Morning Forecast: Monday, 29 December

From Metal to Ledger: How Silver and XRP Are Becoming Mandatory Infrastructure Assets

This content is for informational and educational purposes only and does not constitute financial advice. Always do your own research. Not financial advice (NFA).

👀 Today’s Stories at a Glance

🕊️ Ukraine Peace Deal Close: Trump and Zelensky agree on 90%; thorny territorial disputes still remain unresolved.

📉 Trump Crypto Assets Crash: Retail lost billions; Melania’s token fell 99% after insiders cashed out.

🤖 Tesla Stock Hits Records: Shares rose despite falling sales; investors bet on robotaxi and software growth.

🏛️ Trump Eyes New Fed: The president seeks a dovish chair; inflation fears cause market volatility.

🚀 S&P 500 Hits Record: Markets approached 7,000; investors rotated from tech into healthcare and financials.

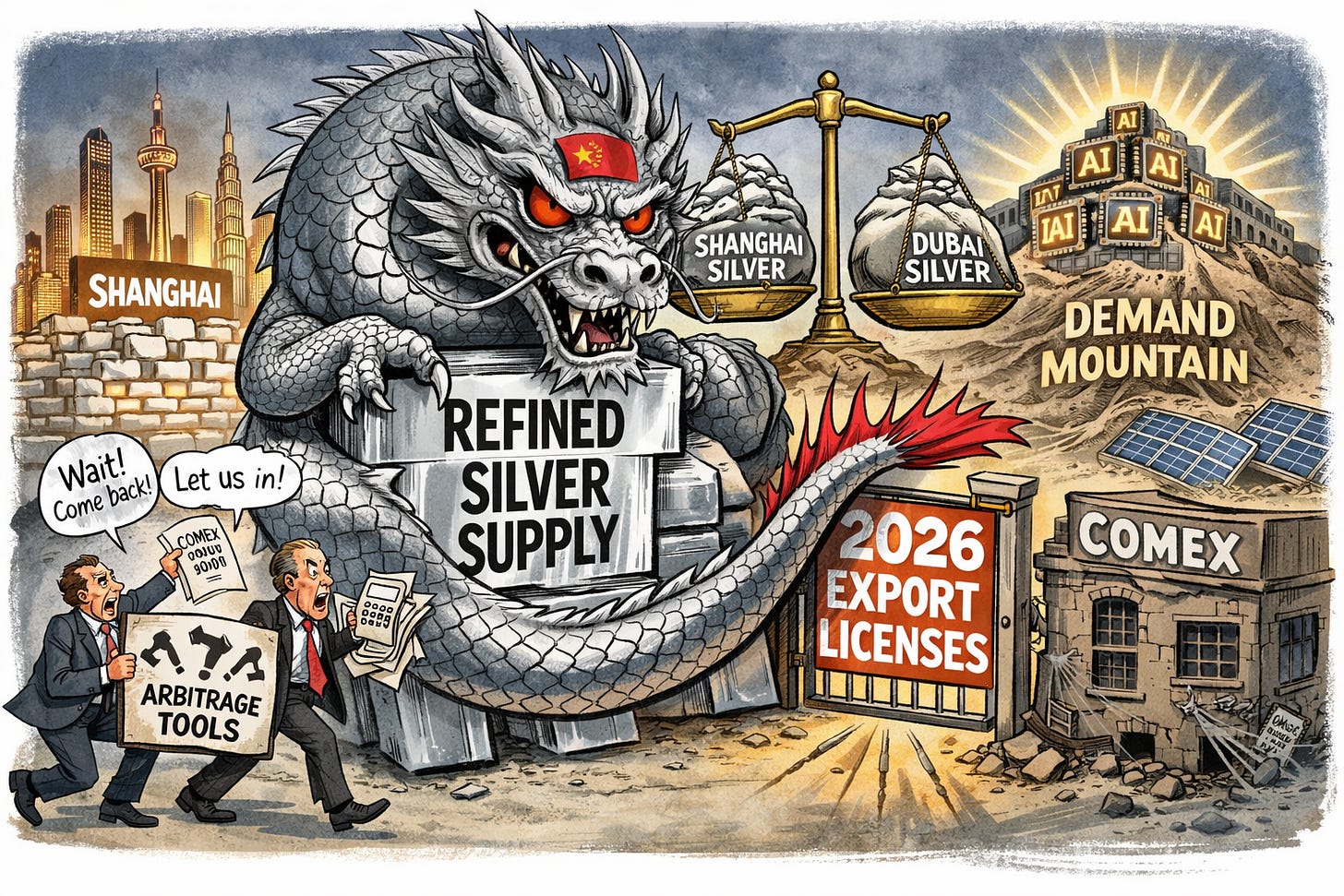

🔍 China Blocks Silver Exports: New licensing rules threaten supply; industrial demand for AI remains high.

