Morning Forecast: Wednesday, 17 December

Today’s briefing spans China’s GPU frenzy, Tesla’s legal squeeze, Britain’s rate-cut pivot, Trump’s oil blockade, streaming consolidation and Medline’s IPO, all under the shadow of AI leverage.

This content is for informational and educational purposes only and does not constitute financial advice. Always do your own research. Not financial advice (NFA).

👀 Today’s Stories at a Glance

🇨🇳 MetaX Skyrockets in Shanghai: Chipmaker jumps 693% on debut, valuing the unprofitable startup at $43 billion.

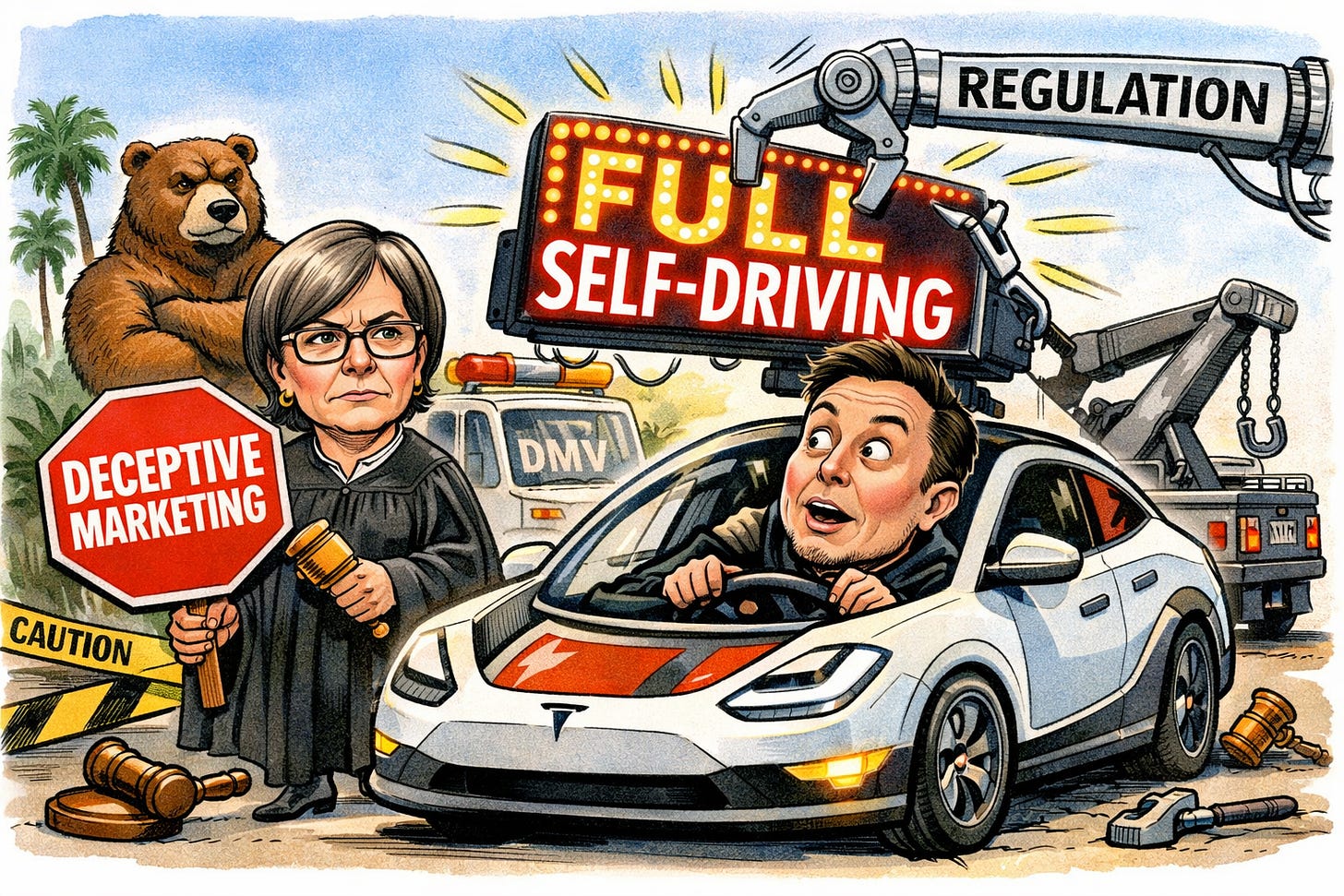

🛑 California Ultimatum for Tesla: Regulators threaten a sales ban unless “Full Self-Driving” marketing claims change immediately.

