Sensei's Morning Forecast: ETH Exit Wave, XRP ETF News, SoftBank’s Chip Bet, SPAC King Returns

Is Ethereum maturing or warning us? Ukraine’s Western backing shifts, Intel lures state cash, Shein adjusts strategy, Chamath’s back, and Zuckerberg faces deposition drama, XRP ETF Delay!

🧠 One Big Thing

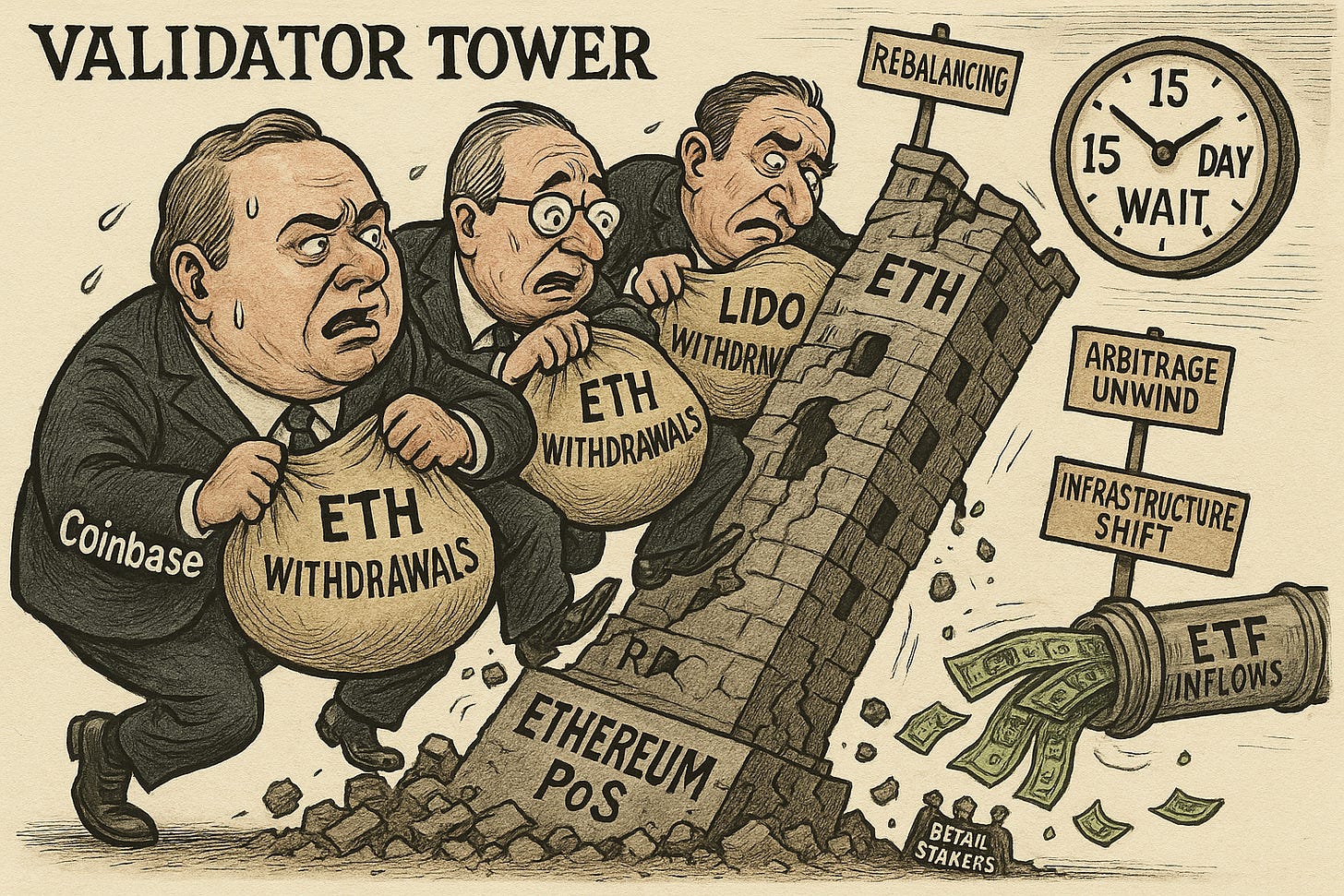

Over $3.91 billion in Ethereum is queued for validator exits — a 47,320% surge in just 30 days — marking the largest infrastructure reshuffle in the network’s history.

