Sensei’s Morning Forecast: FOMC Meeting, Inflation Report, AI Upside, and White House Crypto Report

Fed dissent stirs policy tension, AI giants surge, Strategy earnings awaited, India tariffs escalate trade risks, BoJ hikes forecast, U.S. unveils crypto regulatory roadmap.

🧠 One Big Thing

Two Fed governors just broke ranks to push for a rate cut—the first such dissent in over 30 years. With inflation reaccelerating and election pressure rising, the Fed's internal unity is cracking.

💰 Money Move of the Day

When central banks hesitate, diversification matters more than ever. Keeping part of your portfolio in assets that behave differently in rate cycles—like commodities or dividend-paying stocks—can help you stay balanced without betting on the Fed’s next move.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $118,544 (▲ +0.62%)

Ethereum (ETH): $3,858 (▲ +1.30%)

XRP: $3.17 (▲ +2.51%)

Equity Indices (Futures):

S&P 500 (SPX): 6,424 (▲ +0.49%)

NASDAQ 100: 23,795 (▲ +1.34%)

FTSE 100: 9,185 (▲ +0.49%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.360% (▼ -0.27%)

Oil (WTI): $70.50 (▼ -1.01%)

Gold: $3,299 (▲ +0.69%)

🕒 Data as of UK (BST): 11:54 / US (EST): 06:54 / Asia (Tokyo): 19:54

✅ 5 Things to Know Today

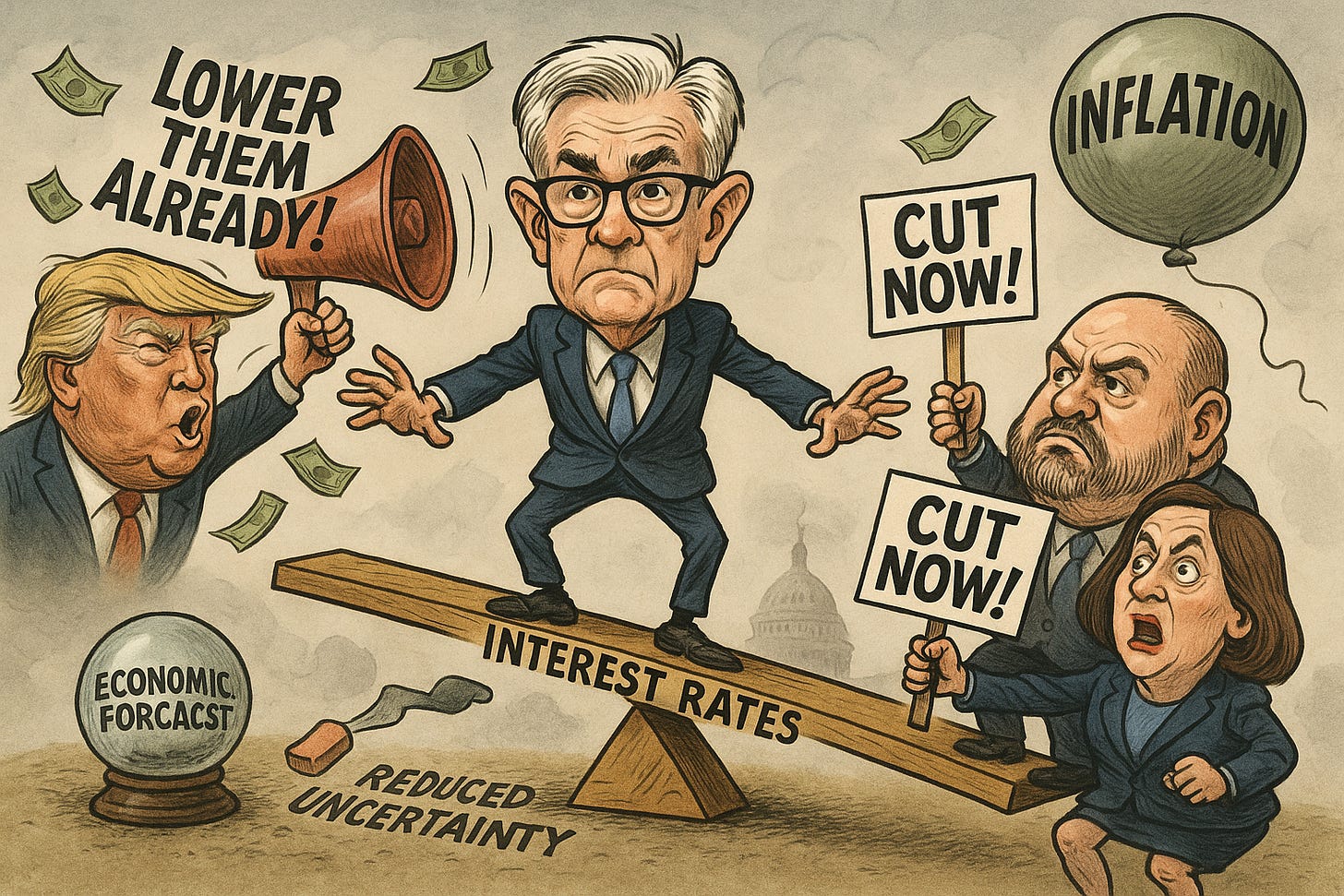

💸 Fed Holds Rates Steady as Two Governors Stage Historic Dissent

