Morning Forecast: Tuesday, 20 January

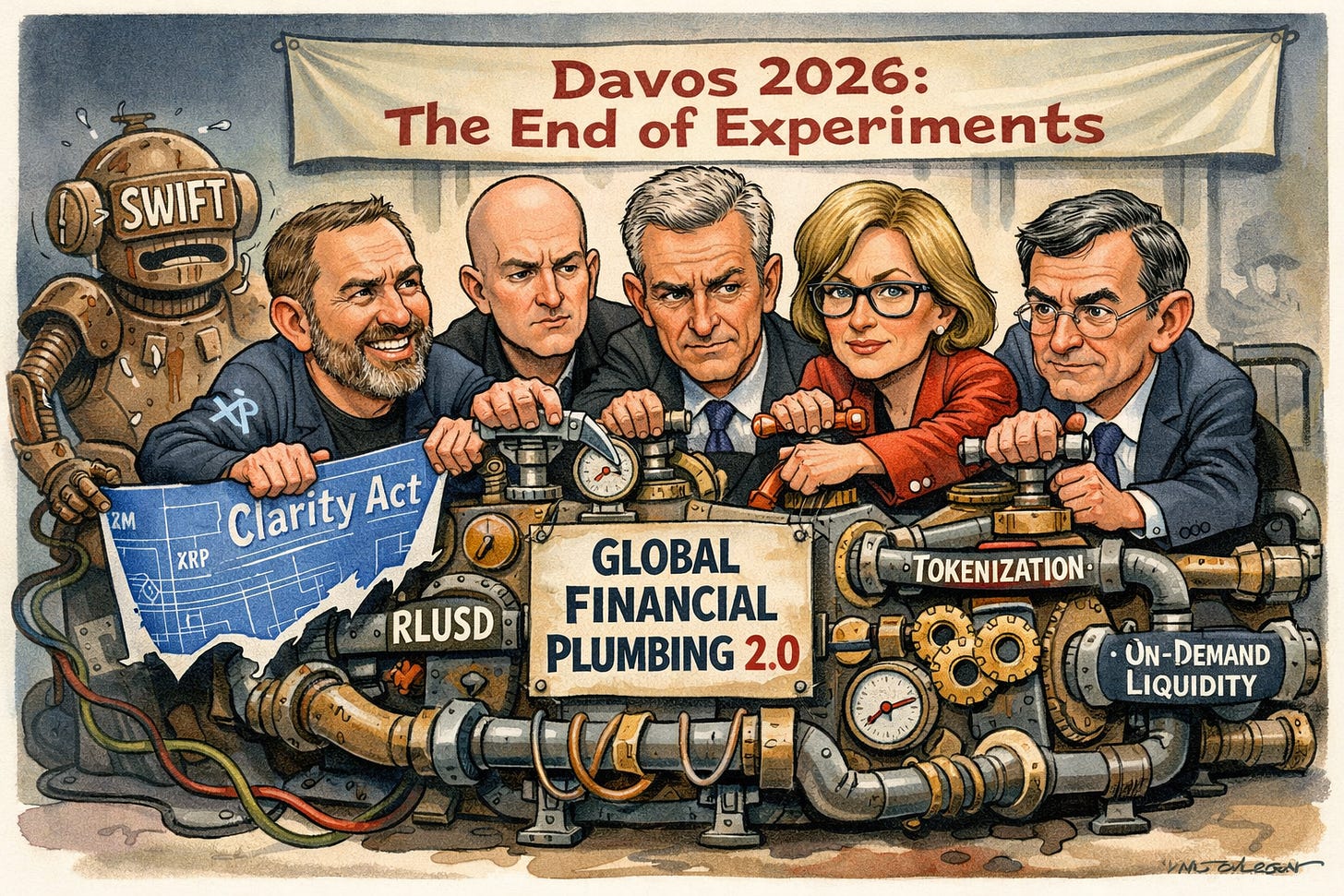

XRP at Davos: The Moment Crypto Became Institutional Infrastructure

This content is for informational and educational purposes only and does not constitute financial advice. Always do your own research. Not financial advice (NFA).

👀 Today’s Stories at a Glance

🇬🇱 Greenland Standoff Triggers Trade War: Trump’s purchase demand sparks tariff threats against NATO allies, sending gold to record highs.

📉 The Magnificent Seven Era Ends: Market dominance splinters as only Nvidia and Alphabet outperform, while retail enthusiasm for Tesla cools.

