Sensei’s Insights – Archer Q2 Earnings, First U.S. Airport-to-Airport eVTOL Flight, Lilium Back in the Game – Saturday LIVE eVTOL Show with Vaz

Archer Q2 Earnings Call Analysis, Joby’s First U.S. Airport-to-Airport eVTOL Flight, CAA Drone and eVTOL Safety Rules, Lilium NV Acquisition, First Offshore eVTOL Supply – and Much More with Vaz

🚀 Archer Aviation Q2 Earnings Call – Cherry Picking from the 8-K Filing

We just delivered the biggest LIVE eVTOL show in history! On Martyn Lucas Investor – the Archer Aviation Q2 Earnings Call LIVE Special. The stream drew an incredible 5.6K live viewers, smashing our previous record. And who did we beat? Ourselves! Our Q1 Archer earnings call pulled in a strong 3.6K live audience, but Q2 took it to the next level, proving just how much interest and momentum the eVTOL story is building.

JOIN US FOR THE SATURDAY LIVE EVTOL SHOW WITH VAZ

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🍒 Top Cherries – Key Highlights

🛩 Six Midnight eVTOL aircraft in production, with three in final assembly – manufacturing ramp-up in full swing.

🏅 Named Official Air Taxi Provider for the LA 2028 Olympics, locking in a high-profile U.S. launch event.

🌍 UAE Launch Edition program: first Midnight delivered to Abu Dhabi, flight testing underway, initial commercial payments expected this year.

🛡 Two strategic defence acquisitions:

Overair’s tiltrotor patent portfolio and engineering talent.

Mission Critical Composites’ manufacturing assets for in-house composite production.

💰 Record $1.7 billion+ in cash & equivalents, giving Archer a robust operational runway.

💹 Financial Snapshot – What Investors Need to Know

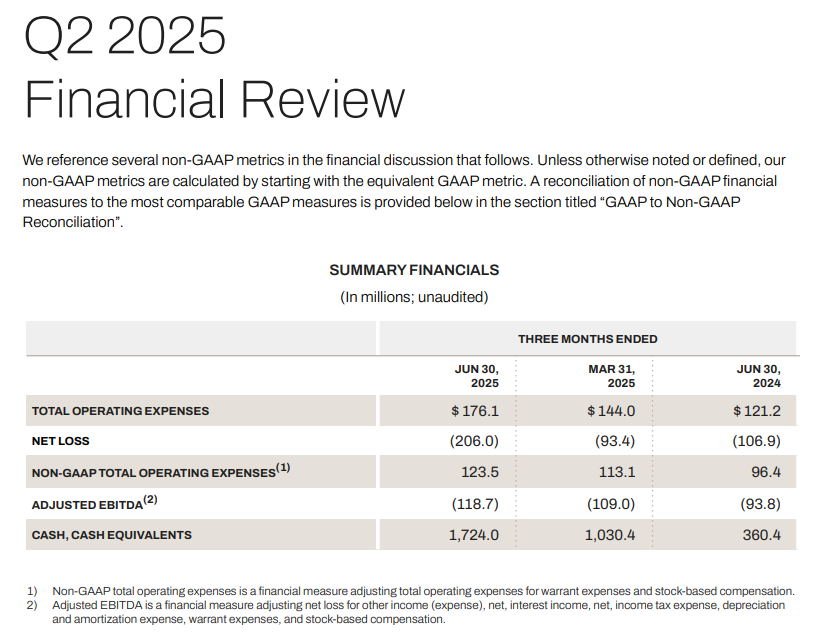

📉 GAAP Net Loss: $206 million (≈ $0.36/share), missing expectations (–$0.25/share) by ~44%.

📊 Adjusted EBITDA (non-GAAP): –$118.7 million, widening from –$109 million in Q1.

📈 Operating Expenses: $176.1 million, up from $121.2 million in Q2 2024.

🏦 Capital Raise: $850 million in Q2, boosting liquidity to record levels.

🔮 Guidance: Q3 Adjusted EBITDA loss forecast between $110–130 million.

🔍 Fresh Cherry Picks – Deeper Insights from the 8-K

💵 Raising Capital & Alliances

$850M raise followed U.S. Executive Order support for faster eVTOL integration.

Strong institutional confidence with major backers like BlackRock.

📦 Sales Traction & Zero Revenue

Q2 revenue: $0, missing analyst estimates (~$200K).

First UAE customer payments expected before year-end.

🛡 Defense & Manufacturing

Acquisitions add advanced in-house composite production capacity.

Four allied military programs in discussion for defense applications.

🛫 FAA Certification & Piloted Testing

FAA inspections underway at California and Georgia facilities for production certification.

Piloted test flights active, with environmental testing in Abu Dhabi (heat, humidity, dust).

📈 Investor Sentiment – Pros & Watch-Outs

✅ Reasons for Optimism:

💰 Record cash reserves ensure stability.

🏅 Olympic partnership boosts visibility and credibility.

🌍 UAE program offers first tangible revenue opportunity.

🛡 Defense diversification can open stable government contract streams.

⚠️ Reasons for Caution:

📉 Persistent heavy losses with no commercial revenue yet.

