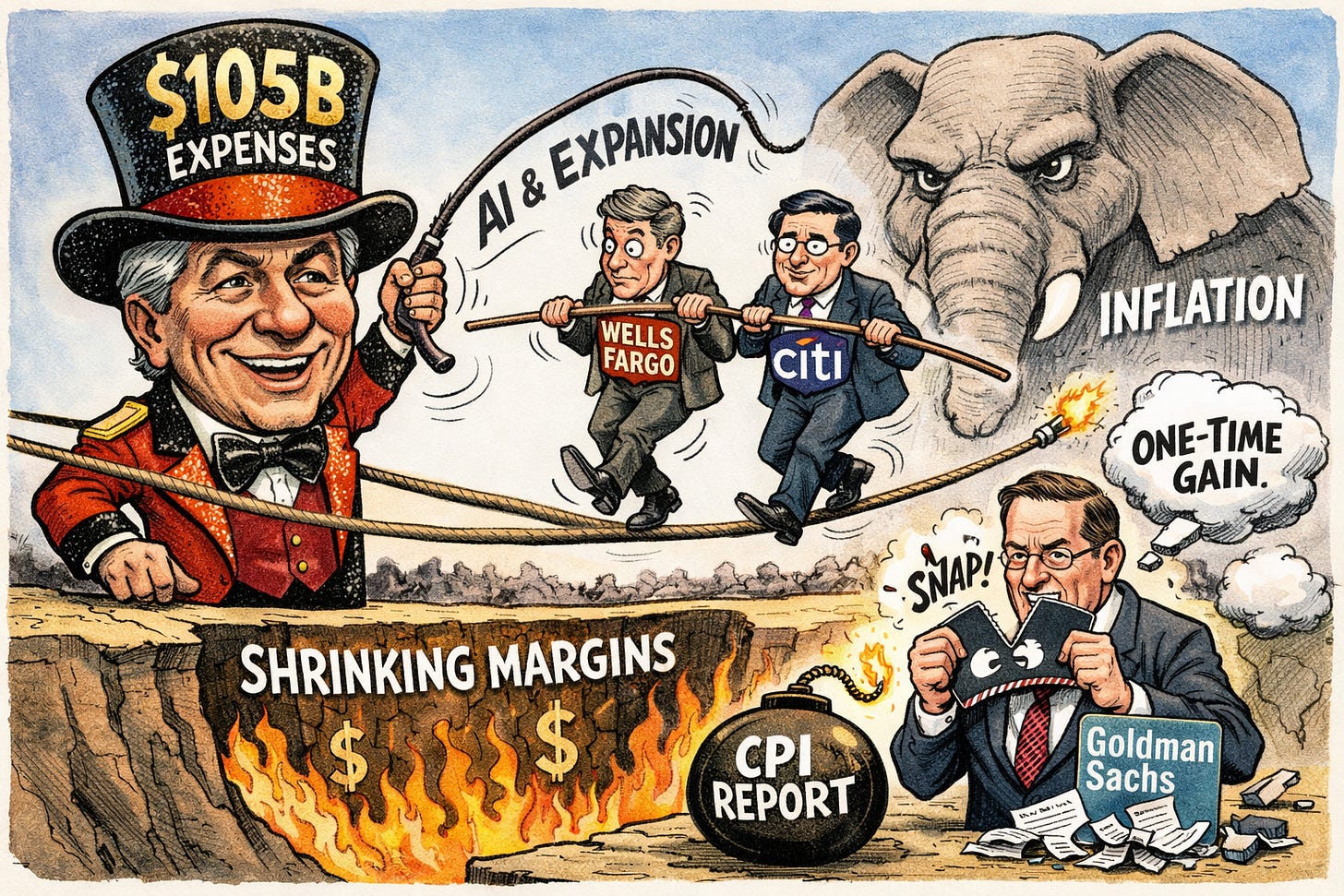

🏦 Banks Kick Off 2026 Earnings Amid Inflation Anxiety

Wall Street’s big hitters are stepping up to the plate this week, with JPMorgan Chase, Wells Fargo, and Citigroup reporting starting Tuesday. This isn’t just a standard quarterly update, it’s a test of whether record stock prices can survive narrowing profit margins. JPMorgan’s CEO Jamie Dimon recently signaled that 2026 expenses could balloon to $105 billion, up from prior expectations of $102 billion, as the bank pours billions into AI automation and new branches. While JPMorgan forecasts revenue growth around 6.9%, the real focus is on Net Interest Income (NII). As the Fed toys with rate cuts, that crucial spread between what banks earn on loans and pay on deposits is shrinking (Barrons).

