Morning Forecast: Thursday, 22 January

The BOJ Decision That Could Unwind the Global Carry Trade

This content is for informational and educational purposes only and does not constitute financial advice. Always do your own research. Not financial advice (NFA).

🇯🇵 BOJ Decision Night – Premium Members Get the Edge

Tonight’s Bank of Japan rate decision is one of the most important global liquidity events of the year, and premium subscribers will get a full Yen Carry Trade Cheat Sheet later today, before the interest rate decision and Ueda’s speech. A limited 60% discount is running so serious investors can get positioned ahead of the volatility.

Premium members will receive:

📉 The BOJ Carry Trade Cheat Sheet – timelines, scenarios, and what actually moves markets

🧭 Live decision & speech framework – what matters, what’s noise, and what’s not priced in

📊 Downside accumulation levels across crypto, equities, and metals

🔴 Real-time risk context for US tech, Bitcoin, XRP, and global liquidity

🎯 Ongoing access to the £5,000 Portfolio Challenge, chart course, and planning tools

This is the same process I use during events that break markets, not hindsight commentary after the fact.

60% off your first year

⏳ 1 week only

🎟️ Limited spots per day

If you want the playbook before the carry trade reacts — this is it.

👀 Today’s Stories at a Glance

🌍 Arctic deal sparks relief rally: Greenland’s agreement ends tariff threats, boosting markets alongside massive AI revenue growth.

🇨🇳 Alibaba plans chip unit spinoff: T-Head eyes an IPO, challenging Nvidia’s dominance in the Chinese AI market.

🏦 Farage proposes bank subsidy cuts: Reform UK targets bank reserve payments to fund tax cuts and stability.

⚖️ PCE report tests Fed’s patience: Core inflation data at 2.8% will dictate upcoming interest rate decisions.

🌐 Davos tech leaders defend AI: CEOs argue that massive infrastructure spending is justified by rising compute demand.

🧠 One Big Thing

Tonight’s Bank of Japan interest rate decision is a high stakes pivot for global finance. Market focus centers on Governor Ueda’s guidance and whether he signals a tightening path as early as April. The central bank is locked in a struggle against aggressive government spending that is destabilizing the yen and pushing bond yields to multi decade highs. Investors face a 500 billion dollar carry trade which remains vulnerable to any hawkish shift in policy tone. This meeting will determine the direction of global risk sentiment for the coming weeks. The press conference is the essential catalyst for today’s market volatility. (A cheat sheet will be provided later today for all Premium Newsletter subscribers).

