Morning Forecast: Monday, 15 December

Rotation, Ruptures, and Regulation. A market pivot toward 2026 optimism collides with corporate bankruptcies, Chinese credit stress, tougher enforcement at sea, and a decisive push to formalise crypto

This content is for informational and educational purposes only and does not constitute financial advice. Always do your own research. Not financial advice (NFA).

👀 Today’s Stories at a Glance

🐂 Traders target 2026 rally: Futures rise as Citi and Goldman predict a 13% S&P 500 surge amid rate cuts.

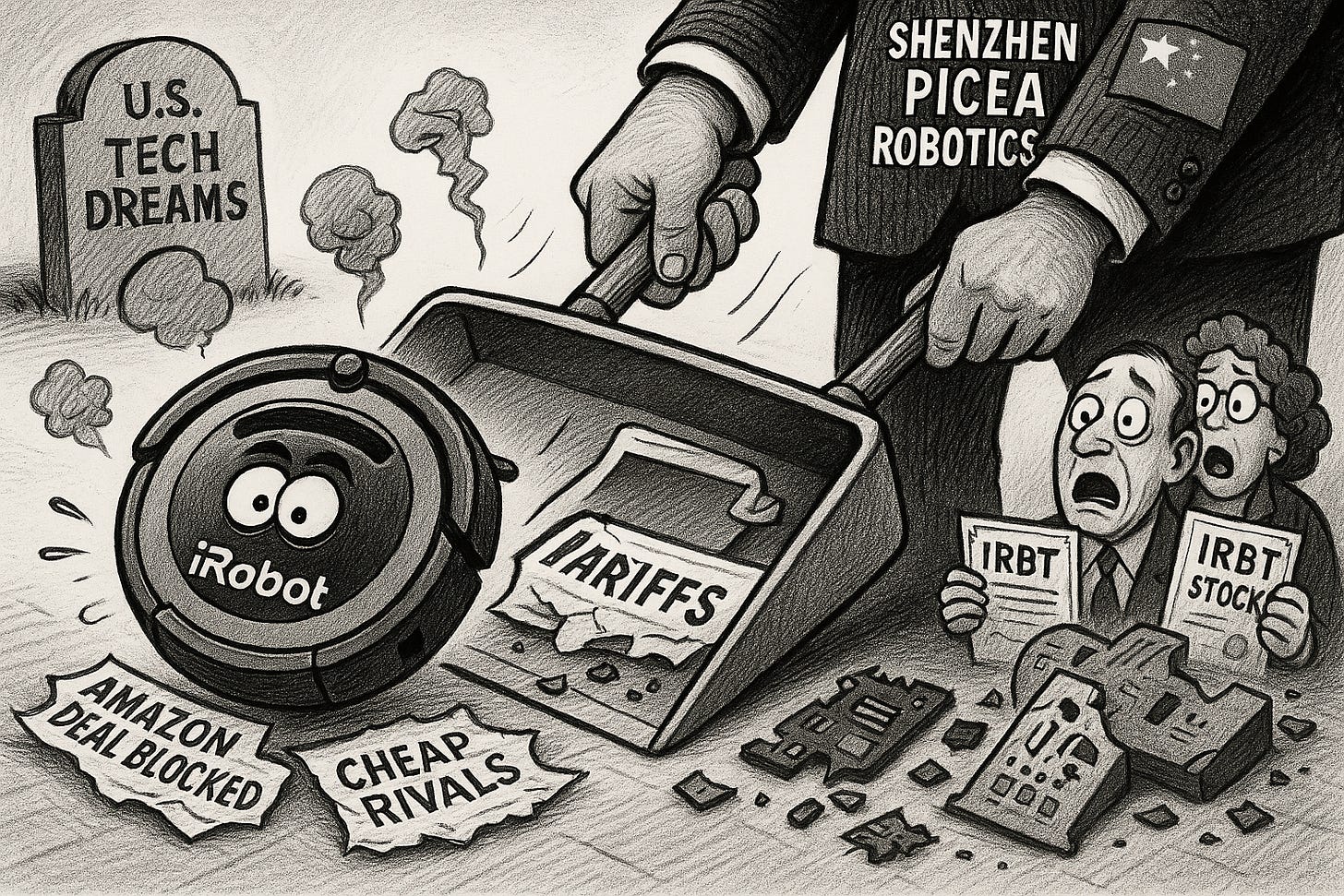

🤖 Roomba maker files for bankruptcy: iRobot enters Chapter 11, wiping out shareholders while transferring equity to its Chinese manufacturer.

