Sensei's Morning Forecast: FOMC Fractures Deepen Ahead of Powell’s Jackson Hole Speech as Crypto Policy Takes Center Stage in Wyoming

Powell’s policy dilemma, Armstrong's bullish bet, UK’s inflation surprise, China’s stablecoin ambitions, and Waller’s pro-DeFi pitch—all converge in today’s cross-market insight and deep Fed dive.

👀 Today’s Key Stories at a Glance

Powell’s Jackson Hole Speech: Powell’s final Jackson Hole appearance could signal a major Fed strategy shift as markets brace for clarity on September rate cuts.

$1M Bitcoin Prediction: Coinbase CEO Brian Armstrong predicts $1M per Bitcoin by 2030, citing rising U.S. policy support and a federal crypto reserve.

UK Inflation Hits 3.8%: July’s CPI surge to 3.8% keeps pressure on the BoE, despite five rate cuts already in place.

China Eyes Yuan Stablecoins: Beijing may pilot yuan-backed stablecoins to chip away at U.S. dollar dominance—but it’s still just a policy review.

Fed & Ripple Lead Crypto Pivot: Fed leaders and Ripple execs are driving crypto integration into U.S. monetary policy at the highest levels.

🧠 One Big Thing

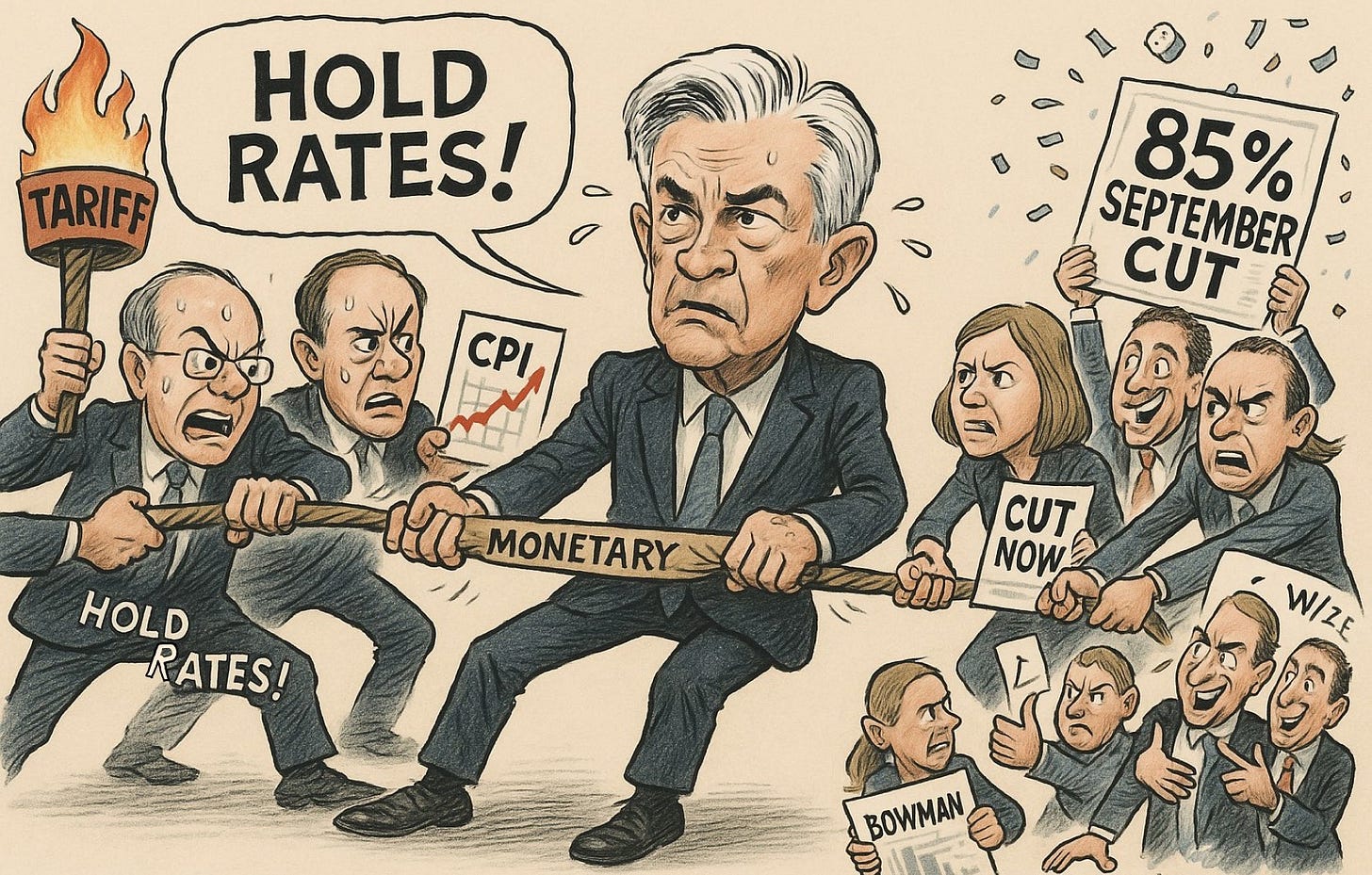

The July FOMC minutes reveal the first dual dissent in over 30 years—Bowman and Waller called for a rate cut, breaking from a majority still more concerned about inflation than jobs.

