Sensei's Morning Forecast: Fed’s Policy Standoff as Bitcoin Gains Institutional Edge

Bitcoin ETFs get in-kind redemptions, Fed faces political heat, Trump escalates tariffs, China targets price wars, Robinhood surges, HSBC slumps, and Bitcoin becomes a U.S. reserve.

🧠 One Big Thing

The Fed’s rate decision today is less about the 4.25%-4.5% hold and more about the political and tariff storm shaping its next move. With inflation stubborn at 2.7% and Trump pressuring Powell for cuts, the central bank is balancing economic stability against unprecedented political interference.

💰 Money Move of the Day

When policy uncertainty peaks, flexibility wins. Consider keeping part of your portfolio in liquid assets (like short-term T-bills or high-yield savings) to stay nimble for sudden market shifts—this isn’t about timing the market, but about having dry powder when opportunities arise.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $118,429 (▲ +0.29%)

Ethereum (ETH): $3,831 (▲ +0.84%)

XRP: $3.13 (▲ +0.12%)

Equity Indices (Futures):

S&P 500 (SPX): 6,406 (▲ +0.25%)

NASDAQ 100: 23,599 (▲ +0.46%)

FTSE 100: 9,141 (▲ +0.59%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.396% (▼ -0.41%)

Oil (WTI): $67.58 (▼ -0.55%)

Gold: $3,320 (▲ +0.19%)

🕒 Data as of UK (BST): 12:16 / US (EST): 07:16 / Asia (Tokyo): 20:16

✅ 5 Things to Know Today (+ Bonus Story)

