Morning Forecast: Thursday, 8 January

Oil, AI, and War Economics: The Market Forces Reshaping 2026

This content is for informational and educational purposes only and does not constitute financial advice. Always do your own research. Not financial advice (NFA).

👀 Today’s Stories at a Glance

🛢️ US seizes Venezuelan oil: Washington will control revenue and sales indefinitely to leverage political coercion against Caracas.

🇬🇱 Greenland purchase odds spike: White House officials suggest military options for acquisition, causing prediction market probabilities to jump.

🍎 JPM acquires Apple Card: JPMorgan Chase bought the subprime-heavy portfolio from Goldman Sachs at a billion-dollar discount.

🤖 Tesla faces AI competition: Shares fell as Nvidia, Hyundai, and Mobileye unveiled advanced robotics and autonomous software.

🛡️ Trump restricts defense spending: New executive orders cap executive pay and block buybacks for underperforming defense contractors.

🏗️ Copper supply gap looms: Surging AI and defense demand could create a 10-million-ton shortage by the year 2040.

🧠 One Big Thing

Tesla’s leadership in physical AI is under pressure as rivals accelerate their autonomous and robotic programs. Recent developments from Nvidia, Mobileye, and Hyundai indicate the sector is no longer a solo race. These competitors are introducing open-source software and mass-production plans that could erode Tesla’s technological lead. This shift is critical because Tesla’s valuation assumes nearly total market dominance. If competitors meet their 2026 targets, the company’s high price-to-earnings multiple becomes difficult to sustain. Investors face the risk of a significant market repricing if Tesla loses its projected share of future revenue streams.

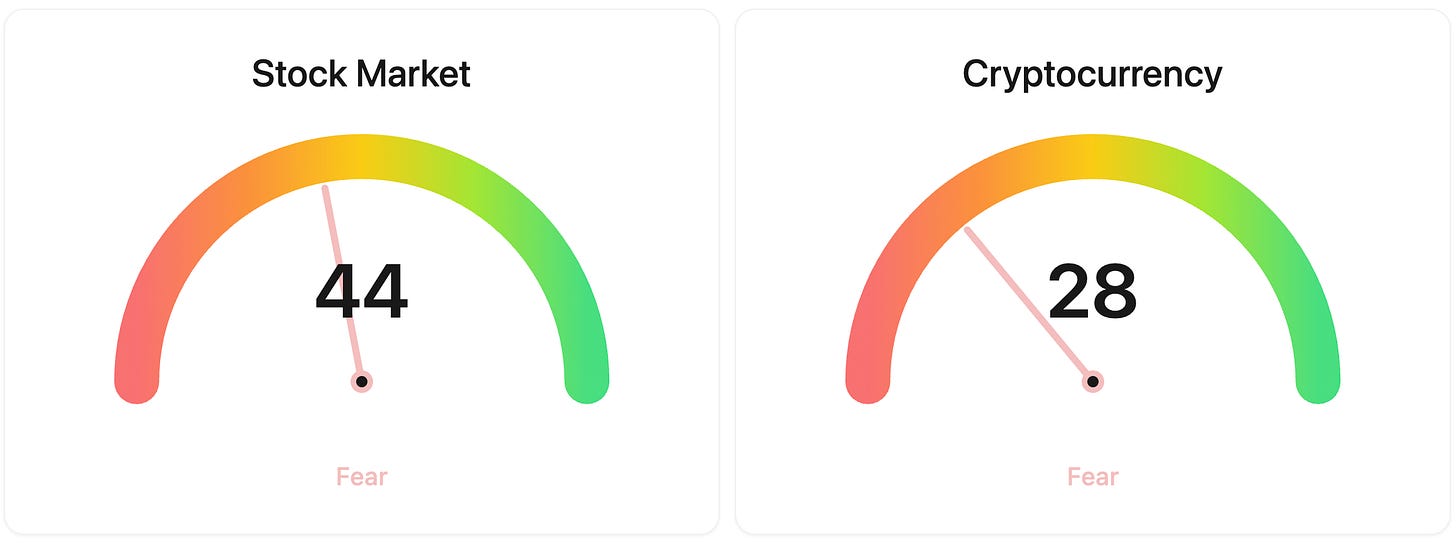

⚖️ Fear & Greed

📉 The Number That Matters

$13,000

London Metal Exchange prices have surged beyond $13,000 per metric ton, driven by Chilean mine outages and aggressive US stockpiling. This record valuation reflects a market pricing in a structural supply-demand squeeze fueled by AI and defense growth.

