Sensei’s Insights – Dubai Air Show Breakthroughs & a Deep Dive Into eVTOL Stocks | Saturday LIVE eVTOL Show with Vaz

A full breakdown of Dubai Air Show developments, how they’re moving the markets, and what the latest flying-taxi milestones mean for the future of eVTOLs — and more with Vaz.

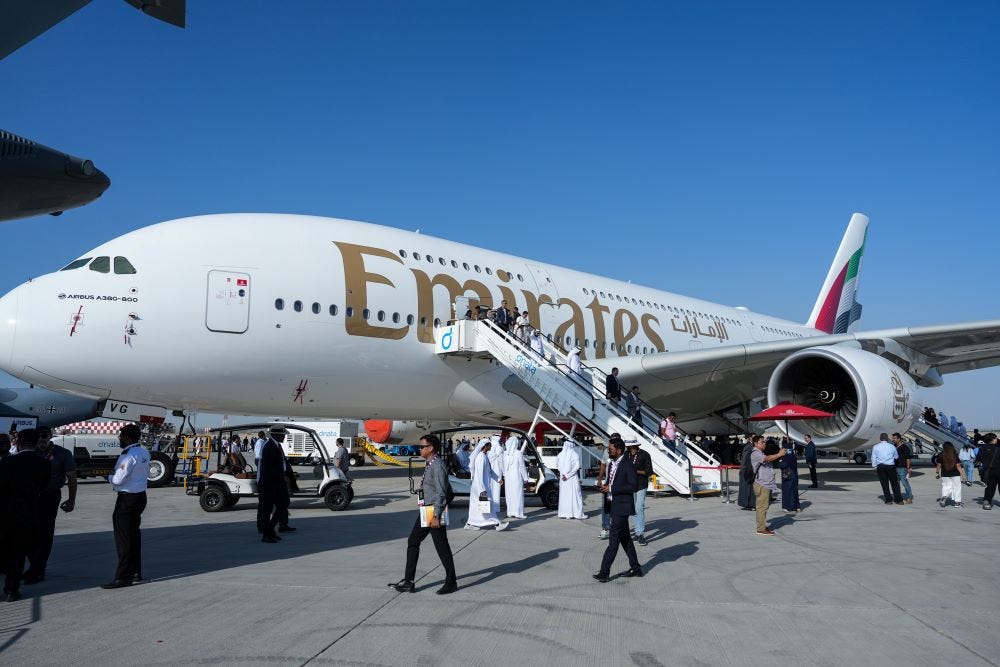

✈️ Dubai Airshow: The Middle East’s Premier Stage for Global Aviation

Every two years, the world’s most powerful aviation forces converge on Dubai for an event that does more than showcase aircraft — it defines the future of flight. The Dubai Airshow (DAS), held at Al Maktoum International Airport from 17–21 November 2025, is where billion-dollar orders are inked, military alliances are signalled, and breakthrough technologies — from eVTOLs and autonomous systems to hydrogen propulsion and next-gen wide-bodies — make their global debut. Over the decades, DAS has become the industry’s ultimate proving ground, a place where ambition meets engineering, and where nations and manufacturers reveal exactly how they intend to shape the skies of tomorrow.

JOIN US FOR THE SATURDAY LIVE EVTOL SHOW WITH VAZ

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

The Dubai Airshow is one of the world’s most influential aviation and aerospace events, held every two years at Al Maktoum International Airport (DWC) within Dubai World Central. Its location is not accidental: it sits at the heart of one of the world’s fastest-growing aviation hubs, surrounded by state-of-the-art logistics, cargo infrastructure, and proximity to Emirates and flydubai’s operational ecosystem. The show typically takes place in November, drawing tens of thousands of industry visitors, hundreds of high-level delegations, and the major players across commercial aviation, defence, space, and—more recently—advanced air mobility (AAM) and eVTOLs.

