Sensei's Morning Forecast: Is the U.S. Collapsing? $3,875 Gold? The Shutdown Just Changed Everything

As shutdown triggers economic chaos, gold soars and data stalls. Tether eyes stablecoin dominance, Taiwan pushes back on U.S., Buffett bets on chemicals, Trump crypto card nears launch.

👀 Today’s Stories at a Glance

🏆 Gold Hits Record High: Gold surged past $3,875 as investors flee to safety amid U.S. government shutdown and global uncertainty.

🇹🇼 Taiwan Rejects U.S. Chip Plan: Taiwan refuses U.S. demands to relocate chip output, risking TSMC expansion and tech supply chain stability.

💸 Tether Teams with Rumble: Tether launches US-compliant stablecoin via Rumble, aiming to challenge USDC with built-in audience reach.

🧠 Buffett Eyes $10B OxyChem Deal: Berkshire nears acquisition of OxyChem, doubling down on stable industrial assets during economic headwinds.

🔗 Trump-Backed Crypto Card Launch: World Liberty to launch USD1 debit card, bridging crypto with Apple Pay—despite token price drop.

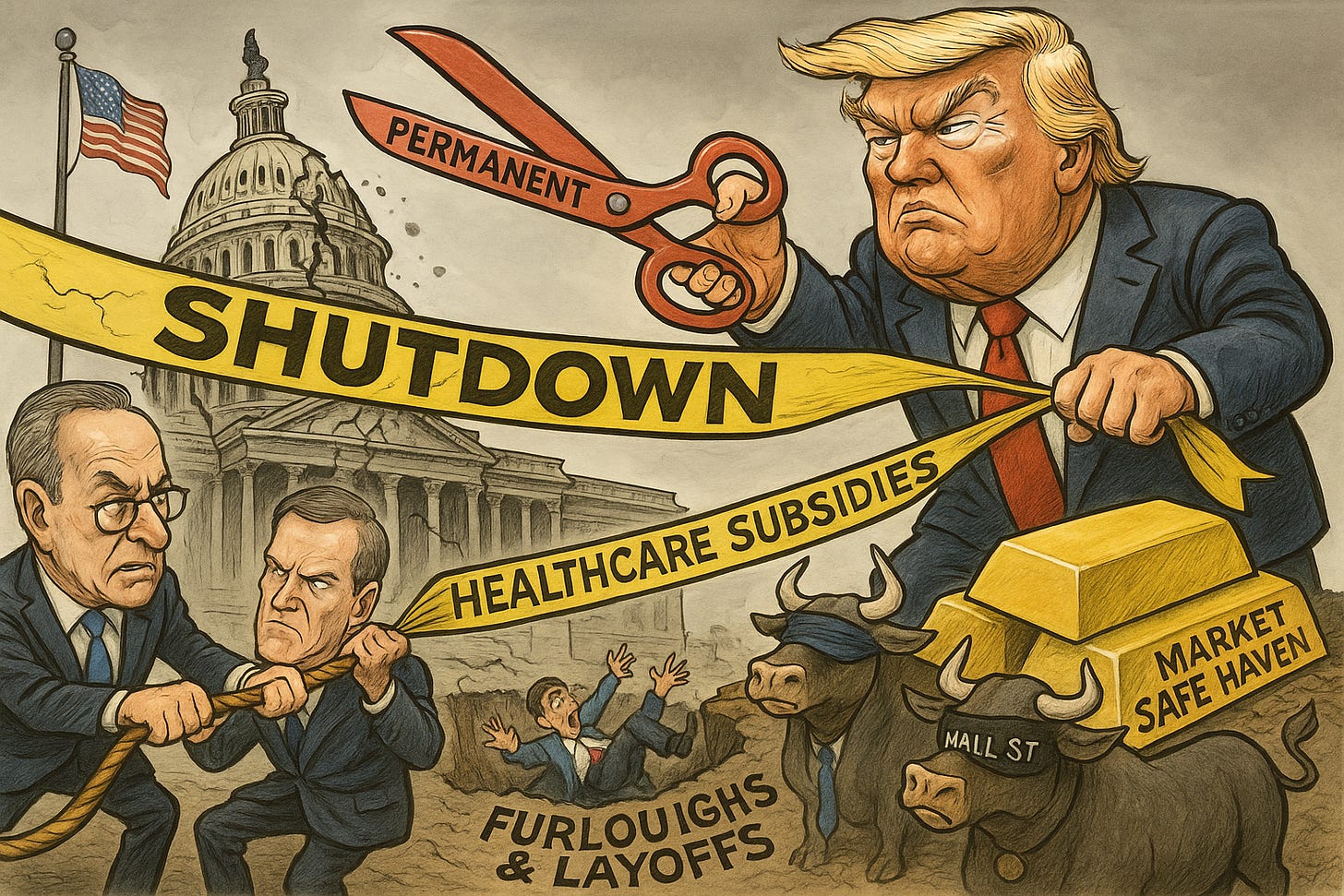

🏛️ U.S. Government Shutdown Begins: Washington gridlock triggers federal shutdown, pressuring markets and data flow—investors rotate into gold and Treasuries.

🧠 One Big Thing

Gold has surged to a record $3,875/oz as investors rush into safe havens amid a U.S. government shutdown—signaling deeper concern about America’s long-term fiscal credibility.

💰 Money Move of the Day

During periods of political uncertainty, some investors consider balancing risk by holding a portion of their portfolio in defensive assets like gold, Treasuries, or cash—not as a reaction, but as preparation. Whether markets soar or stumble, having dry powder can give you options.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $116,238 (▲ +1.86%)

Ethereum (ETH): $4,286 (▲ +3.33%)

XRP: $2.93 (▲ +2.88%)

Equity Indices (Futures):

S&P 500 (SPX): 6,648 (▼ -0.35%)

NASDAQ 100: 24,758 (▼ -0.58%)

FTSE 100: 9,419 (▲ +0.39%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.154% (unchanged)

Oil (WTI): $62.61 (▼ -0.11%)

Gold: $3,887 (▲ +0.73%)