🧠 One Big Thing

XRP is successfully mirroring silver’s industrial utility by evolving into a mandatory structural layer for the global financial supply chain. While silver’s massive 174% rally was driven by inelastic physical demand, XRP is building a parallel foundation through On-Demand Liquidity processing $15 billion annually. The 2026 launch of the RLUSD stablecoin and the arrival of spot ETFs serve as primary catalysts to flip institutional participation from optional efficiency to a banking requirement. Recent data showing a 45 percent decline in exchange holdings confirms that large-scale investors are shifting into a high-conviction accumulation phase. This transition positions XRP to achieve a commodity-like price floor backed by genuine network utilization rather than simple market sentiment. Investors should view this as the moment utility-driven demand finally begins to mirror physical supply constraints.

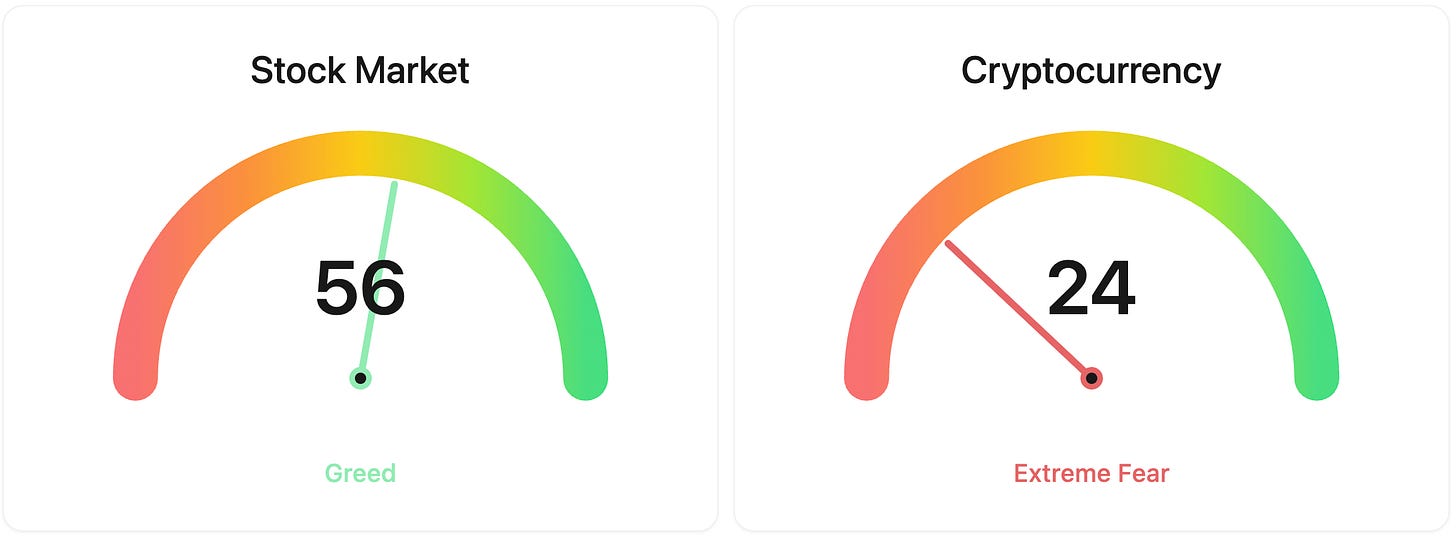

⚖️ Fear & Greed

📉 The Number That Matters

$14

A record $14 premium has emerged between Shanghai physical silver and COMEX paper contracts. This fracture indicates that traditional arbitrage machinery has failed, as physical markets price in actual scarcity while paper markets rely on legacy supply assumptions.

