Morning Forecast: Tuesday, 16 December

All Eyes on Jobs Data, Crypto Volatility, Nasdaq’s Overnight Push, Media Battles & Capital Flight Escalate

This content is for informational and educational purposes only and does not constitute financial advice. Always do your own research. Not financial advice (NFA).

👀 Today’s Stories at a Glance

🇬🇧 UK labor market worsens: Unemployment hit 5.1% as private wage growth collapsed, making a Thursday rate cut nearly certain.

🌙 Nasdaq eyes overnight trading: A proposal for 23-hour sessions aims to capture Asian volume and compete with 24/5 retail platforms.

🏛️ Trump sues BBC: A $10 billion lawsuit alleges a documentary used deceptive editing, testing international media liability in Florida court.

🏰 London luxury property crashes: High-end sales hit post-pandemic lows as tax changes and mansion tax fears drive global capital elsewhere.

🏦 PayPal seeks bank charter: The firm applied for an industrial loan charter to cut middleman fees and boost lending margins.

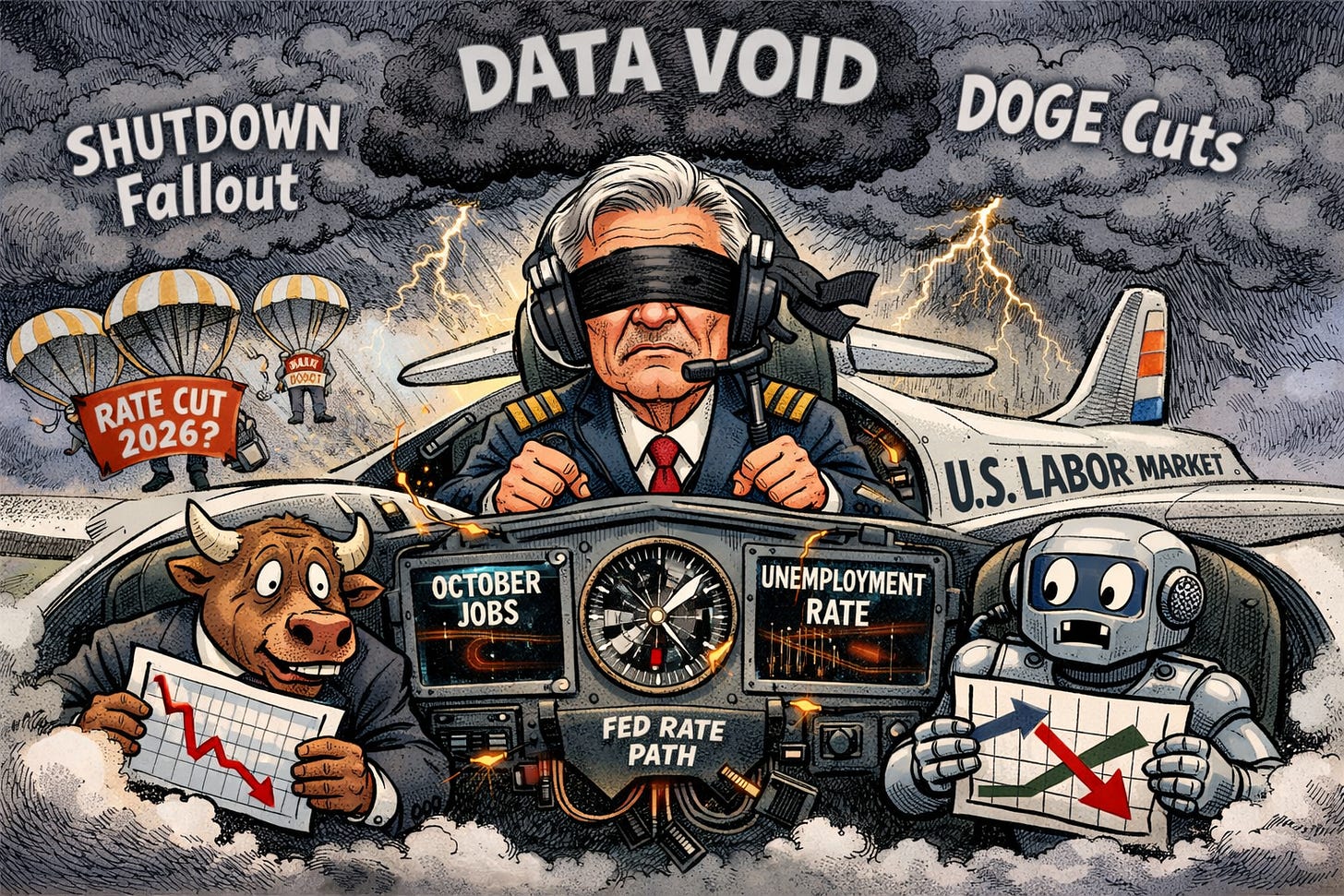