💰 Money Move of the Day

Headlines can scream “$4B ETH exits!” — but the story underneath often tells a different tale. Not every big move signals trouble; sometimes it’s just backend restructuring. When you see eye-popping figures, pause before panicking

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $115,616 (▼ -0.58%)

Ethereum (ETH): $4,295 (▼ -0.49%)

XRP: $3.01 (▼ -1.63%)

Equity Indices (Futures):

S&P 500 (SPX): 6,441 (▼ -0.07%)

NASDAQ 100: 23,758 (▼ -0.17%)

FTSE 100: 9,191 (▲ +0.12%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.328% (▼ -0.16%)

Oil (WTI): $62.84 (▼ -1.07%)

Gold: $3,342 (▲ +0.27%)

🕒 Data as of UK (BST): 12:18 / US (EST): 07:18 / Asia (Tokyo): 20:18

✅ 5 Things to Know Today (+ Bonus Story)

🇺🇸 US and Europe Begin Talks on Ukraine Security Plan

U.S. President Donald Trump hosted Ukrainian President Volodymyr Zelenskyy and several European leaders at the White House on Monday to discuss a framework for long-term Western security commitments to Ukraine (Reuters). While no formal agreement was reached, officials described the talks as a first step toward potential "NATO-style" guarantees as part of wider peace negotiations with Russia. The summit followed Trump’s meeting with Russian President Vladimir Putin in Alaska, where Western officials suggested Moscow may be open to security arrangements for Ukraine that stop short of NATO membership (CNBC). Trump emphasized that Europe would bear the primary defense and financial burden, while the U.S. would play a supporting role: “They are the first line of defense because they're there, but we will help them out” (Fox News).

During the visit, Zelenskyy proposed a $90 billion U.S. weapons procurement package, including aircraft, drones, and air defense systems, to be financed with European support (Seeking Alpha). A separate $50 billion drone production agreement with Ukrainian companies is also under review. NATO Secretary General Mark Rutte confirmed Ukraine’s membership remains off the table but said Article 5-style assurances are being considered (Reuters). Analysts warn these non-binding guarantees are untested, raising concerns about deterrence credibility, while also signaling a possible shift in the structure of European security alliances (RUSI).

Sensei’s Insight: The U.S. and Europe are testing the boundaries of NATO’s model—offering Ukraine serious security commitments without alliance membership. This could reshape Europe’s defense order, but its durability will depend on both political will and Moscow’s response.

