Morning Forecast: Wednesday, 14 January

Record silver, inflation data, and a Bank of America wildcard for XRP.

This content is for informational and educational purposes only and does not constitute financial advice. Always do your own research. Not financial advice (NFA).

👀 Today’s Stories at a Glance

⛏️ Metals hit record highs: Precious and industrial metals peaked as investors rotate into hard assets for safety.

🇮🇷 Iran faces economic collapse: Systemic currency failure and inflation triggered nationwide uprisings and a deadly government crackdown.

🇨🇳 China shatters trade records: A record $1.19 trillion surplus highlights a pivot to high-value exports despite tariffs.

🏦 BitGo files for IPO: The $2 billion listing tests institutional appetite for regulated infrastructure despite margin compression.

🍿 Netflix makes cash bid: Switching to all-cash for Warner Bros. Discovery counters rival bids and simplifies acquisition.

🔍 PPI and retail data: Wholesale inflation and spending numbers today will signal potential stagflation or growth risks.

🏦 BofA earnings watch XRP: Markets monitor the report for mentions of tokenized settlement or digital liquidity rails.

🧠 One Big Thing

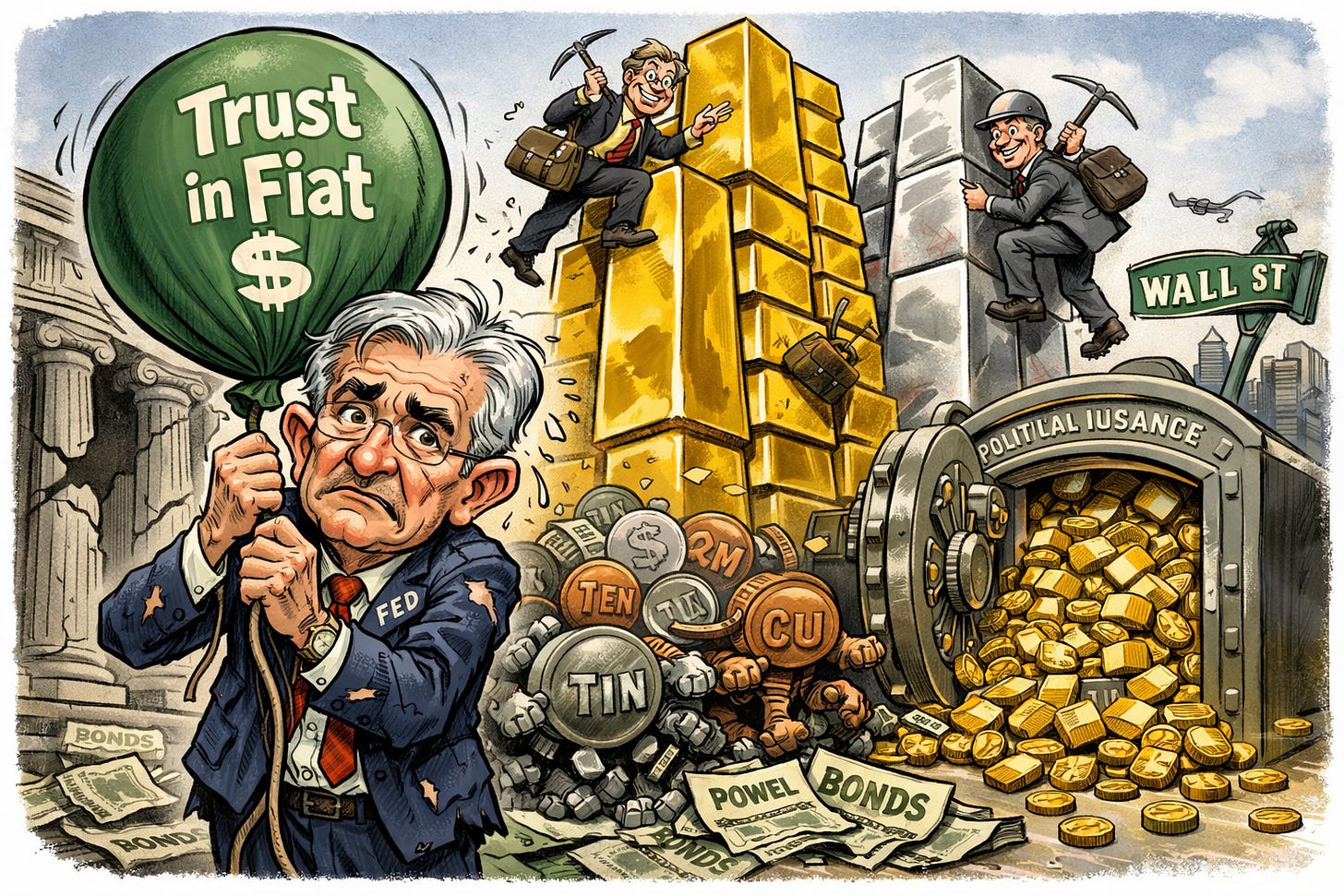

The Great Debasement Trade

Investors are aggressively rotating out of fiat currencies and into physical commodities as trust in traditional financial systems erodes. This shift is driven by a rare synchronized surge in gold, silver, and industrial metals, with silver alone climbing 150% over the past year. Market anxiety is being fueled by a criminal investigation into the Federal Reserve Chair, which has cast doubt on central bank independence and prompted a search for political insurance. Meanwhile, severe supply constraints and trade tariffs are further inflating the cost of tangible assets. For the market, this move represents a structural pivot toward hard assets to hedge against a weakening dollar.

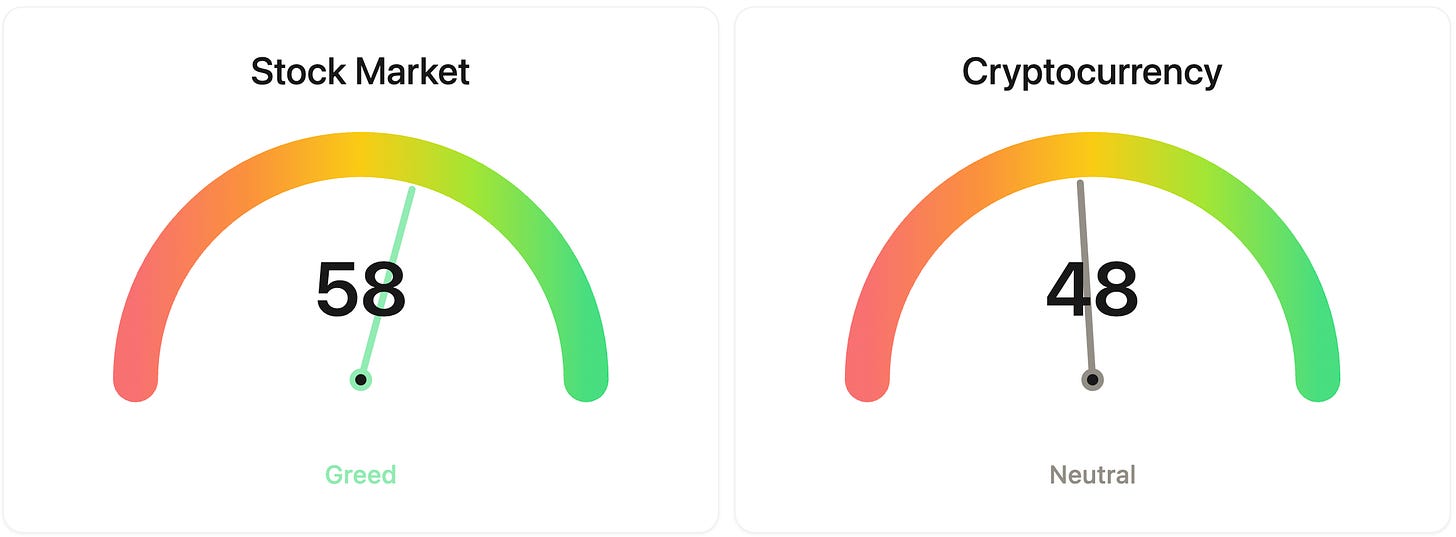

⚖️ Fear & Greed

📉 The Number That Matters

$90

Silver surged past $90 per ounce for the first time in history today, jumping 5.3%. This milestone reflects a major rotation into hard assets as investors seek political insurance against potential central bank instability and currency debasement.

