Morning Forecast: Will Today's PCE Break the Market?

Ronaldo bets on AI, Asia cools, Bessent may centralize US policy, Fed cut risks failure, Netflix hunts HBO, Friday’s PCE decides whose version of reality wins.

👀 Today’s Stories at a Glance

⚽ Ronaldo Enters the AI Arena with Perplexity - Ronaldo invests in Perplexity AI, launching a CR7 search hub that could accelerate mainstream AI adoption and challenge Google dominance.

🌏 Asian Rally Snaps: Tech Weighs on Regional Markets - Asian equities cooled following tech profit-taking, while infrastructure names like NextDC surged on real AI demand and capacity expansion.

👑 Bessent May Become Trump’s Sole Economic Architect - Trump allies consider giving Scott Bessent dual Treasury-NEC control, risking reduced Fed independence and inflation-driven market tension.

⚠️ Fed’s Next Cut May Be a “Broken Switch” - The Fed plans a rate cut, but weak borrower response and heavy fiscal stimulus may fuel stagflation instead of growth.

🍿 Netflix Enters Exclusive Talks for Warner Bros. Assets - Netflix moves to buy Warner Bros studio and HBO Max, but a $5B breakup fee highlights regulatory risk and investor caution.

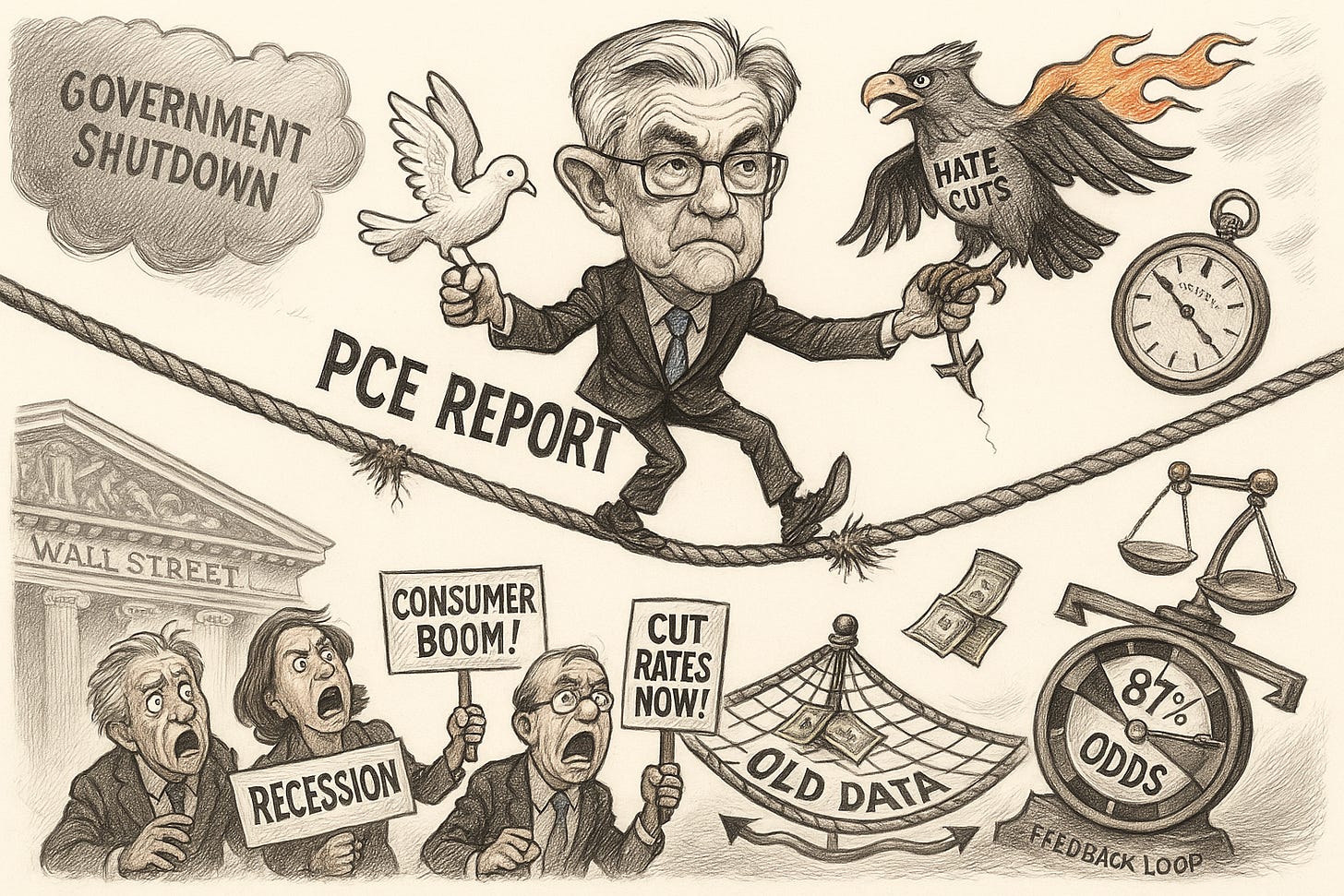

🔍 Deep Dive: ⚖️ The “Vibes” vs Reality Audit - Friday’s PCE as Final Arbiter for December - A delayed PCE print will decide rate-cut expectations as soft survey signals clash with strong spending data and shutdown-imputed figures.