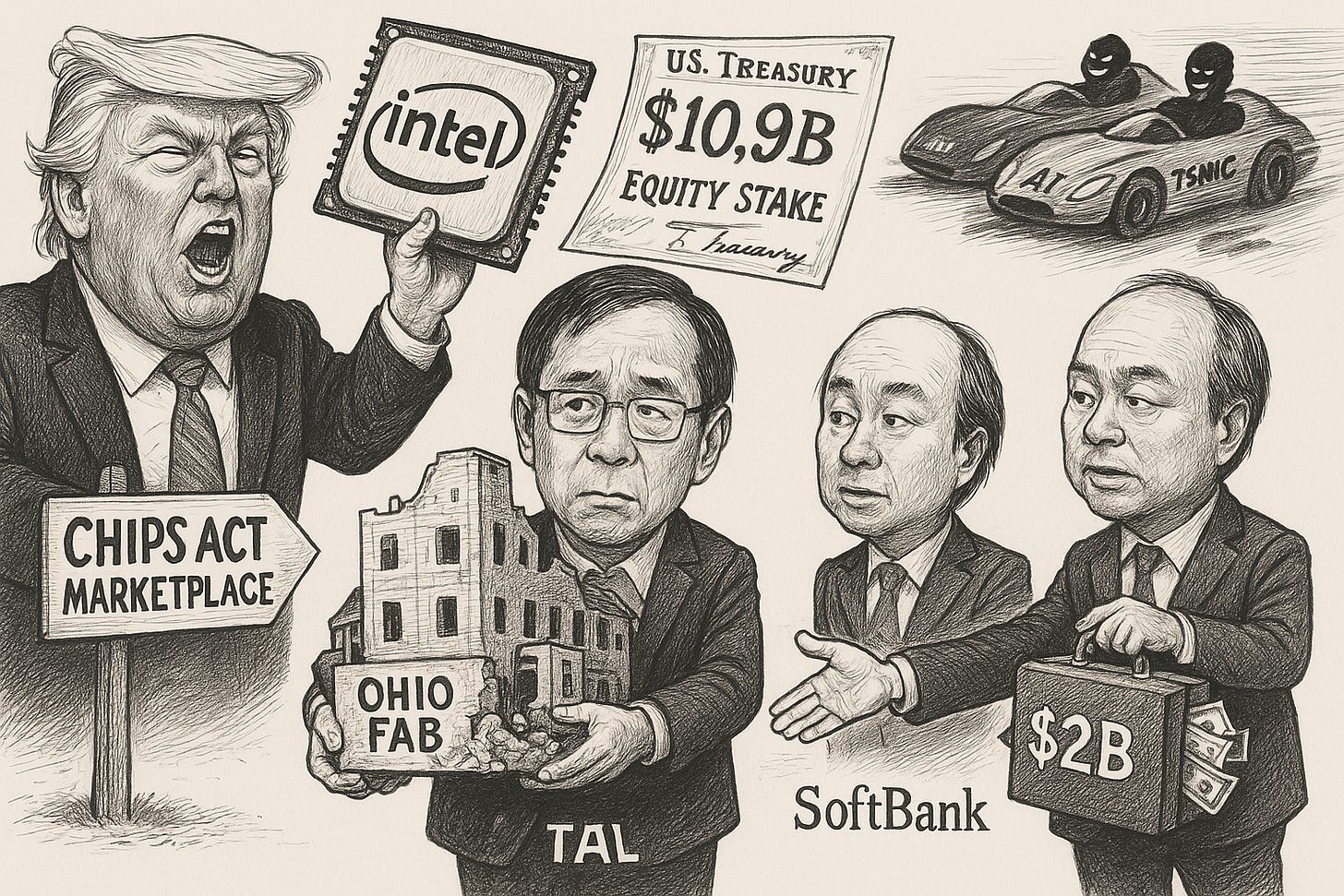

🇺🇸 U.S. Weighs Intel Stake, SoftBank Commits $2B

The Trump administration is reportedly in discussions to convert $10.9 billion in CHIPS Act grants into equity in Intel, potentially giving the U.S. government a stake of roughly 10% in the chipmaker (Bloomberg). If finalized, the stake would make Washington one of Intel’s largest shareholders. The talks gained momentum following a White House meeting between President Trump and Intel CEO Lip-Bu Tan, after Trump had earlier demanded Tan’s resignation over alleged connections to Chinese firms (Fox Business).

Separately, SoftBank announced a completed $2 billion investment in Intel at $23 per share, a deal confirmed in its official press release (SoftBank). The Japanese conglomerate becomes one of Intel’s larger new outside shareholders, though far behind index fund giants like BlackRock and Vanguard. The capital will fund new share issuance rather than secondary market buys, and forms part of SoftBank Chairman Masayoshi Son’s broader $500 billion U.S. tech commitment (Bloomberg). Intel shares rose 6.7% in premarket trading following the announcements (Investing.com).

Intel’s $18.8 billion loss in its foundry unit last year underscores its lag behind rivals like TSMC and Nvidia in advanced chip production (Investors.com). A potential U.S. equity stake is being discussed as a lifeline to support delayed domestic projects like its Ohio fab. However, analysts caution that public funding alone won’t fix Intel’s structural technology gaps, suggesting the move is more about national security than return on investment (MarketWatch).

Sensei’s Insight: The White House is preparing to write a $10B check—not for a bailout, but for a national tech hedge. It’s a power move with no guarantee of performance.

