Sensei's Morning Forecast: AI Mania Meets Gold Rush—Which Will Collapse First?

Investors chase gold, fear AI bubble bursts, UK finds budget reprieve, JPMorgan sees stablecoin dollar surge, and Meta/Apple eye EU settlements under escalating global regulatory pressure.

👀 Today’s Stories at a Glance

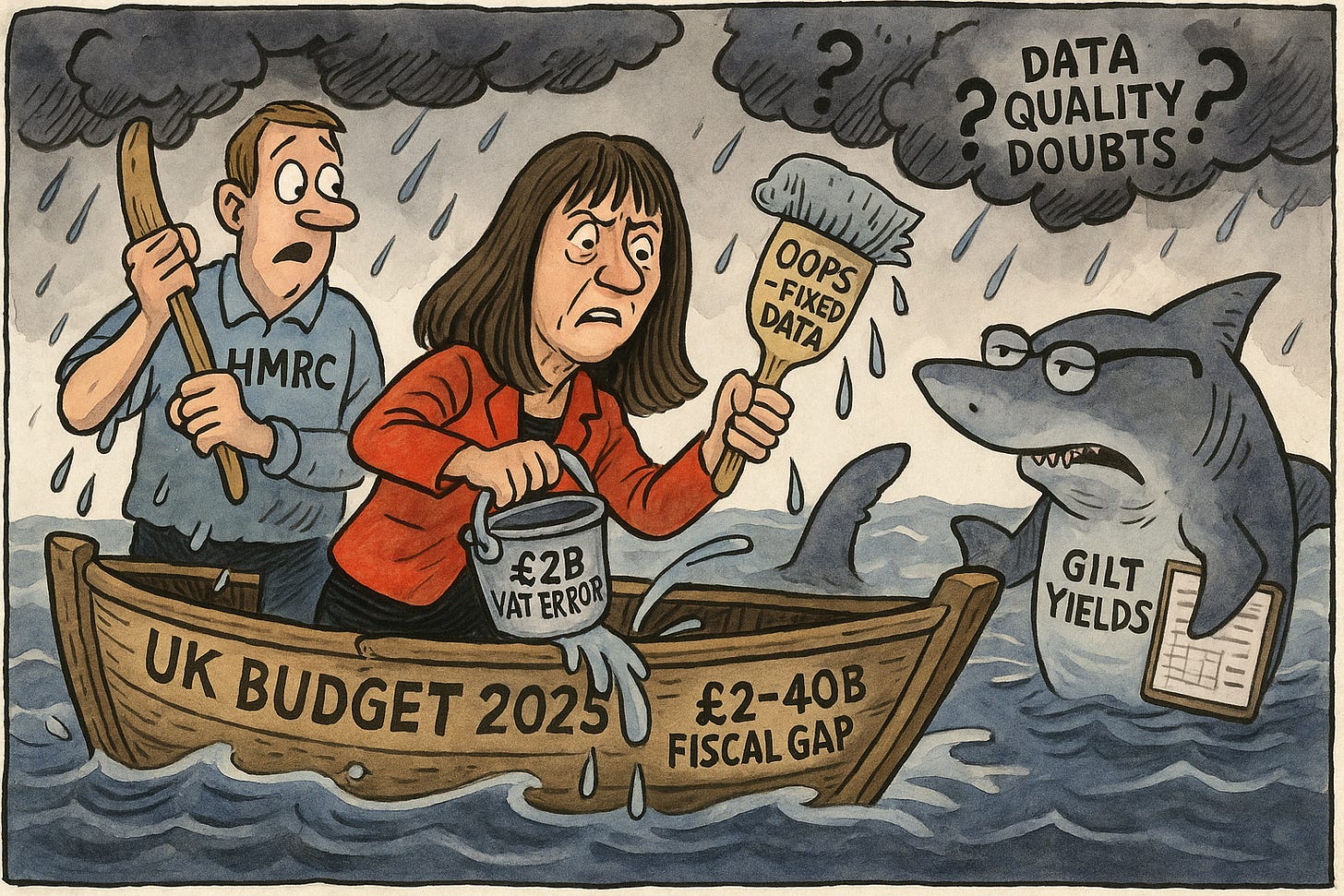

📉 UK Cuts Borrowing by £2B After HMRC VAT Error

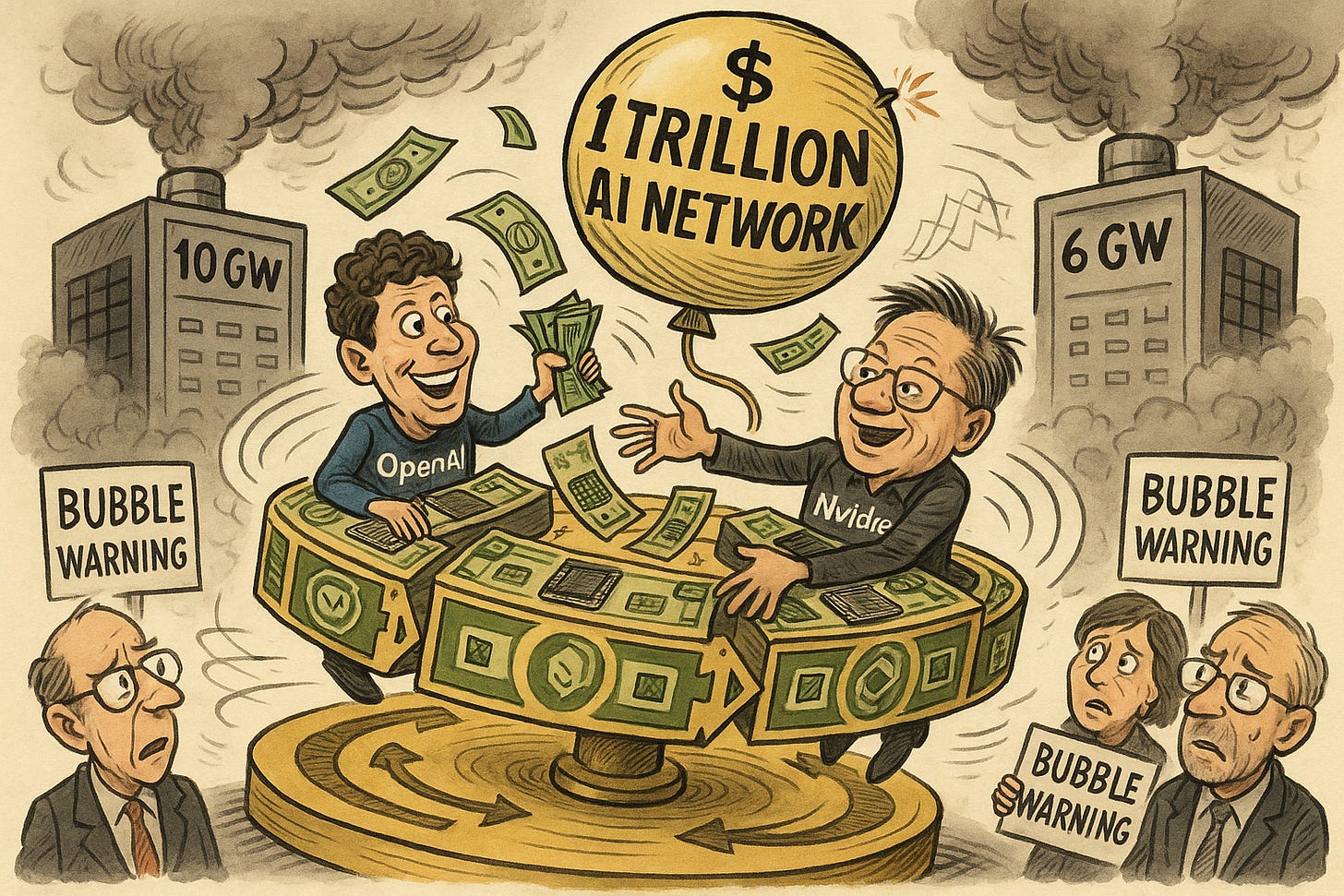

An HMRC data glitch led to a £2B borrowing revision—welcome news amid mounting fiscal stress.🤖 OpenAI’s $1 Trillion AI Deals Stir Bubble Fears

Massive circular deals with Nvidia and others raise alarms over inflated AI demand and valuation risks.💵 JPMorgan Predicts $1.4 Trillion Stablecoin Dollar Boost

Stablecoins may drive huge dollar demand by 2027, reinforcing U.S. dominance in global finance systems.⚠️ Bank of England Flags AI Tech Bubble Risk

The BoE warns AI hype may crash markets, with valuations now echoing the dotcom era’s excess.🇪🇺 Meta & Apple Near EU Settlement Amid DMA Crackdown

