Morning Forecast: Monday, 22 December

From silver squeezes to silent rate hikes, global markets are under rising pressure.

This content is for informational and educational purposes only and does not constitute financial advice. Always do your own research. Not financial advice (NFA).

👀 Today’s Stories at a Glance

🥈 Silver hits record $69 high: Physical shortages and geopolitical risks drive the metal to a massive 127% annual gain.

🛢️ Trump blockades Venezuelan oil tankers: The Coast Guard pursues sanctioned vessels while global supply remains in a massive surplus.

💶 EU backs digital euro mandate: Member states approve a 2029 launch featuring offline privacy and capped individual holdings.

🎢 Wall Street faces AI volatility: Investors balance bubble fears against record-low cash levels and high-conviction tech earnings growth.

📉 Yen falls after BOJ hike: Interest rates hit thirty-year highs but dovish guidance keeps the carry trade alive.

⚖️ Decoding the BOJ’s strategic hike: Japan navigates a cautious normalization path to curb inflation without triggering global market liquidation.

🧠 One Big Thing

The BOJ’s Strategic Tightrope

The Bank of Japan recently raised interest rates to 0.75%, its highest level in thirty years, while simultaneously signaling a slow and cautious path forward. This “dovish hike” aims to curb persistent 3% wage-driven inflation without triggering a chaotic collapse of global carry trades. By maintaining negative real rates, the central bank preserves the profitability of borrowing yen to fund higher-yielding assets abroad. However, the strategy remains fragile due to Japan’s massive debt and the risk of sudden liquidity squeezes in the currency swap markets. Investors must now watch the 150 USD/JPY level, as a strengthening yen could force a systemic liquidation of global risk assets.

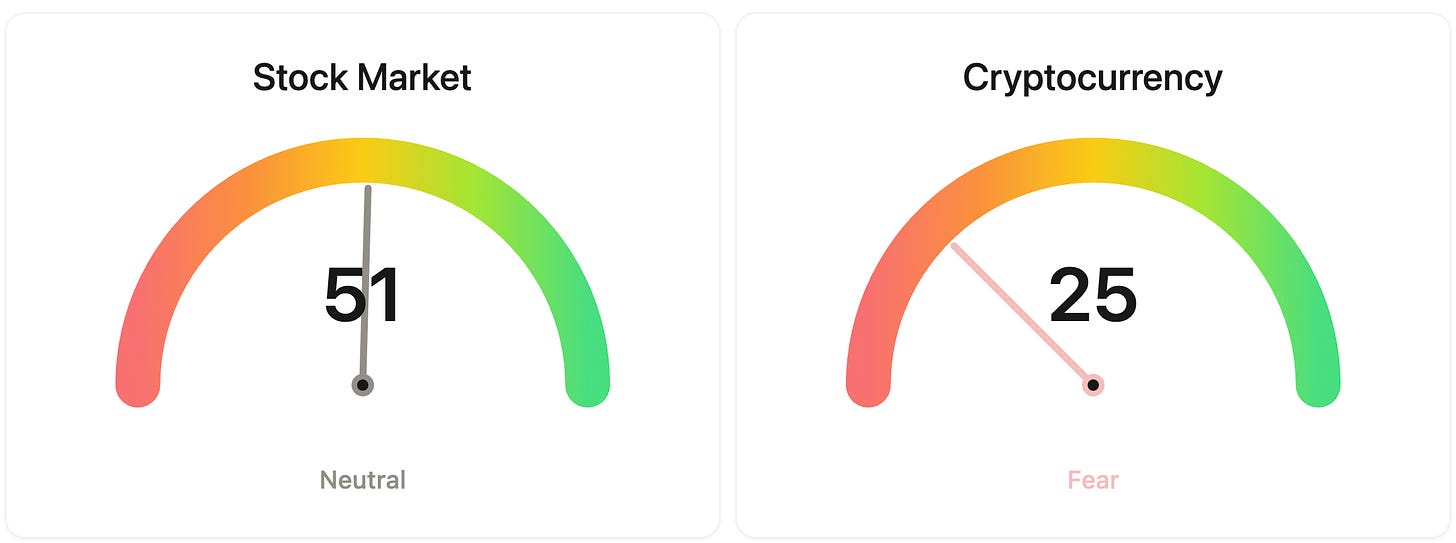

⚖️ Fear & Greed

📉 The Number That Matters

1.0% - 2.5%

The BOJ’s estimated neutral rate sits between 1.0% and 2.5%. Governor Ueda emphasized a gradual approach to reaching this range, signaling that future adjustments will be cautious to avoid destabilizing leveraged market positions.

