Sensei’s Morning Forecast: CPI Day - Today’s inflation print will determine whether markets make new highs or crash

Crypto goes political — 🧨 Trump pardons CZ, 🧭 Coinbase lobbies Congress, 🏛️ Ripple funds the ballroom — all before 🇺🇸 CPI decides if we boom or break.

👀 Today’s Stories at a Glance

🧨 Trump Pardons CZ: Trump grants full pardon to Binance’s CZ, reversing 2023 conviction and signaling a pro-crypto policy pivot.

🧭 Coinbase CEO Pushes FIT21: Coinbase’s Brian Armstrong urges Congress to pass FIT21 crypto bill by Thanksgiving, citing bipartisan momentum.

🏛️ Ripple & Coinbase Fund Trump Ballroom: Ripple, Coinbase, and others donate to Trump’s $300M White House ballroom, deepening crypto’s political influence.

🏛️ Crypto CEOs Face Senate Fire: Crypto leaders met Senate Democrats in a tense session over FIT21’s future and partisan crypto alignment.

🛍️ UK Retail Resilience: UK retail sales rose for the fourth month, bolstering Q3 GDP despite wet weather and rate pressure.

🇺🇸 CPI at the Crossroads: Friday’s inflation print will decide the Fed’s path, risk sentiment, and Q4 market direction.

🧠 One Big Thing

Trump’s full pardon of Binance founder CZ marks a political turning point for crypto in the U.S. The dramatic reversal wipes his 2023 felony conviction — and with it, years of hostile regulatory tone. Combined with warmer policy signals and deeper crypto ties in Washington, digital assets are shifting from defense to offense. Crypto regulation is no longer just about crackdown — it’s now about strategy.

💰 Money Move of the Day

Crypto-friendly policy is gaining ground — and investors should watch where the winds are blowing. With bipartisan support building and Washington no longer reflexively anti-crypto, U.S.-aligned projects could benefit most. Think regulated firms like Coinbase, tokenized assets with clear structures, or ETFs tied to U.S. exchanges. When the rules change, so does the playing field — smart capital rotates early.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $111,269.90 (▲ +1.08%)

Ethereum (ETH): $3,959.99 (▲ +2.66%)

XRP: $2.45 (▲ +2.37%)

Equity Indices (Futures):

S&P 500 (US500): 6,762.80 (▲ +0.33%)

NASDAQ 100 (NQ1!): 25,381.00 (▲ +0.50%)

FTSE 100 (FTSE10): 9,581.93 (▼ -0.09%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.008% (▲ +0.12%)

Oil (WTI): $62.15 (▲ +0.08%)

Gold: $4,066.59 (▼ -1.44%)

Silver: $48.20 (▼ -1.34%)

🕒 Data as of UK (BST): 11:19 / US (EST): 06:19 / Asia (Tokyo): 19:19

✅ 5 Things to Know Today

🧨 Trump Grants Pardon to Binance Founder Changpeng Zhao After 2023 Conviction

U.S. President Donald Trump has granted a full pardon to Changpeng “CZ” Zhao, the founder of Binance, erasing his 2023 felony conviction under the Bank Secrecy Act and the four-month sentence he served last year. The White House framed the move as correcting what it called the previous administration’s “war on crypto,” marking a dramatic policy reversal toward digital assets (Reuters). Zhao had stepped down as CEO following Binance’s $4.3 billion settlement with U.S. authorities over anti-money-laundering failures — one of the largest corporate penalties in crypto history (Bloomberg). The pardon restores Zhao’s eligibility to engage in U.S. business and could reopen regulatory dialogue between Binance and American officials (AP News).

The decision triggered swift political backlash in Washington, with Democrats condemning it as a “reward for crypto criminals” (Washington Post). Still, markets interpreted the move as a regulatory thaw, sending BNB up 6 % in early Asian trading (CoinDesk). Analysts said the pardon may pave the way for Binance to seek renewed U.S. licensing or institutional partnerships under a friendlier policy environment (Cointelegraph).

