Morning Forecast: Thursday, 15 January

From oil and silver to AI and crypto, capital is rotating fast

This content is for informational and educational purposes only and does not constitute financial advice. Always do your own research. Not financial advice (NFA).

👀 Today’s Stories at a Glance

🕊️ Iran Tensions Ease: Trump signals de-escalation as Iran postpones executions, causing oil prices and geopolitical risk premiums to drop.

💰 BlackRock Hits $14 Trillion: Assets reach record highs despite a profit dip from acquisition costs, signaling a massive pivot toward private markets.

🏗️ TSMC’s $56B AI Bet: The foundry giant hikes capital expenditure to meet booming AI demand, validating massive infrastructure spending by tech titans.

🛑 Coinbase Halts Crypto Bill: CEO Brian Armstrong withdraws support for the CLARITY Act over DeFi and stablecoin concerns, stalling Senate progress.

🥈 Silver’s Tariff Premium Evaporates: Prices tumble after Trump delays immediate mineral tariffs, shifting market focus from panic buying to price discovery.

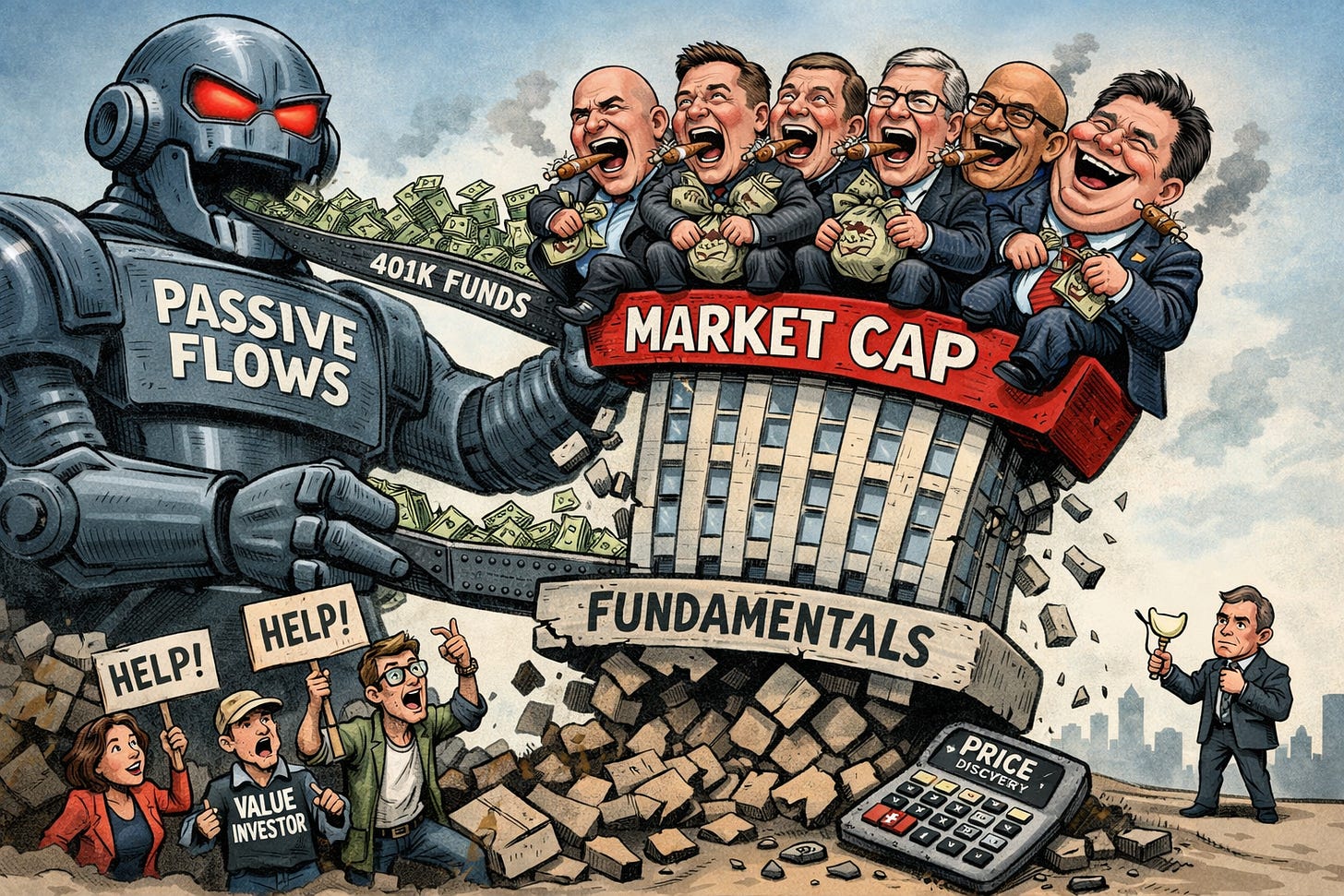

🔍 Deep Dive, Passive investing distorts prices: Mechanical flows from index funds create a price multiplier, potentially inflating valuations beyond reality.

🧠 One Big Thing

Passive investing has transitioned from a tracking tool into the primary driver of global equity valuations. This shift creates an inelastic environment where automated mandates override fundamental value. Data reveals that minor capital injections now spark outsized gains in total valuation because mandatory allocation rules require immediate purchasing. This mechanical process bypasses traditional price discovery and concentrates capital into the largest existing players. Consequently, the market's ability to efficiently allocate resources is breaking down. For investors, this lack of a fundamental floor suggests that future market corrections could be exceptionally violent. (Seen more in the Deep Dive).

⚖️ Fear & Greed

📉 The Number That Matters

$14,000,000,000,000

BlackRock reached a milestone $14 trillion in assets under management despite a 33% dip in GAAP net income. The firm is pivoting aggressively toward private markets, with alternative assets jumping to over $423 billion following major strategic acquisitions.