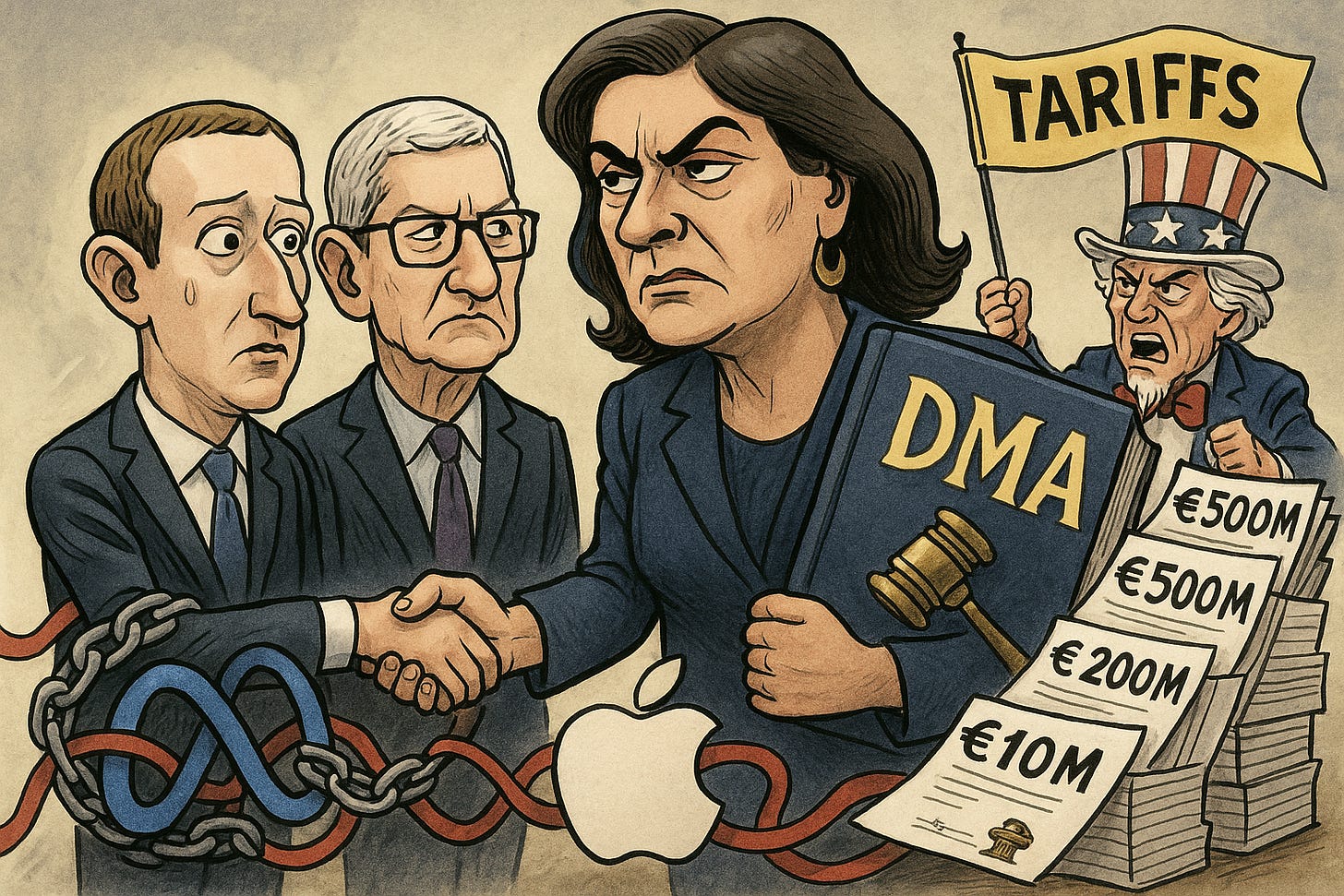

Big Tech faces billion-euro fines and stricter oversight as EU-U.S. tensions escalate over digital policy.🪙 Gold Breaks $4,000: The New Era of Monetary Sovereignty

Gold’s record surge reflects collapsing real yields, central bank buying, and eroding confidence in fiat stability.

🧠 One Big Thing

Gold has surged past $4,000/oz, up over 50% YTD — outpacing stocks, bonds, and even Bitcoin. The rally is fueled by falling real yields, record central bank buying, and rising distrust in the U.S. dollar. This isn’t a hype move — it’s a shift in global financial psychology.

