Sensei’s Insights – Joby Dilution, EHang’s New Aircraft, Lilium Buyout Talks, Tesla x Archer Rumors | Saturday LIVE eVTOL Show with Vaz

How One Tweet Moved the Market, Joby's Latest Offering, Salinas Wrap-Up, EHang's Long-Range Reveal, Horizon CEO Interview — and More with Vaz

🚁 Joby Aviation’s Latest Share Dilution: Lifeline or Investor Pain?

Joby Aviation ($JOBY) has completed a major underwritten public offering — issuing 35.07 million shares at $16.85 each, including the underwriters’ full option (“greenshoe”), raising approximately $591 million in gross proceeds.

This offering came at roughly a 10.9 % discount to the prior close of $18.91, triggering a sharp intraday drop of over 10 % in the share price following the announcement.

JOIN US FOR THE SATURDAY LIVE EVTOL SHOW WITH VAZ

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

💰 Why Joby Did It

Joby remains pre-revenue but is moving aggressively toward commercialization. The new capital extends its financial runway and supports:

FAA certification testing and validation programs

Manufacturing scale-up of its production lines

Operational readiness and vertiport infrastructure

General corporate purposes and integration of new assets

At the end of Q2 2025, Joby held nearly $991 million in cash and short-term investments. This raise effectively doubles its available resources, positioning Joby ahead of most peers in terms of financial flexibility.

📉 Investor Impact: Dilution & Market Reaction

❗ Ownership Dilution

The issuance of over 35 million new shares means existing shareholders now own a smaller slice of the company. The discount pricing further amplified the short-term downside, signaling that Joby needed to offer a meaningful incentive to attract institutional buyers.

🩵 Sentiment Shock

Despite Joby’s strong fundamentals and leading position in eVTOL certification, the market response was swift and negative. In speculative industries like advanced air mobility, discounted offerings often reset investor expectations—at least temporarily.

🎯 Path to Redemption

To win back confidence, Joby must now convert capital into execution:

Achieve tangible FAA milestones

Demonstrate production scalability

Show progress toward commercial deployment

If these milestones materialize, this dilution may be remembered as a strategic move, not a setback.

✈️ Strategic Context in the eVTOL Landscape

Dilution is not uncommon in high-capex frontier technologies like eVTOLs. Cash burn remains heavy before the first passenger ever flies.

Yet, this raise gives Joby a critical advantage: liquidity to push through its certification and production ramp while rivals like Lilium and Vertical Aerospace face ongoing financial strain.

In essence, Joby has bought itself time—and dominance—in a market where time equals survival.

🔭 What to Watch Next

FAA Certification Milestones – Movement toward full Type Certification.

Manufacturing Progress – Evidence of scalable, repeatable builds.

Operational Partnerships – Expansion with Delta, Uber, and others.

Cash Burn vs. Budget – Capital discipline through 2026.

Market Sentiment – Whether investors perceive this as a reset or an opportunity.

📊 The Bigger Picture

Joby’s offering underscores a core truth about the eVTOL sector:

Innovation burns capital faster than it earns it.

But for those who endure, the payoff could reshape urban mobility — and Joby just ensured it’ll still be standing when the takeoff finally comes

🚁 EHang Unveils the VT-35 – A New Chapter in Long-Range eVTOL Flight

EHang ($EH) has officially unveiled its next-generation VT-35 aircraft, a successor to the VT-30, designed for long-range, autonomous inter-city operations.

The reveal marks EHang’s most ambitious step yet — positioning the company not only as a pioneer of short-range urban air taxis but as a credible contender in regional air mobility.

