Morning Forecast: Wednesday, 21 January

Brad Garlinghouse Speaks at Davos as Trump’s Greenland Move Shakes Markets

This content is for informational and educational purposes only and does not constitute financial advice. Always do your own research. Not financial advice (NFA).

👀 Today’s Stories at a Glance

🇬🇱 Greenland tariffs hit markets: New levy threats sparked the worst S&P 500 drop since 2025.

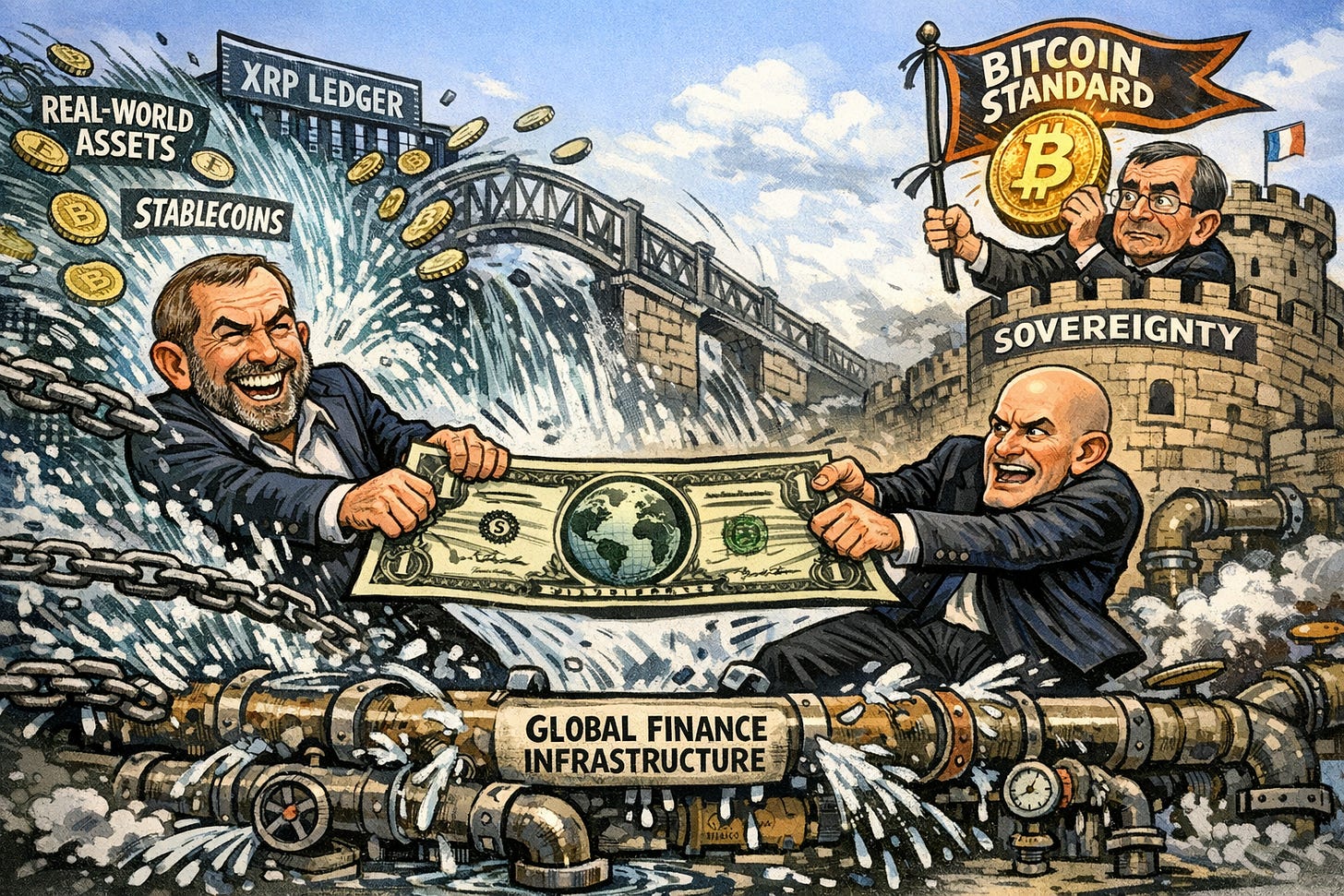

🌐 Crypto leaders debate future money: Ripple and Coinbase spar with bankers over tokenization and sovereignty.