🥂 Peace Board Faces Champagne Wall: Trump threatens 200% French wine tariffs to force Macron into joining a new global board.

🛑 OpenAI Pivots to Ad Model: Facing a $207 billion funding gap, the firm launches ads on free tiers to survive.

💸 NYSE Moves to 24/7 Trading: A new blockchain-based venue will allow instant weekend stock settlements using stablecoins like USDC.

🌐 Davos Seals Institutional Crypto Era: Ripple and Euroclear leaders meet to transition tokenization from experimental pilots to foundational infrastructure.

🧠 One Big Thing

The 2026 Davos summit marks a definitive transition for digital assets as blockchain moves from experimental phases into the foundational plumbing of global finance. Industry giants like Ripple are now presenting production ready systems to settle trillions in daily transactions through on chain tokenization. This structural shift is designed to replace slow legacy messaging protocols with instant value transfers to remove capital inefficiencies. A high stakes conflict over regulatory frameworks remains a significant hurdle for widespread institutional adoption. Coinbase’s recent opposition to the proposed Clarity Act highlights a growing rift between industry leaders and lawmakers regarding decentralized market rules. For investors, these developments indicate that blockchain is becoming a permanent layer of institutional infrastructure (see more in Deep Dive section).

The Next Phase of the Newsletter

Over the next few weeks, premium members get full access to how I actually invest.

This week: a live £5,000 Portfolio Challenge. Real money, real decisions, real risk management, documented as it happens. No hindsight. No trade copying. Just the process.

Next: my Technical Analysis Chart Course. The exact patterns and levels I use, how I manage risk, and how I decide when I’m wrong. Simple. Repeatable.

Then: a Debt, Budget & Net-Worth Planner. Get your finances organised so your investing isn’t fighting chaos.

This is the same framework behind past 1000%+ winners like Tesla, XRP, Coinbase, and Rocket Lab but the value is the process, not the numbers.

All included with premium.

60% off your first year. 1 week only. 5 spots a day.

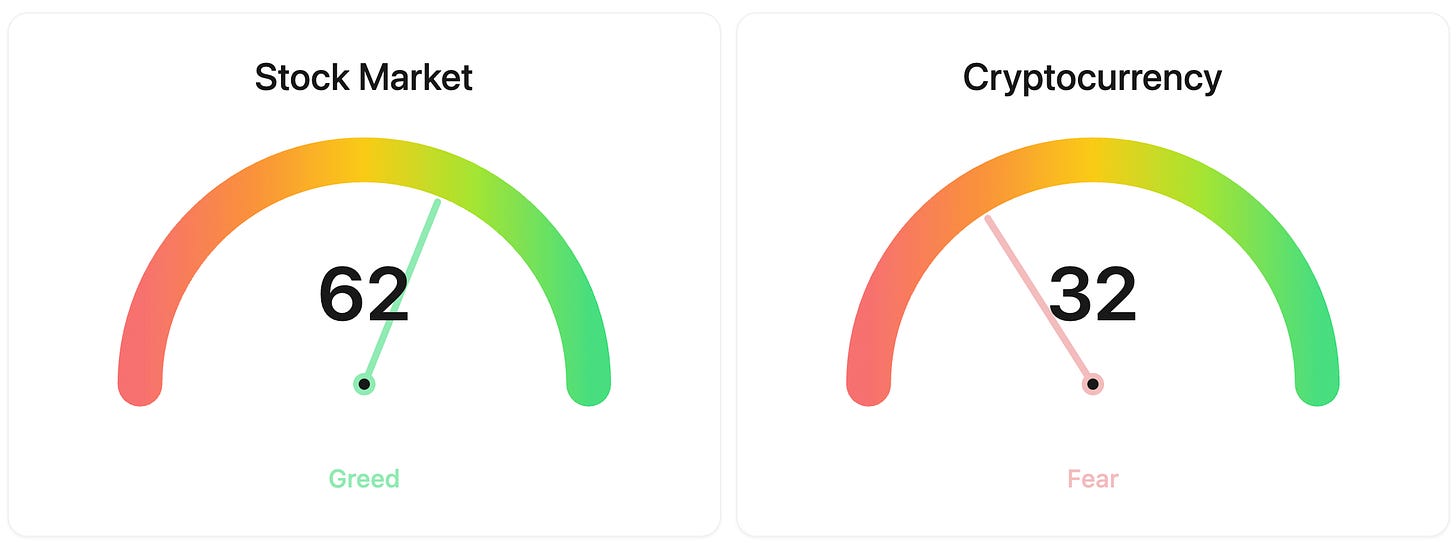

⚖️ Fear & Greed

📉 The Number That Matters

36%

The Magnificent Seven stocks now represent 36% of the S&P 500’s total market cap despite internal performance splintering. This high concentration remains a significant risk for passive portfolios as capital rotates toward small-caps and secondary AI plays.

