Morning Forecast: Monday, 5 January

Venezuela’s shock raid ripples through defense, crypto, energy, and global risk assets.

This content is for informational and educational purposes only and does not constitute financial advice. Always do your own research. Not financial advice (NFA).

👀 Today’s Stories at a Glance

🚁 Delta Force captures Maduro: Markets stay steady as defense stocks and gold rise following the raid.

📈 Bitcoin hits 3-week high: Institutional inflows drive prices past $93,000 as the technical floor firms.

🇬🇱 Trump eyes Greenland annexation: Defense stocks surge as Trump signals Arctic interest despite Danish rebukes.

🚀 Massive 2026 IPO wave: SpaceX and AI firms prep historic listings as institutional appetite returns.

🛡️ Defense and gold rally: Geopolitical shifts spark a flight to safety and increased military demand.

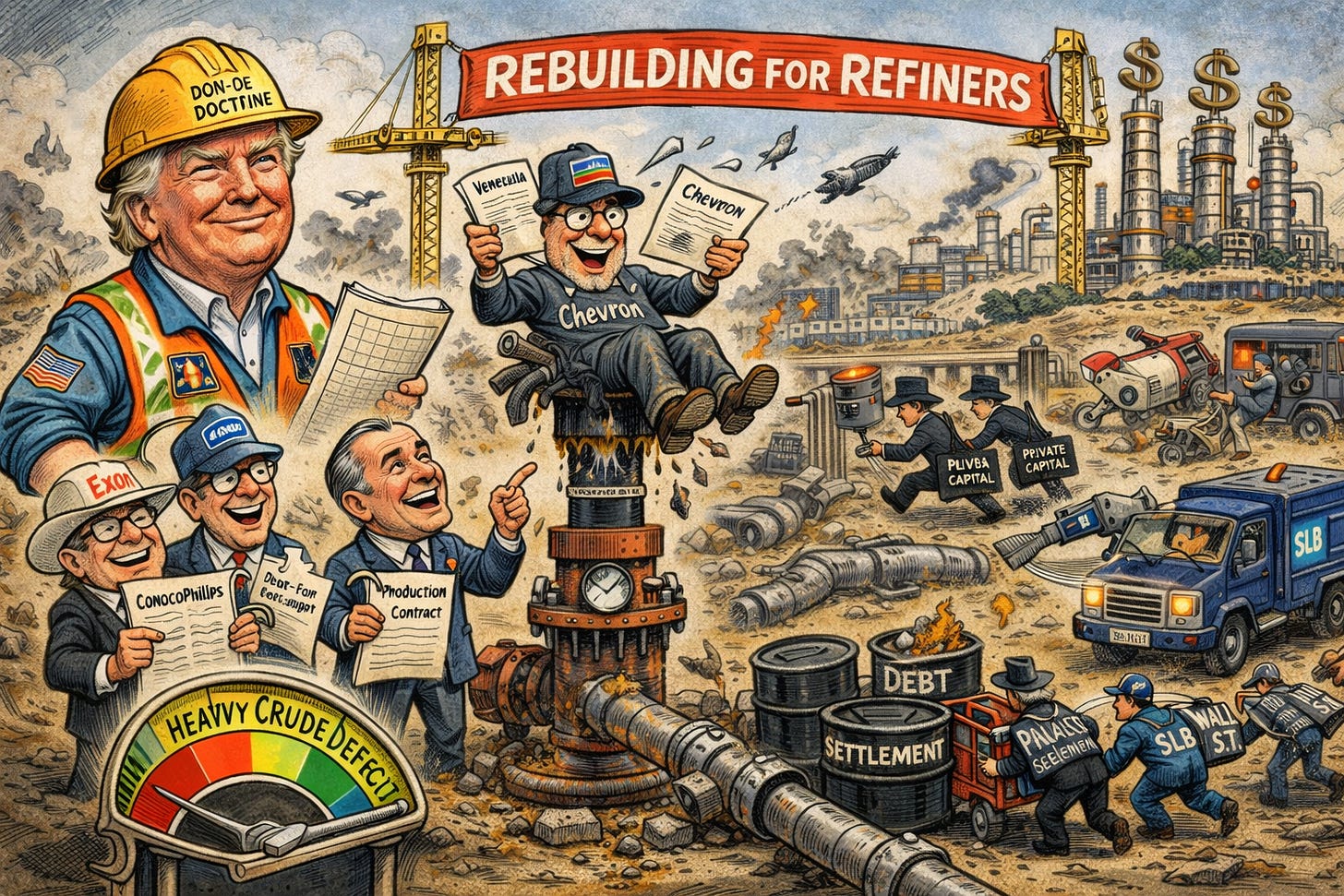

🇻🇪 Re-engineering Venezuela’s energy map: Trump invites oil majors to revitalize infrastructure after the raid.

🧠 One Big Thing

Tesla’s Trillion-Dollar Valuation Gap

Tesla stands as the priciest constituent in the S&P 500 despite a massive divide in professional valuation models. Recent sum-of-the-parts analyses reveal a staggering $1.3 trillion discrepancy between bearish and bullish price targets. While some experts value the firm at only $80 per share, others project worth up to $470 by pricing in future autonomous and robotic sectors. This conflict stems from the challenge of assigning current dollar amounts to unproven AI ventures versus traditional vehicle sales. At 220 times projected 2026 earnings, the stock carries a multiple ten times larger than the index average. Investors must navigate a landscape where market price is decoupled from standardized financial benchmarks.

⚖️ Fear & Greed

📉 The Number That Matters