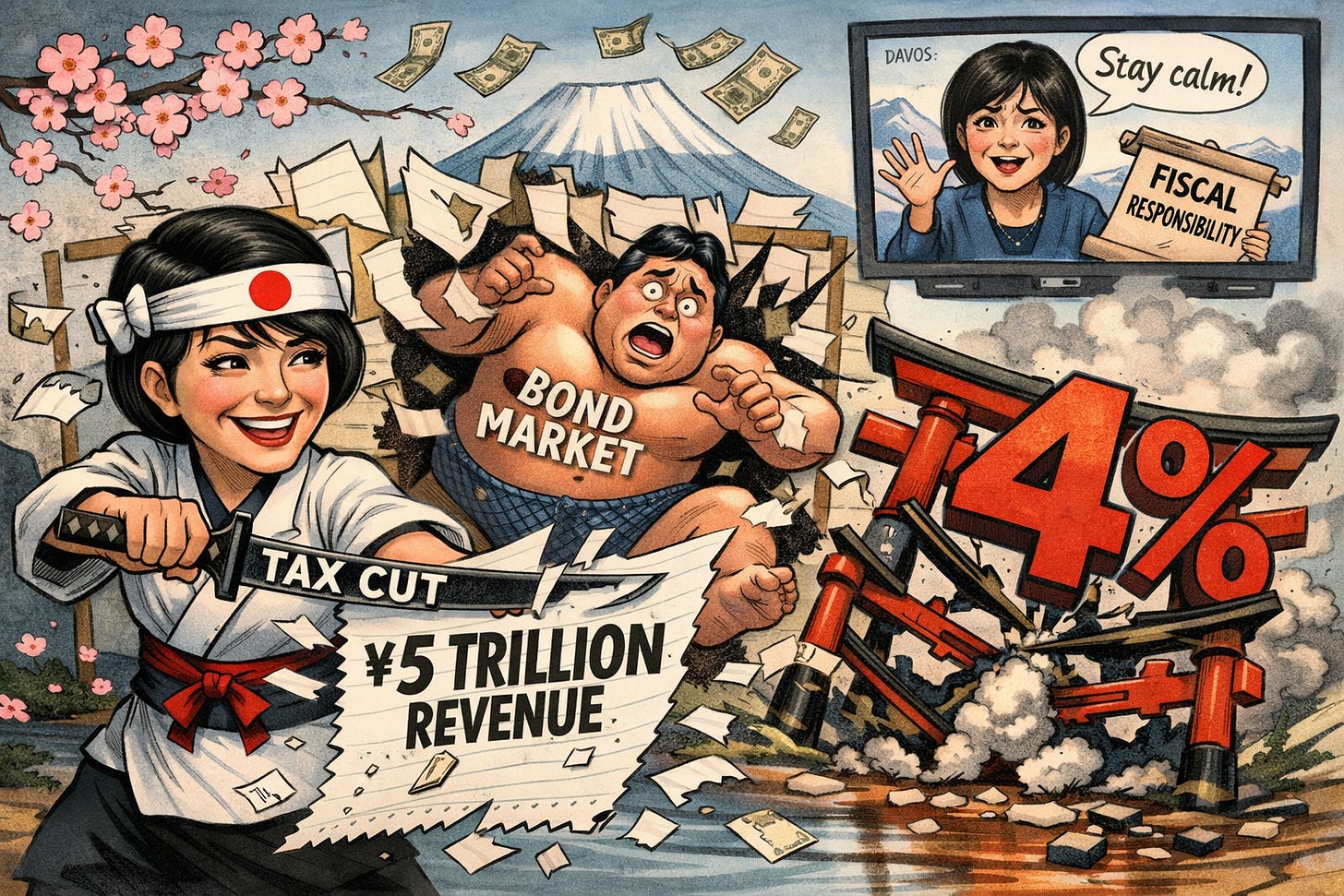

🇯🇵 Japan bond yields hit 4%: Takaichi’s tax cuts pushed 40-year yields to record highs, rattling debt.

