Morning Forecast: Tuesday, 30 December

From AI dealmaking to silver shocks, markets brace for 2026.

This content is for informational and educational purposes only and does not constitute financial advice. Always do your own research. Not financial advice (NFA).

👀 Today’s Stories at a Glance

🐂 Analysts predict 2026 market gains: Experts see 9% upside as focus shifts toward earnings.

🤖 Meta acquires AI startup Manus: The $2 billion deal targets autonomous agents to challenge Microsoft.

📉 MicroStrategy hits 15-month low: Shares fell despite Bitcoin buys as the market premium collapsed.

🥈 Silver prices drop on margins: Futures plummeted after margin hikes triggered massive deleveraging.

🚢 Venezuela shuts down oil wells: Blockades forced production cuts as storage reached capacity.

🔍 Markets await Fed minutes: Investors anticipate insights into policy divisions and the 2026 interest rate trajectory.

🧠 One Big Thing

Today's release of the December FOMC minutes will clarify the growing policy rift within the Federal Reserve. Although officials recently lowered interest rates, the formal inclusion of concerns regarding elevated inflation suggests a shift toward a more cautious stance. Investors are specifically monitoring the rationale behind three rare dissenting votes to gauge internal support for a policy pause in 2026. The primary debate centers on whether current interest levels remain restrictive or have already reached a neutral point. If officials believe rate cuts have reached their limit, market expectations for future easing must be significantly adjusted. This data will determine whether the dollar strengthens or risk assets face selling pressure.

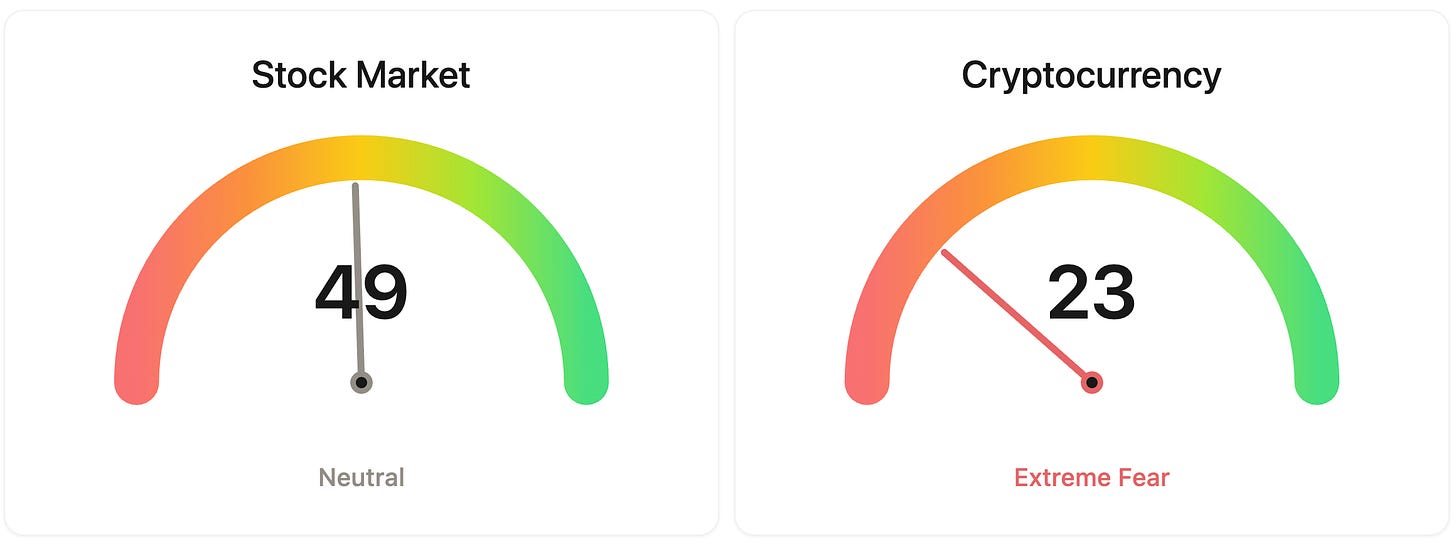

⚖️ Fear & Greed

📉 The Number That Matters

52%

Markets are currently pricing in only 52% odds of a rate cut by March 2026. This reflects investor caution as the FOMC minutes suggest a potential shift toward a slower easing cycle and a possible pause in future meetings.

