Sensei’s Morning Forecast: Bank Panic Returns—Is It Just Fear or a Warning? And Why Is the IMF Warning About Asia?

Bank fraud fears return, FTSE sinks, Trump plans Putin summit, IMF warns on China, dollar weakens, BoE turns cautious, and Ripple makes $1B treasury power play.

👀 Today’s Stories at a Glance

📉 FTSE 100 slides 2.5% as U.S. regional bank fears trigger global selloff, hitting financial stocks hardest.

🤝 Trump plans second Putin summit in Hungary, shaking defense and energy markets with renewed peace talk hopes.

🌏 IMF warns U.S.–China tensions could drag Asia’s growth to 4.1% by 2026, threatening global trade flows.

💵 Dollar posts steepest weekly loss since July as weak data and Fed cut bets pressure the greenback.

🏛️ BoE’s Pill signals slower UK rate cuts, citing inflation risks—markets may need to reset easing expectations.

💼 Ripple makes a $1B move into the $120T corporate treasury market with GTreasury acquisition, expanding blockchain finance reach.

🔍 Regional banks rattled markets as fraud-related loan losses from Zions and Western Alliance reignited credit quality fears.

🧠 One Big Thing

The IMF just flagged U.S.–China tensions as a major threat to global growth. If tariffs or tech curbs escalate, Asia’s economic engine could slow sharply—falling from 4.6% in 2024 to 4.1% by 2026. That’s a big deal for markets exposed to semiconductors, supply chains, and export demand. The message: geopolitics is no longer background noise—it’s moving the macro.

💰 Money Move of the Day

Global risk-off signals—like the IMF’s trade warnings—can sometimes create mispriced fear in cyclical sectors. For example, export-heavy ETFs or Asia-focused industrials may dip on sentiment, not fundamentals. Watching their price action into earnings season could help spot opportunities or risk pivots. Always cross-reference with volume and macro updates before acting.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $104,117.80 (▼ -3.82%)

Ethereum (ETH): $3,689.73 (▼ -5.31%)

XRP: $2.20 (▼ -5.53%)

Equity Indices (Futures):

S&P 500: 6,561.20 (▼ -0.87%)

NASDAQ 100: 24,502.75 (▼ -1.32%)

FTSE 100: 9,313.30 (▼ -0.67%)

Commodities & Bonds:

10-Year US Treasury Yield: 3.949% (▼ -0.65%)

Oil (WTI): $56.89 (▼ -0.87%)

Gold: $4,337.70 (▲ +0.26%)

Silver: $53.98 (▼ -0.34%)

🕒 Data as of UK (BST): 11:30 / US (EST): 06:30 / Asia (Tokyo): 19:30

✅ 5 Things to Know Today + Bonus Story

📉 FTSE 100 Slides 2.5% This Week as U.S. Bank Jitters Spark Global Selloff

The FTSE 100 has fallen 2.5% over the past three sessions, marking its sharpest weekly decline since April’s tariff turmoil, as renewed concerns over U.S. regional lenders rippled through global markets (Bloomberg). Financial stocks led the slide, with Barclays down nearly 6%, NatWest off 3%, and Intermediate Capital Group dropping 7%, reflecting broader unease about credit quality and exposure to corporate loans (Evening Standard). The selloff was triggered by disappointing updates from U.S. regionals — Zions Bancorp disclosed a $50 million write-off tied to commercial real estate loans, while Western Alliance filed a fraud-related lawsuit against a defaulting borrower (Financial Times). The KBW Regional Bank Index plunged 6.3%, its worst performance since the 2023 banking crisis, reigniting fears of broader loan stress. Safe-haven demand surged, with gold topping $4,360/oz and U.S. 10-year Treasury yields sliding toward 3.4% (AP News).

The slump highlights how credit risk is again driving global sentiment, displacing rate expectations as the dominant market narrative. The Stoxx 600 Banks Index is down nearly 3% this week, with analysts warning that rising U.S. loan-loss provisions could pressure European lenders next (MarketScreener). Traders have shifted into defensives and short-dated bonds as volatility spikes to six-month highs, while expectations grow that central banks may have to pause tightening sooner if financial stability risks spread (Business Insider). For now, contagion remains localized — but with earnings season ahead, loan books across regional and mid-tier lenders are under the microscope.

