Sensei's Morning Forecast: House Clears GENIUS Act as Bank of America Eyes Stablecoin

Navigate profit-taking methods and five top stories: GENIUS Act, BofA stablecoin initiative, Trump‑Powell episode, Taiwan chip cyberattacks, Coca‑Cola cane sugar claim—must-read insights.

🧠 One Big Thing

$241 billion. That’s the total global stablecoin circulation as of July 2025—now on track to be federally regulated in the U.S. for the first time. The GENIUS Act's advancement could trigger a flood of institutional capital into digital assets.

💰 Money Move of the Day

When regulatory winds shift, some investors review their portfolio exposure to sectors that stand to benefit. With U.S. stablecoin legislation advancing and banks like Bank of America signaling entry, traditional finance’s crypto adoption could accelerate—prompting some market participants to reevaluate holdings in fintech and blockchain infrastructure plays.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $118,232 (▼ -0.34%)

Ethereum (ETH): $3,441 (▲ +2.05%)

XRP: $3.27 (▲ +7.64%)

Equity Indices (Futures):

S&P 500 (SPX): 6,263 (▲ +0.08%)

NASDAQ 100: 23,084 (▲ +0.03%)

FTSE 100: 8,970 (▼ -0.13%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.465% (▲ +0.13%)

Oil (WTI): $66.77 (▼ -0.07%)

Gold: $3,326 (▼ -0.65%)