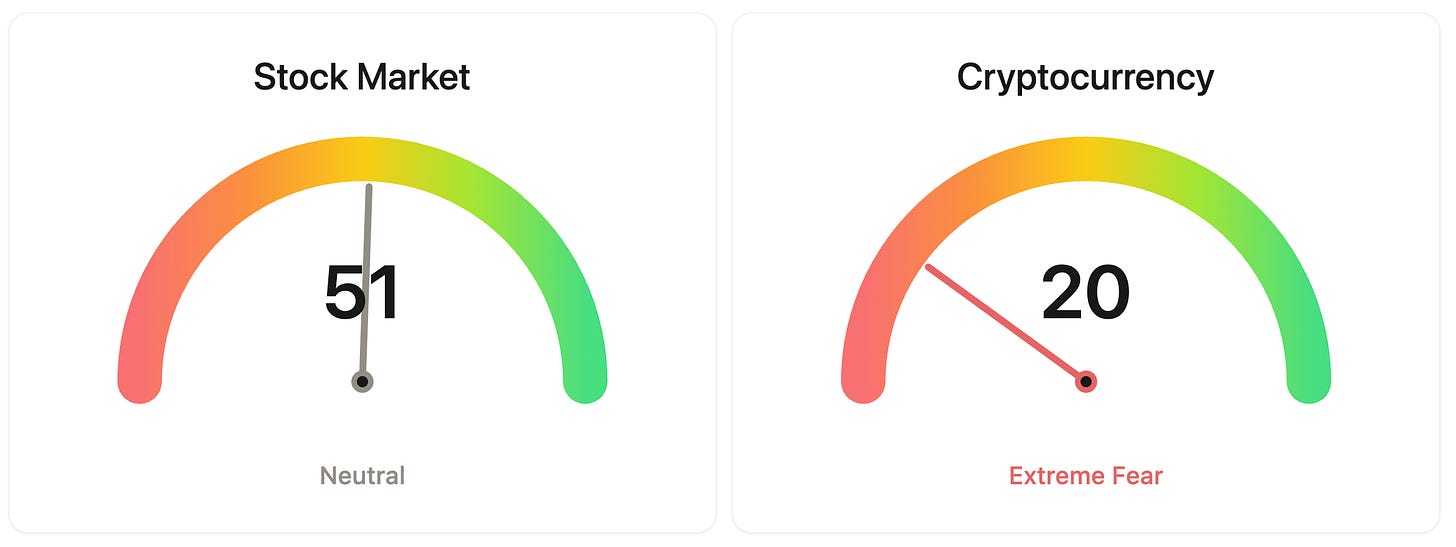

⚖️ Fear & Greed

📉 The Number That Matters

2.0%

The 10-year Japanese government bond yield has punched through 2.0%, hitting heights not seen since 1999. This surge reflects market anxiety over Prime Minister Takaichi’s aggressive fiscal spending plans colliding with the BOJ’s normalization path.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $89,938 (▲ 0.66%)

Ethereum (ETH): $2,987 (▲ 0.28%)

XRP: $1.95 (▲ 0.09%)

Equity Indices (Futures):

S&P 500: $6,915 (▲ 0.48%)

NASDAQ 100: $25,673 (▲ 0.79%)

FTSE 100: £10,170 (▼ 0.36%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.25% (▼ 0.05%)

Oil (WTI): $60 (▼ 1.64%)

Gold: $4,829 (▼ 0.08%)

Silver: $93.46 (▲ 0.38%)

Data as of UK (GMT): 12:23 / US (EST): 07:23 / Asia (Tokyo): 21:23

✅ 5 Things to Know Today

🌍 Greenland Deal and AI Growth Ignite a Relief Rally

Markets caught a massive tailwind after President Trump and NATO Secretary General Mark Rutte announced a framework for Arctic security, abruptly ending a two-week standoff over Greenland. Trump dropped the threat of 10% to 25% tariffs on European allies, causing a sharp collapse in geopolitical risk premiums. Simultaneously, the AI sector provided fundamental backing: Anthropic’s revenue run rate hit $9 billion, more than doubling in six months, while OpenAI is reportedly hunting for a $50 billion funding round. The S&P 500 climbed 1.2% to 6,875, while the Russell 2000 notched its 13th straight day of outperformance (Bloomberg).

This shift suggests the “geopolitical tax” that weighed on stocks for two weeks is evaporating. For retail investors, the real story is the transition from trade-war fear to AI-driven growth. Small-caps are leading the charge because they are often more sensitive to domestic trade policy and fiscal optimism. Meanwhile, the revenue explosions at Anthropic and OpenAI signal that the AI cycle is moving into a massive monetization phase. This validates the heavy spending on infrastructure and chipmakers. We are seeing a market that wants to run hot, supported by both political de-escalation and tech earnings.

Sensei’s Insight: Watch the upcoming PCE inflation print. While the tariff threat is gone, the market needs to see if previous price hikes remain sticky enough to keep the Fed’s hands tied.

🇨🇳 Alibaba’s Chip Unit Eyes a Massive Spin-off

Alibaba is making a strategic play with its specialized chipmaking unit, T-Head. Reports on January 22, 2026, indicate the tech giant plans to restructure the division into a standalone entity with partial employee ownership, a move that typically signals an upcoming IPO. T-Head is far from a startup: its Hanguang 800 processor handles 78,000 images per second, and its newer PPU accelerator matches Nvidia’s H20 specs while costing 40% less to produce. This news helped push Alibaba shares up nearly 5% in premarket trading, continuing a 98% rally seen over the last year (Bloomberg News).