⚔️ Winners vs Losers

Winners

RAPT 0.00%↑: RAPT Therapeutics, Inc. rose after GSK announced a definitive agreement to acquire the company for $2.2 billion at $58 per share.

HL 0.00%↑: Hecla Mining Company climbed as silver prices hit record highs ahead of the company’s investor day scheduled for January 26.

CRML 0.00%↑: Critical Metals Corp. moved higher after announcing a $1.5 billion rare earth processing joint venture with a Saudi Arabian firm.

Losers

APP 0.00%↑: AppLovin Corporation fell as investors questioned its high valuation relative to the sector despite strong year over year revenue growth.

SPHL 0.00%↑: Springview Holdings Ltd plummeted after filing for a public offering of 2.7 million shares following a massive speculative rally.

SHOP 0.00%↑: Shopify Inc. shares fell on profit taking after the launch of its Winter 2026 RenAIssance Edition and Agentic Commerce platform.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $91,295 (▼ -1.41%)

Ethereum (ETH): $3,106 (▼ -2.58%)

XRP: $1.94 (▼ -2.35%)

Equity Indices (Futures):

S&P 500: $6,832 (▼ -0.61%)

NASDAQ 100: $25,214 (▼ -1.85%)

FTSE 100: £10,080 (▼ -1.00%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.30% (▲ 1.61%)

Oil (WTI): $60 (▲ 0.12%)

Gold: $4,726 (▲ 2.84%)

Silver: $95.31 (▲ 5.80%)