🕒 Data as of UK (BST): 11:33 / US (EST): 06:33 / Asia (Tokyo): 19:33

✅ 5 Things to Know Today

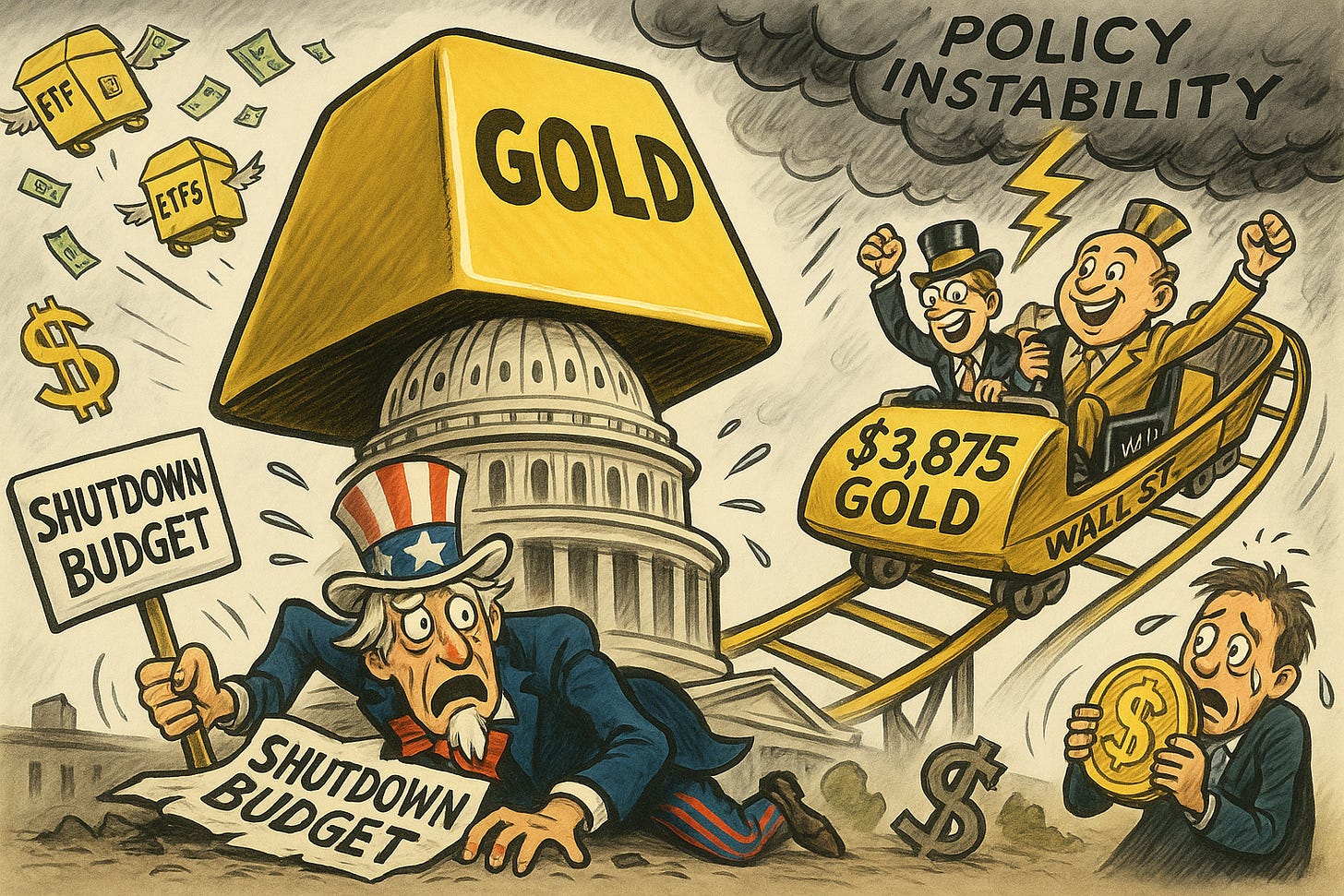

🏆 Gold Hits All-Time High as Flight to Safety Accelerates

Gold prices soared to a record $3,875+ per ounce today as the U.S. government entered its first shutdown in nearly seven years, sparking a rush toward traditional safe-haven assets. The yellow metal is now up 47% year-to-date, tracking for its strongest annual performance since 1979, with spot prices holding near $3,864 by the Asian market close (Reuters). Gold miners such as Newmont and Barrick climbed 2–4% in pre-market trading amid mounting political gridlock in Washington (Yahoo Finance). Fears that the shutdown could delay Friday’s non-farm payrolls report added pressure, potentially influencing the Federal Reserve’s policy path ahead of its next FOMC meeting.

Gold ETFs also saw explosive inflows, with September marking their largest monthly haul in three years. The SPDR Gold Trust (GLD) alone attracted over $11 billion in 2025, eclipsing the $454 million seen in all of 2024 (Bloomberg). The rally extended across the precious metals complex—silver jumped to a 14-year high near $47, and platinum surged 79% year-to-date to top $1,580, its highest level in over a decade (CNBC). Central banks added 900 tonnes to gold reserves this year, and gold mining stocks have mirrored the rally, also rising 79% this quarter (Goldhub). The shift signals more than short-term momentum—investors are rebalancing toward gold as a strategic hedge against geopolitical turmoil and long-term portfolio fragility.

Sensei’s Insight: Gold’s historic surge is not a knee-jerk reaction—it’s a structural repositioning. The message from institutional flows and central banks is clear: in a world of fiscal instability and eroding policy credibility, gold is not just back—it’s central.

