Sensei's Morning Forecast: Fed Flexes Rate Cut Options While Saylor’s Bet Wobbles

Track Bitcoin premium collapse, blockchain‑published GDP, Fed’s aggressive cut hints, China’s AI chip surge, tariff upheaval—all setting the stage for our deep dive into Core PCE’s market‑moving power

👀 Today’s Key Stories at a Glance

📉 Strategy’s Bitcoin Premium Collapse: Strategy Inc. shares tanked as its Bitcoin premium plunges, raising fears about Saylor’s leveraged model.

🧾 GDP Hits the Blockchain: U.S. government publishes GDP data on-chain across nine blockchains, signaling a major shift in crypto legitimacy.

🏦 Fed’s Waller Eyes Jumbo Cut: Fed’s Waller hints at aggressive rate cuts if September jobs data shows worsening economic conditions.

🤖 Cambricon’s AI Boom: Cambricon posts 4,348% revenue surge, riding Nvidia’s exit to become China’s AI chip market leader.

📦 U.S. Ends Tariff-Free Imports: America scraps its $800 de minimis exemption, disrupting e-commerce logistics and igniting global shipping backlash.

🔍 PCE in the Spotlight: Today’s Core PCE print will shape Fed rate cut odds—0.2% is bullish, 0.4% risks derailing soft landing.

🎉 Today: Charity Fundraiser for Development Alert Uganda

At 1:30pm UK time / 8:30am EST / 10:30pm AEST, join the Martyn Lucas Investor channel for a special livestream fundraiser in celebration of reaching 100,000 subscribers!

We're raising funds for Development Alert Uganda, a grassroots initiative serving the Tororo District — one of the most underserved regions in Eastern Uganda. Every $10 donated can make a life-changing impact:

🎒 Equip a child with a full year’s worth of educational materials

💧 Provide an individual with clean, safe water for life

🌱 Plant 30–50 trees to safeguard the local environment

This isn’t just charity — it’s direct action with measurable impact. Be part of something meaningful today.

📍 Livestream begins at 1:30pm UK / 8:30am EST / 10:30pm AEST — tune in and give what you can.

🚨 Missed it? You can still click the link and donate anytime — your contribution still goes straight to the community.

🧠 One Big Thing

Strategy Inc.'s Bitcoin premium has collapsed 54% in two months, from 3.4x to just 1.57x—despite BTC trading near all-time highs. It's a stunning reversal for a company once seen as the ultimate corporate crypto proxy.

💰 Money Move of the Day

When an investment trades at a persistent premium to its underlying assets, ask what you’re really paying for—scarcity, leverage, or narrative. Premiums can inflate fast in bull markets... and unwind even faster when sentiment shifts.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $109,973 (▼ -2.30%)

Ethereum (ETH): $4,338 (▼ -3.85%)

XRP: $2.87 (▼ -3.10%)

Equity Indices (Futures):

S&P 500 (SPX): 6,484 (▼ -0.26%)

NASDAQ 100: 23,633 (▼ -0.57%)

FTSE 100: 9,189 (▼ -0.38%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.223% (▲ +0.43%)

Oil (WTI): $64.98 (▲ +0.06%)

Gold: $3,405 (▼ -0.34%)

🕒 Data as of UK (BST): 12:09 / US (EST): 07:09 / Asia (Tokyo): 20:09

✅ 5 Things to Know Today

📉 Market Revolt Hits Saylor’s Bitcoin Premium Strategy

Strategy Inc. (formerly MicroStrategy) shares fell 15% as investor confidence in Michael Saylor’s leveraged Bitcoin treasury model falters. The company’s premium to its Bitcoin holdings has collapsed to 1.57x—down sharply from a post-Trump peak of 3.4x—even as Bitcoin prices hover near all-time highs. The reversal comes after years of aggressive Bitcoin accumulation, with Strategy now holding 632,457 BTC valued at approximately $70 billion. The downturn accelerated following a disappointing preferred stock offering that raised just $47 million, far short of expectations. Strategy was forced to return to common stock issuance, breaking its prior commitment to avoid dilution—a move that triggered a 7.8% drop in shares (Yahoo Finance, Parameter).

Analysts warn of deeper downside. Monness’s Gus Gala reiterated a Sell rating and a $175 price target, citing risks from $3.4 billion in bond debt and mounting equity dilution. Strategy’s recent decision to abandon its self-imposed floor of issuing shares only above a 2.5x net asset value further rattled investors. This decline reflects a broader shift in sentiment toward corporate Bitcoin proxy models, especially as spot Bitcoin ETFs offer direct exposure with no dilution. Nearly one-third of public companies holding Bitcoin now trade below NAV, and Strategy’s once-revered playbook—emulated across $108 billion in corporate BTC holdings—faces existential scrutiny amid rising funding costs and ETF competition (Bloomberg, Ainvest).