📉 UK Inflation Plunge Shocks: Inflation drops to 3.2%, fueling investor bets on aggressive future interest rate cuts.

🇻🇪 Trump Blockades Venezuelan Oil: “Total blockade” ordered, though oil prices rise only modestly given global supply surplus.

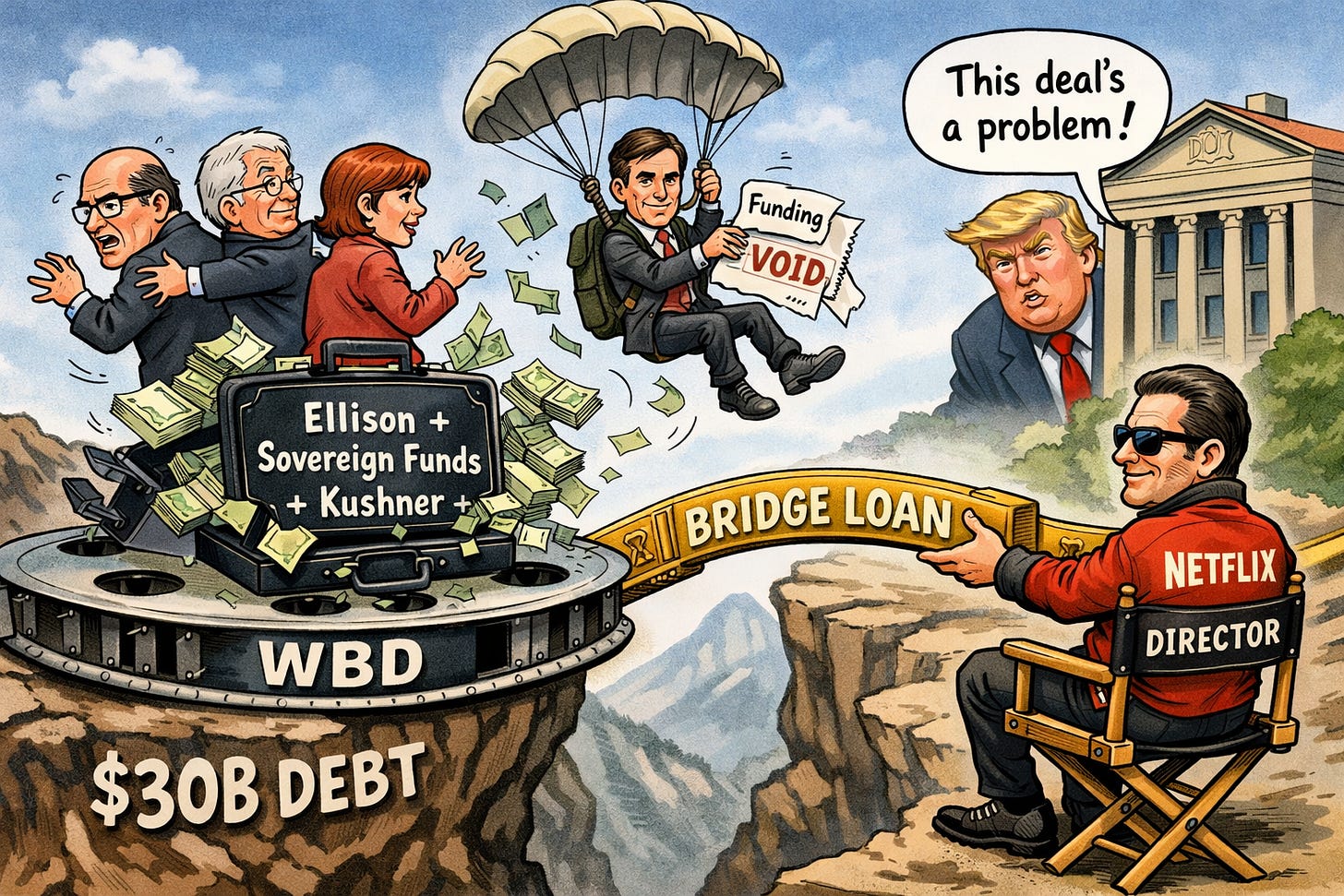

🎬 WBD Picks Netflix Deal: Board rejects Paramount’s higher offer, favoring Netflix’s secure financing over risky debt structures.