⚔️ Winners vs Losers

Winners

RILY 0.00%↑: BRC Group Holdings, Inc. shares soared after reporting a third-quarter net income of $89.1 million and significant growth in its capital markets segment.

RFIL 0.00%↑ : RF Industries, Ltd. stock rallied after the company reported 23% fourth-quarter sales growth and successful revenue diversification into the aerospace and defense sectors.

OCUL 0.00%↑ : Ocular Therapeutix, Inc. rose on reports that Sanofi is preparing an increased takeover bid after the company previously rejected a $16 per share offer.

DRTS 0.00%↑ : Alpha Tau Medical Ltd. shares advanced after submitting its first modular Pre-Market Approval application to the FDA for the Alpha DaRT radiation therapy.

LPTH 0.00%↑ : LightPath Technologies, Inc. moved higher following the completion of a $60 million public offering and its participation in the Needham Growth Conference.

SNDK 0.00%↑ : SanDisk Corporation gained in sympathy with a broader semiconductor rally following AI-related storage technology announcements at the CES 2026 conference.

LRCX 0.00%↑ : Lam Research Corporation shares climbed as the semiconductor equipment sector rallied on expectations of a robust AI infrastructure manufacturing cycle through 2027.

AMAT 0.00%↑ : Applied Materials, Inc. rose amid a widespread semiconductor industry rally driven by surging AI chip demand and projected memory capacity expansions.

TSM 0.00%↑ : Taiwan Semiconductor Manufacturing Co. shares advanced as the chip sector rallied following bullish sentiment surrounding AI infrastructure spending at CES 2026.

KLAC 0.00%↑ : KLA Corporation moved higher in sympathy with semiconductor peers as investors anticipated increased demand for inspection equipment during the upcoming memory expansion cycle.

ASML 0.00%↑ : ASML Holding NV shares reached record highs after Bernstein upgraded the stock to Outperform, citing underestimated growth potential from AI-driven memory demand.

Losers

CMCL 0.00%↑: Caledonia Mining Corporation Plc fell after pricing an upsized $125 million convertible senior notes offering to fund the Bilboes gold project in Zimbabwe.