Sensei’s Insight: Strategy’s shrinking premium is more than a valuation issue—it’s a credibility referendum on the leveraged Bitcoin treasury model that once made Saylor a crypto icon.

🇺🇸 US Puts GDP Data on Blockchain in Historic Transparency Push

In a landmark move, the U.S. Commerce Department has begun publishing official GDP figures across nine public blockchains, including Bitcoin, Ethereum, Solana, and Polygon. The initiative, led by Commerce Secretary Howard Lutnick, embeds cryptographic hashes of Q2 2025 GDP data—showing 3.3% annualized growth—on-chain through the help of Coinbase, Kraken, and Gemini. Chainlink and Pyth are providing oracle services to ensure delivery of the data to smart contracts and decentralized applications, creating an immutable and transparent public record (Cryptoslate, Yahoo Finance).

The department emphasized this is an additive distribution method, not a replacement for traditional reporting. Lutnick credited President Trump’s pro-crypto policy shift, stating, “We are going to put out GDP on the blockchain because you are the crypto President.” Alongside hashes, the department has published some topline numbers, with future plans to include key indicators like the PCE Price Index and Real Final Sales. The move marks a significant evolution in the U.S. government's approach to crypto, signaling institutional endorsement of blockchain's utility beyond currency, and potentially paving the way for expanded on-chain federal data publishing (Coindesk, Ainvest).

Sensei’s Insight: When GDP hits Bitcoin before Bloomberg, it's time to recognize blockchain’s leap from fringe tech to federal pipeline.

