Sensei’s Morning Forecast: A Fragile Reopening: What the End of the Shutdown Really Means

Markets breathe again as Washington reopens, regulators tighten crypto rules, retail eyes new AI access, and global trade shows flickers of renewal — all ahead of XRP’s ETF test.

👀 Today’s Stories at a Glance

🇺🇸 Senate Advances Deal to End Historic 40-Day U.S. Shutdown

Markets cheer as Congress passes temporary funding; shutdown shaved 1.5% off GDP and cost billions weekly.🇬🇧 Bank of England Sets Stricter Stablecoin Rules Than U.S.

New UK rules cap holdings and demand high gilt reserves, sparking fintech concerns over lost competitiveness.🤖 Robinhood Unveils AI Fund to Open Private Markets to Retail

Retail traders may soon access top private AI firms via a closed-end fund under ticker RVI.🔒 Ledger Sees Record Sales as Crypto Thefts Hit $2.2 Billion

Security breaches push retail into cold storage wallets; Ledger mulls IPO amid booming demand for custody.🌾 U.S.–China Trade Thaw Restarts Agricultural Exports

Soybean shipments resume amid cautious optimism, though tariffs and competitive pricing still cloud long-term recovery.

🧠 One Big Thing

After 40 days, the Senate has advanced a deal to end the longest U.S. government shutdown in history. The bipartisan framework funds key agencies and extends temporary support through January 30. The economic toll: $15B/week lost, 1.5% GDP hit, and 1.4M workers unpaid. Markets rallied on signs of progress, but it’s not a done deal until the House passes it.

💰 Money Move of the Day

Shutdowns freeze tax refunds, delay data, and hit markets. It’s a good moment to revisit your emergency cash strategy and understand how political gridlock can ripple through income, filings, and short-term moves. Gold, Treasuries, and futures tend to price in uncertainty fast; knowing how they react can be just as useful as knowing why.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $106,274.15 (▲ +1.49%)

Ethereum (ETH): $3,617.92 (▲ +0.97%)

XRP: $2.55 (▲ +7.56%)

Equity Indices (Futures):

S&P 500 (US500): 6,791.6 (▲ +0.77%)

NASDAQ 100 (NQ1!): 25,509.50 (▲ +1.36%)

FTSE 100: 9,786.18 (▲ +0.52%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.124% (▲ +0.76%)

Oil (WTI): $59.973 (▼ -0.01%)

Gold: $4,082.60 (▲ +2.06%)

Silver: $49.938 (▲ +3.34%)

🕒 Data as of UK (BST): 11:44 / US (EST): 06:44 / Asia (Tokyo): 20:44

✅ 5 Things to Know Today

🇺🇸 Senate Moves to End Record 40-Day U.S. Government Shutdown

After 40 days of paralysis, the U.S. Senate advanced a bipartisan framework to reopen the federal government, marking the longest shutdown in American history. The chamber voted 60-40 late Sunday, with eight Democrats breaking ranks to support the measure (Al Jazeera; ABC News). The deal funds core agencies (Agriculture, Veterans Affairs, and Congress) through the full fiscal year and extends temporary funding for others until January 30. It also promises a December vote on Affordable Care Act subsidy extensions, a key Democratic concession. The Congressional Budget Office estimates the shutdown has already cut 1.5 percentage points from quarterly GDP growth and cost up to $15 billion per week in lost output, while 1.4 million federal workers have gone without pay (CBS News; NPR).

Markets welcomed the progress. S&P 500 futures rose 0.7% and Nasdaq 100 futures gained 1.1%, while 10-year Treasury yields ticked up to 4.13%, signaling relief but ongoing fiscal caution (Reuters; CNBC). Gold surged 2.1% to near $4,080/oz, with silver up 3.3%, as traders priced a 67% chance of a December Fed rate cut and renewed demand for non-yielding safe havens (JPMorgan; CNBC). Analysts warn, however, that much of the rebound reflects a “relief rally,” not a fundamental shift; Congress still faces contentious talks on ACA subsidies and longer-term fiscal policy before the January deadline.

Sensei’s Insight: The market pop is a sigh of relief, not a turning point. Investors should watch whether data restarts (jobs, CPI, GDP) confirm a genuine rebound or just temporary optimism.

🇬🇧 Bank of England Unveils Tougher Stablecoin Rules Than the US

The Bank of England has proposed a stricter regulatory regime for sterling-denominated stablecoins, introducing holding caps and heavy oversight that go beyond US standards. The plan—part of a consultation running until February 10, 2026—targets systemically important payment stablecoins with temporary limits of £20,000 per individual and £10 million per business, aiming to prevent destabilizing outflows from bank deposits. Issuers must back coins primarily with UK government debt and central bank deposits, with a minimum 40% of reserves held at the BOE and up to 60% in short-term gilts (Bloomberg; Reuters). The BOE also introduced a liquidity backstop, granting issuers access to central bank lending if gilt markets seize, acknowledging the limited depth of the UK’s £108 billion bill market.