💰 Money Move of the Day

When Fed policy feels uncertain—like now, with inflation sticky and jobs softening—it’s a reminder to understand how interest rate changes ripple through everything from bond yields to bank stocks. Studying this connection is a smart habit, not a trade idea.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $112,951 (▼ -0.72%)

Ethereum (ETH): $4,286 (▼ -0.82%)

XRP: $2.91 (▼ -1.56%)

Equity Indices (Futures):

S&P 500 (SPX): 6,252 (▼ -0.19%)

NASDAQ 100: 22,227 (▼ -0.13%)

FTSE 100: 9,220 (▼ -0.56%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.339% (▲ +0.49%)

Oil (WTI): $63.79 (▲ +0.66%)

Gold: $3,377 (▼ -0.58%)

🕒 Data as of UK (BST): 11:47 / US (EST): 06:47 / Asia (Tokyo): 19:47

✅ 5 Things to Know Today

📉 Powell Set to Address Rate Cut Expectations at Jackson Hole Speech Friday

Federal Reserve Chairman Jerome Powell will deliver a pivotal speech at 10 a.m. ET Friday during the Kansas City Fed's Jackson Hole Economic Policy Symposium, titled "Economic Outlook and Framework Review." As markets look for clarity on the Fed’s September rate cut intentions, this appearance also marks Powell’s last at Jackson Hole before his term ends in May 2026 (Reuters, CBS News). He steps into the spotlight amid conflicting data: July saw just 73,000 jobs added, with downward revisions erasing 258,000 jobs from May and June, pulling the three-month average down to 35,000 (Fox Business). Meanwhile, the Personal Consumption Expenditures index rose from 2.1% in April to 2.6% in June, pushed higher by lingering tariffs under President Trump (Investopedia). Market pricing now shows an 85% chance of a 25 basis point rate cut at the September 17 FOMC meeting, down from 99% a week ago (Business Insider, CNBC).

Powell's remarks are expected to provide crucial signals for investors ahead of September, as the Fed faces a sharp dual mandate conflict. Analysts expect he may use this platform to propose a shift away from the flexible average inflation targeting policy adopted in 2020, in favor of a more preemptive approach to managing inflation (Yahoo Finance, Proactive Investors). Such a change could reshape the Fed’s approach well beyond Powell's tenure, especially as inflation remains above target and labor market indicators soften (Fortune, USA Today). Markets are bracing for either a dovish pivot that could trigger rallies or a cautious tone that might disappoint those betting on imminent cuts.

Sensei’s Insight: All eyes on Powell—his tone could redraw the monetary map for 2025 and beyond.

💰 Armstrong Predicts $1 Million per Bitcoin by 2030 Amid Strategic Reserve Push

Coinbase CEO Brian Armstrong forecasted that Bitcoin could reach $1 million per bitcoin by 2030 during a recent appearance on the Cheeky Pint podcast. Bitcoin is currently trading at $114,383, down 9% from its recent high of $124,128. Armstrong outlined three major catalysts for his projection: the recent passage of the GENIUS Act, which creates a federal regulatory framework for stablecoins; active Senate negotiations over a market structure bill that could pass by year-end; and the Trump administration’s newly established Strategic Bitcoin Reserve, created by executive order in March 2025. “If you asked me five years ago, that would have been like a vision board—the United States government is not going to officially hold Bitcoin. But they are now,” Armstrong said, referring to the government's aggregation of forfeited Bitcoin assets under the order (Cointelegraph, WhiteHouse.gov).

While the GENIUS Act is now law, both the market structure bill and the Strategic Bitcoin Reserve remain in developmental stages—the former still being debated in the Senate, and the latter awaiting federal agency reporting before further implementation. Armstrong argued that institutional funds hold only about 1% in Bitcoin, and regulatory clarity could pave the way for much greater allocations. His prediction joins similar views from Jack Dorsey and Cathie Wood, though market analysts urge restraint. James McKay cautioned investors to watch the $124,000 resistance level before setting sights higher, stating, “Let’s try and hold 124K first” (Yahoo Finance, Axios).

Sensei’s Insight: Speculative price targets draw headlines, but the real signal here is the policy groundwork being laid—regulation, legislation, and executive orders are quietly shaping Bitcoin’s role in institutional portfolios and national strategy.

🇬🇧 UK Inflation Surges: CPI Hits 3.8%, Remains Far Above BoE Target

UK inflation accelerated in July as the Consumer Prices Index (CPI) jumped to 3.8% year-over-year, up from 3.6% in June and hitting its highest mark since January 2024. The Office for National Statistics attributed the spike primarily to a 30.2% surge in airfares, driven by the school holiday season, alongside continued pressure from rising food prices, which climbed 4.9% ( CIPP, BBC, Reuters ). These price increases have further squeezed household budgets and hit lower-income families hardest. Inflation remains well above the Bank of England's 2% target, prompting renewed scrutiny of the UK’s monetary policy path ( CNBC, PwC ).