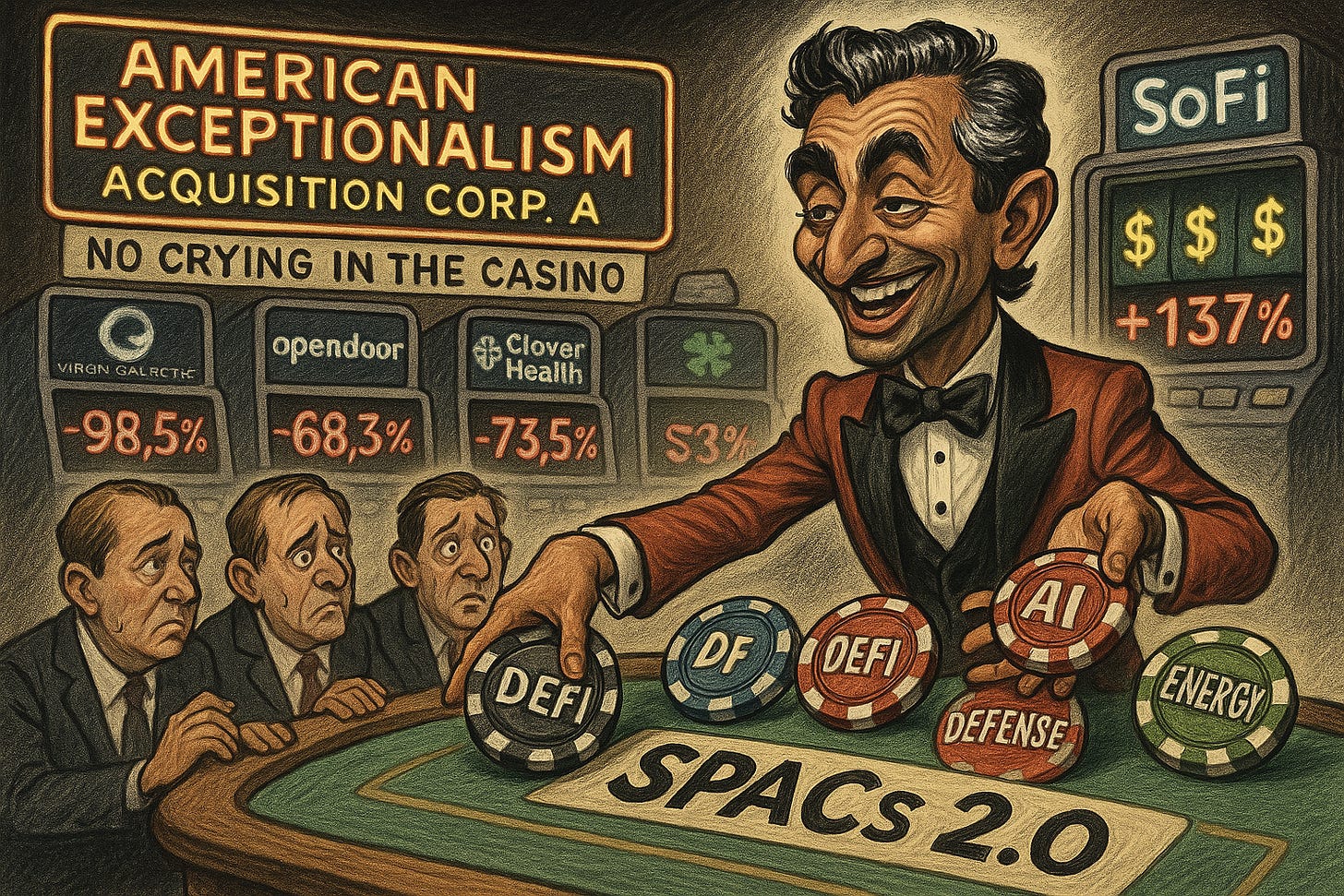

🧠 The SPAC King Returns: Chamath Palihapitiya Files $250M Blank-Check Company

Chamath Palihapitiya, the former Facebook executive and poster child of the SPAC boom, has filed for a new blank-check firm—American Exceptionalism Acquisition Corp. A—seeking to raise $250 million through an IPO (CoinCentral, Cointelegraph). According to the SEC filing, the SPAC plans to offer 25 million shares at $10 each and has applied to list on the NYSE under the ticker AEXA (SEC Filing). It will target acquisitions in artificial intelligence, decentralized finance, defense, and energy sectors. This filing marks Palihapitiya’s first SPAC initiative since 2022, when he shut down two vehicles that failed to secure merger partners (Morningstar).

The filing arrives amid a notable rebound in SPAC issuance. Through August 2025, 81 SPACs have raised a combined $16.15 billion—surpassing the $9.6 billion raised in 2024 and quadrupling the $4 billion total from 2023 (SPACInsider, IFLR). Yet Palihapitiya’s past deals continue to draw scrutiny. Virgin Galactic shares have dropped roughly 98% from their de-SPAC level, Opendoor by 68%, and Clover Health by 73%. Only SoFi Technologies has produced gains, now trading 137% above its merger price (Segler Consulting, VIP Graphics). In response to criticism, the new SPAC excludes warrants and links sponsor equity to performance-based vesting, representing a structural shift from previous models. The S-1 also includes an unusually direct warning to investors: invoking Donald Trump’s “no crying in the casino” mantra, Palihapitiya advises retail participants not to risk more than they can afford to lose.

