Morning Forecast: Wednesday, 7 January

Energy deals, AI disruption, IPO timing, and a stealth bank trade, today’s edition explains what’s really moving markets beneath the noise.

This content is for informational and educational purposes only and does not constitute financial advice. Always do your own research. Not financial advice (NFA).

👀 Today’s Stories at a Glance

🛢️ Trump secures Venezuelan oil: Shift to heavy crude benefits Gulf refineries while sidelining China.

🚗 Nvidia software hits Tesla: Open-source AI tech democratizes autonomous driving, challenging Tesla’s market dominance.

🚀 Discord files for IPO: Platform pivots to new ad models while navigating regulatory scrutiny.

💼 Jobs data sets pace: Market focus shifts to employment as traders anticipate Federal Reserve rate cuts.

🏦 Gang adopts high-tech crime: Prosecutors reveal sophisticated malware and stablecoin laundering tactics.

📈 Banks gain from yield curve: Widening spreads boost income as rates fall and yields stay high.

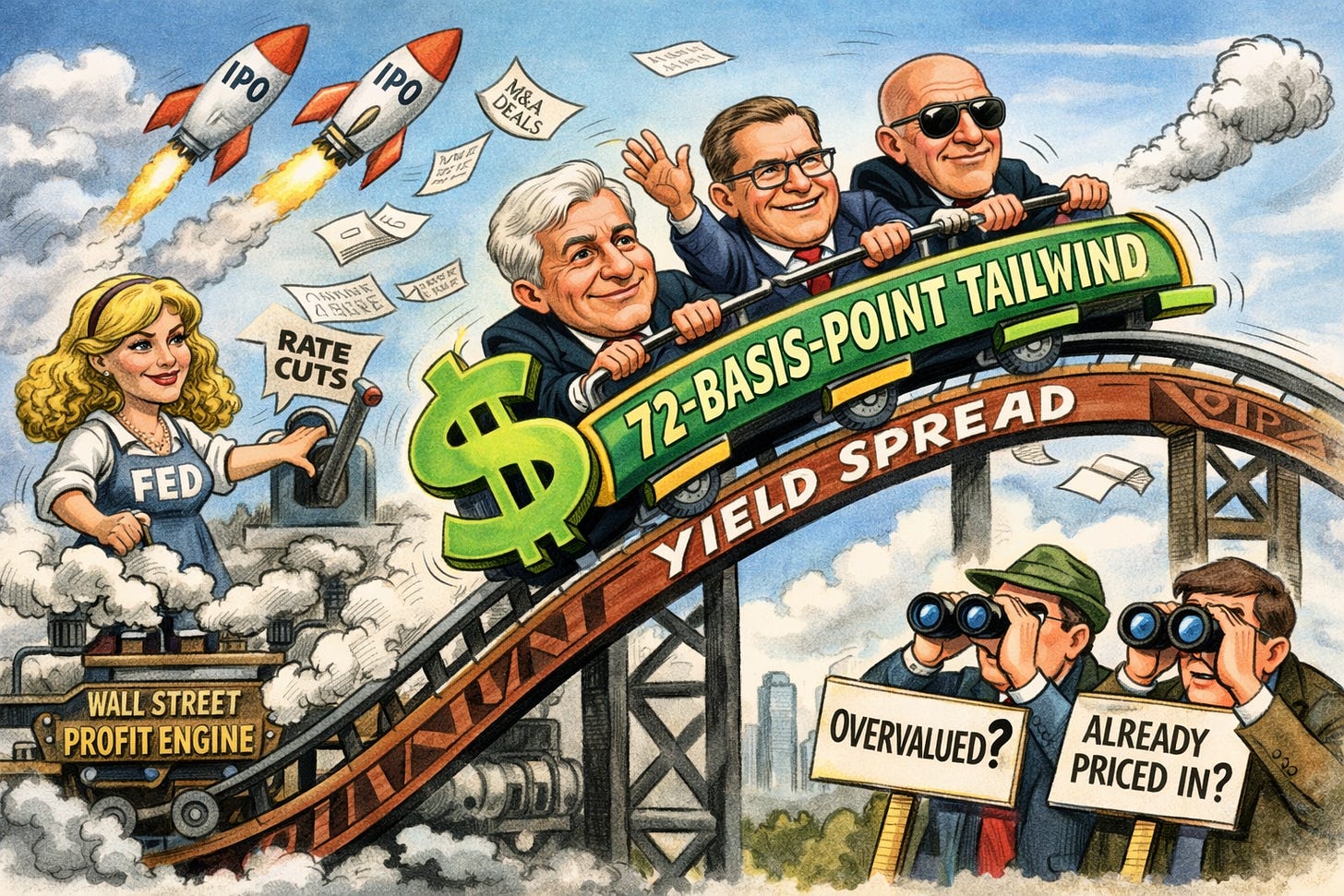

🧠 One Big Thing

A 72-basis-point gap between short and long-term Treasury yields has reached a four-year high, significantly boosting bank lending margins. This spread allows institutions to lower deposit costs while capturing high yields on older, long-term loans. Simultaneously, a massive three trillion dollar IPO pipeline and surging dealmaking activity are providing additional revenue streams. Despite these strengths, a sharp rally has pushed sector valuations to levels that may already account for this growth. The core tension for investors is whether current prices leave any room for further upside. Upcoming earnings must now deliver aggressive guidance to justify these elevated stock prices (see deep dive section for more on this).

⚖️ Fear & Greed

📉 The Number That Matters

1

Despite traders pricing in at least two rate cuts for 2026, official Fed projections currently only show 1. This discrepancy between market expectations and 1 projected cut is driving investor rotation from mega-cap tech into defensive healthcare and value stocks.

⚔️ Winners vs Losers

Winners

VTYX 0.00%↑ Ventyx Biosciences, Inc. shares soared on reports that Eli Lilly is in advanced talks to acquire the company for over $1 billion.

BIOA 0.00%↑ BioAge Labs, Inc. shares extended their rally on momentum despite no news or fresh catalysts being reported within the last 48 hours.