$100,000,000,000

Experts estimate a $100 billion investment is required over the next decade to restore Venezuelan production to 4 million barrels per day. This capital threshold represents the massive scale of infrastructure revival needed to repair years of systemic neglect.

⚔️ Winners vs Losers

Winners

CVX 0.00%↑: Chevron Corporation shares rose as the removal of Nicolás Maduro positions it as the only active U.S. oil major remaining in Venezuela.

GHRS 0.00%↑: GH Research PLC surged after the FDA lifted a clinical hold on its lead depression treatment, clearing the way for Phase 3 trials.

PBF 0.00%↑: PBF Energy Inc. shares rallied as the Martinez refinery rebuild remains on track for March 2026 supported by insurance recovery funds.

INTC 0.00%↑: Intel Corporation gained after finalizing a $5 billion strategic partnership with Nvidia to co-develop multiple generations of AI and x86 chips.

SIDU 0.00%↑: Sidus Space Inc. rallied on speculative momentum following a massive defense contract award and a federal executive order for a 2028 moon mission.

DVLT 0.00%↑: Datavault AI Inc. shares jumped after the company announced an infrastructure deal and a special warrant dividend ahead of its CES showcase.

SLB 0.00%↑: SLB Limited advanced as a secondary beneficiary of energy sector tailwinds and increased oilfield service demand expectations in Venezuela.

COP 0.00%↑ : ConocoPhillips shares rose on analyst upgrades and sympathy with the broader energy sector rally triggered by geopolitical shifts in Venezuela.

VLO 0.00%↑: Valero Energy gained on supply disruption tailwinds and sector-wide momentum following the political transition in Venezuela.

Losers

CMCSA 0.00%↑: Comcast Corporation shares declined following the completed spinoff of Versant Media Group as the market repriced the standalone cable entity.