The Federal Reserve left its benchmark interest rate unchanged at 4.25%-4.5% for the fifth straight meeting on July 30, 2025, resisting pressure from President Trump to lower borrowing costs (Reuters, CNN). In a rare move not seen since 1993, Fed Governors Christopher Waller and Michelle Bowman dissented, voting for a quarter-point cut (Forbes, The Hill). Chair Jerome Powell acknowledged that while higher tariffs are starting to affect goods prices, the broader economic impact remains unclear (Bloomberg). The Fed’s updated statement removed prior language about reduced uncertainty, instead stating that economic uncertainty “remains elevated” (USA Today). Powell emphasized no decisions have been made regarding a potential rate cut in September (CNBC).

Why This Matters: The dual dissent exposes deepening divisions within the Fed as Trump ramps up calls for aggressive monetary easing. Market expectations quickly shifted—odds for a September cut fell from 63.4% to 45.7% after Powell’s remarks (Yahoo Finance, USA Today). The dissenting governors, both considered potential successors to Powell when his term ends in May 2026, add a political layer to the monetary policy debate (Politico). With rising inflation risks from tariffs and escalating public criticism of Powell, the path ahead for interest rates is increasingly clouded.

Sensei’s Insight: A historic split in Fed leadership during a politically charged cycle signals more than policy tension—it hints at a looming power reshuffle atop the U.S. central bank.