Data as of UK (GMT): 11:34 / US (EST): 06:34 / Asia (Tokyo): 20:34

✅ 5 Things to Know Today

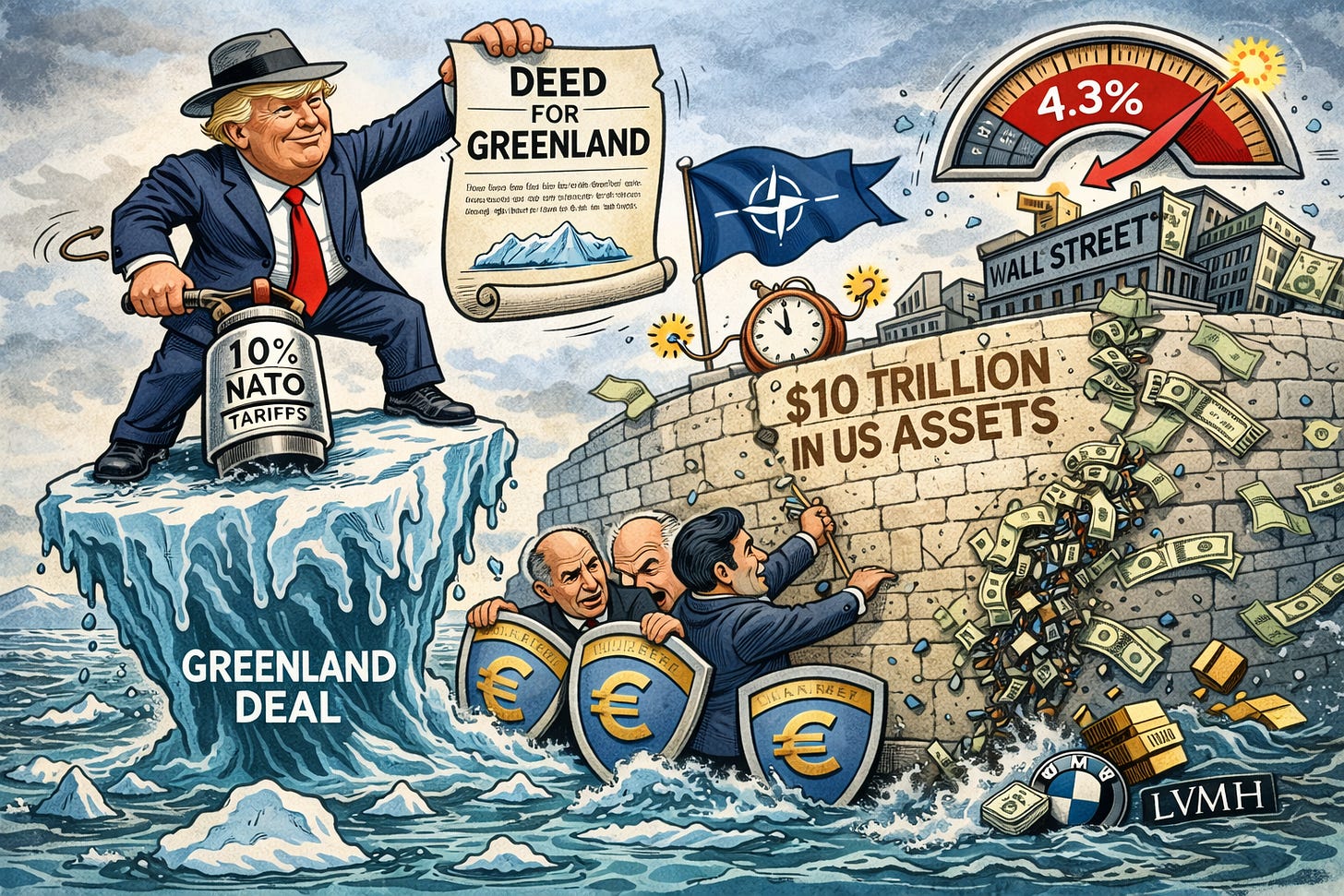

🇬🇱 Greenland Tariff Threats Trigger $10 Trillion Leverage Talk

Trump’s weekend demand to purchase Greenland “completely and totally” has triggered a high-stakes trade standoff with Europe. He’s threatening eight NATO allies, including Germany and the UK, with 10% tariffs starting February 1, scaling to 25% by June. Markets aren’t laughing: gold surged to a record $4,735 per ounce as silver hit $95. In Europe, luxury and auto stocks like LVMH and BMW took a beating while the 10-year Treasury yield spiked to 4.265%. This move indicates a rising risk premium, as the dollar’s status as a safe haven is being questioned by the very allies it usually protects (Bloomberg).

The chatter about Europe “weaponizing” $10 trillion in US assets sounds like a financial nuclear option, but the reality is more nuanced. About 30% of US equities are foreign-owned, and a coordinated exit would be messy. Since most of this capital is private, EU politicians cannot legally force a mass sell-off. Instead, you should watch for “organic” capital flight. Professional managers are already trimming US exposure because of policy uncertainty. This isn’t a government mandate yet, but if the Anti-Coercion Instrument is triggered, it signals a structural breakdown in the Western alliance that could force yields higher and squeeze US growth.

Sensei’s Insight: Keep your eyes on the 4.3% level for the 10-year Treasury. A sustained break above that suggests the market is pricing in a permanent “chaos tax” on US assets.

📉 The Magnificent Seven are Breaking Up

The monolithic “Mag 7” era is splintering. In 2025, the group’s reputation as a guaranteed winner failed for most: only Alphabet and Nvidia outperformed the S&P 500’s roughly 18% return. Alphabet surged about 65% as its Gemini AI took off, while Nvidia stayed the essential infrastructure play. The other five, including Microsoft and Amazon, actually trailed the broader index. This year started just as rocky, with five of the seven underperforming the benchmark through mid-January. Retail enthusiasm is also cooling, evidenced by a 43% drop in Tesla’s average daily turnover since its peak (WSJ).

This divergence suggests the “buy the basket” strategy is losing its edge. Investors are now distinguishing between hyperscalers like Alphabet and Meta, which are spending nearly $400 billion on AI infrastructure, and companies like Apple that have been criticized for a slower AI roadmap. Even though the group’s correlation has fallen apart, these seven stocks still represent about 36% of the S&P 500’s market cap. This high concentration means any stumbling in mega-cap earnings could still drag down passive portfolios, even as capital rotates into:

Small-caps and cyclicals: Industrials and materials are currently outpacing tech.

Secondary AI plays: Semiconductor firms like Broadcom and Micron are gaining traction.

Real-economy beneficiaries: Healthcare and energy sectors are being eyed for their AI adoption potential.

