Sensei's Morning Forecast: Ceasefire in Middle East, XRP ETF Odds Soar, and Trump F-BOMB

Iran and Israel agree to ceasefire as tensions simmer, XRP ETF sees 95% approval odds, Trump shocks with F-bomb and Fed pressure ahead of Powell testimony.

🧠 One Big Thing

The Middle East truce is shaky—but holding. After Israel reportedly violated the ceasefire with strikes near Tehran, Iran responded with limited retaliation. President Trump, who brokered the deal, lashed out at both sides, warning of consequences if the fighting resumes. Despite the tension, the ceasefire remains intact as of this morning. Markets are watching closely—any breakdown could rattle global energy prices and defense sectors. For now, diplomacy is doing just enough.

💰 Money Move of the Day

Breakthroughs like Tesla’s robotaxi launch create buzz—but also blind spots. Major tech pivots bring long-term upside and short-term risk. Before acting on headlines, ask: What’s priced in already? Could regulatory or technical hurdles delay the vision? True opportunity often lies in what others overlook—so weigh excitement against execution when evaluating innovation-driven stocks.

📬 A Quick Personal Note from Sensei

I strive every day to make Sensei’s Insights the best newsletter it can be. I research, edit, and publish it all myself — and I take a lot of pride in delivering value to every subscriber, especially those supporting through paid memberships.

That said, life happens. A close family member had an accident yesterday, and I needed to take them to the hospital (they’re doing okay now, thankfully). Because of that, yesterday’s newsletter came out much later than usual, and today’s has been delayed as well, as we have a follow-up hospital visit.

I also won’t be live for the normal morning show today — I was at the hospital and am taking the rest of the week to spend time with my family. Hopefully, with the war easing, it's a good moment to share with them. I’ll be back for the regular Sunday show.

Everything else is running as normal: you’ll keep receiving newsletters, and Martyn will be live at the usual times.

Thank you for your patience, your support, and your trust. It means the world to me, and I’m always working to show up better for you — especially those of you backing this mission with a paid subscription.

With gratitude,

– Sensei

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $105,222 (▼ -0.15%)

Ethereum (ETH): $2,418 (▲ +0.20%)

XRP: $2.18 (▲ +0.76%)

Equity Indices (Futures):

S&P 500 (SPX): 6,071 (▲ +0.76%)

NASDAQ 100: 22,295 (▲ +1.00%)

FTSE 100: 8,790 (▲ +0.23%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.355% (▲ +0.30%)

Oil (WTI): $66.84 (▼ -2.63%)

Gold: $3,310 (▼ -1.70%)

