Morning Forecast: The $64 Silver Crisis & Cannabis stocks rally on Trump

JPMorgan Forced to Buy Physical Metal; Broadcom Dips on Margin Warning; Copper Scarcity Drives Mining Boom.

This content is for informational and educational purposes only and does not constitute financial advice. Always do your own research. Not financial advice (NFA).

👀 Today’s Stories at a Glance

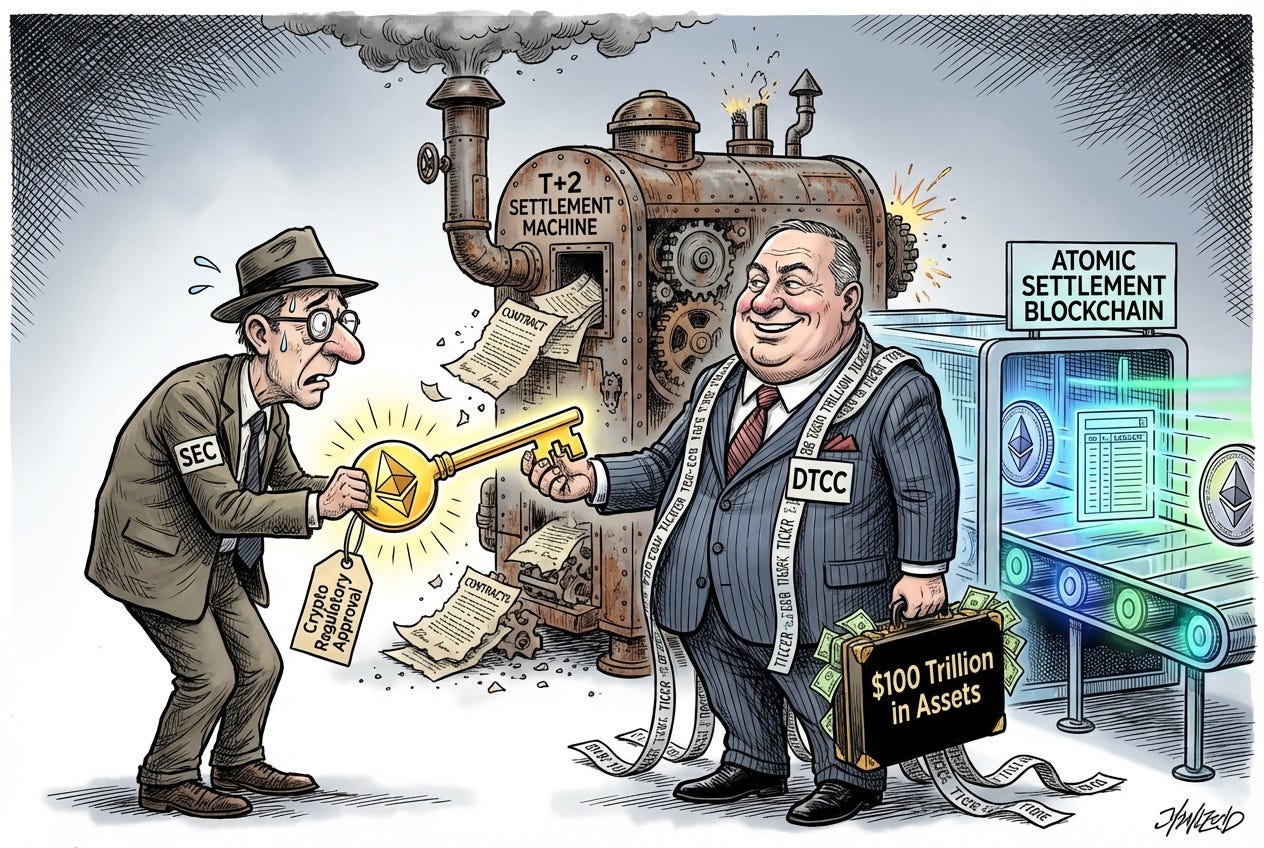

⛓️ Wall Street tests blockchain backend: The SEC authorized DTCC to tokenize stocks for faster, instant trade settlement.