🧱 Top Chinese developer nears default: China Vanke faces default after bondholders rejected a payment extension, risking an Asian credit crisis.

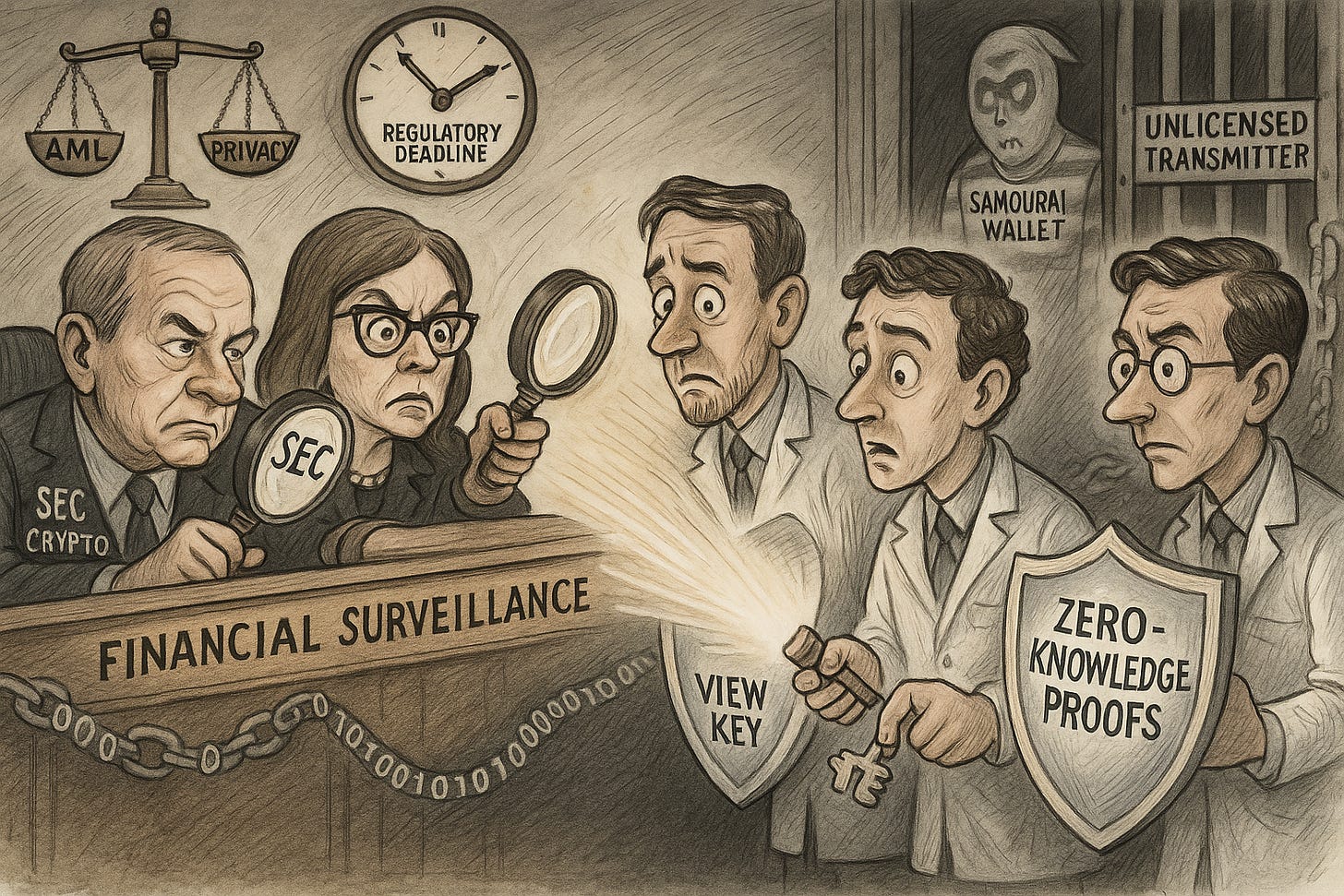

🕵️ SEC debates crypto privacy rules: Regulators and developers discuss if blockchain privacy tools can coexist with anti-money laundering laws.