⚔️ Winners vs Losers

Winners

$DBRG +32.90%: DigitalBridge Group, Inc. shares surged following reports that SoftBank is in advanced talks to acquire the digital infrastructure firm for its AI portfolio.

MB +13.09%: MasterBeef Group shares rallied as the market digested governance continuity following the confirmation of board appointments at the company’s annual general meeting.

Losers

ALVO -5.13%: Alvotech shares dropped after a settlement with Regeneron secured a U.S. launch for its biosimilar but delayed the timeline until late 2026.

ACIU -16.29%: AC Immune SA fell on profit-taking following a recent clinical data rally, with no news catalysts detected during the last 48 hours.

PRVA -5.97%: Privia Health Group, Inc. shares declined due to insider selling and increased short interest, though no news catalysts were reported recently.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $87,718 (▼ 0.19%)

Ethereum (ETH): $2,964 (▲ 0.50%)

XRP: $1.87 (▲ 0.57%)

Equity Indices (Futures):

S&P 500: $6,913 (▼ 0.21%)

NASDAQ 100: $25,738 (▼ 0.48%)

FTSE 100: £9,881 (▲ 0.13%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.11% (▼ 0.44%)

Oil (WTI): $58 (▲ 1.90%)

Gold: $4,466 (▼ 1.47%)

Silver: $75.77 (▼ 4.48%)

Data as of UK (GMT): 11:29 / US (EST): 06:29 / Asia (Tokyo): 20:29

✅ 5 Things to Know Today

🕊️ Mar-a-Lago: The 90% Peace Deal

Donald Trump and Volodymyr Zelensky just emerged from a high-stakes Sunday lunch at Mar-a-Lago, claiming they’re “90% agreed” on a 20-point peace plan to end the four-year conflict. While Trump described the talks as “terrific” and suggested a deal could be reached in a few weeks, the remaining 10% contains the “thorny” issues that have derailed past efforts. Specifically, the future of the Donbas region remains a major hurdle: Ukraine has floated a “free economic zone” to avoid constitutional land cessions, but the Kremlin has already voiced its rejection of the compromise. Trump admitted that while security guarantees for Ukraine are “100% agreed” with the U.S., Russia still refuses a ceasefire, with Putin telling Trump a pause would only “prolong the conflict.”

For investors, this “peace dividend” is already creating ripples. European defense stocks like Rheinmetall and BAE Systems saw a sharp sell-off on the headlines, while European natural gas (TTF) dipped to 18-month lows on hopes of a Russian energy return. However, don’t mistake this for a sector-wide exit. NATO’s 3.5% GDP spending floor through 2035 provides a massive structural safety net for defense, making this more of a volatility spike than a fundamental shift. The real play to watch is the $68 billion reconstruction framework. If the January working groups in Washington show real movement, the pivot from “war stocks” to “rebuild stocks” in infrastructure and engineering will likely accelerate.

Sensei’s Insight: It may be time to start watching the reconstruction play. If those January working groups show real legs, the $67.8 billion rebuild could spark a massive shift from defense into infrastructure and engineering stocks.

