Sensei’s Morning Forecast: Ceasefire Breakthrough, Powell Speaks on Rates, and Crypto ETFs Enter ISA Era

Markets digest a Gaza ceasefire, Powell’s latest signal, HSBC’s $14B Hong Kong play, and the UK’s crypto ETF shift.

👀 Today’s Stories at a Glance

🕊️ Ceasefire Deal Reached: Israel and Hamas agree to a ceasefire and hostage swap amid ICC war crime charges.

📉 Fed Split on Rate Cuts: FOMC minutes show internal division on future cuts, inflation risks still concern several members.

🎙️ Powell’s Silent Signal: Powell’s pre-recorded speech may subtly hint at credit stress and delay in rate-cut timing.

💵 HSBC’s $14B Bet: HSBC fully acquires Hang Seng Bank, pausing buybacks and deepening exposure to stressed Hong Kong markets.

🪙 UK Approves Crypto ETNs: FCA lifts retail ban on crypto ETNs; investors can now hold them inside tax-free ISAs.

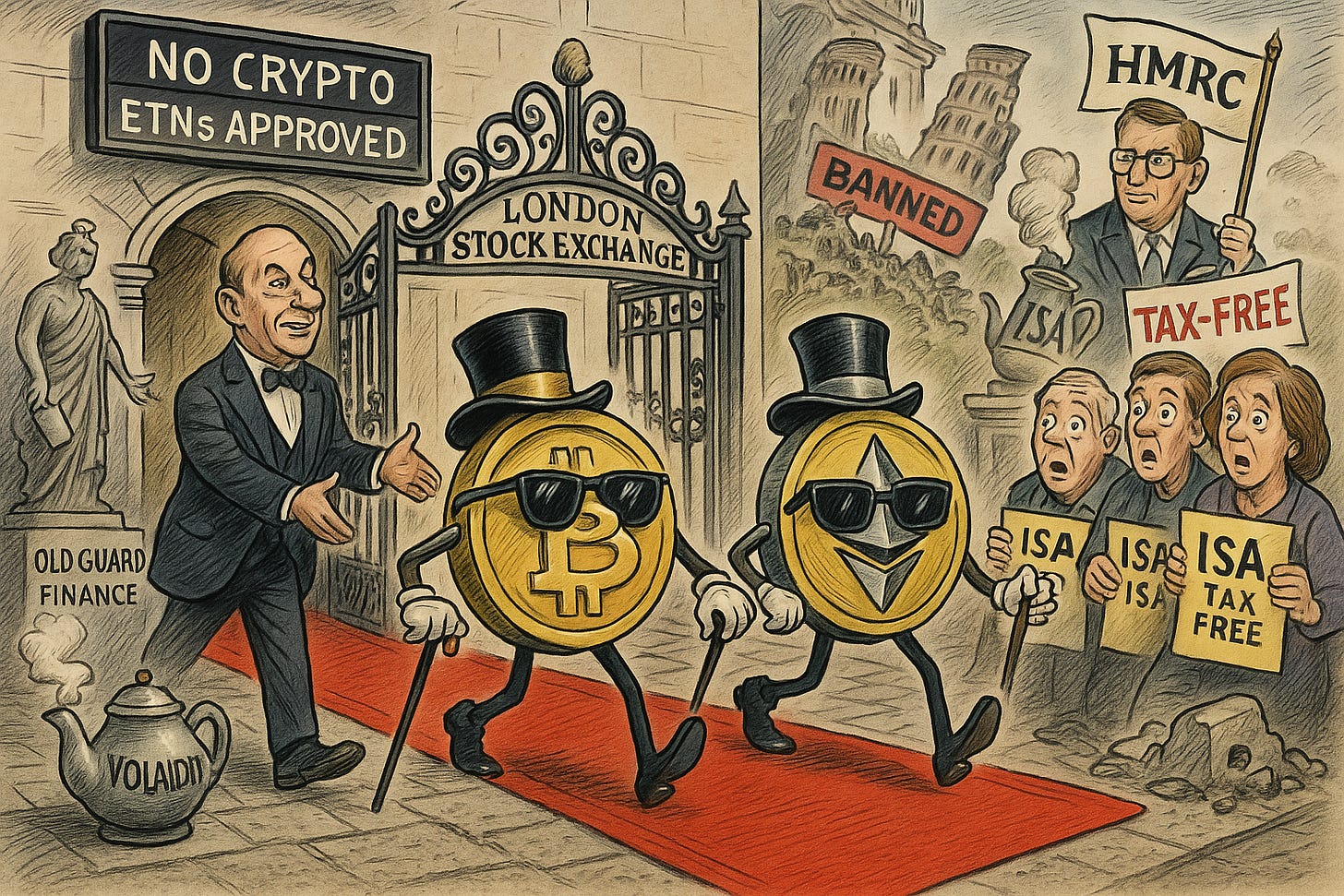

Crypto ETNs Are Coming to the UK

Big news for UK investors: crypto ETNs (Exchange-Traded Notes) have officially launched — and for the first time ever, you can now gain regulated exposure to Bitcoin and Ethereum through the stock market.