⚔️ Winners vs Losers

Winners

FTCI +22.41%: FTC Solar surged following a price target increase from TD Cowen and guidance implying 25% sequential growth and a path to profitability.

SRFM +10.93%: Surf Air Mobility gained momentum following a $100M strategic transaction that reduced debt by 37% and funded its AI platform.

DVLT +39.02%: Datavault AI shares spiked on a strategic partnership with Triton Geothermal involving $8M in upfront fees and an upcoming meme coin distribution.

PSNL +8.42%: Personalis shares rose after receiving Medicare coverage approval for its NeXT Personal test and publishing a study validating immunotherapy predictions.

AXTI +6.89%: AXT Inc shares rallied after crushing Q3 earnings estimates driven by a 250% quarterly surge in indium phosphide revenue for AI data centers.

HYMC +15.47%: Hycroft Mining climbed after reporting record silver grades at its Vortex zone and successfully raising $171.4M through an underwriter over-allotment.

RDW +8.56%: Redwire Corporation moved higher after securing a $44M DARPA contract and an eight-figure docking system deal with European firm TEC.

ABTC +8.43%: American Bitcoin Corp rose on news of a significant insider buy by Director Richard Busch and tailwinds from rising Bitcoin prices.

CWAN +8.31%: Clearwater Analytics shares jumped following an announcement that the company will be acquired by a private equity consortium for $24.55 per share.

TE +8.24%: T1 Energy gained after being assigned detailed engineering for a Thai carbon capture project and breaking ground on a $400M solar fab.

Losers

ZNB -36.27%: Zeta Network Group shares plunged due to renewed crypto mining sustainability concerns and lingering dilution from a previous $230M private placement.

AIIO -34.37%: Robo.ai Inc. dropped as its JIDU Auto restructuring application was viewed as a desperation play despite recent $180M funding.

LW -25.94%: Lamb Weston shares were de-rated after weak topline growth and a decline in price/mix offset an earnings beat and dividend increase.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $89,863 (▲ 1.39%)

Ethereum (ETH): $3,044 (▲ 1.43%)

XRP: $1.93 (▲ 0.28%)

Equity Indices (Futures):

S&P 500: $6,859 (▲ 0.31%)

NASDAQ 100: $25,711 (▲ 0.53%)

FTSE 100: £9,860 (▼ -0.16%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.17% (▲ 0.53%)

Oil (WTI): $58 (▲ 1.84%)

Gold: $4,410 (▲ 1.64%)

Silver: $69.13 (▲ 2.95%)

