Sensei’s Morning Forecast: Apple’s $100B Pivot, Ripple vs SEC , Circle's Risky Run

From Circle’s valuation recalibration and Ripple’s deadline to tariffs reshaping trade, Apple’s manufacturing push, Trump‑Putin diplomacy, and crypto’s 401(k) revolution—all set to move markets.

🧠 One Big Thing

$600 billion. That’s Apple’s total domestic investment commitment after its new $100B pledge—more than the GDP of Sweden. The number marks a historic reshoring shift driven by Trump's aggressive tariff policies.

💰 Money Move of the Day

Watch where the giants build. Apple’s $600B domestic investment signals a powerful reshoring wave—investors should explore U.S.-based semiconductor, AI infrastructure, and advanced manufacturing ETFs poised to benefit from this mega-shift.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $116,787 (▲ +1.57%)

Ethereum (ETH): $3,817 (▲ +3.64%)

XRP: $3.08 (▲ +3.13%)

Equity Indices (Futures):

S&P 500 (SPX): 6,388 (▲ +0.67%)

NASDAQ 100: 23,618 (▲ +0.83%)

FTSE 100: 9,104 (▼ -0.46%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.242% (▲ +0.24%)

Oil (WTI): $65.22 (▲ +0.58%)

Gold: $3,381 (▲ +0.38%)