First launched in 1986, Dubai Airshow quickly evolved from a regional trade fair into a global powerhouse. By the 2000s it had become one of the “big three” airshows, standing alongside Farnborough and Paris, but with a uniquely Middle Eastern flavour—an emphasis on grand reveals, bold aircraft orders, and sweeping strategic partnerships. Over the decades, the show has served as the launchpad for Emirates’ fleet expansions, Boeing and Airbus deal announcements, Gulf defence showcases, and now the rise of next-generation air mobility.

🌍 Meaning & Strategic Importance

Dubai Airshow is not merely an exhibition; it is a barometer of global aerospace confidence. The UAE uses the platform to demonstrate its growing influence in aviation, defence, aerospace manufacturing, and now autonomous systems and AI-enhanced aviation technologies. The event:

Acts as a deal-signing arena, often revealing some of the world’s largest commercial aircraft orders.

Functions as a diplomatic stage, with military delegations and government officials negotiating strategic cooperation.

Serves as a technology showcase, highlighting innovations from hydrogen propulsion and hybrid-electric systems to drone swarms, combat aircraft, and eVTOLs.

Provides a launchpad for advanced air mobility, with Dubai pioneering the world’s first certified air-taxi network, making the Airshow a natural hub for Joby, EHang, Archer, and others.

In essence, Dubai Airshow has become where aviation’s future is demonstrated, debated, and—often—purchased.

🛫 Exhibitions & Demonstrations

The Dubai Airshow is known for its exceptional flying displays, where fighter jets, commercial aircraft, aerobatic teams, and now eVTOLs perform high-profile demonstrations before global media and government representatives.

The static and aerial exhibitions typically include:

✔ Commercial Aviation Hall

Airbus, Boeing, Embraer, COMAC, and major leasing companies use this area to present:

New aircraft types

Cabin innovations

Engine technologies

Sustainable aviation fuel (SAF) developments

Future propulsion systems

This is where many of the major order announcements take place.

✔ Defence & Military Zone

One of Dubai Airshow’s strongest pillars, featuring:

Fighter jets

Trainers

UAVs and UCAVs

Radar, surveillance and C4ISR systems

Anti-missile defence technology

Air-to-air and air-to-ground weapon systems

Countries including the UAE, Saudi Arabia, India, the U.S., France, and China traditionally have a strong presence here.

✔ Advanced Air Mobility & eVTOL Pavilion

One of the newest and most rapidly expanding sectors, with exhibitors such as:

Joby Aviation

Archer Aviation

EHang

Vertical Aerospace

Lilium

Regulators & vertiport operators

Dubai’s aim to launch commercial air-taxi services by 2026 gives this section special significance. The first-ever public Dubai demo flights by Joby in 2024 and 2025 mark a historic turning point.

✔ Space Pavilion

Hosted in partnership with the UAE Space Agency, featuring:

Satellite manufacturers

Launch service providers

Space robotics

Earth-observation platforms

Deep-space mission partners

✔ Airport, Vertiport & Infrastructure Hall

Exhibitors here focus on:

Ground handling systems

Air-traffic management

Vertiport design

Smart-airport technologies

Robotics for airport operations

This hall is increasingly important as the UAE integrates drones, air taxis, and autonomous aircraft into national airspace.

✔ Start-ups & Future Technology Zone

A modern feature showcasing disruptive firms in:

AI aviation systems

Digital twins

Predictive maintenance

Hydrogen & hybrid powertrains

Simulation and pilot-training systems

Cyber-security for aviation

👥 The Exhibitors – From Giants to Innovators

Dubai Airshow typically attracts more than 1,400 exhibitors representing the entire spectrum of aerospace. These include:

Major OEMs

Airbus

Boeing

Embraer

COMAC

Dassault

Bombardier

Lockheed Martin

Northrop Grumman

BAE Systems

eVTOL & AAM Manufacturers

Joby Aviation

Archer Aviation

EHang

Vertical Aerospace

Eve Air Mobility

ZURI

Chinese start ups

Skyports & other vertiport operators

Engine Makers

Rolls-Royce

GE Aerospace

Pratt & Whitney

Safran

Space Industry Leaders

UAE Space Agency

ESA

NASA representatives

Satellite operators & launch companies

Airlines

Emirates

Etihad

flydubai

Qatar Airways

Saudia

Dozens of African and Asian carriers

Defence Ministries & Air Forces

Representatives from more than 80 countries attend, making this a major diplomatic and procurement venue.

