Morning Forecast: Tuesday, 13 January

The CPI Test That Shapes 2026, Amid Power Grid Strain, Trade Threats, and Political Pressure

This content is for informational and educational purposes only and does not constitute financial advice. Always do your own research. Not financial advice (NFA).

👀 Today’s Stories at a Glance

⚖️ DOJ subpoenas Fed Chair Powell, escalating political pressure on monetary policy and testing U.S. central bank independence credibility.

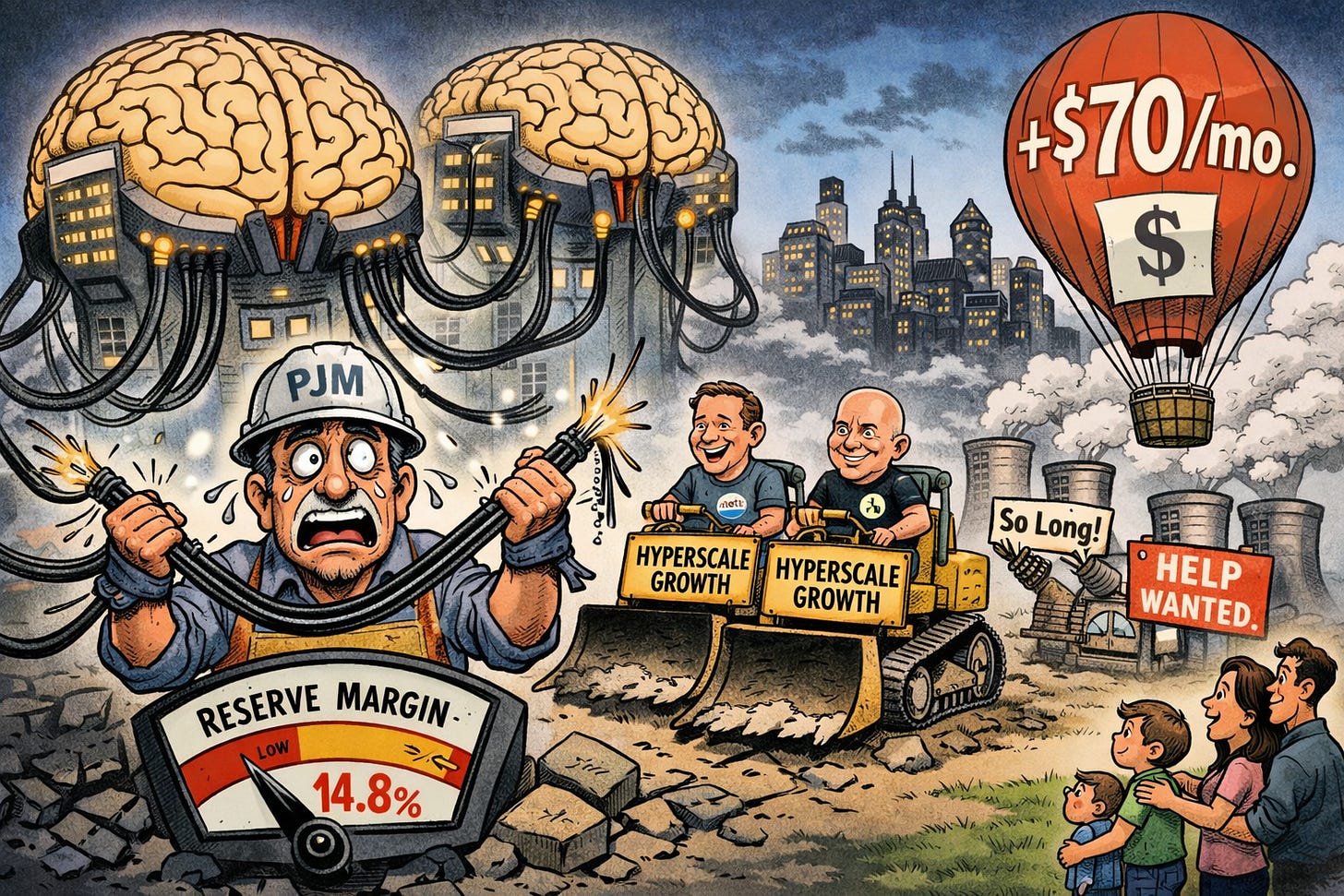

⚡ AI data centers overwhelm PJM’s grid, crushing reserve margins, lifting power costs, and forcing hyperscalers toward self-supplied energy.

