Sensei’s Morning Forecast: Crypto ETFs Go Live in a Government Shutdown — Can XRP Be Next?

Trump and Takaichi forge rare-earth pact, Amazon slashes jobs, U.S. backs nuclear power for AI, markets pause pre-Fed, and Enphase faces a critical margin test.

👀 Today’s Stories at a Glance

🇯🇵 U.S.–Japan Rare Earth Pact: Trump and Takaichi sign pact to reduce China reliance and boost industrial investment coordination.

💼 Amazon Job Cuts: Amazon to slash 30,000 corporate jobs, prioritizing efficiency and profitability over post-pandemic workforce expansion.

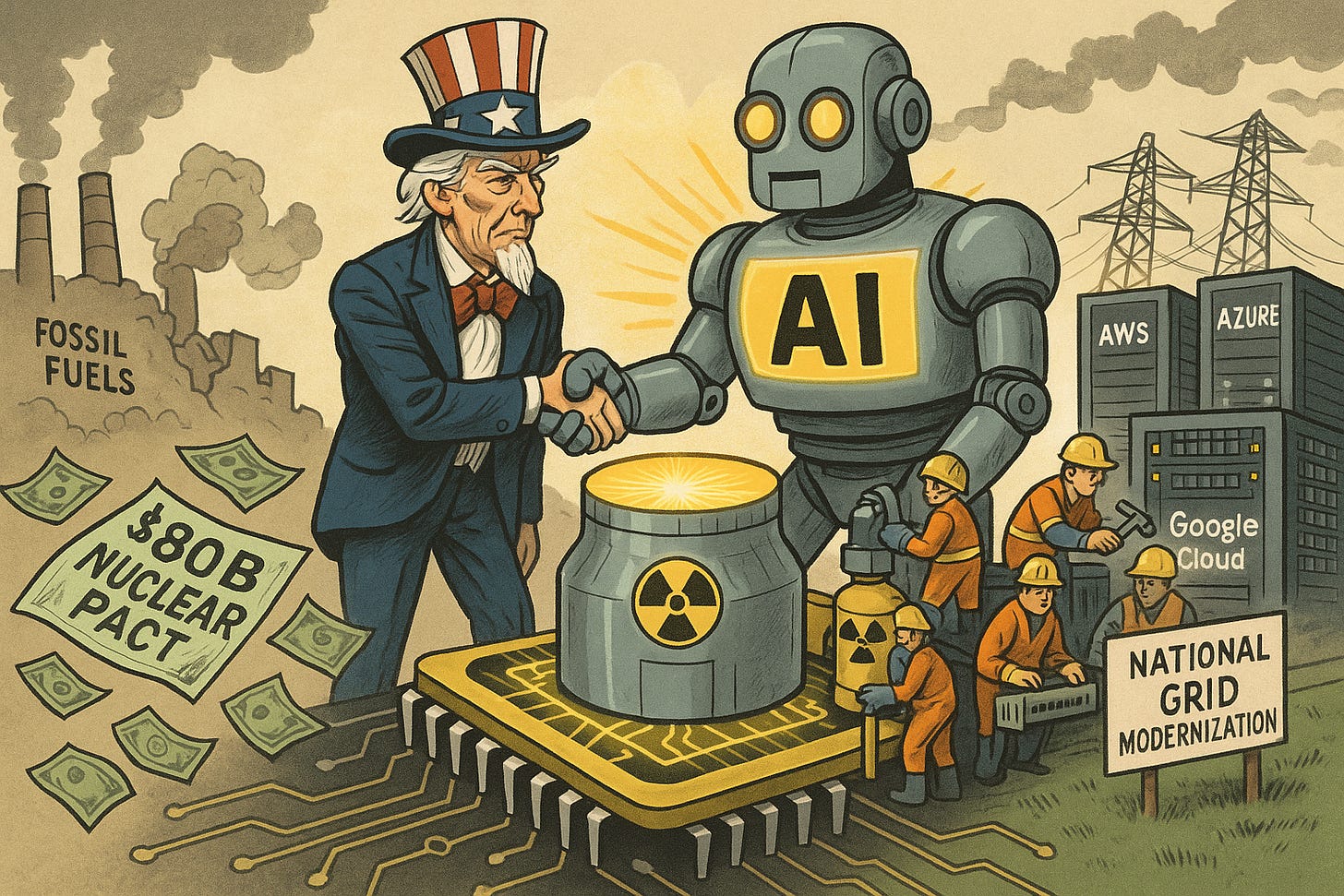

⚛️ Nuclear Power for AI: U.S. signs $80B nuclear deal to support AI-driven energy demand and grid modernization nationwide.