Sensei’s Insight: This week’s selloff shows how hidden credit risks can resurface suddenly. Watch bank earnings and loan-loss trends — they’re the new pulse of market volatility.

🤝 Trump Plans Second Putin Summit to Revive Ukraine Peace Talks

U.S. President Donald Trump said he plans to meet Russian President Vladimir Putin again “within two weeks,” following what he described as a “productive” phone call between the two leaders (Reuters). The meeting is expected to take place in Budapest, Hungary, with Prime Minister Viktor Orbán offering to host and facilitate the talks. Trump’s team confirmed that U.S. Secretary of State Marco Rubio and Russian Foreign Minister Sergey Lavrov will coordinate summit logistics and a draft framework for renewed Ukraine negotiations (Reuters). The planned summit follows their previous August meeting in Alaska, which ended without agreement on ceasefire terms. Trump said the goal this time is to “bring this inglorious war to an end,” calling for a “real peace, not paperwork.” (Bloomberg)

The announcement rattled European defense and energy markets, with the Stoxx Europe Aerospace & Defense Index down 3.4% as traders reassessed expectations for long-term defense budgets (Reuters). Brent crude and WTI both eased around 0.1% intraday, extending a nearly 3% weekly slide, as optimism over potential de-escalation pressured the geopolitical risk premium. Analysts noted that while investors are unlikely to fully price in peace without tangible progress, any formal commitment from Washington or Moscow could shift capital flows away from defense and into risk assets. The ruble also strengthened modestly against the dollar, reflecting speculation that sanctions relief could enter the discussion.

Sensei’s Insight: Geopolitical risk premia drive major asset classes. Even talk of détente can move defense, oil, and FX markets—proof that headlines still trade faster than treaties.

🌏 IMF Warns of “Significant Downside Risks” as U.S.–China Tensions Escalate

The International Monetary Fund (IMF) warned that renewed trade frictions between the U.S. and China pose “significant downside risks” to global growth, particularly if they lead to higher tariffs or supply-chain disruptions (Reuters). Krishna Srinivasan, Director of the IMF’s Asia and Pacific Department, said at the Fund’s annual meetings in Washington that if those risks materialize, economic activity could fall “meaningfully below current forecasts.” The IMF expects Asia’s GDP growth to slow to 4.5% in 2025 from 4.6% in 2024, and further to 4.1% in 2026, citing a combination of weaker exports, tighter financial conditions, and trade uncertainty. The Fund maintained its global growth outlook at 3.2% for 2025 but stressed that the forecast assumes no further escalation in tariffs or technology restrictions (Reuters).

For investors, the IMF’s comments reinforce that policy-driven trade shocks remain a live risk. Asia’s deep integration into global manufacturing and semiconductor supply chains leaves it especially exposed to geopolitical friction and export curbs (Business Standard). Equity markets across the region, particularly in South Korea, Taiwan, and Japan, could face renewed pressure if sentiment toward export-oriented sectors weakens. Meanwhile, any slowdown in Asia’s growth engine may spill over into global commodities and corporate earnings, with implications for cyclical assets and multinational revenue forecasts.

Sensei’s Insight: Trade frictions now rival rates as a market risk driver. Watch export-heavy equities and supply-chain data—they’ll be the first to signal whether policy tension becomes market contagion.