⚔️ Winners vs Losers

Winners

NUAI +5.58%: New Era Energy & Digital, Inc. shares rebounded slightly following a sharp 41% decline triggered by a New Mexico fraud lawsuit naming its CEO.

FONR +25.51%: Fonar Corporation shares surged after the company announced a definitive agreement for a management led buyout at $19 per share in cash.

SIDU +12.45%: Sidus Space, Inc. rose after closing sequential equity offerings totaling $41 million and highlighting participation in Missile Defense Agency and NASA contracts.

Losers

SMX -14.14%: SMX (Security Matters) Public Ltd fell as the stock pulled back following a speculative squeeze driven by previous financing and capital announcements.

GBTG -5.59%: Global Business Travel Group, Inc. declined in line with broader travel sector volatility and macro risk sentiment rather than specific corporate disclosures.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $87,716 (▲ 0.62%)

Ethereum (ETH): $2,972 (▲ 1.22%)

XRP: $1.86 (▲ 0.53%)

Equity Indices (Futures):

S&P 500: $6,905 (▼ 0.03%)

NASDAQ 100: $25,713 (▼ 0.11%)

FTSE 100: £9,915 (▲ 0.39%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.12% (▲ 0.10%)

Oil (WTI): $58 (▲ 0.91%)

Gold: $4,382 (▲ 1.16%)

Silver: $74.81 (▲ 3.71%)