⚔️ Winners vs Losers

Winners

ACRV 0.00%↑: Acrivon Therapeutics, Inc. shares surged after the company announced positive clinical data for its ACR-368 and ACR-2316 cancer drug candidates.

ANIX 0.00%↑ : Anixa Biosciences, Inc. rose on bullish pre-earnings positioning ahead of the company’s Q4 2025 financial results scheduled for January 9.

OSS 0.00%↑ : One Stop Systems, Inc. gained following the announcement of a $1.2 million U.S. Army defense contract and an additional $1.2 million Safran order.

RGC 0.00%↑ : Regencell Bioscience Holdings moved higher on speculative momentum trading; Low Confidence as there is no official news to support the price action.

Losers

ELME 0.00%↑ : Elme Communities shares declined mechanically as the stock traded ex-dividend following a $14.67 per share special liquidating distribution.

CSGP 0.00%↑ : CoStar Group, Inc. fell after Goldman Sachs lowered its price target, overshadowing the company’s new FY2026 guidance and $1.5 billion share buyback.

SWKS 0.00%↑: Skyworks Solutions, Inc. traded lower amid sector-wide weakness despite debuting new connectivity modules at CES 2026.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $90,222 (▼ 1.22%)

Ethereum (ETH): $3,123 (▼ 1.42%)

XRP: $2.10 (▼ 3.20%)

Equity Indices (Futures):

S&P 500: $6,910 (▼ 0.22%)

NASDAQ 100: $25,777 (▼ 0.24%)

FTSE 100: £10,023 (▼ 0.07%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.16% (▲ 0.31%)

Oil (WTI): $57 (▲ 0.53%)

Gold: $4,428 (▼ 0.63%)

Silver: $75.58 (▼ 3.57%)

Data as of UK (GMT): 11:16 AM / US (EST): 6:16 AM / Asia (Tokyo): 20:16

✅ 5 Things to Know Today

🛢️ DC Seizes the Keys to Venezuelan Oil

Energy Secretary Chris Wright just confirmed the US intends to control Venezuelan oil sales indefinitely. This follows President Trump’s announcement that 30 to 50 million barrels, worth roughly $2.8 billion, will be transferred to the US. It’s a total takeover of the revenue stream: payments will flow into US Treasury accounts rather than to Caracas. To keep the taps open, Washington is even providing the diluent needed to move Venezuela’s extra-heavy crude through pipelines. This represents a radical shift that uses the country’s primary resource as a tool for political coercion (Bloomberg).

This move signals a clear win for specific equities but a headache for the commodity itself. Chevron shares jumped 10% on the news, as it’s the only US major already on the ground, while Gulf Coast refiners like Valero and Phillips 66 are cheering for the heavy crude feedstock. However, global oil futures slipped 1.5% to $60 a barrel. Traders are pricing in a supply glut, since the global market is already oversupplied. Geopolitically, this move effectively severs China’s influence as a major creditor and could trigger a total energy collapse in Cuba, which relies on these shipments.

Sensei’s Insight: If Venezuelan production scales toward the 1.4 million barrel target, a deepening global surplus could keep a persistent lid on energy sector gains.

🇬🇱 Greenland Odds Spike as White House Floats “Military Option”

On Wednesday, January 7, 2026, the White House confirmed it’s actively exploring pathways to acquire Greenland from Denmark, with Press Secretary Karoline Leavitt stating that military action remains an option available to the Commander in Chief. This escalation follows the January 3 capture of Venezuelan President Nicolás Maduro, a military success that appears to have emboldened the administration’s territorial rhetoric. Secretary of State Marco Rubio told lawmakers the administration prefers a purchase, but the strategic goal of deterring Russian and Chinese Arctic activity remains a priority. Danish Prime Minister Mette Frederiksen countered that any military move against a NATO ally would signal the end of the alliance itself (Bloomberg)

The sudden surge in prediction market odds suggests traders are pricing in “sentiment spillover” rather than new diplomatic breakthroughs. On the Kalshi exchange, the probability of a Greenland purchase jumped from 16% to 40% this week, largely because the Venezuela raid convinced bettors the administration is willing to ignore traditional norms. However, investors should be wary of the “resolution crisis” seen in the Venezuela markets. Polymarket recently refused to pay out on “invasion” contracts despite Maduro’s capture, arguing a targeted raid doesn’t meet their specific definition of an invasion. This highlights a massive risk: even if a geopolitical event occurs, platform-specific definitions may still wipe out your position.