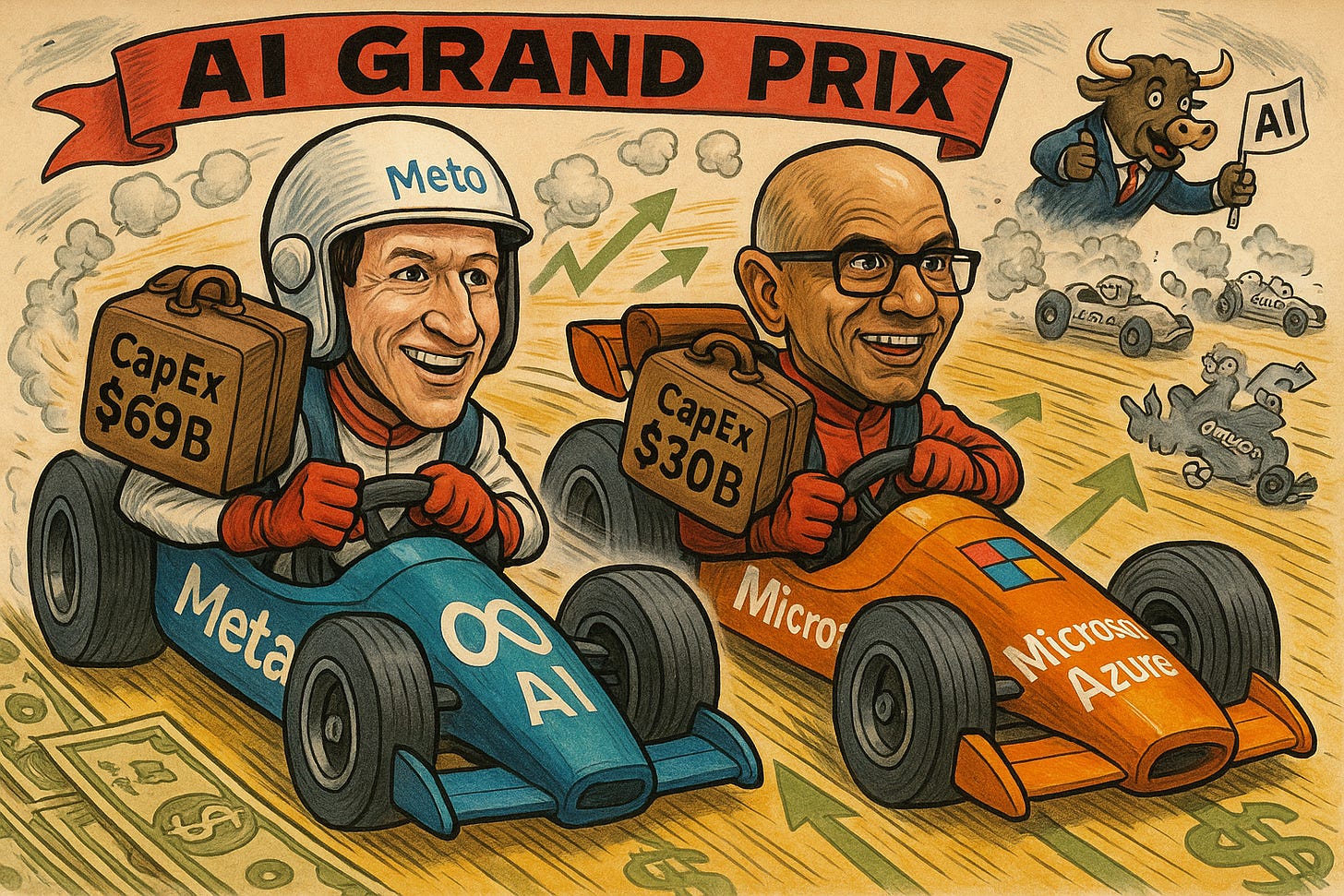

Meta and Microsoft Dominate AI Race with Massive Q2 Beats, Stock Surge

Meta and Microsoft delivered standout Q2 2025 earnings, each surpassing Wall Street expectations and sending their stocks sharply higher in after-hours trading—strong validation that colossal AI investments are starting to deliver. Microsoft reported revenue of $76.4 billion (+18% YoY) and earnings per share of $3.65, beating forecasts of $73.81 billion and $3.37, respectively (Independent, Yahoo Finance). Azure cloud revenue topped $75 billion annually for the first time, with a 39% Q4 jump in Azure and related services (GeekWire). Microsoft’s stock jumped 8–9% after hours, pushing its market cap past $4 trillion alongside Nvidia (Fortune).

Meta posted even more dramatic numbers with $47.5 billion in revenue (+22% YoY) and EPS of $7.14, crushing projections of $44.8 billion and $5.88 (Forbes, Variety). Advertising revenue hit $46.5 billion, while daily active users across its family of apps reached 3.48 billion (+6% YoY) (Deadline). Meta’s stock soared 11–12% in extended trading (Business Insider). Both companies emphasized sustained AI investment: Microsoft projects over $30 billion in Q1 2026 capex, while Meta raised its 2025 guidance to a $69 billion midpoint (Reuters, Yahoo Finance). Analysts noted the results legitimize the "AI supercycle" thesis driving tech valuations (AINvest).

Sensei’s Insight: These earnings mark a tipping point in the AI arms race—finally delivering measurable ROI on years of capex. Investors betting on long-term AI monetization now have hard proof to back those trades.