MBLY 0.00%↑ Mobileye Global Inc. gained following a JPMorgan upgrade and a definitive agreement to acquire Mentee Robotics for its AI and robotics expansion.

CRML 0.00%↑ Critical Metals Corp. advanced after announcing a rare-earth processing joint venture in Romania and positive drilling results from its Tanbreez project.

Losers

FSLR 0.00%↑ First Solar, Inc. declined on low confidence and no news as the stock faced profit-taking following a strong multi-week run.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $91,819 (▼ 2.05%)

Ethereum (ETH): $3,212 (▼ 2.56%)

XRP: $2.25 (▼ 2.42%)

Equity Indices (Futures):

S&P 500: $6,935 (▼ 0.16%)

NASDAQ 100: $25,735 (▼ 0.34%)

FTSE 100: £10,059 (▼ 0.50%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.14% (▼ 0.60%)

Oil (WTI): $57 (▼ 0.34%)

Gold: $4,466 (▼ 0.63%)

Silver: $79.52 (▼ 2.03%)

Data as of UK (GMT): 10:45 / US (EST): 05:45 / Asia (Tokyo): 19:45

✅ 5 Things to Know Today

🛢️ Trump Takes 50M Barrels of “Sanctioned” Venezuelan Oil

President Trump announced late Tuesday that Venezuela’s interim authorities will transfer between 30 and 50 million barrels of crude oil to the U.S. immediately. The oil, currently held in storage and aboard ships, is valued at roughly $2.8 billion based on the market price of $56 per barrel. Trump noted the proceeds will be “controlled by me” to ensure the funds benefit both nations, while Energy Secretary Chris Wright handles the logistics. This moves the needle for Gulf Coast refineries like Valero and Phillips 66, which rallied up to 9% as they are uniquely equipped to process this specific heavy, high-sulfur grade (Bloomberg).

While 50 million barrels is a drop in the bucket for global supply, it signals a massive shift in how the U.S. intends to use Venezuela’s energy assets. This isn’t about immediate relief at the pump, since the volume equals only about 2.5 days of U.S. consumption, but rather a strategic play to freeze out China, Venezuela’s former primary buyer. The market’s reaction, a 2% drop in WTI crude, suggests the world is already pricing in a glut, as this “one-off” transfer simply redirects existing inventory rather than creating new production. For investors, the real story is in the refining margins, as Gulf Coast plants gain access to discounted heavy crude they haven’t seen in years.

Sensei’s Insight: Watch the 50 million barrel target versus actual vessel arrivals at Gulf ports. If the delivery hits the high end, it confirms the “Monroe Doctrine” strategy is effectively sidelining Beijing.