🧠 One Big Thing

The Triple-Test for the Soft Landing

Market conviction in the current economic narrative faces a critical test immediately following the data release. A Core PCE print exceeding 0.2 percent would signal entrenched inflation and significantly lower the probability of a December rate cut. This outcome would likely drive the 10-Year Treasury yield toward 4.5 percent, a threshold that typically triggers volatility across equity markets. Investors must validate these signals by observing flows between consumer discretionary and staples stocks to see if capital is shifting defensive. The alignment of these three indicators will effectively confirm if the soft landing thesis remains viable.

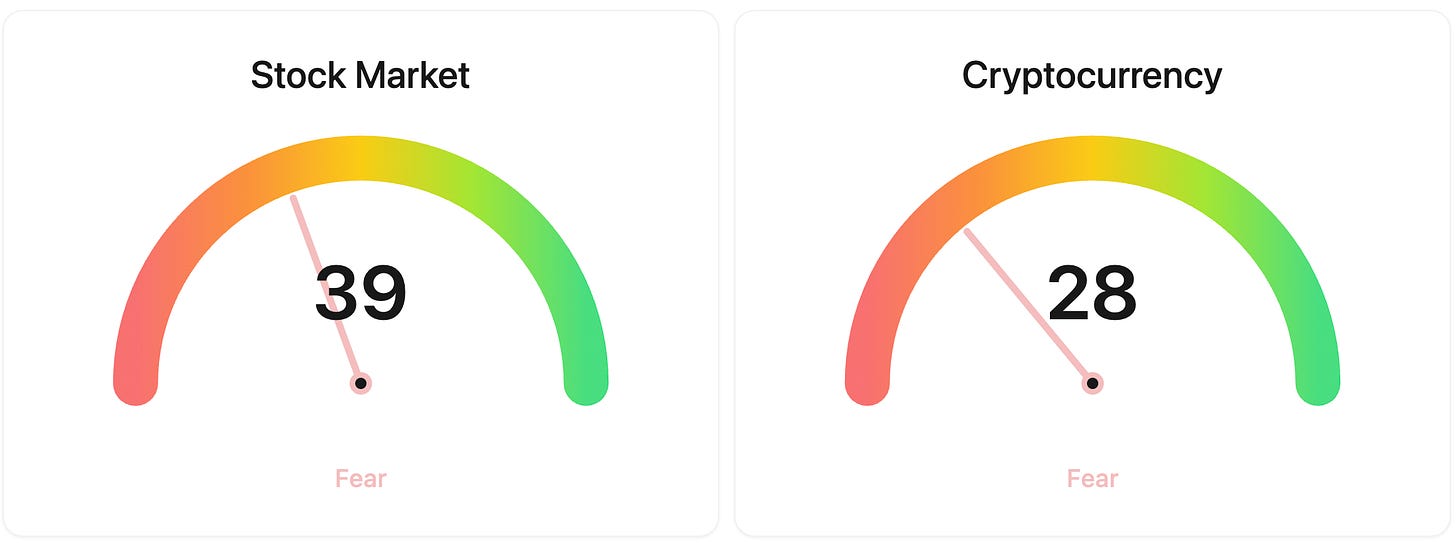

⚖️ Fear & Greed

📉 The Number That Matters

2.9%

Markets are bracing for a 2.9% year-over-year print, representing zero progress from the previous month. This “flatlining” near 3% is the bond market’s nightmare scenario: inflation stuck well above target despite restrictive rates. A surprise tick up to 3.0% would shatter the “disinflation is working” narrative, forcing an immediate hawkish repricing of the 2026 Fed funds curve and spiking front-end yields.