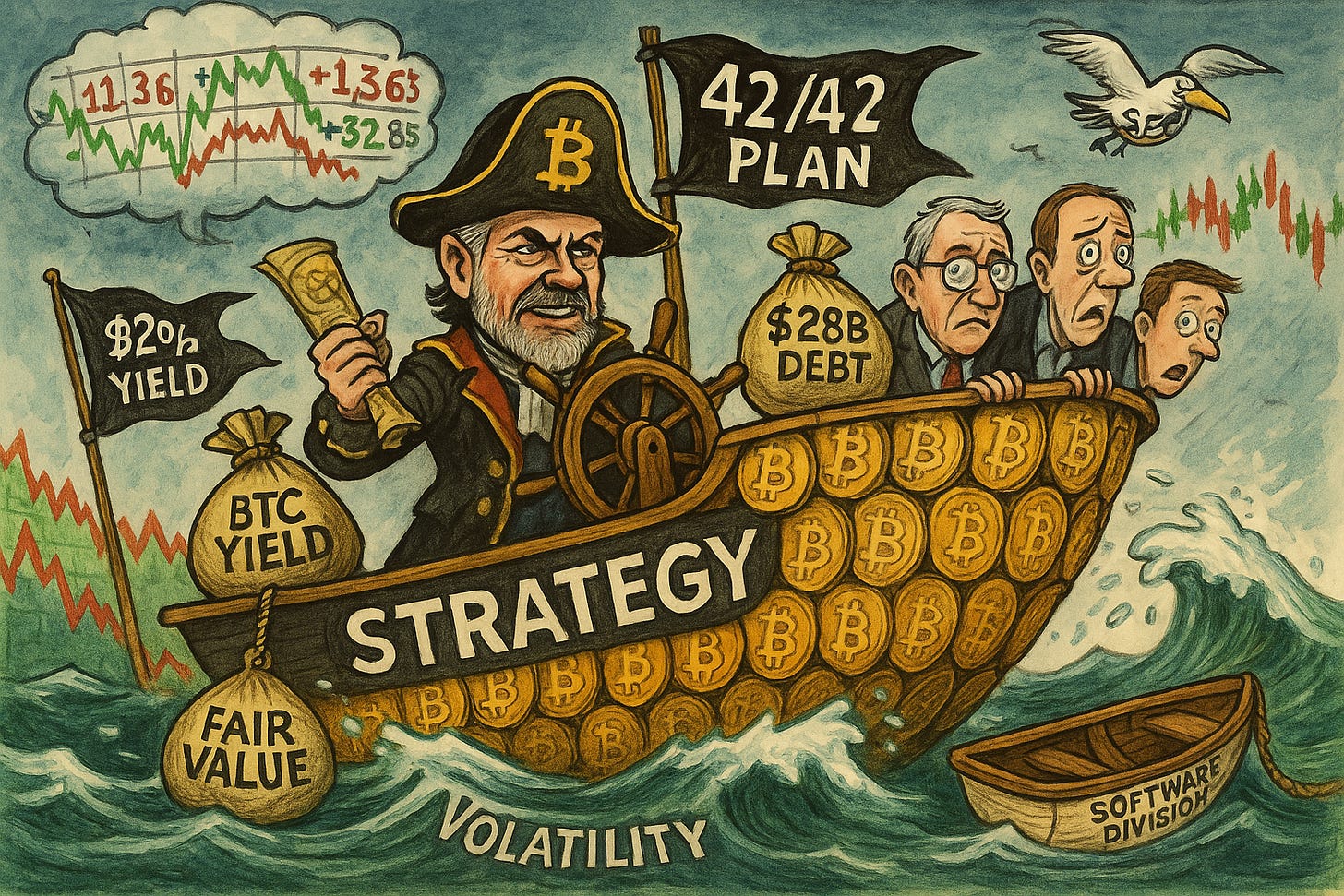

💡 MicroStrategy Faces Crucial Q2 Earnings Test as Bitcoin Strategy Takes Center Stage

MicroStrategy (MSTR), now rebranded as “Strategy,” will report its Q2 2025 earnings later today after the bell, representing a pivotal checkpoint for the largest corporate Bitcoin holder as it contends with volatile markets and aggressive growth ambitions (Zacks). Wall Street anticipates a loss of $0.12 per share, improving from last year’s $0.76 loss, alongside projected revenues of $112.15 million—a marginal 0.64% year-over-year gain (Seeking Alpha). However, traditional metrics now take a back seat to Bitcoin-specific indicators. Strategy currently holds 607,770 BTC, valued near $72 billion, purchased at an average of $73,227 per coin (Strategy). Its new core metric, “BTC Yield”—which gauges Bitcoin accumulation per share—hit 13.7% YTD through April and is on pace to reach a raised target of 25% for 2025, eclipsing the company’s still-active software division.