🕒 Data as of UK (BST): 13:45 / US (EST): 08:45 / Asia (Tokyo): 21:45

✅ 5 Things to Know Today

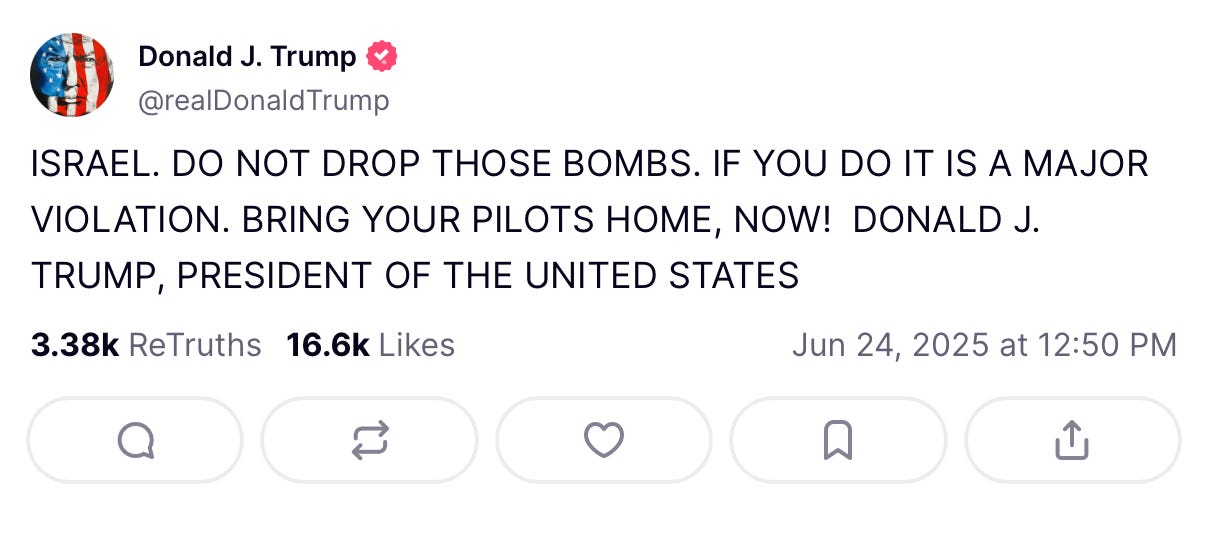

🇮🇷🇮🇱 Ceasefire Declared Between Israel and Iran + F-bomb

A US-brokered ceasefire between Israel and Iran took effect late Monday after 12 days of escalating cross-border missile and air strikes. President Donald Trump announced the agreement following direct negotiations with Israeli Prime Minister Benjamin Netanyahu, while Iran agreed to halt hostilities through Qatari mediation. The truce followed a final barrage of Iranian missiles, including deadly strikes on Beersheba that killed at least four people, and a symbolic but non-lethal hit on the US al Udeid Airbase in Qatar. At nearly the same time, Israeli forces launched airstrikes deep inside Iran, including an attack on Tehran’s Evin Prison and Revolutionary Guard sites (Reuters, ISW, Al Jazeera, Washington Post, New York Post). Both Israeli and Iranian state media confirmed the ceasefire early Tuesday, though each side accused the other of last-minute violations.

Israel declared it had met its military objectives, particularly after joint US–Israeli strikes on Iranian nuclear facilities. Iran’s foreign minister responded by indicating that Tehran would halt attacks if Israeli airstrikes ended by a specified deadline. While calm has mostly held, both sides remain on high alert—Israel threatening swift retaliation for any breach, and Iran maintaining military readiness. Israeli emergency services reported civilian casualties and property damage; Iranian outlets cited explosions in Tehran before the ceasefire's onset (Al Jazeera, Times of Israel, Washington Post).

The ceasefire offers a temporary de-escalation in a region crucial to global energy and defense markets. Defense stocks initially dipped on peace hopes, but analysts note the deal lacks enforcement mechanisms and underlying tensions persist. The risk of renewed conflict remains high, with potential disruptions to Middle Eastern energy supplies and ongoing volatility in related equities (AINVEST, Washington Post). Beyond the markets, the truce affects millions of civilians across the region living under threat of air raids, infrastructure collapse, and humanitarian crises, and underscores the fragility of international diplomacy in containing a broader war.

Sensei’s Insight: Diplomacy wins—for now. Iran’s calibrated strike on U.S. bases likely helped avoid all-out war and opened the door to a ceasefire. But let’s not get ahead of ourselves. Reports suggest Israel may have already violated the truce, with retaliatory moves from Iran soon after. Tensions remain razor sharp.

🚕 Tesla’s Robotaxi Era Begins with Stock Spike—and Lane Trouble

Tesla officially launched its first autonomous robotaxi fleet in Austin, Texas on Sunday, June 22, marking a major step in its pivot from automaker to mobility provider (Reuters, AP). The pilot includes 10–20 modified Model Y vehicles operating within a geofenced area from 6 AM to midnight, charging $4.20 per ride (MarketWatch, The Verge, Not a Tesla App). Each vehicle has a Tesla safety monitor onboard, contradicting earlier "unsupervised" claims by Elon Musk. Access is invite-only via iPhone app, with influencers and investors among the first to livestream their rides (The Verge, Yahoo Finance). Tesla shares jumped 8.2% to $348.68 on Monday, adding $26.52 per share and increasing Elon Musk's net worth by $15 billion (Forbes, The Street). After opening at $327.70, the stock peaked at $357.46 before closing at its highest level in two months (Investopedia), with volume surging to 186.3 million shares, well above average levels (Economic Times).