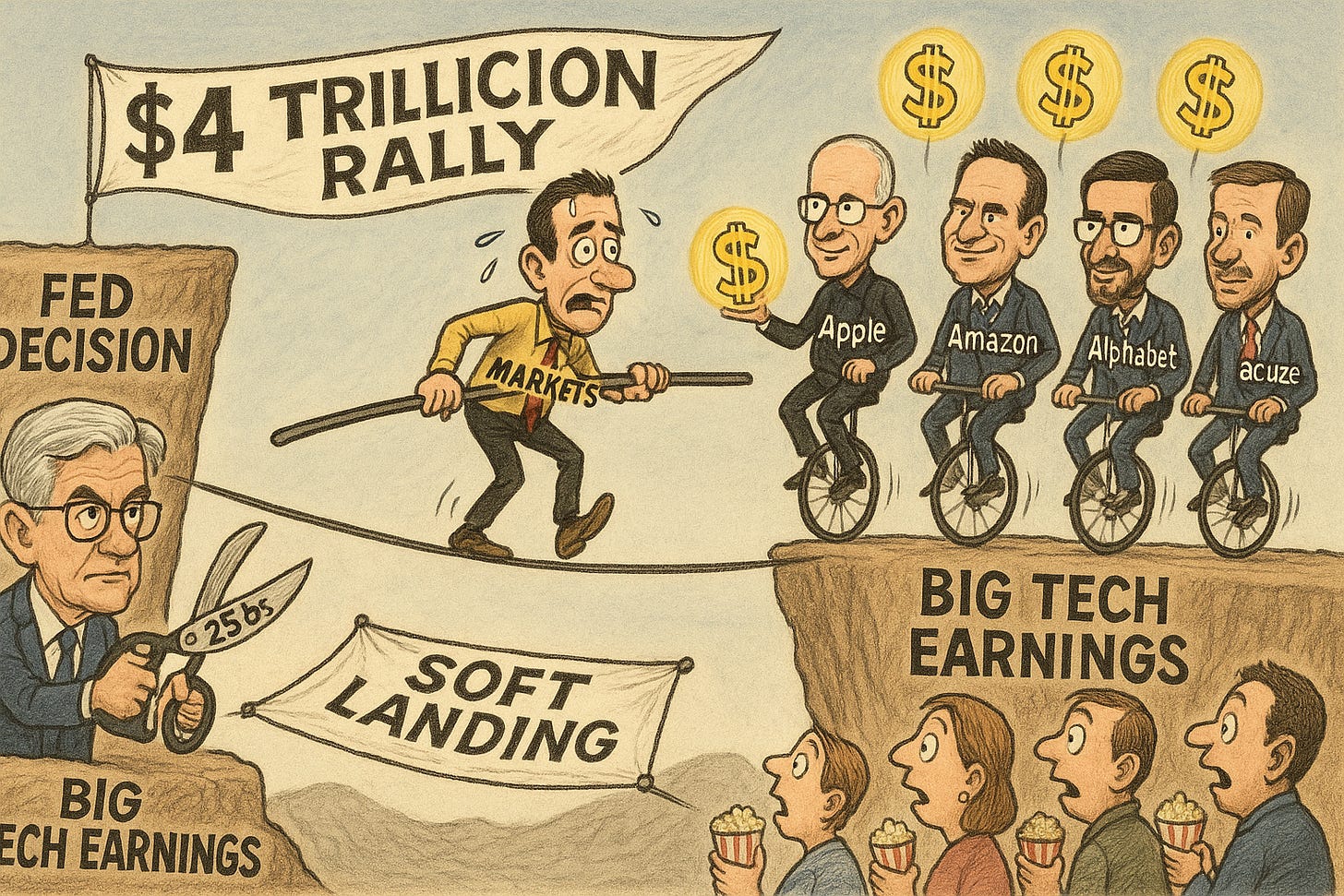

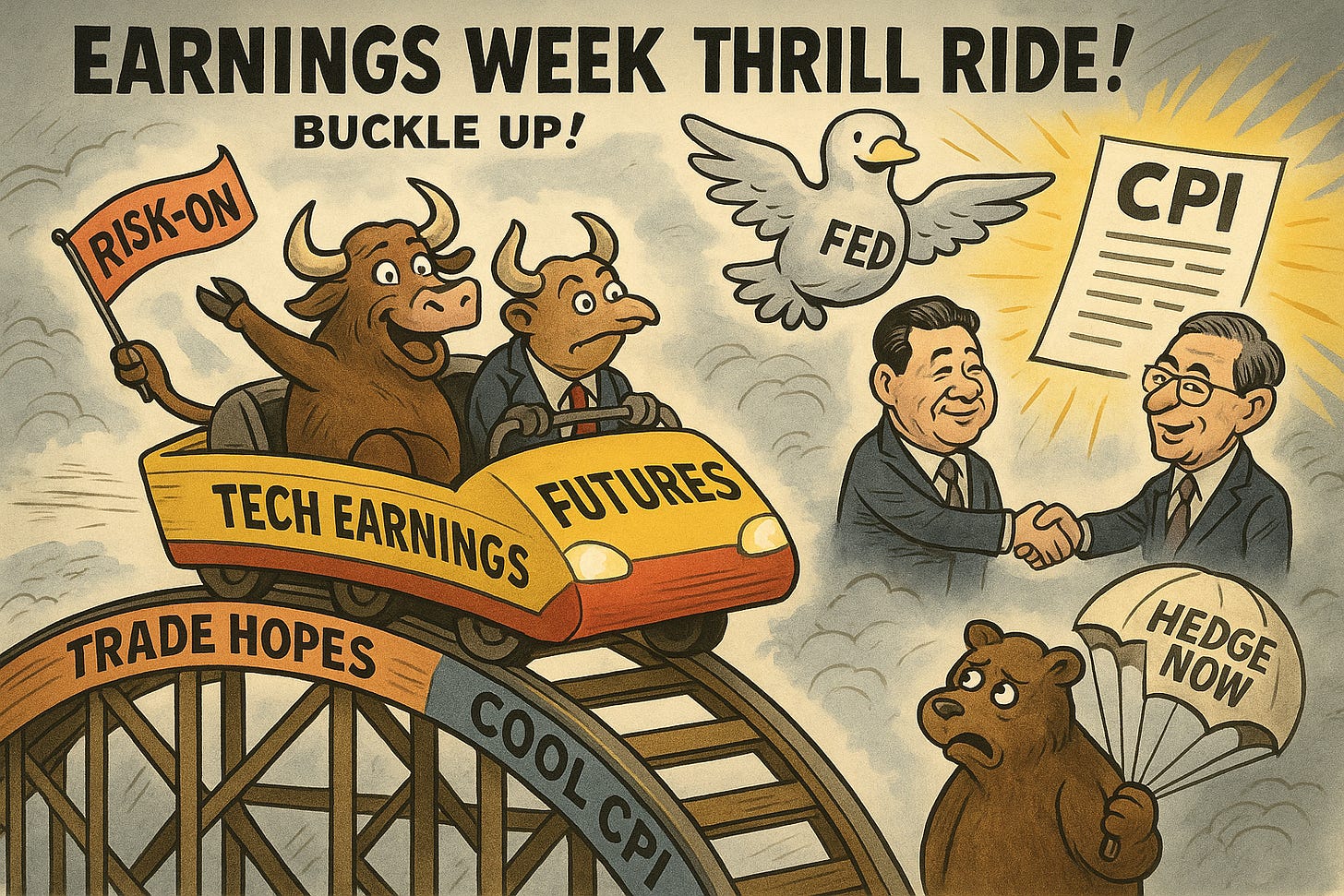

📊 Markets Stall Pre-Fed and Earnings: Global stocks stall as traders await Big Tech earnings and a likely Fed rate cut.

🔋 Enphase Earnings Watch: Enphase reports tonight; investor focus on margin stability, U.S. demand recovery, and China tariff impact.

🔍 Spot ETFs Go Live During Shutdown: Solana, Litecoin, and HBAR spot ETFs launch via automatic SEC rule, bypassing formal approval.

🧠 One Big Thing

Markets added $4 trillion in three weeks—then hit pause. The S&P 500 slipped from highs as traders await Big Tech earnings and a Fed rate cut expected Wednesday. With stretched valuations and sky-high expectations, any slip in guidance or hawkish Fed tone could trigger sharp reversals.