ETNs track the price of a cryptocurrency like Bitcoin, but without needing to hold the coins yourself.

They’re listed on the London Stock Exchange, regulated by the FCA, and now eligible to be held inside a Stocks & Shares ISA — meaning any gains are completely tax-free.

If you want to be among the first to access these new products when they go live, join Freetrade — one of the first UK investing apps rolling out crypto ETNs.

Use my referral link below to sign up and get a free share worth up to £100 👇

👉 Join Freetrade and claim your free share

🧠 One Big Thing

The UK just gave crypto its biggest stamp of legitimacy yet: retail investors can now hold Bitcoin and Ethereum exchange-traded notes (ETNs) inside tax-free ISAs. After years of bans, the FCA’s reversal opens the door to billions in potential inflows — and signals a turning point in crypto’s integration with traditional finance. It’s a regulatory greenlight that could reshape how digital assets are held, taxed, and trusted in one of the world’s top financial hubs.

💰 Money Move of the Day

If you’re a UK investor with a Stocks & Shares ISA, start researching crypto ETNs. Starting next week, you can get regulated, tax-free exposure to Bitcoin or Ethereum via listed ETNs — a potential cleaner, safer route than offshore exchanges. Watch for FCA-approved products on the London Stock Exchange, and remember: these are high-risk, so diversify and size your positions accordingly.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $121,809.61 (▼ -1.27%)

Ethereum (ETH): $4,333.91 (▼ -4.29%)

XRP: $2.8093 (▼ -2.49%)

Equity Indices (Futures):

S&P 500 (US500): 6,751.9 (▼ -0.05%)

NASDAQ 100 (NQ1!): 25,327.00 (▼ -0.02%)

FTSE 100: 9,512.04 (▼ -0.48%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.129% (▲ +0.15%)

Oil (WTI): $62.477 (▲ +0.06%)

Gold: $4,039.160 (▼ -0.03%)

🕒 Data as of UK (BST): 11:01 / US (EST): 06:01 / Asia (Tokyo): 19:01

✅ 5 Things to Know Today

🕊️ Israel–Hamas Ceasefire Deal Sealed Amid Famine, ICC Arrest Warrants

Israel and Hamas have reached a U.S.-brokered ceasefire and hostage exchange deal, marking the first major diplomatic progress since the conflict began in October 2023. The agreement provides for the release of 48 hostages, around 20 of whom are believed to be alive, in exchange for up to 1,700 Palestinian detainees, including 250 serving life sentences (Reuters). More than 67,000 Palestinians have been killed in Gaza, according to health authorities, amid a collapse of food supply chains and critical infrastructure that has pushed the enclave to the brink of famine (AP News). Since May 2025, over 2,500 civilians have reportedly died near aid distribution sites under Israeli fire or in clashes, with more than 18,800 wounded (Wikipedia). The International Criminal Court has issued arrest warrants for Israeli Prime Minister Benjamin Netanyahu and Defense Minister Yoav Gallant on charges of war crimes and crimes against humanity, including the alleged use of starvation as a weapon of war (Reuters).

The ceasefire’s implementation will require significant international coordination, with Egypt, Qatar, and the United States acting as guarantors to monitor compliance and humanitarian aid delivery. Financially, the truce opens pathways for foreign reconstruction funding, potentially led by Gulf states, and could restore limited trade flows through Israeli and Egyptian crossings if stability holds. However, the situation remains fragile. The United Nations warns that famine conditions are spreading despite the deal, while analysts note that risk premiums in oil, defense, and regional sovereign bonds are likely to stay elevated until a sustained peace framework is verified. Markets will be watching closely for signals that humanitarian relief, infrastructure rebuilding, and governance reforms are genuinely taking hold — or whether renewed hostilities could trigger another round of volatility.