THH 0.00%↑ : TryHard Holdings Limited shares dropped sharply after the company announced a $25 million equity purchase facility, triggering concerns regarding potential shareholder dilution.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $96,649 (▼ -0.25%)

Ethereum (ETH): $3,350 (▼ -0.09%)

XRP: $2.11 (▼ -1.34%)

Equity Indices (Futures):

S&P 500: $6,952 (▲ 0.44%)

NASDAQ 100: $25,834 (▲ 0.79%)

FTSE 100: £10,231 (▲ 0.09%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.15% (▲ 0.34%)

Oil (WTI): $60 (▼ -1.03%)

Gold: $4,615 (▼ -0.25%)

Silver: $90.82 (▼ -2.53%)

Data as of UK (GMT): 12:21am / US (EST): 7:21pm / Asia (Tokyo): 9:21am

✅ 5 Things to Know Today

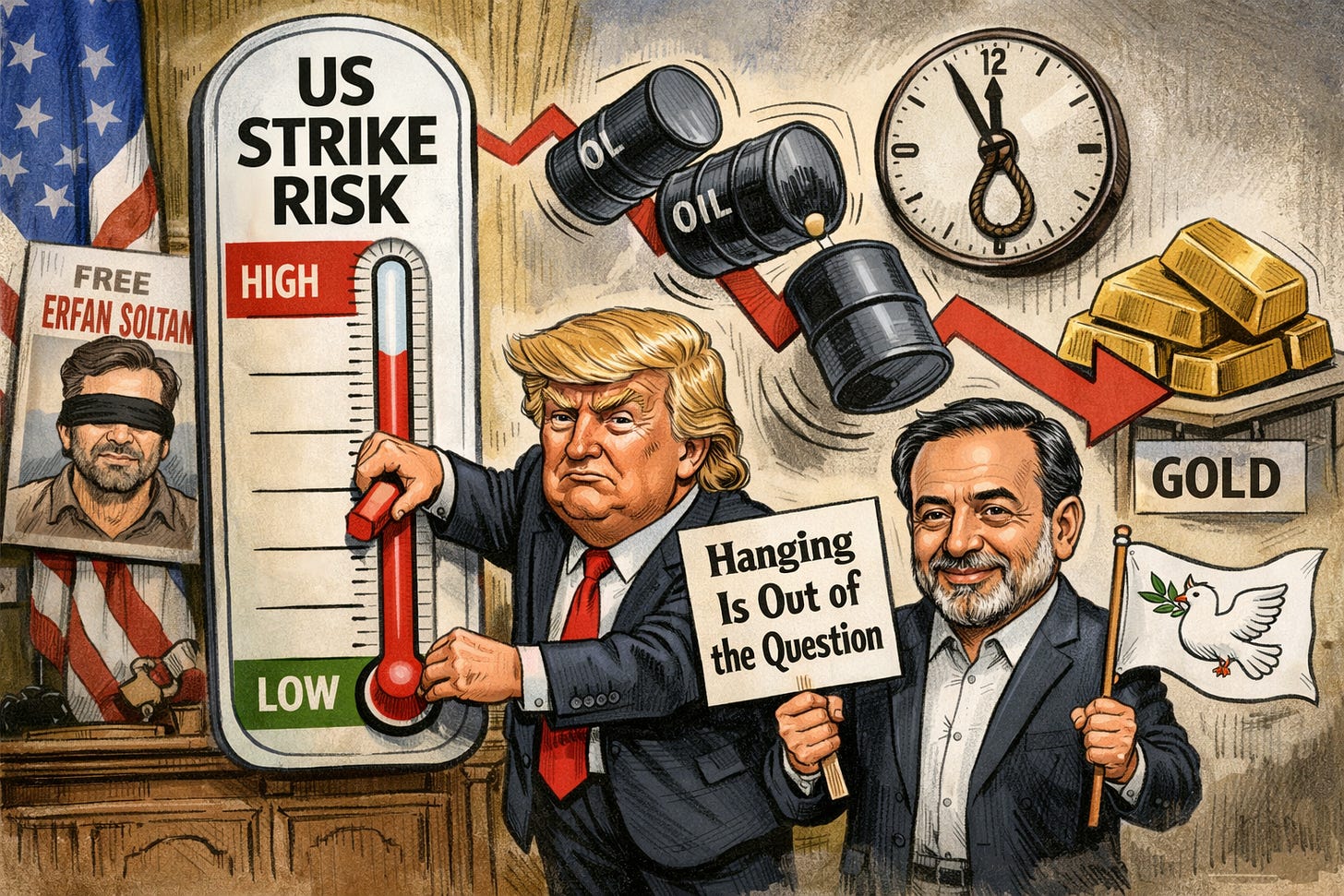

🕊️ Iran Tensions Ease After Trump Backs Down

US President Donald Trump signaled a de-escalation on January 14, claiming he has “good authority” that Iran’s lethal crackdown on protesters has stopped. This shift follows days of threats of “very strong action” and reports of the scheduled execution of Erfan Soltani, which has since been postponed. Iranian Foreign Minister Abbas Araghchi echoed this on Fox News, stating that “hanging is out of the question.” Oil markets reacted sharply: Brent crude futures dropped 3.4% to $64.25 per barrel, while WTI fell to $59.89. This move effectively erased the 11% geopolitical risk premium built up over the previous week (Bloomberg).

This pivot matters because it suggests a move away from military conflict toward a “watch and see” economic pressure campaign. While gold hit record highs near $4,643 per ounce during the peak of the tension, it’s now retreating as safe-haven demand cools. For retail investors, this signals that the immediate “war trade” in energy is cooling, though regional stability remains fragile. Iran’s internal economic crisis persists, with inflation at 42.2% and a currency that hit 1.25 million rials per dollar in December. This structural weakness may continue to fuel unrest, regardless of the temporary pause in US strike threats.

Sensei’s Insight: Watch the $60 support level on WTI crude. If oil stays above this mark despite the de-escalation, it may signal that underlying supply concerns are more persistent than the current headlines suggest.

💰 BlackRock Hits $14 Trillion Despite GAAP Profit Dip