🕒 Data as of

UK (BST): 12:27 / US (EST): 07:27 / Asia (Tokyo): 20:27

✅ 5 Things to Know Today

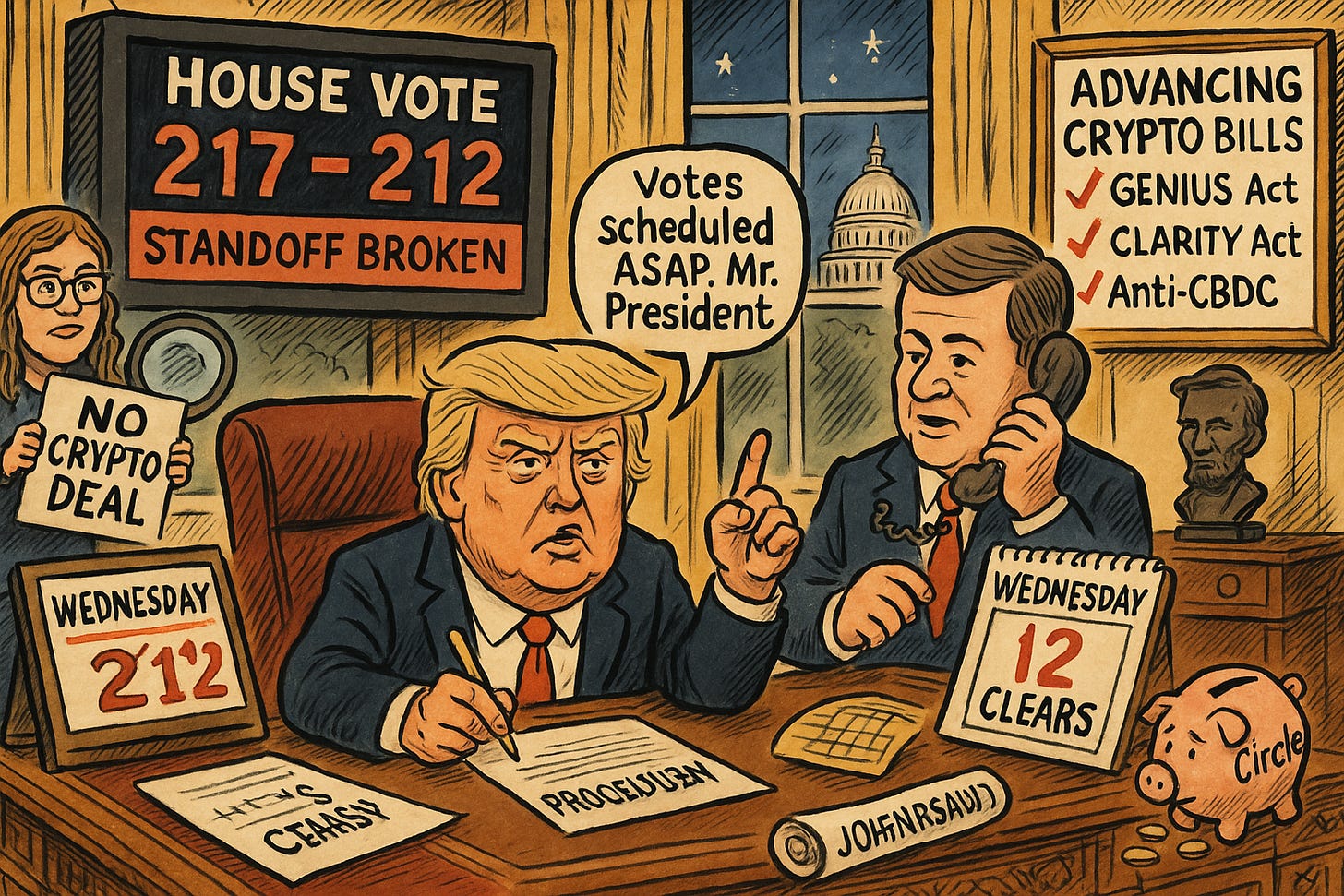

House Clears Procedural Hurdle for Crypto Bills After Record-Breaking Standoff

The House of Representatives late Wednesday night cleared a key procedural vote for three landmark cryptocurrency bills, including the GENIUS Act, after an unprecedented 10-hour session—the longest vote in House history (The Hill, Reuters). The 217-212 vote followed direct intervention from President Trump, who met with 11 of the 12 Republican holdouts in the Oval Office to resolve a two-day blockade (Politico, Forbes). Speaker Mike Johnson joined the meeting by phone and confirmed votes would be scheduled "as early as possible" (Politico).

The GENIUS Act, which would establish the first federal regulatory framework for stablecoins, is now poised to reach the President’s desk by the end of the week (The Block, Bloomberg). The Digital Asset Market Clarity Act (CLARITY Act) and the Anti-CBDC Surveillance State Act also advanced but still require Senate approval. The GENIUS Act could unlock billions in sidelined capital and position the U.S. as the leading jurisdiction for digital asset innovation, with Circle Internet Group shares rising 14% and Coinbase gaining 3% on the news (Investopedia, Business Insider). With stablecoin issuance surpassing $200 billion globally, institutional confidence is surging as Trump’s "crypto capital of the world" agenda advances (Reuters).

Sensei’s Insight: The GENIUS Act’s advancement is more than a procedural win—it’s a regulatory cornerstone that may redirect the future of digital finance. Keep eyes on the Senate.

🏦 Bank of America Signals Stablecoin Move as Crypto Bills Advance

Bank of America reported Q2 2025 results on July 16, posting $0.89 EPS (vs. $0.86 expected) and $26.6 billion in revenue (vs. $26.7 billion expected), with net income rising 3% YoY to $7.1 billion thanks to record net interest income of $14.8 billion (Investing.com, Reuters). On the post-earnings call, CEO Brian Moynihan confirmed the bank has been developing stablecoin infrastructure, saying "We've done a lot of work" and "you would expect our company to move on that" (CryptoBriefing, Reuters). The launch will depend on client demand and regulatory clarity, with Moynihan noting the bank is still evaluating scale and awaiting legal guidance (Investopedia).

This aligns with Capitol Hill developments, where the House narrowly advanced the GENIUS Act in a 215-211 vote, sending stablecoin legislation toward President Trump’s desk (The Block). Bank of America’s move positions it alongside JPMorgan, Citigroup, and Morgan Stanley in pursuing stablecoin strategies (Cointelegraph, Yahoo Finance), a trend driven by the $257 billion stablecoin market projected to hit $2 trillion by 2028 (AINVEST). Traditional banks are now preparing to compete directly with fintech-native issuers like Circle and Tether, leveraging their regulatory status and deposit bases to gain early footholds as digital dollar infrastructure becomes reality (Reuters).

Sensei’s Insight: Stablecoin regulation is becoming a forcing function. Bank of America’s signal isn’t just about readiness—it’s about pre-positioning before the gates open.

🇺🇸 Trump Denies Plan to Ax Powell After Floating Idea to Lawmakers

President Trump on Wednesday dismissed reports suggesting he intended to fire Federal Reserve Chair Jerome Powell, calling such action "highly unlikely" after earlier raising the idea with House Republicans. This denial followed a flurry of reports, including one from Bloomberg, that Trump was preparing to remove Powell and had even circulated a draft dismissal letter during a closed-door meeting. Multiple outlets, including ABC News and Axios, confirmed Trump sought input from GOP lawmakers, some of whom backed the proposal. The president later walked back the idea, telling reporters it would only be considered in cases of fraud and that he was "more conservative" on the matter than those advising him.