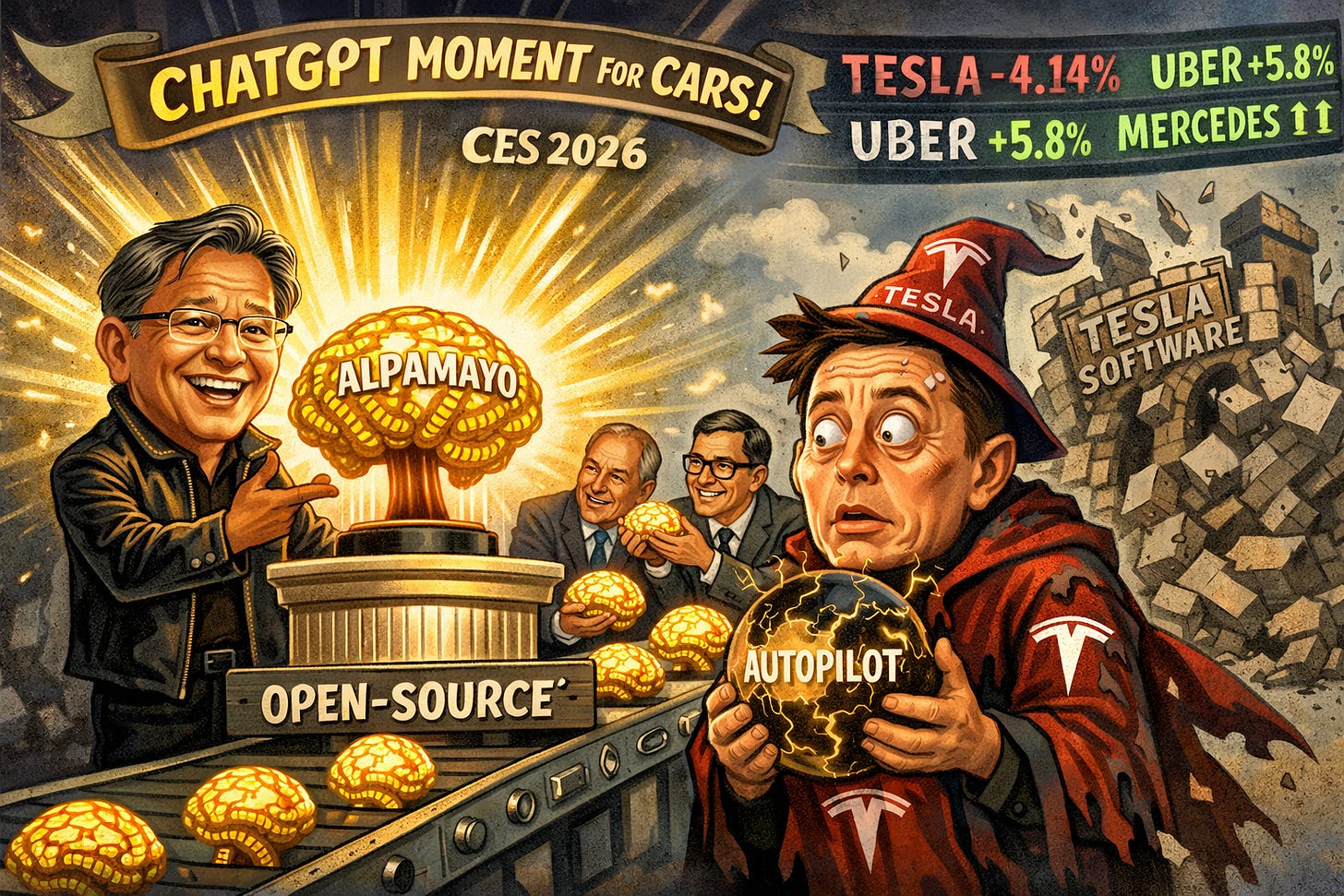

🚗 Nvidia’s Alpamayo software triggers a Tesla sell-off

Nvidia just shook the autonomous driving tree at CES 2026. CEO Jensen Huang unveiled Alpamayo, an open-source AI stack that helps cars reason through complex scenarios like humans. It’s built on a 10-billion-parameter model designed to solve the “long tail” of rare road hazards. The announcement sent Tesla shares down 4.14% as markets digested news that Mercedes-Benz plans to launch a Level 2 system using this tech as early as Q1 2026. Meanwhile, Uber jumped nearly 6% after revealing a robotaxi partnership with Lucid and Nuro powered by the same ecosystem (MarketWatch).

