Morning Forecast: Stealth QE, Mergers & The $50B Gamble

Oracle rattles the AI trade, Mexico blocks China, and the Fed admits labor data is wrong.

This content is for informational and educational purposes only and does not constitute financial advice. Always do your own research. Not financial advice (NFA).

👀 Today’s Stories at a Glance

🇲🇽 Mexico targets Asian imports: High tariffs on Asian goods aim to close the trade loophole into American markets.

🚨 Oracle’s massive spending scares investors: A fifty billion dollar spending plan tanked the stock amid fears of rising debt.

🗳️ Paramount launches hostile Warner bid: A hostile takeover bid faces political headwinds over foreign backing and antitrust concerns.

🏴☠️ US Marines seize Venezuelan tanker: Special forces boarded a vessel moving sanctioned oil, signaling a shift to physical enforcement.

📉 Fed doubts official jobs data: Powell suspects payroll numbers are overstated, prompting rate cuts despite sticky inflation signals.

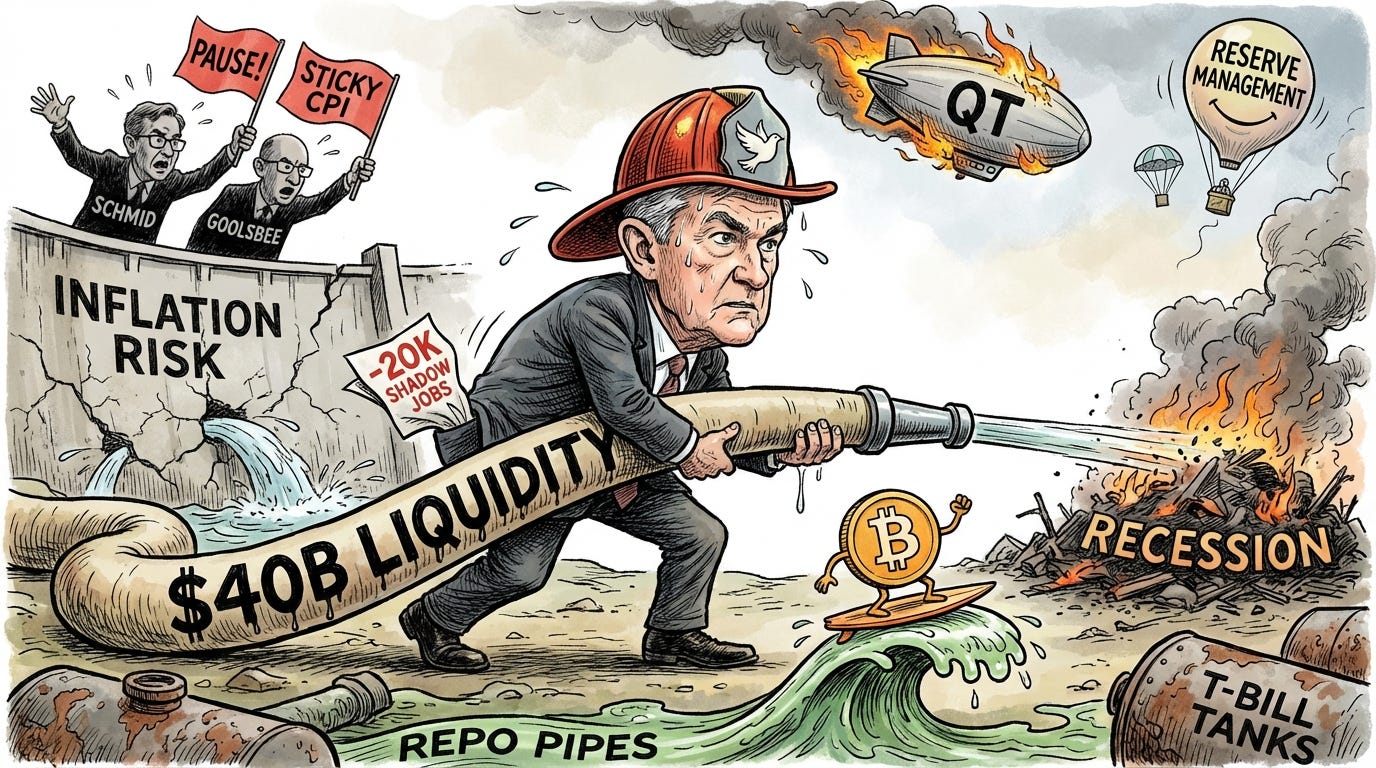

🦅 Fed liquidity boost hides dissent: The central bank effectively restarted quantitative easing while ignoring tariff inflation to avoid recession.