⚔️ Winners vs Losers

Winners

MREO 0.00%↑: Mereo BioPharma shares rose after the company extended its cash runway to 2027 and provided Phase 3 data clarity for its setrusumab program.

ALTS 0.00%↑: ALT5 Sigma Corporation climbed following strong Q3 net income of $57 million and progress toward regaining Nasdaq compliance.

MRNO 0.00%↑: Murano Global Investments moved higher on sector momentum despite no news reported for the company.

TGTX 0.00%↑: TG Therapeutics gained as the company reported preliminary 2025 revenue of $616 million and issued strong 2026 BRIUMVI sales guidance.

Losers

GKOS 0.00%↑: Glaukos Corp. shares fell after the company reaffirmed its 2026 revenue guidance instead of raising it despite reporting record Q4 sales.

TCOM 0.00%↑: Trip.com Group shares plummeted after China’s State Administration for Market Regulation initiated an anti-monopoly investigation into the company.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $94,931 (▼ 0.39%)

Ethereum (ETH): $3,296 (▼ 0.79%)

XRP: $2.13 (▼ 1.69%)

Equity Indices (Futures):

S&P 500: $6,938 (▼ 0.32%)

NASDAQ 100: $25,738 (▼ 0.65%)

FTSE 100: £10,164 (▲ 0.16%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.16% (▼ 0.46%)

Oil (WTI): $62 (▲ 1.13%)

Gold: $4,636 (▲ 1.10%)

Silver: $90.74 (▲ 4.41%)

Data as of UK (GMT): 11:25 / US (EST): 06:25 / Asia (Tokyo): 20:25

✅ 5 Things to Know Today

⛏️ Metals Break to New Highs Across the Board

Precious and industrial metals hit a rare synchronized peak today. Today silver surged 5.3% to cross $90 per ounce for the first time. Gold notched its own all-time high at approximately $4,645 per ounce. The rally extends beyond the shiny stuff: tin jumped 6% while copper hovers near record highs above $6 per pound. These moves follow a massive 2025 where silver climbed nearly 150%. This price action suggests a major “debasement trade” is underway. Investors are rotating away from fiat currencies and into hard assets as trust in traditional systems wavers (Bloomberg).

This movement reflects a structural shift in risk. The criminal investigation into Fed Chair Jerome Powell has markets questioning central bank independence. If the Fed faces political coercion, gold and silver become essential “political insurance.” Physical supply is also genuinely tight. Indonesia’s crackdown on illegal mining has slashed tin exports, and 50% US tariffs on copper products are forcing traders to hoard inventory. Citi suggests gold could hit $5,000 by April. For retail investors, this signals that institutional money is rotating away from nominal bonds and toward tangible protection against a weakening dollar.

Sensei’s Insight: Watch the $5,000 gold level and $100 silver resistance. This rally signals a deep loss of confidence in fiat. If Powell’s legal troubles escalate, the premium on “political insurance” assets will likely keep climbing.