Sensei’s Insight: The CZ pardon marks a clear regulatory pivot — short-term bullish for crypto sentiment, but it raises long-term questions over fairness, enforcement, and political influence in markets.

🧭 Coinbase CEO Pushes for U.S. Crypto Market-Structure Bill by Thanksgiving

Coinbase CEO Brian Armstrong said there is “strong bipartisan support” in Congress to pass the long-discussed digital-asset market-structure bill — formally known as the Financial Innovation and Technology for the 21st Century Act (FIT21) — before year-end. (Reuters) Speaking in Washington, D.C., Armstrong urged lawmakers to “get it done by Thanksgiving,” following a series of closed-door meetings with both House and Senate leaders from the Financial Services and Agriculture Committees. The legislation seeks to clarify jurisdiction between the SEC and CFTC, define how digital assets are classified (as securities or commodities), and establish a single, federal framework for exchange registration and investor protection. (Bloomberg)

If enacted, FIT21 would represent the most comprehensive U.S. crypto legislation to date — addressing the regulatory grey zone that has fueled years of enforcement disputes. Armstrong has made multiple trips to Capitol Hill this quarter, pressing for predictable rules that encourage innovation while keeping oversight onshore. Lawmakers from both parties have signaled growing consensus after months of hearings, raising the likelihood of a vote before the holiday recess. (CoinDesk)

Sensei’s Insight: FIT21 would mark the first true framework for how U.S. regulators govern crypto — resolving jurisdictional deadlock and giving investors long-awaited clarity on digital-asset compliance and oversight.

🏛️ Ripple, Coinbase Among Donors to Trump’s $300M White House Ballroom

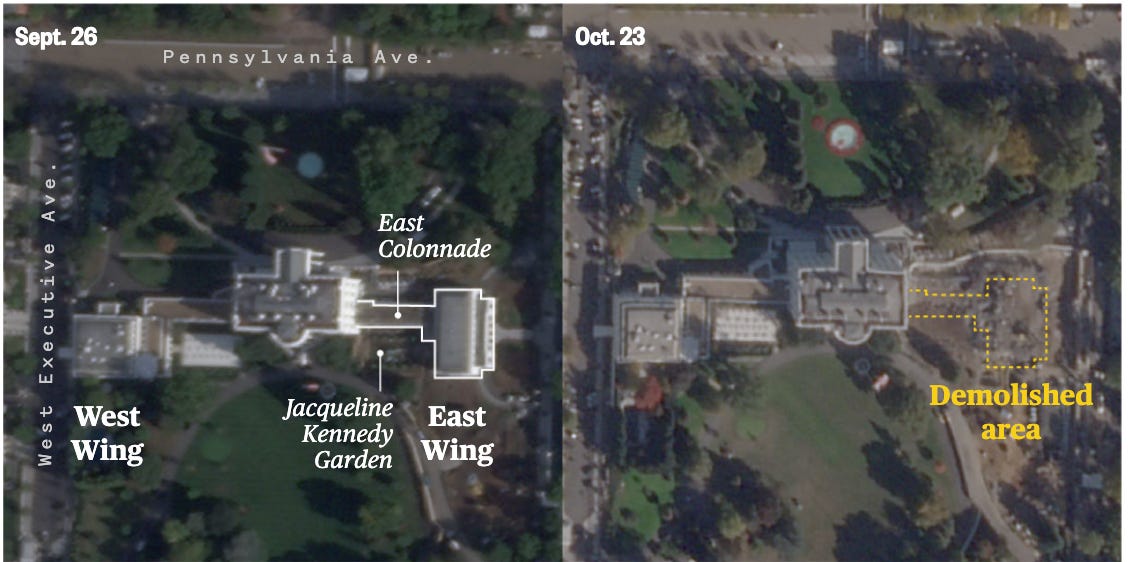

A newly released donor list for President Donald Trump’s $300 million White House ballroom project shows contributions from several of America’s largest corporations — and a handful of leading crypto firms. The 90,000-square-foot expansion, funded through private donations managed by the Trust for the National Mall, lists Ripple Labs, Coinbase Global, and Tether Holdings among its contributors, alongside major companies including Apple, Microsoft, Amazon, Meta, and Lockheed Martin (Reuters). According to the filings, Ripple is understood to be one of the most prominent donors, marking its largest public political-adjacent contribution to date. Other notable supporters include Palantir Technologies, NextEra Energy, and Hard Rock International, as well as philanthropic foundations linked to Stephen A. Schwarzman, Kelly Loeffler, and the Winklevoss twins (Politico).