Sensei’s Insight: Watch the “definition risk” on these contracts. The Venezuela debacle proves that reality and a platform’s fine print can diverge, potentially leaving you right on the news but wrong on the payout.

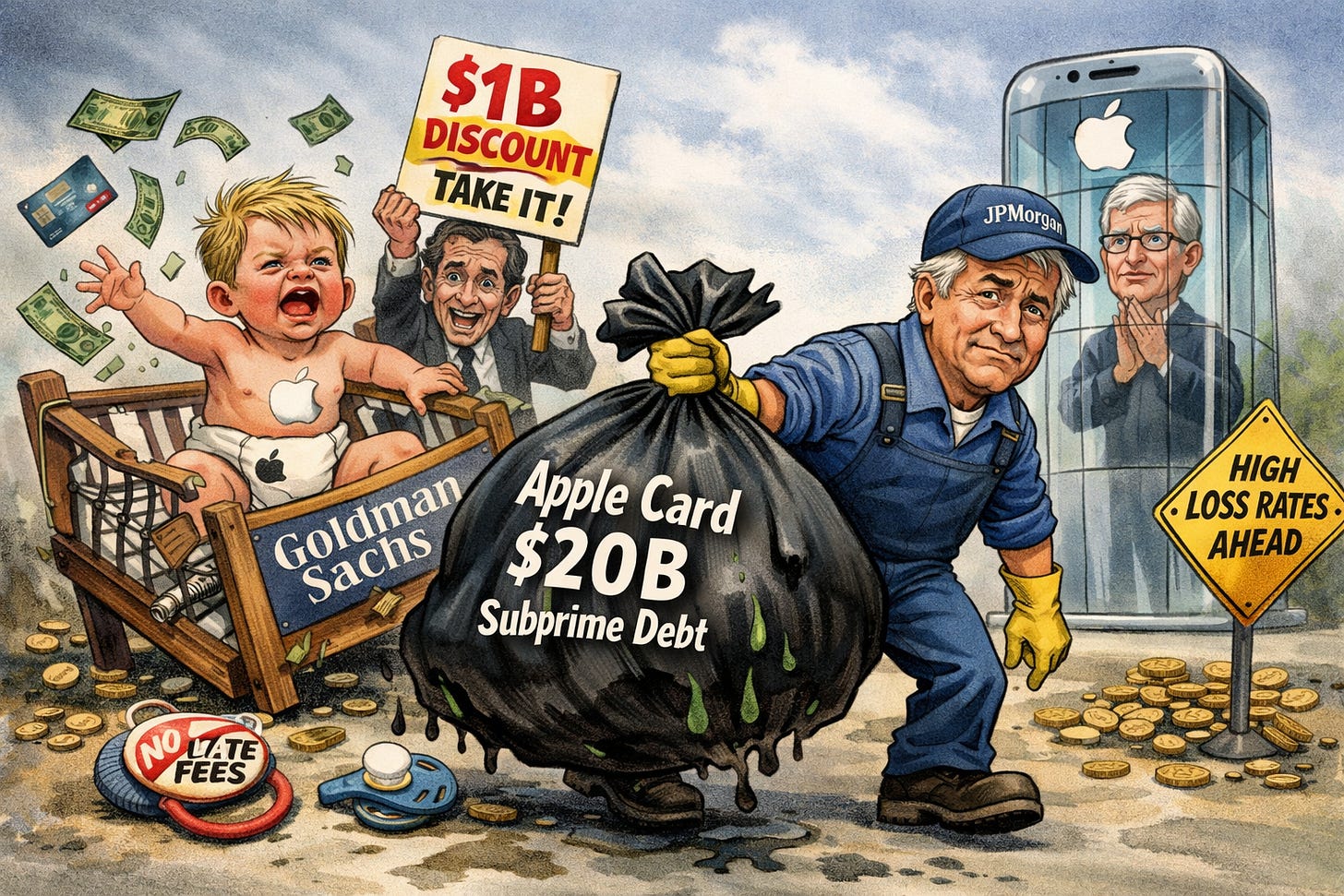

🍎 JPM Picks Up Apple’s Problem Child

JPMorgan Chase just finalized a deal to rescue Apple’s credit card program from Goldman Sachs, taking on roughly $20 billion in outstanding balances. It’s a rare fire sale in the credit world: Goldman is offloading the portfolio at a discount of more than $1 billion. Usually, these co-branded deals command a premium, so this massive haircut highlights the toxic nature of the book. The move ends Goldman’s disastrous retail banking experiment, which racked up $7 billion in losses since 2020. The transition will take about 24 months, with Goldman continuing operations until the handoff is complete (WSJ).

Why the discount? The Apple Card has a serious subprime problem. About 35% of its balances belong to borrowers with FICO scores below 660, which is more than double JPMorgan’s usual 15% exposure. This led to a 6.2% loss rate for Goldman, nearly triple the industry average. Apple also famously prohibited late fees, removing a key profit lever that typically accounts for up to 25% of returns for subprime-heavy issuers. JPMorgan is betting it can use its $3 trillion asset base to absorb these risks while cross-selling products to 12 million cardholders. Watch for tighter underwriting and likely the return of late fees as Jamie Dimon cleans house.

Sensei’s Insight: Watch the $2.2 billion provision JPMorgan just took for expected losses. It signals that even with a discount, cleaning up Goldman’s underwriting mess could be a long, expensive slog.