Data as of UK (GMT): 11:53 / US (EST): 06:53 / Asia (Tokyo): 20:53

✅ 5 Things to Know Today

🐂 Wall Street’s Unanimous Bet on 2026

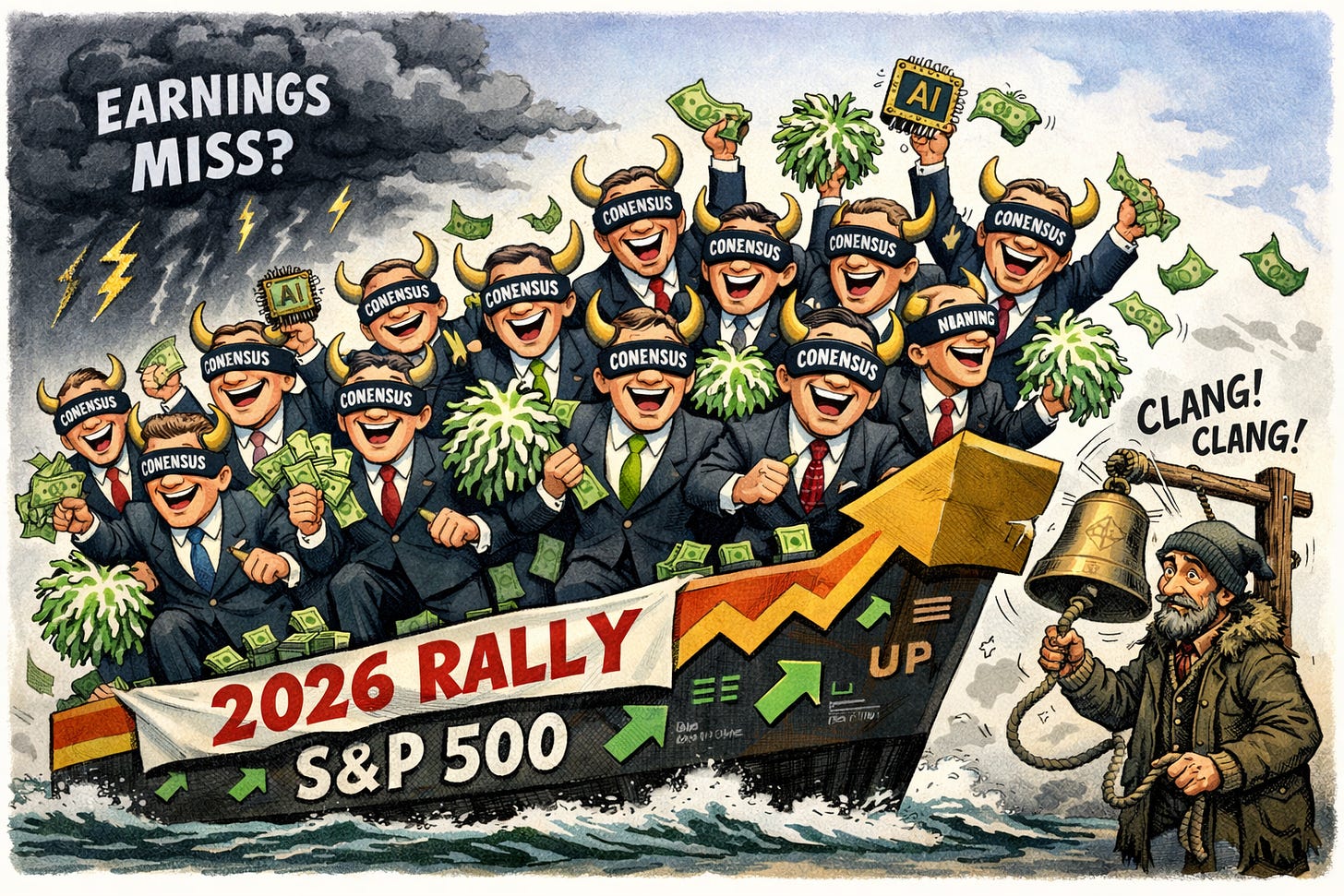

On December 29, a Bloomberg survey of 21 Wall Street strategists revealed a rare moment of total consensus: for the first time in recent memory, every single analyst predicts the S&P 500 will rise in 2026. Not one strategist called for a decline. The average year-end target sits at 7,555, suggesting about 9% upside from the index’s current level of roughly 6,900. This follows a wild 2025 where markets survived a $588.8 billion single-day wipeout in Nvidia after the DeepSeek AI launch and a nearly 20% bear market dip in April triggered by tariff fears. Despite those shocks, the street expects a fourth consecutive year of gains, the longest winning streak since the mid-2000s (Bloomberg).

This shift suggests the market is moving away from pure AI hype and toward a focus on hard profits. While the 2023 to 2024 rally relied on expanding valuations, the 2026 outlook is anchored by projected earnings growth of 13% to 14%. This is well above the historical average of 8%, signaling that the massive AI infrastructure investments are finally showing up in profit margins. Even the most cautious forecast from Bank of America targets 7,100, a modest 3.2% gain, while Oppenheimer sees a jump to 8,100. It seems the repeated “comeback” stories of 2025 have exhausted the skeptics, leaving even the most hardened bears looking for reasons to stay optimistic.

Sensei’s Insight: When everyone agrees, my contrarian alarm bells ring. Watch the 7,100 level for support: if earnings growth misses that 13% bar, this unanimous confidence could quickly turn into a crowded exit.