⚔️ Winners vs Losers

Winners

SMX +39.3%: Security Matters rallied on heavy volume after securing a $111.5 million equity purchase agreement to fund its global verification technology expansion.

RBRK +17.7%: Rubrik Inc. shares surged after Q3 earnings beat expectations with 52% subscription revenue growth, prompting multiple analyst upgrades.

COO +13.5%: The Cooper Companies rallied on a Q4 earnings beat and the announcement of a formal strategic review to enhance shareholder value.

DNA +11.2%: Ginkgo Bioworks rose after securing a collaborative role in an $8.4 million ARPA-H contract to develop in vivo CAR-T therapeutics.

HOV +5.8%: Hovnanian Enterprises climbed after reporting strong Q4 results and completing a $900 million debt refinancing that extended maturities.

Losers

HPE -9.0%: Hewlett Packard Enterprise slid after missing Q4 revenue estimates and issuing weak fiscal 2026 guidance due to server margin compression.

DOMO -14.2%: Domo, Inc. shares dropped after the company reported flat year-over-year revenue and issued fiscal 2026 guidance below analyst consensus.

TARA -16.3%: Protara Therapeutics fell sharply after announcing a $75 million public offering that overshadowed positive interim Phase 2 bladder cancer trial data.

SPWH -19.6%: Sportsman’s Warehouse plunged after management cut fiscal year EBITDA guidance by roughly 35% citing a sharp slowdown in consumer spending.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $91,181 (▼ 1.01%)

Ethereum (ETH): $3,126 (▼ 0.26%)

XRP: $2.07 (▼ 1.43%)

Equity Indices (Futures):

S&P 500: $6,870 (▲ 0.23%)

NASDAQ 100: $25,715 (▲ 0.36%)

FTSE 100: £9,718 (▲ 0.08%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.11% (▲ 0.34%)

Oil (WTI): $60 (▼ 0.19%)

Gold: $4,227 (▲ 0.45%)

Silver: $58.12 (▲ 1.80%)

Data as of UK (GMT): 12:47 / US (EST): 07:47 / Asia (Tokyo): 21:47

✅ 5 Things to Know Today

⚽ Ronaldo Enters the AI Arena with Perplexity

Football icon Cristiano Ronaldo has officially acquired an equity stake in Perplexity AI, the San Francisco search startup challenging Google. Announced Thursday, the deal is a dual-component agreement comprising a direct financial investment and a global brand ambassadorship. While specific terms remain undisclosed, the partnership launches the “Perplexity x CR7” Hub, a specialized search vertical trained on Ronaldo’s career data. This strategic entry follows Perplexity’s September funding round, which valued the three-year-old company at a massive $20 billion (MoneyControl).

This marks a significant psychological shift in the AI adoption cycle. Ronaldo’s entry effectively “normalizes” AI search for his 600 million social media followers, moving the technology from a tool for tech workers to a mass-market consumer product. For investors, this signals a potential acceleration in the “habit shift” away from traditional Google keyword search. The infrastructure demand is real. Foxconn, a key manufacturer for Nvidia servers, reported a 26% revenue jump in November, suggesting the hardware supply chain is ramping up to support exactly this kind of consumer-scale AI usage.

Sensei’s Insight: Celebrity endorsements can sometimes signal a sector “top,” but here it acts as a trust anchor for that $20 billion valuation. Watch user retention numbers on the new Hub. If fans permanently switch their search habits, Google’s dominance could erode faster than current models predict.

🌏 Asian Rally Snaps: Tech Weighs on Regional Markets

The party paused in Asia overnight. After a solid three-day run, regional equities hit a wall, with the MSCI Asia-Pacific index slipping 0.6% in early trading. Japan led the retreat, seeing the Nikkei reverse course despite hitting three-week highs just a session earlier. The anchor here was the technology sector, specifically a cooling in sentiment toward mega-cap tech valuations. Investors appear to be taking profits and questioning the immediate return on investment for massive AI capital expenditures, dragging the broader benchmarks down with them (Yahoo Finance).

This isn’t a panic exit; it’s a reallocation. While the broader tech sector struggled, we saw a massive signal in “picks and shovels” infrastructure. NextDC, an Australian data center operator, surged nearly 11% after announcing a partnership with OpenAI to build a hyperscale facility in Sydney. This tells us the market is punishing vague AI valuations but aggressively buying the physical infrastructure needed to power it. Additionally, support may be incoming from India, where the central bank is expected to cut rates to 5.25% to combat deflation, potentially unlocking fresh liquidity for the region.

