Sensei’s Morning Forecast: Bullish Crypto Exchange IPO Eyes $4.2B as Bitcoin Nears Record

Bullish IPO tests institutional crypto; Bitcoin nears ATH; US taxes China chip sales; Trump sparks cannabis rally; Europe asserts in Putin talks; Martyn Lucas milestone honored.

🧠 One Big Thing

Nvidia and AMD will now send 15% of their China AI chip sales revenue straight to the U.S. Treasury in exchange for export licenses—marking the first time Washington has taken a direct cut of overseas tech sales.

💰 Money Move of the Day

Bullish, the Peter Thiel-backed institutional crypto exchange, is targeting a $4.2B valuation in its U.S. IPO—potentially the biggest crypto listing since Coinbase. When a high-profile IPO drops—especially in a hot sector—watch how it trades in its first week. Price action often reveals more about market sentiment than any pre-listing hype.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $120,848 (▲ +1.28%)

Ethereum (ETH): $4,217 (▼ -0.82%)

XRP: $3.2445 (▲ +1.78%)

Equity Indices (Futures):

S&P 500 (SPX): 6,399 (▼ -0.02%)

NASDAQ 100: 23,732 (▲ +0.07%)

FTSE 100: 9,120 (▲ +0.28%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.269% (▼ -0.37%)

Oil (WTI): $64.41 (▲ +0.94%)

Gold: $3,353 (▼ -1.34%)

🕒 Data as of UK (BST): 12:18 / US (EST): 07:18 / Asia (Tokyo): 20:18

✅ 5 Things to Know Today

🎵 15 Years On – Martyn Lucas’ Sawmills Album Still Resonates

Fifteen years ago today, Martyn Lucas released his landmark album, recorded at the legendary Sawmills Studio in Cornwall — a creative home to artists such as Oasis, The Verve, Muse, and Robert Plant. Known for its distinctive atmosphere that has inspired some of the UK’s biggest acts, the studio provided the perfect setting for Martyn’s powerful piano and vocal performances, honed through years of touring across the UK and around the world.

In the years that followed, Martyn’s music career would earn him the title of “World Piano Man” from Elton John, alongside tours across multiple continents. Today, many know him as the voice of Martyn Lucas Investor, his fast-growing trading and investing channel, but he continues to perform on his Martyn Lucas music channel — keeping alive the creative spark captured in those Sawmills sessions 15 years ago.

🎧 Relive the Album – You can listen to the original recording here on YouTube Music. Martyn’s music channel runs live shows every week, and he’s currently on a mission to reach 10,000 subscribers so YouTube can unlock charitable fundraising tools. If you haven’t already, head over, subscribe, and be part of the journey.

🇺🇸 Nvidia, AMD Agree to Pay 15% of China AI Chip Sales to US Government

Chipmaking giants Nvidia and AMD have struck an unprecedented deal to remit 15% of their revenue from artificial intelligence chip sales to China directly to the US government in exchange for export licenses (Reuters, BBC). The agreement covers Nvidia’s H20 chips and AMD’s MI308 processors, both designed for the Chinese market under tightened export restrictions. This marks the first instance of US companies engaging in revenue-sharing with Washington as a condition for overseas market access. The arrangement followed an August 6 White House meeting between Nvidia CEO Jensen Huang and President Trump, with export licenses issued just two days later. Nvidia had been barred from selling H20 chips to China since April 2025—costing $4.6 billion in first-quarter sales and prompting a $4.5 billion inventory writedown—while AMD faced an $800 million hit from halted MI308 sales (Yahoo Finance, Al Jazeera).

The US has not disclosed how it will use the collected funds, but analysts project over $2 billion in annual Treasury revenue from the scheme (Fox Business). China remains a critical market—Nvidia generated $17 billion there in fiscal 2024 (13% of total sales) and AMD $6.2 billion (24%). The deal raises questions about whether export controls are driven by national security or economic leverage, with critics warning it could undermine the credibility of US policy and hasten China’s push for domestic chip alternatives (CNBC, Techzine).

Sensei’s Insight: A 15% cut may buy US companies a ticket back into China, but it’s also a loud signal—Washington is willing to tax tech exports as much as restrict them. In the long game, that might push China to play without foreign chips entirely.