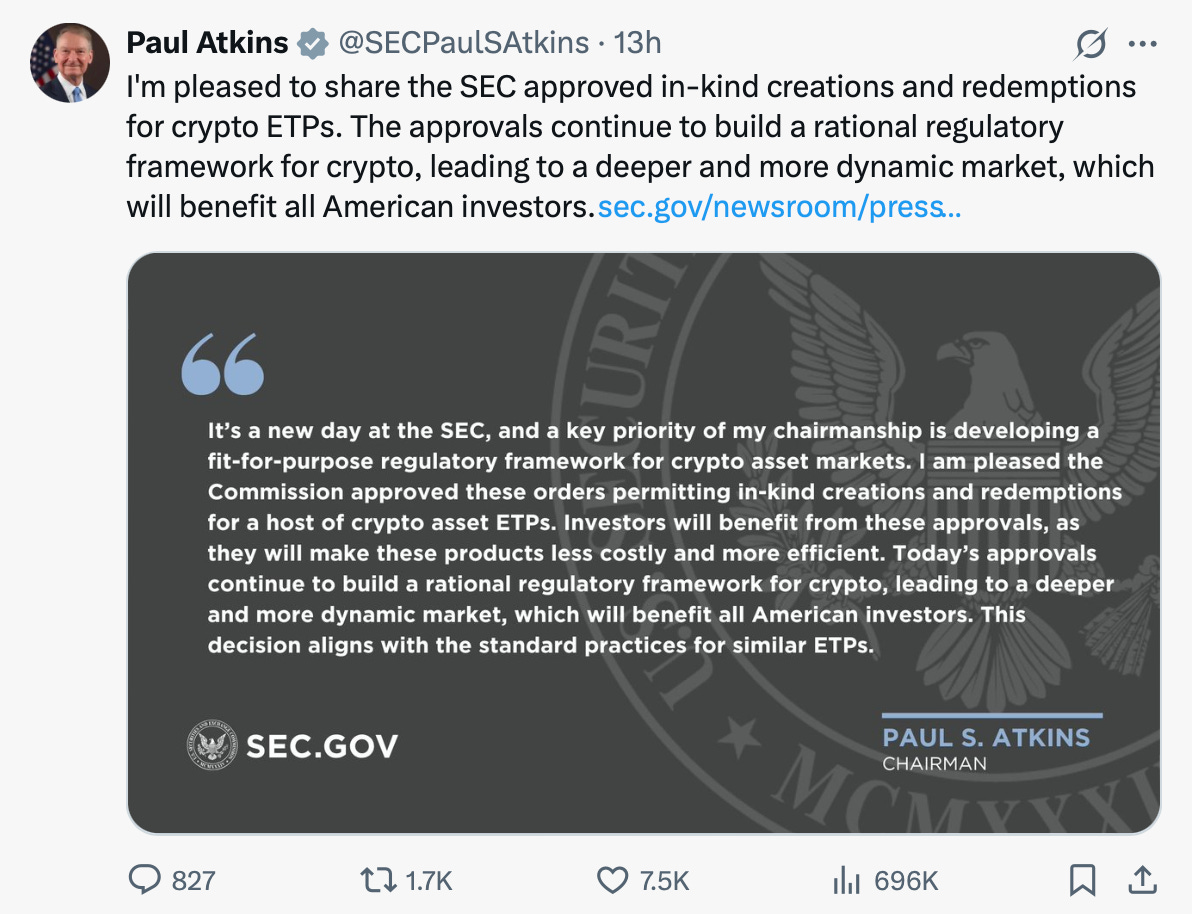

SEC Approves In-Kind Redemptions for Crypto ETFs

The Securities and Exchange Commission (SEC) has approved in-kind creation and redemption mechanisms for all spot Bitcoin and Ethereum exchange-traded products (ETPs), marking the first significant crypto-friendly regulatory shift under Chairman Paul Atkins (SEC, Reuters). This move allows authorized participants to exchange actual cryptocurrency—rather than cash—when creating or redeeming ETF shares, aligning crypto products with traditional commodity ETFs for the first time. Previously, spot crypto ETFs approved in 2024 were limited to cash-only transactions, creating inefficiencies and higher costs for market makers and investors (SEC, BusinessWire). The SEC also approved exchange applications for mixed Bitcoin-Ethereum ETPs, options trading on Bitcoin ETFs, and increased position limits of up to 250,000 contracts for Bitcoin ETP options (The Block).

The regulatory change enhances ETF efficiency by reducing transaction costs, enabling tighter bid-ask spreads, and lowering tax exposure through in-kind transfers (TradingView, Mitrade). Crypto ETFs have already grown rapidly, with spot Bitcoin ETFs holding over $153 billion in assets under management as of July 28, led by BlackRock's IBIT at $86 billion (Wall Street Horizon, Techi). Chairman Atkins, confirmed in April, emphasized that this policy is part of a “rational regulatory framework for crypto” aimed at building a deeper and more dynamic market (SEC, Fortune). The decision signals broader institutional acceptance and could accelerate crypto ETF growth as operational hurdles are removed.

Sensei’s Insight: In-kind redemptions are a game-changer for crypto ETFs, bringing them on par with traditional ETFs and reducing friction for institutional investors. This shift not only slashes costs but could also ignite a new wave of capital inflows into crypto markets.

White House Drops Landmark Crypto Report: Bitcoin Strategic Reserve Takes Center Stage

The White House has released its first comprehensive cryptocurrency policy report following a 180-day review mandated by President Trump’s January executive order. Developed by Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick, and SEC Chair Paul Atkins, the report outlines the regulatory framework for Trump’s pro-crypto agenda and details the creation of a Strategic Bitcoin Reserve (Coingape) (Mondaq) (TheStreet) (Bitcoin Magazine). According to the report, the U.S. government currently holds 198,000 BTC valued at $23.2 billion, primarily seized through criminal asset forfeitures, including $13.65 billion from the Bitfinex hack and $8.26 billion from Silk Road investigations (TradingView) (CryptoDnes). These holdings will serve as the foundation for the Strategic Bitcoin Reserve, designating Bitcoin as a national reserve asset alongside gold and petroleum, while a separate U.S. Digital Asset Stockpile will manage forfeited altcoins like Ethereum, XRP, Solana, and Cardano (Burr) (White House).