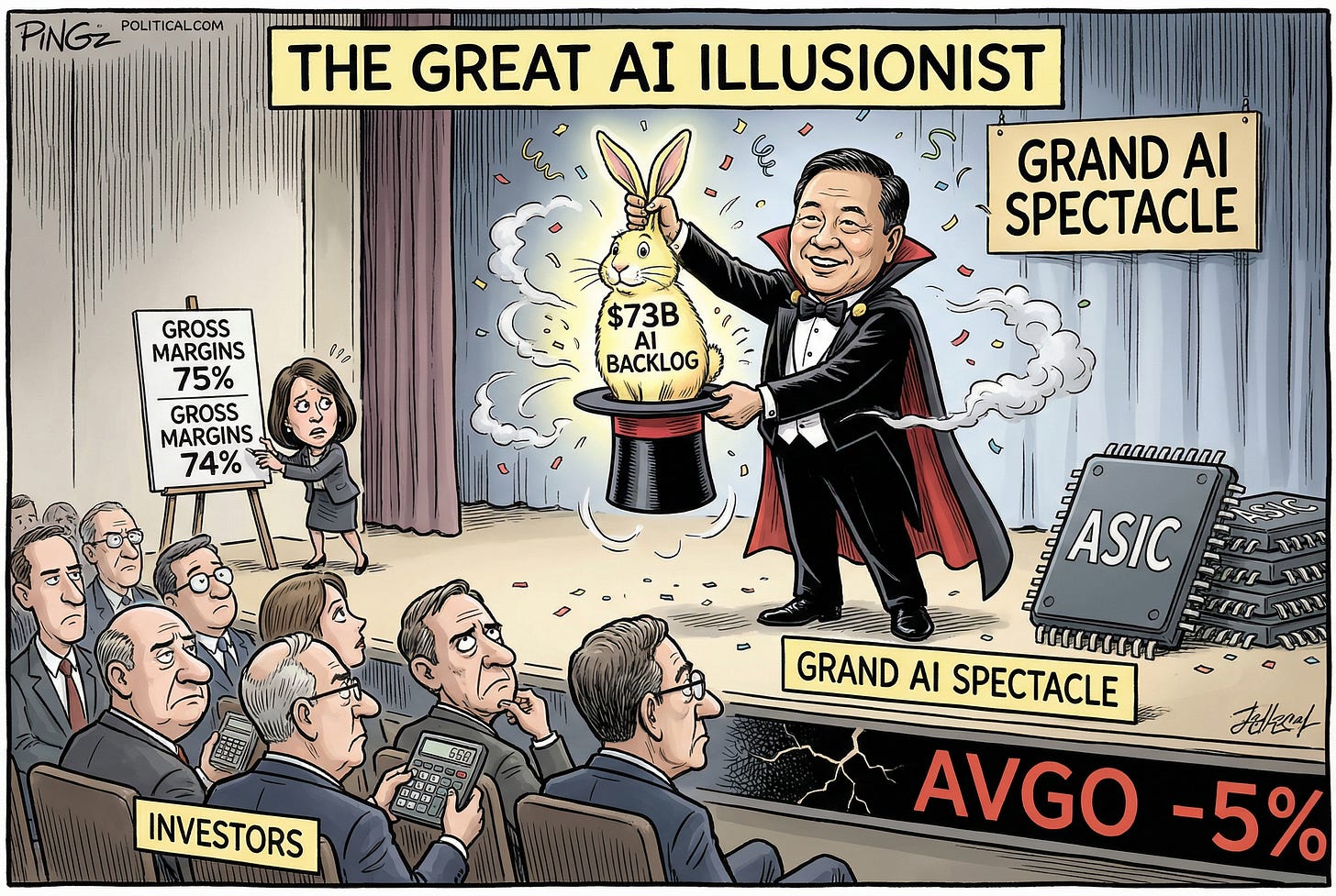

📉 Broadcom drops despite revenue beat: Shares fell after the CEO refused 2026 guidance and warned of tighter profit margins.

🌿 Pot stocks rally on Trump: Investors cheered plans to reclassify marijuana, which would drastically slash industry tax burdens.

⛏️ Copper scarcity boosts miners: European mining stocks rallied as looming global copper shortages drive bullish price forecasts.

⚓ US commandos seize oil tanker: Commandos boarded a vessel carrying Venezuelan crude to crack down on illicit shadow fleets.