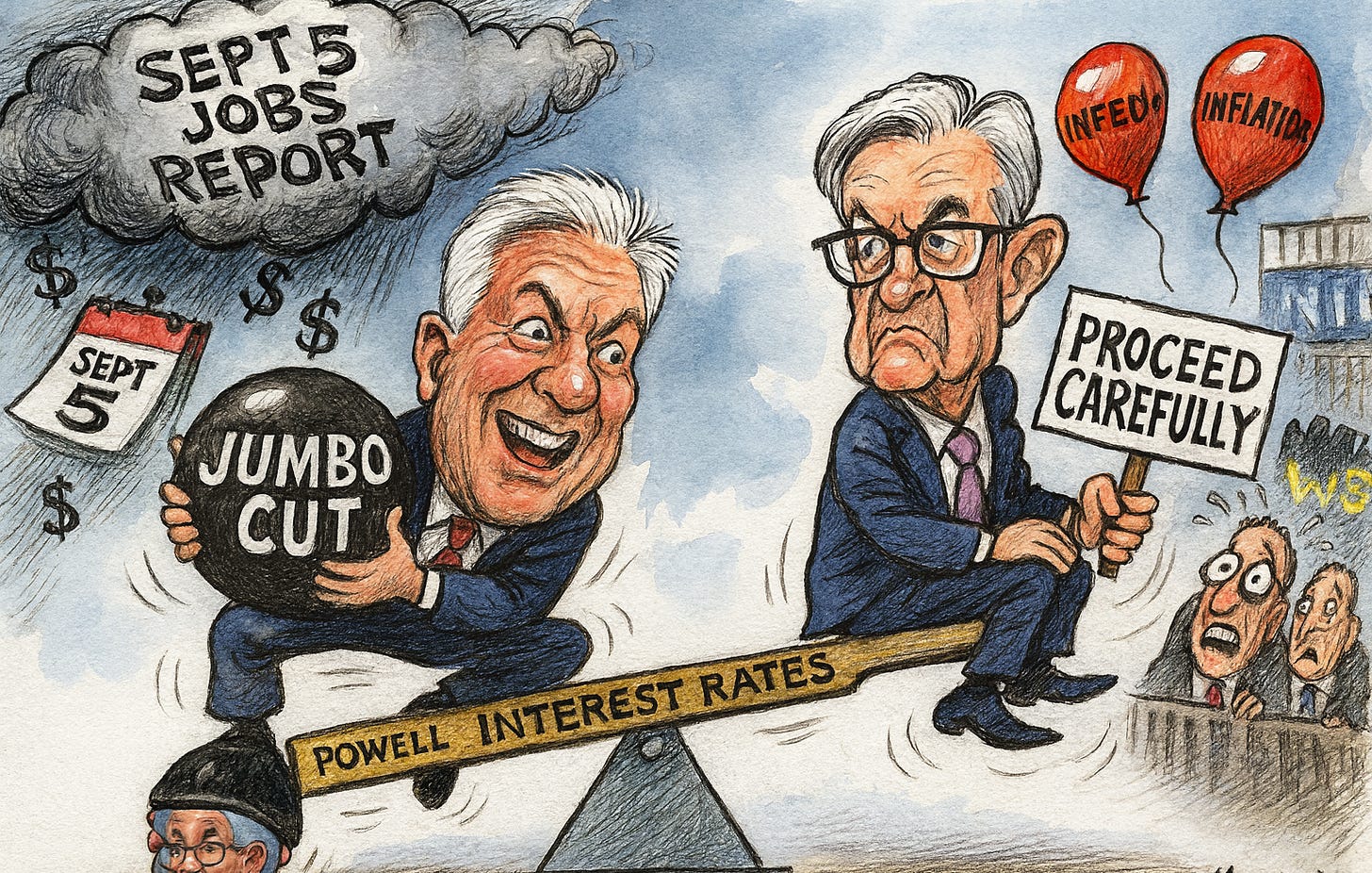

Fed’s Waller Signals Openness to Jumbo Rate Cut if Economy Deteriorates

Federal Reserve Governor Christopher Waller said he supports a 25 basis point rate cut in September but would back a larger "jumbo" cut if upcoming data point to significant economic weakness. Speaking at the Economic Club of Miami, Waller noted that the September 5 jobs report will be pivotal, especially if it reflects a deteriorating labor market and subdued inflation. His remarks show a more aggressive posture than Fed Chair Jerome Powell's cautious stance at Jackson Hole last week, where Powell urged proceeding "carefully" and refrained from signaling any specific cut sizes or timing (Reuters, Morningstar, Al Jazeera).

Waller’s comments diverge sharply from Powell’s, with the governor emphasizing his openness to “additional cuts over the next three to six months” as the Fed moves toward a neutral rate estimated at 1.25–1.50 percentage points below current levels. Markets have now priced in an 89% probability of a September cut, and Waller’s posture adds weight to expectations for a potentially faster easing cycle. His stance underscores internal debate at the Fed, heightens sensitivity to labor market data, and injects new uncertainty into rate-sensitive sectors and duration bets (MarketWatch, Reuters).

Sensei’s Insight: Watch the September 5 jobs report closely. If the numbers disappoint, markets may see a steeper cut than expected—and Waller has just put that risk on the table.