📋 Historic double jobs report: Investors must navigate distorted data from a government shutdown to gauge the Fed’s 2026 rate path.

🧠 One Big Thing

The Inflation Blind Spot

Markets risk misreading a soft jobs report today as bullish only to face a sharp hawkish correction when inflation figures arrive on Thursday. The government shutdown has eliminated critical short-term inflation data, leaving investors with an incomplete picture for Thursday’s CPI release. Because the Bureau of Labor Statistics canceled the October report, the market will only receive year-over-year figures without the usual month-over-month context. This forces the Federal Reserve to gauge price stability using a slower and less precise metric. If the remaining annual data shows sticky inflation alongside high wage growth, it immediately undermines the argument for 2026 rate cuts.

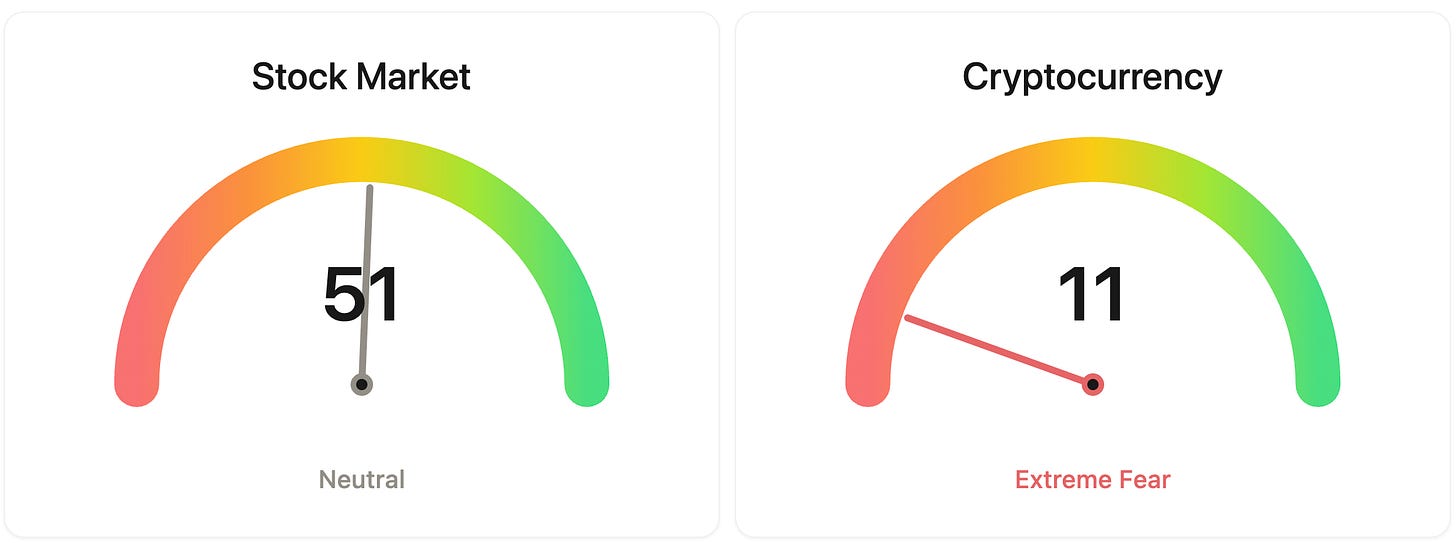

⚖️ Fear & Greed

📉 The Number That Matters

4.5%

Market consensus for today’s unemployment print is 4.5%. Holding at this level indicates a cooling but stable labor market, allowing investors to maintain a soft-landing narrative while leaning on secondary payroll and wage data.