⏳ FAA certification still carries timing and execution risk.

📝 Many deals remain MOUs, not binding contracts.

💸 Non-GAAP adjustments hide recurring costs (e.g., Stellantis warrants).

🏁 Closing Thoughts

Archer’s Q2 shows a cash-rich, aggressively expanding eVTOL contender moving fast in consumer mobility, international markets, and defense. Still deep in the red, but with the resources and partnerships to potentially deliver a breakthrough in the next 12–24 months.

🔎 Key milestones to watch:

FAA production certification progress.

UAE commercial operations commencement.

Defense contracts moving from discussions to signed deals.

The story has the market’s attention — now it’s all about execution. Rewatch the Q2 Earnings Call Special LIVE with Vaz in the link below!

🛡 UK CAA Lays Groundwork for eVTOL Safety

The UK Civil Aviation Authority (CAA) has published a landmark 18-month safety study under its Future of Flight programme, supported by the Department for Transport (DfT) and carried out in partnership with the University of Warwick’s WMG institute. The research identifies more than 50 high-priority areas to ensure the safe integration of electric Vertical Take-Off and Landing aircraft (eVTOLs) into UK airspace. This study is a crucial step in building the regulatory and technical framework to support the rollout of commercial flying taxi operations in the UK by 2028.

🇬🇧 United Kingdom – CAA’s Safety Priorities

The CAA’s report focuses on the most pressing areas needed to prepare the UK for advanced air mobility.

Key areas include:

Advanced airspace monitoring systems to detect altitude, speed, or trajectory deviations.

Vertiport standards, including real-time energy sensors to ensure safe landings.

Oversight of automation and predictive simulation tools used to anticipate flight-path conflicts or anomalies.

The CAA is working closely with stakeholders including Bristow Group, National Air Traffic Services (NATS), Vertical Aerospace, and Joby Aviation to bring these insights into practice.

🇺🇸 United States – FAA’s Powered-Lift Framework

The Federal Aviation Administration (FAA) introduced the powered-lift category in October 2024—the first new aircraft classification in decades.

Highlights:

Establishes pilot training, safety standards, and operational rules designed specifically for eVTOLs.

Creates a Special Federal Aviation Regulation (SFAR) running for 10 years to guide early powered-lift operations.

Forms part of the FAA’s Innovate28 plan, a roadmap to enable scaled Advanced Air Mobility (AAM) by 2028, including infrastructure such as vertiports and adapted air traffic control procedures.

🇪🇺 Europe – EASA’s SC-VTOL Standards

The European Union Aviation Safety Agency (EASA) has been a global leader since 2019 with its Special Conditions for Vertical Take-Off and Landing aircraft (SC-VTOL).

Sets detailed airworthiness standards specific to eVTOL designs.

Creates requirements distinct from conventional rotorcraft and fixed-wing aircraft.

Supported by the North Atlantic Authorities (NAA) Network, which aims to harmonize certification, reduce duplication, and promote safety innovation.

🔄 Alignment and Divergence

UK: Aligns with EASA’s SC-VTOL standards while adding national safety research through the CAA’s Future of Flight programme.

U.S.: Pursuing a distinct powered-lift framework, though also building partnerships with the UK, Canada, and Australia to harmonize rules.

Europe: Continuing to lead on technical design standards, focusing on multilateral validation through the NAA Network.

Shared goal: Safe and large-scale eVTOL operations by the late 2020s, with 2028 emerging as the global target year.

🚀 Why This Matters for the Industry

For developers such as Archer Aviation, Joby Aviation, Lilium, and Vertical Aerospace, this regulatory clarity is vital:

Certification timelines are becoming clearer and more predictable.

Investor confidence grows as regulatory pathways solidify.

Governments and regulators are creating the foundation for urban air mobility at scale.

👉 The message is consistent across regions: 2028 is shaping up as the breakthrough year for eVTOL commercialization worldwide.

✈ Joby Aviation Completes First Piloted eVTOL Flight Between U.S. Airports

Milestone Flight:

Route: Marina Municipal Airport (OAR) → Monterey Regional Airport (MRY).

Duration: ~12 minutes, including a 5-minute holding pattern to integrate into FAA-controlled airspace.

Significance: First piloted eVTOL flight between two public U.S. airports.

Capabilities Demonstrated:

Vertical takeoff and wing-borne cruise.

Smooth air traffic control coordination.

Ground support operations away from base.

🚀 Context: Joby’s Push Toward Commercial Operations

Testing Record: Over 40,000 miles flown across its eVTOL fleet.

Next Steps: FAA pilot flight testing to begin in early 2026.

Market Positioning:

Acquisition of Blade Air Mobility’s passenger business to expand network.

Partnerships with Delta and Virgin Atlantic for future operations in New York, Los Angeles, and beyond.

Commercial Target: Service launch planned for 2026.

Market Reaction: Stock saw early gains before pulling back—reflecting both excitement and caution from investors.

🚨 Lilium’s Potential Acquisition – Deal in the Works

AAMG (Ambitious Air Mobility Group) is in talks to acquire Lilium for ~€20 million.

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.