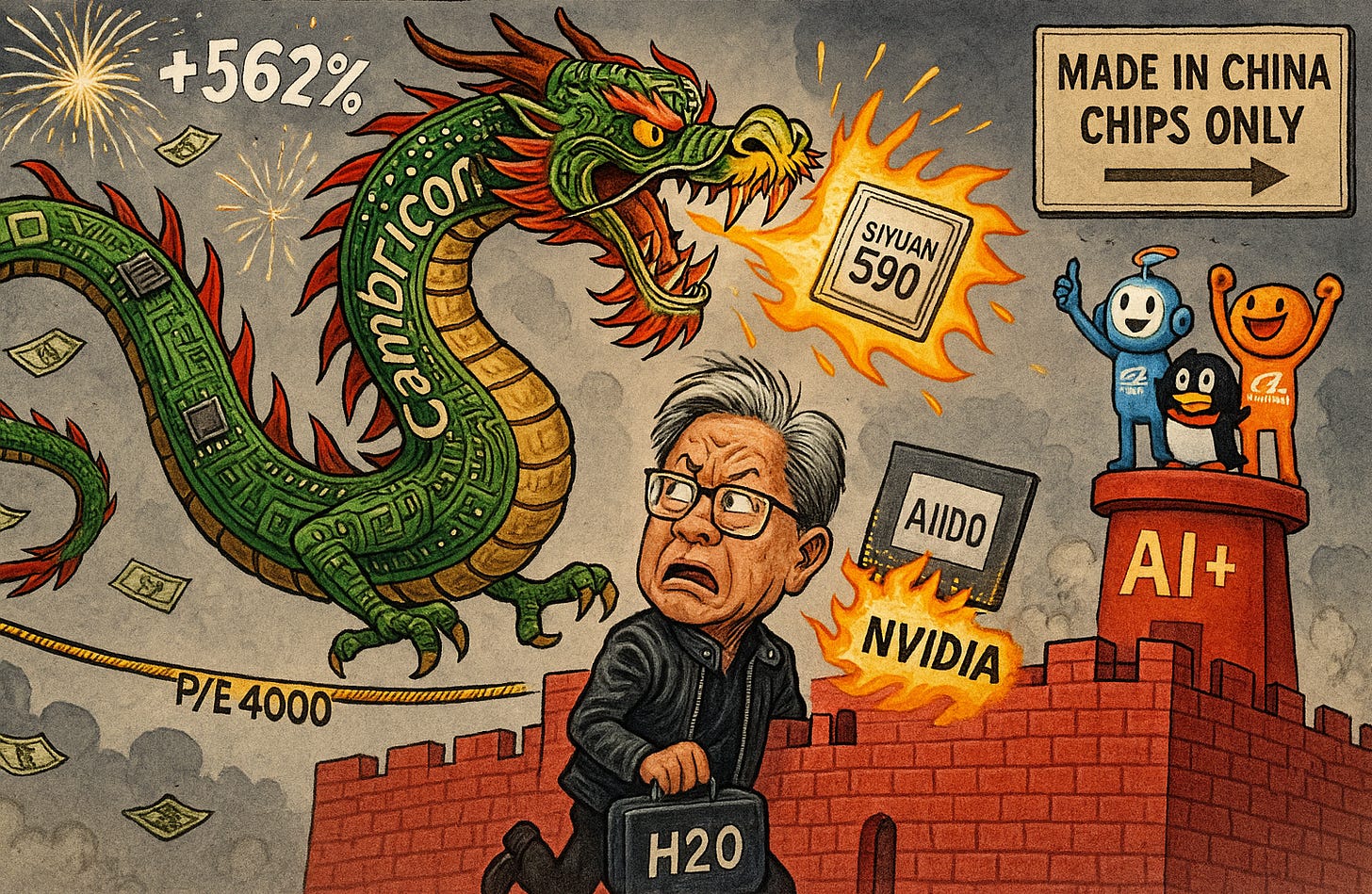

🇨🇳 Cambricon Surges as China’s AI Chip Champion

Cambricon Technologies has staged a dramatic financial comeback, marking a pivotal moment in China’s push for semiconductor independence. The Beijing-based AI chipmaker reported a record 1.04 billion yuan profit ($144 million) for H1 2025, swinging from a 533 million yuan loss a year earlier, as revenue exploded 4,348% to 2.88 billion yuan. Its stock has soared over 562% since September 2024, briefly surpassing Kweichow Moutai to become China’s most valuable public company with an $80 billion market cap (Fortune, Caixin). The surge was catalyzed by U.S. export restrictions, which removed Nvidia’s H20 chips from the Chinese market in April, creating space for Cambricon’s Siyuan 590 chips—offering 80% of A100 performance at 30% lower cost—to dominate.

Adding fuel to the rally, DeepSeek’s V3.1 model was trained using the UE8M0 FP8 format optimized for "home-grown chips soon to be released," prompting speculation about Cambricon’s next-gen Siyuan 690 rivaling Nvidia’s H100 (SCMP, Reuters). With major partnerships from DeepSeek, Alibaba's Qwen, and Tencent's Hunyuan, plus support from Beijing’s “AI+” policy, Cambricon is securing dominant domestic positioning. Yet risks loom large: the company trades at a P/E above 4,000, five customers make up 94% of sales, and advanced manufacturing constraints persist. Still, its ascent marks China’s first real challenge to Nvidia’s AI chip supremacy, with localization expected to hit 55% by 2027 and Nvidia’s share projected to fall to 54% in 2025 (TrendForce).

Sensei’s Insight: Cambricon isn’t just a stock story—it’s the new face of China’s AI sovereignty ambitions.