🎯 Why Dubai Airshow Matters in 2025 and Beyond

For your work, Vaz—especially with your eVTOL Hub brand—Dubai Airshow is becoming the key global platform where aviation and advanced air mobility finally converge. The UAE’s push to integrate air taxis into public transport, build vertiports, and operate the world’s first certified AAM network turns Dubai Airshow into a milestone event for every manufacturer.

It is:

A forecasting tool for future fleet compositions

A window into upcoming geopolitical shifts in aerospace

A market thermometer for commercial and defence expenditure

A staging ground for AAM, hybrid-electric aircraft, and new-energy propulsion

A place where investors, innovators, and regulators announce the next decade of aviation

✈️ Dubai Airshow 2025 — Full Orders Breakdown

17–21 November 2025 • Al Maktoum International Airport (DWC)

Total UAE carrier commitments: 502 aircraft • Dh418 billion (~US$114B)

🇦🇪 EMIRATES — Widebody Dominance Continues

Total: 73 aircraft • ≈ US$41.4B

• 65 × Boeing 777-9

Value: US$38B

Largest single wide-body order of the show

Reinforces Emirates’ long-haul expansion for the 2030s

• 8 × Airbus A350-900

Value: US$3.4B

Top-up to bring total A350-900 commitment to 73

🇦🇪 FLYDUBAI — Narrowbody Expansion & Fleet Diversification

Total: 225 aircraft • ≈ US$37B

• 75 × Boeing 737 MAX (firm)

Value: US$13B

Includes 75 more in options

Strengthens short-to-medium haul regional capacity

• 150 × Airbus A321neo (MoU)

Value: US$24B

First major Airbus order in airline history

Strategic shift from all-Boeing to mixed narrowbody fleet

🇦🇪 ETIHAD AIRWAYS — Broad Widebody Renewal

Total: 16 direct OEM orders + additional leasing package

(Values not formally disclosed; estimated low-double-digit billions USD)

• 6 × Airbus A330-900neo

• 7 × Airbus A350-1000

• 3 × Airbus A350F Freighters

Big push into next-gen efficient widebodies

Additional 9 A330neo + 4 A320neo via Avolon leasing

🇧🇭 GULF AIR — Next-Gen Long-Haul Boost

• 15 × Boeing 787 Dreamliner (firm) + 3 options

Estimated value: US$7B

Major investment into Bahrain’s long-haul fleet

🇪🇹 ETHIOPIAN AIRLINES — Dual Boeing & Airbus Expansion

Total: 19 aircraft

• 11 × Boeing 737-8

Converted options into firm orders

Adds to Africa’s largest MAX fleet

• 6 × Airbus A350-900 (direct)

• +2 × A350-900 (via Novus Aviation leasing)

Expands one of the strongest A350 fleets globally

🇸🇳 AIR SENEGAL — Largest Deal in National History

• 9 × Boeing 737 MAX 8

Value: Not disclosed (~US$1B+ list price equivalent)

Strengthens Dakar as a West African hub

🇪🇸 AIR EUROPA — Massive Long-Haul Renewal

• Up to 40 × Airbus A350-900 (MoU)

Estimated value: €11B

Signals long-term widebody investment under IAG influence

🇦🇿 SILK WAY WEST — Freighter Strategy Expansion

• 2 × Airbus A350F (firm)

Completes fleet to 4 total A350Fs

Estimated value: ~US$700M+ (catalogue)