For retail investors, the story is actually hidden in the credit data. Watch those delinquency rates, because they’ll tell you if the consumer is finally starting to buckle. Goldman Sachs is also navigating a messy divorce from Apple Card, which may provide a temporary 46-cent boost to earnings through a $2.48 billion reserve release, but the underlying markdown of that loan portfolio is the part that matters. Tuesday’s CPI print is the other elephant in the room. Analysts expect headline inflation to stay flat at 2.7% year-over-year, but any “pop” in core goods prices could force the Fed to keep rates higher for longer, further squeezing those bank margins we’re all watching.

Sensei’s Insight: Watch for the “expense shock” across the sector. If JPMorgan’s $105 billion spending spree becomes the industry standard, even a revenue beat might not be enough to keep these stocks at record highs.

🇬🇱 NATO’s “Arctic Sentry” Play for Greenland

The UK and Germany are spearheading a plan to deploy NATO forces to Greenland, a strategic move designed to head off President Trump’s recent threats to acquire the territory. The proposed mission, dubbed “Arctic Sentry,” would mimic current operations in the Baltic to monitor Russian and Chinese activity. It’s a direct response to Trump’s “hard way” rhetoric: he’s signaled that if a purchase deal isn’t reached, he’s prepared to take “title” to the land, citing recent US military action in Venezuela as a template. European leaders are trying to “NATO-ize” the region before it becomes a bilateral fight between Washington and Copenhagen (Bloomberg).

For retail investors, this isn’t just a map-room dispute: it’s a major test of NATO’s internal plumbing. While markets haven’t panicked yet, a US move to seize land from an ally would be a black-swan event for sovereign risk. We’re seeing a clear thematic tailwind for European defense contractors and companies specializing in ice-hardened maritime tech or subsea sensors. If the “Arctic Sentry” mission moves forward, it signals a long-term shift toward militarizing the High North, which may add a geopolitical risk premium to Arctic mining and energy projects that once seemed safely dormant.

Sensei’s Insight: Watch the upcoming meeting between Secretary Rubio and Danish officials. If rhetoric doesn’t soften, the “alliance risk” could start hitting Danish bond yields and broader European defense valuations by early spring.

🛢️ Trump Sidelining Exxon from Venezuela?

President Trump, speaking aboard Air Force One late Sunday, signaled he would likely block ExxonMobil from his initiative to rebuild Venezuela’s oil industry. The move follows a tense Friday meeting where CEO Darren Woods labeled the country “uninvestable” without major legal reforms. Trump’s frustration was blunt: “I didn’t like their response. They’re playing too cute.” This clash comes just days after the U.S. military captured Nicolás Maduro, with the administration now aiming to mobilize $100 billion in private capital to tap Venezuela’s 303 billion barrels of reserves. Exxon’s skepticism stands in sharp contrast to more bullish tones from competitors like Chevron (Bloomberg).

This standoff highlights a major rift between corporate risk management and the administration’s fast-moving foreign policy. Exxon has been burned by Venezuelan nationalizations twice before, most recently in 2007, and still seeks $2 billion in compensation. Woods is demanding durable investment protections and changes to hydrocarbon laws before committing shareholder cash. Conversely, Chevron is positioning itself as the primary beneficiary, claiming it can ramp up output by 50% in the next 18 to 24 months. Exxon shares fell roughly 1% to $123.33 on the news, suggesting investors are weighing the cost of this political sidelining against the firm’s cautious capital discipline.

Sensei’s Insight: Watch the $123 support level for Exxon (XOM). If political friction persists, the market may favor firms like Chevron that are willing to play ball with the administration’s aggressive timeline.

🤖 DeepSeek’s Parent Fund Just Posted 57% Returns

DeepSeek founder Liang Wenfeng isn’t just leading the AI race, he’s also crushing the trading floor. His quant firm, High-Flyer Asset Management, posted a 56.6% average return across its funds in 2025. Managing roughly $10 billion, the firm nearly doubled the 30.5% average return seen across the broader Chinese quant industry. This performance follows a bold 2024 decision to abandon market-neutral hedges and move entirely into long-only equity strategies. With a Sharpe ratio of 2.8 for its top products, High-Flyer is signaling that its algorithmic models are finding massive success in the Shanghai and Shenzhen markets (Bloomberg).

This performance creates a unique financial engine for DeepSeek. High-Flyer generates enough fee revenue, estimated at over $700 million annually, to fund AI research and 10,000 Nvidia GPUs without needing a dime of outside venture capital. It’s a self-sufficient model that allows Liang to prioritize long-term tech breakthroughs over the typical short-term demands of VC partners. For retail investors, this highlights how AI-driven institutional capital is gaining a massive edge in Chinese stocks. However, the shift to “long-only” means the fund has traded its safety net for upside. The model works perfectly in a rising market, but it leaves the firm fully exposed if Chinese benchmarks stumble.

Sensei’s Insight: Watch for any shift in High-Flyer’s long-only positioning. While they’re riding high now, their lack of hedging means they are essentially a leveraged bet on Chinese market beta.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_live_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

🔍Deep Dive: ⚖️ The Subpoena: Assessing the Erosion of Fed Independence

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.