Sensei's Morning Forecast: From US Government Shutdown Risk to KDP's Coffee Gambit and XRP ETF Update

Shutdown looms, oil jobs cut, tariffs rise, BOJ splits, Saylor shrugs, ETFs accelerate, Swift upgrades — and we dive into whether KDP’s bold coffee pivot pays off.

👀 Today’s Key Stories at a Glance

🚨 U.S. faces imminent shutdown as Trump and Democrats clash over ACA credits, Medicaid cuts, and permanent layoffs.

🛢️ ExxonMobil cuts 2,000 jobs in global restructuring, joining wider oil industry layoffs amid falling crude prices.

🇺🇸 Trump slaps tariffs on lumber and furniture, escalating Canada tensions while worsening U.S. housing affordability crisis.

🇯🇵 BOJ holds rates but dissenters push for hikes, signaling possible October tightening as inflation pressures mount.

🎯 Michael Saylor downplays Strategy Inc.’s shrinking Bitcoin premium, but investor confidence wanes amid ETF competition.

🪙 SEC scraps 19b-4 for crypto ETFs via Generic Listing Standards; S-1 clearance could accelerate launches this October.

🔗 Swift unveils blockchain shared ledger with Consensys, 30 banks—aiming instant cross-border settlement while validating Ripple’s approach lead.

☕️ KDP buys JDE Peet’s, plans beverage/coffee split by 2026; dividend steady, but leverage and execution risks loom.

🧠 One Big Thing

900,000 federal jobs at risk. The looming U.S. government shutdown isn’t just another political standoff—it comes with a threat of permanent layoffs and delayed economic data, potentially kneecapping the Fed ahead of its next rate decision.

💰 Money Move of the Day

In moments of political gridlock, cash buffers matter. Not a prediction, but a habit: some investors reevaluate their emergency funds when major government services risk halting—especially if paychecks or benefits could be disrupted.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $112,858 (▼ -1.33%)

Ethereum (ETH): $4,144 (▼ -1.73%)

XRP: $2.84 (▼ -1.39%)

Equity Indices (Futures):

S&P 500 (SPX): 6,649 (▼ -0.09%)

NASDAQ 100: 24,794 (▼ -0.18%)

FTSE 100: 9,297 (▼ -0.10%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.129% (▼ -0.29%)

Oil (WTI): $62.94 (▼ -0.73%)

Gold: $3,801 (▼ -0.83%)

🕒 Data as of UK (BST): 10:59 / US (EST): 05:59 / Asia (Tokyo): 18:59

✅ 5 Things to Know Today (+ 2 Bonus Stories)

🚨 Government Shutdown Looms: Trump, Democrats at Impasse Over Health Care

The U.S. government is on track for a shutdown beginning 12:01 AM ET, Wednesday, October 1, if Congress fails to pass a stopgap funding measure. After a Monday meeting with President Trump ended without agreement, Republicans—who hold a 53–47 Senate majority—must secure at least seven Democratic votes to overcome the 60-vote threshold and advance a continuing resolution that would fund operations through November 21. Democrats are demanding a permanent extension of the enhanced Affordable Care Act premium tax credits set to expire at the end of 2025, along with a reversal of the $860 billion to $1 trillion in Medicaid cuts embedded in Trump’s recently enacted “One Big Beautiful Bill.” Senator JD Vance stated “we’re headed to a shutdown because Democrats won’t do the right thing,” while Democratic leaders maintain that Republicans will be blamed for any lapse in funding (Reuters, NBC News, KFF).

The Trump administration has heightened pressure by ordering agencies to submit reduction-in-force (RIF) contingency plans—typically used for permanent staffing cuts—as part of shutdown preparations. However, federal law prohibits agencies from executing layoffs during a shutdown, and the RIF directives appear aimed at strengthening the administration’s negotiating position. Even so, agencies are preparing significant furloughs, including 41% of the Department of Health and Human Services workforce (over 32,000 employees). A lapse in funding would also pause the release of critical economic indicators such as Friday’s jobs report, potentially complicating policy decisions ahead of the October 28–29 FOMC meeting, where markets currently expect a 25 basis point rate cut. While historical data shows limited direct market impact—shutdowns have coincided with positive S&P 500 returns in 12 of the past 21 instances—this episode carries elevated uncertainty due to its potential depth and timing amid fragile economic conditions (CBS News, Federal Reserve, Investopedia).