Wedbush analyst Daniel Ives, who test-rode the service in Austin, reaffirmed his $500 price target and described the rollout as potentially triggering a "$1 trillion autonomous journey" (Forbes). Analysts now estimate that 60% of Tesla’s $1.12 trillion market cap is tied to its autonomous tech, rather than traditional vehicle sales (Yahoo Finance). The Austin launch underscores Tesla’s bet on a camera-only system, in contrast to rivals like Waymo that use lidar and radar (Reuters). Videos from Tesla’s Austin rollout show concerning behavior: some robotaxis were seen swerving across double-yellow lines and briefly accelerating up to 39 mph in 30 mph zones (New York Post). The U.S. National Highway Traffic Safety Administration (NHTSA) has since contacted Tesla and is reviewing the incidents captured in those online videos (Reuters). But legal risks loom: Texas House Bill 3837 requires autonomous permit compliance by September 2025, and Tesla still faces federal scrutiny after crashes involving its Full Self-Driving system (AINVEST, Yahoo Finance). Elon Musk has pledged millions of robotaxis by 2026, but analysts warn that technical and regulatory hurdles could delay that vision—and impact the stock’s autonomy-driven premium (TechXplore).

Sensei’s Insight: This launch was expected to generate buzz—and it did. But the real test for Tesla's robotaxi vision won't come from a limited, geofenced pilot with handpicked riders. Tesla’s current system, reliant on cameras alone, still hasn’t proven it can operate safely without supervision in open environments. Waymo, by contrast, is already running fully driverless rides in multiple cities with lidar support. Until Tesla breaks out of the Austin sandbox, this rally feels more about hype than reality. The upside? Massive. The risk? Also big.

🏛️Powell Faces Congress Amid Trump Pressure and Market Uncertainty

Federal Reserve Chair Jerome Powell begins his semi-annual testimony before Congress today at 10:00 AM EST before the House Financial Services Committee, with a second session scheduled Wednesday before the Senate Banking Committee (Financial Express, House Financial Services). He faces bipartisan scrutiny over the Federal Reserve’s decision to hold interest rates steady at 4.25%-4.50% for a fourth consecutive meeting (Reuters, CNBC, Bloomberg). Former President Trump increased political pressure this morning with a Truth Social post calling Powell “very dumb” and “hardheaded,” urging Congress to “work this person over,” and demanding a 2–3 percentage point rate cut to purportedly save the U.S. $800 billion annually (Fox Business, Screenshot). Market expectations remain cautious, with only an 18.6% probability priced in for a July cut, and most traders anticipating the first reduction in September (FXStreet, Statista).

Recent data shows inflation rose to 2.4% in May from 2.3% in April (CNBC), while the Fed’s latest dot plot projects only two quarter-point cuts in 2025 (BondSavvy). Supreme Court decisions have reinforced Powell’s independence by shielding him from presidential removal efforts (Politico). Trump contrasted the Fed’s inaction with the European Central Bank’s eight rate cuts this year (CNBC). Meanwhile, Fed Governors Michelle Bowman and Christopher Waller have signaled possible openness to easing in July (CNBC). Analysts warn that Powell’s language on tariffs, labor markets, and inflation expectations could trigger significant market moves, with dovish tones favoring bond rallies and a weaker dollar, and hawkish signals likely to buoy the dollar but pressure equities (Tastylive, Investopedia, Arabic Trader).