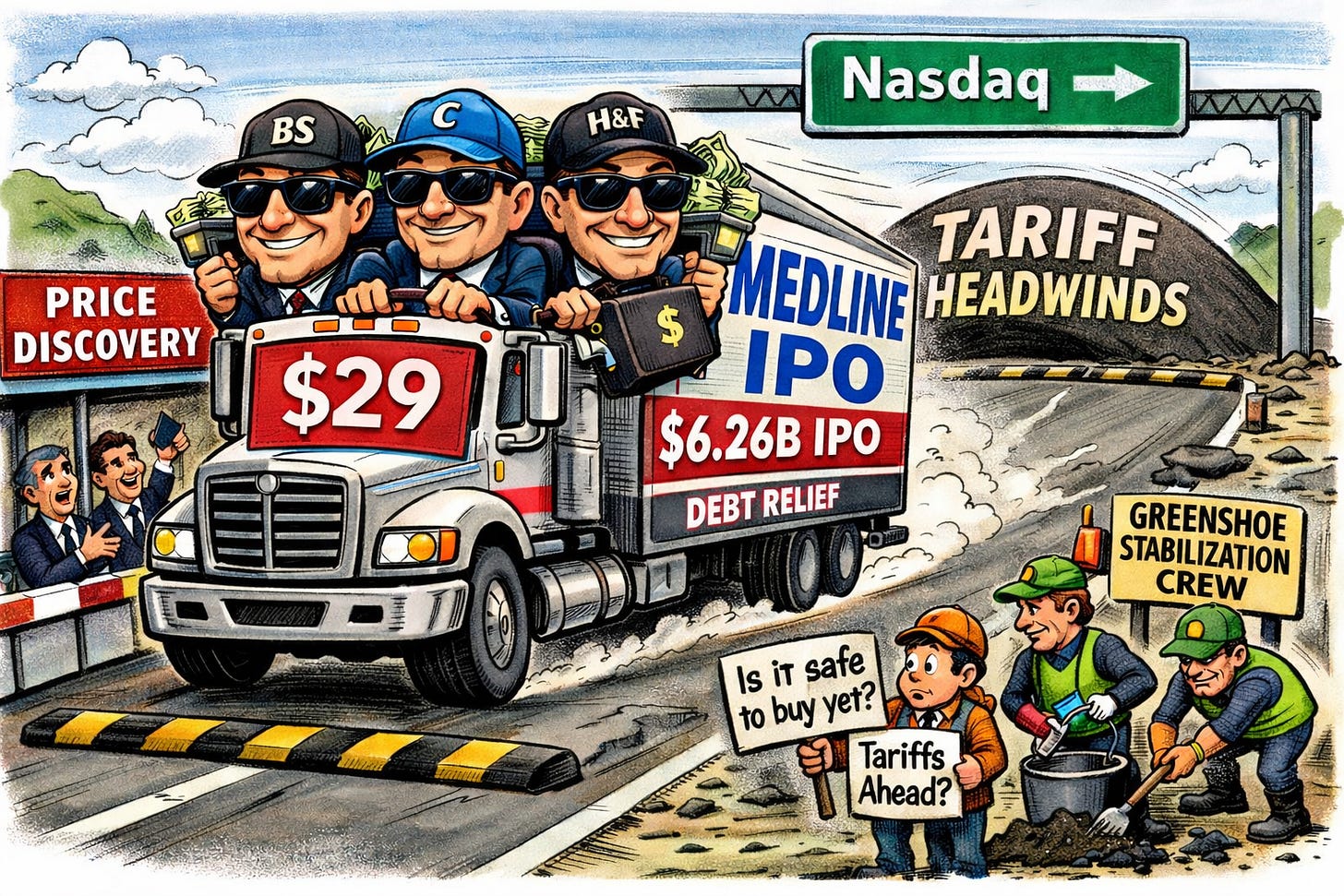

🏥 Medline Launches Record IPO: Largest 2025 listing raises $6.3 billion to repay debt and test market appetite.