🇱🇾 BURAQ AIR — New Airbus Customer

• 10 × Airbus A320neo family (MoU)

Value: ~US$1–1.2B

Significant step for Libyan commercial recovery

🇺🇿 UZBEKISTAN AIRWAYS — Narrowbody Lease Additions

• 6 × Airbus A321neo (via Chinese lessors)

Value: underlying metal ~US$800–900M

Reinforces fleet modernisation

🇨🇮 AIR CÔTE D’IVOIRE — Regional Jet Growth

• 4 × Embraer E175 (firm) + 8 purchase rights

Value: Few hundred million USD

Supports West African connectivity expansion

🇿🇦 FLYSAFAIR (via AerCap)

• 3 × Boeing 737 MAX 8 + 2 × 737-800NG (leases)

Value: Undisclosed

Boosts South Africa’s LCC capacity

🇪🇪 MARABU AIRLINES (via CDB Aviation)

• 4 × Airbus A320neo (leases)

Value: Undisclosed

🇮🇳 INDIAONE AIR — STOL Market Expansion

• Up to 10 × DHC-6 Twin Otter 300-G (LoI)

Value: Tens of millions USD

For regional/remote connectivity

🚁 Rotorcraft Orders

🇲🇦 Morocco

• 10 × Airbus H225M helicopters

New-generation military upgrade

🌍 Bristow Group

• Up to 5 × Airbus H160 (lease from Milestone Aviation)

Offshore operations across Africa

🧾 SUMMARY — TOTAL SHOW IMPACT

Total orders, MoUs, and commitments: Multiple hundreds across all OEMs

UAE carriers alone: 502 aircraft

Headline value: Dh418B (~US$114B)

Emirates leads in widebody spending, flydubai leads in volume, Etihad leads in balanced renewal, and Airbus secures the largest show-wide tally in units.

🚁 Advanced Air Mobility at Dubai Airshow 2025

How Dubai positioned itself as the global launchpad for the eVTOL era

The 2025 edition of the Dubai Airshow was the most AAM-centric in its history. With Dubai preparing for commercial air-taxi operations in 2026, the event became a proving ground for manufacturers, vertiport developers, infrastructure partners, and regulators showcasing their readiness. This year delivered the clearest signs yet that the UAE intends to lead the world into the next chapter of electric vertical mobility.

🛫 eVTOL Demonstrations & Flight Activity

✔ Joby Aviation Takes Centre Stage

First-ever public Dubai demonstrations of the Joby S4 under UAE flight approvals.

Multiple demo flights at Margham and at the airshow flight line, signalling confidence in operational readiness.

Showcased piloted operations, aligning with the UAE’s planned certified air-taxi launch in 2026.

Significant presence with regulators and potential partners, making Joby the leading AAM highlight of DAS 2025.

✔ EHang Showcases Autonomous Capability

EH216 series presented as a mature autonomous solution, contrasting Joby’s piloted approach.

Discussions with Middle Eastern operators on autonomous cargo, emergency response, and aerial tourism.

✔ Archer Aviation Presence (Showcase Only)

Archer displayed their Midnight eVTOL and simulator systems.

No local demo flights noted at the show due to ongoing certification dependencies.

Strong investor and regulatory interest, especially around the Midnight’s piloted CTOL-to-VTOL demo programme and the N704AX full-VTOL aircraft.

✔ Vertical Aerospace & Others

VX4 development updates featured in the AAM pavilion.

Vertiport and transition testing progress communicated, along with hybrid testing plans for 2026.

Multiple emerging regional players (Jetson Aero, hybrid-electric innovators, and small VTOL platforms) presented use cases for tourism, emergency services, and sports-event mobility.

✔ Eve Air Mobility – Bringing the Embraer Ecosystem to AAM

Eve presented updated mock-ups and systems for its lift+cruise eVTOL, emphasising Embraer’s certification experience.

Demonstrated advanced Urban ATM (UATM) solutions — a standout differentiator among AAM OEMs.