ZBIO 0.00%↑: Zenas BioPharma shares crashed in a valuation reset despite the company announcing positive Phase 3 trial results for its lead drug obexelimab.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $92,857 (▲ 1.48%)

Ethereum (ETH): $3,170 (▲ 0.84%)

XRP: $2.13 (▲ 1.77%)

Equity Indices (Futures):

S&P 500: $6,878 (▲ 0.30%)

NASDAQ 100: $25,556 (▲ 0.67%)

FTSE 100: £9,977 (▼ 0.26%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.18% (▼ 0.48%)

Oil (WTI): $58 (▲ 1.06%)

Gold: $4,416 (▲ 1.94%)

Silver: $75.25 (▲ 3.34%)

Data as of UK (GMT): 1:05 pm / US (EST): 8:05 am / Asia (Tokyo): 10:05 pm

✅ 5 Things to Know Today

🚁 Caracas, Chaos, and the Calm VIX

Over the weekend, U.S. Delta Force units executed “Operation Absolute Resolve,” a surgical strike on Caracas that ended with Nicolás Maduro in a Brooklyn detention center. While the geopolitical shockwaves were historic, the market’s reaction was steady. S&P 500 futures rose 0.3% and Nasdaq-100 futures climbed 0.7%, while the VIX “fear gauge” sat at a sleepy 14.51. The Trump administration is framing this as the “Donroe Doctrine,” a pivot toward transactional resource extraction over long-term nation-building. Gold’s 2.3% jump to $4,430.99 represents a tactical hedge in an otherwise risk-on environment, showing investors are buying protection without fleeing the stock market (Bloomberg).

The resilience of the AI narrative remains the dominant force. Even with a head of state in handcuffs, investors are focusing on Micron and AMD, which led premarket gains because global tech demand stays indifferent to Caracas. In Europe, defense plays like Rheinmetall and Saab surged 6% as the operation signaled that unilateral “hard power” is back on the table, potentially forcing European nations to hike their own military budgets. Meanwhile, Acting President Delcy Rodríguez has already pivoted from calling the raid “criminal” to inviting a “cooperation agenda.” This suggests the regime may choose survival through transactional diplomacy rather than risk a full power vacuum or further military intervention.

Sensei’s Insight: Watch the speculative “pop” in defaulted Venezuela sovereign bonds, which could jump 10 points today. It’s a high-stakes bet on whether Rodríguez prioritizes debt restructuring to stay in power.