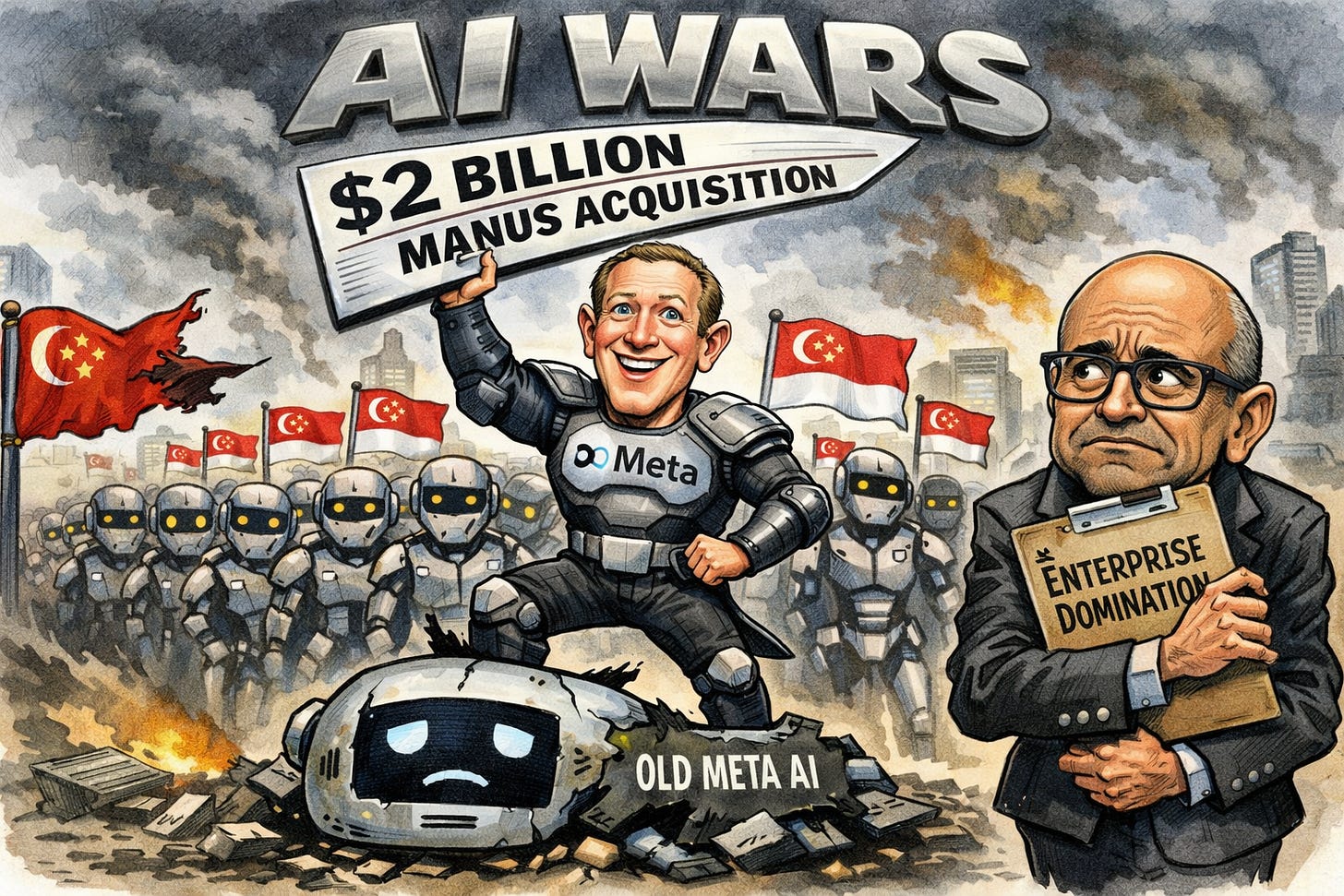

🤖 Meta Spends $2B to Secure AI Agent Dominance

Meta Platforms just closed a $2 billion deal to acquire Manus, a Singapore-based startup that builds “autonomous agents” rather than just chatbots. Announced on December 29, the acquisition is a fast-tracked move: Meta matched the $2 billion valuation Manus was seeking for its Series B just ten days into negotiations. Manus isn’t a typical cash-burning AI lab. It hit a $100 million annual recurring revenue (ARR) run rate only eight months after its 2025 launch, growing to $125 million by the time of this deal. That’s a 16x revenue multiple, showing Meta’s willingness to pay a premium for growth (Wall Street Journal)

This acquisition signals a shift in Meta’s strategy from building massive infrastructure to buying finished products that actually work. Unlike basic chatbots, Manus acts as an orchestration layer that executes complex tasks like market research and resume screening. For investors, the immediate $125 million in revenue offers a rare validation of AI monetization, though the 16x multiple suggests Meta expects rapid scaling to justify the price. There’s also a heavy geopolitical play here: Meta is cutting all Chinese ties for the startup, which was originally founded in Wuhan. This move highlights Singapore’s rise as a neutral hub where tech giants can scoop up talent while side-stepping U.S.-China regulatory friction.

