Nvidia’s Earnings Tonight Could Make or Break the Entire Market Rally

NVDA’s results could shift market momentum, ignite tech breakouts, or stall the rally — and I’ve broken down everything you need to know before the bell.

Nvidia reports Q1 FY2026 earnings after the bell on May 28. The stock has climbed nearly 60% off its April lows (~$86 to $135), and with Nvidia now making up over 6% of the S&P 500 and 6.5% of the Nasdaq-100, this isn’t just a company event — it’s a macro catalyst. A blowout beat could push SPY, QQQ, and VOO to fresh all-time highs. A miss? It could trigger sharp rotation out of tech. While everyone’s waiting on forward guidance, Wall Street will likely react first to one thing: gross margin. That number — released before the call — offers the clearest signal of demand strength, pricing power, and cost pressures under the hood.

Inside: my key chart levels, price targets, and resistance zones, plus earnings predictions, the impact of the $5.5B China write-down, options pricing, Blackwell rollout momentum, and everything else you need to know before the numbers hit.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🎥 Live Earnings Coverage — Join Us Tonight

We’ll be covering Nvidia’s earnings live with full breakdowns as the numbers hit — including initial market reaction, key highlights from the call, and what the results mean for SPY, QQQ, and top AI stocks.

Analyst Expectations (Q1 FY2026)

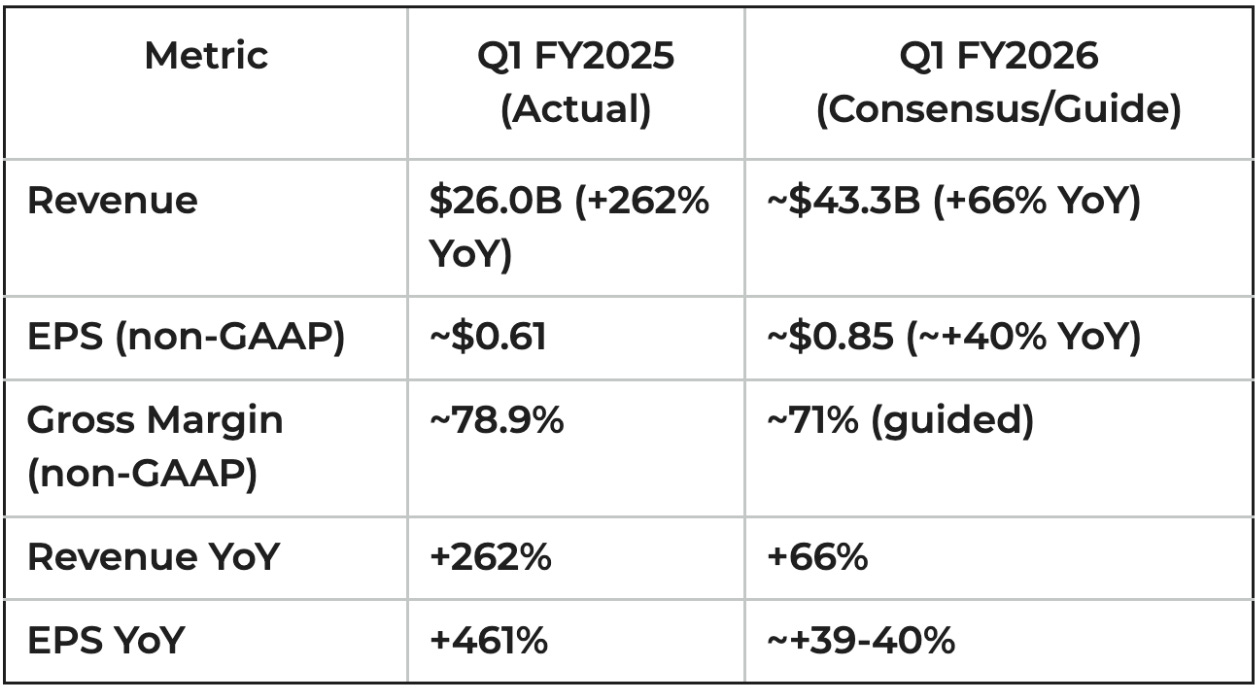

Revenue: Consensus is ~$43.3 B (+66% YoY). That matches Nvidia’s guidance of $43.0±0.9 B.

EPS: Estimates range from $0.73 to $0.86 (non-GAAP), roughly +20–40% YoY. For example, FactSet/Thomson consensus sees ~$0.73 kiplinger.com, Zacks $0.85 nasdaq.com, and Investopedia cites ~$0.86 investopedia.com. (Past Q1 FY2025 was ~$0.61.)

Gross Margin: Nvidia guided ~70.6% GAAP (71.0% non-GAAP) for Q1, down from ~78.4% in Q1 FY2025 due to mix (more gaming vs. H100 sales). Analysts will watch if NVDA can exceed that guidance.

YoY Growth: Street forecasts imply ~65–66% revenue growth and ~40% EPS growth (non-GAAP). (GAAP EPS growth will be lower due to mix and inventory charges.)

Sources: Company filings and consensus estimates nvidianews.nvidia.com fastcompany.com nasdaq.com nvidianews.nvidia.com.

Key Risks and Opportunities

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.