Highlighted progress on simulations, service readiness, and partnerships with regional operators who want eVTOL capacity beyond 2026.

Strong discussions on fleet planning for 2028–2030, aligning with Eve’s expected entry into service.

✔ Zuri – Long-Range Hybrid eVTOL Concept Draws Attention

Czech-based Zuri showcased its hybrid-electric VTOL concept offering extended range compared to pure-electric competitors.

Strong interest in missions beyond urban taxi operations:

regional intercity hops,

tourism routes,

remote-access transport.

Highlighted ongoing development of its 5-7 seat platform and modular hybrid powertrain — an appealing fit for GCC regional geography.

🤝 AAM Partnerships, MoUs & Strategic Moves

✔ UAE Government & eVTOL Stakeholders

Continued alignment between Joby, GCAA and RTA to prepare for the world’s first regulated air-taxi network in 2026.

Cross-OEM discussions on corridor design, vertiport spacing, and initial passenger flows.

✔ Vertiport Developers & Infrastructure Providers

Skyports, Urban-Air Port and regional groups showcased multi-pad vertiport configurations designed for Dubai’s transport nodes:

Dubai International (DXB)

Al Maktoum International (DWC)

Palm Jumeirah

Dubai Marina

Downtown hubs

✔ Urban Traffic Management & Digital Twins

Eve Air Mobility and other UATM specialists presented airspace management platforms including conflict detection, traffic scheduling and urban integration.

Multiple full-city digital-twin models simulated peak-time routing for piloted and autonomous eVTOL networks.

✔ Energy, Charging & Hybrid Power

Charging-standard workshops included input from Eve, Joby and infrastructure providers.

Zuri highlighted how hybrid-electric systems could extend route maps into regional destinations where pure-electric charging is not yet feasible.

🛬 Vertiports & AAM Infrastructure Showcase

✔ Full-Scale Vertiport Concepts

Featured designs included:

Multi-aircraft pads

Passenger lounges and security flow

eVTOL-specific fire/thermal containment systems

Integrated rapid-charging and battery cycling

5–8 minute vehicle turnaround concepts

✔ Real-World UAE Vertiport Planning

RTA previewed vertiport hubs aligned to metro, tram and water-taxi nodes.

Early construction footprints rumoured for initial Dubai–Marina–Palm corridors.

✔ Unified Ground-to-Air Passenger Experience

Eve presented concepts for integrated booking and passenger flow.

Operators trialled mock processes aimed at a “premium express shuttle” experience.

🛡 Regulatory & Safety Framework Updates

✔ GCAA & RTA Joint Sessions

Confirmed path toward 2026 piloted service launch.

Key priorities:

battery safety standards,

redundancy validation,

vertiport evacuation design,

weather constraints for early operations.

✔ Certification Streamlining

UAE aims to harmonise elements of EASA SC-VTOL and FAA frameworks.

Joby, Eve and Vertical all deepened their certification dialogue with UAE regulators.

✔ Public Safety & Emergency Protocols

Demonstrations included propulsive-loss scenarios, fire-suppression logic, and emergency landing area mapping.

🚀 Key Takeaways for AAM & eVTOL Investors

Joby leads operational readiness, with the only live flights at the show.

Eve strengthens its position with Urban ATM systems—an underrated but essential part of real-world AAM.

Zuri enters the spotlight as a hybrid long-range eVTOL option ideal for GCC regional missions.

Vertiport development is accelerating, aligned with Dubai’s 2026 timeline.

Regulatory momentum is real, not theoretical — the UAE continues to set the global pace.

AAM is no longer a showcase sector at Dubai Airshow; it is now a core pillar of the event.