⚔️ Winners vs Losers

Winners

UXIN +12.21%: Uxin Limited rose on momentum appearing to be a short-squeeze in China ADRs despite no new filings.

ORGO +9.73%: Organogenesis Holdings Inc. traded higher on small-cap biotech risk-on flows without new trial data or headlines.

RILY +28.76%: B. Riley Financial, Inc. rallied after its Q2 10-Q filing revealed profits and significant debt reduction.

ADAG +16.17%: Adagene Inc. continued rising on follow-through momentum from the FDA Fast Track designation for its muzastotug combo.

Losers

LWLG -19.10%: Lightwave Logic, Inc. shares dropped on likely small-cap photonics volatility amid no fresh filings or news releases.

CGC -3.61%: Canopy Growth Corporation pulled back on profit-taking following a run-up on U.S. rescheduling reports and the MTL Cannabis acquisition.

ALDX -9.77%: Aldeyra Therapeutics, Inc. declined after the FDA extended the PDUFA action date for its reproxalap NDA to March 2026.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $87,275 (▲ 0.96%)

Ethereum (ETH): $2,959 (▼ −0.22%)

XRP: $1.93 (▲ 1.49%)

Equity Indices (Futures):

S&P 500: $6,812 (▼ −0.11%)

NASDAQ 100: $25,287 (▲ 0.77%)

FTSE 100: £9,703 (▼ −0.56%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.18% (▲ 0.00%)

Oil (WTI): $56 (▼ −1.27%)

Gold: $4,282 (▼ −0.52%)

Silver: $62.99 (▼ −1.69%)

Data as of UK (GMT): 12:07 / US (EST): 07:07 / Asia (Tokyo): 21:07

✅ 5 Things to Know Today

🇬🇧 UK Jobs Crack: BoE Rate Cut Now “Locked In”

The UK labor market is in the worst situation since the pandemic. Unemployment climbed to 5.1% in the three months through October, a five-year high. The damage is tangible: 158,000 more people are unemployed, and payrolls shrank by 38,000 in November alone. Most critically for the inflation narrative, private sector wage growth collapsed to 3.9%. That is the lowest read since 2020 and signals that corporate Britain is slamming the brakes on spending. Redundancies also surged by 156,000, confirming this is an active contraction, not just a hiring freeze (Bloomberg).

This data essentially forces the Bank of England’s hand for Thursday. Markets immediately priced a 90% probability of a rate cut to 3.75% because Governor Bailey’s main excuse to hold, sticky private wages, just vanished. But realize what is driving this. This isn’t a gentle economic cooling; it is a reaction to policy shocks, specifically the April National Insurance hikes and recent budget uncertainty. Companies are cutting headcount to absorb higher government-mandated costs. The BoE now has to pivot from fighting inflation to preventing a deeper recession, which likely brings 2026 rate cuts into sharper focus.

Sensei’s Insight: Watch the voting split on Thursday, not just the decision. A tight 5-4 vote is expected, but if the doves grow louder about “growth risks,” markets may aggressively price in a drop to 3.25% by next year.

🌙 Nasdaq Moves to Launch 23-Hour Trading by 2026

Nasdaq Inc. officially asked the SEC yesterday (December 15) for permission to expand weekday trading to 23 hours. The proposal adds a new overnight session from 9 p.m. to 4 a.m. ET, bringing total operation up from the current 16 hours. This won’t happen tomorrow. Nasdaq targets a Q3 2026 launch, a timeline designed to sync with critical upgrades from the DTCC (which handles clearing) and SIPs (which broadcast price data). If approved, the exchange will run a massive day session from 4 a.m. to 8 p.m. ET, take a one-hour maintenance break, and then reopen for the night shift (Bloomberg).

This is a strategic play for global capital, specifically from Asia. Data from overnight platforms like Blue Ocean shows that roughly 70% of current off-hours volume originates from Asia-Pacific investors wanting to trade US tech stocks during their local day. Nasdaq is effectively trying to recapture volume from retail-focused 24/5 platforms (like Robinhood) and keep pace with the NYSE, which filed for 22-hour trading back in February. However, liquidity remains the wildcard. Major Wall Street desks don’t operate 24/7 yet. Without institutional depth, this new session could suffer from wide bid-ask spreads and jagged volatility.