🍔 Berkshire may exit Kraft Heinz: Greg Abel’s filing indicates a massive sale, ending a Buffett era.

🇮🇷 Trump weighs Iran military action: Naval buildups signal a pivot toward decisive action against Tehran’s regime.

🚀 Musk and Ryanair clash: O’Leary rejected Starlink over fuel costs, sparking a feud and investor caution.

🧠 One Big Thing

At Davos 2026, the global financial narrative has shifted from theoretical debate to the operational integration of tokenization and stablecoins into mainstream markets. Leaders like Ripple’s Brad Garlinghouse and Coinbase’s Brian Armstrong are advocating for digital assets as critical tools for real-time settlement and broader capital access, while traditional giants like Euroclear and Standard Chartered are already moving market ecosystems on-chain. This transition represents a fundamental rewiring of financial infrastructure, where stablecoins act as a primary bridge between legacy systems and decentralized finance.

For investors, this signals a “production era” where the value of digital assets is increasingly tied to institutional utility rather than pure speculation. While central banks remain cautious about preserving monetary sovereignty, the consensus suggests that regulated tokenization is now a competitive necessity for global capital markets.

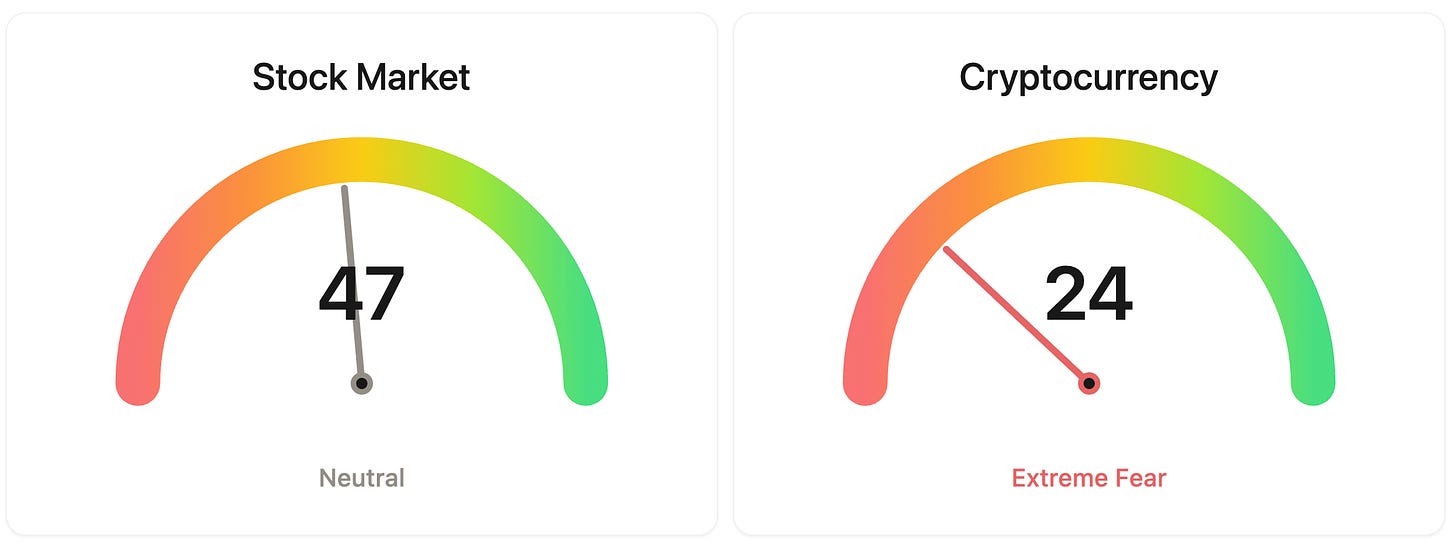

⚖️ Fear & Greed

📉 The Number That Matters

27.5%

Berkshire Hathaway may divest its 27.5% stake in Kraft Heinz, representing 325 million shares. The potential exit by new CEO Greg Abel signals a portfolio cleanup as the food giant prepares to split into two independent companies by late 2026.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $89,186 (▲ 0.92%)