This shift matters because the Chinese AI chip market is entering a period of forced domestic growth. Analysts expect Nvidia’s market share in China to drop from 66% to just 8% by late 2026 as domestic alternatives take over. While recent chip IPOs like MetaX surged 755% on their debut, investors should look past the initial excitement. These companies often trade at over 50 times sales without being profitable. T-Head’s actual growth may be limited by manufacturing bottlenecks at SMIC, where production capacity is currently tight and often prioritized for competitors like Huawei.

Sensei’s Insight: The IPO hype could be massive, but the real story is production. Watch for whether T-Head can secure enough 7-nanometer capacity from SMIC to actually meet its commercial goals.

🏦 Farage’s Davos plan: Ending the banks’ “free money”

Nigel Farage used his Davos platform to signal a radical shift in UK economic policy. If Reform UK wins the next election, he plans to scrap the Bank of England’s interest payments on commercial bank reserves. He views the roughly £20 billion annual cost as a “free money” subsidy for banks that should fund tax cuts instead. To prevent a repeat of the 2022 market crisis, he’s proposing aggressive welfare cuts to keep fiscal hawks happy. He also questioned the credibility of the OBR and the future of Governor Andrew Bailey (Bloomberg).

This is a direct shot at the institutional status quo that’s governed the UK since the nineties. For anyone holding UK bank stocks, this policy is effectively a massive stealth tax that could hit margins or lead to tighter credit for everyone. While markets haven’t panicked yet, a sustained lead for Reform in the polls may force investors to price in a political risk premium on the pound and gilts. It’s a move away from globalist norms toward a more volatile, nation-state focused regime that could redefine how the BoE operates.

Sensei’s Insight: Watch the polling data and gilt yields. If Reform’s lead holds, the market may begin pricing in institutional erosion, potentially making UK assets more expensive to hedge against political volatility.