🧠 One Big Thing

The Leverage Trap

Speculative mania is inflating asset classes ranging from gold to collectibles, yet the leverage fueling the artificial intelligence boom poses the most severe systemic risk. Corporations are on track to spend nearly $1.6 trillion annually on data centers by 2030 despite a lack of proven profit models. This rapid infrastructure expansion relies increasingly on opaque private credit and aggressive debt financing rather than balance sheet cash. The market is effectively wagering borrowed capital on unproven technology. If AI adoption stalls, this accumulation of debt could trigger a broader economic collapse. We have shifted dangerously from legitimate innovation to a fragile casino economy.

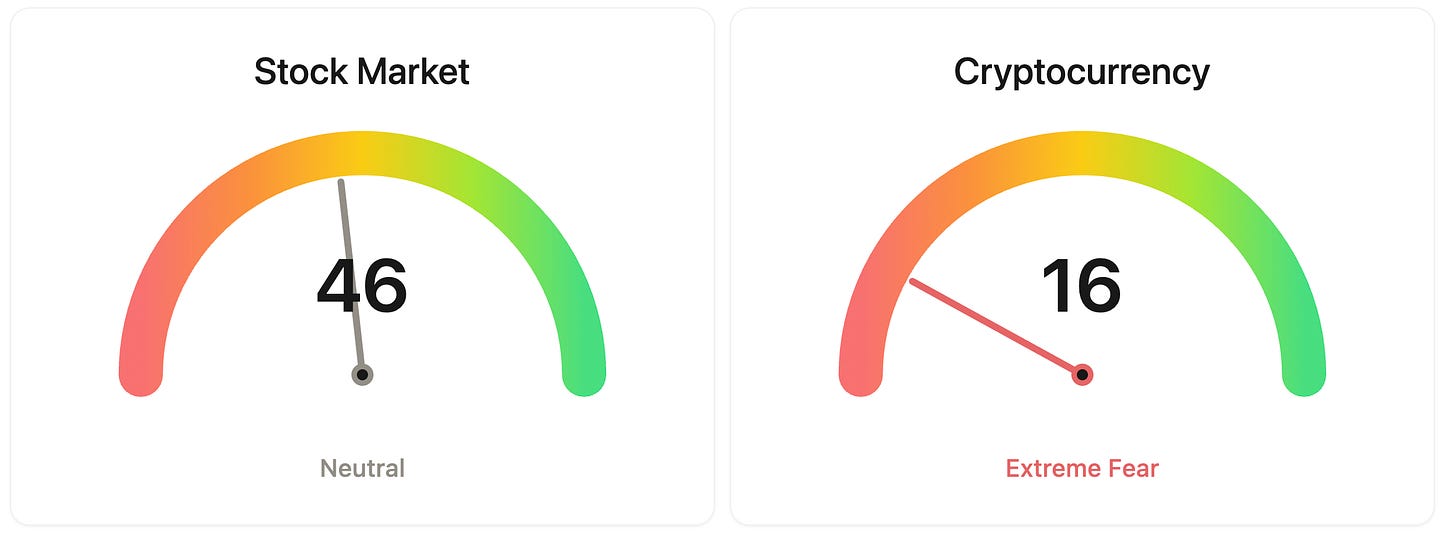

⚖️ Fear & Greed

📉 The Number That Matters

30

The Bank of Japan is expected to hike interest rates to a 30-year high this Friday. Policymakers aim to curb 3.0% inflation and stabilize the yen before external economic headwinds from US tariffs intensify further.

⚔️ Winners vs Losers

Winners

HUT +20.60%: Hut 8 Corp. shares jumped following a 15-year, $7 billion AI data center lease agreement with Fluidstack, supported by Google financial backing.

DBVT +37.71%: DBV Technologies SA stock surged after announcing positive Phase 3 VITESSE trial results for its Viaskin Peanut patch in children aged 4-7.

CGC +7.85%: Canopy Growth Corp. rallied on sympathy from potential U.S. marijuana reclassification policy and the announced acquisition of MTL Cannabis for $179 million.

