Sensei's Morning Forecast: Fed Outlook, GENIUS Act, XRP ETF Delay

Markets brace for FOMC, stablecoin rules advance in Senate, XRP ETF hits pause, Enphase sinks, and Paris Air Show electrifies aviation—dive into the Forecast for key insights.

🧠 One Big Thing

All eyes on the Fed today: The June FOMC meeting could reshape 2025’s interest rate outlook. While no rate change is expected, even a single dot shift in the Fed’s “dot plot” could spark major moves in stocks, bonds, and currencies.

💰 Money Move of the Day

Before big Fed days, rebalance your risk: Consider reducing leverage or tightening stops in rate-sensitive trades. The market often prices in policy direction—not policy itself—so staying nimble can protect you from post-Fed whiplash.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $104,325 (▼ -0.27%)

Ethereum (ETH): $2,498 (▼ -0.52%)

XRP: $2.13 (▼ -1.37%)

Equity Indices (Futures):

S&P 500 (SPX): 5,981 (▲ +0.01%)

NASDAQ 100: 21,981 (▲ +0.12%)

FTSE 100: 8,826 (▼ -0.17%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.375% (▼ -0.27%)

Oil (WTI): $75.02 (▼ -0.44%)

Gold: $3,381 (▼ -0.25%)

🕒 Data as of UK (BST): 12:03 / US (EST): 07:03 / Asia (Tokyo): 20:03

🎥 Live Show Link – Join the Market Breakdown

Catch the full morning breakdown live with Sensei on YouTube. Watch Now:

We go deeper into today’s moves, charts, and headlines. Bring your coffee, questions, and watchlist.

✅ 5 Things to Know Today

Senate Passes GENIUS Act, Setting U.S. Stablecoin Rules

The U.S. Senate passed the GENIUS Act on June 17, 2025, by a bipartisan 68-30 vote, establishing the first federal regulatory framework for stablecoins. The bill introduces dual compliance paths: one for federally approved issuers, including nonbanks and uninsured national banks, and another for state-qualified issuers that meet federal criteria (Reuters, CNBC, Crypto.news). Key provisions require 1:1 reserve backing with high-quality assets, rigorous anti-money laundering compliance, bankruptcy protections favoring stablecoin holders, and penalties up to $500,000 for misrepresenting stablecoins as legal tender. The bill clarifies that payment stablecoins are not securities or commodities, addressing a long-standing regulatory gap that impeded industry growth (Galaxy, Cwallet). The legislation now advances to the House of Representatives before potentially reaching President Trump’s desk.

Ripple CEO Brad Garlinghouse called the GENIUS Act a “truly historic moment” having previously noted that the crypto industry has long awaited legislative clarity (Cryptopolitan). He emphasized the bill as a major first step in creating enforceable rules, and thanked key senators for their leadership. With stablecoins accounting for 1% of the U.S. dollar supply and posting $27.6 trillion in 2024 transfer volume, the bill could usher in institutional adoption and mainstream usage—though issuers will face increased compliance costs and regulatory oversight (Coindesk, Reuters, CNBC).

Sensei’s Insight: The GENIUS Act’s dual-track framework is more than regulatory housekeeping—it signals Washington’s strategic embrace of blockchain infrastructure as a core component of the financial system. With 1:1 reserve mandates and clear asset classifications, the bill sets a precedent for legitimizing digital dollars within traditional finance rails. Institutional capital—long sidelined by ambiguity—now has the green light.

SEC Extends Review of Franklin Templeton’s Spot XRP ETF—Public Comment Period Now Open