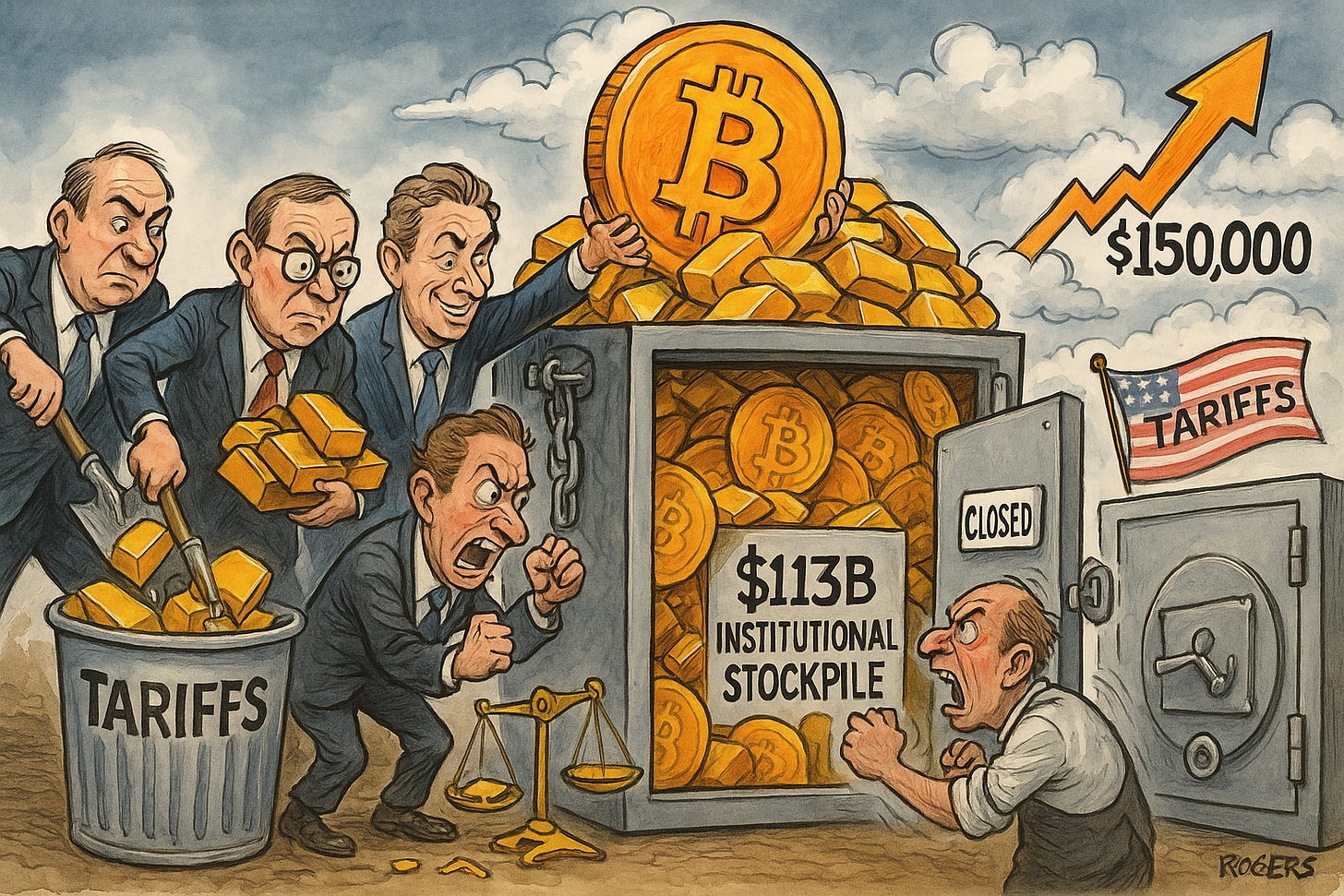

💰 Bitcoin Nears Record as Corporate Treasuries Drive $113B Institutional Stockpile

Bitcoin rose to $122,000 on Monday, coming within striking distance of its all-time high of $123,205 set in mid-July, as institutional demand from corporate treasury buyers lifted the broader cryptocurrency market (Finance Magnates, GuruFocus, NDTV Profit). Ethereum climbed above $4,300, its highest level since December 2021. Digital-asset treasury companies now hold $113B worth of Bitcoin and $13B in Ethereum tokens (CoinGecko), fueled by steady inflows into U.S. spot ETFs and a shift in sentiment following U.S. tariffs on imported gold bars (CNN, Bloomberg). Analysts say these tariffs enhance Bitcoin’s appeal as a “borderless, tariff-free store of value.”

Corporate treasury adoption has surged, with companies adding 107,082 BTC in July alone—valued at $428B across tracked entities (AInvest). Gold market disruptions could further cement Bitcoin’s role as a digital store of value, especially amid supply chain issues and policy uncertainty (Independent). New Bitcoin addresses hit a one-year high of 364,126 daily, and derivatives markets remain heavily skewed toward bullish September and December calls, with analyst targets of $130,000 to $150,000 in the months ahead (CoinCentral, Euronews).