Data as of UK (GMT): 11:27 / US (EST): 06:27 / Asia (Tokyo): 20:27

✅ 5 Things to Know Today

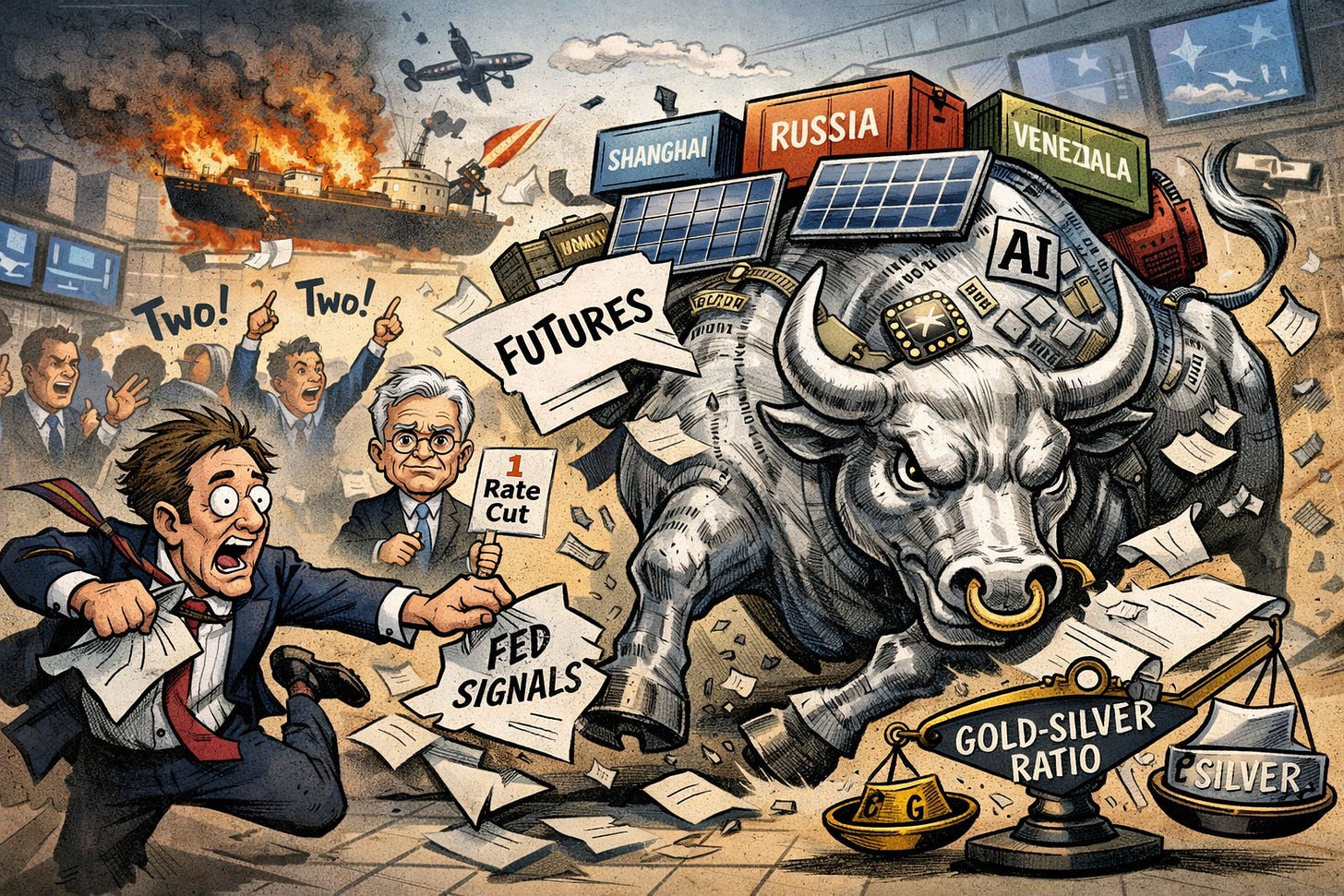

🥈 Silver Tests $69 Resistance

Silver just hit a record intraday high of $69 per ounce, continuing a massive 127% run for the year. This isn’t just a quiet climb: the metal is in “backwardation,” meaning traders are paying a premium for immediate physical delivery rather than waiting for future contracts. The rally is being fed by a perfect storm: a 400-million-ounce buy order in Shanghai triggered a physical shortage, while a U.S. blockade on Venezuelan oil tankers and a Ukrainian drone strike on a Russian tanker in the Mediterranean have sent geopolitical risk premiums through the roof. With silver lease rates hitting extreme levels, the paper market is struggling to keep up with physical demand (Bloomberg).

The context here is a widening gap between market bets and reality. While the Federal Reserve signals only one rate cut for 2026, the market is aggressively pricing in two, creating a tailwind for non-yielding assets like silver. We are also seeing a structural deficit, as industrial demand for AI data centers and solar panels collides with stagnant mine production. This supply-demand mismatch explains why mining stocks like Hecla Mining have surged nearly 300% this year. For retail investors, the gold-silver ratio at 83.3 is the number to watch: if it compresses toward historical norms, silver could still have room to run despite the vertical move.

Sensei’s Insight: Watch the $69 resistance level closely. The Shanghai volume spike suggests speculative fever is high, but the physical supply shortage provides a hard floor that could prevent any major collapse.

🛢️ Naval Blockade: Trump Ramps Up Venezuela Oil Crackdown

The U.S. Coast Guard is currently in “active pursuit” of a third oil tanker, the Bella 1, in international waters off the coast of Venezuela as of Sunday, December 21. This follows the pre-dawn seizure of the Centuries on Saturday and the capture of the Skipper on December 10. These operations aren’t isolated incidents: they’re the direct result of President Trump’s December 16 order for a “total and complete blockade” of sanctioned tankers. The administration has officially designated the Maduro government as a foreign terrorist organization, claiming the “shadow fleet” of aging, false-flagged vessels funds narco-terrorism. Despite the “largest armada” ever assembled in South America patrolling the Caribbean, the market response has been strangely quiet.