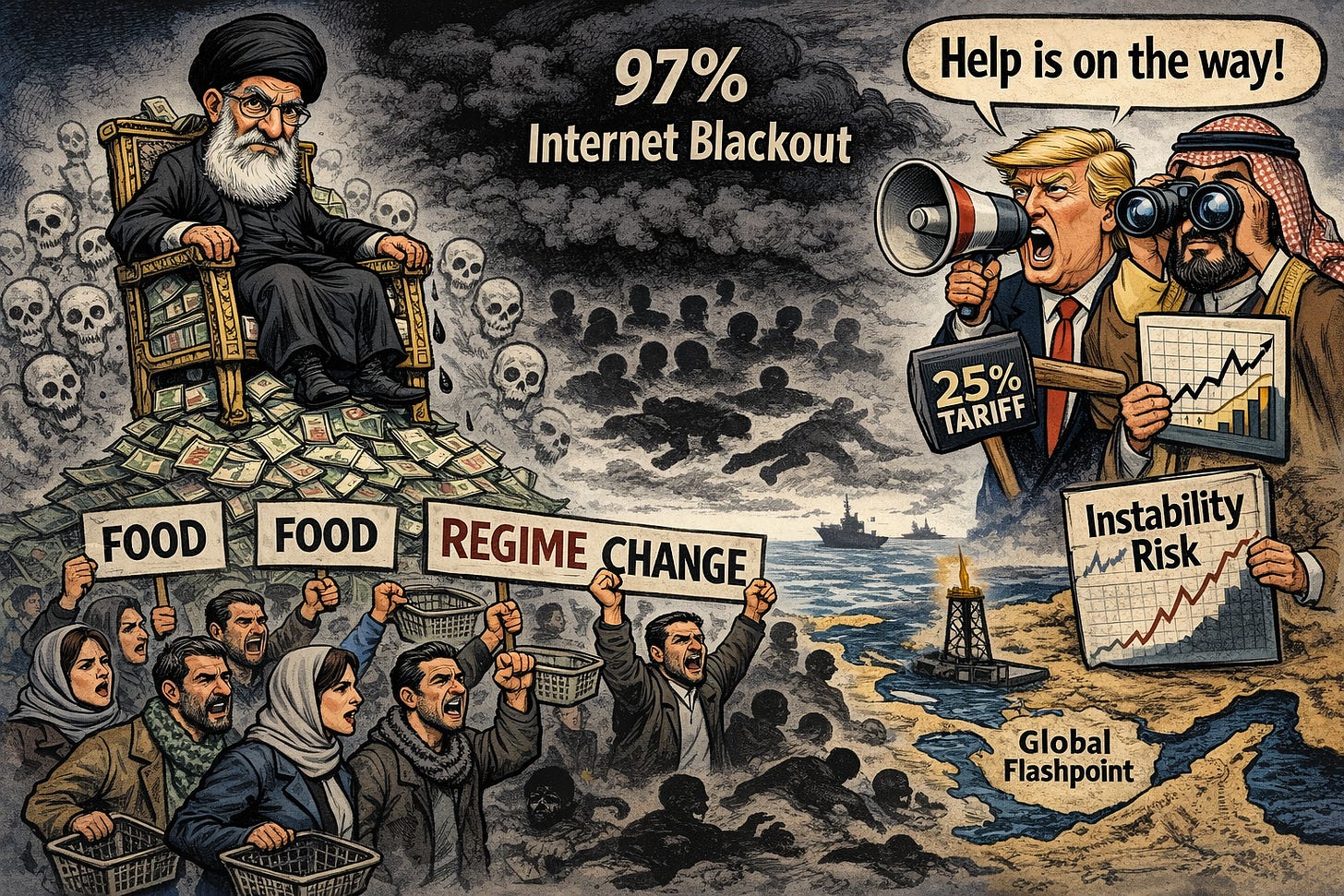

🇮🇷 Iran’s Economic Collapse Leaves Thousands Dead

Iran is reeling from a systemic currency collapse that turned a food-price crisis into a nationwide uprising. On December 28, the rial hit a record low of 1.42 million to the US dollar, marking an 84% decline over the last year. This triggered 72% food inflation, forcing people into the streets. By January 8, demands shifted from economic relief to regime change, meeting a brutal government response. While human rights groups have verified 2,571 deaths, the real toll may exceed 12,000 as a 97% nationwide internet blackout conceals the scale of the crackdown (Bloomberg).

For investors, the immediate ripple is felt in energy and geopolitical risk premiums. Brent Crude has climbed to $65 per barrel, a 2% rise reflecting a roughly $4 “insurance” premium against supply disruptions. Trump’s promise that “help is on its way” along with a proposed 25% tariff on Iran’s trade partners adds significant uncertainty for Chinese markets. However, the lack of a major price spike suggests markets don’t anticipate a total supply cutoff yet. Watch the Gulf states: Saudi Arabia is privately lobbying against US military intervention, fearing that regional instability could derail its own economic diversification plans.

Sensei’s Insight: Watch for any sign of US military escalation or a blockade in the Strait of Hormuz. Until the internet blackout lifts, the market is trading on incomplete data and presidential ambiguity.