🇸🇦 Saudi Arabia Opens Its Skies to eVTOL Trials — A New Frontier for AAM in the Gulf

Saudi Arabia has entered the regional AAM race with two major announcements revealed alongside the Dubai Airshow narrative. On 19 November 2025, both Joby Aviation and Archer Aviation signed independent agreements with:

The Helicopter Company (THC) — backed by Saudi Arabia’s Public Investment Fund (PIF)

Red Sea Global — operator of one of the world’s most ambitious luxury and sustainable tourism projects

These MoUs initiate pre-commercial eVTOL flight trials in the Kingdom starting in 2026, establishing Saudi Arabia as the next major testbed for electric air mobility in the Middle East.

🚁 Joby Aviation — Strengthening Its Lead in Operational Maturity

Joby’s announcement reinforces its status as the most flight-proven and deployment-ready eVTOL OEM in the Western world. Building on successful public demonstrations in the UAE, Joby will now conduct structured flight assessments inside Saudi Arabia focused on:

Charging infrastructure testing

Weather and climate integration

Route validation and corridor mapping

Passenger logistics and operational modelling

Regulatory coordination with Saudi aviation authorities

This places Joby in a unique position as the only OEM simultaneously advancing evaluation programmes in both the UAE and Saudi Arabia, giving it an early multi-market advantage in the Gulf.

🛩 Archer Aviation — Securing a Strategic Foothold in the Kingdom

Archer’s deal with THC and Red Sea Global positions the Midnight aircraft at the centre of a purpose-built “sandbox environment” designed for real operational trials. Areas of focus include:

Resort-to-resort premium mobility across the Red Sea corridor

Short, high-demand routes ideal for the Midnight’s piloted configuration

Infrastructure integration with luxury tourism assets

Operational testing in controlled environments that mirror Archer’s early-launch vision

While Archer has yet to perform public eVTOL flights in the UAE, the Saudi programme gives the company a major opportunity to demonstrate readiness and accelerate Middle-East positioning.

🏨 The Customer Perspective — Why THC and Red Sea Global Are Ideal Early Adopters

Saudi Arabia’s customer-side motivation is driven by strategic, financial, and experiential priorities. Both organisations represent perfect early partners for eVTOL deployment:

The Helicopter Company (THC)

Backed by PIF, with national-scale aviation ambitions

Largest rotorcraft operator in the Kingdom

Strong demand for quiet, low-emission VIP and tourism mobility

Natural transition path from helicopters → eVTOLs

Red Sea Global

Operator of one of the world’s most advanced luxury tourism ecosystems

Strong focus on sustainability, low-impact transport, and premium guest mobility

Sees eVTOLs as a high-end, low-carbon layer within its multimodal transport network

Ideal geography for early eVTOL deployment: controlled, scenic, corridor-based routes

Together, they provide the region’s strongest real-world foundation for phased eVTOL introduction beginning in 2026, complementing Dubai’s momentum and positioning Saudi Arabia as a parallel AAM powerhouse.

🇦🇪 A Tragic Moment at the Dubai Airshow 2025

The Dubai Airshow 2025 was overshadowed by tragedy on Thursday, 20 November, at approximately 11:40 AM local time, when an Indian Air Force HAL Tejas fighter jet crashed during a rehearsal demonstration. The aircraft went down shortly after initiating a high-energy manoeuvre, erupting into a fireball upon impact near the show grounds. Emergency responders reached the site within seconds, but despite rapid intervention, the pilot did not survive. With tens of thousands of spectators and aviation professionals present at the show, the incident cast a sombre tone over what had otherwise been a global celebration of aerospace innovation.

🛫 Who Was Involved

The aircraft involved was the HAL Tejas, India’s indigenous light combat aircraft and a cornerstone of the Indian Air Force’s modernisation programme. The demonstration team had been scheduled to perform high-performance routines showcasing the aircraft’s agility and fly-by-wire capabilities. The Indian Air Force confirmed the death of the pilot, an experienced demonstration aviator with significant flight hours on the type. HAL and IAF representatives immediately coordinated with UAE authorities as part of the standard investigation protocol.