Sensei’s Insight: Palihapitiya—the architect of the last SPAC cycle—returns with new rules but old baggage. His new blank-check vehicle is pitched as a more disciplined structure, but performance history and market scrutiny will dictate whether investors buy the comeback story.

🧵 Shein Weighs China Move to Salvage Hong Kong IPO Plans

Shein, the fast-fashion giant founded in China and headquartered in Singapore since 2021, is reportedly exploring a potential shift back to mainland China in order to smooth regulatory approval for a long-pursued Hong Kong listing.

According to multiple reports, the company has begun preliminary consultations with legal advisors about establishing a parent entity in China, though no final decision has been made (Retail Gazette, Proactive Investors). The move, if pursued, would be aimed at easing approval from the China Securities Regulatory Commission (CSRC), which regulates offshore listings for companies with substantial operations in China. Shein confidentially filed for a Hong Kong IPO in June 2025 (Reuters), after earlier efforts to list in New York and London reportedly stalled due to lack of regulatory approval from Beijing amid rising geopolitical tensions (Bloomberg).

Despite its Singapore incorporation, Shein remains deeply tied to China’s manufacturing base, placing it under the CSRC’s purview. Legal and regulatory analysts suggest that creating a mainland parent entity could enhance its chances of receiving listing clearance — though, as of now, the idea remains under internal review. Meanwhile, valuation concerns continue to hang over the offering: after reaching a $100 billion peak in 2022, Shein was marked down to $66 billion in a 2023 funding round. Current market chatter places a potential Hong Kong IPO closer to $50 billion (TechBuzz, Modaes).

Sensei’s Insight: Shein’s experience highlights how Beijing’s grip over overseas listings is reshaping global IPO strategies. For firms with strong China ties, navigating regulatory approval is now as critical as market fundamentals.