BlackRock just hit a massive milestone, closing out 2025 with a record $14 trillion in assets under management. While headline GAAP net income dropped 33% to $1.13 billion, the story is more nuanced. That dip was largely fueled by one-time acquisition costs and integration expenses for major deals. On an adjusted basis, the firm posted $13.16 per share, comfortably beating the $12.24 consensus. Long-term net inflows hit $268 billion, which actually came in slightly below the $311.6 billion analysts wanted to see. Still, total quarterly inflows reached $342 billion, suggesting investors are still leaning into the market.

The real signal here is the aggressive pivot toward private markets. Alternatives assets under management jumped to over $423 billion, a massive leap from roughly $290 billion just a year ago. This growth isn’t just organic: it’s the result of folding in firms like HPS Investment Partners and Global Infrastructure Partners. BlackRock is clearly trying to bridge the gap between low-fee ETFs and high-margin private credit. For retail investors, this suggests that the industry’s heavyweights see private assets as the next major growth engine. Even with the inflow miss, the stock rose about 1.4%, showing that the market is focusing on fee growth rather than temporary acquisition hurdles.

Sensei’s Insight: Watch how quickly BlackRock integrates these high-fee private credit platforms. If they can hit their $400 billion fundraising goal by 2030, it may signal a permanent shift in how capital is allocated globally.

🏗️ TSMC’s $56B Bet on the AI “Megatrend”

TSMC just dropped a Q4 hammer, reporting a record NT$505.74 billion ($16.01 billion) in net income, a 35 percent jump that blew past expectations. Even more striking is the 2026 playbook: the foundry is hiking capital expenditure to a massive $52 billion to $56 billion range. That’s a 27 to 37 percent increase over last year, signaling that management sees the AI boom as a structural shift rather than a fleeting cycle. High-performance computing, which covers those coveted AI chips, now drives 55 percent of quarterly revenue. While CEO C.C. Wei admitted he’s “nervous” about the sheer scale of this investment, the company is doubling down on its Arizona expansion to dodge Taiwan’s power constraints.