🇨🇳 China’s $1.2 Trillion Surplus Shatters Global Trade Records

China just reported a record annual trade surplus of $1.19 trillion for 2025, shattering the $1 trillion ceiling for the first time. This is a 20% jump from 2024, despite US tariffs reaching 145% on specific goods. December exports were the real shocker, growing 6.6% and doubling analyst expectations. The numbers reveal a major geographic pivot: while exports to the US plummeted 20%, shipments to Africa and Southeast Asia surged 26% and 13% respectively. China is no longer just moving cheap toys, as high-value exports like semiconductors and autos both jumped over 20% this year (Bloomberg).

For investors, this surplus is a double-edged sword. While the export engine is firing, annual imports grew only 0.5%, a sign that Chinese consumers are still reeling from the property market slump. It suggests Beijing is pushing excess capacity onto the global market because domestic demand is stagnant. We also need to watch the fragility of the current trade truce. With new tariff threats looming over countries trading with Iran, the export momentum seen in late 2025 could face a sharp reversal if the US-China relationship hits another rough patch in the coming months.

Sensei’s Insight: Watch the regulatory tightening. Beijing’s move to hike margin requirements to 100% suggests they’re more concerned with containing a potential bubble than celebrating this record-breaking trade performance.

🏦 BitGo’s $2B IPO tests institutional crypto appetite

BitGo Holdings just pulled the trigger on its long-awaited IPO, filing to list on the NYSE under ticker BTGO the week of January 19, 2026. They’re aiming for a $1.96 billion valuation, offering 11.8 million shares between $15 and $17. The numbers from the first half of 2025 are a bit of a head-scratcher: revenue exploded 274% to $4.19 billion, yet net income slid 59% to just $12.6 million. That margin compression looks scary, but it’s largely due to BitGo reporting gross trading volumes as revenue. It’s a volume game where they prioritize institutional trust over high retail spreads (Yahoo finance).

This isn’t a standard exchange play like Coinbase. BitGo is positioning itself as the boring, regulated plumbing of the industry. They recently secured a federal national trust bank charter, which puts them in a rare group with companies like Circle and Fidelity. This status helps them court pension funds and big asset managers who won’t touch unregulated platforms. However, investors should keep an eye on their concentration risk. Bitcoin makes up nearly 43% of their assets under custody, meaning a major price swing in BTC can swing their net income by hundreds of millions. It’s a bet on infrastructure, but it’s still heavily tethered to the underlying market’s pulse.

Sensei’s Insight: Watch if BTGO can break the 2025 curse where crypto debuts like Gemini and Bullish cratered. If the market values its bank charter over its thin margins, the IPO window stays open.

🍿 Netflix Goes All-In with Cash for Warner

Netflix is pivoting its $82.7 billion pursuit of Warner Bros. Discovery, ditching the stock portion for a straight all-cash offer. It’s offering $27.75 per share, matching the previous total value but removing the volatility of Netflix’s own equity. This move comes just as Paramount Skydance pushes a hostile $30 per share all-cash bid, backed personally by Larry Ellison. Netflix is leaning on a massive $59 billion bridge loan to fund the acquisition of WBD’s studios and streaming units, while leaving legacy cable networks like CNN to be spun off into a new company (Bloomberg).

This shift isn’t just about simplicity; it’s defensive. Netflix stock has slid about 25% since October, trading near $89 on January 13. That decline gave Paramount room to argue that Netflix’s original deal was losing value every day the market stayed red. By switching to cash, Netflix signals it has the balance sheet to weather the fight. The real math for us to watch is the spinoff, Discovery Global. Netflix claims it’s worth $3 to $4 per share, while Paramount says it’s under $1. That gap determines if Netflix’s offer actually beats Paramount’s $30 headline number.

Sensei’s Insight: Watch the January 21 tender deadline. If WBD shareholders don’t bite on Paramount’s offer, Netflix’s cash pivot likely seals the deal, though regulatory reviews could still take over a year.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_live_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

🔍 Deep Dive #1 — Data Release

🔍 Deep Dive #2 — Bank of America / XRP

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.