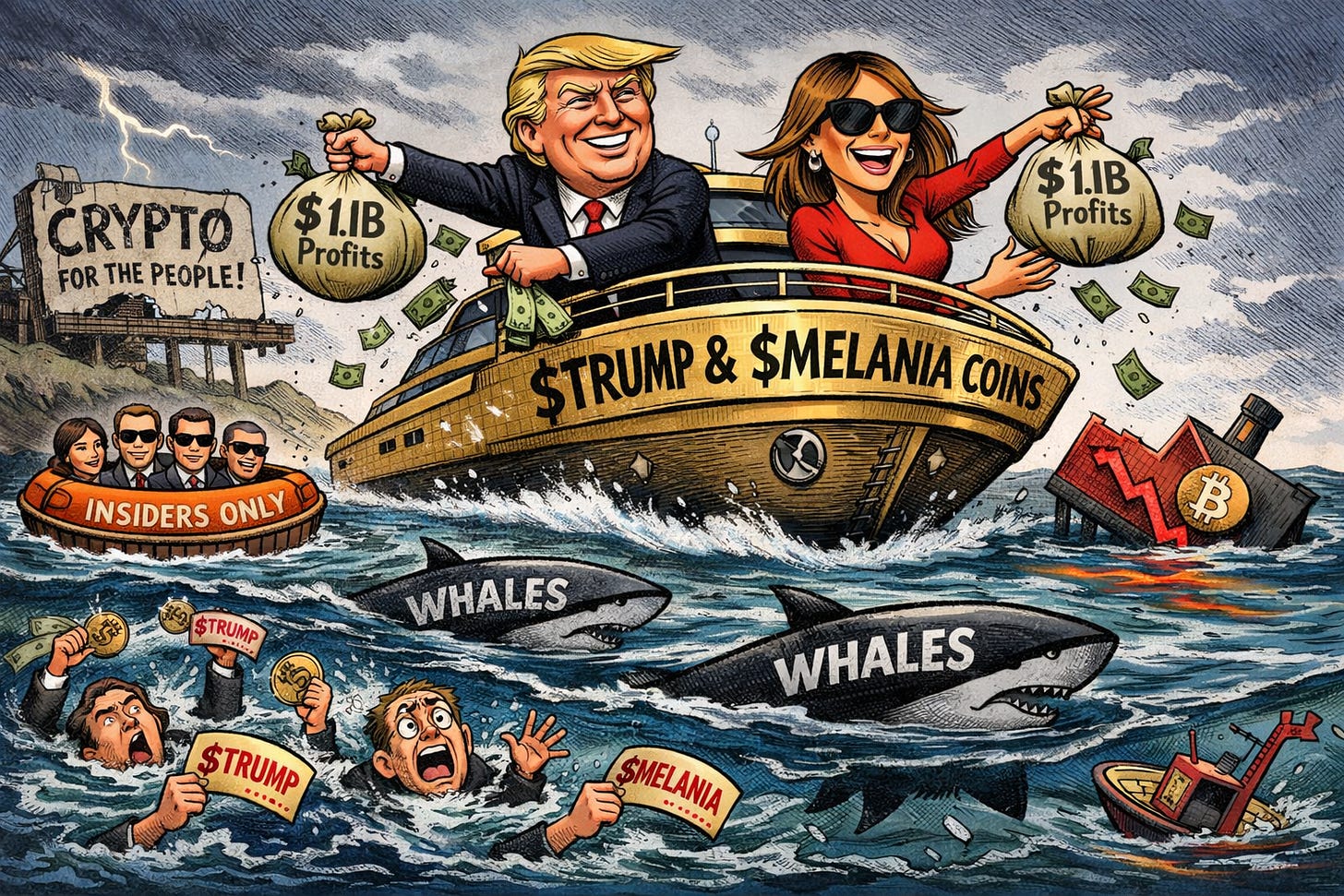

📉 The 99% Wipeout: Trump’s Crypto Experiment

The political momentum trade of 2025 officially hit a wall. Following President Trump’s January inauguration, a wave of digital assets flooded the market, from his own memecoin to the First Lady’s $MELANIA token. The results were brutal for anyone who wasn’t an insider. The $TRUMP coin, which peaked near $75 in January, is currently trading 80% below those highs. Even worse, the $MELANIA token has cratered 99% from its $13.73 launch price to a measly $0.09. Data shows that while 58 “whale” wallets walked away with $1.1 billion in profits, over 764,000 retail investors are sitting on losses.

This isn’t about politics: it’s about the immutable physics of liquidity. Even with a friend in the White House, these tokens couldn’t escape the pattern where prices rise, leverage floods in, and liquidity eventually dries up. A New York lawsuit filed in October alleges that the $MELANIA project was a “pump and dump” scheme designed to lure retail buyers before insiders dumped their holdings. For retail investors, the lesson is that political branding provides zero protection against market mechanics. When insiders and early participants cash out aggressively, the exit door is always too small for the crowd.

Sensei’s Insight: When just 58 people capture $1.1 billion while nearly 800,000 others lose, the retail crowd is simply serving as exit liquidity. Be Careful; these trades are sometimes good in short term but rarely for the long term!