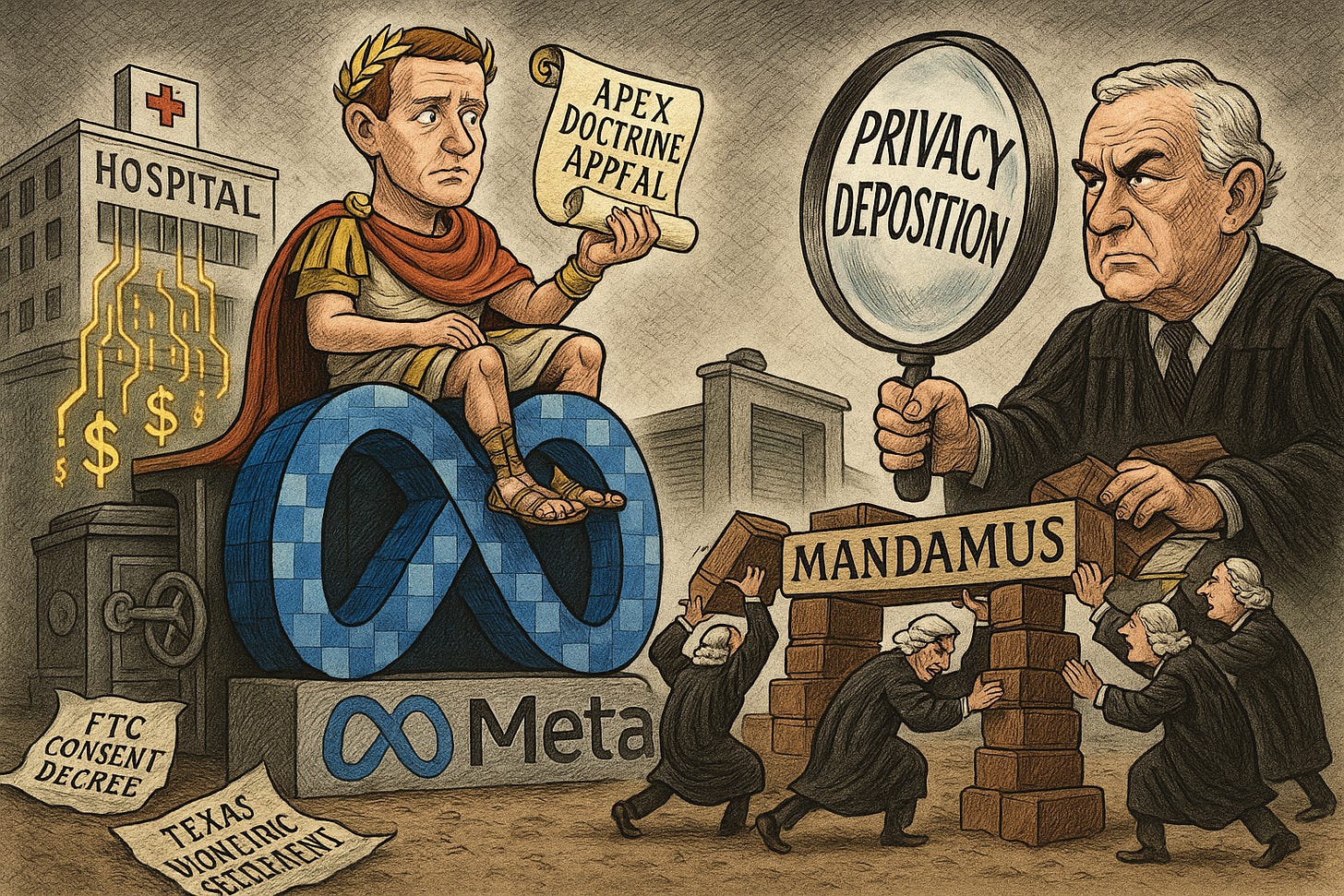

🧑⚖️ Zuckerberg Battles Privacy Class Action Deposition Order

Meta CEO Mark Zuckerberg is challenging a federal court order compelling him to testify in a class action lawsuit over the company’s Meta Pixel tracking tool, which plaintiffs allege allowed hospitals and healthcare providers to transmit sensitive patient data to Facebook without consent (Reuters). In June 2025, U.S. District Judge William Orrick upheld a magistrate judge’s ruling requiring Zuckerberg to sit for up to three hours of deposition. The court pointed to Zuckerberg’s position as Meta’s final authority on privacy policy and the relevance of the company’s prior consent decree with the FTC (AOL).

Meta has petitioned the 9th U.S. Circuit Court of Appeals for a writ of mandamus, invoking the apex doctrine, which shields high-level executives from deposition unless they possess unique, first-hand knowledge. The appeals court is expected to weigh the request before the currently scheduled deposition date of August 21 in Palo Alto (Cohen Milstein). The 2022 lawsuit accuses Meta of violating federal wiretap law and California privacy statutes to generate advertising revenue. It adds to the company’s mounting privacy-related legal exposure, including a $1.4 billion biometric data settlement with Texas in 2024 over unauthorized data collection under state law (Texas AG) (Spencer Fane).

Sensei’s Insight: The dispute puts a spotlight on the apex doctrine’s role in shielding executives and could establish a precedent for compelling CEO testimony in privacy litigation—reshaping accountability standards across Big Tech.