Sensei’s Insight: Watch the integration of Manus into Meta’s business tools. If Meta successfully scales these autonomous agents, it could signal a major shift from “chatting” to “doing,” directly challenging Microsoft’s enterprise dominance.

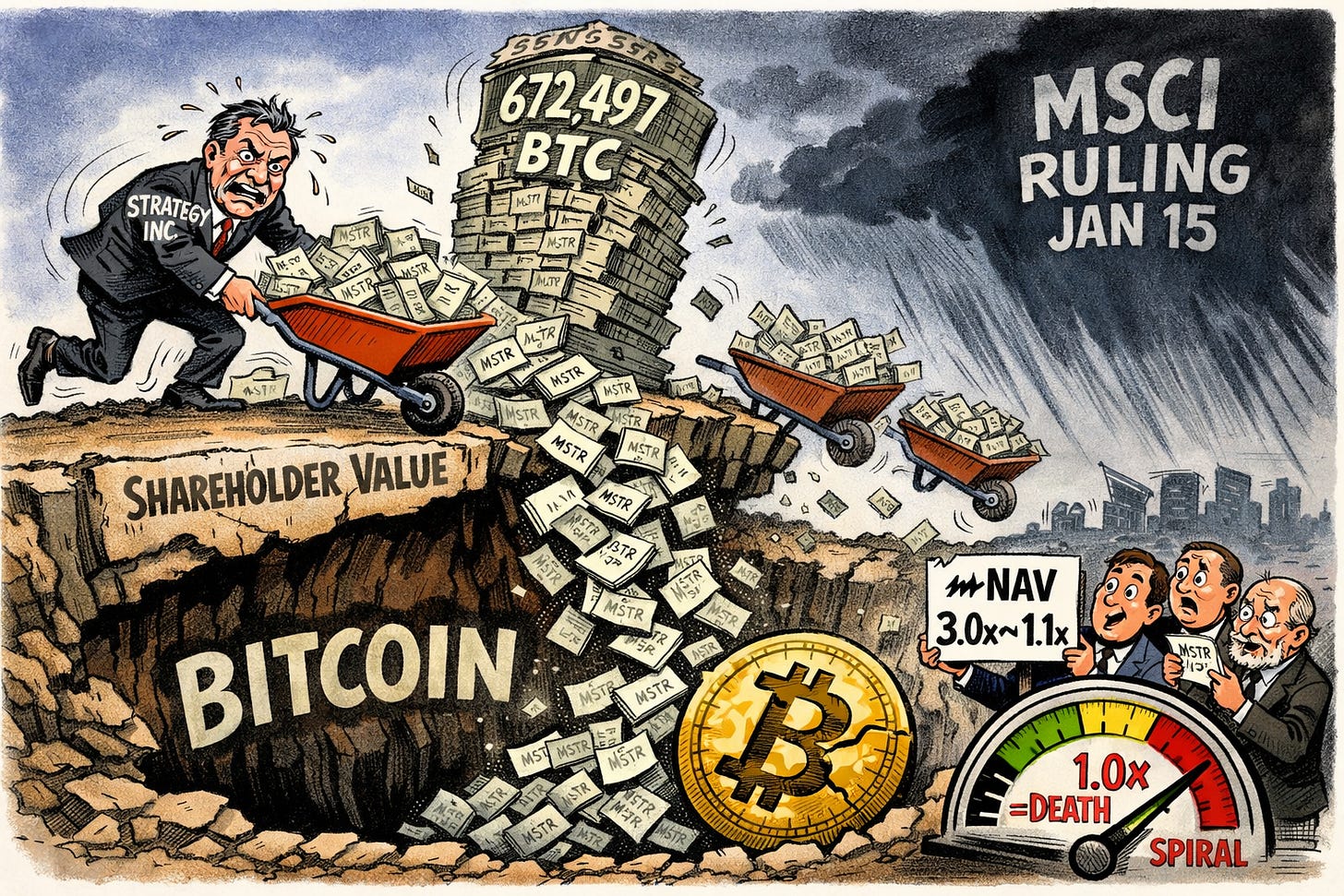

📉 Strategy Hits 15-Month Low Despite Fresh Bitcoin Buy

Strategy Inc. (MSTR 0.00%↑ ) just added 1,229 bitcoins to its massive treasury, but the market isn’t exactly cheering. The company spent $108.8 million on the coins between December 22 and 28, funded entirely by selling more than 663,000 common shares. Despite the aggressive accumulation, the stock slid 2.2% on Monday to $155.39, marking its lowest close since September 2024. This latest purchase brings their total stash to 672,497 BTC with an average cost basis of $74,997. It looks like the “accumulate at all costs” strategy is meeting heavy resistance as the share price decouples from the buying activity (MarketWatch).

The real concern for us isn’t just the price, it’s the collapsing mNAV premium. Investors used to pay over $3 for every $1 of Bitcoin the company owned, but that confidence multiple has shriveled to roughly 1.1x. That premium was the engine for their growth, and it’s basically stalled. Constant dilution is the silent killer here: the company has watered down shareholders by 22% in 2025 alone. With management recently shifting to hoard cash and the MSCI (the firm that manages the influential indexes used by pension funds and ETFs to decide which stocks they are required to buy) delisting decision looming on January 15, the market signals a potential structural break in the model rather than a simple dip.

Sensei’s Insight: Watch the January 15 MSCI ruling. If the premium drops below 1.0x, the leverage flywheel could flip into a mechanical death spiral.

🥈 Silver’s Margin Shock and Bank Collapse Rumors

Silver futures just took a massive intraday hit, dropping as much as 11% after hitting record highs above $80/oz. The move coincided with the CME Group raising silver margin requirements for the second time in a month. Initial margins for March 2026 contracts jumped to $25,000 from $22,000, forcing a massive deleveraging event. While a viral screenshot claimed a “systemically important” US bank blew up and was liquidated in the middle of the night, there’s zero evidence of this. No default notices have been issued by the CME, and the Fed hasn’t confirmed any emergency bailouts linked to metals (CryptoSlate).