Sensei’s Insight: Watch the divergence between software and hardware stocks in Asia. The easy money trade is fading; the market is now demanding to see who actually owns the power and the servers.

👑 Bessent May Become Trump’s Sole Economic Architect

Trump’s inner circle is actively discussing a massive power consolidation: Treasury Secretary Scott Bessent may simultaneously serve as Director of the National Economic Council. This rare “double duty” scenario hinges on current NEC Director Kevin Hassett leaving the West Wing to replace Jerome Powell at the Federal Reserve, a move prediction markets like Kalshi recently priced at an 86% probability. While the White House currently calls this speculation, the plan would essentially leave Bessent managing the entire economic portfolio while Hassett runs the central bank, creating a singular chain of command for Trump’s financial agenda starting in early 2026 (Bloomberg).

This matters because it removes the historic institutional friction between fiscal and monetary policy. Typically, the Treasury and NEC act as separate power centers that check each other. Under a dual-role Bessent, they would function as one engine for deregulation and tariffs. Markets are effectively “voting” on this coordination already: despite Hassett’s reputation for wanting lower rates, the 10-year Treasury yield actually ticked up to 4.10% this week. Bond traders aren’t celebrating potential rate cuts; they are pricing in an “inflation risk premium,” fearing that a politically aligned Fed might cut rates before inflation is truly dead.

Sensei’s Insight: Watch the U.S. Dollar. If the market believes the Fed is losing independence to this consolidated economic team, we could see a resumption of the dollar selling reminiscent of early 2025.

⚠️ Fed’s Next Cut May Be a “Broken Switch”

The Federal Reserve is set to cut rates next week, likely bringing the target range to 3.50%-3.75% to support a wobbly labor market. But Bloomberg data suggests this cut might be a dud. The economy isn’t responding to cheaper money like it usually does. Mortgage rates have dipped to 6.19%, yet buyers remain paralyzed by record-high prices and job anxiety. Simultaneously, manufacturers aren’t borrowing to expand; they are hoarding cash until the tariff landscape settles. The Fed is flipping the switch to “growth,” but the wiring appears disconnected (Bloomberg).

This disconnection signals a major risk for retail portfolios in 2026. While the Fed tries to stimulate via cuts, the government is about to flood the system with fiscal stimulus via the “One Big Beautiful Bill Act” and larger tax refunds. Bank of America warns this mix could spark inflation rather than sustainable growth. If companies keep freezing capex due to trade uncertainty while consumers get a cash injection, we get higher prices instead of more jobs. The market is pricing in a recovery, but the data points toward stagflationary friction.

Sensei’s Insight: Watch the 10-year Treasury yield range of 4.0%-4.2%. If yields hold firm or rise after the cut, the bond market is rejecting the Fed’s narrative and pricing in sticky inflation.

🍿 Netflix Enters Exclusive Talks for Warner Bros. Assets

It’s official: Netflix has won the bidding war for Warner Bros. Discovery’s (WBD) crown jewels. The streaming giant has entered exclusive negotiations to acquire the WB film/TV studio and HBO Max, effectively carving them out from linear assets like CNN and TNT, which will remain separate. The proposal reportedly values the target assets at roughly $28–$30 per share in a structure that is approximately 85% cash. To soothe nerves about a likely regulatory crackdown, Netflix has offered a massive $5 billion breakup fee if the government blocks the merger (WSJ).

This signals the potential endgame for the “streaming wars.” By absorbing the Harry Potter and DC libraries, Netflix pivots from a pure tech platform into a dominant legacy media titan. However, the market isn’t popping champagne just yet: Netflix shares dropped ~5% on the news, reflecting investor fears of the “winner’s curse” and a brutal antitrust battle ahead. For WBD holders, this is a “cash out” moment, locking in liquidity now rather than gambling on a turnaround, but missing out if the combined entity eventually rallies.

Sensei’s Insight: The massive $5 billion breakup fee proves the board knows the real opponent here isn’t a rival bidder, but the FTC. Watch the spread between WBD’s trading price and the reported $28 offer; a wide gap suggests the market is betting regulators will kill this deal.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive: ⚖️ The “Vibes” vs. Reality Audit: Why Friday’s Delayed PCE is the Final Arbiter for December

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.