Sensei’s Insight: Watch the spread between AI spending and actual profit. The “rising tide” stage is over: future gains may depend on which giants can turn that massive capex into visible cash flow.

🥂 Trump’s Peace Board meets a 200% Champagne Wall

President Trump is turning up the heat on allies to join his new “Board of Peace,” a global body designed to handle international conflicts starting with Gaza. While countries like Argentina and Hungary are already in, French President Emmanuel Macron is reportedly set to decline the invitation. In response, Trump threatened a 200% tariff on French wines and champagnes to force a change of heart. The board’s draft charter shows it’s a high-stakes club: permanent membership requires a $1 billion contribution, and Trump, as inaugural chairman, retains a veto over all decisions. Even Israel is showing friction, with Netanyahu’s office claiming the board’s Gaza committee was not coordinated with their policy (Bloomberg).

European luxury houses like LVMH and spirits giants like Pernod Ricard are already seeing their valuations trimmed as the market prices in this renewed trade friction. It shows that the administration is using specific export sectors as leverage for diplomatic goals. A 200% tariff means a $50 bottle of champagne could be taxed an additional $100 at the border, effectively pricing these products out of the U.S. market. If this board succeeds in siphoning power from the UN, we’re looking at a world where international governance is replaced by transactional agreements, making geopolitical risk a permanent fixture in your “luxury” bucket.

Sensei’s Insight: Watch the luxury and beverage sectors. These “political tariffs” turn stocks into proxies for diplomatic spats. If Macron doesn’t blink by Thursday’s Davos signing, expect more volatility in French exporters.