Deputy Governor Sarah Breeden said the tighter stance reflects structural banking differences with the US—where mortgage finance relies on Fannie Mae and Freddie Mac rather than deposits. Crypto firms, however, warn that the UK risks losing competitiveness, as neither the EU’s MiCA, Singapore, nor Dubai impose ownership caps. Coinbase’s Tom Duff Gordon called the limits “bad for UK savers,” while lawmakers urged the BOE to publish its impact modelling (DL News; Scottish Financial News). The consultation will shape final rules later in 2026, cementing the UK’s more conservative path as the US GENIUS Act rolls out a looser federal framework (Brookings).

Sensei’s Insight: The BOE’s stablecoin rules highlight a widening regulatory divide—the UK prioritizing financial stability, the US emphasizing innovation. For investors, this split could reshape where global liquidity and fintech talent flow next.

🤖 Robinhood’s AI Fund Pushes Retail Into Private Markets

Robinhood CEO Vlad Tenev is preparing to open the gates of private AI investing to everyday traders. The brokerage plans to launch a publicly traded closed-end fund, pending SEC approval, that will invest in five to ten private artificial intelligence companies under the ticker RVI (Reuters). The goal is to give retail investors exposure to high-growth startups typically reserved for venture capital funds. The move comes as the private-market ecosystem exceeds $10 trillion in value, with AI firms like OpenAI ($300B), Anthropic ($62B), and xAI ($50B) driving nearly $1 trillion in new paper wealth over the past year (Bloomberg). Robinhood shares have climbed 255% year-to-date, buoyed by Q3 crypto revenue up 300%, giving Tenev momentum to extend his “democratize finance” mission into alternative assets.

The closed-end structure, however, carries risks: investors cannot easily redeem shares during downturns, and the portfolio’s high concentration limits diversification. Analysts warn that managing illiquid, high-valuation private assets could stress Robinhood’s fast-moving retail base. The fund underscores a broader shift; capital is migrating from public to private markets, leaving retail investors scrambling for access. Tenev’s push mirrors a wider industry pivot as asset managers like Blackstone and Apollo race to open private-equity and credit exposure to retail savers following new U.S. regulatory allowances.

Sensei’s Insight: Robinhood is blurring the line between public and private markets. It’s a milestone for access, but it also tests whether retail investors truly understand the trade-off between innovation and liquidity.

🔒 Ledger’s Record Year as Crypto Theft Surges Past $2.2 Billion

Crypto investors are rushing to secure their holdings offline as digital theft reaches unprecedented levels. Ledger, the French manufacturer of hardware wallets that store cryptocurrencies on USB-like devices, is reporting its best year since launching in 2014, with revenues in the triple-digit millions for 2025. CEO Pascal Gauthier attributed the boom to a wave of sophisticated cyberattacks hitting both exchanges and individual users, calling security breaches “systemic” across the crypto ecosystem (Coinlaw). In just the first half of 2025, hackers stole $2.2 billion in crypto assets, already surpassing 2024’s total. Roughly 23% of those attacks targeted individual holders rather than exchanges, a shift that Chainalysis describes as a growing threat category tied to surging crypto prices (Coinlaw).

The largest incident came in February 2025, when North Korean hackers stole $1.5 billion from the Bybit exchange, marking the biggest crypto heist on record. The fallout accelerated adoption of cold storage solutions like Ledger, which now safeguards over $100 billion in bitcoin for customers worldwide. Competing hardware wallet makers Trezor (Czech Republic) and Tangem (Switzerland) are also benefiting from demand, as the global market expands from $474.7 million in 2024 to an estimated $2.4 billion by 2033 (SQ Magazine; Coinlaw). Gauthier said Ledger is exploring a New York IPO or private raise in 2026, citing a growing capital shift from Europe to the U.S. as the crypto security sector matures (The Street).

Sensei’s Insight: The surge in cold wallet demand shows how institutional-grade security is becoming retail-standard. As crypto markets grow, self-custody is evolving from ideology to necessity.

🌾 U.S. Farm Exports Tentatively Resume as China Signals Thaw in Trade Tensions

U.S. agricultural exporters arrived at Shanghai’s China International Import Expo (CIIE) this week with cautious optimism following the Trump–Xi framework agreement reached in late October. The U.S. pavilion was 50% larger than last year’s, underscoring renewed hopes that the worst of the trade friction may have passed. China has resumed purchases of soybeans and sorghum, restoring export licenses and initiating fresh shipments after months of boycott (Reuters; SCMP). Still, the détente is partial: U.S. soybeans face a 13% tariff, keeping them less competitive than Brazilian supplies, and the deal suspends rather than eliminates existing tariffs. The CIIE recorded $83.49 billion in intended turnover, a 4.4% increase year-on-year, with over 4,100 firms from 155 countries participating (Business Times).