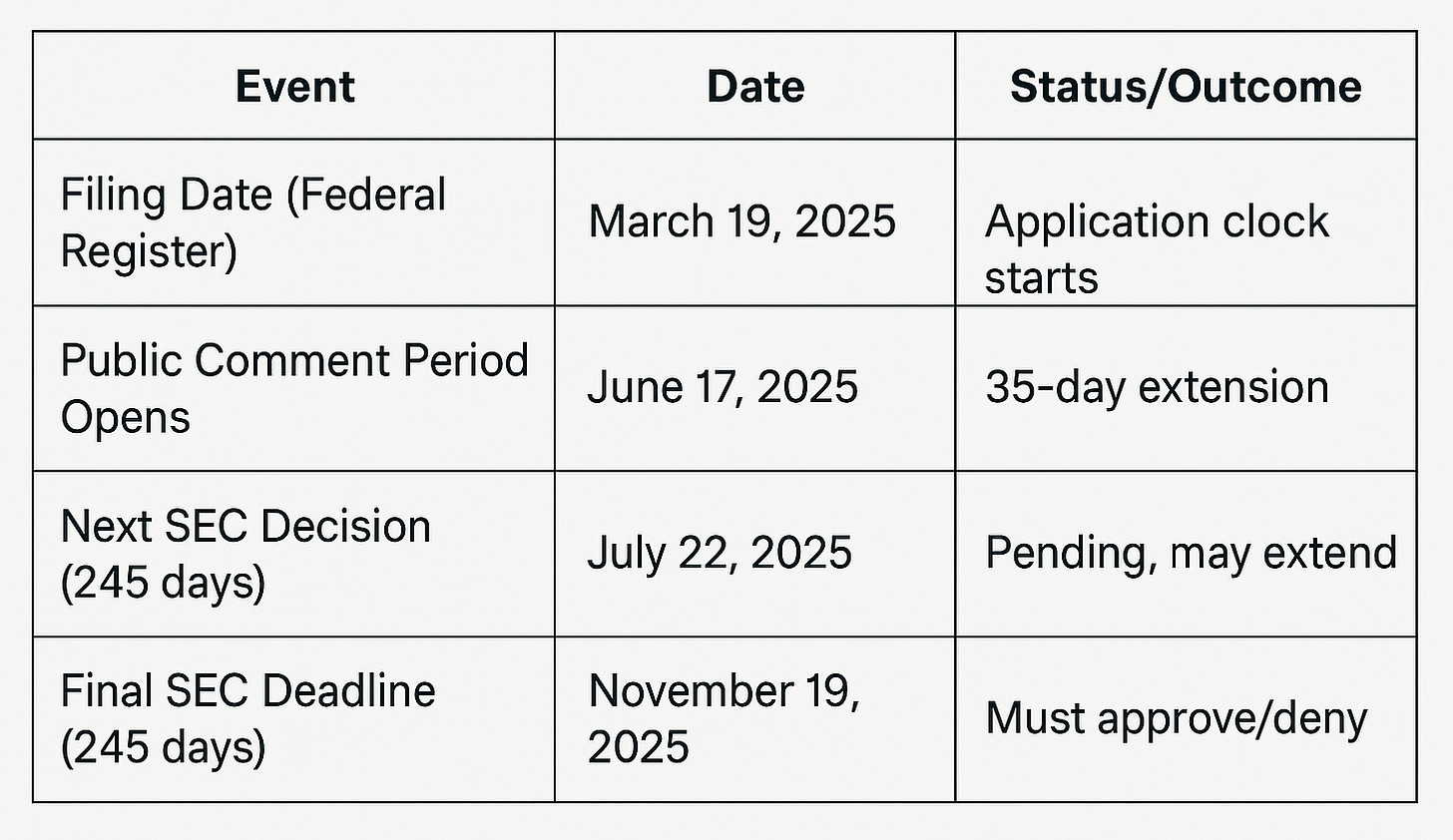

The U.S. Securities and Exchange Commission (SEC) has delayed its decision on Franklin Templeton’s proposed spot XRP ETF, formally opening the application to public comment as of June 17, 2025 (CryptoTimes, Cointelegraph). The next regulatory deadline for this ETF now falls in late July, following a 35-day extension from the latest SEC notice (CryptoTimes, Cointelegraph). Under standard SEC procedures, the agency can continue to extend its review, but must issue a final decision no later than November 19, 2025—245 days from the original filing date of March 19, 2025 (Cointelegraph, ICI). A similar extension and comment period has been applied to Franklin Templeton’s Solana ETF proposal, with both funds seeking listing on the Cboe BZX Exchange (CryptoTimes, Cointelegraph).

The SEC’s move to open a formal public comment period is a routine step in its ETF review process, previously used for Bitcoin and Ethereum ETF applications (Cointelegraph, ICI). This stage allows market participants, industry experts, and the public to submit feedback or concerns before the SEC makes a final determination (Cointelegraph, ICI). Prior to June 17, the Franklin Templeton XRP ETF application was under standard review, but the official comment window had not yet been opened for this proposal (Cointelegraph).