Sensei’s Insight: Markets are conditioned to dismiss shutdown noise—but permanent layoffs and blackout periods for key Fed data are rare and potentially destabilizing. Track the shutdown’s length closely—short disruption is noise, but prolonged gridlock could break the pattern.

Exxon Cuts 2,000 Jobs Amid Sector-Wide Streamlining

ExxonMobil announced plans to lay off approximately 2,000 employees globally—about 3–4% of its workforce—as it consolidates offices into larger regional hubs to enhance operational efficiency. In an internal memo on Tuesday, CEO Darren Woods stated that the move is part of a broader corporate restructuring initiative. The cuts come just a day after Imperial Oil, which is 69.6% owned by Exxon, revealed its intention to eliminate around 1,020 jobs (20% of its workforce) by 2027, aiming to save C$150 million (≈US$108 million) annually by 2028. These announcements signal a deepening wave of consolidation across the oil industry, with major players pivoting toward regional models to reduce costs and boost shareholder returns.

The layoffs arrive amid sustained pressure on the sector. Brent crude futures have dropped roughly 10.5% year-to-date, weighed down by increased OPEC+ output and ongoing demand uncertainty. Other oil majors have also announced deep cuts: ConocoPhillips is reducing its workforce by 20–25%, Chevron plans to cut 15–20% (~8,000 jobs), and Halliburton has enacted broad layoffs across multiple divisions. In August, U.S. oil and gas payrolls declined by approximately 6,000 jobs (~1%), according to both federal and trade-group data.

Sensei’s Insight: The oil industry’s cost-cutting spree marks a historic shift away from growth-at-all-costs. But while investors may cheer leaner operations and steadier dividends, shrinking headcounts and capital spending raise long-term questions about production capacity and global energy security.

🇺🇸 Trump Targets Wood Imports with New Tariffs

President Donald Trump has announced new tariffs targeting foreign wood products, imposing a 10% duty on softwood timber and lumber and a 25% tariff on kitchen cabinets, vanities, and upholstered wood furniture, effective October 14, 2025. Under Section 232 of the Trade Expansion Act, the administration justified the move as necessary to protect national security by reviving domestic industrial capacity. The proclamation includes a second phase: starting January 1, 2026, tariffs will increase to 30% for upholstered furniture and 50% for cabinets and vanities from countries that do not negotiate bilateral agreements. The U.S. granted carve-outs to allies—UK wood products are capped at 10%, while EU and Japanese imports are limited to 15% under recent trade arrangements (Reuters, White House). Canada, which supplies roughly 24% of U.S. softwood lumber (~12 BBF in 2024), faces the steepest impact. The U.S. Lumber Coalition, citing an April 2025 white paper, claims Canada maintains 8.7 BBF of “excess capacity”—about 17% of U.S. demand—and welcomed the tariffs as a corrective. However, Canadian lumber output has fallen by 43% since 2004, and Canadian exporters are already subject to average combined duties of 34–35% as of mid-2025, following updated anti-dumping and countervailing duty reviews.

The policy arrives amid mounting affordability pressures in the housing market. While the National Association of Home Builders estimates that over 100 million U.S. households would be priced out of buying a modeled $459,826 “median new home” with a 6.5% mortgage rate, the latest official figures show median prices of ~$423,000 for existing homes and ~$414,000 for new homes as of August 2025. Lumber accounts for an estimated 1.7% of new home construction costs, according to the coalition, though builder groups argue the full pass-through effects could be broader. U.S. sawmills currently operate at around 80% capacity, implying roughly 20% available headroom should imports decline (Fastmarkets). Meanwhile, furniture inflation continues to bite, with CPI data showing a 9.5% year-over-year increase for living room, kitchen, and dining room items (Bureau of Labor Statistics). With tariffs rising and supply chain shifts pending, economists warn of increased costs for consumers and delays in housing development.