This move suggests Tesla’s technical moat may be evaporating faster than expected. While Elon Musk says he isn’t losing sleep, Nvidia is democratizing the tools needed for high-level autonomy. Previously, an automaker needed billions in R&D to compete with Tesla’s proprietary data. Now, firms like BYD and Lucid can license a “reasoning” brain that mimics human judgment. Jensen Huang calls this the “ChatGPT moment for physical AI,” which could signal a shift toward a commoditized market. It’s less about having a data monopoly and more about who has the most efficient reasoning model.

Sensei’s Insight: Watch the Mercedes CLA launch in Q1 2026. If their Nvidia-powered system handles complex city streets, it could signal a major repricing of Tesla’s software valuation premium as the playing field levels.

🚀 Discord quietly enters the IPO arena

Discord reportedly submitted a confidential filing for its initial public offering on January 6, 2026. The San Francisco-based platform, which boasts over 200 million monthly active users, is working with heavyweights Goldman Sachs and JPMorgan Chase to lead the debut. This move follows a massive leadership shift in April 2025, where co-founder Jason Citron handed the CEO reins to Humam Sakhnini, a former Activision Blizzard vice chairman with a track record of scaling gaming giants in public markets. While the company declined to comment, the filing signals a major bet on a rebounding tech IPO market that saw issuance double to $15.6 billion in 2025 (Bloomberg).

This isn’t just a gaming story anymore. Discord is evolving its business model to move beyond Nitro subscriptions, which currently drive the bulk of its estimated $725 million in annual recurring revenue. Under Sakhnini, the platform is leaning into “Quests” and “Orbs”—opt-in ad formats aimed at matching its subscription income. However, investors should keep an eye on the regulatory baggage: Discord is facing intense scrutiny over child safety, including a lawsuit in New Jersey and new age-verification requirements in the UK and Australia. These compliance costs and potential legal liabilities could weigh on the company’s valuation, which secondary markets currently peg between $10 billion and $20 billion.

Sensei’s Insight: Watch how Discord handles its 15-day public disclosure window once the SEC gives the nod. If they delay, it suggests valuation friction or regulatory nerves.

💼 Jobs Data Trifecta Sets the 2026 Rate Pace

Today marks the start of a massive 48-hour data window. We’re getting the ADP private payrolls and JOLTS job openings today, followed by the big nonfarm payrolls report on Friday. Analysts expect private employers added about 45,000 jobs in December, which would be a solid bounce back from November’s 32,000-job loss. That previous slump was clouded by a 43-day government shutdown, so this week’s data will show if the labor market is actually stalling or just shaking off noise. With unemployment forecast to tick down to 4.5%, the Fed has plenty of data to digest before its next meeting.

This is a major pivot point. The Fed is now prioritizing employment over inflation, and there’s a clear divide between what the market expects and what officials are signaling. Traders are pricing in two rate cuts for 2026, but the Fed’s own projections only show one. We’re already seeing money rotate out of pricey mega-caps like Microsoft and Nvidia into more affordable areas like Micron and Intel. Healthcare also remains a stronghold, adding 33,000 jobs even when tech and finance sectors shed roles. If jobs numbers miss expectations, it could accelerate the shift into these defensive and value areas.

Sensei’s Insight: Watch the quit rate in the JOLTS report. If it remains stuck at 1.8%, it signals workers are afraid to leave their roles, which reveals more about labor fragility than headline hiring.