This looks like a classic case of market plumbing meeting a crowded trade. When an asset goes parabolic, exchanges hike margins to mitigate risk, which often triggers profit-taking from those who can’t or won’t post more cash. With over 220,000 open contracts, this $3,000 per contract hike suggests a collective $675 million collateral call hit the market at once. For retail investors, it’s a reminder that leverage works both ways. The panic selling may signal that the rally was overheated, as traders scrambled to exit rather than face the increased costs of staying long.

Sensei’s Insight: Watch the CME silver CVOL and open interest levels. A sharp drop in open interest could confirm a total wipeout of leveraged positions, signaling the end of the current volatility.

🚢 Maduro’s Triage: PDVSA Begins Shutting Wells

Venezuela’s state-owned oil company, PDVSA, has started the operational equivalent of financial triage. As of December 28, 2025, the company began shutting down producing wells across the Orinoco Belt, home to the world’s largest proven reserves. This isn’t a policy choice: it’s a forced response to a military blockade. With the U.S. Navy seizing tankers like the Skipper and Centuries, Venezuela’s onshore storage at the Jose terminal hit a critical capacity of 12.6 million barrels. PDVSA is now aiming to slash production by 25% in the Orinoco region, dropping from roughly 667,000 to 500,000 barrels per day (Bloomberg).

For investors, the immediate oil price reaction has been muted because the market is staring at a projected 3.84 million barrel-per-day global surplus for 2026. However, the move signals a terminal decline for the Maduro regime’s financial lifeline. The “Chevron exception” remains the key detail to watch: Chevron still accounts for about 20% of Orinoco production and continues exporting to the U.S. Gulf Coast under a specific license. While the global supply glut prevents a price spike, the “last resort” nature of disabling wells is significant. These assets are notoriously difficult and expensive to restart, meaning even a sudden political shift won’t bring this heavy crude back online quickly.

Sensei’s Insight: Watch the $65 Brent level. While Venezuela’s 150,000 bpd cut is currently a rounding error, any escalation that threatens Chevron’s operations or triggers broader regional instability will finally force a risk premium.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_live_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive: Navigating the December FOMC Minutes

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.