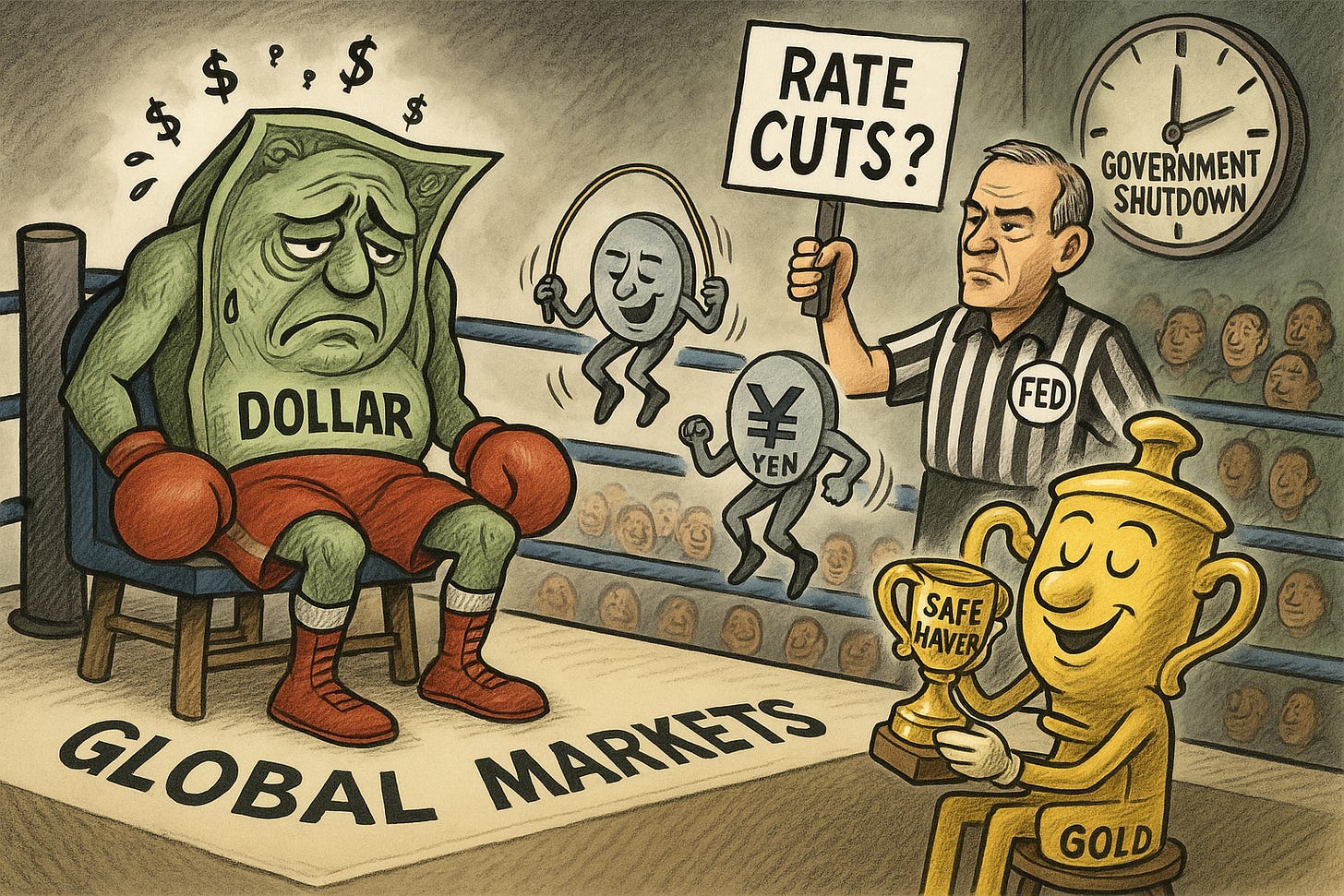

💵 Dollar Poised for Sharpest Weekly Decline Since July

The U.S. dollar index (.DXY) is sliding toward its largest weekly drop in nearly three months, falling 0.7% this week amid weak economic data, trade tensions, and a looming U.S. government shutdown (Reuters). The index currently sits near 98.19, down ~0.1% on the day, as markets ramp up expectations for at least one or more Fed rate cuts in 2025. (Reuters) The dollar is under pressure against major peers: the yen and euro have gained on renewed risk appetite, while safe-haven bids into gold and other non-dollar assets are picking up.