Sensei’s Insight: The truce offers short-term relief for energy and defense markets, but legal fallout and humanitarian instability keep regional risk elevated. Reconstruction may spur liquidity, yet lasting calm remains uncertain.

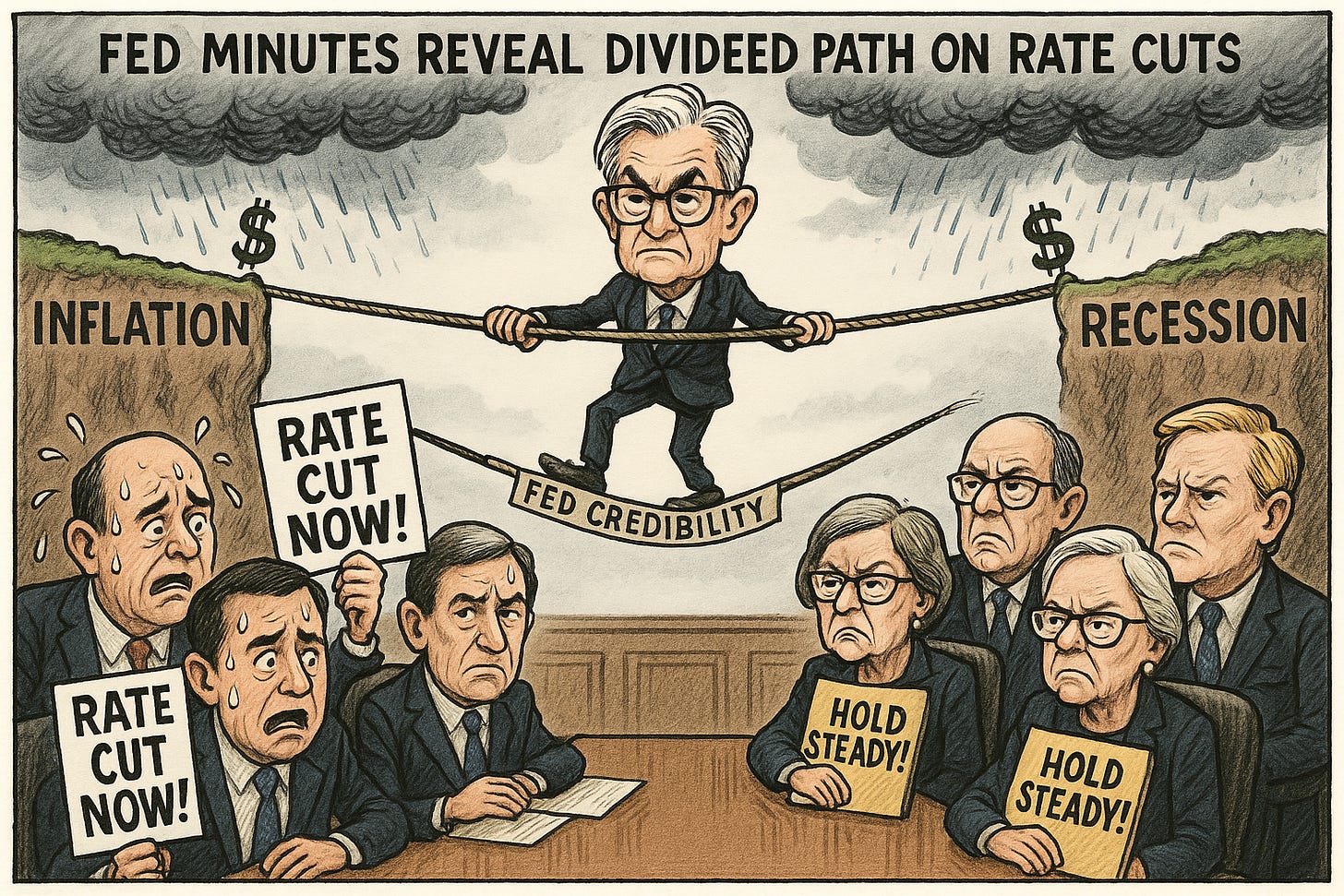

🏦 Fed Minutes Reveal Divided Path on Rate Cuts

The Federal Reserve’s September meeting minutes show most policymakers supported last month’s quarter-point rate cut, bringing the federal funds target range to 4.00%–4.25%, while a narrow majority signaled openness to two additional cuts before year-end (Federal Reserve). Yet, internal divisions were clear: one member advocated for a larger 50 bps cut, while “a few participants” preferred holding rates steady due to lingering inflation pressures. The committee acknowledged that inflation remains “somewhat elevated”, particularly under the strain of new tariff measures, even as labor-market risks have grown (AP News).