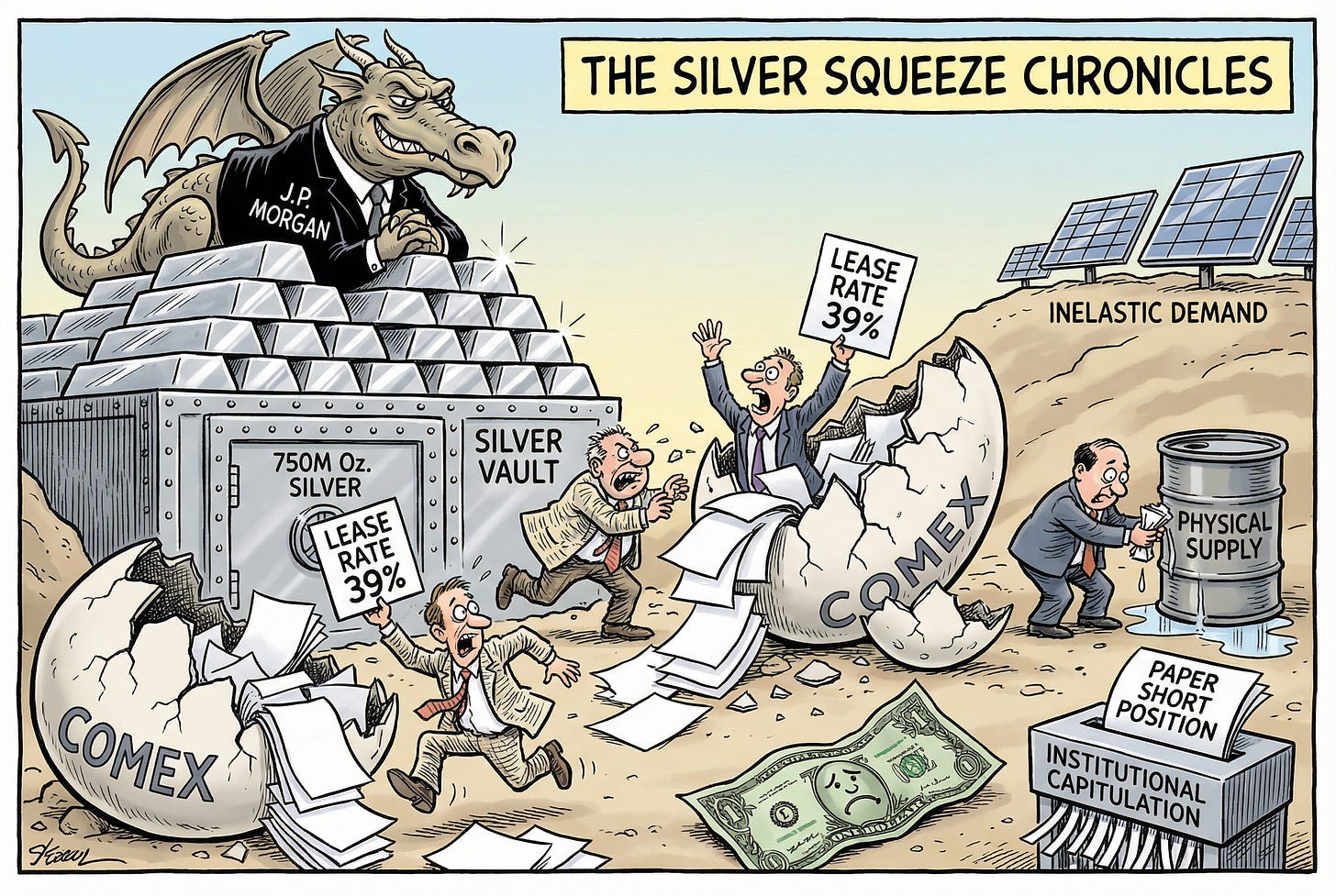

🚨 Silver prices smash records: Prices surged past $64 as physical shortages forced JPMorgan to aggressively accumulate metal.

🧠 One Big Thing

Silver’s Dual-Engine Breakout

Silver prices breached $64 per ounce for the first time, marking a 125% annual surge fueled by dual demand for inflation hedging and AI hardware components. This rally is compounded by acute supply tightness, as anticipated 2026 tariffs triggered an import rush that drained Shanghai inventories to decade lows. While retail investors are aggressively buying ETFs due to a scarcity of large-cap miners, professional sentiment has turned cautious. CFTC data reveals that bullish speculative bets have actually retreated to a 19-month nadir. This divergence signals heightened volatility risks for a market that suffers from significantly lower liquidity than gold.