Ethereum (ETH): $2,962 (▲ 0.81%)

XRP: $1.90 (▲ 0.57%)

Equity Indices (Futures):

S&P 500: $6,802 (▼ 0.03%)

NASDAQ 100: $25,132 (▲ 0.01%)

FTSE 100: £10,099 (▼ 0.01%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.28% (▼ 0.28%)

Oil (WTI): $61 (▲ 1.46%)

Gold: $4,861 (▲ 2.06%)

Silver: $94.60 (▲ 0.04%)

Data as of UK (GMT): 11:46am / US (EST): 6:46am / Asia (Tokyo): 8:46pm

✅ 5 Things to Know Today

🇬🇱 Trump’s Greenland Gambit Triggers a Market Correction

President Trump turned campaign rhetoric into a concrete trade war this week, threatening eight NATO allies with 10% tariffs starting February 1 unless they sell or transfer Greenland to the U.S. These levies are scheduled to escalate to 25% by June.1 The shock wiped out early January gains, giving the S&P 500 its worst day since October 2025 with a 2.06% drop to 6,796.86. Major tech names like Nvidia and Amazon fell over 3%, while 10-year Treasury yields spiked to 4.299% as trade war fears reignited global market volatility (Bloomberg).

This represents a structural reassessment of geopolitical risk rather than a simple technical dip. When the U.S. threatens its closest partners, it creates massive uncertainty for corporate margins and global supply chains. We’re seeing a classic risk-off rotation. While tech and cyclicals took the brunt of the selling, defensive plays like Walmart and precious metals surged. Gold hit a record $4,866 as investors look for safety from potential tariff-driven inflation.2 If these deadlines stick, the market is signaling that higher costs for tech components and consumer goods are practically inevitable.

Sensei’s Insight: Watch the rhetoric at Davos today. If Trump doesn’t offer a path to de-escalation, this technical correction could easily turn into a deeper, fundamental slide for global equities.

🌐 Ripple and Coinbase Spar Over the Future of Money

At the World Economic Forum 2026, Ripple CEO Brad Garlinghouse and Coinbase CEO Brian Armstrong made it clear that the financial system’s “analog era” is ending. Garlinghouse reported a massive surge in tokenized assets on the XRP Ledger, arguing that stablecoins are the first real “poster child” of this shift. While Armstrong pushed for a “Bitcoin standard” as a hedge against inflation, Central Bank of France Governor Francois Villaroy-Dicollo voiced the Fed-aligned perspective: money is a matter of national sovereignty. He warned that “privatized money” could lead to instability, suggesting that central bank digital currencies (CBDCs) must remain the “anchor” for trust in the system.

This debate matters because it’s no longer about speculation; it’s about the “plumbing” of global wealth. Ripple is focusing on building bridges between traditional finance and decentralized ledgers to solve real-world efficiency problems. Meanwhile, major players like BlackRock and Apollo are moving to tokenize their funds to meet rising demand. For retail investors, this transition could democratize access to assets like commercial paper, which Euroclear is already tokenizing in France. The friction remains between the speed of innovation and the “sovereignty concerns” held by central bankers who fear losing control over the money supply.

Sensei’s Insight: Watch the “interoperability” between the XRP Ledger and traditional bank infrastructures. If the Fed and other central banks don’t provide a clear path for regulated stablecoins, expect a messy, fragmented transition.