This capex surge is a major validation for the entire AI ecosystem, specifically for equipment giants like ASML, which saw its market cap cross $500 billion on the news. TSMC’s confidence suggests that the $1 trillion in planned data center spending from the likes of Nvidia and Microsoft is firmly on track. However, there’s a growing divergence to watch: while AI logic chips are soaring, a secondary shortage in high-bandwidth memory (HBM) is starting to squeeze the consumer electronics market. TSMC remains insulated for now, but the rising cost of memory could dampen broader smartphone and PC demand even as the AI infrastructure buildout hits high gear.

Sensei’s Insight: Watch the 2nm yield rates and Arizona power logistics. TSMC is pricing in a “no-fail” AI future, but any softening in hyperscaler demand could make this massive capex cycle look top-heavy.

🛑 Coinbase Pulls the Plug on Senate Crypto Bill

Late Wednesday, Coinbase CEO Brian Armstrong stunned DC by withdrawing support for the Digital Asset Market Clarity Act (CLARITY Act) just hours before its scheduled Senate markup. The move forced Senate Banking Committee Chair Tim Scott to postpone the hearing indefinitely to allow for “continued negotiations.” Armstrong cited five deal-breakers in the draft text, specifically targeting a “de facto ban” on tokenized equities, restrictions on stablecoin rewards, and DeFi provisions he claims would give the government unlimited access to private financial records. Despite the legislative friction, Bitcoin hit an intraday high of $97,700 before settling around $96,703, showing surprising resilience as institutional accumulation continues to offset retail’s notable absence from the current rally (Barron’s).

This isn’t just a spat over semantics; it’s a high-stakes game of chicken over the future of the U.S. crypto ecosystem. Coinbase’s “no bill rather than a bad bill” stance highlights a growing rift between industry giants and traditional banking lobbyists, who successfully pushed for restrictions on stablecoin yields to prevent “deposit flight” from legacy banks. For retail investors, the immediate takeaway is the divergence in price action: while Bitcoin remains buoyant on institutional optimism and cooling inflation data, altcoins like XRP fell 2% as the path to regulatory clarity hits another roadblock. The delay suggests that while a framework is closer than ever, the final rules may not materialize until mid-2026 or later, keeping the “regulation by enforcement” status quo alive for the foreseeable future.

Sensei’s Insight: Watch the $96k support level on Bitcoin. If this legislative “pause” turns into a permanent stalemate, institutional patience may wear thin, potentially triggering a sharp correction across the broader crypto market.

🥈 Silver’s Tariff Premium Evaporates

Silver tumbled 7.3% on January 15, closing at $87.78 per ounce after President Trump announced he’ll hold off on immediate tariffs for critical minerals. This move follows a nine-month Section 232 national security probe into U.S. mineral dependencies. Instead of sweeping duties, the administration is pivoting to a 180-day negotiation window to secure bilateral trade deals with allies like Australia and Saudi Arabia. The pivot effectively deflated a massive “tariff premium” that had pushed silver to a record high of $93.75 just days earlier. Traders who were stockpiling physical silver in U.S. warehouses to get ahead of potential duties are now hitting the sell button, as the immediate threat of a double supply squeeze, between U.S. tariffs and China’s new export restrictions, has eased (Bloomberg).

This isn’t necessarily a shift in the long-term bull case, but it’s a reality check on recent “speculative fever.” While the immediate tariff risk is gone, China still controls roughly 70% of refined silver supply and enacted strict export licensing on January 1. Industrial demand from solar manufacturers and EV makers remains structural, not cyclical, meaning the underlying supply deficit hasn’t vanished. However, the next six months will be a waiting game. If Commerce Secretary Howard Lutnick and USTR Jamieson Greer can’t secure binding agreements by the July 13 deadline, Trump has signaled he may resort to price floors or quotas. For now, the market is shifting from “panic buying” to “price discovery” as the technical resistance at $93 triggered a wave of algorithmic selling and margin liquidations.

Sensei’s Insight: The “tariff trade” is on ice for 180 days. Watch the $85 support level: if it holds, the structural deficit remains the story; if not, we’re seeing a deeper flush of speculative froth.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_live_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

🔍Deep Dive: Is Passive Dominance Distorting Market Reality?

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.