This slide matters because it alters the backdrop for global capital flows, commodities, and emerging markets. A weaker dollar can boost U.S. exports and relieve import pressure for other countries, but it may also stoke inflationary pressures globally. Commodity prices may get a lift, while yield harvesting and currency carry trades could see rotations into higher-beta currencies. For U.S. investors, offshore equity and bond exposures may benefit from translation effects, but those betting on the dollar as a “safe currency” will see that narrative tested further.

Sensei’s Insight: The dollar’s weakness is now a market mover—not just a backdrop. Watch Fed signals, positioning flows, and commodity FX cross moves for early clues on whether this is a correction or structural trend.

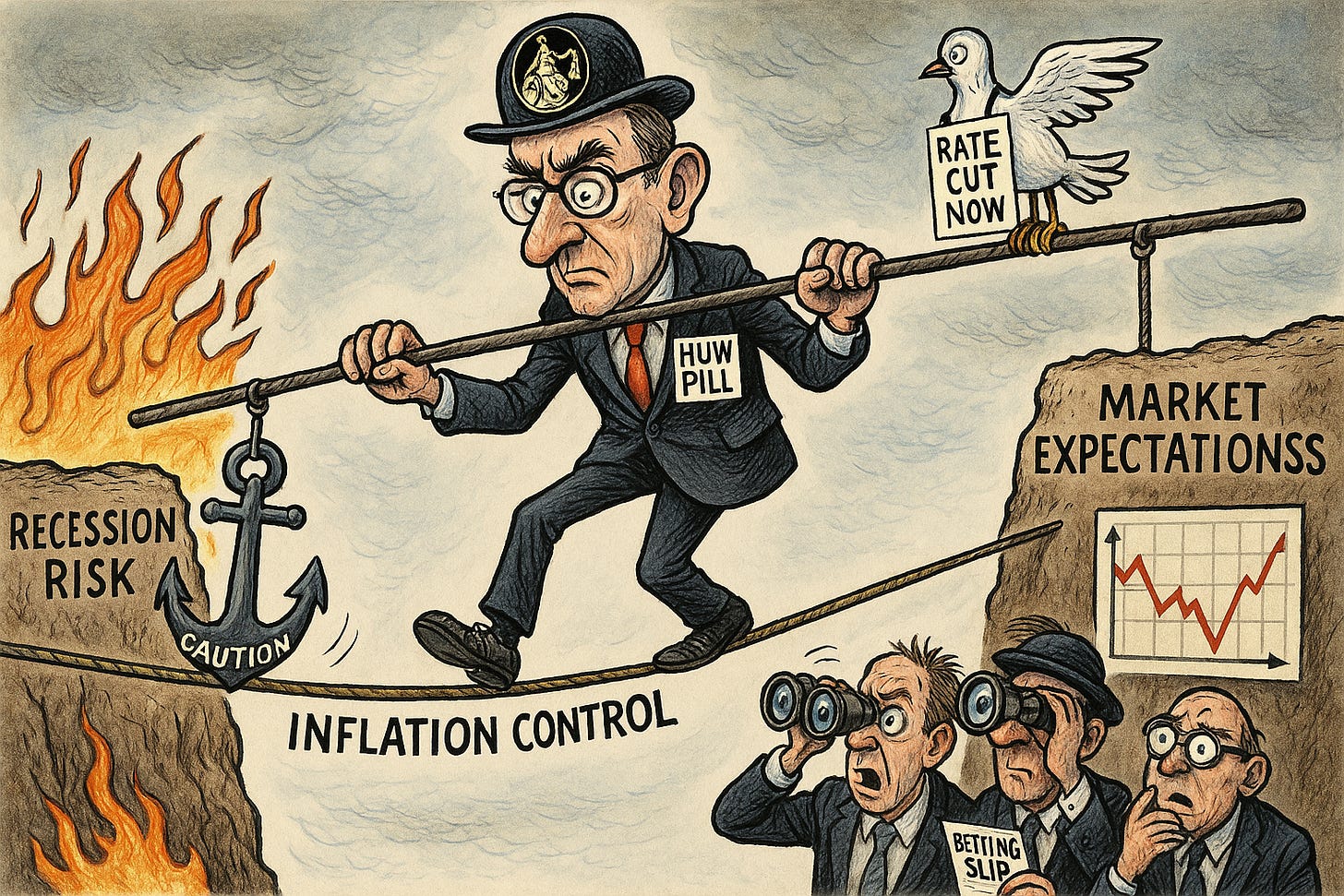

🏛️ BoE’s Pill Urges Caution, Advocates Slower Rate Cut Pace

Bank of England Chief Economist Huw Pill has called for a more measured approach to policy easing, warning that recent rate cuts may be moving too quickly amid persistent inflation pressures. Speaking to the Institute of Chartered Accountants in England and Wales, he underscored the importance of maintaining monetary discipline and being ready to act if price growth overshoots expectations. Pill has long been cautious: he voted against the BoE’s August cut to 4.0% and described aggressive quarterly reductions as risky given structural inflation dynamics. (Reuters) He views a pause or slower cadence not as a reversal but a tactical adjustment to ensure inflation remains anchored.

Markets have interpreted his remarks as a signal that the next BoE move could be more gradual than currently priced. Investors had been leaning toward a rate cut as early as February 2026; Pill’s caution suggests that could be pulled later if inflation surprises to the upside. His stance aligns with broader MPC hawkish sentiment, underscoring that while further easing is not off the table, its timing and magnitude will be highly data dependent. The pound may find stronger support on each dip, and UK gilt markets could experience flattening pressure if policymakers lean toward patience.

Sensei’s Insight: With Pill’s cautious tone, rate cuts in the UK may turn into a waiting game—volatility and yield curve shifts will be your earliest signals.

💼 Ripple Enters $120T Corporate Treasury Market With $1B GTreasury Bet