🕒 Data as of UK (BST): 12:28 / US (EST): 07:28 / Asia (Tokyo): 20:28

✅ 5 Things to Know Today

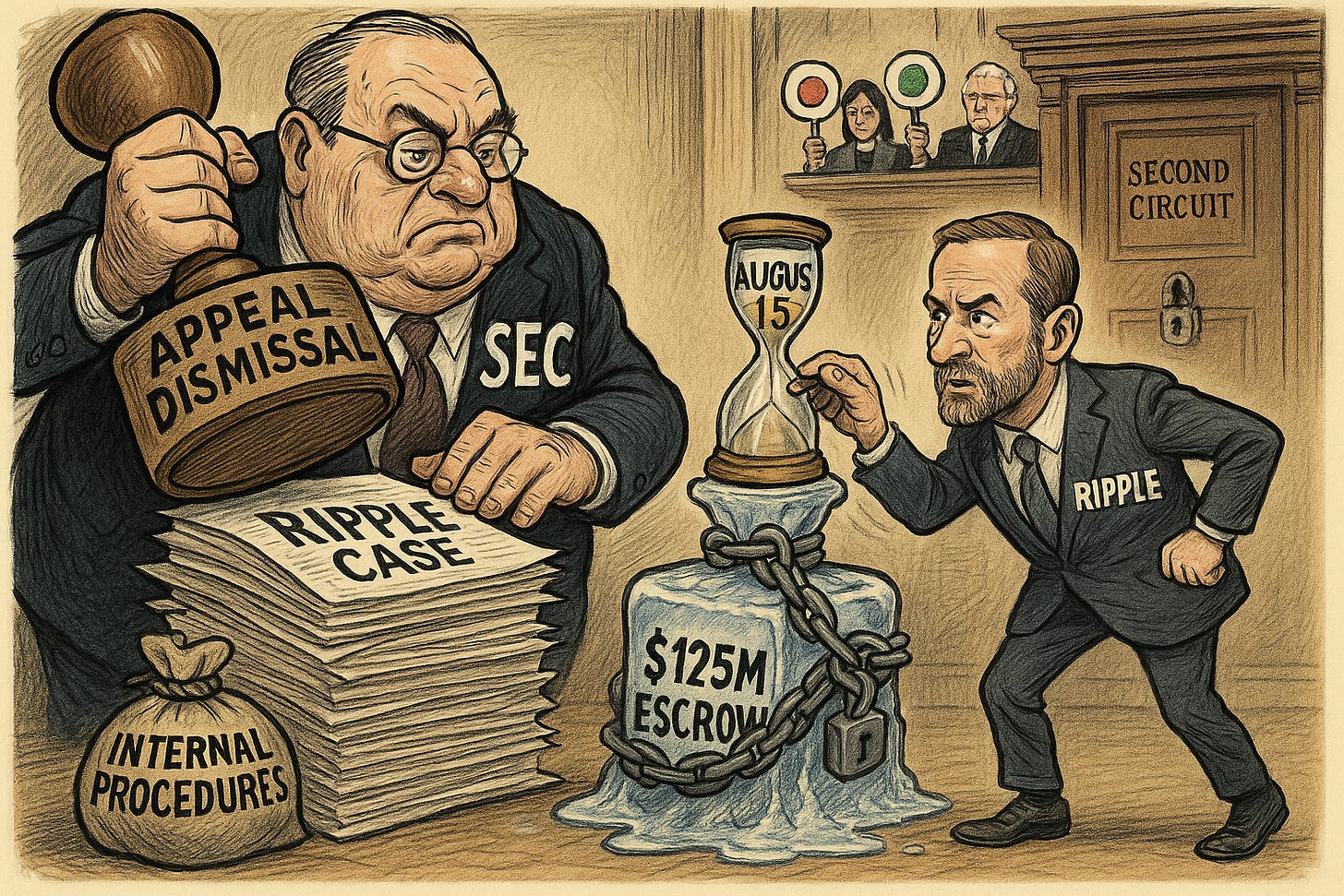

📝 SEC vs Ripple: Critical Vote and August 15 Deadline Approach

The SEC is set to hold a closed-door meeting today, August 7, to potentially vote on dismissing its appeal in the high-profile Ripple case, as attention turns to the looming August 15 deadline. Legal analysts say it's "more likely than not" that the SEC will withdraw its appeal before that date. This comes after Ripple dropped its own cross-appeal in June and placed the agreed $125 million penalty in escrow. Despite these steps, the case has remained technically active due to internal procedural requirements. Former SEC attorney Marc Fagel explained that the agency must secure commissioner approval before filing a dismissal, causing the delay (Coinpedia, AInvest, FXLeaders, BeInCrypto).

The August 15 date is not a final resolution but a mandated status update deadline with the Second Circuit Court of Appeals. Both parties must submit a joint report on their positions, which could force the SEC to show its hand. The $125 million remains frozen in escrow and cannot be transferred to the U.S. Treasury until all appeals are withdrawn. Analysts emphasize the delay is due to internal SEC voting rather than disagreement over settlement terms (Mitrade, TheCurrencyAnalytics, TheCurrencyAnalytics).

Sensei’s Insight: Institutional eyes are watching closely. If the SEC drops the case, XRP may finally escape its regulatory shadow—clearing a path toward broader U.S. integration, ETF potential, and renewed institutional traction.

🍎 Apple Commits $100B to U.S. Manufacturing Amid New Tariff Policy

Apple CEO Tim Cook stood beside President Trump at the White House to unveil a new $100 billion U.S. investment pledge, raising the company's total domestic commitment to $600 billion over four years. The announcement coincided with Trump introducing a 100% tariff on imported semiconductors, with exemptions for companies investing in U.S. manufacturing. The new initiative—Apple’s American Manufacturing Program—includes $2.5 billion to expand Corning’s Kentucky glass plant and ensures all iPhone and Apple Watch glass will be made domestically. It also establishes new supply agreements with Coherent for Face ID laser components and strengthens chip manufacturing operations across Texas, Arizona, and New York. Apple shares surged 5.1% to $213.25 following the announcement (Reuters, CNBC, Time, Yahoo Finance).

The move is widely seen as a tactical shield against mounting tariff pressure—Apple absorbed $800 million in tariff costs last quarter and is bracing for another $1.1 billion this quarter. Though the commitment earns Apple a tariff carveout, analysts remain skeptical about large-scale iPhone manufacturing in the U.S. due to cost barriers: a domestically produced iPhone could cost $3,000–$3,500, compared to the current $999–$1,599 range (Bloomberg, Mashable, CNBC). Still, the announcement underscores the effectiveness of tariff threats in steering tech giants toward domestic investment, even as the long-term feasibility of reshoring high-end electronics remains unresolved.