The Bank now forecasts inflation to peak at 4% in September before tapering, though CPI is unlikely to fall below 3% until at least Q2 2026 ( ONS, BoE ). Despite five interest rate cuts since the new government assumed power, core inflation in services and food remains sticky, complicating monetary easing efforts. Markets are adjusting rate cut expectations accordingly, with persistent inflation likely to support higher-for-longer yields. This has direct implications for sectors tied to travel, food, and hospitality, while also pressuring equities and bonds vulnerable to sustained inflationary pressures ( Independent, ONS Bulletin ).

Sensei’s Insight: A 3.8% CPI print amid five rate cuts reveals just how stubborn UK inflation has become. The BoE’s roadmap is pinned to a September peak—but sticky categories like food and services suggest volatility ahead..

🇨🇳 China Explores Yuan-Backed Stablecoins to Challenge Dollar Dominance

China is considering the introduction of yuan-backed stablecoins as part of a broader strategy to internationalize its currency, with the State Council set to review a policy roadmap by late August. This marks a potential shift from Beijing’s 2021 ban on crypto trading and mining, though no authorization has been granted as of August 21. Hong Kong and Shanghai are identified as strategic centers for potential pilot programs if the roadmap is approved. The move comes amid a global stablecoin market dominated by dollar-backed assets—controlling over 98%—while the yuan’s share of international payments fell to 2.88% in June, its lowest level in two years and trailing behind currencies like the Canadian dollar (Reuters, Cointelegraph, Yahoo Finance).

While China’s Cross-border Interbank Payment System (CIPS) has seen a notable increase in volume, the yuan's global usage continues to slip per SWIFT data. Policymakers view stablecoins as a strategic tool to reduce reliance on the U.S. dollar and regain control over cross-border digital payments. However, significant structural hurdles remain, including capital controls, low yuan convertibility, and regulatory uncertainty. The initiative is expected to be a key topic at the upcoming Shanghai Cooperation Organization Summit (August 31–September 1), where the potential for yuan-stablecoin use in BRICS-aligned trade settlements will be discussed—but outcomes remain speculative and no rollout has occurred (CoinCentral, Blockhead, SCMP).

Sensei’s Insight: This is not a stablecoin launch—it’s a policy pivot under review. China’s evaluation of yuan-backed stablecoins reflects strategic urgency, but the global dominance of dollar-backed assets isn’t under threat just yet. Watch for what emerges from the SCO Summit.

Waller and Alderoty Lead U.S. Shift Toward Crypto Integration

Federal Reserve Governor Christopher Waller delivered a landmark pro-crypto speech at the Wyoming Blockchain Symposium on August 20, declaring that decentralized finance innovations are “nothing scary” and encouraging financial institutions to adopt blockchain-based payment systems. Waller likened DeFi mechanics to traditional transactions, noting that smart contracts, tokenization, and distributed ledgers are simply new tools to transfer and record ownership. He highlighted stablecoins as a promising private sector innovation capable of maintaining the dollar’s international role while enhancing 24/7 retail and cross-border payments. Waller also endorsed the GENIUS Act as a key enabler for payment stablecoins to achieve broad utility (Federal Reserve, Coindesk). As a top candidate to succeed Jerome Powell when his term ends in May 2026, Waller’s strong support for DeFi and market-driven solutions signals a major shift in Fed leadership, especially amid criticism from Trump over the central bank’s crypto stance (CNBC, Fox Business).

Ripple Chief Legal Officer Stuart Alderoty participated in a key policy panel at the Wyoming Blockchain Symposium, joining Senator Cynthia Lummis and senior Fed officials to discuss the future of digital asset oversight. Held during the SALT Conference from August 18–21, the event brought together 350 major figures from finance and policymaking. Fed Vice Chair for Supervision Michelle Bowman delivered a bold speech urging regulators to shed their cautious stance, warning that banks ignoring crypto could face marginalization in the financial system. Bowman proposed that Fed staff be allowed to hold limited crypto holdings for firsthand experience with the technology they regulate (CoinDesk, Mitrade, Futunn). Senator Lummis reaffirmed her intention to pass crypto market structure legislation before Thanksgiving, with the Senate Banking Committee targeting September for movement. The event’s overlap with the Jackson Hole Economic Symposium—where Fed Chair Powell is expected to address monetary policy—underscores the integration of digital assets into top-tier economic policy debates (AINVEST, Coindesk).

Sensei’s Insight: The Fed’s crypto pivot has gone from speculative to structural. With Waller eyeing Powell’s seat and Ripple’s legal team now helping shape federal policy, blockchain finance has reached the inner sanctum of U.S. monetary power.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍 Deeper Dive: July FOMC Minutes Explained: What Retail Investors Need to Know

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.