Why the “Armada” Isn’t Spiking Your Gas Prices? The lack of a price surge comes down to simple math: Venezuela represents less than 1% of global oil supply. Even if the blockade successfully chokes off all 780,000 barrels exported daily, the global market is currently drowning in a surplus. Kpler data shows “oil on water”, crude stored at sea, has hit 1.3 billion barrels, the highest level since the 2020 lockdowns. Additionally, Ukraine’s recent drone strikes on Russian “shadow” tankers in the Mediterranean and Caspian Seas are effectively neutralizing any supply-tightening by keeping the global glut in the spotlight. For retail investors, the blockade is a geopolitical firework, but the real story remains a massive supply overhang that’s keeping Brent pinned near $60.

Sensei’s Insight: Watch the “right of visit” legal justifications. If the U.S. starts seizing non-sanctioned vessels like the Centuries regularly, the risk premium will finally decouple from the oversupply narrative.

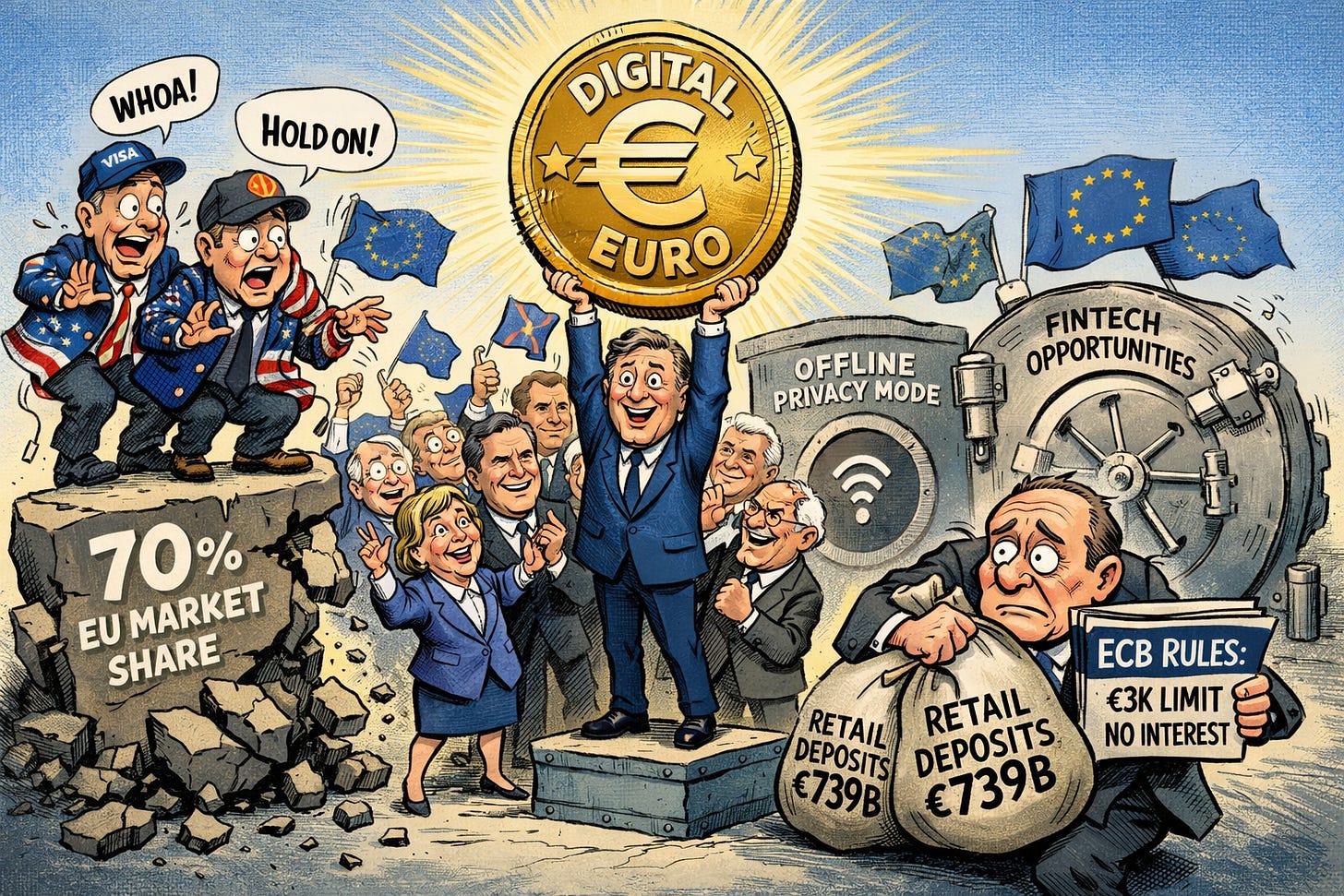

💶 Europe Greenlights the Digital Euro

On December 19, all 27 EU member states reached a landmark agreement on a negotiating mandate for the digital euro. This isn’t just a technical upgrade; it’s a unified political push led by the Council of the European Union to create a public alternative to foreign payment giants. The mandate explicitly requires both online and offline functionality from day one. While the “offline” mode uses NFC technology to mimic the privacy of physical cash for peer-to-peer payments, the “online” version is designed for e-commerce and cross-border transfers. To protect the banking sector, the ECB will cap individual holdings, likely around €3,000, and the digital currency will pay zero interest to discourage savers from draining their traditional bank accounts (Bloomberg).

The move is a direct defensive play against the dominance of Visa and Mastercard, which control 70% of EU card payments, and the recent US push for dollar-denominated stablecoins. For retail investors, this signals a long-term structural shift. Payment processors may face valuation compression as their European oligopoly is challenged by a state-backed competitor with legal tender status. Meanwhile, eurozone banks face a dual-edged sword: they risk losing roughly €739 billion in cheap retail deposits to the ECB, yet they gain a new open platform to build fintech services without building their own payment rails. It’s a move toward “strategic autonomy” that could fundamentally reprice the European financial sector by the targeted 2029 launch.

Sensei’s Insight: Watch the European Parliament’s response in early 2026. Any push to strip the “online” functionality would neuter the project, while a confirmed €3,000 holding limit remains the “red line” for bank stability.

🎢 Wall Street Braces for an AI Tug-of-War

