Sensei’s Morning Forecast: CPI Day, Tariff Tension, and Nuclear Revival

All eyes on today’s US inflation report, sticky price risks, VivoPower’s XRP pivot, and nuclear stocks in the spotlight.

🧠 One Big Thing

All eyes are on today’s U.S. Consumer Price Index (CPI) report—the final inflation print before next week’s Fed decision. Economists expect headline CPI to rise 0.2% month-over-month and 2.5% year-over-year, up from 2.3% in April. Core CPI, which excludes food and energy, is forecast to rise 0.3% MoM and 2.9% YoY, reflecting persistent underlying inflation that could keep policymakers cautious.

💰 Money Move of the Day

Inflation affects everything from savings yields to mortgage rates — so understanding how your portfolio responds is key. Many investors use a mix of Treasury Inflation-Protected Securities (TIPS), gold, or dividend-paying stocks to help mitigate inflation risk while staying invested.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $109,283 (▼ -0.94%)

Ethereum (ETH): $2,764 (▼ -1.90%)

XRP: $2.31 (▲ +0.23%)

Equity Indices (Futures):

S&P 500 (SPX): 6,021 (▼ -0.21%)

NASDAQ 100: 21,918 (▼ -0.20%)

FTSE 100: 8,854 (▼ -0.09%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.498% (▲ +0.54%)

Oil (WTI): $66.05 (▲ +1.81%)

Gold: $3,331 (▲ +0.26%)

🕒 Data as of UK (BST): 12:17 / US (EST): 07:17 / Asia (Tokyo): 20:17

🎥 Live Show Link – Join the Market Breakdown

Catch the full morning breakdown live with Sensei on YouTube. Watch Now:

We go deeper into today’s moves, charts, and headlines. Bring your coffee, questions, and watchlist.

✅ 5 Things to Know Today

US-China Trade Breakthrough Lifts Global Markets

Asian and Gulf equities rallied after the US and China reached a framework agreement in London to ease trade tensions and relax China’s rare earth export restrictions—a critical supply chain issue for sectors like autos, defense, and technology. US Commerce Secretary Howard Lutnick described the talks as a breakthrough, saying, “We have reached a framework to implement the Geneva Consensus,” and emphasized that the deal’s approval now rests with Presidents Trump and Xi. China’s Vice Commerce Minister Li Chenggang called the discussions “professional, rational, thorough, and open,” expressing hope that this progress would “facilitate greater trust” between the two countries (Al Jazeera, FXStreet, Fortune).

For investors, this agreement signals a potential turning point in a trade standoff that has rattled global markets for months. The prospect of restored rare earth supplies and a possible easing of US tech export controls has lifted risk sentiment, with the MSCI Asia-Pacific index up 0.5% and Gulf markets also gaining ground (Reuters, Reuters). However, analysts note that the muted reaction in US and Chinese equity futures suggests much of the optimism was already priced in, and the market is now focused on the details—especially the scale of rare earth shipments and any reciprocal moves on US chip exports (Economic Times, Reuters). If the framework holds, it could reduce volatility, support supply chains, and provide a tailwind for global equities and commodities. But investors remain cautious, watching for concrete actions and wary that renewed tariff threats could quickly reverse the rally (Economic Times, Investopedia).

Sensei’s Insight: If rare earths flow and chip curbs ease, semis and defence stocks get a second wind—this rally’s real, only if details deliver.

Gold Overtakes Euro as World’s #2 Reserve Asset

In a historic shift, gold has surpassed the euro to become the world’s second most held reserve asset after the US dollar, according to the latest data from the International Monetary Fund and confirmed by commentary from the European Central Bank. As of the end of 2023, central banks held an estimated $2.38 trillion in gold reserves, edging out the euro’s $2.28 trillion share. This move is the result of sustained gold accumulation by central banks—especially in Asia, Africa, and South America—over the past decade, with central banks buying one-eighth of all gold mined since the 2008 financial crisis (MetalMarket, Bitbo, TFTC, Gainesville Coins).

The ECB notes that “gold performs well during episodes of stress” and has outperformed both equities and the US dollar during periods of economic and geopolitical uncertainty. The surge in gold’s value—driven by persistent inflation, geopolitical tensions, and concerns over the stability of fiat currencies—has prompted central banks to diversify away from the dollar and the euro, viewing gold as a safe-haven asset free from the political and sanction risks that affect currencies. This diversification is seen as a hedge against the vulnerabilities of the global financial system, with the ECB warning that the growing exposure to gold derivatives in the euro area could introduce new risks if market volatility spikes or leveraged positions unwind rapidly (Royal Mint). For investors, this marks a significant endorsement of gold’s strategic role in modern portfolios, reinforcing its appeal as a long-term store of value and a buffer against systemic shocks.

Sensei’s Insight: Central banks now hold more gold than euros—proof that gold remains the top hedge in a world of currency risk. Despite Bitcoin's rise, gold’s non-digital, sanction-proof status gives it unique utility. For portfolios, this is a wake-up call: gold’s not just alive—it’s institutional money’s insurance policy.