Ripple has acquired GTreasury for $1 billion, marking its third major deal of 2025 and signaling a direct move into the $120 trillion corporate treasury market. The Chicago-based treasury platform serves more than 1,000 corporate clients in 160 countries—including American Airlines, Goodyear, Volvo, and Goldman Sachs—and processes $12.5 trillion in annual payments volume across 48 million transactions. This acquisition follows Ripple’s $1.25 billion Hidden Roadpurchase in April and $200 million Rail acquisition in August, bringing its 2025 M&A total to $2.45 billion. Ripple aims to unify traditional treasury functions with crypto-native tools, enabling CFOs to manage assets like RLUSD, which now exceeds $840 million in supply, alongside tokenized deposits and fiat liquidity.

The combined Ripple-GTreasury platform will provide institutional treasurers with 24/7 cross-border payments and access to repo markets through Hidden Road’s prime brokerage, unlocking yield opportunities on idle capital. Ripple CEO Brad Garlinghouse framed the acquisition as a remedy to outdated infrastructure slowing global commerce, while GTreasury CEO Renaat Ver Eecke called the deal a “watershed moment” that shifts treasury management “from managing capital to activating it.” The move also escalates Ripple’s competition with legacy treasury software providers by offering blockchain-enabled liquidity tools and real-time settlement infrastructure under one roof.

For XRP holders, the deal materially expands the token’s utility through deeper institutional distribution. Ripple’s On-Demand Liquidity (ODL) service—using XRP as a bridge asset—will now have potential access to GTreasury’s $12.5 trillion annual payments flow. As CFOs seek to streamline foreign exchange and optimize working capital, even modest ODL adoption by GTreasury’s Fortune 500 clientele could meaningfully boost XRP’s on-chain velocity and institutional relevance. The acquisition affirms Ripple’s broader pivot from crypto-native player to enterprise financial infrastructure provider, positioning XRP not as a speculative asset, but as a high-throughput liquidity rail for cross-border transactions.

Sensei’s insight: Ripple is building TradFi plumbing with blockchain rails, and GTreasury’s Fortune 500 client base could finally channel real enterprise payment volume through XRP, delivering the institutional utility thesis bulls have waited years to materialize.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive: Are Regional Banks in Trouble Again?

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.