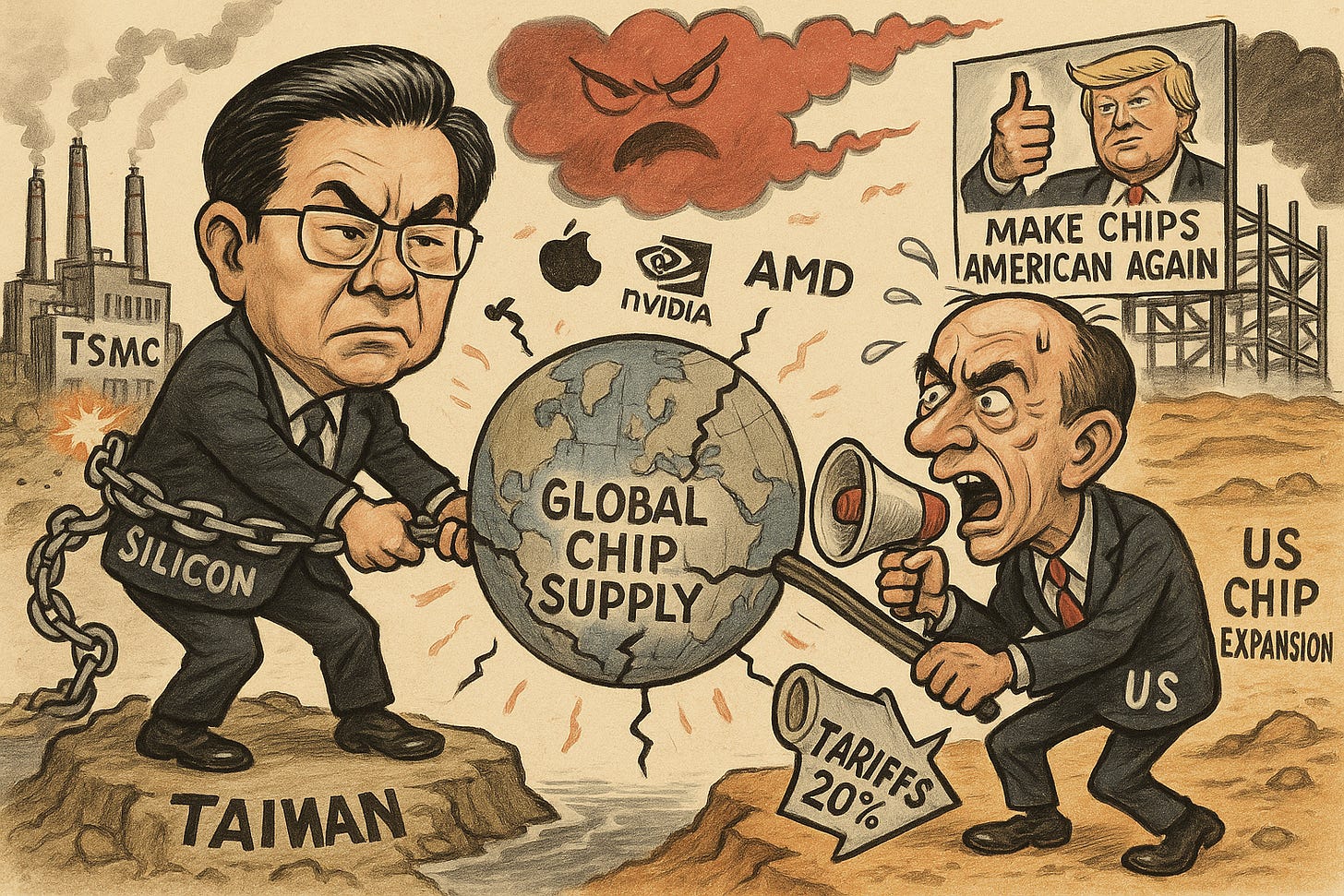

🇹🇼 Taiwan Rejects US Chip Demand in Trade Standoff

Taiwan has flatly rejected a US proposal to relocate half of its semiconductor production to American soil, intensifying a key standoff in bilateral trade talks. Vice Premier Cheng Li-chiun, who leads Taiwan’s tariff negotiations, said the island “will not agree” to Commerce Secretary Howard Lutnick’s proposed 50-50 production split, aimed at bolstering US chip self-sufficiency (Reuters). The Trump administration has already imposed a temporary 20% tariff on Taiwanese exports, increasing pressure on Taipei to strike a broader trade agreement. Over 70% of Taiwan’s $70 billion trade surplus with the US comes from semiconductors and related ICT products. In a recent interview with NewsNation, Lutnick dismissed Taiwan’s longstanding “silicon shield” defense model, insisting the US must manufacture at least half of its chips domestically to counter Chinese threats and secure supply chains.

The standoff puts the spotlight on Taiwan Semiconductor Manufacturing Company (TSMC), which has pledged $165 billion to build six fabs in Arizona while maintaining its primary manufacturing base in Taiwan (CNN). Lutnick’s goal is to boost US semiconductor manufacturing to 40-50% of domestic demand by the end of President Trump’s term (Bloomberg). The unresolved dispute threatens to delay TSMC’s US expansion and destabilize global tech supply chains. Companies like Apple, Nvidia, and AMD—dependent on TSMC’s advanced node production—may face ripple effects. With Taiwan producing more than 90% of the world’s most advanced semiconductors, disruptions to its strategic positioning could reverberate across AI development, defense, and broader technology sectors (TechXplore).