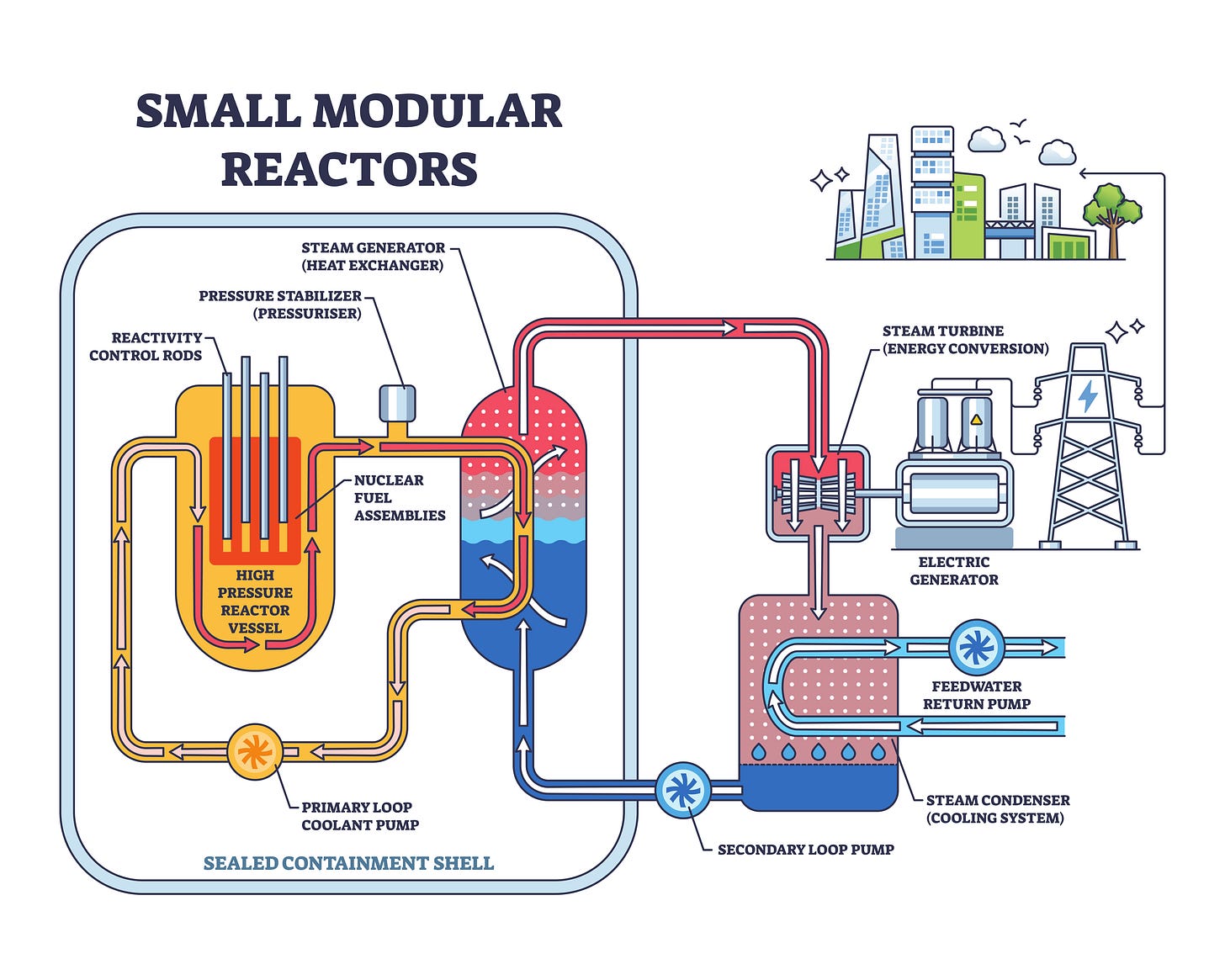

Nuclear Power Investment Accelerates in UK and Europe

The UK government has selected Rolls-Royce to build the country’s first small modular nuclear reactors (SMRs), a major step in its plan to decarbonize the power grid by the mid-2030s and boost energy security (Reuters via TradingView). This follows a £14.2 billion commitment to the Sizewell C nuclear plant, expected to supply power to six million homes and create 10,000 jobs. Across Europe, policymakers are reversing course on nuclear, launching new projects and crafting supportive regulation to cut energy imports and meet climate goals. The EU nuclear industry already supports nearly 900,000 jobs and generates over €250 billion in annual output.

For investors, this nuclear resurgence opens new opportunities in listed utilities, engineering firms, and suppliers tied to SMRs and major infrastructure builds. The UK's use of the Regulated Asset Base (RAB) model for Sizewell C aims to de-risk capital investment by ensuring cost transparency and stable returns. As public funding and private capital flood in, nuclear is reemerging as a long-duration, inflation-hedged asset class. Still, investors must watch for execution risks and regulatory shifts that could affect margins or delay cash flows.