Markets responded with a 20–40 bps decline in short-term Treasury yields and a steeper yield curve, reflecting increased confidence in a 2025 easing cycle. Equities rallied toward record highs as traders priced in a softer Fed stance, while money-market conditions tightened slightly amid higher Treasury issuance and continued balance-sheet runoff (Reuters). The minutes reinforced the view that future policy will hinge on upcoming inflation and labor data — much of which remains delayed by the ongoing U.S. government shutdown.

Sensei’s Insight: The Fed’s tone leans dovish, but the internal split suggests cuts are not yet on autopilot. Investors chasing risk assets may benefit near-term, but volatility could spike if upcoming inflation data challenges the easing narrative.

🏦 Powell to Speak at Community Banking Conference

Federal Reserve Chair Jerome Powell is set to deliver pre-recorded remarks today at the Community Bank Conference in Washington, D.C., marking his first scheduled appearance since the release of yesterday’s FOMC minutes (Federal Reserve). While the video message is expected to be largely ceremonial, markets will watch closely for any indirect cues on regional banking stress, credit conditions, or the broader lending environment—areas under growing scrutiny as higher rates continue to squeeze smaller lenders and tighten financial conditions (Reuters).

The timing adds weight: the September minutes showed officials divided on how quickly to cut rates, with several calling for patience until inflation risks subside. Even a subtle shift in Powell’s tone—especially around credit health or economic resilience—could influence market sentiment and recalibrate expectations for the Fed’s next move. Traders will parse his comments for any hints about whether policymakers remain on track for a December rate cut or prefer a slower approach.

Sensei’s Insight: Powell may not move markets with a pre-recorded clip—but silence can speak volumes. Investors should listen for what he doesn’t say about rate cuts and regional bank stress.

💰 HSBC Makes $14 Billion Hong Kong Bet

HSBC has moved to fully acquire Hang Seng Bank, offering HK$155 per share in an all-cash deal that values the lender at roughly HK$290 billion (≈ US$13.6 billion) — a 30% premium to its last close (FT). The bank already owns around 63% of Hang Seng and plans to buy out the remaining minority stake via a court-approved scheme of arrangement (HSBC). Once complete, Hang Seng will be delisted and become a wholly owned subsidiary — marking the largest Hong Kong banking transaction in more than a decade (Reuters). HSBC said the deal would trim its Common Equity Tier 1 ratio by about 125 basis points, prompting a temporary pause in share buybacks for up to three quarters. Shares of HSBC fell about 6% in London trading, while Hang Seng stock surged more than 25% toward the offer price (Reuters).

The move deepens HSBC’s long-term exposure to its core Hong Kong franchise amid rising non-performing loans linked to property market stress. Hang Seng’s bad-loan ratio climbed to 6.7% of gross loans as of June 2025, up from 2.8% at the end of 2023 (Reuters). Executives framed the transaction as a strategic bet on Hong Kong’s recovery rather than a bailout, positioning the group for greater control across its Asia Pacific operations. CEO Georges Elhedery also suggested HSBC could pursue more deals in transaction banking and wealth management after completing the buyout (Reuters).

Sensei’s Insight: For investors, this is a classic trade-off between control and capital discipline. HSBC gains full ownership and long-term synergy potential in its most profitable region — but at the cost of near-term capital pressure and suspended buybacks. The market’s cautious reaction shows that confidence in Hong Kong’s financial rebound remains far from guaranteed.