Markets reacted swiftly to the news, with the dollar index falling up to 0.8% before paring losses after Trump's clarification, according to CNN. The incident underscores Trump’s continued frustration with Powell’s reluctance to cut interest rates and his broader campaign to influence Fed policy. Powell’s term runs through May 2026, and Fortune reports that a formal process to identify a successor is underway. Legal experts emphasize that removing a Fed chair without cause would face steep judicial hurdles, as Supreme Court precedent protects against firings over policy disagreements (Harvard Gazette). Trump’s team has highlighted the Fed’s over-budget $2.5 billion headquarters renovation as potential grounds for dismissal, though legal analysts view this as inadequate justification (NYT, NPR).

Sensei’s insight: The Fed’s independence is facing one of its most public tests since 1981. Even a bluff to remove Powell is enough to move markets and stir institutional alarm.

🇨🇳 China-Linked Hackers Target Taiwan's Chip Industry

Cybersecurity researchers have uncovered a surge in cyber espionage campaigns against Taiwan’s semiconductor sector, with at least three China-linked hacking groups launching coordinated attacks from March to June 2025 (NewsBytes, Taipei Times, Proofpoint). These groups targeted 15–20 entities, including leading chipmakers and financial analysts at US investment banks. Their methods involved hijacked university email accounts, fake investment firm identities, and phishing emails containing malware-laden PDFs and encrypted archives. Some firms received up to 80 malicious messages, indicating an organized and persistent effort to infiltrate this critical industry.

This escalation coincides with new US export restrictions on high-end semiconductors to China, further straining an already tense geopolitical landscape. Taiwan dominates global chip production, generating 90% of the world’s most advanced semiconductors and an estimated $39.6 billion in revenue for 2025 (DataCube Research, Statista). Major firms like TSMC ($1.2T market cap), MediaTek, UMC, Nanya, and Realtek are crucial suppliers to Apple, Nvidia, and others (CompaniesMarketCap). With Taiwan accounting for 53.8% of China's chip imports in 2023 (ISDP), any security breach could accelerate China’s domestic semiconductor push or disrupt global tech supply chains. The stakes are high—analysts warn a Taiwan conflict could trigger a $10 trillion global economic shock (Vision of Humanity).

Sensei’s Insight: The semiconductor arms race isn’t just about chips—it’s about control, power, and resilience. These cyberattacks highlight the fragility of a supply chain that props up the global tech economy.

Trump Claims Coca-Cola Will Switch to Cane Sugar, Sparking Market Reactions

President Donald Trump claimed Wednesday that Coca-Cola has agreed to replace high-fructose corn syrup with "real cane sugar" in its U.S. beverages following direct talks with company executives, announced via Truth Social. He wrote, “I have been speaking to Coca-Cola about using REAL Cane Sugar in Coke in the United States, and they have agreed to do so.” Coca-Cola has yet to confirm the switch, instead issuing a diplomatic statement that it "appreciates President Trump's enthusiasm" and will soon share "more details on new innovative offerings" (CBS News). Coca-Cola already uses cane sugar in international markets, including Mexico (CNN), and the announcement aligns with Health Secretary Robert F. Kennedy Jr.’s “Make America Healthy Again” campaign (Independent).

The market responded quickly, with corn syrup suppliers Archer Daniels Midland (ADM) and Ingredion plunging 5.6% and 7.7% in after-hours trading (MarketWatch). Coca-Cola shares remained stable. ADM derived $8.6 billion in 2024 from starches and sweeteners, representing 10% of its total revenue (Stocktwits). The Corn Refiners Association criticized the potential move, warning it could harm U.S. food manufacturing jobs and farm income without offering nutritional gains (Reuters). With Coca-Cola’s Q2 earnings due July 22, investors await clarification on the timeline and scope of any formula changes (AInvest).

Sensei’s Insight: A bold claim from Trump hits both the sweet tooth and the stock charts—watch for July 22 to separate fizz from fact.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍 Deeper Dive: Crypto Profit-Taking: A Strategic Guide for Retail Investors

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.