Top Nuclear Stocks on the Radar

The sector's revival is also reshaping the stock watchlist for those seeking direct exposure:

Rolls-Royce Holdings (RR.L): Leading the UK's SMR push, Rolls-Royce is poised to benefit from government contracts and global demand for compact nuclear solutions.

EDF (Électricité de France): As Sizewell C’s developer and a nuclear heavyweight across Europe, EDF is at the heart of the EU’s nuclear expansion.

Vistra Corp. (VST): A dominant US utility with growing nuclear assets, strong liquidity, and shareholder-friendly capital programs.

BWX Technologies (BWXT): A nuclear supplier with deep ties to commercial and defense sectors. Its recent acquisition of Kinetrics and US Navy contracts point to continued growth.

GE Vernova (GEV): Expanding aggressively in SMRs and advanced nuclear tech, GE Vernova is positioning itself for the next phase of global nuclear adoption.

These companies represent direct exposure to nuclear’s momentum, while sector-specific ETFs offer broader, diversified access. Execution, policy consistency, and geopolitical factors remain the key variables for long-term success (Forbes). Not financial advice.

Sensei’s Insight: Governments are turning pro-nuclear again—this isn’t just climate policy, it’s energy sovereignty. SMRs (Small Modular Reactors) are the new frontier, and capital is chasing durable yield. Nuclear is back on the institutional menu.

VivoPower’s $121M XRP Treasury Pivot: What It Means for XRP and Investors

VivoPower International (Nasdaq: VVPR) has become the first publicly traded company to adopt an XRP-focused treasury strategy, raising $121 million in a private placement led by Saudi Prince Abdulaziz bin Turki Abdulaziz Al Saud (CryptoTimes, Investing.com, TokenPost, Coindesk). The majority of funds will be used to acquire XRP, with BitGo providing institutional-grade custody and trading support (BusinessWire, AINvest). VivoPower also plans to build real-world decentralized finance (DeFi) applications on the XRP Ledger (XRPL).

The strategic shift is underscored by the appointment of Adam Traidman—former Ripple board member and CEO of SBI Ripple Asia—as Chairman of VivoPower’s Board of Advisors (TheCryptoBasic). This signals deep alignment with Ripple’s ecosystem and XRPL’s broader vision.

For XRP, this move represents a significant milestone in institutional adoption. It positions XRP not just as a speculative token but as a reserve-grade asset and DeFi infrastructure layer. The involvement of BitGo addresses long-standing regulatory and security concerns, potentially paving the way for more corporate treasuries to follow suit. Increased demand and liquidity could also help stabilize XRP’s historically volatile price.

For investors, VivoPower’s pivot offers rare public market exposure to XRP performance and institutional crypto integration—but with high risk due to regulatory uncertainties and XRP’s price sensitivity. The stock surged as much as 26% on the news before settling up 11%, reflecting both excitement and volatility.

“We all share a common vision and objectives with regards to how a publicly listed XRP-focused treasury company can be scaled for the benefit of the XRP community and VivoPower stakeholders alike,” said Executive Chairman Kevin Chin (StockTitan).

Sensei’s Insight: VivoPower’s plan to allocate $100M out of a $121M raise into XRP vs. a $69M market cap highlights a rare valuation disconnect—investors see risk, not just reserves. Until the June 18 vote clears and strategy proves out, the stock trades like a leveraged bet on XRP execution.

Ondo Finance Launches Tokenized U.S. Treasuries on XRP Ledger

Ondo Finance has launched its tokenized U.S. Treasuries product, OUSG, directly on the XRP Ledger (XRPL)—a major step forward for real-world asset tokenization. Backed by BlackRock’s BUIDL fund, OUSG allows institutions to mint and redeem short-term Treasury tokens 24/7 using Ripple’s RLUSD stablecoin as the settlement layer (CryptoTimes, Crypto.news).

Ripple and Ondo have seeded liquidity to jumpstart usage. OUSG currently holds $30 million on XRPL and $670 million across all chains. This launch gives institutions direct, real-time access to U.S. government debt—without traditional finance’s slow settlement windows—and positions XRPL as a serious platform for institutional-grade DeFi (CoinGape, TheStreet Crypto).

RippleX SVP Markus Infanger put it bluntly: “Ondo’s OUSG going live on the XRPL demonstrates that tokenized finance is no longer theoretical, it’s maturing in real markets.”

Sensei’s Insight: Real-world Treasuries on XRPL deepen XRP’s use case. More volume means more demand for XRP as a bridge asset and fee layer. This isn’t hype—it’s infrastructure. Institutional finance just took a step closer to settling on-chain.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍 Deeper Dive – US CPI Report for May 2025: Tariffs Test Fed’s Inflation Fight

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.