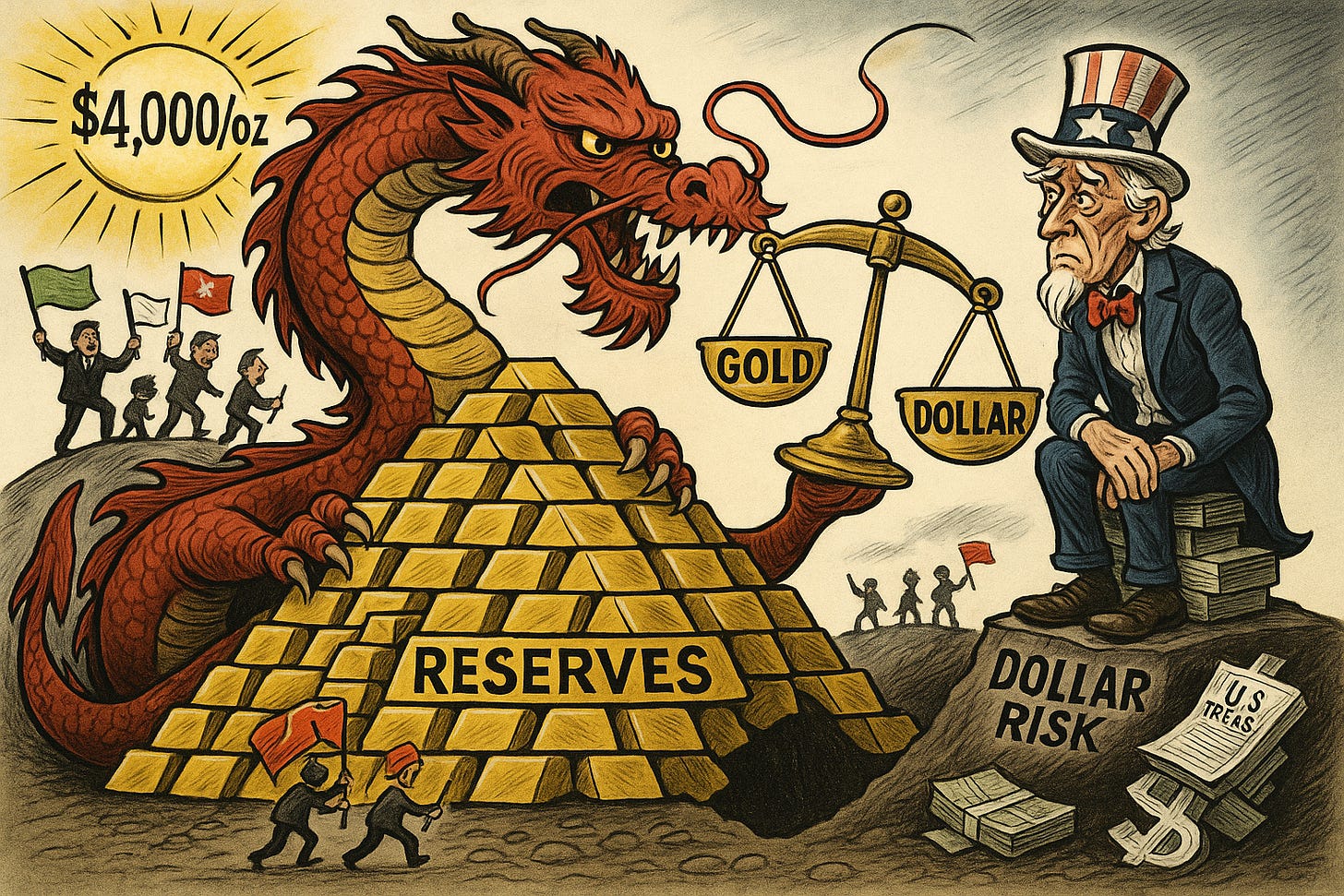

🥇 Gold’s Record Rally Strengthens China’s Hand Against the Dollar

Gold’s historic climb above $4,000/oz is now reshaping global power dynamics, with China using the metal to quietly erode dollar dominance. Beijing’s central bank has expanded its gold reserves for nine consecutive months, part of a deliberate shift away from U.S. Treasuries amid rising geopolitical tension and uncertainty over a potential Trump return to office (Bloomberg). The move aligns with a broader de-dollarization push across emerging markets, where gold-backed trade settlements and yuan-based oil contracts are gaining traction. Meanwhile, gold ETFs have seen record inflows of $64 billion year-to-date, and Chinese mining stocks have surged between 10–17 % following bullion’s latest breakout (Reuters).

For investors, this is more than a commodities story — it’s a signal of shifting reserve behavior and the geopolitical hedging reshaping capital flows. If gold continues displacing Treasuries as a store of value, it could dampen dollar liquidity, elevate long-term yields, and reinforce real-asset inflation hedges. But the trade cuts both ways: a sudden rebound in U.S. rates or capital controls in China could reverse momentum just as quickly. Volatility in both metals and FX markets is expected to remain elevated as global reserve strategies diverge (WSJ).

Sensei’s Insight: Gold’s ascent isn’t just about inflation fears — it’s about trust. As Beijing builds a “post-dollar” playbook, investors should watch how central banks vote with their reserves.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive — Crypto Goes Legit: The UK’s ETN Revolution

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.