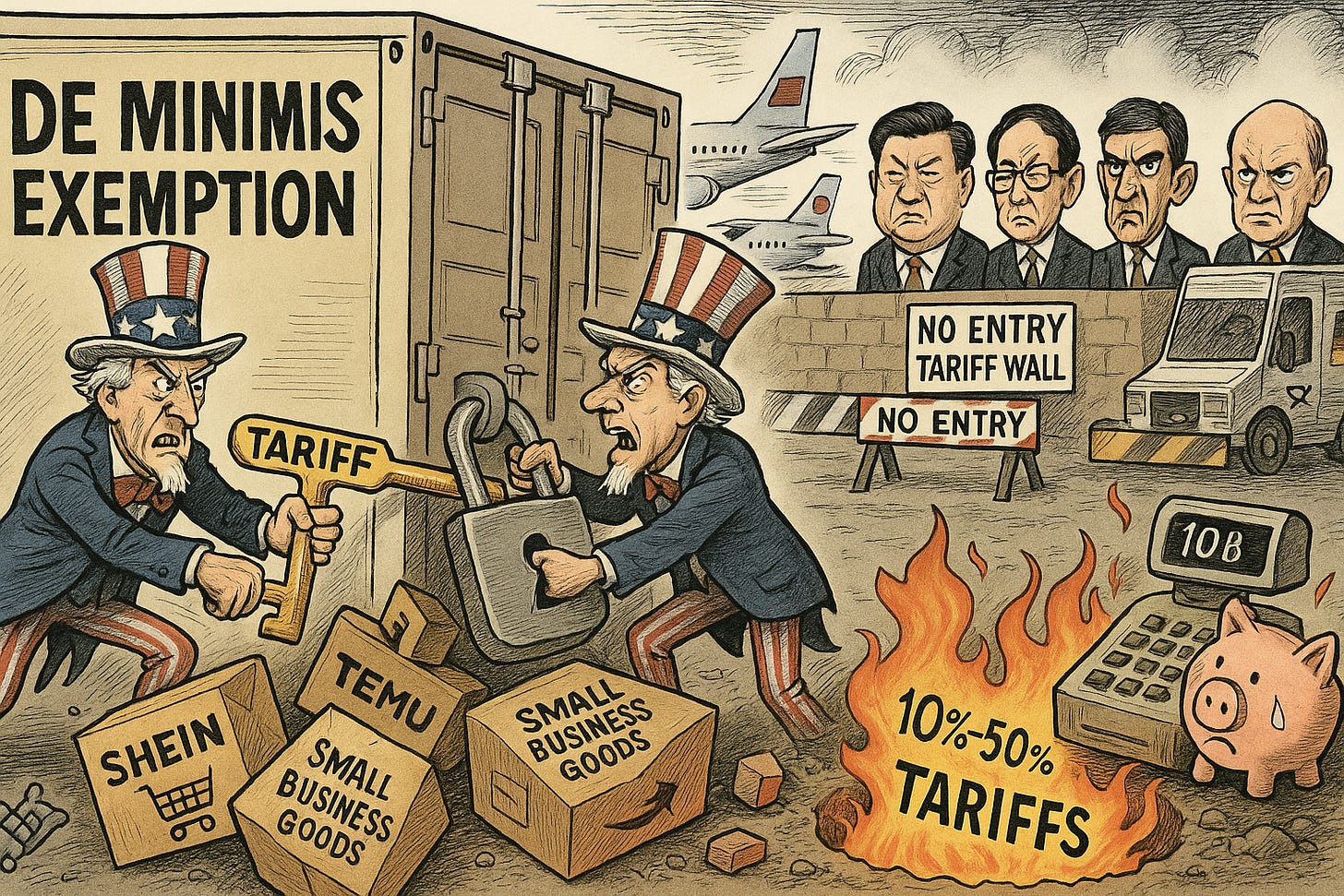

📦 US Ends Low-Value Package Tariff Exemption, Disrupting Global Shipping

The United States officially ended its 87-year-old “de minimis” tariff exemption on Friday, August 29 at 12:01 a.m. EDT, eliminating duty-free treatment for packages valued under $800. All international shipments are now subject to tariff rates ranging from 10% to 50% depending on country of origin, or flat fees of $80–$200 through postal channels during a six-month transition. Previously covering over 4 million daily packages—totaling 1.36 billion shipments worth $61 billion in FY2024—the exemption played a crucial role in U.S. e-commerce. More than 60% of these parcels originated from China before its exclusion in May 2025, accelerating the policy overhaul.

Global fallout was immediate: over 30 countries including Japan, Germany, and the U.K. have suspended or halted U.S.-bound package shipments. Customs data shows de minimis entries made up 94% of all import transactions and were responsible for 90% of narcotics, agricultural, and counterfeit seizures. The White House projects up to $10 billion in new tariff revenue annually, while citing national security risks and unfair trade practices as key motivators. E-commerce platforms like Shein and Temu lose a major cost advantage, and small businesses face rising customs broker fees that could double shipment costs. Retailers are bracing for Q4 fulfillment disruptions amid a fractured global logistics network.

Sensei’s Insight: A tectonic shift in global trade mechanics—watch closely how Q4 logistics, SMB margins, and platform pricing recalibrate under the new rules.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔎 Deeper Dive: Soft Landing or Sticky Prices? Why Core PCE Matters Most

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.