Sensei’s Insight: When gold gets taxed, Bitcoin smiles. Institutional treasuries are stacking sats at a historic pace, and the price ceiling might soon feel like a floor.

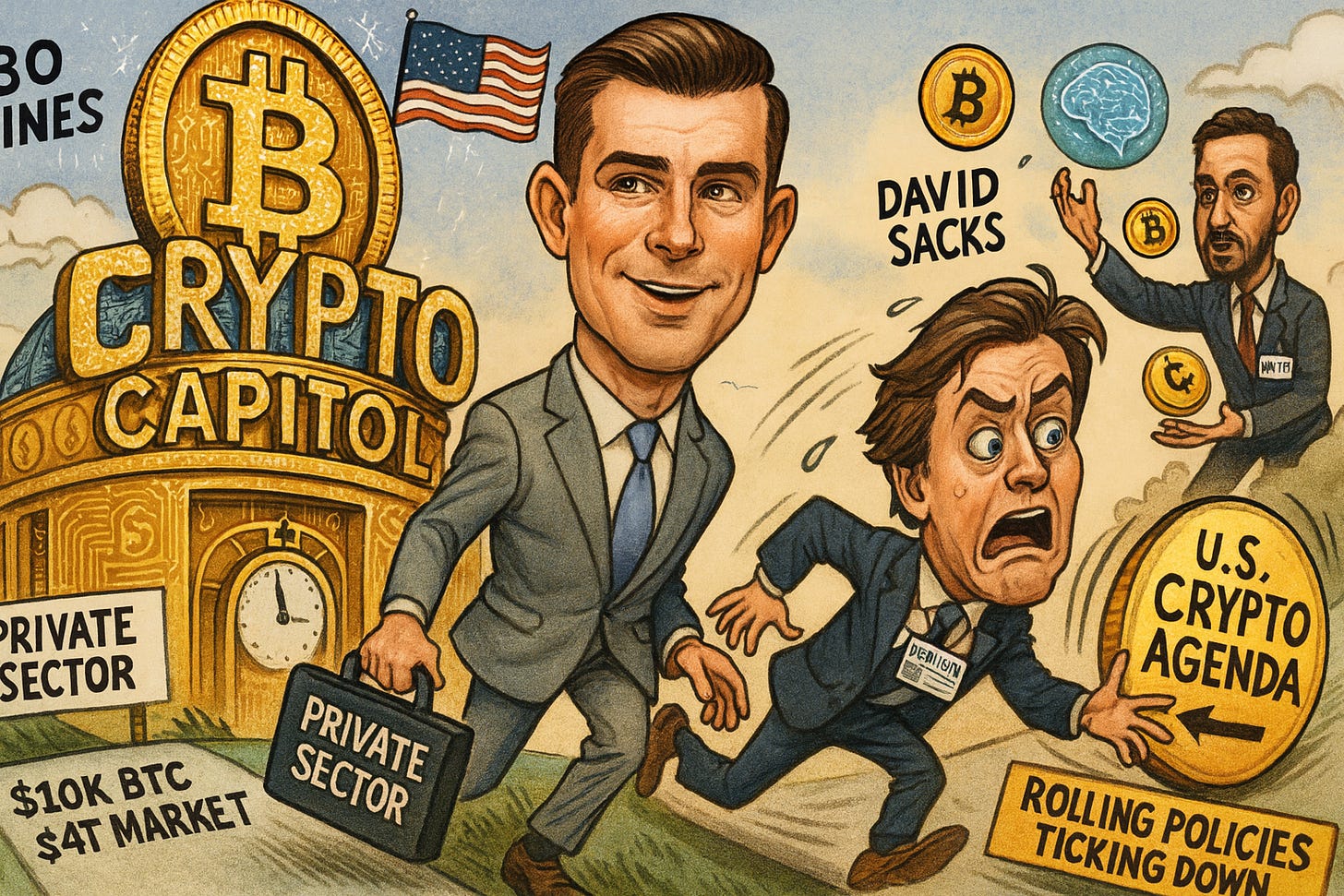

White House Crypto Council Director Bo Hines Steps Down

Bo Hines, executive director of the White House Crypto Council, announced his resignation on August 9 after just eight months in the Trump administration’s top cryptocurrency policy role (MEXC, DigWatch, Yahoo Finance, WorldCoinIndex, Economic Times, Cointelegraph). Patrick Witt, his deputy and current acting director of the Pentagon’s Office of Strategic Capital, is expected to succeed him. Hines cited a desire to return to the private sector while expressing gratitude for helping position the U.S. as the “crypto capital of the world.” He will remain involved as a special government employee, assisting AI and Crypto Czar David Sacks on artificial intelligence initiatives. His departure comes during the rollout of the administration’s crypto agenda, including the recently passed GENIUS Act establishing federal stablecoin regulation (BCLP) and efforts to create a Strategic Bitcoin Reserve (Latham, White House).