Sensei’s Insight: Taiwan’s defiance signals it won’t trade strategic dominance for tariff relief—especially when the world’s tech giants still rely on its silicon.

Tether to Leverage Rumble Platform for New US Stablecoin Distribution Strategy

Tether Holdings is rolling out a new U.S.-compliant stablecoin, USAT, with video platform Rumble as its primary distribution channel. Unveiled by CEO Paolo Ardoino at Singapore’s Token2049 conference, the initiative includes a Tether-powered crypto wallet to be launched by Rumble by the end of 2025, targeting its 51 million monthly active users. This strategy builds on Tether’s $775 million investment in Rumble completed in February 2025, giving it a 48% ownership stake in the conservative-leaning platform (Bloomberg, Rumble).

The USAT token will be issued by federally chartered Anchorage Digital Bank with reserves held by Cantor Fitzgerald. Unlike Tether’s globally used USDT, USAT is designed for regulatory compliance under the GENIUS Act. Bo Hines, a former White House crypto advisor, has been named CEO of Tether’s U.S. operations to steer the project. Anchorage is scaling up its team to support the token’s anticipated year-end launch, aiming for a $10 billion circulation mark that would place it under federal jurisdiction rather than fragmented state oversight (FXCintel, Yahoo Finance).

Sensei’s Insight: Tether’s deep integration with Rumble provides a rare native distribution advantage over competitors like Circle, positioning USAT to challenge USDC’s dominance in the U.S. But building liquidity from scratch—especially in a heavily regulated market—will test whether this new model can match the global traction of USDT.