Behind the optimism lies fragility. The framework only freezes tariffs for one year, leaving a 24-point reciprocal duty in place until November 2026—a structure that can be reactivated without new legislation if talks falter (China Briefing). China’s trade surplus remains near $1 trillion, with gains from other export markets offsetting reduced U.S. sales. While Beijing pledged to buy 12 million metric tons of U.S. soybeans through 2025 and 25 million tons annually thereafter, analysts caution the commitments hinge on pricing competitiveness versus Brazil (CSIS). Industry leaders say the deal restores dialogue, not normalcy; a ceasefire, not peace, as both sides test whether trade flows can recover without political setbacks.

Sensei’s Insight: The trade thaw lifts sentiment for U.S. farm exporters, but structural tariffs and price competition mean the rally’s sustainability depends on execution—not symbolism.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

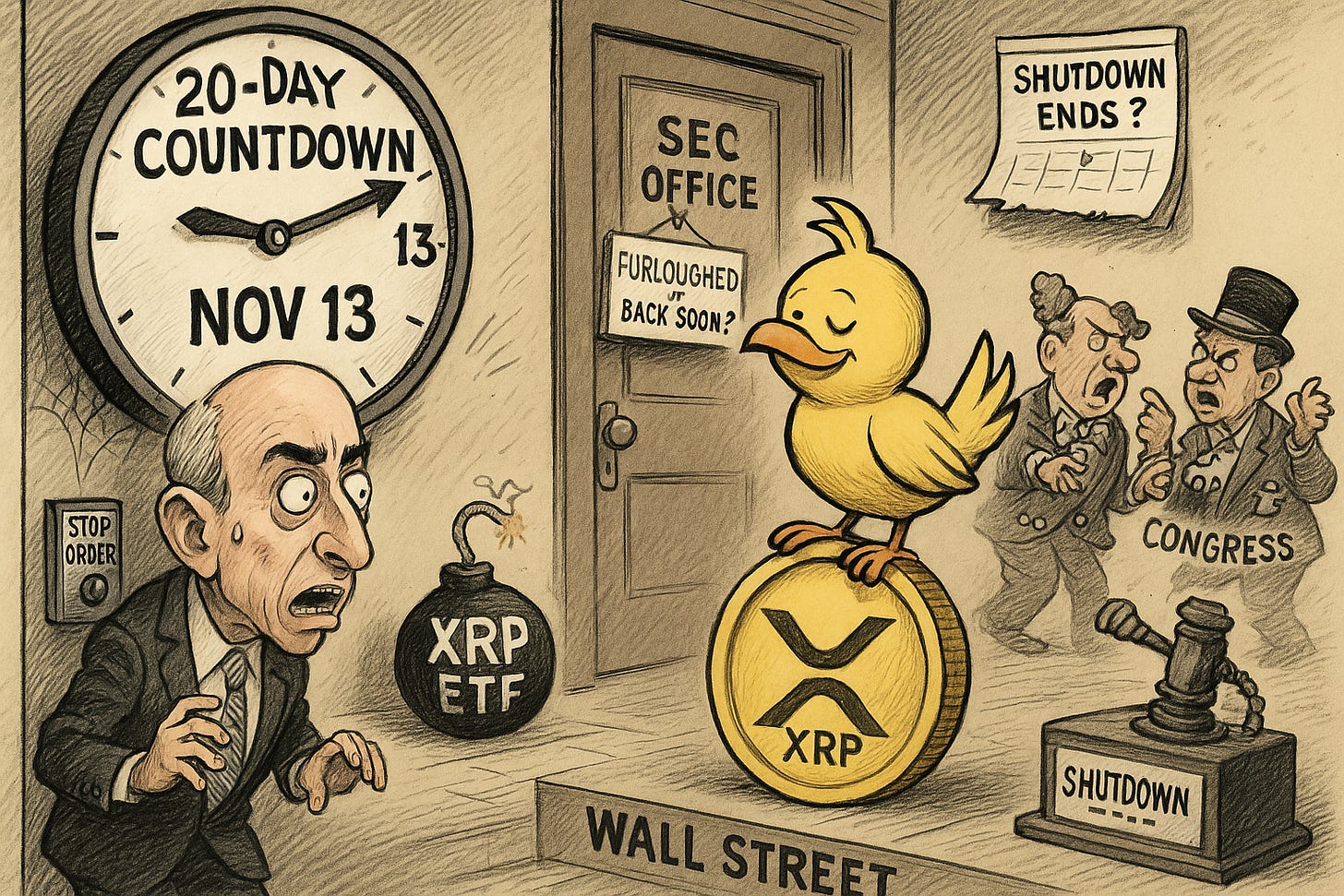

🔍Deep Dive: XRP ETF Launch Timeline Meets Shutdown Drama: What November 13 Means for Canary and Beyond

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.