💰 Money Move of the Day

With rate cuts on deck, rate-sensitive sectors like real estate and tech may see action. Even without trading, watching sector ETFs this week can offer sharp clues on market rotation and sentiment shifts.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $114,464 (▲ +0.30%)

Ethereum (ETH): $4,111 (▼ -0.23%)

XRP: $2.66 (▲ +0.84%)

Equity Indices (Futures):

S&P 500 (SPX): 6,873 (▼ -0.08%)

NASDAQ 100: 25,987 (▲ +0.09%)

FTSE 100: 9,664 (▼ -0.17%)

Commodities & Bonds:

10-Year US Treasury Yield: 3.981% (▼ -0.15%)

Oil (WTI): $60.91 (▼ -1.52%)

Gold: $3,915 (▼ -1.68%)

Silver: $46.15 (▼ -1.74%)

🕒 Data as of UK (BST): 10:40 / US (EST): 06:40 / Asia (Tokyo): 18:40

✅ 5 Things to Know Today

🇯🇵 Trump and Japan’s Takaichi Seal Rare-Earth and Investment Pact in Tokyo

U.S. President Donald Trump and Japan’s Prime Minister Sanae Takaichi signed a landmark framework in Tokyo on Tuesday, October 28, aimed at strengthening supply chains for critical minerals essential to energy, defense, and semiconductor manufacturing. The pact creates a U.S.–Japan Critical Minerals Task Force and sets out plans for coordinated investment, joint stockpiles, and transparent market frameworks to reduce reliance on China (Reuters). Implementation measures are expected within six months, including regulatory harmonization and new export-financing tools. The agreement follows Trump’s ASEAN summit visit and highlights a broader U.S. shift toward resource security as the foundation of Indo-Pacific economic strategy. Both leaders also reaffirmed defense and energy collaboration under the Indo-Pacific framework to bolster resilience against supply-chain shocks.

For investors, the Tokyo accord signals structural capital realignment across the region. Japan reaffirmed its $550 billion U.S. investment pledge covering LNG infrastructure, semiconductor plants, and defense manufacturing—with initial projects expected to involve Mitsubishi Heavy Industries and U.S. partners by year-end (Reuters). The Nikkei 225 climbed 0.8% and U.S. equity futures advanced overnight as investors priced in policy continuity and new industrial demand. Analysts see potential upside for energy-transition metals, defense suppliers, and logistics firms aligned with the rare-earth diversification agenda, while currency traders monitor the yen’s stability amid deepening U.S.–Japan capital links.

Sensei’s Insight: Tokyo’s new pact marks a quiet turning point — trade diplomacy is morphing into industrial strategy. For markets, this is where geopolitics becomes earnings growth.

💼 Amazon Plans Major Job Cuts Across Core Corporate Divisions

Amazon is preparing to cut as many as 30,000 corporate jobs—around 10% of its white-collar workforce—as part of a sweeping internal restructuring across key divisions, including human resources, cloud computing, logistics, and retail operations (Reuters). The layoffs, expected to roll out in stages beginning this week, mark one of the company’s largest cost-cutting drives since the pandemic-era hiring surge. CEO Andy Jassy has reportedly directed department heads to identify overlapping roles and reduce management layers to improve efficiency and profitability (LA Times). Amazon’s Devices & Services division, which includes Alexa and Kindle, and its cloud unit AWS are expected to see the most significant cuts, alongside PXT (People Experience and Technology), its HR arm. The restructuring comes as Amazon faces persistent margin pressure, rising labor costs, and slowing global e-commerce demand.

For investors, the job cuts reflect Amazon’s sharpened focus on operational discipline amid a cooling retail environment and intense competition in cloud and AI infrastructure. Analysts expect the move to improve near-term margins, with estimated cost savings of $4–5 billion annually if fully implemented (CBS News). The company’s shares rose 1.2% in after-hours trading as markets interpreted the cuts as a profitability play rather than a retrenchment signal. Still, execution risk remains: aggressive headcount reduction could disrupt innovation cycles in AWS and delay AI-driven product rollouts—two areas central to Amazon’s long-term growth narrative. Investors will be watching next quarter’s margin guidance for confirmation that efficiency gains are materializing.

Sensei’s Insight: Amazon’s pivot toward leaner operations mirrors a broader tech reset—growth now hinges on AI leverage and cost control. Margins, not market share, are this cycle’s true scoreboard.

⚛️ U.S. Signs $80 Billion Nuclear Pact to Power AI Expansion

The U.S. government has signed an $80 billion agreement with Westinghouse Electric Co. to construct a new fleet of nuclear reactors aimed at addressing the surging energy demand from artificial intelligence data centers and next-generation chip manufacturing. The pact, coordinated through the Department of Energy, is designed to expand domestic clean-power capacity and reduce dependence on fossil fuels as AI-driven workloads accelerate U.S. electricity consumption forecasts (Bloomberg Law). Under the deal, Westinghouse will develop advanced modular reactors capable of delivering steady baseload power to major cloud-computing hubs, with deployment expected to begin before the end of the decade. Officials described the program as part of a “national infrastructure modernization initiative” to future-proof the grid and strengthen domestic energy resilience for high-performance computing environments.