💳 Trump’s proposed 10% credit-card rate cap rattles banks, threatening JPMorgan’s card economics and tighter lending standards.

🇮🇷 Trump threatens 25% Iran-linked tariffs, risking U.S.–China trade rupture as markets await Supreme Court authority ruling.

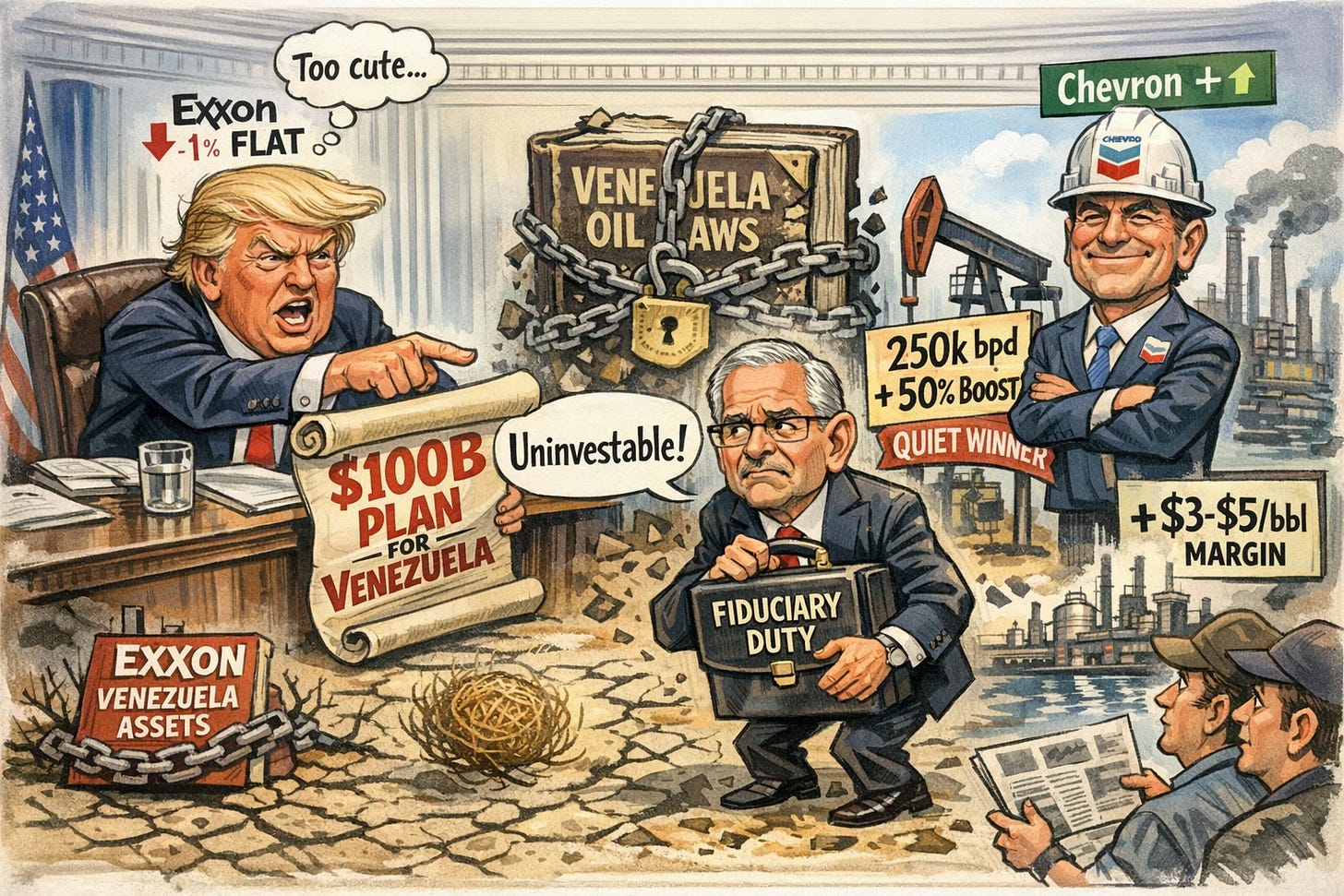

🛢️ Exxon calls Venezuela uninvestable post-Maduro, while Chevron quietly gains advantage with existing infrastructure and preferential positioning.