🇯🇵 Japan’s Bond Market Hits a 4% Reality Check

Prime Minister Sanae Takaichi just set off a firestorm in the Japanese government bond market. After calling a snap election for February 8, she pledged to suspend the 8% consumption tax on food for two years. This move, which would wipe roughly 5 trillion yen from annual revenue, sent investors sprinting for the exits. On Tuesday, the 40-year JGB yield pierced 4% for the first time since its 2007 debut, marking the highest level for any Japanese sovereign maturity in over 30 years. Global yields followed suit, with US 10-year Treasuries climbing toward 4.29% on contagion fears (Bloomberg).

This isn’t just a localized tremor: it’s a fundamental challenge to the Takaichi trade. For months, investors bet on her reflationary agenda, but the lack of a funding plan for these tax cuts has shattered confidence in fiscal stability. Finance Minister Satsuki Katayama tried to talk the market down from Davos, calling for calm and insisting policy remains responsible. This verbal intervention helped yields retreat slightly on Wednesday, but the damage to bank stocks like Mitsubishi UFJ, which fell over 3%, shows deep skepticism. If the 40-year JGB auction on January 28 sees weak demand, the selloff could resume with renewed violence.

Sensei’s Insight: Watch the 40-year auction on January 28. If demand doesn’t return, this recovery is just a brief pause. Japan’s fiscal credibility is on the ballot before the first vote is cast.

🍔 Buffett’s successor signals Kraft Heinz exit

Kraft Heinz just dropped a filing that suggests its largest shareholder, Berkshire Hathaway, may be looking for the exit. The regulatory update shows Berkshire could sell its entire stake of roughly 325 million shares, a massive 27.5% piece of the company. It’s the first major capital move under new CEO Greg Abel, who took the reins from Warren Buffett on January 1. While the filing doesn’t guarantee a sale, the markets reacted quickly: Kraft Heinz shares fell nearly 4% in after-hours trading Tuesday, closing at $22.85, a signal of investor anxiety over a potential supply overhang (MarketWatch).

This potential breakup marks the end of a long, difficult road for a merger Buffett once championed but recently called “not a brilliant idea.” The timing is notable: Kraft Heinz is already moving forward with a plan to split into two independent companies by late 2026, a strategy both Buffett and Abel reportedly opposed. Under Abel, Berkshire may be pivoting toward a more aggressive “portfolio cleanup” than the buy-and-hold style of the past. Retail investors should keep a close eye on the $22 support level, as a confirmed exit by Berkshire could spark a significant repricing.

Sensei’s Insight: Watch the volume on any bounce. If Berkshire starts selling in earnest, the high dividend yield won’t be enough to protect the floor. This is Abel’s new Berkshire: performance over sentiment.

🇮🇷 Trump’s “Decisive” Pivot on Iran

After a brief pause last week, President Trump is back to pressing aides for “decisive” military options against Iran. The Pentagon isn’t just talking: the USS Abraham Lincoln carrier strike group is moving toward the Persian Gulf, and F-15E fighters have landed in Jordan. This buildup follows a brutal Iranian crackdown on protesters where death tolls are estimated to be at least 4,500. While Trump recently praised Tehran for halting some executions, the surge of Patriot and THAAD missile defenses suggests the White House wants a loaded gun on the table if things turn south again.

For investors, this is about more than just a headline. We’re seeing a shift from symbolic threats to a literal “menu of options” for the administration. While oil prices cooled slightly after Trump’s recent praise for the regime’s restraint, this military movement puts a firm floor under energy prices. Defense names like Lockheed Martin and RTX are already seeing the benefit as the U.S. triples interceptor production to meet regional demand. The real risk is a multi-week campaign rather than a one-night raid. Experts are warning that airpower alone can’t fix the governance vacuum if the regime actually topples.

Sensei’s Insight: Watch the $65 level on Brent crude. If executions resume or a strike is ordered, that “war premium” could turn into a full breakout, dragging defense stocks higher with it.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_live_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

🔍Deep Dive: 🚀 The Starlink Standoff: Airline Economics vs. The “Musk Takeover” Narrative

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.