💰 Money Move of the Day

Gold Isn’t Just a Trade — It’s a Role Player. When it comes to gold, think beyond price — consider its role. It doesn’t yield, but it can hedge inflation, diversify risk, and anchor a portfolio. Whether held via ETFs or physical bullion, its value lies in what it offsets, not just what it gains.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $122,909.75 (▲ +1.25%)

Ethereum (ETH): $4,491.94 (▲ +0.95%)

XRP: $2.88 (▲ +0.78%)

Equity Indices (Futures):

S&P 500 (SPX): 6,726.70 (▲ +0.13%)

NASDAQ 100: 25,078.50 (▲ +0.16%)

FTSE 100: 9,567.42 (▲ +0.78%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.102% (▼ -0.56%)

Oil (WTI): $62.75 (▲ +0.88%)

Gold: $4,036.87 (▲ +1.32%)

🕒 Data as of UK (BST): 12:47 / US (EST): 07:47 / Asia (Tokyo): 20:47

✅ 5 Things to Know Today

📉 UK Borrowing Cut by £2 Billion After HMRC Tax Error Discovery

The UK’s fiscal outlook saw a rare administrative reprieve after HM Revenue & Customs identified a significant error in VAT receipt data, prompting the Office for National Statistics to revise borrowing figures downward by £2 billion for the current fiscal year. The adjustment impacts data from January to August 2025, lowering borrowing estimates for the April-August period from £83.8 billion to £81.8 billion and reducing last year’s figures by an additional £1 billion. Despite this revision, the UK remains £9.4 billion over the Office for Budget Responsibility’s forecast and well above the initial £72.4 billion projection. The discrepancy stemmed from overstated monthly borrowing estimates—by £200–500 million—due to the faulty VAT data initially used in the September 19 public finance release (Bloomberg).

The correction was triggered when HMRC flagged the issue to the ONS, allowing statisticians to revise figures before the next official release on October 21. James Benford of the ONS credited HMRC’s swift action, while the total £3 billion downward revision across two fiscal years gives Chancellor Rachel Reeves limited—but welcome—relief ahead of her November 26 Budget. Reeves is under pressure to find £20–40 billion in fiscal adjustments amid elevated gilt yields and market anxiety about the UK’s fiscal credibility. The revision, though modest, emphasizes persistent quality control issues at UK agencies, compounding earlier inflation and retail data inaccuracies (Reuters) that have rattled investors.

Sensei’s Insight: An accidental win is still a win—yet even this £2 billion reprieve leaves Chancellor Reeves far short of the fiscal room she needs. Markets aren’t likely to overlook the mounting evidence of data fragility.

🤖 OpenAI and Nvidia Forge $1 Trillion AI Network, Sparking Bubble Fears

OpenAI has locked in over $1 trillion in computing deals with tech giants, forging a vast and unprecedented AI financing network. Its $500 billion pact with Nvidia, $300 billion with Oracle, $270 billion with AMD, and $22 billion with CoreWeave form a web of intertwined supply agreements and financial commitments. These arrangements have raised alarms from analysts who warn of “circular deals”—transactions where companies invest in and simultaneously buy from each other, potentially distorting market dynamics and investor perception.

The structure of these deals is drawing scrutiny for its self-reinforcing mechanics. Nvidia’s $100 billion investment includes the expectation that OpenAI will purchase chips for 10 gigawatts’ worth of data center power—comparable to the energy needs of a city. AMD’s agreement grants OpenAI warrants for up to 160 million shares, potentially giving it a 10% stake in the chipmaker, alongside a 6-gigawatt chip purchase. According to JPMorgan, AI-related debt now totals $1.2 trillion, making it the largest high-grade investment sector, surpassing banks. NewStreet Research calculates that every $10 billion Nvidia puts into OpenAI yields $35 billion in GPU purchases—over a quarter of Nvidia’s annual revenue. With OpenAI already burning through $2.5 billion in H1 2025 and Bain estimating the sector will need $2 trillion annually by 2030 but fall $800 billion short, investors are questioning whether this financial choreography reflects real growth or engineered demand.

Sensei’s Insight: When the same dollar changes hands in a circle, the illusion of prosperity can outpace its foundation.

💵 JPMorgan Forecasts $1.4 Trillion Stablecoin-Driven Dollar Surge by 2027

JPMorgan Chase analysts forecast that global stablecoin adoption will inject an additional $1.4 trillion into US dollar demand by 2027, a counterweight to fears of de-dollarization. The bank’s foreign exchange strategists base this on projected stablecoin market growth, noting that roughly 99% of stablecoins are pegged to the dollar or dollar-denominated assets. While internal projections vary between $500 billion and $2 trillion, JPMorgan emphasizes that this growth would stem from new dollar purchases by foreign corporates and households—not from a reshuffling of US bank deposits or money market funds (Reuters, Coin-Turk).