⚓ US seizes shadow fleet vessel: Kinetic enforcement against non-standard vessels signals potential shipping rate hikes and squeezed corporate margins.

🔍 Tilray surges on tax reform: Rescheduling removes 280E taxes, driving a 44% rally and boosting projected income.

🧠 One Big Thing

The SEC Revisits Privacy

The Securities and Exchange Commission is convening a roundtable on December 15 to reassess financial surveillance standards in the crypto era. Spearheaded by the Crypto Task Force, the session aims to explore how emerging technologies can balance regulatory oversight with individual liberty. The agency has assembled a roster of privacy-focused developers and civil rights advocates, including founders from Zcash and Aleo alongside the ACLU. This lineup indicates regulators are actively investigating how privacy-enhancing protocols function rather than dismissing them outright. The discussions could shape future compliance frameworks for decentralized assets. Investors should watch this event for signs of a shift in how the US governs financial privacy.

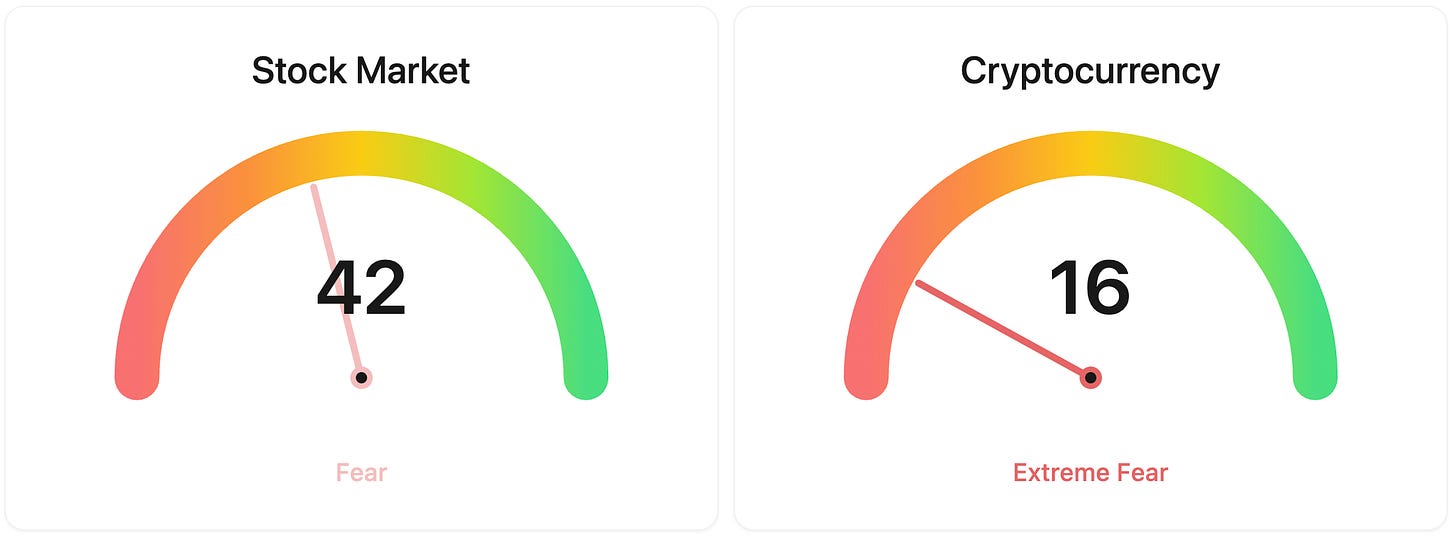

⚖️ Fear & Greed

📉 The Number That Matters

Magnificent 7

Three years after OpenAI ignited the AI boom, cracks are forming in the market’s most crowded trade. Recent selloffs in Nvidia and Oracle have sharpened concerns around valuation stretch, rising capital intensity, and uncertain payoffs from massive AI spending. As a result, Wall Street is beginning to rotate away from the seven “Magnificent” tech giants toward undervalued cyclicals, small-caps, and economically sensitive sectors like industrials and energy. The AI trade isn’t ending, it’s maturing, with investors increasingly focused on breadth, balance-sheet discipline, and who benefits after the infrastructure buildout.