🔍 Possible Cause — Early Indications Only

While a full accident investigation is underway, early footage and eyewitness accounts suggest the aircraft may have suffered a loss of control or critical systems failure during a vertical manoeuvre. There is currently no confirmed mechanical cause, no suggestion of external interference, and no preliminary ruling. Analysts note that airshow display routines are inherently high-risk due to low altitude, aggressive manoeuvring and tight timing, meaning even minor anomalies can escalate rapidly. Until the official report is released, all causes remain speculative.

📉 Impact on the Airshow & the Future of Aerial Displays

The crash led to a temporary halt in flight demonstrations at the Dubai Airshow and prompted organisers to reassess sections of the flying programme. More significantly, this marks the second major airshow crash this year, following the fatal incident in Bytom, which resulted in the entire event being cancelled. These back-to-back tragedies are likely to accelerate discussions around:

stricter manoeuvre envelopes for display pilots,

increased altitude margins for high-energy routines,

enhanced aircraft maintenance verification before displays,

and whether fast-jet demonstrations should remain a staple of civilian airshows.

While airshows continue to play a crucial role in aerospace diplomacy, public engagement and industry visibility, the events of 2025 may push regulators and organisers toward more conservative display standards, especially for high-performance military aircraft. The Dubai accident will almost certainly shape how future shows balance spectacle with evolving expectations of safety and risk mitigation.

Vaz comments:

We extend our heartfelt condolences to the pilot’s family, colleagues, and the Indian Air Force. Demonstration pilots embody exceptional skill and dedication, and this loss is felt across the entire aviation community. We honour his service and hope his legacy strengthens the commitment to safety and excellence within the industry.

📸 Picture of the Week

One shot, one story. The image that defined this week in the world of eVTOLs and aviation.

https://x.com/BoeingAirplanes/status/1991651299407151605?s=20

💸 Introducing: The Ultimate eVTOL Market Trading 212 Pie

⚠️ Disclaimer: This pie is for entertainment and informational purposes only. It is not financial advice.

Retail investors looking to enter the eVTOL space are met with one big problem: there’s no ETF dedicated to this transformative market—yet. That’s why we created The Ultimate eVTOL Market Trading 212 Pie: a curated, balanced portfolio that gives you exposure to every critical tier of the eVTOL ecosystem.

Link to the eVTOL Pie here:

https://www.trading212.com/pies/lu9LjaG6fqknxzodrGm9AYCd1aENp

This pie is more than a watchlist. It’s a smart, evolving benchmark built for those who believe in the electric air mobility revolution and want to stay ahead of the market as it develops.

✅ Why this Pie?

Solves the ETF gap for retail investors wanting focused exposure to the eVTOL industry

Covers the full ecosystem: from manufacturers (Tier 1), to institutional backers (Tier 0), to suppliers and operators (Tier 2)

Actively balanced: proportioned for long-term growth, not just hype

Weekly performance tracking: stay updated on stock price changes and key market movements

Ideal for beginners and experts: whether you're new to the sector or deep in AAM research

📊 The pie currently includes 29 companies, each with a defined role in shaping the future of urban air mobility. From $ACHR and $JOBY to $BA, $PLTR, $RR, and more—we’ve got the vertical covered.

⚠️ Again, a reminder: This is not financial advice. This pie is intended for entertainment and educational purposes only—to help visualize and track the evolution of the eVTOL market as a whole.

Tier 1 – eVTOL Manufacturers (45.5%)

Archer Aviation – $ACHR – 11% – U.S.-based eVTOL manufacturer developing the Midnight aircraft for urban air mobility, targeting commercial launch by 2025–2026.

Joby Aviation – $JOBY – 11% – California-based eVTOL pioneer focused on passenger air taxi services, with extensive FAA certification progress.

Vertical Aerospace – $EVTL – 9% – UK eVTOL company developing the VX4, with a strong pre-order pipeline but still in prototype flight testing.

EHang – $EH – 5% – Chinese autonomous aerial vehicle company, first to receive type certification for a passenger-carrying eVTOL.