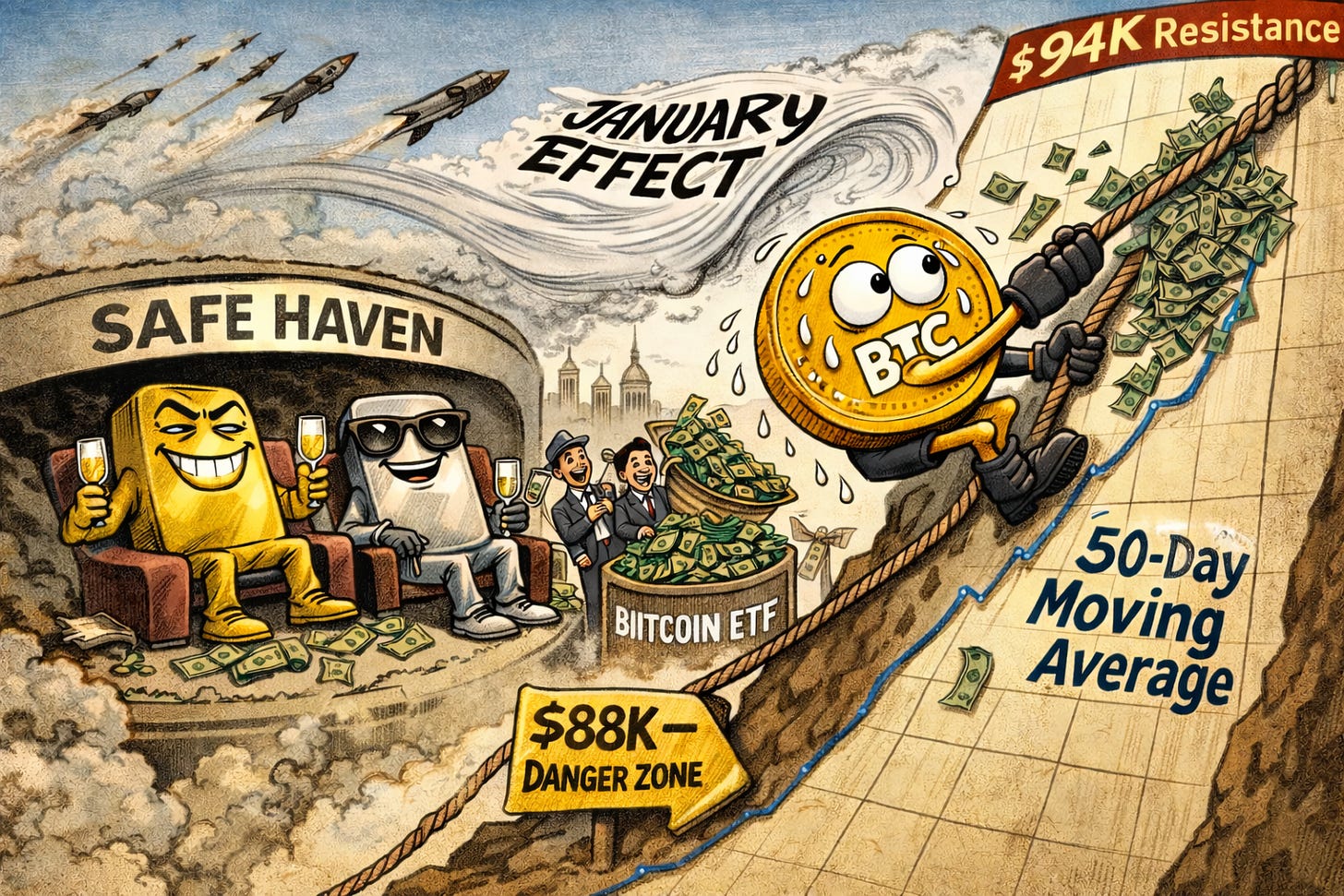

📈 Bitcoin Hits 3-Week High: Institutional Rebound or Geopolitical Noise?

Bitcoin climbed 2.3% to $93,323 in early Asia trading on Monday, marking its highest level since December 11. It’s a welcome bounce after a sluggish 2025 where the asset finished down 6.5% despite pro-crypto signals from Washington. Interestingly, the move appears driven by crypto-native firms and a lack of selling from miners and family offices rather than a broad retail frenzy. While some link the rally to weekend geopolitical headlines, the groundwork was laid on January 2 when US-listed Bitcoin ETFs saw a massive $471 million net inflow, the largest single-day surge since November. BlackRock’s IBIT led the pack, soaking up $287.4 million alone (Bloomberg).

The technical picture is turning into a classic “show me” moment. For the first time since October’s crash, Bitcoin has reclaimed its 50-day moving average, signaling that the price floor may finally be firming up. However, the asset still lacks the “safe-haven” velocity seen in precious metals today: Gold jumped 2% and silver nearly 5%, proving that big money still prefers bullion when the missiles fly. Traders are now laser-focused on the $94,000 resistance level. Clearing that with high volume would confirm a shift from defensive consolidation to a new uptrend, while $88,000 remains the critical line in the sand for bulls.

Sensei’s Insight: Watch the $94,000 ceiling. Bitcoin is currently catching a “January Effect” lift from institutional rebalancing, but until it outperforms gold during global instability, it’s still being traded like a high-beta tech stock.

🇬🇱 Trump Pushes Greenland Annexation After Venezuela Victory

Following the weekend capture of Nicolás Maduro in Venezuela, the Trump administration has shifted its sights to the Arctic. On Saturday, Katie Miller, wife of a top White House aide, posted a map of Greenland draped in the U.S. flag with a single word: “SOON.” By Sunday, Trump doubled down, telling reporters on Air Force One that the U.S. “absolutely” needs the territory for national security. Danish Prime Minister Mette Frederiksen issued a sharp rebuke, stating the U.S. has no right to annex any part of the Kingdom. Greenland’s Premier, Jens-Frederik Nielsen, dismissed the “fantasies of annexation” as disrespectful but urged calm, noting the island’s status is anchored in international law (Bloomberg).