🧠 One Big Thing

The “Bad News is Good News” Paradox

This counterintuitive dynamic currently dominates market behavior. Stocks and the real economy have decoupled because investors now prioritize future liquidity over present growth. Strong economic data signals a threat because it compels the Federal Reserve to keep interest rates restrictive. This tightness drains necessary capital from the market. Conversely, signs of labor weakness or recession risks act as bullish signals. They suggest the central bank will pivot to rate cuts and inject fresh cash to support the system. Investors therefore find themselves in the strange position of hoping for economic deterioration to sustain the rally.

⚖️ Fear & Greed

📉 The Number That Matters

$40,000,000,000

This $40 billion monthly purchasing pace, announced by Jerome Powell at yesterday’s FOMC, signals the effective end of quantitative tightening and the commencement of stealth quantitative easing. Regardless of Fed nomenclature, this liquidity injection suppresses short-term yields and compels capital into high-beta assets, barring an unexpected resurgence in inflation.

⚔️ Winners vs Losers

Winners

PL +18.08%: Planet Labs PBC surged on a third-quarter earnings beat and a record $734.5 million backlog that offset a soft fourth-quarter revenue outlook.

GEMI +16.81%: Gemini Space Station rallied on no specific news, likely moving as a result of a short squeeze and trying to find a bottom.

NXDR +22.53%: Nextdoor Holdings, Inc. spiked after activist investor Eric Jackson published a bullish thesis calling the platform undervalued and highlighting its AI potential.

Losers

ORCL -12.44%: Oracle Corporation shares tumbled after reporting disappointing cloud revenue growth and raising capital expenditure guidance by $15 billion, signaling slower AI monetization.

MSTR -2.84%: MicroStrategy Inc. shares slipped on no specific news, likely reflecting profit-taking following a massive Bitcoin purchase and broader crypto market consolidation.

OXM -21.14%: Oxford Industries, Inc. plummeted after issuing weak fourth-quarter guidance and reporting gross margin compression driven by tariff headwinds and increased promotional activity.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $90,238 (▼ 1.94%)

Ethereum (ETH): $3,195 (▼ 3.89%)

XRP: $2.01 (▼ 1.62%)

Equity Indices (Futures):

S&P 500: $6,856 (▼ 0.43%)

NASDAQ 100: $25,623 (▼ 0.68%)

FTSE 100: £9,672 (▼ 0.12%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.14% (▼ 0.39%)

Oil (WTI): $58 (▼ 2.05%)

Gold: $4,209 (▼ 0.44%)

Silver: $62.08 (▲ 0.62%)

Data as of UK (GMT): 12:00 / US (EST): 07:00 / Asia (Tokyo): 21:00

✅ 5 Things to Know Today

🇲🇽 Mexico Slams the Door on Asian Imports

Mexico officially joined the trade war yesterday. The Senate voted 76-5 to slap tariffs ranging from 5% to 50% on over 1,400 products from Asian nations lacking trade agreements, specifically targeting China, India, and South Korea. This legislation hits everything from electronics to textiles, but automobiles take the heaviest blow with a massive 50% levy. The finance ministry projects this will pull in nearly $3 billion in revenue next year, but the real goal is curbing the flood of Asian goods. Chinese cars alone have grabbed 20% of the Mexican market in just six years, a surge that President Sheinbaum is now aggressively halting (Bloomberg).

This moves aligns Mexico with Washington just ahead of the high-stakes 2026 USMCA review. By closing the “transshipment” loophole, where Chinese goods enter the U.S. duty-free via Mexico, Sheinbaum is insulating her country’s manufacturing sector from potential U.S. penalties. For investors, this reshuffles the deck. BYD, which sold roughly 40,000 EVs in Mexico last year, now faces a math problem that destroys its pricing edge against U.S. legacy automakers. However, don’t overlook the cost ripple. Traditional OEMs like GM and Ford get domestic protection, but their margins could compress as the Asian components they rely on just got significantly more expensive.

Sensei’s Insight: This effectively kills the “China backdoor” trade thesis. Watch Indian auto exporters and EV giants like BYD closely; without a trade deal, their growth story in North America is now on ice.