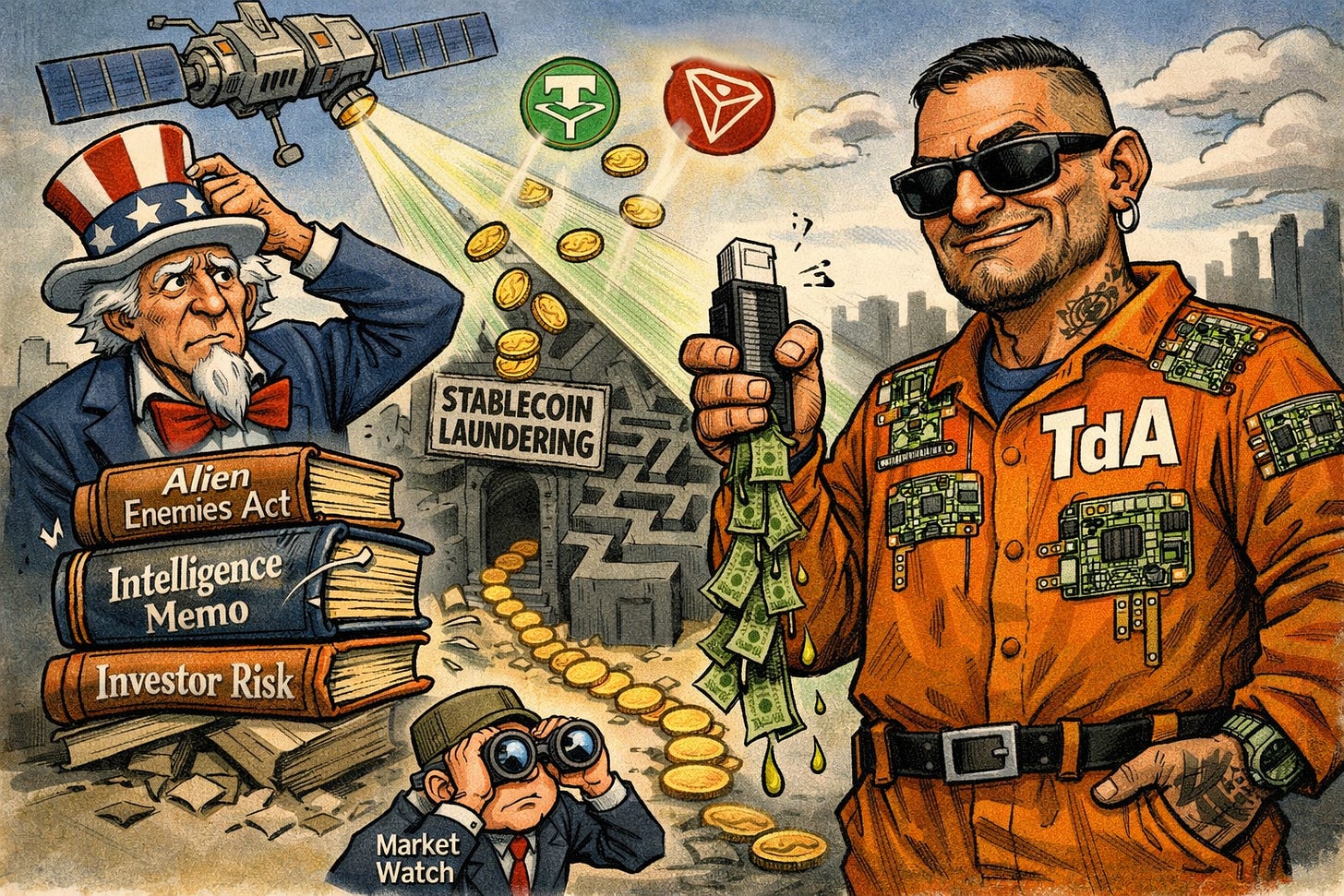

🏦 Tech-Savvy Terror: The Real Face of Tren de Aragua

Beyond the headlines of the Maduro capture, federal prosecutors are painting a picture of Tren de Aragua (TdA) as a sophisticated multinational syndicate rather than just a street gang. In December 2025, an indictment unsealed in Nebraska charged 54 members for a nationwide ATM jackpotting scheme using Ploutus malware to drain millions from banks. Led by Hector Guerrero Flores, the group has moved from its prison origins to laundering drug proceeds via stablecoins like USDT on the TRON blockchain. The U.S. State Department’s $5 million bounty on Flores reflects TdA’s evolution into a tech-literate organization involved in everything from human trafficking to high-tech bank heists across the Western Hemisphere (U.S. Department of Justice).

For investors, the real significance lies in the disconnect between political narrative and intelligence reality. While the administration invoked the 1798 Alien Enemies Act by labeling TdA a state-directed invasion force, a declassified April 2025 memo from the National Intelligence Council suggests most analysts find no credible evidence that Maduro actually directs the gang. This gap creates significant legal uncertainty for any actions taken under that Act. Even the viral takeover of Aurora, Colorado apartments appears more like a vacuum created by property management failures than a military-style conquest. Watch the Fifth Circuit Court of Appeals for rulings on these executive powers, as they could impact how foreign criminal risks are priced and handled moving forward.

Sensei’s Insight: Don’t mistake street violence for a lack of financial sophistication. Watch TdA’s use of stablecoins and malware as a signal that transnational crime is entering a high-tech, decentralized phase.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_live_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

🔍Deep Dive: 📈 Bank Earnings and the 72-Basis-Point Tailwind

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.