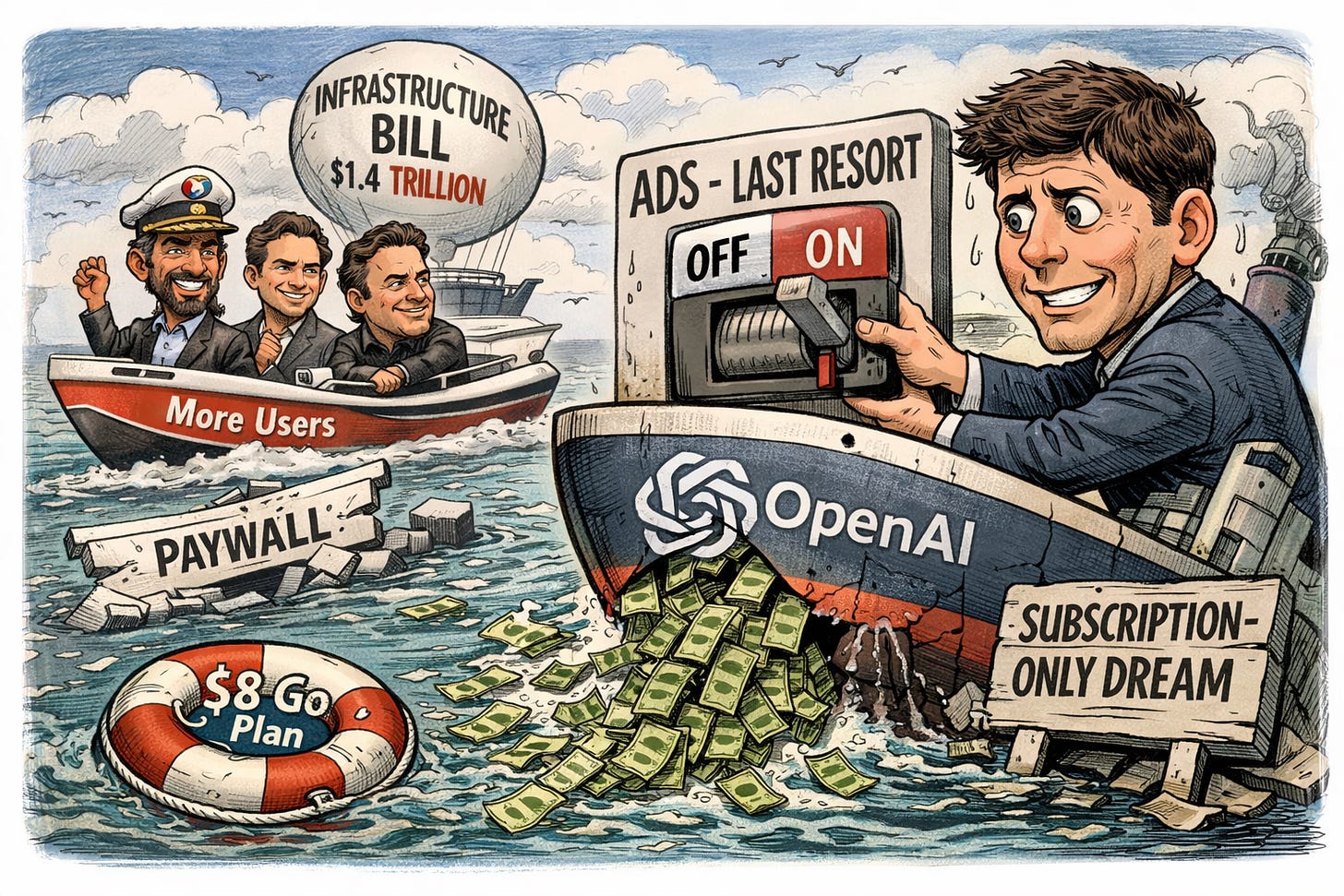

🛑 OpenAI’s Ad Pivot: The “Last Resort” Has Arrived

OpenAI announced Friday it’ll start testing ads on its free tier and its new $8 monthly Go plan, marking a sharp pivot from CEO Sam Altman’s 2024 claim that ads were a “last resort.” The numbers explain the sudden change of heart: the company faces a $207 billion funding gap through 2030 and currently spends $1.69 for every dollar it earns. While high-tier subscribers like the $200 monthly Pro users won’t see sponsored content, the 95% of users who don’t pay are now being monetized to help fuel a $1.4 trillion infrastructure bill. OpenAI insists that these ads will be clearly labeled and won’t influence chatbot answers, but the move signals that the subscription-only dream is hitting a financial wall (Morningstar).

This isn’t just about extra cash: it’s an admission that OpenAI’s product moat is leaking. Google’s Gemini has surged to 650 million users, and the enterprise crowd is starting to bolt. Salesforce CEO Marc Benioff dumped ChatGPT for Gemini 3 after just two hours, while investor Jason Calacanis famously killed his firm’s $10,000 annual subscription, calling ChatGPT “4th place” behind competitors like Claude and xAI. When your most vocal advocates start leaving, the “free” user base becomes a massive liability. OpenAI is using ads to bridge the gap because they can’t afford to raise prices further without losing more users to a rapidly improving Google. For investors, this shift proves that even the most “principled” AI builders are eventually forced to embrace the legacy ad models they once mocked.

Sensei’s Insight: Watch for a spike in “Plus” cancellations. If users find the $8 Go tier’s ads too intrusive, they might not upgrade: they’ll just move to Gemini or Claude.

💸 NYSE flips the switch on 24/7 trading

The New York Stock Exchange is officially moving toward a “never sleeps” model. Its parent company, Intercontinental Exchange (ICE), just announced plans to launch a blockchain-based venue for trading tokenized U.S. stocks and ETFs around the clock. Led by Michael Blaugrund and Lynn Martin, the platform aims to offer immediate settlement (T+0) using stablecoins like USDC and PYUSD for funding. This means instead of waiting a full day for your cash to clear, you could sell a position at 5:04 p.m. on a Saturday and reinvest it by 5:05 p.m. while the rest of the world is offline. The move follows a December 2025 SEC decision allowing the DTC to pilot similar technology, signaling that the regulatory gates are finally opening for on-chain market infrastructure (Bloomberg).

This isn’t just about longer hours: it’s a fundamental rewrite of market “plumbing.” By using stablecoins as settlement rails, ICE is effectively legitimizing digital dollars as institutional-grade infrastructure rather than just crypto-native tools. For us, this eliminates the “overnight gap” where news breaks after 4 p.m. and leaves retail investors stuck until the next morning’s bell. However, keep an eye on liquidity fragmentation. With Nasdaq also pushing its own tokenization proposal, we might see volume split between traditional and digital venues, which can mess with execution quality in the short term. It’s a land grab for the future of global capital, and ICE is currently leading the charge.

Sensei’s Insight: Watch the liquidity split between NYSE and Nasdaq. If volume fragments too much, early 24/7 trading might offer convenience at the cost of wider spreads and worse execution.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_live_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

🔍Deep Dive: 🌐 The Davos Inflection Point: Ripple and the New Institutional Plumbing

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.