⚔️ Winners vs Losers

Winners

QIPT +32.18%: Quipt Home Medical Corp. rallied after agreeing to be acquired by Kingswood Capital and Forager Capital for $3.65 per share.

KYTX +24.15%: Kyverna Therapeutics advanced after reporting positive topline data from its Phase 2 KYSA-8 trial showing significant patient improvement.

IMNM +29.23%: Immunome, Inc. shares surged after announcing positive topline results from the Phase 3 RINGSIDE trial for varegacestat in desmoid tumors.

Losers

IRBT -68.98%: iRobot Corporation collapsed after filing for Chapter 11 bankruptcy and agreeing to a take-private acquisition by Picea Robotics.

CLDX -8.43%: Celldex Therapeutics traded lower on Low Confidence as the stock appeared to move in sympathy with broader biotech sector weakness.

CV -15.72%: CapsoVision, Inc. declined on Medium Confidence, likely driven by profit-taking or sector headwinds following a recent leadership change.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $89,823 (▲ 1.86%)

Ethereum (ETH): $3,160 (▲ 3.14%)

XRP: $1.99 (▲ 0.68%)

Equity Indices (Futures):

S&P 500: $6,859 (▲ 0.45%)

NASDAQ 100: $25,335 (▲ 0.48%)

FTSE 100: £9,738 (▲ 0.76%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.17% (▼ 0.43%)

Oil (WTI): $57 (▼ 0.28%)

Gold: $4,340 (▲ 0.95%)

Silver: $63.69 (▲ 2.86%)

Data as of UK (GMT): 11:30 / US (EST): 06:30 / Asia (Tokyo): 20:30

✅ 5 Things to Know Today

🐂 Wall Street Bets Big on ‘26

The mood has shifted fast. US stock futures and European markets (+0.7%) are rallying as traders look past the recent tech wobble and focus on 2026. The heavy hitters are putting numbers on the optimism: Citigroup predicts a 13% rally for the S&P 500 in 2026, while Morgan Stanley and Goldman Sachs are also issuing bullish outlooks. The catalyst is a return to the “bad news is good news” dynamic. Weak labor data is currently fueling the rally because it practically guarantees the Federal Reserve will keep cutting rates to protect a “soft landing.” (Bloomberg)

This pivot matters because it changes the playbook for the next 12 months. We are moving from a fear of recession to a “Goldilocks” scenario where the economy is just cool enough to lower borrowing costs but warm enough to support corporate earnings. Morgan Stanley’s Michael Wilson notes that moderate labor weakness is now a “bullish context” for equities. Crucially, the AI trade is evolving. Strategists see money rotating from “AI enablers” (the chipmakers and infrastructure builders) to “AI adopters”, companies that will use the tech to boost productivity and margins.

Sensei’s Insight: Watch the “AI Adopters” basket closely in Q1. If the “enabler” trade is crowded, the next wave of value suggests looking at boring sectors effectively integrating these new tools.

🤖 Roomba’s Clean Sweep: iRobot Files for Bankruptcy

The dust has finally settled, and it’s bad news for the pioneer of home robotics. iRobot (NASDAQ: IRBT 0.00%↑ ), maker of the Roomba, filed for Chapter 11 bankruptcy yesterday, December 14. This isn’t a liquidation, but a “pre-packaged” restructuring that hands 100% of the company’s equity to its primary manufacturer, Shenzhen PICEA Robotics. The deal wipes out all $352 million of iRobot’s debt but also completely zeroes out current shareholders, meaning the stock is now effectively worthless, plummeting over 80% this morning. The company expects the process to finish by February 2026 (Reuters).

This is a classic “death by a thousand cuts.” First, European regulators blocked Amazon’s $1.7 billion acquisition earlier this year, leaving iRobot with massive bridge loans and no buyout cash. Then came the operational squeeze: aggressive Chinese rivals like Ecovacs and Roborock flooded the market with cheaper, high-tech alternatives, pushing iRobot from #1 to #6 globally. Add in a 46% tariff hike on its Vietnam-based production, and margins simply evaporated. For retail investors, this is a stark reminder that brand dominance doesn’t guarantee survival when R&D budgets and supply chains (Picea was their own supplier!) are weaponized against you.