This latest extension comes amid heightened anticipation for an “Altcoin ETF Summer.” Polymarket traders currently assign an 88% probability to spot XRP ETF approval in 2025 (CryptoTimes). Standard Chartered estimates up to $8.3 billion in first-year flows if approved, based on comparative data from other spot crypto ETFs (CoinStats, Binance). The delay also coincides with Ripple and the SEC jointly requesting suspension of the agency’s appeal in their ongoing lawsuit, following a preliminary settlement in April (CryptoTimes). Meanwhile, Canada has already approved its first spot XRP ETF, underscoring the U.S. regulatory lag (CryptoTimes, Cointelegraph). For investors, the SEC’s continued caution highlights ongoing regulatory uncertainty in the U.S. crypto market (Cointelegraph). The next 35–44 days will be critical, as the SEC reviews public comments and approaches its next decision window in late July (CryptoTimes, Cointelegraph). The ProShares XRP ETF, a separate application, faces its own SEC deadline on June 25, 2025 (CryptoTimes).

Sensei’s Insight: The SEC’s procedural delay on Franklin Templeton’s XRP ETF—despite growing institutional interest and global precedent—highlights a core truth in U.S. crypto regulation: clarity is lagging, but scrutiny is intensifying. The 35-day extension and open comment period are less about obstacles and more about optics—giving regulators breathing room amid ongoing litigation and political pressure.

🎯 Fed Day: Markets Brace for Projections, Not Policy Move

Fed to Hold Steady at 4.25%–4.50%

The Federal Reserve is expected to maintain the federal funds rate at 4.25%–4.50% at the conclusion of today’s FOMC meeting. Market attention is fixed on the updated “dot plot” and Chair Jerome Powell’s 2:30 p.m. ET press conference. In March, projections showed two rate cuts for 2025; even minor shifts among Fed participants could pare that down to one. While markets currently price in a September cut, today’s communication could reframe expectations. Analysts at Goldman Sachs predict one cut by December; Bank of America sees none this year. Powell is expected to maintain a cautious tone and reinforce that policy is “in a good place” (CNBC).

The Summary of Economic Projections may revise several key estimates: core inflation to 3.0%, GDP growth to 1.5%, and unemployment to 4.5%. Any departure from dovish guidance could spark higher Treasury yields, strengthen the dollar, and pressure rate-sensitive equities. With geopolitical risks, cooling labor data, and modest inflation in view, investors will recalibrate positioning based on whether the Fed signals one, two—or zero—rate cuts in 2025 (CNBC).

Sensei’s Insight: Don’t let the steady rate fool you—today’s real story lies in the Fed’s forecast. One shifted dot could ripple across the yield curve, FX markets, and tech valuations. Stay nimble.

Cramer Warns: Misreading the Fed Can Cost You

Cramer Reflects on Fed Missteps in 1998 and 2008

Jim Cramer revisited the Federal Reserve's crisis management strategies during the 1998 Long-Term Capital Management (LTCM) collapse and the 2008 financial meltdown. In 1998, he prematurely called for a sell-off due to perceived Fed inaction, only to be proven wrong when the central bank swiftly cut rates and coordinated a bailout, an error he termed his “worst professional mistake” (CNBC, NBC Los Angeles). In contrast, the Fed’s hesitation in 2008, including raising rates amid deteriorating credit markets, exacerbated the crash, with the Dow plummeting from 10,200 in October 2008 to under 7,000 by March 2009 (CBS News).

Markets Move Before the Fed Does

Cramer emphasized that market participants don’t wait for formal Fed actions—they react to anticipated policy changes. In 2024, equities rallied well before the Fed’s first rate cut in September, highlighting the power of expectation over execution (CNBC). He cautioned that any shift in Fed messaging or tone could trigger immediate portfolio rebalancing across Wall Street, amplifying volatility and forcing traders to respond swiftly to perceived pivots.Sensei’s Insight: The June FOMC meeting isn’t just about holding rates—it’s about recalibrating expectations. With inflation cooling but still sticky, and geopolitical risks muddying the macro picture, the Fed’s tone on rate cuts will steer global sentiment. Watch the dot plot and Powell’s language—this is where 2025’s monetary path takes shape.