This landmark policy represents the first unified U.S. regulatory framework for digital assets, which could resolve years of uncertainty that hindered institutional adoption. Analysts suggest that designating Bitcoin as a strategic reserve may push other nations to follow suit, tightening global supply against Bitcoin’s fixed 21-million cap. Bitcoin has risen 26% year-to-date amid growing policy momentum, holding steady at $117,850 as markets absorb the news (CoinEdition). The announcement also coincides with the Federal Reserve’s rate decision, adding potential volatility as traders weigh both monetary policy shifts and crypto regulation.

Sensei’s Insight: The U.S. officially treating Bitcoin as a reserve asset marks a paradigm shift in global finance. Watch for central banks worldwide to accelerate Bitcoin accumulation, potentially driving long-term price floors higher.

China Makes Ending Price Wars a Top Priority Amid Trade Tensions

China has unveiled a sweeping draft amendment to its pricing law, aimed at curbing destructive price wars that have destabilised industries for nearly three years (Reuters, MarketScreener). Released on July 24, the proposal expands prohibitions on selling below cost, targeting “involution-style” competition that has driven 33 consecutive months of factory-gate deflation. It also cracks down on algorithm-driven pricing manipulation and introduces tougher penalties for violations (US News). The move follows President Xi Jinping’s high-level policy meetings earlier this month pledging to rein in “disorderly competition” across critical sectors including electric vehicles, solar panels, steel, and cement (Business Times, Bloomberg).

The policy shift is already visible in the EV industry, where BYD’s aggressive price cuts triggered a nationwide price war that reduced sector profit margins to just 4.5% in 2025 (Dunham). Solar panel manufacturers have agreed to cut production by 30%, while authorities have launched auto safety inspections over concerns that intense competition has compromised quality (Independent, Delta Optimist). The campaign marks a broader pivot from export-driven growth to domestic stabilization, coming as U.S. tariffs on Chinese goods have peaked at 135%, forcing manufacturers to slash prices and flood global markets with cheap exports (ECB). Analysts say the policy could ease trade tensions and support industry consolidation, but enforcement among private-sector companies may prove more difficult than past state-led reforms (Yahoo Finance).

Sensei’s Insight: Beijing’s anti-price war strategy signals a shift toward margin preservation and industrial consolidation. If effective, this could temper deflationary pressures and stabilize global supply chains—but private-sector compliance remains a wildcard.

Robinhood's Q2 Earnings Tonight: Crypto Boom and Tokenization Drive Sky-High Expectations

Robinhood Markets (HOOD) will release its Q2 2025 earnings after the market close, with Wall Street forecasting a 48% jump in EPS to $0.31 and a 34% rise in revenue to $913 million compared to Q2 2024’s $0.21 EPS and $682 million revenue (Yahoo Finance). Shares closed at $106.78 on July 28, up 177% year-to-date but 7% below the 52-week high of $113.44. Transaction-based revenue is expected to soar 55.5% to $508.4 million, fueled by a 38.6% increase in options revenue to $252.2 million and a 93.2% surge in cryptocurrency trading revenue to $156.1 million (Nasdaq). Crypto trading volumes have leapt from $7.1 billion in May 2024 to $11.7 billion in May 2025 (inkl), while equity trading volumes rose 108% year-over-year to $180.5 billion and options contracts hit 179 million. Net interest revenue is projected to rise 8% to $307.8 million despite no Fed rate cuts. Robinhood has surpassed earnings expectations in three of the past four quarters, averaging a 20.6% surprise.