The leadership change comes at a pivotal moment for U.S. digital asset policy. Witt brings Pentagon technology and capital markets experience but lacks direct crypto industry background—potentially signaling a shift in strategy while maintaining the administration’s pro-digital asset stance. The move coincides with Bitcoin trading above $100,000 and total crypto market capitalization nearing $4 trillion (DL News), as the industry awaits finalization of key initiatives such as the Bitcoin reserve and broader regulatory frameworks that Hines helped design. With these policies entering implementation, the transition will test the administration’s ability to maintain momentum in its aggressive push to secure U.S. leadership in the global crypto economy.

Sensei’s Insight: Leadership changes in high-stakes policy arenas rarely happen in a vacuum—expect markets and stakeholders to read between the lines on whether this is evolution… or quiet course correction.

Trump Cannabis Remarks Send Tilray Soaring 25% After Hours 🌿📈

Tilray Brands (NASDAQ: TLRY) surged roughly 25% in after-hours trading to $0.81 following President Trump’s weekend remarks about potentially reclassifying marijuana as a less dangerous drug (Reuters, Fox Business, WSJ, WallStreetZen). The stock closed Friday’s regular session at $0.65, making the post-market rally a sharp reversal for the struggling cannabis company. At a $1 million-per-plate fundraiser at his Bedminster, New Jersey golf club, Trump told donors that marijuana rescheduling is “something we’re going to look at.” Attendees included Trulieve CEO Kim Rivers, whose company has contributed $250,000 to Trump-aligned PACs this year. Cannabis industry groups have collectively donated $1 million to Trump’s MAGA Inc. super PAC. These remarks are Trump’s first substantive public comments on cannabis policy since returning to office, despite earlier campaign pledges to support moving marijuana from Schedule I to Schedule III (Marijuana Moment, CNN).

Cannabis stocks have endured a punishing multi-year downturn, with the AdvisorShares Pure US Cannabis ETFdropping 86% over five years amid continued federal prohibition. Tilray exemplifies this collapse—down 66% from its 52-week high of $2.03. Any credible sign of federal reform has an outsized impact on these beaten-down names. Rescheduling marijuana would remove IRS Section 280E’s punitive tax rules, expand banking access, and potentially unlock institutional investment currently sidelined by federal restrictions (Finviz, Zacks). While Trump’s remarks stop short of policy action, they represent the strongest White House signal in months for an industry desperate for regulatory clarity.

Sensei’s Insight: When a single sentence from the president can move a stock 25% in minutes, you’re not trading fundamentals—you’re trading politics.

🇪🇺 European Leaders Demand Seat at the Table Before Trump-Putin Summit

European leaders moved swiftly over the weekend to avoid being sidelined as U.S. President Donald Trump readies for a direct meeting with Russian President Vladimir Putin on Friday, August 15 in Alaska—the first face-to-face encounter between Putin and a Western leader since Russia’s 2022 invasion of Ukraine (Sky News, ABC News, BBC, CBS News, CNN). The UK, France, Germany, Italy, Poland, Finland, and the European Commission issued a joint statement stressing that “the path to peace in Ukraine cannot be decided without Ukraine” and rejecting any settlement altering international borders by force. Ukrainian President Volodymyr Zelenskyy dismissed Trump’s floated “territorial swaps” as “dead decisions,” warning against legitimizing Russian control over occupied regions (CNBC, BBC, NYT).

The Alaska summit is fueling market uncertainty as traders weigh the possibility of sanctions relief against Russia versus persistent geopolitical risk. Oil prices fell 4.4% last week on speculation that a Ukraine ceasefire could normalize Russian energy exports and boost supply, with OPEC+ already increasing production by 547,000 bpd, pushing Brent crude near $66/barrel (TP ICAP, Reuters, Bloomberg, CNBC). But failure at the negotiating table could see Washington impose secondary sanctions on major Russian crude buyers like China and India, potentially tightening supply and reversing recent price declines (The National).

Sensei’s Insight: In geopolitics, as in chess, the real game is often played before the first move. Europe is making sure it’s not left watching from the sidelines when the Alaska talks begin.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍 Deeper Dive: Bullish Exchange IPO: Institutional Crypto’s Next Big Test

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.