🤖 Tesla Shares Hit Records While Car Sales Stall

Tesla closed 2025 with a paradox: its stock hit an intraday record of ~$500 on December 22, yet its actual car business is struggling. While the S&P 500 rose 17.9%, Tesla outpaced it with a 20.2% gain, despite U.S. sales dipping 9% and European volume crashing 39%. The market is clearly looking past the showroom and betting on the code. Musk’s 2025 goal of 450 robotaxis in Austin missed the mark, with trackers showing only about 32 active vehicles. Still, mid-December saw the first unsupervised test rides, suggesting the pivot from automaker to AI powerhouse is gaining technical friction (MarketWatch).

This shift matters because it changes how we value the ticker. If Tesla is a software platform, its 12% FSD adoption rate is a monetization engine waiting to be flipped. We are already seeing premium Model S and X owners adopt the tech at rates over 50%, which signals high-margin revenue potential that could eventually dwarf car sales. The 2026 roadmap is packed, from the Optimus V3 robot reveal in March to the in-house AI5 chip launch. Watch the regulatory hurdles in China and the EU this spring: they will determine if Tesla can actually scale these AI dreams globally.

Sensei’s Insight: Watch the FSD “take rate” in the next quarterly report. If software adoption keeps climbing while hardware sales fall, the market will likely keep forgiving these missed robotaxi delivery targets.

🏛️ The High-Stakes Chess Match for Powell’s Seat

President Trump is gearing up for an early 2026 announcement to replace Fed Chair Jerome Powell, whose term expires in May. This isn’t just a routine personnel change: it’s a battle for the Fed’s soul. Candidates like Kevin Hassett, who holds an 84% probability of nomination according to CNBC, are signaling an “ultra-dovish” future with claims that there is “plenty of room” for aggressive rate cuts. However, the market is sending mixed signals. Gold has surged 70% in 2025, a massive flight to safety as investors hedge against the potential erosion of the Fed’s inflation-fighting credibility. Meanwhile, the 10-year Treasury yield is hovering around 4.15%, reflecting sticky long-term borrowing costs despite Trump’s push for rates at “1% or lower.” (Wall Street Journal)

The real story for retail investors isn’t just the name on the door; it’s the math of the FOMC. Even a hand-picked chair can’t unilaterally slash rates, as the committee remains deeply divided. We saw this in December, when the Fed faced three dissenting votes, the highest level of internal friction since 2019. If Trump successfully installs a majority on the board by removing Governor Lisa Cook or if Powell vacates his board seat entirely in May, the “checks and balances” of the regional presidents could be the last line of defense. The 10Y-2Y yield spread has already flattened to 0.68%, signaling that the market is bracing for policy uncertainty and potential volatility as the independence of the world’s reserve currency is tested.

Sensei’s Insight: Watch the Supreme Court’s January ruling on Governor Lisa Cook. If she’s ousted, the path to a Trump-controlled Fed majority clears, likely triggering a sharp re-pricing of inflation expectations.