Sensei’s Insight: This isn’t just Apple hedging its bets—it’s Trump’s tariff policy bending Silicon Valley’s biggest player into a made-in-America pledge. Expect ripple effects across the tech supply chain.

🇺🇸 Trump's Sweeping Tariffs Take Effect in Historic Global Trade Test

President Donald Trump’s aggressive new tariff regime launched at 12:01 AM on Thursday, August 7, imposing duties of 10% to 50% on imports from nearly 70 countries. The sweeping action raises the average U.S. tariff rate from 2.3% in 2024 to 15.2%, the highest level since World War II, according to Bloomberg Economics. Brazil and India now face 50% tariffs, Canada 35%, while the EU, Japan, and South Korea secured reduced rates of 15% (CNN, Reuters). Mexico was granted a 90-day delay, and China reached a short-term truce until August 12, which could see its rates revert to 30% (ABC News).

Economic fallout is already emerging: prices for home furnishings rose 1.3% in June—the largest increase since March 2022—while recreational goods and vehicles jumped 0.9%. Trump also announced forthcoming tariffs on pharmaceuticals (up to 250%) and semiconductors (100%), signaling continued escalation (Yahoo Finance). Wall Street firms like Morgan Stanley and Evercore are warning of market pullbacks, while modeling suggests a 1% hit to U.S. GDP and a 1.4% drop in real wages (CEPR). Sectors heavily reliant on imports face immediate challenges: Starbucks, for example, is weighing price hikes in response to the 50% tariff on Brazilian coffee (China Daily).

Sensei’s Insight: This is the most consequential trade pivot in modern U.S. history. Inflation, wages, and global supply chains just entered a new volatility regime.

🇷🇺 Trump-Putin Summit Confirmed Amid Ceasefire Push

The Kremlin confirmed that U.S. President Donald Trump and Russian President Vladimir Putin will meet "in the coming days," following three hours of talks in Moscow between Putin and Trump's special envoy Steve Witkoff. The meeting—still without a confirmed date or location—aims to secure a Ukraine ceasefire before Trump’s August 8 deadline. Trump called the talks “great progress” and is also eyeing a follow-up trilateral summit with Ukrainian President Volodymyr Zelenskyy, although Russia has historically resisted such formats (ABC News, Times of India, Politico, Reuters).

This will be the first in-person meeting between Trump and Putin since Trump’s return to office in January, following heightened tensions and renewed sanctions threats. The summit holds major implications for markets, particularly energy and defense. Trump’s warning of 100% secondary tariffs on nations trading with Russia—especially India and China—could reshape oil flows and impact commodity prices. Russia accounts for roughly 10% of global oil production, and any disruption could ripple through supply chains and affect emerging market currencies tied to Russian trade. Investors are watching closely to determine whether the summit signals meaningful diplomatic momentum or calculated optics (Al Jazeera, BBC).

Sensei’s Insight: Tariffs, oil, and diplomacy are converging fast. Watch the energy tickers—they’ll speak first if this meeting moves the needle.