🏛️ Deep Dive: The DOJ–Powell clash exposes how political pressure could reprice U.S. assets by undermining Fed credibility.

🧠 One Big Thing

America’s largest power grid operator is facing a reliability crisis as AI data centers consume massive amounts of electricity. Recent auctions show the PJM grid failed to meet safety reserve targets because demand from tech giants is outstripping new supply. This shortfall has pushed electricity prices to regulatory limits while aging power plants retire faster than replacements can be built. Consequently, households face billions in potential cost increases to fund necessary infrastructure upgrades. Technology companies are now forced to secure their own power sources or partner with nuclear providers to bypass grid limitations. This shift marks the end of low-cost expansion for the AI sector.

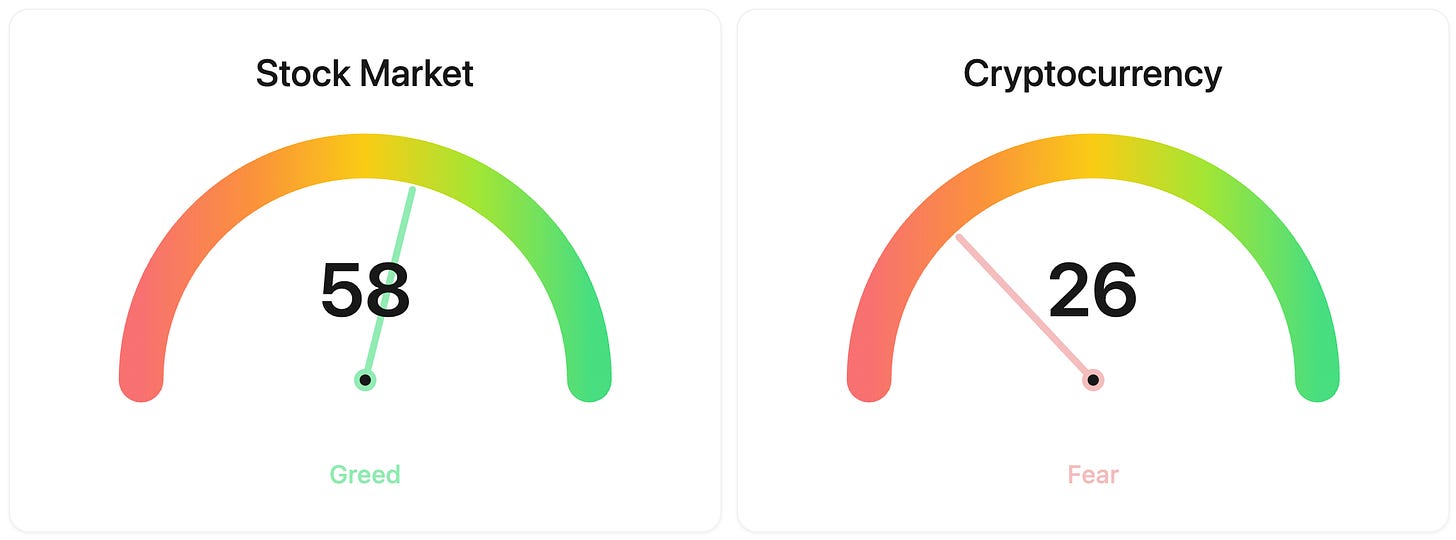

⚖️ Fear & Greed

📉 The Number That Matters

2.7%

Market consensus for Headline and Core Year-over-Year figures sits at 2.7%. This statistic serves as the primary benchmark for Federal Reserve independence and the viability of the projected June 2026 interest rate easing cycle.

⚔️ Winners vs Losers

Winners

KELYA 0.00%↑: Kelly Services, Inc. shares surged after the board adopted a stockholder rights plan following a 92.2% Class B stake sale to a private buyer.

OSS 0.00%↑: One Stop Systems, Inc. gained on news of a $1.2 million Army pre-production order for ruggedized GPU-accelerated computing systems in U.S. combat vehicles.