Sensei’s Insight: With tariffs rising and home prices already stretched, the real pressure will land on American builders and buyers. Watch closely: lumber policy just became a housing market flashpoint.

🇯🇵 BOJ Stays Put With Split Board Signal for October Rate Hike

The Bank of Japan held its policy rate steady at 0.5% during its September meeting but sent a surprisingly hawkish signal as two board members dissented in favor of a 0.75% rate. Naoki Tamura and Hajime Takata opposed the 7-2 majority decision, with Tamura citing “increasing risk of rising prices” and the need to approach a neutral rate, while Takata argued the BOJ’s inflation target had been “achieved for the most part.” These marked the first two-member pro-hike dissent under Governor Kazuo Ueda. In a further step toward normalization, the BOJ announced plans to begin selling ETFs at an annual pace of ¥330 billion on a book value basis—or approximately ¥620 billion at market value (Reuters, XTB).

Following the meeting, swap markets priced the odds of a rate hike at the October 29–30 meeting between 50–70%. Tamura’s dissent drew particular attention given his solo opposition in December 2024 that preceded the BOJ’s January 2025 hike. A newly released summary of opinions revealed broader support for near-term tightening, with one member stating, “it may be time to consider raising the policy interest rate again, given that it has been more than six months since the last rate hike.” Five board members indicated a preference to resume rate hikes in the foreseeable future (Channel News Asia, Business Times). Former board member Seiji Adachi expects growth and inflation forecasts to be revised upward in October, potentially justifying tightening (Reuters, BOJ).

Sensei’s Insight: With inflation steady above 2.5% and wage growth firming, the BOJ’s pivot signals a serious end to the ultra-easy era. Investors should watch the October Tankan and earnings season—one strong data beat could seal the deal.

🎯 Saylor Dismisses Strategy’s Shrinking Bitcoin Premium as Market Adjustment

Michael Saylor is brushing off concerns about Strategy Inc.’s narrowing share premium, even as its stock has fallen 20% since June while Bitcoin hits new record highs. In an interview with Bloomberg, the former MicroStrategy CEO framed the compression—from historical levels above 3x to approximately 1.46x the value of the company’s $73 billion Bitcoin holdings—as a natural market rebalancing. Strategy now trades at a market cap of roughly $88.6 billion, down from multiples as high as 3.4x post-2024 U.S. election, indicating a substantial convergence toward Bitcoin’s net asset value. This reflects a significant underperformance, with Bitcoin gaining 6% over the same period.

The decline in Strategy’s market-implied NAV multiple to around 1.6x highlights growing structural concerns about its Bitcoin acquisition model. The firm recently walked back a July pledge to avoid issuing shares below a 2.5x multiple—raising investor doubts about management credibility. With spot Bitcoin ETFs now offering cheap, direct exposure, Strategy’s traditional role as a proxy for Bitcoin is being eroded. The narrowing premium jeopardizes the company’s $42 billion capital raise planned through 2027, a strategy that has underpinned its 2,400% stock gain since adopting Bitcoin as its core treasury asset, as noted by Fortune and Coindesk.

Sensei’s insight: If the market no longer rewards your multiplier, your leverage strategy can turn into a liability.