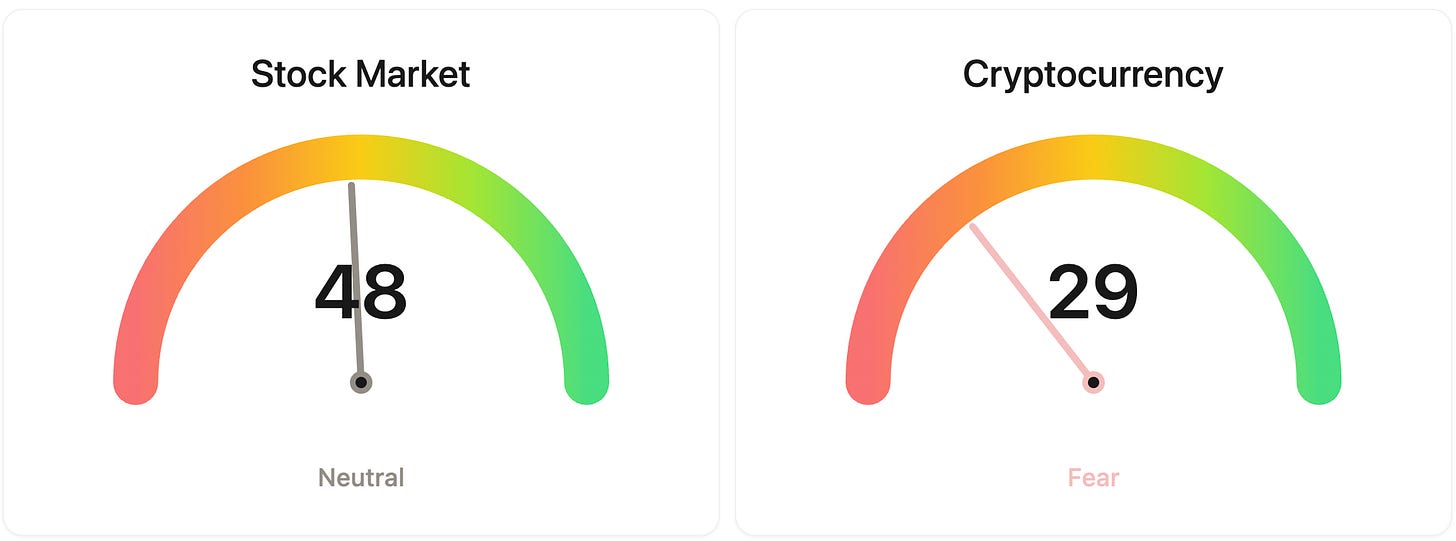

⚖️ Fear & Greed

📉 The Number That Matters

$3.7 QUADRILLION

The SEC has authorized the DTCC to tokenize U.S. securities. This entity processes this massive figure in annual trades, and the pilot allows it to create digital twins of stocks and bonds, testing instant blockchain settlement for American finance.

⚔️ Winners vs Losers

Winners

TLRY +27.4%: Tilray Brands, Inc. surged after reports that the Trump administration intends to reclassify marijuana to Schedule III, potentially unlocking massive U.S. market opportunities.

SNDL +19.8%: SNDL Inc. rallied in sympathy with broader cannabis peers following reports that the Trump administration plans to reclassify marijuana as a Schedule III drug.

CGC +19.0%: Canopy Growth Corporation jumped on sector-wide optimism regarding potential U.S. marijuana rescheduling, further supported by an analyst upgrade citing improved financial footing.

ACB +16.7%: Aurora Cannabis Inc. moved higher on U.S. rescheduling hopes and the launch of its Black Jelly medical cannabis cultivar in the Polish market.

BYSI +20.2%: BeyondSpring, Inc. shares spiked after presenting positive Phase 3 data at the ESMO Asia Congress showing Plinabulin improved survival in lung cancer patients.

NX +22.1%: Quanex Building Products rallied after beating Q3 earnings estimates by 61% and raising guidance due to successful synergies from its Tyman acquisition.

MITK +23.4%: Mitek Systems, Inc. surged after delivering a strong Q4 earnings beat and raising FY2026 revenue guidance driven by accelerating demand for its fraud solutions.

LULU +10.3%: Lululemon Athletica Inc. gained on a Q3 earnings beat and a $1 billion buyback authorization, overshadowing the announced departure of CEO Calvin McDonald.