LHX 0.00%↑: L3Harris Technologies, Inc. rallied following a $1 billion Department of Defense investment in its Missile Solutions unit ahead of a planned late-2026 IPO.

Losers

TVTX 0.00%↑: Travere Therapeutics, Inc. shares crashed after the FDA requested more clinical data for FILSPARI just before today’s scheduled PDUFA decision date.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $91,869 (▲ 0.76%)

Ethereum (ETH): $3,131 (▲ 1.28%)

XRP: $2.06 (▲ 0.28%)

Equity Indices (Futures):

S&P 500: $6,971 (▼ 0.02%)

NASDAQ 100: $25,896 (▼ 0.24%)

FTSE 100: £10,133 (▼ 0.17%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.20% (▲ 0.33%)

Oil (WTI): $61 (▲ 1.27%)

Gold: $4,586 (▼ 0.27%)

Silver: $85.66 (▲ 0.67%)

Data as of UK (GMT): 12:06 / US (EST): 07:06 / Asia (Tokyo): 21:06

✅ 5 Things to Know Today

⚖️ The Fed’s “Independence War” Goes Legal

The Department of Justice has served Federal Reserve Chair Jerome Powell with grand jury subpoenas over his 2025 testimony related to cost overruns at the Federal Reserve’s Washington headquarters. While the DOJ frames the probe around hundreds of millions in renovation overruns, Powell has publicly called the investigation a “pretext” to pressure the Fed into accelerating rate cuts. President Trump denies direct involvement but continues to criticize Powell for keeping policy “excessively tight.” Markets initially reacted by pushing the S&P 500 and Dow to record highs as investors speculated that political pressure could force earlier easing, even through unconventional means.

This confrontation represents a direct stress test of U.S. central bank independence. If criminal probes can be used to influence monetary policy, investors must price in a higher political risk premium across the dollar, rates, and financial stocks. Gold surged to record highs above $4,600 while the dollar weakened sharply, signaling unease beneath the equity rally. Bank shares also came under pressure amid fears of policy interference and regulatory overreach, suggesting institutional confidence is fraying. For now, markets are balancing short-term hopes for lower rates against longer-term risks of inflation credibility loss and weakened monetary guardrails.

Sensei’s Insight: This is no longer about renovation costs — it’s about whether markets can trust the Fed to act independently under political pressure. If gold remains elevated while bank stocks lag and the dollar weakens, it signals investors expect lower rates but are quietly hedging against a loss of policy credibility and future inflation risk.

⚡ AI Data Centers Push PJM Grid to the Brink

America’s largest power grid operator, PJM Interconnection, is struggling to maintain reliability as AI data centers swallow capacity. In the December 2025 capacity auction, PJM failed to meet its 20% reliability reserve target, securing only 14.8%. This 6,623-megawatt shortfall, roughly equal to Philadelphia’s total consumption, comes as data centers added over 5,000 megawatts of new demand. Prices hit a regulatory cap of $333.44 per megawatt-day, signaling a market that’s effectively maxed out while older coal and nuclear plants retire faster than new generation can be built (Wall Street Journal).

This supply-demand gap means higher costs for everyone, not just tech giants. Estimates suggest households in the region could pay an additional $70 per month by 2028, totaling $100 billion in extra costs through 2033. Retail investors should watch how regulatory friction evolves: Virginia is already implementing a new rate class to force data centers to pay upfront for infrastructure. As the grid reaches its limit, hyperscalers like Meta and Amazon are being forced to explore self-supply or nuclear partnerships. This shift suggests the era of “cheap growth” for data centers is fading, replaced by a “bring your own power” model.

Sensei’s Insight: Watch for rolling blackout warnings during summer peaks. The grid’s 14.8% reserve margin leaves little room for error if extreme weather hits, making energy reliability the primary bottleneck for AI’s next phase.