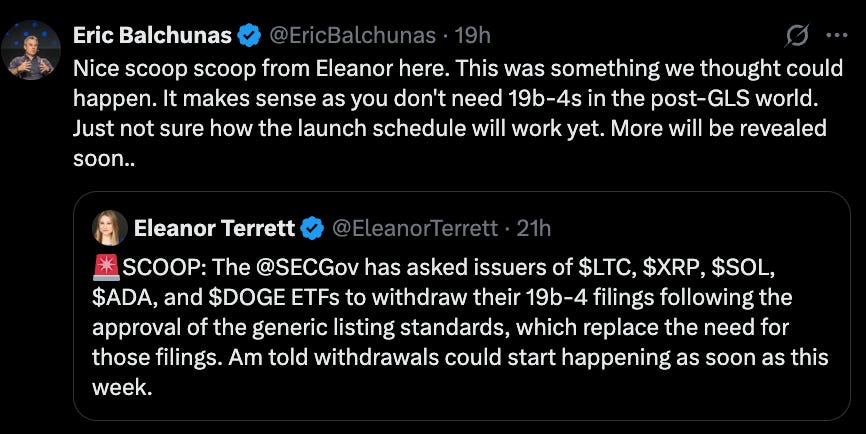

🚨 Crypto ETF Shake-Up: Faster Than Expected

The SEC has told issuers of upcoming crypto ETFs — including Solana, XRP, Litecoin, Cardano, and Dogecoin — to withdraw their 19b-4 filings. Normally, those filings triggered the long 245-day review clock, which is why October was seen as “decision month.” But with the SEC’s new Generic Listing Standards (GLS) approved, those rule-change filings are no longer needed. Instead, exchanges can list crypto ETFs under the generic framework, just like gold or silver funds, removing the biggest procedural delay. That means the old October deadline doesn’t matter anymore — and the race to market may actually speed up. (CoinDesk)

From here, the only step left is for the SEC’s Corporate Finance division to clear each fund’s S-1 registration statement, which covers disclosures and structure. Analysts like Bloomberg’s Eric Balchunas say this makes approvals virtually guaranteed, with odds now at “100%.” Timing is the wild card: there’s no fixed 45-day or 245-day deadline anymore, but since many S-1s (like Solana’s) have already been amended several times, launches could come in weeks — or even days. In short: ETFs aren’t being delayed — they’re now on a much faster, more predictable path to market.

To put this into perspective, Eleanor Terrett, a journalist at FOX Business who closely tracks SEC policy and crypto regulation, highlighted the withdrawal requests and their implications. Meanwhile, Eric Balchunas, Senior ETF Analyst at Bloomberg Intelligence, added that the new framework makes approvals virtually certain, with timing potentially moving “absurdly fast.”

Sensei’s Insight: In theory, this change could accelerate approvals, but given we were already near the old October deadline, I’m only slightly cautious. Bottom line: I still expect ETFs this year — and likely in October.

🚨 Swift Enters the Blockchain Payments Race

Swift has announced plans to launch a blockchain-based shared ledger in partnership with Consensys and 30 global banks, aiming to deliver 24/7, near-instant cross-border payments with smart contract functionality and links to tokenized assets. Rather than replacing its existing rails, Swift will layer this new system on top of its trusted global network, allowing banks to choose between traditional messaging or blockchain settlement. The move is positioned as a direct response to growing competition from stablecoins and blockchain-native players, signaling Swift’s recognition that its decades-old infrastructure needs a major upgrade to stay relevant in the evolving world of digital finance.

For Ripple, the headline might sound threatening, but the reality is more nuanced. Ripple and the XRP Ledger already have years of real-world adoption, liquidity corridors, and regulatory testing under their belt, while Swift is only beginning to experiment with Ethereum-based technology through Consensys. Banks are conservative and may take years to fully integrate Swift’s blockchain layer, leaving Ripple room to grow its foothold. More importantly, Swift’s announcement shows that Ripple’s model was right all along — cross-border payments need blockchain speed and settlement — but Swift is playing catch-up. The bottom line: Swift’s move validates the space, but it doesn’t erase Ripple’s lead, especially in markets and use cases where XRP’s efficiency and proven corridors already outpace traditional rails.

Sensei’s Insight: Swift is finally admitting Ripple was right — blockchain is the future of payments — but arriving late to a race where Ripple already has the head start.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive — Keurig Dr Pepper (KDP)

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.