BEAT +13.08%: Heartbeam, Inc. shares rose after securing FDA 510(k) clearance for its 12-lead ECG synthesis software following a successful regulatory appeal.

Losers

PLCE -32.38%: Children’s Place, Inc. shares plunged after the retailer reported a Q3 earnings miss, including a 13% revenue collapse and significant e-commerce traffic declines.

WOR -8.51%: Worthington Enterprises stock fell after posting a Q2 earnings miss and receiving analyst downgrades due to concerns over operating margins and macro headwinds.

KYTX -17.88%: Kyverna Therapeutics shares traded lower as a $100 million dilutive common stock offering offset positive topline data from its registrational KYSA-8 clinical trial.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $87,092 (▼ 0.88%)

Ethereum (ETH): $2,932 (▼ 1.01%)

XRP: $1.91 (▼ 0.93%)

Equity Indices (Futures):

S&P 500: $6,823 (▲ 0.48%)

NASDAQ 100: $25,494 (▲ 0.45%)

FTSE 100: £9,841 (▲ 1.61%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.18% (▲ 0.84%)

Oil (WTI): $57 (▲ 2.37%)

Gold: $4,315 (▲ 0.31%)

Silver: $65.93 (▲ 3.46%)

Data as of UK (GMT): 12:11 pm / US (EST): 7:11 am / Asia (Tokyo): 9:11 pm

✅ 5 Things to Know Today

🇨🇳 MetaX IPO Explodes 693% in Shanghai Debut

MetaX Integrated Circuits, a Shanghai-based GPU maker founded by former AMD engineers, just staged one of the year’s wildest IPOs. Debuting on Shanghai’s Star Market Wednesday, shares opened at 700 yuan, a massive 669% jump from the listing price, before closing up 693% at 829.9 yuan. The debut values the unprofitable five-year-old startup at roughly $42.6 billion, making it China’s largest GPU chipmaker by market cap. Retail investors showed insatiable appetite, oversubscribing the $600 million offering by 4,000 times, dwarfing the frenzy seen with rival Moore Threads just weeks ago (Reuters).

This isn’t just retail gambling; it’s a bet on Beijing’s aggressive tech independence roadmap. Following a November directive mandating state data centers switch to domestic chips, local players are scrambling to fill the vacuum left by U.S. export bans. Nvidia CEO Jensen Huang recently admitted their China market share has effectively hit “0%,” leaving billions in revenue up for grabs. While MetaX revenue quadrupled this year, it’s still burning cash and trading at a steep 50x sales multiple. Investors are pricing in guaranteed state support rather than current fundamentals, betting this “AMD gene” startup can deliver where others haven’t.

Sensei’s Insight: This valuation assumes flawless execution. Watch the “froth” levels carefully, rival Moore Threads dropped 19% shortly after its own pop. If the tech gap doesn’t close fast, gravity will kick in.

🛑 California Threatens 30-Day Tesla Sales Ban

On December 16, California regulators issued a sharp ultimatum to Tesla: change your marketing or lose your license to sell cars in the state for 30 days. Administrative Law Judge Juliet Cox ruled that terms like “Autopilot” and “Full Self-Driving” are deceptive because they imply the cars are autonomous when they are actually just Level 2 driver-assist systems requiring human attention. The DMV granted Tesla a 90-day grace period to correct the language before any suspension hits. Importantly, this order restricts selling, not manufacturing, so the Fremont factory lines will keep moving regardless of the outcome (CNBC).

California is Tesla’s critical anchor market, even as local registrations fell 11.6% last year. The market’s calm reaction, shares dipped only 1%, implies investors see this as a manageable compliance hurdle rather than an existential crisis. However, the long-term risk is significant. With Tesla’s valuation increasingly detached from car sales and pinned to a future robotaxi narrative, strict regulatory policing of “autonomy” claims creates friction. If the gap between Tesla’s marketing and its actual technological capabilities is legally enforced, it complicates the massive growth story Musk is selling to Wall Street.

Sensei’s Insight: Watch the compliance response in the next 60 days. If Tesla is forced to completely scrub “Full Self-Driving” from its vocabulary, it could deflate the autonomy premium currently propping up the stock’s record valuation.