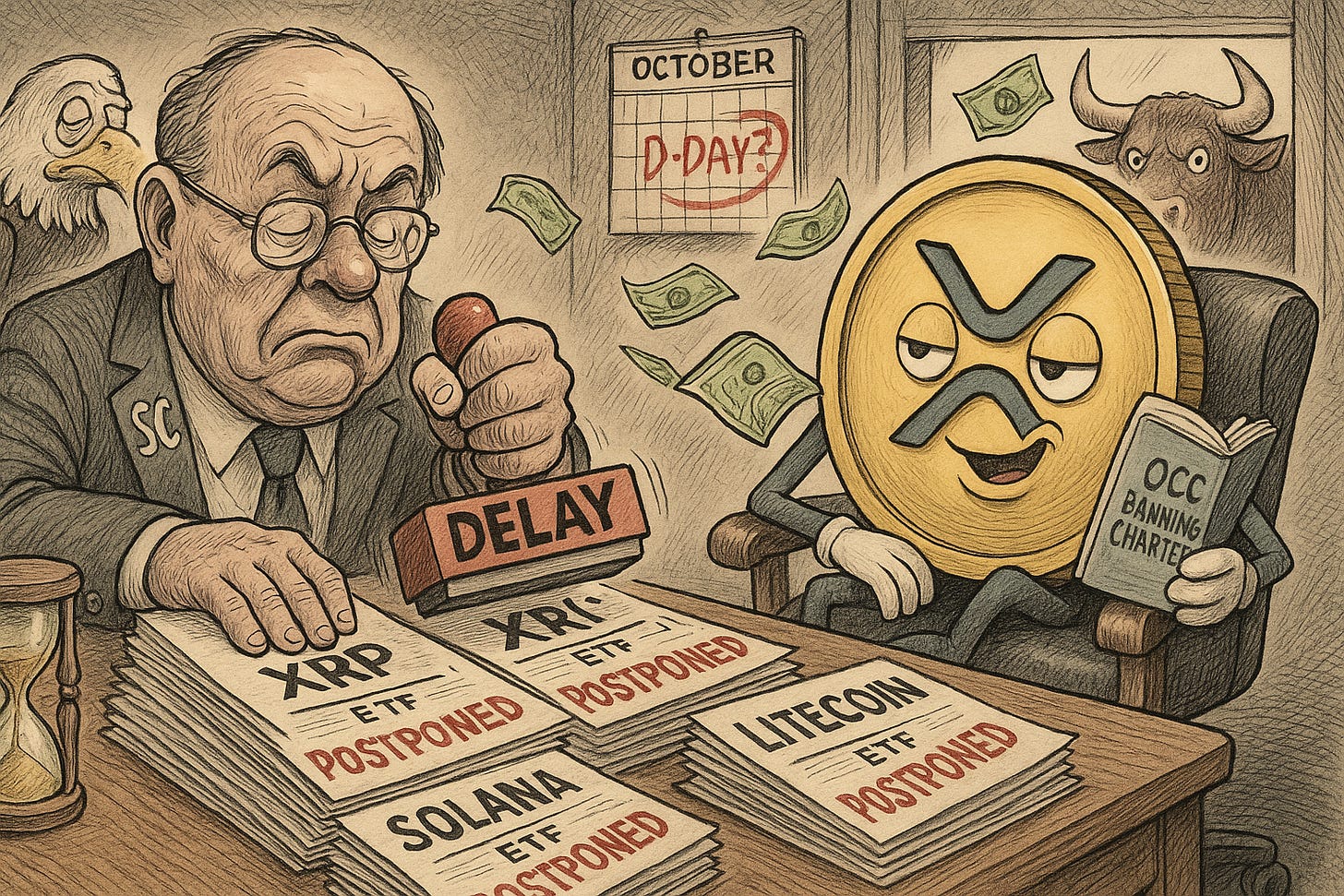

🚨 SEC Delays XRP ETF Decisions to October Amid Rising Approval Odds

The U.S. Securities and Exchange Commission has postponed decisions on eight major spot XRP ETF proposals, pushing deadlines to mid-to-late October. This impacts applications from 21Shares, CoinShares, Grayscale, Bitwise, and Canary Capital, with new deadlines between October 18–23. The SEC cited the need for additional time to evaluate public input and regulatory considerations under the Securities Exchange Act (CoinGape, CryptoBriefing, Reuters). These delays mirror similar extensions for Solana and Litecoin ETF filings, clustering multiple altcoin ETF decisions into a single high-stakes October window. 21Shares’ Core XRP Trust, initially due August 20, now faces an October 19 decision. CoinShares' Nasdaq-listed fund will wait until October 23 (U.Today, Coinpedia).

Despite the deferral, sentiment remains bullish. Bloomberg ETF analysts maintain a 95% probability of XRP ETF approval—substantially above the 77% odds reflected in Polymarket prediction markets (CoinCentral). Ripple's recent legal victory over the SEC has bolstered confidence, with potential institutional inflows estimated at over $5 billion if approvals are granted. October may be doubly pivotal: Ripple's application for a national banking charter with the OCC also reaches its 120-day deadline that month, creating potential dual catalysts for institutional adoption (FXEmpire, TheCryptoBasic).

Sensei’s insight: XRP’s regulatory moment of truth now rests on October’s dual fronts: ETF greenlighting and banking status. If both fall Ripple’s way, expect a flood of institutional capital—and a redefined crypto landscape.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍 Deeper Dive: The $4 Billion Ethereum Validator Exodus

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.