💳 Trump’s Rate Cap Jolts JPMorgan’s Earnings Debut

JPMorgan Chase reports Q4 2025 earnings today, January 13, facing a sudden political headwind that has the sector on edge. On Friday, President Trump called for a one-year, 10% interest rate cap on credit cards starting January 20, 2026, arguing that consumers are being “ripped off” by current rates of 20% to 30%. The timing is complex for JPMorgan, which just announced it’s taking over the $20 billion Apple Card portfolio from Goldman Sachs. To prepare for this massive shift, the bank is recording a $2.2 billion provision for credit losses this quarter. While analysts expect $4.85 EPS on $46.17 billion in revenue, the market is bracing for how this rate cap threat might derail the bank’s expansion into premium co-branded cards (CNBC)

This proposal has already rattled the sector, with Capital One dropping 6% and American Express falling 4.3% as investors digest the implications. A 10% cap fundamentally breaks the economics of subprime lending, where higher rates are necessary to offset the risk of delinquencies. Analysts suggest that if enacted, banks would likely respond by slashing credit limits or closing accounts for up to 80% of cardholders, particularly those with scores below 740. For JPMorgan, the focus shifts to whether its massive $105 billion expense budget for 2026, driven by AI and branch expansion, can still deliver results if its core credit card engine is forced to downshift.

Sensei’s Insight: Watch the earnings call for any downward revisions to 2026 credit card guidance. If management flags a “tightening of standards,” it signals they are pricing in the rate cap as a real legislative risk.

🇮🇷 Trump’s 25% Iran Tariff Threat: Negotiating Tool or Trade War 2.0?

On Monday evening, President Trump announced an “effective immediately” 25% tariff on any country doing business with Iran, a move clearly aimed at strangling the regime’s finances during its deadliest anti-government uprising in decades. The announcement, made via Truth Social, lacked formal White House documentation or a specific timeline, leaving markets to scramble over the definition of “doing business.” The stakes are highest for China, which buys roughly 80% to 90% of Iran’s oil. If these tariffs stack on top of existing ones, China’s average export rate to the U.S. could climb above 70%, a level that most analysts believe would effectively end viable trade between the two superpowers and shatter the fragile truce reached last October (CNBC).

This isn’t just about human rights; it’s a high-stakes stress test for your portfolio’s China exposure. Experts like Henrietta Treyz of Veda Partners suggest this may be a classic Trump pressure play, predicting potential “walk-backs” or exclusions within 48 hours to avoid an economic meltdown. However, the legal floor under this policy is shaky. The Supreme Court is expected to rule as early as Wednesday on whether Trump actually has the authority to bypass Congress for these tariffs. If the court rules against him, the administration might lose its most potent negotiating lever, but if they delay, we could be looking at months of headline-driven volatility and upward pressure on inflation (Barron’s).

Sensei’s Insight: Watch the Wednesday Supreme Court ruling. It’s the ultimate binary event: it either cements Trump’s leverage or forces a massive retreat on trade policy that could trigger a relief rally.

🛢️ Exxon’s Reality Check on Venezuela

Following the capture of Nicolás Maduro, the White House convened top energy executives on January 9 to pitch a $100 billion plan to rebuild Venezuela’s oil sector. While President Trump sought immediate commitments to restart production under U.S. security guarantees, ExxonMobil CEO Darren Woods labeled the country “uninvestable” under current conditions. Woods pointed to the 2007 expropriation of Exxon’s assets as a cautionary tale, insisting that before capital flows, the country needs fundamental changes to hydrocarbon laws and “durable investment protections.” This isn’t a total exit, as Woods noted Exxon is ready to send a technical team if the administration can deliver these legal reforms, but it signaled a preference for fiscal sanity over political theater (Bloomberg).

The friction peaked when Trump told reporters he “didn’t like” the response and might keep Exxon out of future deals, accusing them of “playing too cute.” For retail investors, the market’s reaction tells the real story: Exxon stock barely budged, dipping about 1% while investors recognized that Woods was simply upholding his fiduciary duty. Meanwhile, Chevron is the clear tactical winner here. Unlike Exxon, Chevron never fully left and already has 250,000 barrels of daily capacity and infrastructure on the ground. By staying quiet and pledging a 50% production increase, Chevron has secured the inside track for preferential licensing while Exxon plays the long game on legal reform.

Sensei’s Insight: Watch the “crude differential” in Gulf Coast refineries. If Chevron successfully ramps up heavy Venezuelan crude, those refiners could see margins improve by $3 to $5 per barrel.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_live_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

🔍Deep Dive: Navigating the December 2025 CPI and the Post-Shutdown Inflation Reality

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.