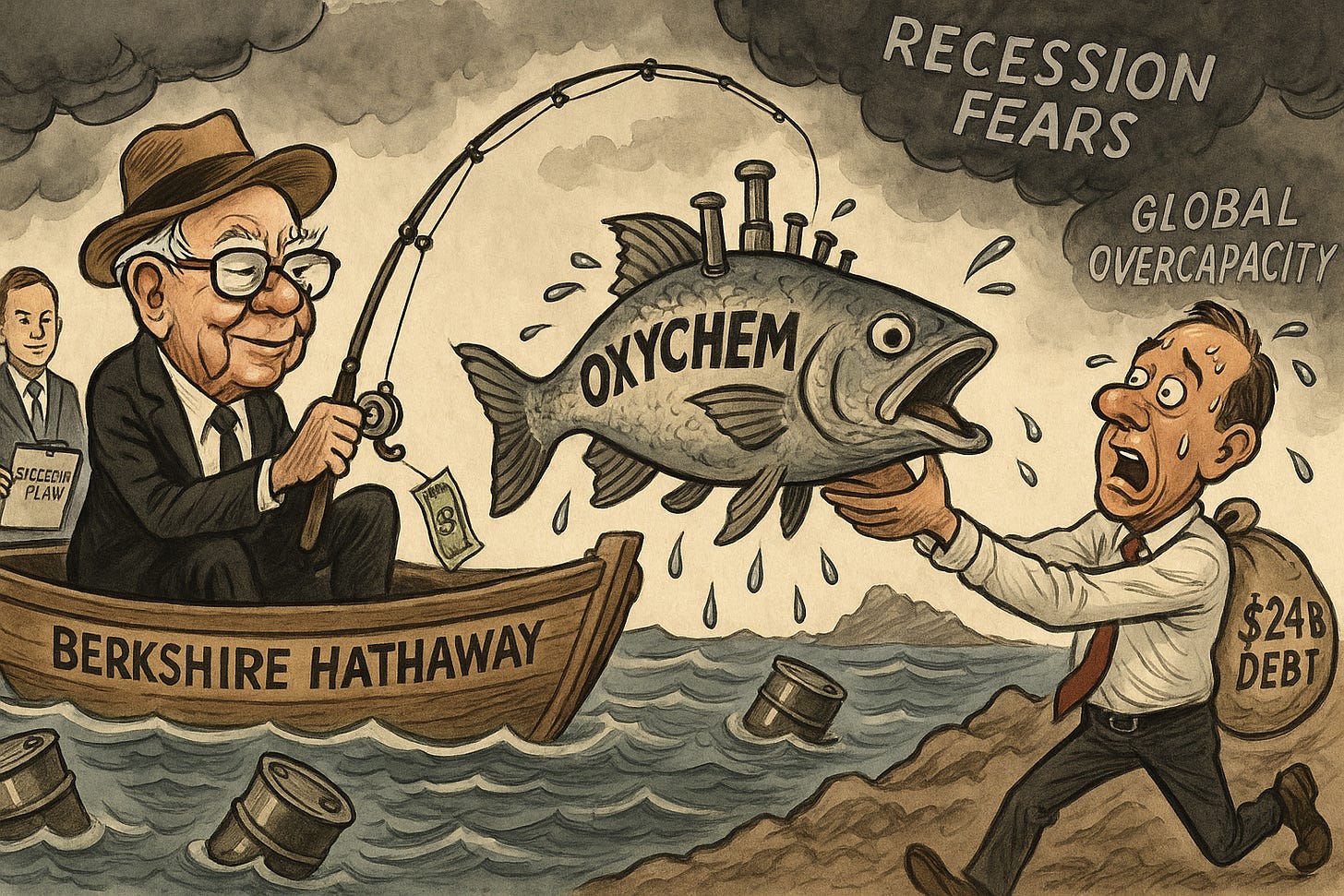

🧠 Buffett’s Berkshire Nears Deal to Buy OxyChem for $10 Billion

Warren Buffett’s Berkshire Hathaway is reportedly in advanced negotiations to acquire Occidental Petroleum’s petrochemical arm, OxyChem, for around $10 billion—a potential landmark deal that would be Berkshire’s largest since acquiring Alleghany for $11.6 billion in 2022. The deal could close within days, according to people familiar with the matter (Reuters, CNBC). OxyChem, a manufacturer of core industrial inputs such as chlorine, sodium hydroxide, and vinyl products, posted nearly $5 billion in revenue over the 12 months ending June 2025, with pretax earnings forecasted between $800–900 million for the year. Berkshire, already Occidental’s largest shareholder with a 28.2% stake valued over $11 billion, is expected to finance the acquisition from its $344 billion cash reserve rather than using its OXY holdings (Bloomberg, Yahoo Finance).

The sale supports Occidental’s ongoing debt-reduction campaign—having already cut obligations from $49 billion to $24 billion, the company now targets sub-$15 billion levels (Barron’s, Chemanalyst). With petrochemical margins squeezed globally due to overcapacity and rising competition from China, the sale allows Occidental to reallocate capital more effectively. Meanwhile, for Berkshire, the move offers long-term exposure to essential industrial assets—industries that align with Buffett’s conservative investment style—as he prepares to hand over leadership to Greg Abel at year-end. The acquisition reinforces Berkshire’s tilt toward defensive sectors that can generate consistent returns amid economic uncertainty (TipRanks, AInvest).