The privately financed expansion has drawn scrutiny for its timing and optics, coming as the Trump administration pushes for accelerated crypto regulation under the FIT21 market-structure bill. Analysts note that the inclusion of major crypto players among the project’s donors underscores how deeply digital-asset firms are embedding themselves within U.S. political and corporate networks (The Guardian). For investors, it reflects a growing convergence between Washington influence and crypto policy direction — one that could shape both regulatory tone and institutional adoption in the months ahead.

Sensei’s Insight: Ripple’s presence among top donors shows crypto’s evolution from outsider to insider — influence now trades hands in boardrooms and ballrooms, not just on blockchains.

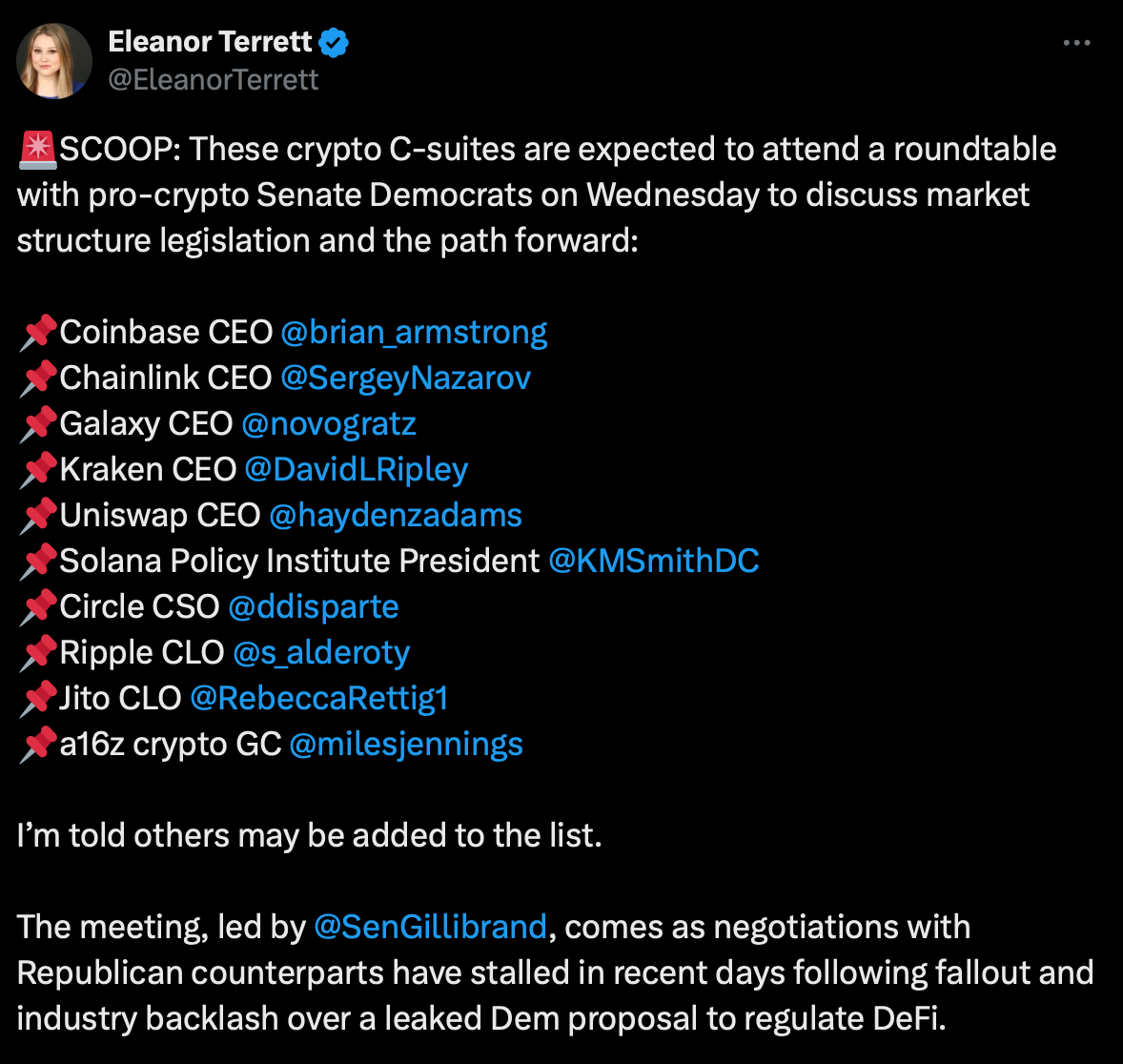

🏛️ Crypto CEOs Face Heated Senate Democratic Meeting Over Market-Structure Bill

Executives from Coinbase, Ripple, Galaxy Digital, Kraken, Chainlink, Uniswap, and Circle met with senior Senate Democrats on Capitol Hill on Thursday to revive stalled negotiations over the digital-asset market-structure bill (FIT21). (Axios) The roundtable, convened by Sen. Kirsten Gillibrand (D-NY), included Senate Minority Leader Chuck Schumer and ten other Democratic lawmakers active in the talks. Sources in the room described the meeting as “heated,” with Sen. Ruben Gallego (D-AZ) reportedly telling the executives, “I’m really fing pissed about what happened last week. Don’t be an arm of the Republican Party — they used you all and your megaphones to f* us.”* (Brendan Pedersen/X) The exchange underscored lingering partisan tensions after crypto industry leaders appeared at a separate closed-door session with Senate Republicans earlier this week.

The Democratic meeting followed a morning briefing between Trump’s crypto and AI policy lead David Sacks and GOP senators on the Banking Committee, where the administration reiterated that passing market-structure legislation remains a “top Trump priority.” (Fox Business) Democrats worry Republicans are attempting to fast-track their version of the Clarity Act without bipartisan hearings. Participants said Gillibrand’s goal was to “re-center” Democrats in the conversation and restore momentum for a unified approach to FIT21 before midterms consume the legislative calendar. Industry executives framed the meetings as a sign that both parties still see an opening to deliver comprehensive crypto regulation before year-end. (CoinDesk)