🚨 Oracle’s $50B AI Gamble Rattles the Market

Oracle dropped a bombshell during its Q2 earnings yesterday, triggering a sharp re-evaluation of the AI trade. While cloud revenue grew, the headline number was a massive spending hike: management raised fiscal 2026 capital expenditure guidance by $15 billion, pushing the total to a staggering $50 billion, a 43% jump year-over-year. The immediate cost of this ambition is steep. Free cash flow plunged to negative $10 billion, nearly double the loss Wall Street expected. The stock tanked over 10% in premarket trading, dragging Nvidia down 1.8% and pressuring the entire “Magnificent Seven” cohort (CNBC)

This signals a critical shift in market psychology: the “build it and they will come” grace period for AI infrastructure is ending. In mid-2025, high spending sparked optimism; today, it sparks anxiety about debt and payoff timelines. Oracle is effectively borrowing billions to build servers for future contracts (like its OpenAI partnership) that haven’t yet turned into cash. This “CapEx shock” was severe enough to overshadow the Federal Reserve’s rate cut yesterday, suggesting investors are currently more worried about tech sector solvency than monetary policy. Watch closely to see if this skepticism spreads to Broadcom’s earnings later today.

Sensei’s Insight: Watch the corporate bond market, not just stock prices. If Oracle’s credit spreads continue to widen, it suggests smart money sees genuine risk in how these massive AI buildouts are being funded.

🗳️ Trump, Saudis, and the $108B Battle for Warner Bros.

Just three days after Netflix clinched a deal to buy Warner Bros. Discovery’s studios and HBO Max for roughly $27.75 a share, the agreement is effectively under siege. Paramount Skydance launched a hostile $30-per-share all-cash tender offer on December 8, valuing the total package at $108.4 billion. Unlike Netflix’s plan, which spins off CNN and linear networks to appease antitrust regulators, Paramount wants the whole pie. The situation turned chaotic Wednesday when President Trump demanded any deal guarantee CNN is “sold separately,” while Democratic lawmakers raised national security flags over Paramount’s $24 billion in backing from Saudi, Qatari, and Emirati sovereign wealth funds (Reuters).

This is no longer just a media consolidation play; it is a geopolitical football. For retail investors, the arbitrage gap is the signal to watch. WBD stock jumped to around $26 on the news, yet it sits significantly below Paramount’s $30 offer. That discount implies the market doubts a clean close due to the intense regulatory headwinds. You have a “pick your poison” scenario here: Democrats fear Netflix’s streaming monopoly power could crush consumer choice, while national security hawks worry about foreign influence over Paramount’s content. Meanwhile, cinema chains warn the Netflix deal could wipe out 25% of the domestic box office. The final value of your shares now depends entirely on which political faction wins the regulatory argument.

Sensei’s Insight: The “Trump Put” is now a merger variable. Watch the spread between WBD’s trading price and that $30 cash offer. If it widens, the market is pricing in a regulatory kill shot.

🏴☠️ US Seizes Venezuelan Supertanker: Sanctions Go Kinetic

Yesterday morning, U.S. special operations forces and Marines rappelled onto the deck of The Skipper, a Very Large Crude Carrier (VLCC) off the coast of Venezuela, seizing the vessel and its 1.8 million barrels of crude oil. President Trump confirmed the operation, calling it the “largest seizure ever.” This marks a distinct shift in strategy: for the first time since the recent Caribbean buildup, the administration moved from financial penalties to physical interdiction. The vessel, part of the so-called “shadow fleet” moving sanctioned oil, was allegedly transferring cargo to a Cuban intermediary when U.S. forces boarded (Reuters).

This matters because it fundamentally changes the risk calculation for the global energy trade. Until now, sanctions enforcement meant blocked bank accounts; now it means armed Marines on your deck. While oil prices reacted modestly (Brent rose about $0.30), the market is now pricing in a “geopolitical floor.” There are over 30 other sanctioned tankers currently operating near Venezuela. If the U.S. targets them next, we aren’t just looking at legal wrangling, but a physical removal of supply from the market. Shipping insurers and logistics firms, not just energy producers, now face immediate confiscation risks in the region.

Sensei’s Insight: Watch the other 30 “dark fleet” vessels near Venezuela. One seizure is a warning, but a second one confirms a campaign that will spike shipping premiums and heavy crude prices globally.