Investor focus is now locked on whether Strategy’s leveraged accumulation model is viable under increasing scrutiny and evolving accounting standards. Having just raised $2.5 billion via a preferred stock issuance, the firm’s total capital raised stands at over $28 billion toward its $84 billion “42/42 plan” goal (CoinDesk). With fair value rules set to swing earnings based on BTC’s price movement, today's report may reflect large unrealized gains or losses. Despite a 36% stock gain YTD, MSTR still trails Bitcoin's broader rally, spotlighting investor skepticism over premium equity exposure to crypto assets (TradingView).

Sensei’s Insight: With over 600,000 BTC on the books, Strategy's quarterly earnings have become a proxy for institutional Bitcoin sentiment. But as BTC performance decouples from MSTR’s, the premium on crypto equity exposure is increasingly under pressure.

🇮🇳 Trump Slaps 25% Tariffs on India as Trade Talks Stall

President Donald Trump announced a 25% tariff on Indian imports, set to take effect August 1, alongside an unspecified “penalty” tied to India’s military and energy dealings with Russia, just hours before a trade deal deadline, upending months of negotiations (Reuters, CNN, Reuters). Trump blasted India’s “far too high” tariffs and “obnoxious non-monetary trade barriers,” targeting $87 billion in exports covering sectors like pharmaceuticals, electronics, gems and jewelry, textiles, and petrochemicals (Times of India, News18). India stated it was “studying the implications” and would take “all steps necessary” to defend its national interest, while reiterating its commitment to fair negotiations (Indian Express).

The tariffs disproportionately impact India compared to other Asian economies—Vietnam (20%), Indonesia (19%), Japan (15%)—raising competitive concerns and potentially shaving 0.2–0.5% off India’s GDP if sustained (Business Today). Indian equity markets initially dipped, with the Nifty 50 down 0.66% and Sensex falling 0.71%, before rebounding later in the session (NDTV, Times of India). Key sectors at risk include textiles, auto components, and marine products, while pharmaceuticals and semiconductors remain mostly exempt. With the US comprising 18% of India’s export market, this poses a major challenge for trade-exposed firms. Still, analysts suggest the 25% figure may be a bargaining position, expecting a compromise in the 15–20% range by late August (Times of India, BBC).

Sensei’s Insight: Tariffs are tools of leverage, not permanence. Watch for a walk-back once political optics are satisfied.