Stablecoin market capitalization currently sits between $250–300 billion, making the projected $1.4 trillion surge highly significant even as it remains below the Bank for International Settlements’ $8.6 trillion in daily USD trading volume. JPMorgan highlights that stablecoins are largely backed by US Treasury bills and money market instruments, thereby amplifying demand for short-term government debt. This structure reinforces the dollar’s primacy in global finance, particularly under emerging regulatory regimes such as the GENIUS Act, which would create a federal licensing pathway for stablecoin issuers (Bloomberg, JPMorgan). Still, rival forecasts—like Standard Chartered’s $2 trillion estimate by 2028—point to ongoing uncertainty around long-term adoption and stablecoins’ role beyond crypto trading (Reuters).

Sensei’s Insight: The debate over stablecoins isn’t just about crypto—it’s about who controls the pipes of global liquidity. JPMorgan’s analysis suggests these digital dollars may end up reinforcing, not replacing, America’s monetary dominance.

⚠️ BoE Warns of AI-Driven Tech Bubble Risk

The Bank of England’s Financial Policy Committee has issued a stark warning about a potential “sudden correction” in tech equity prices, citing the surge in investor optimism around artificial intelligence. In its latest quarterly financial stability report, the BoE highlighted that valuations for major tech stocks—especially those riding the AI wave—have reached levels not seen since the dotcom era. It flagged “stretched” valuations and growing concentration within major indices, suggesting markets are highly exposed should AI-related expectations falter. The Committee emphasized that such a downturn could pose a systemic risk, particularly due to the influence of a small group of companies dominating market indices like the S&P 500, which now sees its five largest firms accounting for 30% of its total value—the highest concentration in five decades (Bloomberg, Reuters).

Despite price-to-earnings ratios being extremely elevated, valuations may still appear justified to investors banking on robust future profits. However, the BoE cautioned that real-world bottlenecks—like energy and data shortages or sluggish AI adoption—could swiftly derail growth projections. For retail investors, this signals significant vulnerability, particularly as tech-heavy portfolios remain susceptible to sentiment-driven sell-offs. The Bank also warned of “material” spillover risks to the UK, as British borrowing costs often mirror shifts in U.S. Treasury yields, deepening exposure to a global AI valuation reset (Sky News, Independent).

Sensei’s Insight: As AI hype drives markets to historic concentration levels, even a modest shake in investor confidence could unleash outsized ripple effects.

🇪🇺Meta and Apple Near EU Settlement Deal as Big Tech Faces Brussels Pressure

Meta and Apple are reportedly in the final stages of settlement negotiations with the European Commission to resolve multiple high-profile antitrust cases, potentially ending a wave of regulatory actions that have already resulted in €700 million in fines under the EU’s Digital Markets Act (DMA) (FT, MarketScreener). Apple was fined €500 million in April 2025 for breaching anti-steering rules that prevented app developers from directing users to alternative payment options outside the App Store (Reuters). Meta, meanwhile, was hit with a €200 million penalty for its “consent or pay” ad model, which regulators say pressured users into accepting targeted ads or paying subscription fees (Reuters). Both firms are challenging the penalties—Apple through a series of appeals, and Meta by arguing the process violated its right to defense (NatLawReview).

These negotiations are unfolding amid growing U.S.-EU friction over digital policy. The Trump administration has called the EU’s fines a “novel form of economic extortion” and floated retaliatory tariffs targeting countries that “disadvantage” American firms (SiliconRepublic). In response, EU Competition Chief Teresa Ribera warned that the bloc may walk away from trade negotiations with the U.S. rather than weaken the DMA (Computing). The regulatory divergence underscores a growing transatlantic rift: Europe’s precautionary digital rules now stand in direct opposition to America’s harm-based framework. These potential settlements could shape the blueprint for Big Tech’s future compliance strategy—either by establishing cooperative models or triggering continued litigation and fines that could reach up to 10% of global annual revenue for repeat violations (Noerr).

Sensei’s Insight: With penalties reaching up to 10% of global annual revenue for repeat offenders, these settlements are more than just legal housekeeping—they’re a strategic pivot in how tech giants engage with EU regulators under a rapidly evolving digital rulebook.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive — The Great Gold Rush: Why $4,000 Is Just the Beginning

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.