GRWG +14.1%: GrowGeneration Corp. rose in sympathy with the cannabis sector on rescheduling news, supported by recent operational momentum from its proprietary brand restructuring.

MAPS +14.0%: WM Technology, Inc. rallied alongside broader cannabis stocks on speculation that the Trump administration will reclassify marijuana to Schedule III.

SMX +12.7%: SMX (Security Matters) Pub. climbed after amending an equity purchase agreement to add capital flexibility without toxic terms, extending its runway to 2027.

Losers

FRMI -32.6%: Fermi Inc. plummeted after a prospective tenant terminated a $150 million funding agreement for the Project Matador data center following the expiration of exclusivity.

ABVE -21.4%: Above Food Ingredients Inc. sold off after announcing a delay in its FY2025 audit, overshadowing positive news regarding raised profit guidance and debt elimination.

AVGO -5.8%: Broadcom Inc. dipped despite beating earnings estimates as management warned of near-term margin compression due to a shift in product mix toward AI.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $92,274 (▼ 0.27%)

Ethereum (ETH): $3,238 (▲ 0.01%)

XRP: $2.04 (▲ 0.24%)

Equity Indices (Futures):

S&P 500: $6,889 (▼ 0.43%)

NASDAQ 100: $25,552 (▼ 0.63%)

FTSE 100: £9,720 (▼ 0.04%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.17% (▲ 0.51%)

Oil (WTI): $58 (▼ 0.59%)

Gold: $4,334 (▲ 1.29%)

Silver: $64.42 (▲ 1.29%)

Data as of UK (GMT): 12:08 / US (EST): 07:08 / Asia (Tokyo): 21:08

✅ 5 Things to Know Today

⛓️ SEC Approves Historic Blockchain Pilot for US Stocks

The SEC has quietly capitulated to crypto infrastructure in a move that could reshape Wall Street. On Thursday, regulators issued a “No-Action Letter” authorizing the DTCC, the entity that processes $3.7 quadrillion in trades annually, to tokenize U.S. securities. This three-year pilot allows the custody giant to create digital twins of Russell 1000 stocks, ETFs, and Treasuries on a blockchain. While the service won’t launch until the second half of 2026, it opens the door for the DTCC to eventually migrate its $100 trillion in assets onto distributed ledgers (Bloomberg).

This isn’t about buying Apple shares on a decentralized exchange just yet; it’s about modernizing the archaic backend of finance. Currently, trades take two days to settle (T+2), locking up billions in capital and creating counterparty risk. This pilot tests “atomic settlement,” where trades clear instantly, 24/7. VanEck analysts see a “99% chance” the DTCC uses Ethereum for this, given its dominant role in real-world assets. While retail investors won’t interact with this directly for years, it signals that the SEC finally accepts blockchain as valid market infrastructure.

Sensei’s Insight: Watch the infrastructure plays like Ethereum and Chainlink. If the “plumbing” of the stock market actually moves on-chain, these networks could capture immense value from institutional transaction fees.

📉 Broadcom’s AI “Beat” That Felt Like a Miss

Broadcom (AVGO) just delivered a textbook “sell the news” quarter. The chip giant beat expectations with record Q4 revenue of $18.02 billion and EPS of $1.95, while its AI revenue surged 74% to $8.2 billion. Yet, the stock tumbled ~6% this morning. Why? Investors were spooked by what CEO Hock Tan didn’t say. Despite boasting a massive $73 billion AI backlog over the next 18 months, Tan refused to provide full-year 2026 AI guidance, calling it “a moving target.” Adding to the unease, CFO Kirsten Spears warned that gross margins would compress by ~100 basis points in Q1 as lower-margin custom AI chips make up a bigger slice of the pie (Broadcom Investor Relations).

This drop signals a shift in how the market values AI infrastructure: “Growth at any cost” is out; profitable scaling is in. The math on that $73 billion backlog suggests average quarterly AI revenue of roughly $8.5 billion, barely higher than the current $8.2 billion run rate. This implies growth might plateau in the short term due to 6-to-12-month lead times. Furthermore, the margin compression reveals a structural reality: building custom silicon (ASICs) for clients like Anthropic ($21 billion in orders) and OpenAI is less profitable per unit than selling off-the-shelf parts. Broadcom is trading near-term margins for long-term dominance, but a stock up 75% this year wasn’t priced for that friction.