Sensei’s Insight: With energy markets turbulent and recession fears simmering, Buffett’s pivot toward stable, essential industries shows Berkshire’s enduring commitment to long-view value.

🔗 Trump-Backed World Liberty Eyes Debit Card Rollout

World Liberty Financial, the crypto venture supported by the Trump family, is targeting a Q4 2025 or Q1 2026 launch for its new debit card aimed at bridging digital assets with retail payments. CEO Zach Witkoff announced the timeline today at the TOKEN2049 conference in Singapore, noting that a pilot program will begin next quarter. The card will integrate with Apple Pay and connect to the firm’s USD1 stablecoin, enabling crypto-linked everyday spending. Co-founder Zak Folkman described the retail app as a hybrid of “Venmo meets Robinhood,” merging P2P payments with trading tools (Reuters, CoinDesk).

The launch aligns with broader ambitions to tokenize real-world assets (RWAs), with Witkoff citing oil, gas, cotton, and timber as upcoming targets, arguing “all of those things frankly should be traded on chain.” The USD1 stablecoin currently has a market cap of $2.69 billion, while the WLFI governance token has declined 35% from its September 1 debut, now trading around $0.20. World Liberty also signed a memorandum of understanding with Korean exchange Bithumb to expand its Asian footprint (AIBC, FXLeaders).

Sensei’s insight: The WLFI debit card could accelerate crypto’s real-world usability, but a falling token price and high execution bar leave plenty of ground to cover. The backing of the Trump family brings visibility—but also scrutiny.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive — 🏛️ U.S. Government Shuts Down: What It Means for Markets

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.