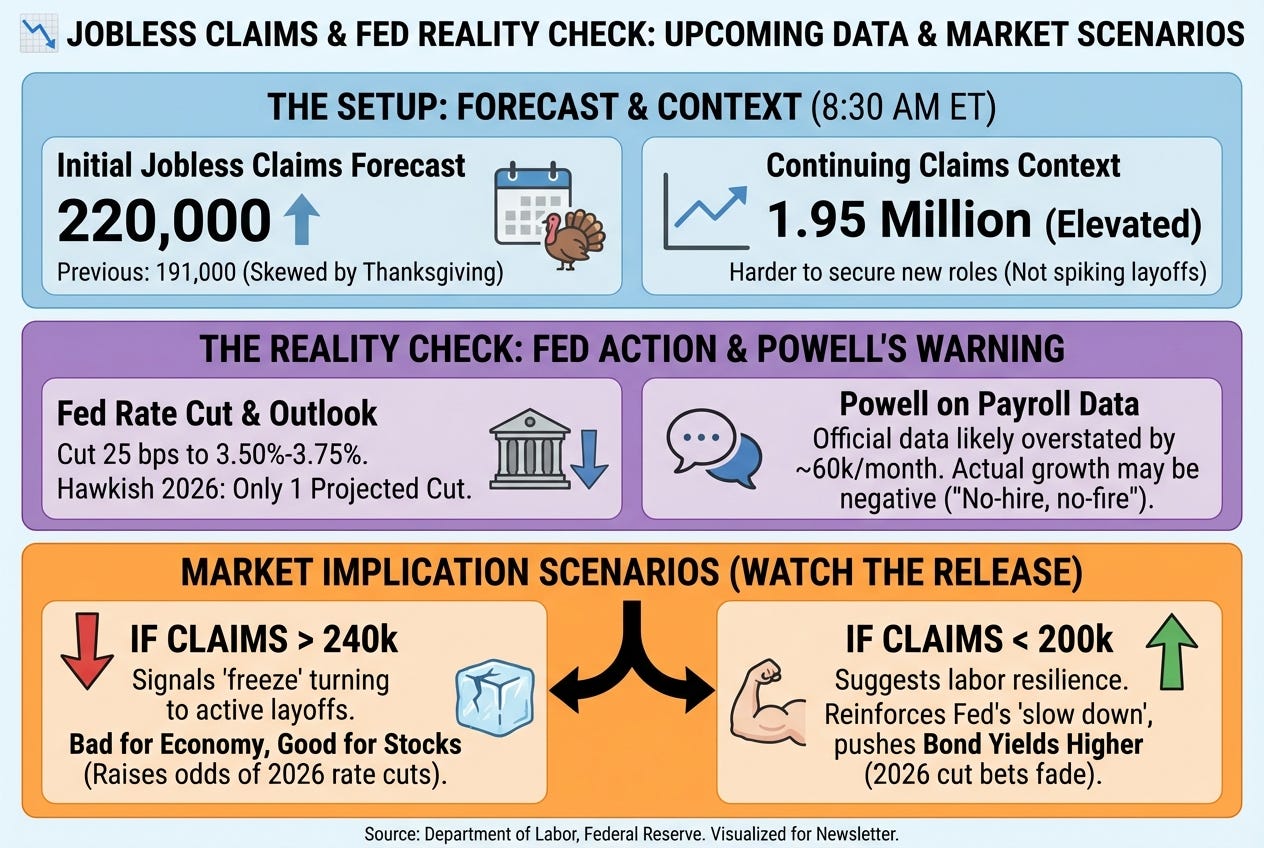

📉 Jobless Claims & Fed Reality Check

At 8:30 AM ET, the Department of Labor releases initial jobless claims. The consensus forecast is a rebound to 220,000, up from last week’s 191,000. Note that last week’s low number was skewed by Thanksgiving holiday adjustments and is not considered a reliable trend signal. A more critical metric to watch is continuing claims, which remain elevated near 1.95 million, indicating that while layoffs are not spiking, unemployed workers are finding it harder to secure new roles.

This release follows yesterday’s Federal Reserve meeting, where the central bank cut rates by 25 basis points to a range of 3.50%-3.75%. However, the outlook for 2026 turned hawkish, with officials projecting only one additional cut next year. Crucially, Chair Jerome Powell stated that official payroll data is likely overstated by approximately 60,000 jobs per month. This suggests actual job growth may be negative, confirming a “no-hire, no-fire” dynamic where companies are freezing hiring rather than conducting mass layoffs.

Market Implication

If Claims > 240k: Signals the “freeze” is turning into active layoffs. Bad for the economy, but good for stock market raises the odds of rate cuts in 2026.

If Claims < 200k: Suggests labor resilience. Reinforces the Fed’s “slow down” message, likely pushing bond yields higher as 2026 rate cut bets fade.

Sensei’s Insight: Watch the disparity between “official” data and Fed actions. The Fed is cutting rates because they know the employment data is misleading. Defensive sectors like Healthcare will likely outperform Tech in this “hidden” downturn.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_live_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive: 🦅 The “Fractured” Cut: Stealth Liquidity, Silent Dissents & The Tariff Gamble

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.