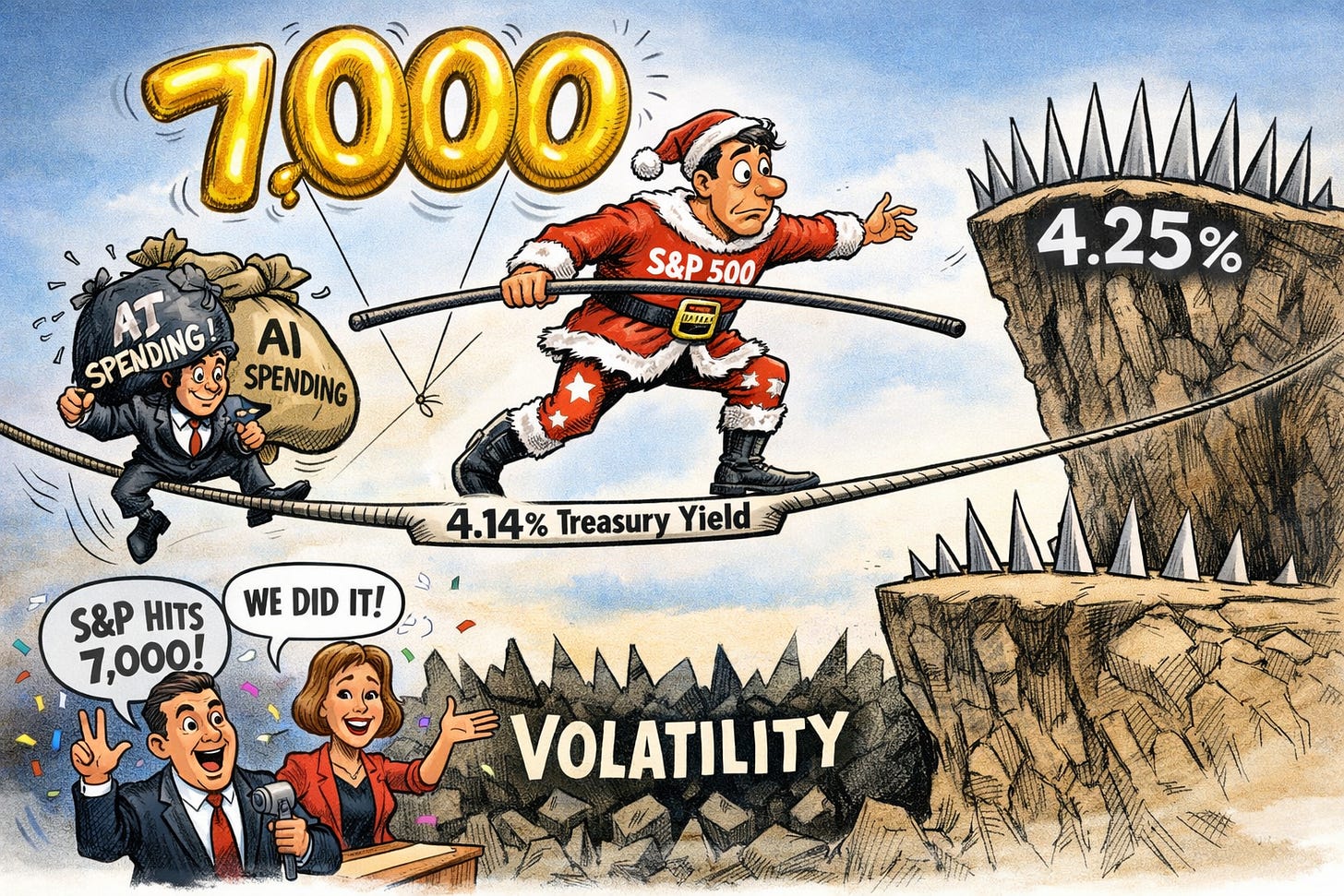

🚀 Chasing 7,000: The Market’s Holiday High Wire Act

The S&P 500 finished Christmas week with a flourish, clinching a new record close of 6,932.05 on Christmas Eve. It’s the first time since 2013 that we’ve seen a record high on the final trading day before the holiday. While some headlines prematurely claimed the index crossed the 7,000 milestone, the reality is a bit more grounded: the S&P sits at 6,924 as of December 29, roughly 76 points shy of that psychological barrier. This rally is backed by some serious muscle, with Q3 GDP expanding at a 4.3% annualized rate, the fastest pace in two years. This growth easily beat the 3% consensus, though it came with a side of stubborn inflation as PCE rose to 2.8%, keeping the Fed in a tight spot regarding 2026 rate cuts.

This “Goldilocks” growth story isn’t without its cracks. While the broader index is up 18% year-to-date, we’re seeing a distinct shift under the hood. Tech has actually slipped more than 3% since November 1, with money rotating into financials, healthcare, and small-caps. These sectors are better positioned for a resilient economy and higher-for-longer rates. Oracle has become the cautionary tale here: despite a massive $523 billion backlog, the stock has struggled as investors question if high AI spending will actually turn into near-term profit. With the 10-year Treasury yield hovering around 4.14%, the market is walking a narrow path. If yields breach the 4.25% level, historical trends suggest volatility could spike.

Sensei’s Insight: Watch the 4.25% level on the 10-year Treasury. If the 10-year yield stays high, money tends to flee the expensive Mag 7 and hide in the safe Treasury bonds. The Mag 7 don't need the money, but they do need the investors—and those investors are starting to look elsewhere for yield.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_live_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive: The China Chokehold: Silver’s Structural Breakout and the Physical-Paper Divergence

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.