✈️ What’s New in the VT-35

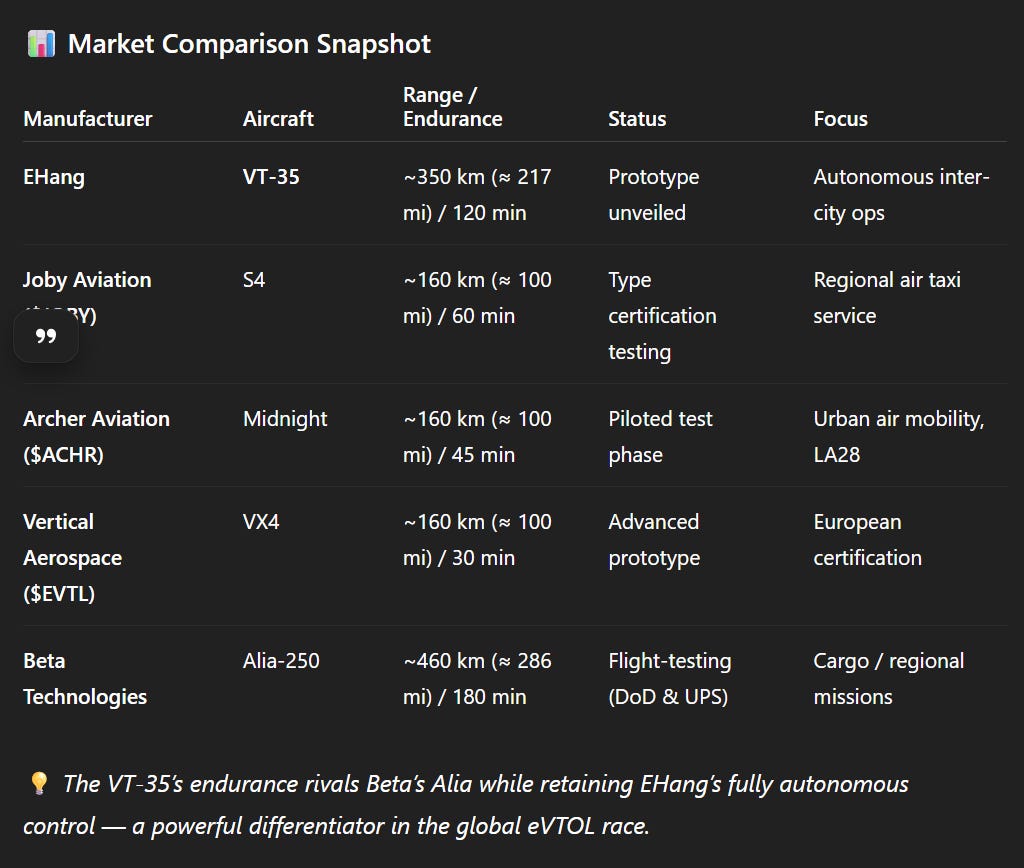

Extended range: Up to 350 km (≈ 217 mi) per flight — surpassing the VT-30’s ~300 km (≈ 186 mi) benchmark.

Improved flight time: About 120 minutes endurance for cross-regional operations.

Refined lift-plus-cruise design: Eight vertical propellers plus twin pushers for efficient forward flight.

Enhanced autonomy and upgraded flight-control redundancy for improved safety.

Target missions: Inter-city corridors (150–300 km / 93–186 mi) across Asia and the Middle East, complementing EHang’s EH216 intra-city focus.

🔗 EHang described the VT-35 as “bridging the gap between cities and regions,” aligning with its roadmap toward a global AAM network.

⚙️ Why It Matters

EHang is building on the momentum of its EH216-S certification by extending its reach to longer routes — directly entering the regional eVTOL market.

While Joby, Archer, and Beta Technologies chase FAA certification in the U.S., EHang’s advantage lies in China’s regulatory support and autonomous operations framework, potentially allowing earlier commercial deployment.

🎥 Join Our LIVE Special with Vaz

📺 This Monday — Only on Martyn Lucas Investor & eVTOL Hub LIVE

Get the first look at the VT-35, full specs analysis, real-time commentary, and investor breakdown with Vaz as we cover this global debut LIVE.🎥

🎙️ Meet the CEO: Horizon Aircraft’s Brandon Robinson Takes the Stage

On Tuesday before the closing bell, Martyn Lucas and Vaz hosted another exciting edition of Meet the CEO, featuring Brandon Robinson, CEO of Horizon Aircraft ($HOVR).

In this lively Martyn Lucas Investor LIVE Special, the conversation went far beyond business — we explored Horizon’s hybrid eVTOL program, Brandon’s aviation background, and the mindset that shaped his journey from military pilot to aerospace innovator.

From his time flying the F-18 to developing Horizon’s next-generation hybrid-electric vertical aircraft, Brandon shared a fascinating perspective on how fighter jet experience translates into eVTOL design and discipline.

It was an episode full of authenticity, humor, and insight — proving that when it comes to aviation, F-18s and eVTOLs have more in common than you might think.

👉 Watch the full interview now — available exclusively on Martyn Lucas Investor & eVTOL Hub LIVE.

🚑 Archer Launches Medical eVTOL Service in Abu Dhabi

Archer Aviation ($ACHR) has announced a partnership with Cleveland Clinic Abu Dhabi to develop the UAE’s first hospital-based vertiport, supporting both helicopter and eVTOL operations.

The project will enable paramedic and medical logistics flights, marking Archer’s entry into mission-critical air mobility.

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.