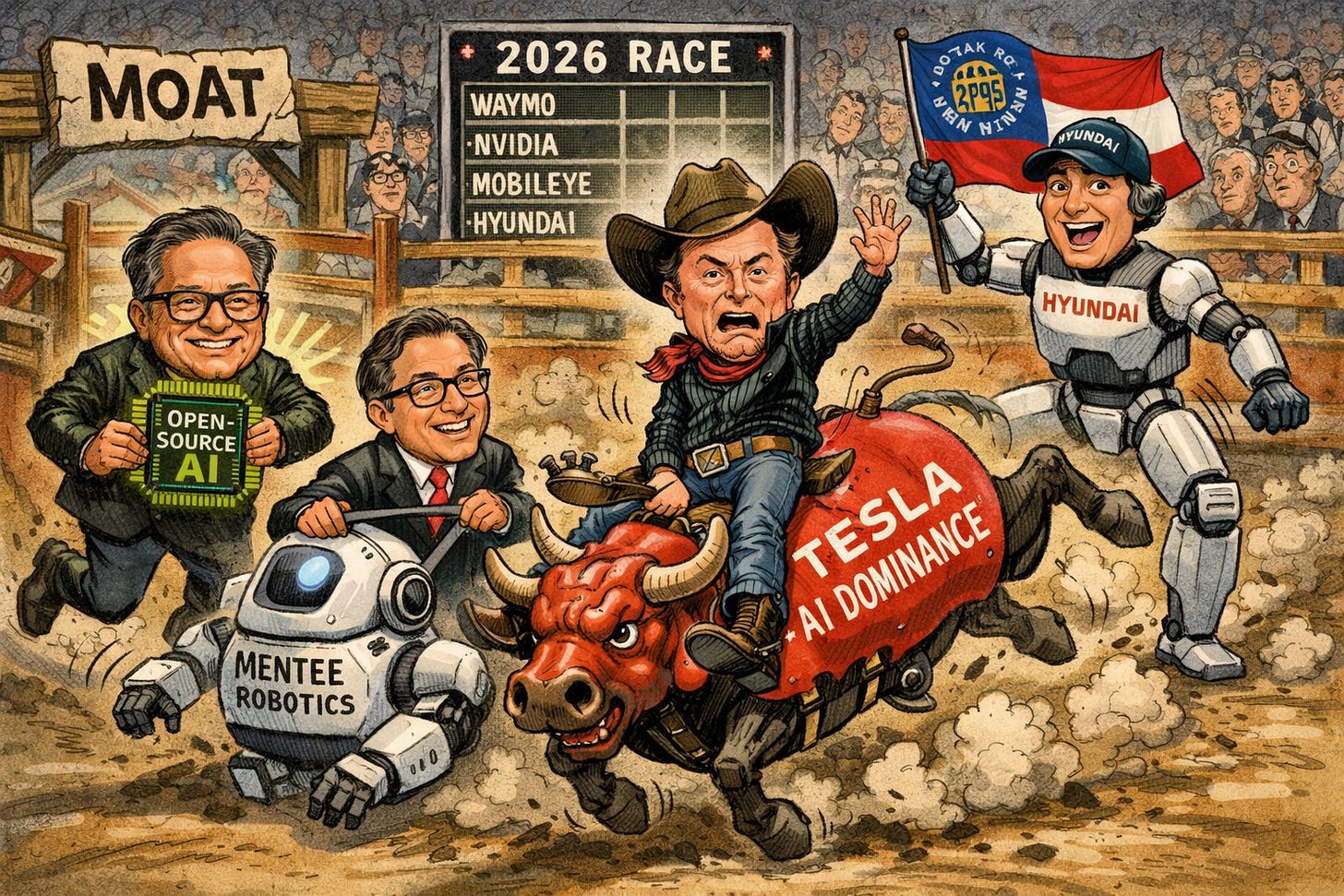

🤖 Tesla’s “Physical AI” Moat Just Got Crowded

The Consumer Electronics Show just delivered a sharp reality check to Tesla. On Tuesday, shares fell 4.1% after a series of competitive moves in autonomy and robotics. Nvidia unveiled Alpamayo, an open-source reasoning AI for vehicles that Mercedes-Benz will launch in early 2026. Mobileye also announced a $900 million acquisition of Mentee Robotics, while Hyundai revealed plans to mass-produce 30,000 Atlas humanoid robots annually in Georgia by 2028. This wave of announcements signals that the physical AI space is no longer a one-horse race, putting immediate pressure on Tesla’s premium valuation (Barron’s)

The significance here lies in the valuation math. Tesla trades at roughly 200 to 289 times its estimated 2026 earnings, a price that assumes absolute market dominance. Nvidia’s decision to open-source its AI tools could allow legacy automakers to catch up without building their own software from scratch. With Waymo already completing 250,000 rides a week and Hyundai partnering with Google’s DeepMind for its robotics push, Tesla’s projected market share may be at risk. If the competition proves more capable than expected, the market might struggle to support Tesla’s current growth multiple as it reprices these future revenue streams.

Sensei’s Insight: Watch Tesla’s P/E ratio relative to its robotaxi rollout milestones. If competitors like Waymo and Nvidia hit their 2026 targets first, that 289x multiple might become very difficult to justify.

🛡️ Trump Caps Defense Pay and Targets Institutional Landlords