Sensei’s Insight: With Powell under fire from both political and market fronts, his testimony could serve as the pivot point for Q3 monetary policy sentiment. Expect heightened volatility if even subtle language suggests deviation from the Fed’s current stance—position accordingly.

🔄 Nvidia CEO’s $865M Sell-Off Begins Under 10b5-1 Plan

Nvidia CEO Jensen Huang initiated a pre-planned 2025 stock sale between June 20–23, offloading 100,000 shares for $14.4 million under a Rule 10b5-1 trading plan created in March. The plan, which allows insiders to schedule stock sales in advance to avoid accusations of insider trading, permits Huang to sell up to 6 million shares by December 31, 2025, worth roughly $865 million at Monday’s closing price of $144.17 (Investing.com, Economic Times). SEC filings show an additional 50,000 shares are queued for immediate sale. Separately, Nvidia board director Mark Stevens sold over 600,000 shares for $88 million on June 18 (Business Times, Wall Street Pit).

Why It MattersHuang still owns over 900 million Nvidia shares—nearly 4% of the company—making the planned disposals under 1% of his total holdings (Financial Modeling Prep, AInvest). The world's 12th wealthiest person, with a net worth of $126 billion, has used similar 10b5-1 plans to sell $1.9 billion in Nvidia stock over his career. While some investors worry about insider selling, these are mechanical, pre-approved transactions and not signs of pessimism. Notably, Nvidia insiders have conducted 161 sales totaling $3.4 billion over five years with no purchases, yet the stock surged 400% during the same period (CNBC, Fool UK).

Sensei’s Insight: When insiders sell through Rule 10b5-1 plans, it's not about timing the market—it's about managing personal exposure legally. Always examine the structure of sales, not just the headlines.

☕️ Starbucks Denies Full China Exit Amid Deepening Sales Slump

Starbucks has publicly denied reports that it is considering a full sale of its China operations, following media claims that the company engaged in preliminary talks with more than a dozen potential buyers (Reuters, CNBC). The move comes as Starbucks faces mounting headwinds in China—its second-largest market—where revenue from over 7,300 stores dropped 11% year-on-year to $734 million in the latest quarter. Comparable store sales plunged 14%, driven by a 7% decline in both transaction volume and average order value, as local rivals like Luckin Coffee and Cotti Coffee capture market share with aggressive pricing and rapid expansion (Ainvest, VNExpress, Business Insider).

Starbucks’ market share in China has fallen sharply from 34% in 2019 to just 14% in 2024. The company’s premium pricing—where a tall latte can cost three times more than local competitors—has become a liability amid a broader consumer spending pullback. Local chains, particularly Luckin and Cotti, have expanded rapidly with low-cost offerings, eroding Starbucks’ once-dominant position and forcing the U.S. giant to consider strategic changes, including potential partnerships or a stake sale (Reuters, Intelligence.Coffee, Ainvest, VNExpress).

For investors, Starbucks’ China challenges underscore the risks of international expansion in fast-evolving consumer markets. Intensifying price wars, shifting consumer preferences, and the rise of nimble domestic competitors threaten both growth and profitability. The company’s response—whether through operational pivots, pricing adjustments, or strategic partnerships—will be closely watched as a bellwether for foreign brands navigating China’s increasingly competitive retail landscape (Business Insider, Reuters, Intelligence.Coffee).

Sensei’s Insight: When a global giant stumbles in its most important growth market, pay attention—not just for what it says about that company, but about the macro. Starbucks’ China woes highlight a broader consumer reset: value beats brand, and local players move faster. For investors, it’s a cautionary tale about mistaking early dominance for lasting advantage in emerging economies.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍 Deeper Dive: The XRP ETF Surge: Why Approval Odds Hit 95%

The race for a U.S. spot XRP exchange-traded fund is accelerating, with approval odds soaring and major deadlines looming. What was once improbable is now, according to Bloomberg, a near-certainty — reshaping expectations for institutional crypto adoption.

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.