Sensei’s Insight: Watch the $0.00 equity recovery, this is a total wipeout for common stock. If you see a “dead cat bounce” or meme-stock rally, stay away. It’s a trap.

🧱 China’s “Safe” Developer Faces Imminent Default Risk

China Vanke, formerly the nation’s most stable state-backed developer, just hit a wall. On Monday, bondholders overwhelmingly rejected a proposal to extend the deadline for a 2 billion yuan ($283.5 million) bond payment due today. The plan needed 90% approval but saw 76.7% of votes cast against it. Vanke now enters a critical five-day grace period. If they cannot settle the debt or sway investors in a desperate second vote by December 22, they face formal default. Markets reacted instantly, with Vanke’s Hong Kong shares sliding nearly 4% and its 2028 yuan bonds crashing 20% (Reuters)

This signals a potential shift in Beijing’s playbook. Analysts suggest the government may be stepping back from rescuing even “safe,” state-linked players like Vanke. If the sector’s supposed safety net is gone, the risk profile for all Chinese assets changes. The economic backdrop is equally grim: data released Monday shows new home prices fell 2.4% year-over-year, the 29th straight month of declines, while retail sales grew a meager 1.3%, missing expectations. With consumption broken and property values eroding, the “bailout put” investors relied on appears to be expiring.

Sensei’s Insight: Watch the December 22 deadline closely. A formal default here could force a repricing of all Asian credit risk. If Vanke falls, the “too big to fail” theory is officially dead.

🕵️ Today’s SEC Roundtable: Privacy vs. Surveillance

Today from 1:00 PM to 5:00 PM ET, the SEC’s Crypto Task Force hosts a critical roundtable to debate whether blockchain privacy can coexist with anti-money laundering (AML) enforcement. Chair Paul Atkins and Commissioner Hester Peirce will join developers from Zcash, Aleo, and Espresso Systems to discuss “programmable privacy.” The meeting occurs just weeks after the Samourai Wallet founders received federal prison sentences for operating unlicensed money transmitters, raising the stakes for developers. The core tension is whether privacy code is a tool for financial freedom or a liability for facilitating crime (SEC).

This discussion could determine if privacy-preserving assets enter the regulatory fold or remain marginalized. The technical argument from builders like Zooko Wilcox is that Zero-Knowledge Proofs enable users to prove compliance (e.g., “I am not sanctioned”) without revealing their full financial history. With the CLARITY Act recently distinguishing between “privacy-enhancing” tools and total anonymity, a positive signal here could validate Zcash’s hybrid model for institutional use. Conversely, if officials insist on full transparency, the recent institutional interest in privacy-centric ETFs and infrastructure could evaporate quickly.

Sensei’s Insight: The SEC is the ultimate kingmaker here. Hosting frequent, technical roundtables signals a massive pivot from “regulation by enforcement” to sophisticated policymaking. They aren’t just fighting crypto anymore; by engaging this deeply, they are actively building the permanent rails for institutional adoption.