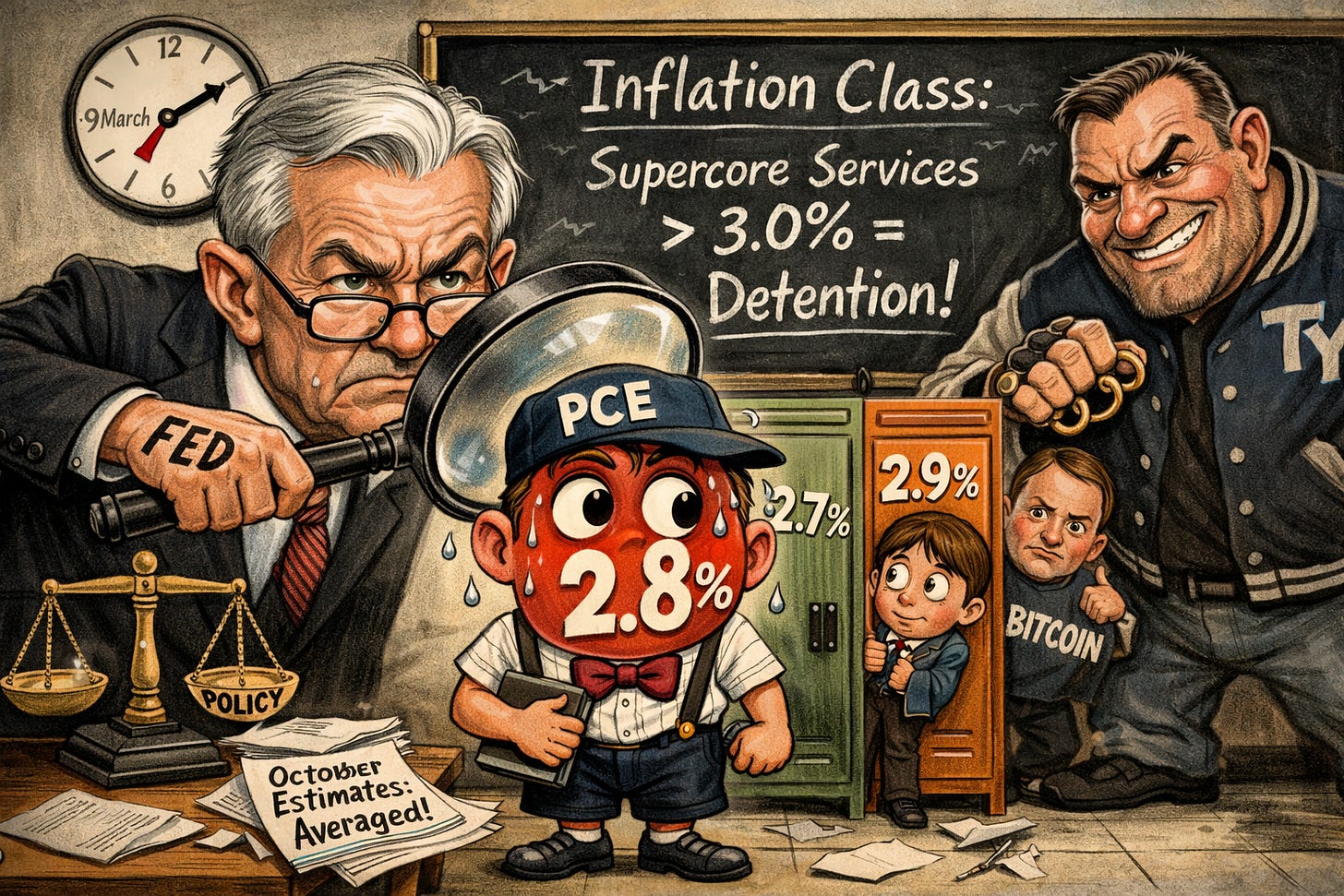

⚖️ The 2.8% Threshold: PCE’s Last Stand Before the Fed

The Personal Consumption Expenditures (PCE) report for November drops today at 10:00 a.m. ET, serving as the Fed’s final data point before next week’s meeting. Wall Street expects core inflation to hold steady at 2.8% year over year, a level that remains stubbornly above the 2% target. This release is unusually complex: a 43-day government shutdown forced the Bureau of Economic Analysis to estimate October figures by averaging neighboring months. Consequently, officials may view today’s numbers as noisy, reinforcing the consensus that interest rates will stay on hold through March (Investing.com).

This report is the primary compass for Fed policy, and its outcome will dictate the mood for equities and crypto. A 2.8% print is already priced in, likely leaving markets flat. However, a surprise drop to 2.7% could spark a relief rally in the Nasdaq and Bitcoin, signaling that the disinflationary trend is reviving. Conversely, a print of 2.9% or higher would empower the hawks, likely pushing Treasury yields up and pressuring growth stocks. For retail investors, the real story is “supercore” services, which reveals if wage-driven inflation is truly losing its grip.

Sensei’s Insight: Watch the supercore services component specifically. If it prints above 3.0%, the “higher for longer” narrative is ironclad, and growth assets may remain under a heavy cloud until summer.