📉 UK Inflation Plunge Unlocks Aggressive 2026 Rate Cuts

Wednesday morning delivered a shock to the system for UK policymakers. Headline inflation for November cooled to 3.2%, significantly undershooting both the market’s 3.5% forecast and the Bank of England’s own 3.4% prediction. The “sticky” parts of the economy are finally unstcking: Core inflation dropped to 3.2%, and the critical services inflation metric slowed to 4.4%. This is the largest forecast miss in months. It effectively dismantles the arguments used by hawks to hold rates steady in November, as the fears of persistent food price pressure have evaporated almost overnight (Office for National Statistics).

Markets reacted violently to the data. The pound slumped toward $1.3340, not because the economy is failing, but because traders immediately repriced 2026 expectations from “cautious cuts” to “3+ cuts likely.” Lower interest rates generally weaken a currency by reducing its yield advantage. Meanwhile, the FTSE 100 rallied 1.3%, buoyed by the prospect of cheaper borrowing and specific movers like Serco (SRP), which jumped 5.7% after upgrading its 2025 profit forecast to £270 million. The deeper signal here is housing: London rent inflation collapsed to 2.8%, proving that 2025’s policy shocks are finally suppressing demand. The BoE is now fighting deflationary pressure in assets, not just inflation in goods.

Sensei’s Insight: Watch the BoE’s tone tomorrow. Markets have now priced in a 90% chance of a cut, but the language matters. If Governor Bailey doesn’t validate these aggressive new dovish bets for 2026, Sterling is primed for a sharp snap-back rally.

🇻🇪 Trump Orders “Total Blockade” on Venezuelan Oil

Yesterday evening President Trump announced a “total and complete blockade” of all sanctioned oil tankers entering or leaving Venezuela. He stated the country is now surrounded by the “largest Armada ever assembled” in South American history and designated the Maduro regime a Foreign Terrorist Organization. This escalation follows the US seizure of the supertanker Skipper last week. Markets reacted immediately but cautiously to the news. Brent crude popped 2.2% to just over $60 per barrel while European energy majors like Shell and BP posted modest gains on the potential for tightened supply (Al Jazeera).

The Context: You might wonder why oil didn’t spike higher on such aggressive news. The answer is volume. Venezuela’s output has collapsed 70% since 2006 to roughly 850,000 barrels per day. That is a drop in the bucket compared to the massive global supply surplus expected in 2026. The real story here isn’t a supply shock but the return of “risk-off” geopolitics. With Trump also threatening retaliation against EU tech firms (impacting Siemens and Spotify), capital is fleeing to safety. Gold surged to $4,330/oz, closing in on record highs, while Bitcoin slipped 1.7% to ~$86k.

Sensei’s Insight: Don’t chase the oil knee-jerk as the global glut remains heavy. Instead watch Gold ($4,380 level). If it breaks October’s record it signals the market is pricing in sustained geopolitical conflict.

🎬 WBD Rejects Paramount’s $108B Bid, Backs Netflix

Warner Bros Discovery’s board intends to reject Paramount’s $108.4 billion hostile takeover, favoring Netflix’s $82.7 billion agreement. Despite Paramount offering $30 per share versus Netflix’s $27.75, the board balked at financing risks. Specifically, Paramount relied on a revocable trust from Larry Ellison and foreign sovereign wealth funds, creating unacceptable uncertainty. The final blow came this morning when Jared Kushner’s Affinity Partners pulled its funding, validating the board’s fears that the money wasn’t solid (Reuters).

This is a defensive move to secure operational safety over a higher sticker price. Netflix provides $59 billion in committed bridge loans, whereas Paramount restricted WBD’s ability to manage its $30 billion debt load during regulatory review. For investors, the structure is key: Netflix gets the premium studios and HBO Max, while WBD’s declining cable assets (CNN, TNT) will be spun off into a risky new stock called “Discovery Global.” WBD shares fell 1.3% on the news, a sign the market knows the bidding war is effectively over.

Sensei’s Insight: Watch the regulatory headlines closely. Trump has already called the deal “a problem,” suggesting the real battle now shifts from the boardroom to the DOJ.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_live_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive: 🏥 The Medline Breakout: Mechanics of 2025’s Largest IPO

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.