The markets aren’t ignoring the saber-rattling. While broad indices remained steady, defense stocks surged as investors priced in a more aggressive U.S. posture. Germany’s Rheinmetall jumped 7%, and Japan’s Mitsubishi Heavy Industries climbed 8%. This isn’t necessarily a bet on a northern war, but rather a reaction to the certainty of bloated defense budgets. Greenland is a critical “northern flank” for ballistic missile defense and holds rare earth minerals that could break China’s supply chain monopoly. However, because Greenland is a NATO member, any unilateral move by Washington would trigger a systemic crisis within the alliance, making actual annexation a high-risk, low-probability outlier.

Sensei’s Insight: Watch the defense sector ETFs like ITA or XAR. The rhetoric alone is a catalyst for procurement contracts, even if the “SOON” on social media never becomes a reality.

🚀 The $3 Trillion Mega-IPO Wave Hits 2026

Wall Street is prepping for a seismic shift as SpaceX, Anthropic, and OpenAI lead a $3 trillion IPO pipeline for 2026. This isn’t just noise: SpaceX has already started “bake-offs” with investment banks, targeting a historic $1.5 trillion valuation. That’s nearly double its $800 billion mark from late 2025, but it’s supported by Starlink’s projected $24 billion in annual revenue. Anthropic is also moving fast, hiring elite law firms for an early 2026 debut. The gates are open after Medline’s $6.3 billion IPO surged 40% last month, signaling that institutional appetite for mega-deals has finally returned (Barron’s).

These listings represent a massive “prove-it” moment for the AI and space sectors. Once these companies file their S-1 registration statements, we’ll get a transparent look at OpenAI’s $7.8 billion annual burn and Anthropic’s real enterprise margins. For retail investors, this transparency could be a double-edged sword. A $1.5 trillion SpaceX valuation might act as an anchor, potentially lifting smaller space stocks that currently look cheap by comparison. But remember, OpenAI and Anthropic are still burning billions. Their success depends on whether public markets are willing to fund infrastructure-heavy growth during a period of selective investor sentiment.

Sensei’s Insight: Watch the SpaceX S-1 for Starlink’s specific profit margins. If the numbers don’t justify a 75x revenue multiple, it may signal a valuation ceiling for the entire 2026 tech pipeline.

🛡️ The “Regime Change” Premium: Defense and Gold Rally

Recent U.S. actions signal a new era of regime-change risk being priced into markets: it was a massive catalyst for the defense sector. While the oil market stayed flat, defensive players like Germany’s Rheinmetall jumped as investors realized the “Operation Absolute Resolve” template relies on high-end military hardware. This move signals a new era where unilateral force replaces slow-moving diplomacy. Investors took the hint, piling into precious metals as a hedge against the potential fallout. Gold climbed 2.7% and silver soared 6.6%, which are massive moves that reflect a sudden, urgent demand for safety in a world where the old rules of sovereignty no longer apply (Bloomberg).

This matters because we’re seeing the “peace dividend” of the last few decades get liquidated in real-time. Smart money is moving into these defensive positions because the Caracas operation creates a “regime-change premium.” If the administration is willing to snatch a head of state without UN approval, it suggests they might take a similar stance on other regional disputes. This isn’t just about one raid: it’s about the long-term demand for military services and the insurance policy that gold provides. For anyone watching their portfolio, the message is clear: when global order gets rewritten, the defense sector becomes a primary guardrail against volatility.

Sensei’s Insight: Watch the 2.7% gold jump as a floor for future volatility. This rally signals that the market views the Caracas raid as a permanent shift in policy, not a one-off event.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_live_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

🔍Deep Dive: 🇻🇪 How U.S. Majors Are Re-Engineering Venezuela’s Energy Map

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.