Sensei’s Insight: This is a classic “air pocket” in a long-term uptrend. The thesis isn’t broken, but the easy money is made. Watch the $380 level closely; if margins compress further without volume acceleration, the valuation reset could deepen.

🌿 Trump Signals Major Cannabis Shift (and Tax Cuts)

President Trump is reportedly preparing to reclassify marijuana from Schedule I to Schedule III, a move that would fundamentally alter the industry’s economics. On a December 10 call with House Speaker Mike Johnson and HHS Secretary RFK Jr., Trump signaled he is inclined to direct the DOJ to fast-track this change, effectively bypassing a stalled DEA hearing process. While the White House cautions that “no final decision has been made,” the market wasted no time reacting. Cannabis stocks and ETFs like MSOS 0.00%↑ and TLRY 0.00%↑ surged over 30% in after-hours trading, betting that the 50-year federal prohibition is finally cracking (Bloomberg).

For investors, the critical implication here is immediate cash flow relief. Currently, IRS Code 280E blocks cannabis companies from deducting standard business expenses, often pushing effective tax rates above 70%. Moving to Schedule III would eliminate this burden, potentially making major operators profitable overnight by allowing them to write off rent, payroll, and marketing like any other business. However, political friction remains high. Speaker Johnson voiced concerns about “risks to children” during the call, and DEA Administrator Terrance Cole has previously deprioritized rescheduling, signaling that internal resistance could still derail the process.

Sensei’s Insight: Watch the Attorney General, not the headlines. Trump cannot unilaterally reschedule; he needs the DOJ to issue a final rule. If administrative delays persist, those recent 30% gains could evaporate quickly.

⛏️ Copper Shortage Ignites European Mining Rally

European mining stocks are hitting a critical turning point as we head into 2026. The Stoxx 600 Basic Resources Index has already jumped 22% this year, its best performance since 2016, but smart money signals there is more room to run. Analysts at Citi and Barclays have turned bullish, with Citi naming Glencore their top 2026 pick and predicting a 15% rally. This isn’t just enthusiasm; it is a hard supply problem. Glencore slashed its 2026 copper guidance to under 870,000 tonnes, while the International Copper Study Group now forecasts a 150,000-ton global deficit next year (Bloomberg).

This rally matters because it is structural, not just cyclical. While demand is growing 2.8% annually, driven by EVs and AI data centers (a single Microsoft facility can consume over 2,000 tonnes), supply is hitting a wall. Ore grades have collapsed below 0.7%, and new projects like Rio Tinto’s Simandou take years to ramp up. The market is pricing in this scarcity now. UBS sees copper hitting $13,000/ton by 2026, meaning miners with volume growth could see earnings expand significantly even if the broader economy cools.

Sensei’s Insight: Watch the China economic data closely in Q1. While the supply deficit is mathematically undeniable, China still consumes half the world’s copper. A sharp slowdown there is the primary risk that could derail this thesis.

⚓ US Seizes “Shadow Fleet” Tanker in Major Escalation

On Wednesday, US commandos fast-roped onto the Skipper, a supertanker carrying 1 million barrels of Venezuelan crude. This marks a sharp pivot from financial sanctions to physical interdiction. The vessel, part of the clandestine “shadow fleet” often used by Iran and Russia, was intercepted in international waters off Venezuela. President Trump confirmed the move, casually noting the US would “keep” the cargo. Reports indicate this is just the start, with over 30 additional vessels potentially on a target list as the administration ramps up pressure on the Maduro regime (Reuters).

The immediate oil price reaction was muted because Venezuela provides only ~1% of global supply, but the economic ripple effects are significant. This operation attacks the financial piping of the “shadow fleet.” By physically seizing cargo, the US effectively forces buyers to demand massive upfront guarantees from Venezuela to cover the risk of loss. This severely tightens Maduro’s cash flow. It introduces a physical risk premium to shipping lanes that were previously just legally risky. If this tactic expands, it could spook the wider network of vessels moving Russian and Iranian barrels, complicating global energy logistics.

Sensei’s Insight: Watch maritime insurance premiums and shipping rates for non-standard vessels. If kinetic enforcement widens, transport costs could creep up invisibly, squeezing margins for companies relying on complex supply chains.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_live_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive: 🚨 The Great Divergence: Institutional Capitulation and the Physical Silver Squeeze

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.