Major strategists at UBS, JPMorgan, and Citigroup are warning that 2026 will be defined by a violent split in investor psychology. We’re seeing a collision between the fear of missing out (FOMO) on the AI rally and growing “bubble angst,” with 45% of fund managers now citing an AI collapse as their top tail risk. Despite this fear, cash levels have plummeted to record lows of 3.3% to 3.7%, suggesting investors are fully “all-in” even as they eye the exits. This setup, where technical positioning is maxed out but nerves are frayed, suggests we’ll see sharp 10% pullbacks followed by rapid snapbacks rather than a steady climb (Bloomberg).

This matters because the “protective” effect of 2025 is starting to fray. For the last year, tech gains often offset losses elsewhere, which kept the VIX artificially suppressed. Now, with the Magnificent Seven making up roughly 35% of the S&P 500 and tech/communications hitting 50% of the index, the market has zero margin for error. If chip stocks stumble due to slowing AI spending, the entire index could move in unison, causing a rapid spike in the VIX. UBS is even calling a “long tech volatility” trade their highest conviction play for next year, betting that the calm we’ve enjoyed is about to break.

Sensei’s Insight: Watch the gap between tech volatility (VXN) and the broader market (VIX). If they start moving together, the “diversification” your portfolio relies on may vanish exactly when you need it.

📉 The Yen’s “Dovish Hike” Backfire

The Bank of Japan (BOJ) just pulled the trigger on a historic rate hike, but the market isn’t buying the drama. On Friday, December 19, the BOJ raised its policy rate to 0.75%, a three-decade high. Yet by Monday morning, the Yen had collapsed instead of rallying. The culprit is Governor Kazuo Ueda’s notably cautious tone during his press conference. He offered zero guidance on future hikes, signaling a “one and done” stance that left the Yen vulnerable. As a result, the Euro/Yen pair hit a record high of 184.92, while the Swiss Franc/Yen reached 198.4. Traders are essentially betting that Japan’s rates will stay frozen while the rest of the world remains higher (Reuters).

This disconnect stems from a growing tug-of-war between the BOJ and Prime Minister Sanae Takaichi’s government. While the central bank is trying to tap the brakes on inflation, Takaichi is slamming the gas with an “Abenomics-style” fiscal policy, including a record ¥120 trillion budget for 2026. This massive spending makes it nearly impossible for the BOJ to stay aggressive without crashing the bond market. For retail investors, this means the “Carry Trade”, borrowing cheap Yen to invest elsewhere, is still very much alive.

Sensei’s Insight: The “Widow Maker” trade is back. With Takaichi spending and Ueda hesitating, Japan’s policy friction is a green light for Yen shorts. Watch for a “flash crash” if Tokyo suddenly intervenes.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_live_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive: ⚖️ The Dovish Hike: Decoding the BOJ’s Strategic Tightrope

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.