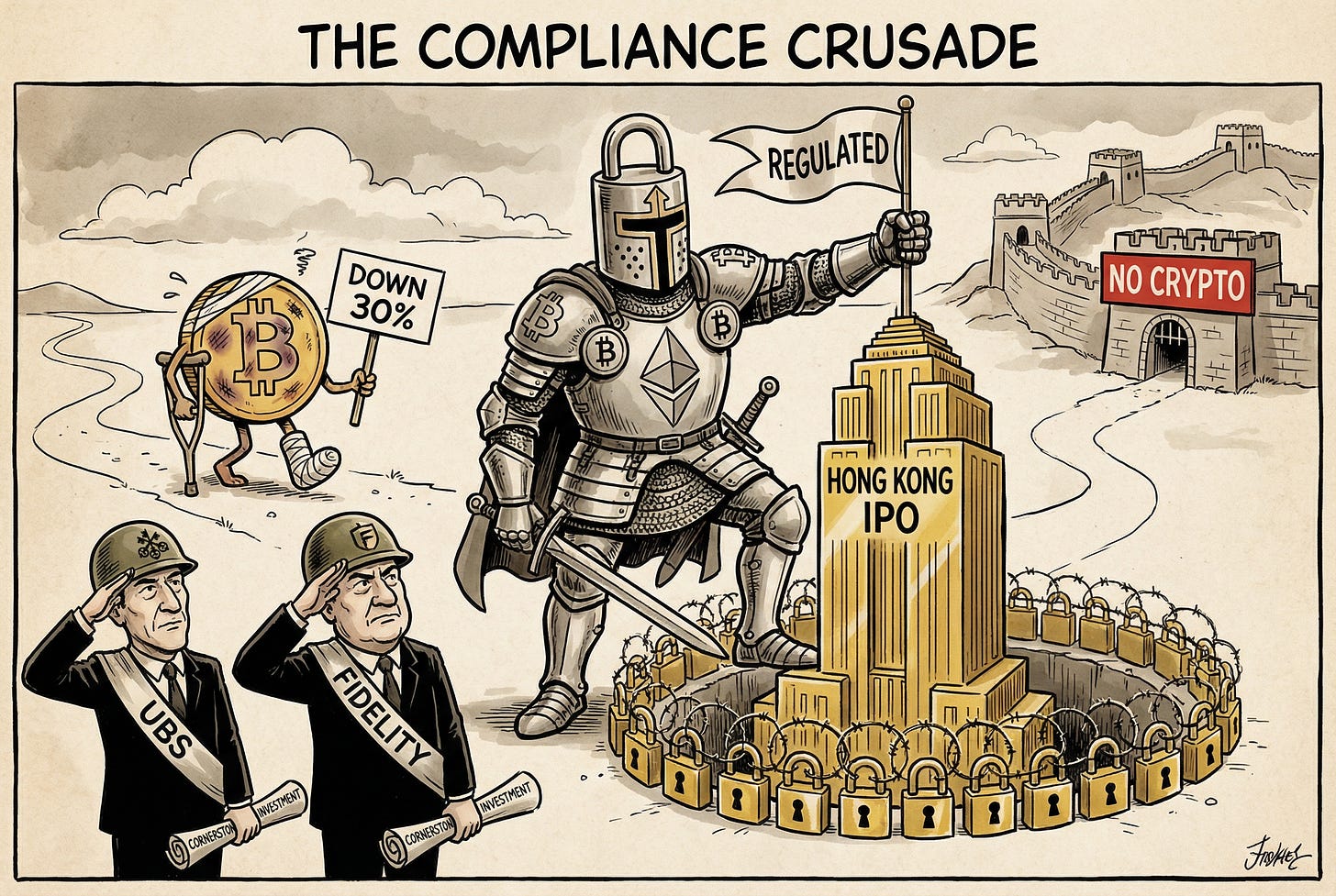

🇭🇰 HashKey IPO: Institutions Bet on Rules, Not Just Token Prices

HashKey Holdings successfully priced its IPO at HK$6.68 per share, hitting the top of its marketed range to raise roughly $206 million (HK$1.6 billion). This robust demand stands in stark contrast to the company’s financials: HashKey remains deeply unprofitable, posting an adjusted net loss of HK$506 million in the first half of 2025 due to heavy spending on compliance and infrastructure. Investors, including heavyweights like UBS and Fidelity International, ignored the recent 30% correction in Bitcoin prices to fill the order book. They aren’t buying current earnings; they are buying a “call option” on Hong Kong’s regulatory framework.

This listing signals a disconnect between institutional strategy and retail sentiment. While the broader market frets over Bitcoin’s drop from $122,000, smart money is betting on a “flight to quality” mechanism. HashKey dominates 75% of Hong Kong’s licensed spot market, and in a strict regulatory regime, liquidity is legally forced into the few venues holding a license. Institutions are wagering that this regulatory moat is a more durable asset than short-term trading volumes. They are accepting current cash burn as the necessary cost to build a monopolistic bridge for mainland wealth entering the crypto space.

Sensei’s Insight: Watch the price action on the December 17 debut. If the stock holds or pops above HK$6.68 while Bitcoin remains flat, it confirms the market is valuing regulatory safety over raw crypto exposure.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_live_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive: 🌿 Tilray Brands TLRY 0.00%↑: The Schedule III Arbitrage & Capital Structure Reset

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.