Eve Air Mobility – $EVEX – 3.5% – Embraer-backed eVTOL firm with a unique focus on air traffic management software alongside its aircraft.

Horizon Aircraft – $HOVR – 3% – Canadian hybrid-electric VTOL developer targeting longer-range missions with its Cavorite X-series.

AIRO Group – $AIRO – 2% – Aerospace group developing eVTOL solutions for both civil and defense applications.

Global Electric VTOL – $GEV – 1% – Developer of fully electric vertical lift aircraft with a focus on sustainability and niche markets.

Tier 0 – Parent & Institutional Investors (24.5%)

Delta Air Lines – $DAL – 3% – U.S. legacy carrier investing in eVTOL partnerships to expand urban mobility offerings.

Textron – $TXT – 3% – Parent company of Bell Helicopter, entering the eVTOL market with tiltrotor and electric concepts.

Toyota Motor – $TM – 3% – Japanese auto giant providing funding, engineering, and supply chain support to eVTOL programs like Joby.

United Airlines – $UAL – 3% – U.S. airline with significant eVTOL pre-orders to integrate into regional and city-center routes.

Airbus – $AIR – 2.5% – European aerospace leader developing its own eVTOL and UAM ecosystem solutions.

Boeing – $BA – 2.5% – U.S. aerospace giant backing Wisk Aero and other advanced air mobility projects.

Stellantis – $STLA – 2.5% – Automotive group partnering with Archer to mass-produce eVTOL aircraft.

BlackRock – $BLK – 2% – Major institutional investor with holdings across multiple eVTOL and aerospace companies.

Embraer – $ERJ – 2% – Brazilian aircraft manufacturer and parent company of Eve Air Mobility.

Honda Motor – $HMC – 1% – Japanese automotive leader developing its own hybrid eVTOL concept.

Tier 2 – Operators & Suppliers (30%)

Blade Air Mobility – $BLDE – 5% – U.S.-based urban air mobility operator transitioning from helicopters to eVTOL aircraft.

Bristow Group – $VTOL – 4.5% – Global vertical flight operator planning to integrate eVTOLs into offshore and urban missions.

Honeywell – $HON – 3% – Aerospace systems provider supplying avionics and propulsion technology for eVTOL programs.

Surf Air Mobility – $SRFM – 2.5% – Electric aviation operator focusing on regional mobility and commuter air routes.

Leonardo DRS – $DRS – 2% – Defense contractor supplying mission-critical electronics and systems to aerospace projects.

Palantir – $PLTR – 2% – Data analytics firm providing AI-driven operational platforms for eVTOL and aerospace logistics.

Rolls-Royce – $RR – 2% – Power systems manufacturer developing electric and hybrid propulsion for advanced aircraft.

Uber – $UBER – 2% – Rideshare giant with past eVTOL initiatives and potential future urban mobility platform integration.

▶️Amprius Technologies – $AMPX – 1.5% – Battery technology company producing high-energy-density cells for aviation.

▶️L3Harris Technologies – $LHX – 1.5% – Aerospace and defense supplier with expertise in hybrid propulsion and mission systems.

Cisco – $CSCO – 1% – Networking technology provider supporting smart infrastructure for vertiports and air traffic systems.

Dassault Systèmes – $DSY – 1% – Developer of 3D design and simulation software widely used in eVTOL R&D.

Safran – $SAF – 1% – Aerospace manufacturer producing electric motors, avionics, and landing systems for eVTOL aircraft.

▶️AECOM – $ACM – 1% – Global infrastructure engineering firm capable of designing and building vertiports and mobility hubs.

Disclaimer: This is for entertainment and informational purposes only. It is not financial advice (NFA).

🔍See poll results from our X account below:

We asked - you delivered! Every week, we run a poll on our X account.

No polls were held last week.

👉 Follow us and join us as we unpack the next chapter in Joby’s ascent.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here