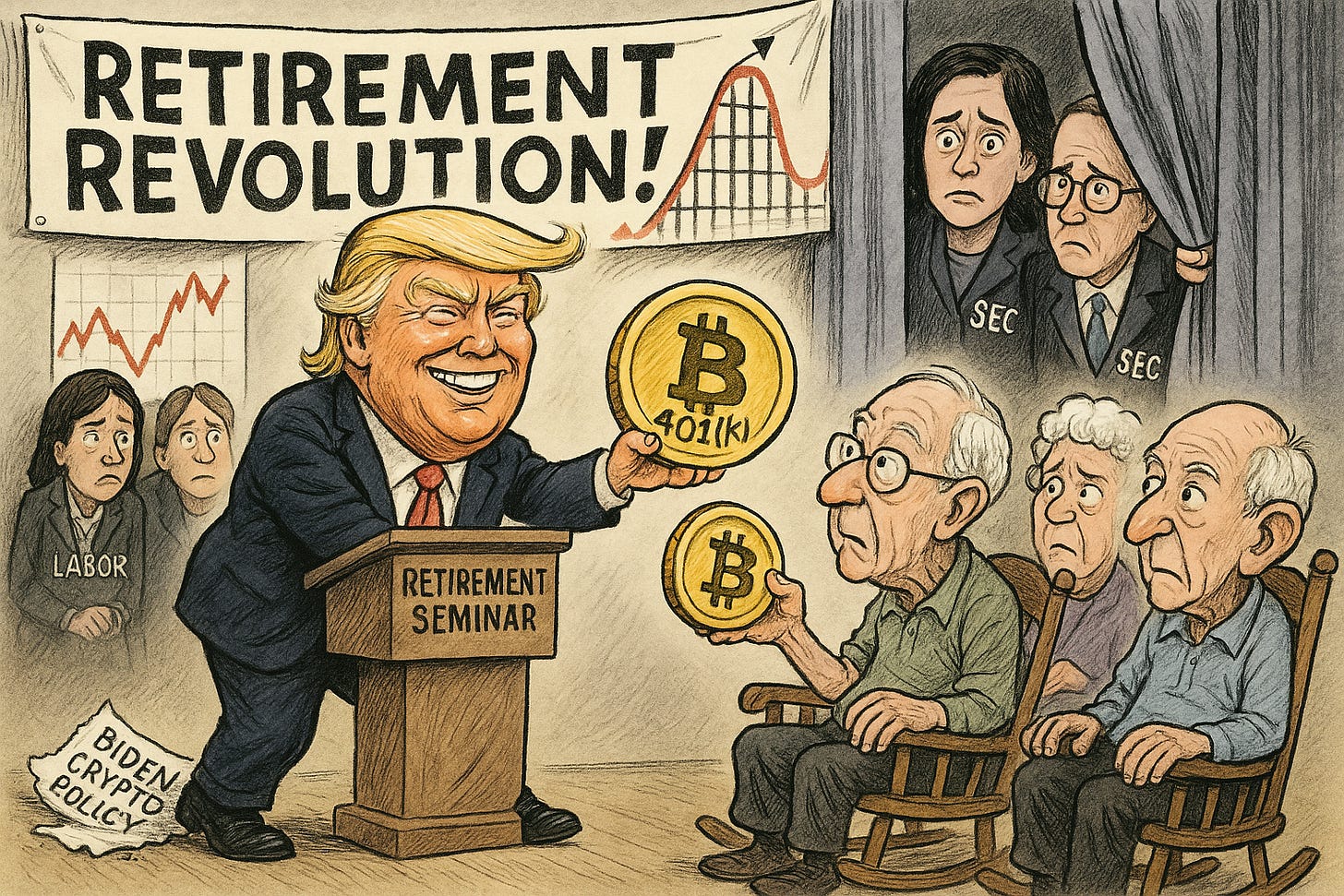

🇺🇸 Trump Executive Order Opens 401(k) Market to Crypto

President Donald Trump is signing an executive order directing the Department of Labor to ease restrictions that have historically barred alternative assets—such as cryptocurrency, private equity, and real estate—from being included in 401(k) retirement plans. The directive tasks Labor Secretary Lori Chavez-DeRemer with collaborating alongside the Treasury Department and SEC to issue new guidance for plan sponsors across the $12.5 trillion retirement sector. Bitcoin responded modestly, trading near $115,000 within a $110,000–$116,000 band (CryptoBriefing), (CoinDesk), (New York Post), (YCharts).

The move reverses Biden-era policies that discouraged crypto investments in retirement accounts and builds on Trump’s 2020-era Labor Department letter that enabled alternative assets in target-date funds. Major asset managers—BlackRock, Apollo Global Management, and State Street—are positioned to launch private market products quickly pending regulatory clearance. The order also follows the Department of Labor’s May decision to rescind a 2022 warning against crypto in retirement plans (WSJ), (PlanSponsor), (Mayer Brown). Despite potential execution challenges under ERISA, the policy shift may unlock vast institutional flows into crypto, echoing momentum from recent congressional moves supporting digital assets (Bloomberg), (Reuters).