Sensei’s Insight: Crypto’s push on Capitol Hill has turned openly political — the industry’s credibility now hinges on staying bipartisan as Washington races to shape the rules of digital finance.

🛍️ UK Retail Sales Rise for Fourth Straight Month Despite Cool Weather

UK retail sales grew 0.5% month-on-month in September, marking a fourth consecutive monthly increase as consumers continued to spend despite unseasonably wet weather. (ONS) Non-food sales rose 0.9%, with household goods stores recording the strongest gains, while online and in-store volumes both advanced modestly. Economists said the steady performance suggests retail spending made a positive contribution to GDP in Q3, extending the economy’s modest growth trend amid easing inflation pressures and stabilising wage gains.

Analysts also noted that households still retain sizable excess savings, accumulated during the pandemic and energy-shock periods, which could support a pick-up in discretionary spending if consumer confidence continues to recover. The data reinforces the view that domestic demand is holding up even as broader economic momentum slows, giving the Bank of England some leeway to calibrate rate cuts without stoking inflationary risk. However, the stronger-than-expected sales could delay deeper or faster rate cuts, with markets now pricing a more gradual easing path into early 2026 as policymakers weigh inflation stickiness against steady household demand.

Sensei’s Insight: The resilience in retail points to a UK consumer base that’s cooling—but not cracking—suggesting steady near-term GDP support even as monetary policy begins to ease. Rate cuts remain on the table, but patience may prevail before pace.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive: CPI Showdown: Will Inflation Cool or Come Roaring Back?

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.