President Trump just threw a massive wrench into the machinery of both the defense industry and the housing market. On Wednesday, he signed an executive order that blocks defense contractors from paying dividends or engaging in stock buybacks if they fail to meet production speeds or prioritize government work. This targets a massive cash flow stream: the top four Pentagon contractors spent $89 billion on shareholders between 2021 and 2024, with nearly $58 billion of that coming from taxpayer funds. On the same day, Trump announced a push to ban large institutional investors from purchasing single-family homes, claiming that “people live in homes, not corporations.” (White House).

For us, this is a clear signal that the era of unfettered capital allocation in these sectors is over. Defense stocks like RTX and Lockheed Martin dropped sharply as investors priced in the risk of losing buyback protections and a new $5 million cap on executive pay. In housing, firms like Blackstone and Invitation Homes took a hit despite the fact that large institutions only own 3% of single-family homes and have been net sellers for over a year. It suggests that political sentiment, rather than fundamental market data, is now driving policy. We’re seeing a pivot to a state-directed industrial policy where the government, not the board of directors, decides how a company spends its profits.

Sensei’s Insight: Watch the 30-day review window for defense firms. If the Pentagon starts naming names, the dividend yield you’re counting on could vanish overnight in favor of mandated factory upgrades.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_live_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

🔍Deep Dive: 🏗️ The Copper Bottleneck: AI and Defense Drive a Structural Supply-Demand Squeeze

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.