Sensei’s Insight: Trump’s pivot could redefine the future of retirement planning, positioning crypto as a normalized investment vehicle in one of the world’s largest financial ecosystems.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

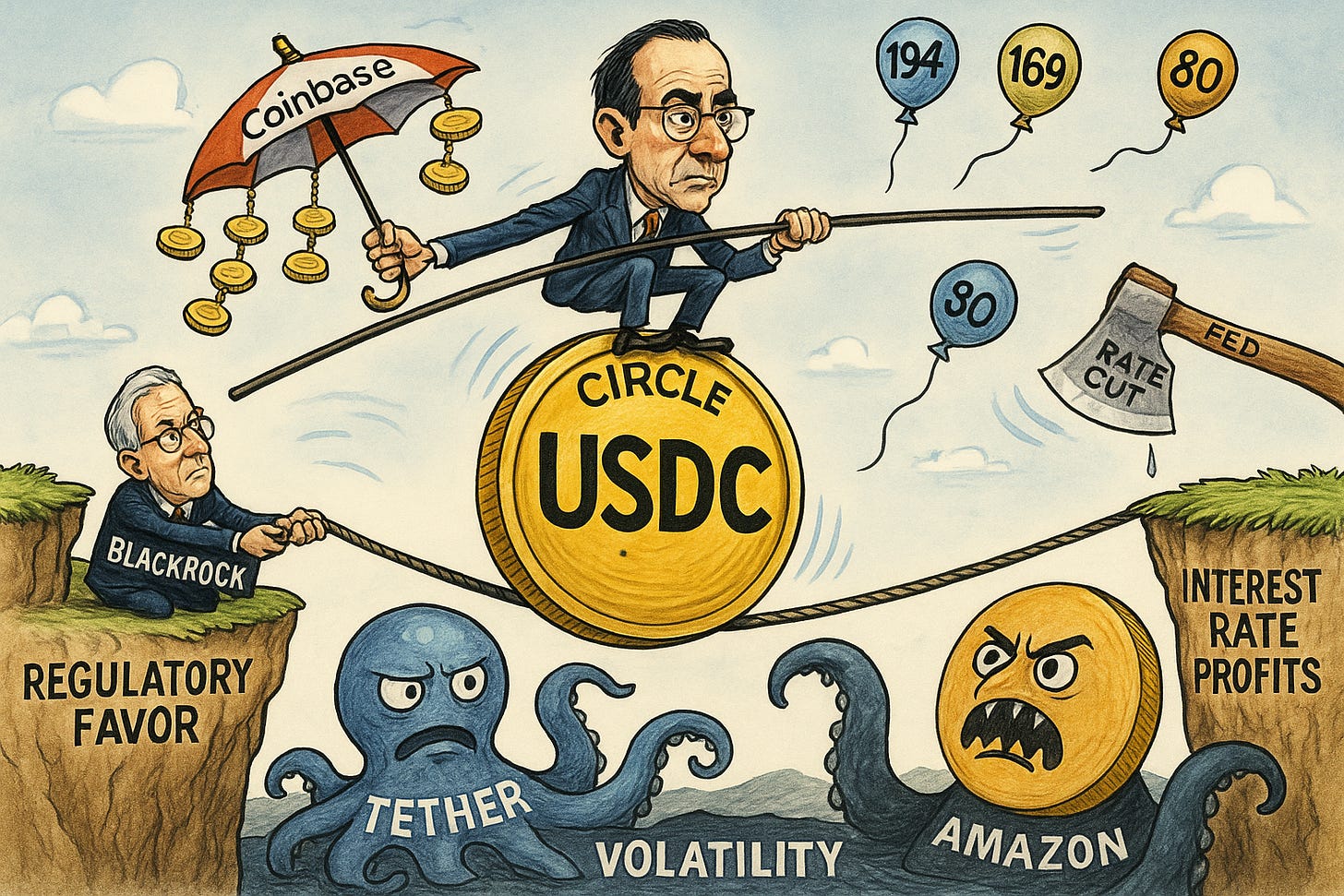

🔍 Deeper Dive: 2 months in - Circle Internet Group (CRCL) Financial Analysis

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.