The company’s growth narrative is being driven by tokenized assets and global expansion, which investors will scrutinize given its lofty 60x P/E ratio (Yahoo Finance). Key drivers include the rollout of tokenized U.S. stocks for European clients, the $200 million Bitstamp acquisition completed in June, and upcoming Bitcoin futures access (CoinDesk). JPMorgan recently doubled its 2026 price target to $98, citing crypto and tokenization tailwinds, with analyst price targets spanning $48 to $125 and averaging $85 (MarketBeat). However, any weakness in crypto revenues—35% of total Q4 revenue—could spark volatility as HOOD’s 145% YTD rally is heavily tied to digital asset trading volumes (IO Fund).

Sensei’s Insight: Robinhood’s Q2 print is more than just an earnings test—it’s a referendum on whether crypto and tokenization can justify the stock’s explosive rally and premium valuation.

HSBC Profit Slumps on China Woes, Dragging Down FTSE 100

HSBC posted a 26% decline in first-half pretax profit to $15.8 billion, falling short of analyst expectations and down sharply from $21.6 billion a year earlier (Reuters). The bank cited $2.1 billion in impairment losses tied to its stake in China’s Bank of Communications and rising credit provisions related to Hong Kong’s real estate sector. Net profit fell 30% to $12.4 billion, while return on tangible equity dropped to 14.7% from 21.4%. HSBC announced a $3 billion share buyback and a $0.10 interim dividend, but shares still slid 4.5% in London trading (Proactive Investors).

With its heavy exposure to Asia, HSBC has been hit by ongoing turbulence in China’s property sector, trade tensions, and weakening Hong Kong property values. The bank’s net interest margin dropped 5bps to 1.57%, while operating expenses rose 4%. HSBC also flagged a potential $1.4 billion loss from its French mortgage portfolio, adding to pressures from increased loan loss allowances (Investegate). The weak earnings report weighed on the FTSE 100, where HSBC’s performance is a key index driver, amplifying concerns about shrinking margins amid Hong Kong rate cuts and deepening China risk (Standard).

Sensei’s Insight: HSBC’s results underscore the fragility of global banking exposure to China’s slowdown and real estate risks. Investors should watch whether the bank’s capital returns and restructuring efforts can offset rising credit costs and margin pressure in the months ahead.

Trump's Brazil Tariff Threat Amplifies Legal Challenges to Presidential Trade Authority

President Trump's threat to impose a 50% tariff on all Brazilian imports is fueling renewed legal scrutiny of his use of emergency powers for trade actions, with critics asserting the move underscores unconstitutional overreach (Reuters). Announced for August 1, the tariff is explicitly tied to Brazil’s prosecution of former President Jair Bolsonaro over alleged coup attempts rather than any economic justification (CNN). The U.S. currently holds a $7.4 billion trade surplus with Brazil, undercutting Trump’s stated rationale for the levy (Atlantic Council). Legal experts argue the politically motivated measure exposes flaws in Trump’s claims of unchecked tariff authority, with Professor Ilya Somin stating that the Brazil tariff “underscores the untenable nature of his assertion that his trade actions are beyond the reach of the courts” (IDN Financials).

The move strengthens active lawsuits challenging Trump’s tariff agenda, which rely on the claim that the International Emergency Economic Powers Act (IEEPA) does not grant unlimited trade authority. The U.S. Court of International Trade struck down Trump’s IEEPA-based tariffs in May, ruling they exceeded presidential powers, though the decision is under appeal (Akerman). The Brazil threat provides fresh evidence of executive overreach, bolstering challengers’ arguments that Trump’s tariff actions are not insulated from judicial review (International Trade Insights). If appellate courts uphold the lower court ruling, much of Trump’s tariff regime could collapse, reshaping global trade dynamics, supply chain planning, and corporate market expectations (GTR Review).

Sensei’s Insight: This tariff escalation is more than a trade maneuver—it’s a legal stress test on presidential economic powers. A court rejection could dismantle Trump’s trade framework, forcing markets to recalibrate assumptions about the durability of U.S. tariffs.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍 Deeper Dive: Inside Today’s Fed Meeting: Rate Cut Hopes and Political Pressure

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.