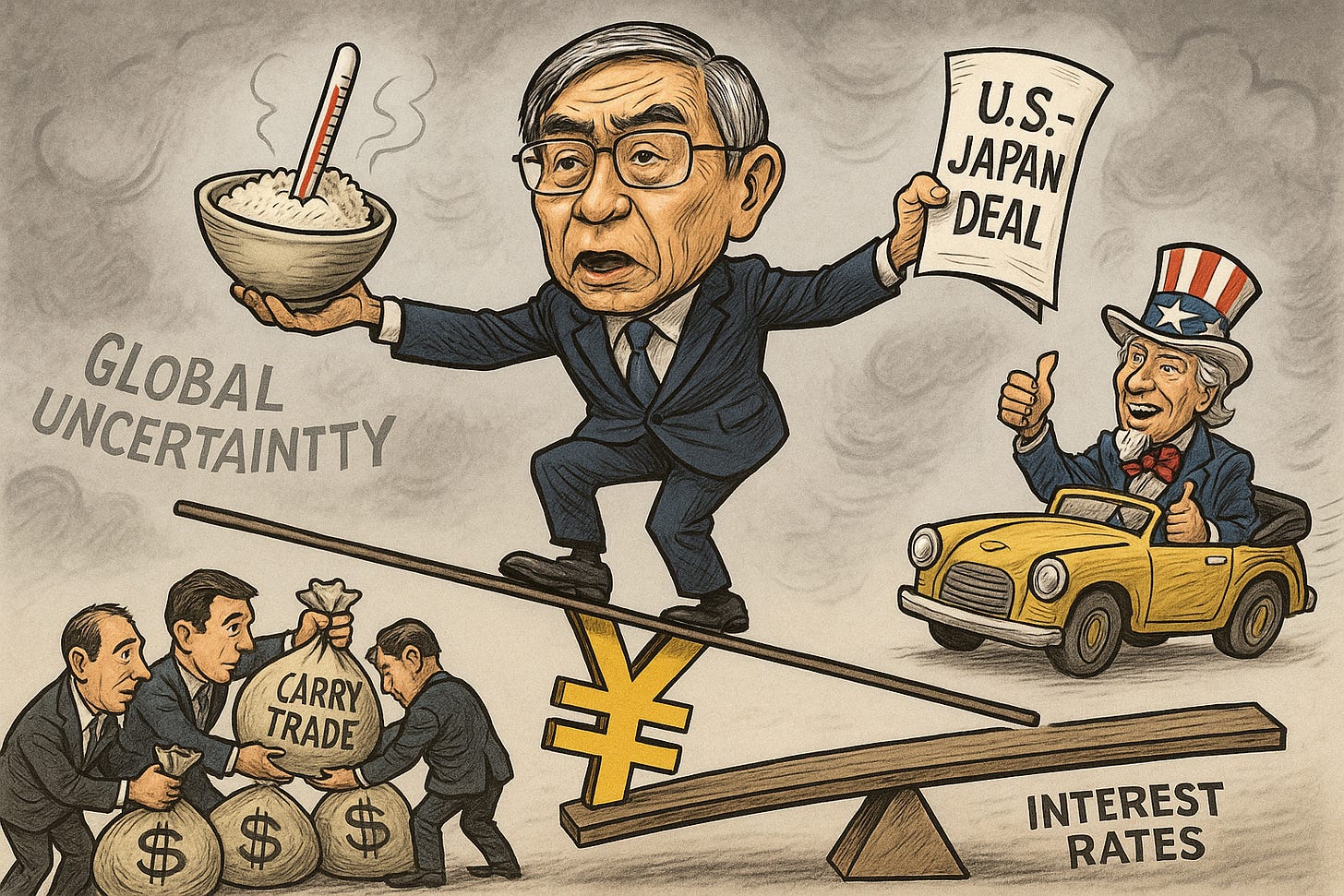

🇯🇵 BOJ Holds Rates Steady, Raises Inflation Outlook as Trade Deal Reduces Uncertainty

The Bank of Japan left its benchmark interest rate unchanged at 0.5% for the fourth straight meeting on Thursday (BOJ, NHK), while revising its core inflation projection for fiscal 2025 up to 2.7% from 2.2% (AINVEST, Nippon). It also slightly increased its growth forecast to 0.6% from 0.5% for the current fiscal year (Morningstar, Trading Economics). The central bank expects inflation to settle at 1.8% in fiscal 2026 and reach 2.0% in 2027, aligning with its 2% target. Despite the steady rate, analysts anticipate potential hikes later in the year amid persistent inflationary pressures, particularly in food prices like rice.

The policy move follows the conclusion of a major U.S.-Japan trade agreement, announced last week (CNN, Al Jazeera) that cut tariffs on Japanese auto exports to 15% from 25% (BBC) and secured a $550 billion Japanese investment pledge in the U.S. (Reuters). BOJ Governor Kazuo Ueda acknowledged the agreement’s benefits but warned of lingering global trade uncertainties (AA). Implications for the yen carry trade remain significant, as Japan’s low-rate environment continues to support borrowing in yen to invest abroad. However, rising inflation and a more hawkish BOJ outlook could disrupt this dynamic if tightening resumes (Finextra, Schwab).

Sensei’s Insight: Japan’s upgraded inflation outlook and U.S. trade pact are shifting the monetary chessboard. Investors should watch the BOJ’s next move—yen carry trades may not remain a one-way bet.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍 Deeper Dive: White House Crypto Report – Context and Analysis

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.