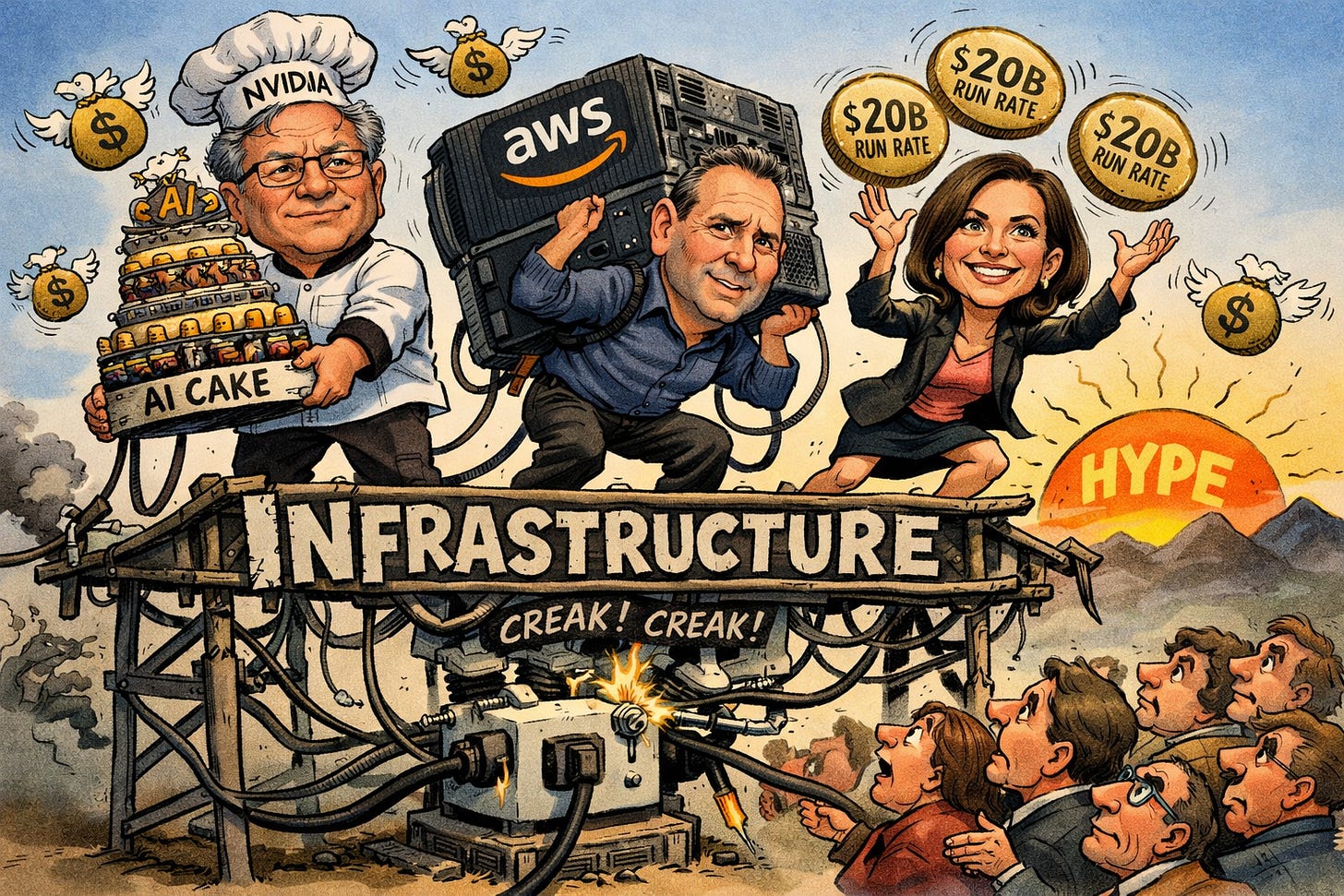

🌐 Davos 2026: Big Tech challenges the AI bubble narrative

The 2026 World Economic Forum in Davos has become a unified front for Big Tech CEOs to argue that the AI boom is sustainable, not speculative. Nvidia’s Jensen Huang and Amazon’s Andy Jassy delivered a consistent message: the world is only a few hundred billion dollars into a multi-trillion dollar infrastructure shift. Jassy described compute consumption as unprecedented, noting that AWS actually lacks the capacity to meet current demand. Meanwhile, OpenAI CFO Sarah Friar revealed their enterprise pivot is accelerating, with over 1 million business customers and an annual revenue run rate hitting $20 billion. This momentum helped push the Philadelphia Semiconductor Index to record highs as markets digested the shift from “AI hype” to “operational scale.” (Forbes).

For retail investors, the shift in metrics is the real story. Instead of talking about what AI might do, executives are pointing to “hard” scarcity signals like rising GPU rental prices. Huang noted that finding an available Nvidia GPU in the cloud is increasingly difficult, with spot rates for H100 equivalents stabilizing at $2.27 per hour in mid-January. This suggests that the hundreds of billions already deployed are producing real-world utility. However, a new bottleneck is emerging: energy. Huang’s “five-layer cake” framework places power at the absolute base, suggesting that future growth may be limited by electricity grids rather than chip designs. Watch for companies that can secure their own power or proprietary data moats, which Microsoft’s Satya Nadella calls “firm sovereignty.”

Sensei’s Insight: The debate has moved from “Is this a bubble?” to “Who has the power?” Watch energy constraints and GPU rental rates as the new lead indicators for infrastructure health.

Today’s issue is intentionally reduced; a full market playbook with detailed chart levels will be released later today for premium subscribers ahead of the BOJ event.

This content is for informational and educational purposes only and does not constitute financial advice. Always do your own research. Not financial advice (NFA).