Sensei’s Insight: When volatility rises, don’t just watch what the Fed does—listen to what it might do. As Cramer’s hard-earned lessons show, markets price in expectations, not confirmations. Mastering the art of reading between the Fed’s lines can mean the difference between leading the move or chasing the fallout.

Gold Surges to Record Highs, Cementing Its Safe-Haven Status

Gold prices have surged 28% year-to-date in 2025, hitting a new record of $3,506 per ounce on June 17. The rally reflects escalating global demand as investors flee market volatility amid persistent geopolitical tensions, tariff conflicts, and inflation worries. Central banks have ramped up purchases—most notably China and Poland—accelerating a move away from US dollar reserves. In China, demand has outstripped supply, leading to reported shortages of physical gold at banks and dealers (Business Insider, Entrepreneur, POEMS).

Gold has outperformed every major safe-haven asset in 2025. While the S&P 500 is down 9% YTD, US Treasurys, the yen, and the Swiss franc have lagged. Bitcoin—once hailed as "digital gold"—has failed to hedge effectively, moving in sync with risk assets instead. Analysts point to gold’s scarcity, central bank accumulation, and its longstanding portfolio role as key drivers of its dominance in times of uncertainty (Business Insider, CNBC Africa, Financial News).

Sensei’s Insight: The gold rally isn’t just a reaction—it’s a recalibration. As central banks aggressively de-dollarize and physical shortages hit retail markets in China, gold’s resurgence reflects a deeper structural shift in global finance. With traditional safe-havens faltering and Bitcoin failing to decouple from risk assets, gold is reasserting its primacy not just as a hedge—but as the foundation of trust in an uncertain world.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

✈️ Paris Air Show 2025 – Day Two Highlights

Day Two at Le Bourget kicked off with high momentum as the aviation world turned its attention to future-ready technologies and major industry collaborations. From pivotal regulatory announcements in the eVTOL sector to multi-billion-dollar aircraft deals, the day was packed with strategic showcases, international partnerships, and strong signals of where the aerospace industry is heading. With our feet on the ground, we’ve picked the top stories and standout winners shaping the narrative today.

Join our Vaz on the ground end of the week, broadcasting from the Hall 5 - AAM/eVTOL section LIVE on Saturday!

🥉 Number Three Winner – Beta Technologies

Beta impressed with piloted demo flights of the ALIA CX300 during the show, marking their first European demonstrations. Pilots included company executives, showcasing the aircraft's readiness and reinforcing Beta’s leadership in the eCTOL (electric conventional take-off and landing) segment.

🥈 Number Two Winner – Archer Aviation ($ACHR)

Archer delivered a highly coordinated media and regulatory engagement across three major events:

10:00 AM – “Road to LA28” Fireside Chat with CEO Adam Goldstein at the USA Pavilion

11:30 AM – AAM industry panel with Honeywell, WEF, and the Royal Aeronautical Society at the Archer stand (Hall 5, E260)

2:30 PM – FAA & USDOT Press Conference featuring AAM CEOs, including Archer

Their involvement in strategic discussions highlights Archer’s growing influence and visibility in global AAM planning.

🥇 Number One Winner – The Entire eVTOL Market

The FAA, alongside aviation authorities from the UK, Australia, Canada, and New Zealand, announced a joint roadmap to streamline eVTOL certification and deployment. This historic five-nation partnership is a major boost for the entire AAM sector, signaling global momentum toward regulatory harmonisation.

🎖 Extra Winner – Airbus

Airbus secured firm orders for 132 aircraft, plus options for another 141, bringing the potential total to 273 jets. Key deals included:

100 A321neo (plus 50 options) with VietJet

40 A220s for LOT Polish Airlines

Additional widebody and freighter orders from Riyadh Air and AviLease

This strong commercial showing further solidified Airbus's commanding position at the show.

Keep looking out for updates from Vaz on his X account eVTOL Hub below and join him for the LIVE Paris Air Show Special on Saturday!

🔍 Deeper Dive: Enphase Energy (ENPH) - Forward-Looking Analysis

Enphase Energy stands at a crossroads: its innovative technology and global reach are offset by policy headwinds, margin pressure, and shifting analyst sentiment. The company is actively repositioning itself through product innovation, supply chain diversification, and international expansion, but faces a challenging U.S. market and regulatory uncertainty. Below, we break down what management, analysts, and industry observers are saying about Enphase’s future, with a focus on strategic direction and qualitative insights.

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.