Sensei’s Insight: Wall Street is trying to reverse-engineer the 24/7 access of crypto markets using 1970s plumbing. Since this relies on the DTCC rather than a real-time ledger, trades after 9 p.m. are artificially logged as “next day” activity to make the math work. It’s a software patch, not a modernization.

🏛️ Trump Files $10 Billion Lawsuit Against BBC

President Donald Trump officially escalated his battle with the press today, filing a massive $10 billion lawsuit against the BBC in Miami federal court. The suit targets a November 2024 documentary, Trump: A Second Chance?, accusing the broadcaster of selectively splicing his January 6 speech to fabricate a continuous call for violence. The edit combined two quotes, ”walk down to the Capitol” and “fight like hell”,which were originally delivered nearly an hour apart. While BBC Chairman Samir Shah apologized on November 10 for creating a “mistaken impression,” the network retracted the segment but refused Trump’s compensation demands (Bloomberg).

This isn’t just a grievance; it’s a calculated stress test of international media liability. While the BBC argues the documentary was geo-blocked to the UK and never aired on US television, Trump’s legal team is leveraging Florida’s “Deceptive and Unfair Trade Practices Act.” This strategy is clever because it may bypass the high bar of proving “actual malice” required in standard defamation cases. Coming off recent $15-16 million settlements with CBS and ABC, this suit suggests Trump is aggressively scaling his litigation strategy from domestic networks to state-owned foreign broadcasters.

Sensei’s Insight: Watch the Florida “deceptive practices” count closely. If this tactic succeeds in bypassing standard defamation defenses, it signals significantly higher liability risk for any global media entity covering US politics.

🏰 London Luxury Real Estate Cracks: Worst Year Since Covid

London’s high-end property market just hit a wall. New data reveals 2025 was the worst year for luxury sales since the pandemic lockdowns of 2020. The numbers are brutal. Sales of homes over £5 million dropped 18% in the first three quarters. Even more telling is the “super-prime” freeze. In 2024, the market saw deals as high as £139 million. In 2025? Zero sales cleared the £50 million mark. Vendors are desperate. Some sellers are slashing asking prices by up to 50% just to find liquidity in a paralyzed market (Bloomberg)

This is a policy-driven exodus. The market faced a “triple whammy” in 2025: the abolition of non-dom tax status, a stamp duty hike, and the confirmation of a “mansion tax” starting in 2028. Experts note that months of speculation created a “drip-feed of uncertainty” that froze buyers. The result is global capital flight. While London recorded only 189 ultra-luxury deals, tax-free Dubai recorded 510. Even with outliers like George Lucas buying a £40 million home, the trend is clear. Smart money flows to where it is treated best, and right now, that isn’t the UK.

Sensei’s Insight: Watch the April 2026 valuation dates for the incoming mansion tax. This policy shift suggests continued headwinds for UK wealth managers and lenders holding these devalued assets as collateral.

🏦 PayPal Makes Its Official Bank Charter Play

On Monday, December 15, PayPal officially filed applications to launch “PayPal Bank.” They are seeking a Utah-based industrial loan company (ILC) charter, which would allow them to hold deposits and lend directly without a middleman. This aggressive move lands just three days after federal regulators conditionally approved five crypto firms for trust charters, a clear signal that the Trump administration is opening the door for non-traditional financial players. PayPal aims to consolidate its $30 billion lending business in-house, effectively firing current partners like Goldman Sachs and Wells Fargo to capture better economics (Bloomberg).

For investors, this is strictly a margin expansion story. Renting banking licenses is expensive; owning one could lower PayPal’s funding costs by roughly 170 basis points and eliminate millions in sponsor fees. That capital efficiency supports aggressive retail plays, like the 4.25% APY savings yields they recently tested. It also signals a critical pivot for the stock, which has slid ~14.5% since late October. Management is betting that vertical integration is the necessary cure for slowing checkout momentum. If approved, PayPal stops being just a digital wallet and becomes a genuine financial fortress.

Sensei’s Insight: Watch the regulatory response timeline closely. Approval validates the “fintech graduation” thesis, but a rejection would leave PayPal paying rent to traditional banks forever. The moat is narrowing.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_live_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive: The Double-Barrel Jobs Report

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.