For investors, the deal underscores a major policy alignment between the AI and energy sectors. Nuclear’s re-emergence as a strategic technology could spark a multi-year capex cycle benefiting companies in uranium mining, grid engineering, and small modular reactor (SMR) design. Utility and industrial stocks with exposure to nuclear build-outs, including Southern Co. and Fluor Corp., may see upward re-rating on expectations of long-term contract growth. The move also supports the White House’s broader decarbonization goals, while providing a low-carbon power source for hyperscale data centers run by Amazon Web Services, Microsoft Azure, and Google Cloud, which collectively account for nearly 4% of U.S. electricity demand (Reuters).

Sensei’s Insight: This deal cements energy as the new bottleneck in the AI race. Investors should watch how nuclear capacity—once a policy debate—becomes a competitive edge for data-center scalability and tech valuations.

📊 Stock Rally Stalls Ahead of Big-Tech Earnings and Fed Decision

Global equities paused on Tuesday as investors braced for a high-stakes week featuring Big Tech earnings, a Federal Reserve policy decision, and major macro releases. The S&P 500 slipped from record highs, while Nasdaq 100 futures held steady ahead of results from Apple, Microsoft, Alphabet, and Amazon—all set to report within 72 hours (Bloomberg). Treasury yields hovered near 4.10%, and the U.S. dollar softened as traders positioned for what is widely expected to be another rate cut from the Fed. Optimism around a potential U.S.–China trade framework and Japan’s $550 billion investment pledge in U.S. industries offered support, but valuations remain stretched after a three-week rally that added over $4 trillion to global equities. With positioning crowded, markets are approaching the Fed decision with caution.

According to CME FedWatch, traders now assign a 97% probability that the Fed will cut rates by 25 basis points, marking a continuation of the central bank’s mid-cycle easing path (Investing.com). Markets expect the move to reinforce the “soft landing” narrative and extend liquidity support into 2026, benefiting rate-sensitive sectors such as real estate, utilities, and high-growth tech. Still, analysts warn that expectations for both earnings and policy dovishness may already be fully priced in. Consensus forecasts call for 11% year-on-year profit growth among the Magnificent Seven—leaving little room for disappointment. Any hawkish nuance from Chair Powell or weaker-than-expected Big Tech guidance could prompt profit-taking across overextended equity benchmarks.

Sensei’s Insight: Markets are priced for perfection—another Fed cut and flawless Big Tech earnings. Any deviation from that script could turn this week’s pause into a decisive pivot.

🔋 Enphase Energy Reports Earnings Tonight: Margin Watch and Guidance Key

Enphase Energy Inc. (NASDAQ: ENPH) will report third-quarter results after market close on Tuesday, October 28, with investors focused on margin stability, U.S. demand recovery, and tariff exposure. Analysts expect earnings per share of $0.60–0.62 on revenue between $330–370 million, compared with $551 million a year earlier (Zacks). Enphase previously guided for GAAP gross margins of 41–44%, reflecting higher input costs, while non-GAAP margins may remain near 45–47% (Investor Relations). The company’s Q2 print showed revenue of $363.2 million with EPS $0.69, down 63% year-over-year as elevated channel inventory and weaker European shipments pressured results (Investor Relations). Management’s commentary on Q4 demand trends—particularly in the U.S. residential market—and progress on its IQ Battery rollout will be crucial for sentiment.

Investor attention will also center on whether Enphase can stabilize shipments ahead of the 2026 U.S. tax-credit adjustment and ongoing trade frictions with China. Analysts warn that tariffs could trim margins by 3–5% if supply-chain costs remain elevated (TipRanks). Meanwhile, the firm’s U.S. production ramp in South Carolina and planned European expansion are intended to offset declining California volumes following NEM 3.0. For now, the stock trades near $36.80, down ~35% year-to-date, with implied post-earnings volatility near 8%. A revenue beat or constructive guidance could re-anchor investor confidence after four straight quarters of contraction.

Sensei’s Insight: Enphase faces a credibility test—margins, not megawatts, will dictate direction. Tonight’s tone on demand recovery and cost control will decide whether patience or pessimism prevails.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive: How Spot ETFs for Solana, Litecoin, and HBAR Went Effective Without the SEC—During a Shutdown

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.